MAXIMISE - QSuper Fund...retirement outcomes for all members through the introduction of QSuper...

Transcript of MAXIMISE - QSuper Fund...retirement outcomes for all members through the introduction of QSuper...

MARCH 2014

BeaQSuper member

since 1991

How financial advice can keep you on track

Page 3

Enjoy the benefits of your new look pension account

Page 6

MAXIMISEYOUR RETIREMENT

THE BESTJUST GOTBETTER

Get the latest

important super

updates

Page 10

WHAT’S

THE SCOOP?

Giving back in retirement

Page 4

VIRTUES OFVOLUNTEERING

My story

profilememberReal

2 Super Scoop March 2014

WelcomeLast year, our centenary year, was a significant one for QSuper. It allowed us to reflect on a one hundred year history of championing better retirement outcomes for Queenslanders, but more importantly it saw us introduce innovations that will build on our proud heritage and shape an even better future for our members.

For our members in retirement, we know that we have a responsibility to provide the best possible products to support your lifestyle. That’s why we recently made changes to our award-winning pension product1 – now known as the Income account. It may have been named as pension fund of the year, but we wanted to ensure it can continue to meet the evolving needs of our diverse membership. You could say that the best just got even better! There’s more information about the new features of your account, and how they could benefit you, in the article on page 6.

Choice and controlWe’re also introducing an exciting new investment option that gives you even more possibilities when it comes to managing your Income account. Launching later this year, the QSuper Self Invest investment option will allow you to invest directly in the Australian share market. Additionally, we know from listening to our retired members that many of you would like the ability to invest in term deposits. So that’s why we’re putting arrangements in place with some of Australia’s top financial institutions to make term deposits available through Self Invest.

Direct investment options are a relatively new development for the Australian superannuation industry,

and I’m delighted that we will be one of the first funds to offer this kind of product to members in the pension phase of life. More information about Self Invest, and when it will be available, can be found on page 9.

Looking to the futureI personally find it very pleasing that as one of the largest super funds in the country we can continue to offer our members industry-leading products and services. I can assure you that this passion for innovation remains undiminished, as we look to the future with the vision of offering more members even better products to help all of you live your retirement dreams.

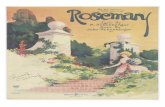

Rosemary Vilgan Chief Executive OfficerQSuper

A prestigious achievement

A message from QSuper’s CEO

“We have the responsibility to provide the best possible

products to support your retirement lifestyle.”

Rosemary Vilgan

On behalf of the QSuper Board, I would like to congratulate Rosemary on being named 2013 Telstra Australian Business Woman of the Year. This is a tremendous honour for Rosemary – who also received the Community and Government award, and was recognised at state level with the Business Innovation Award – as the fi nalist fi eld was comprised of some very impressive candidates.It is also a huge honour for the Fund, as the win is refl ective of the innovative and often industry-leading approach we

have taken as we look to create better retirement outcomes for all members through the introduction of QSuper Lifetime. These awards acknowledge how instrumental Rosemary has been in driving this vision, both for us as a fund and for the industry as a whole, and recognises her courage, vision and passion. As a member you can feel secure that your super is in the hands of a fund whose leader is truly committed to your future fi nancial security.

Karl MorrisChairman of the QSuper Board

A prestigiousachievement

> FROM THE COVER Meet BeaOne of the things that motivates me every day as I come to work is knowing that at QSuper we are here to serve a membership base that at its heart is here to support the people of Queensland. Many of our members – teachers, doctors, nurses, police officers and paramedics to name just few – spend their careers helping others in what can often be very challenging circumstances. It gives me a great deal of personal satisfaction to know that what we do here as a fund can help our members have financial dignity in retirement, and I love hearing about members like Bea Duffield, who is enjoying retirement.

What I find especially inspiring about Bea is that having spent her working life with the Queensland Government, she is now continuing to give by volunteering overseas. The interview with Bea on page 4 details some of the work she is doing with disadvantaged people in South East Asia, and also contains information on how you can offer your own skills and expertise to similar worthy projects.

Bea QSuper member

1 Chant West Conexus Financial Super Fund Awards 2013.

3Super Scoop March 2014

understand your options, make informed decisions and plan ahead with more confidence.

Maximise your moneySo, how could a financial adviser help you? Well for starters, they could look at your current investment and draw down strategies to help ensure your money lasts as long as possible.

They can also help structure your Income account payments to make the most of your Centrelink entitlements. Or they could help you with wills, trusts and estate planning – ensuring your affairs are in order and allowing you to get on and enjoy retirement.

Tailored to suit your situationIt’s important to remember that getting advice doesn’t have to be a big commitment if you don’t want it to be. Many advisers can give advice on just a single topic, often over the phone, taking just a few minutes of your time. Of course if you want more in-depth advice on your whole situation you could choose to take advantage of an ongoing review service to check your financial plan on a regular basis, and make sure it remains on track.

As you can see, there are plenty of ways a financial adviser can help. Whatever situation you find yourself in, the key is to make the most of it – and some quality financial advice could really help you do that.

Stay on trackAll the stats show that the average Australian is living longer and living better. All the more reason to review your finances regularly and make sure they’re good to go the distance with you.

What to look for in an adviserAs with any good partnership, trust is the key, and that’s never more true than when it comes to looking after your money and your financial future. You should always do your homework before choosing an adviser.

Word of mouth can be great (although always make sure the person doing the recommending isn’t being offered an incentive for their endorsement), but also never be afraid to ‘interview’ an adviser before committing yourself. The following questions are a great place to start:

Q What will this advice cost me?

Q What are your areas of expertise?

Q Are you licensed, and what services do you have a licence for?

Need advice? For quality financial

advice you can trust,

talk to a QInvest adviser. QInvest,

who are wholly owned by QSuper

Limited, can offer advice on a range

of topics, and fees start at just $55

for phone advice about your super.

1800 643 893 qinvest.com.au

Everyone will have their own ideas about the best way to spend retirement. Some choose to travel or do voluntary work; others look forward to quality time with the grandchildren or in the garden.

Whatever your preferences, it’s vital to make sure your finances are structured to support them. The last thing you want is to be running short of money when there are still so many things to see and do – after all, you’ve worked hard for it.

Some regular financial advice could help you avoid this ‘worst-case’ scenario and ensure your finances are fit to meet not only your needs… but those of your children and grandchildren too!

Good for your money, good for your mindDepending on your requirements, a financial adviser can look at individual aspects of your situation – or the ‘big picture’. Either way, you’ll get financial advice that’s tailored to your own unique situation.

Advisers understand that your priorities may have changed over the years, and that you may now be looking to balance your own needs with those of other family members too.

Reliable financial advice offers both peace of mind and financial benefits. An experienced adviser can help you

4 Super Scoop March 2014

Ask Bea Duffield why she volunteered to help deaf and hearing-impaired people in Ho Chi Minh City and she replies with a smile. “I’ve reached a stage in life where I want to give something back – before I kick the bucket!”

“I’ve been lucky enough to travel extensively throughout my life, and it’s made me realise just how lucky we are to live in Australia. Our way of life and democratic freedoms are things that many other people can only dream about.”

Putting into practiceNow back from her 3-month volunteer assignment in Vietnam, Bea, 59, has a chance to reflect on her time as a Business Strategy Adviser at a centre for the deaf and hearing impaired.

“My job was to work with the director and staff to ensure the centre was sustainable in the long term. Deafness is a major problem in Vietnam, affecting both adults and children, so the centre has an important role to play in delivering support, research and education. It’s vital it stays open.”

It’s a role that Bea is well qualified for, having worked for many years at an executive level with the Queensland Government. Her experience spans research, business development, international consultancy and risk management across various departments.

ABV SchemeBea’s Vietnam assignment was arranged by the Australian Business Volunteer scheme. “It’s my first assignment through the ABV scheme, but I hope it won’t be my last. The training they offered was terrific, and really helped me appreciate different cultural values.”

According to Bea, there are a wealth of overseas opportunities available, and retired people are the ideal candidates. ‘We have the skills, experience and wisdom to make a difference,” she says. “And now we have the time too!”

This is not the first time that Bea has volunteered, having previously worked with minority groups in Laos and people with disabilities in Cambodia.

Even when she is back home, she finds time to teach English as a second language through a community-based Brisbane organisation. Her classes are made up of pupils from as far afield as Iran, Iraq, Mongolia, Sri Lanka and China.

Bea is quick to credit her partner, Gavin, for his support while she is busy volunteering. “He’s my biggest supporter. In fact, he’s considering volunteering himself as an engineer when he retires. That won’t be for a few years yet…”, she says with a smile, “…I married a younger man!”

Moving forward, giving back.

When QSuper member Bea Duffield opted to take early retirement, rest and relaxation were the last things on her mind. Instead, she chose to put a lifetime of professional experience to good use, working as a volunteer in Vietnam.

We have the skills, experience and wisdom to make a dif erence

My story

profilememberReal

5Super Scoop March 2014

Bea is one of many volunteers who donate their time and skills with Australian Business Volunteers (ABV). If you have the time to help, perhaps international volunteering could be for you too!

There are a wide range of opportunities with ABV for both working and retired business experts. ABV currently operates in 16 countries throughout Asia Pacific, strengthening local businesses and the communities that rely on them.

There are a number of different short-term assignments – from graphic design to business development. To find out more, or to put your name forward, visit www.abv.org.au.

Aiding othersWhile working overseas has its challenges, it has also been hugely rewarding for Bea. On a recent visit to a Hmong village in Laos, Bea first truly understood what a difference international cooperation could make.

“An elderly man stopped me and invited me into his home. He explained that his grandson had received a scholarship to study in Melbourne, and was the first person in the village to go to university. He wanted to thank me as a representative of Australia. At that moment, I felt very proud of Australia’s aid program!”

Firm foundationsFor Bea, the decision to take early retirement and spend more time volunteering was based on a solid financial platform. Bea is fortunate in being financially secure now, and partly credits this to an early interest in financial matters as well as a long-term view. “My best investments are my home and my super, and they have both been long-term investments.”

According to Bea, it’s also important to understand how the financial system works. “I’m a big believer in research and education, particularly when it comes to investment risks and rewards.”

Understandably, Bea is a fan of QSuper’s member education initiatives. “I learnt a lot about asset classes from QSuper, but I also recommend their retirement seminars. The one I attended last year really helped me get my finances in order before retiring.”

Now happily retired, Bea is planning on being busier than ever. As well as her volunteering, she is also learning French, playing the piano, and sits on the board of a community-based not-for-profit organisation.

So, does Bea have any advice for other members in retirement? “It’s not about sitting on the sofa looking back on your accomplishments. Retirement is about having the time to try new things. Life doesn’t end when you retire. In fact, for me it feels like it’s only just beginning!”

Have you been inspired to volunteer?

We have the skills, experience and wisdom to make a dif erence

Bea with some of the many children and young people, including children with disabilities, that she worked with during her time in south east Asia

We recently relaunched your account as the Income account, with some great new features. But what does this really mean to you?

Life just got a little easier

6 Super Scoop March 2014

More flexible access to your moneyMarch saw us launch a new fortnightly payment option for your regular income. We did this because so many of you were telling us this was what you wanted as it makes it easier to budget. And for those of you used to a fortnightly wage, this option can make the financial transition from working life to retirement a little easier to manage.

We’ve also abolished the four lump sum withdrawals a year limit, and reduced the minimum amount you have to withdraw from $5,000 to $1,000. This means that if you give in to those impulse buys you don’t need to worry that you’ve used up all your withdrawals and won’t be able to access funds in an emergency. It also means that you aren’t forced to take out more than you actually need for one-off purchases.

Keep up with the cost of livingWe all know things get a little more expensive every year, so to maintain your standard of living you need to increase your income. Well now instead of working out yourself how much more income to request each year, you can leave it to QSuper to do the thinking for you. If you ask us to, we’ll increase your income payments each

year with inflation – using the Pension Beneficiary Living Cost Index, essentially giving you an annual ‘pay rise’.

You can take advantage of this option from 1 July this year. You simply need to tell us by completing an Update Your Income Account Details form.

Cut the paperworkForms are never the most fun thing to fill out, so we’ve updated all the forms associated with the Income account to make them shorter and easier to complete.

But in even better news, in most cases you now don’t need to fill out a form. We’ve added some great new functionality to our Member Online service which means you can now manage your account almost exclusively online. You can change your payment frequency and amount, update your personal or bank details, make an investment switch quickly and easily without going to the hassle of printing a form, filling it in and returning it to us. If you haven’t yet registered for Member Online, why not do it today? It only takes a few minutes and you’ll have your Income account at your fingertips. Visit qsuper.qld.gov.au/memberonline to find out more.

The best of the restSome other improvements we’ve brought in include:4 No more limits on the number of investment switches

you can make4 The option to specify the investment options your

payments come from in order of preference.4 The introduction of binding death benefit nominations,

giving you more control over your estate planning.But this is just the start. Over the coming months and years we will continue to make improvements and innovations to our award-winning account to ensure it is positioned to give you the best possible support throughout your retirement. And the first of these is Self Invest, our new investment option that will allow you to invest directly with term deposits, shares and exchange traded funds. There is more information on this exciting new option on page 9.

Case study corner

By Nicholas Prideaux

Financial Adviser

Brought to

you by QInvest

James and Karen

James and Karen’s storyJames and Karen came to see me as James was about to reach Age Pension age. They had both retired the previous year, and up to this point had been living off a $50,000 a year income from James’ Income account.

They wanted to try and maintain this income level, as they are enjoying living life to the full, but like many retirees are concerned that their funds won’t last the distance. James and Karen want to know how they could structure their various assets to get their maximum possible entitlement to the Age Pension to minimise the amount of money they need to withdraw from their own funds.

What are James and Karen’s options?With the way their funds are currently structured, James is entitled to around $7,300 a year in Age Pension, meaning that James and Karen would need to find around $43,000 a year from their other assets to continue to fund their lifestyle. I explained to them that one of the reasons the Age Pension estimate is relatively low is because both the funds in their savings account and in James’ Income account were assessed under Centrelink’s asset test.

I then outlined a strategy that could considerably reduce their assessable assets. As Karen is under Age Pension age, any funds in her Accumulation account aren’t counted as assets by Centrelink. And as Karen is under age 65, she can use the ‘bring forward’ rule to contribute up to $450,000 to her account as an after-tax contribution. I therefore suggested that the couple move $150,000 from their bank account

into Karen’s Accumulation account. Additionally, James could close his Income account, contribute $300,000 to Karen’s Accumulation account, and re-open a new Income account in his name with the remaining $200,000.

I ran the numbers, and showed the couple that by doing this, James’ Age Pension entitlement is an estimated $16,000 a year, so the couple would only need an additional $34,000 a year from their own funds. This would come partially from James’ Income account, and partially from lump sum withdrawals from their bank account and Karen’s Accumulation account. Karen wondered if she would have to pay tax on any withdrawals on her Accumulation account. I explained that because of the low rate cap, any withdrawals she made to help them achieve this desired income would be tax-free, provided she did not withdraw more than $180,000 before age 60.

What do James and Karen do?James and Karen decided to follow the strategy I recommended. They understand that it will only be effective for the next eight years, until Karen reaches Age

Pension age of 66, but over that time they will save tens of thousands of dollars of their own savings thanks to the boost in James’ Age Pension entitlement.

They resolve that as Karen gets close to Age Pension age, they will come back to see a QInvest adviser to reassess their options so they can continue to maximise their retirement income.

7Super Scoop March 2014

Name: James and Karen Age: 64 and 58James’ Income account balance: $500,000Karen’s Accumulation account balance: $50,000Other assets: $200,000 in bank account, car worth $20,000 and household contents of $15,000

How can we structure our assets to maximise Age Pension payments?

84+16+z

68+32+z

Without strategy

With strategy

$7,300

$16,000

$42,700

$34,000

$50,000Total income:

$50,000Total income:

First year saving: $8,700

Age Pension income

Income from assets

$50K

$50K

The figures in this case study have been calculated using Centrelink rates and thresholds as at 31 January 2014. The members depicted are not real members and the case study is used for illustrative purposes only.

From September 2014, QSuper

will be offering members access

to term deposits via our

new Self Invest

investment option.

We know that many of our members in retirement are looking for safety and security for their hard earned super, and have at least a portion of their account balance invested in our lower-risk investment options such as Cash. We also know that there can be some confusion over what exactly the Cash option is invested in and how it differs from placing your money in a term deposit.

8 Super Scoop March 2014

Unrisky businessThe difference between QSuper’s Cash option and term deposits explained

Cash Term depositQSuper’s Cash option invests in something called the short-term money market by trading bank bills, which is currently done through a fund manger. Bank bills are a wholesale investment generally only available to institutional or professional investors. To further ensure the security of this option, we invest almost exclusively in cash instruments issued by the four major Australian banks – ANZ, Commonwealth, Westpac and NAB.

Current interest rates are used by investors when determining a trade price. The Cash option is revalued daily, which is why the unit price changes every day. Returns for the Cash option can fluctuate on a month by month basis but the annual return is never expected to be negative. In fact over the long term they sit between 4% - 5% per annum.1

The returns offered by the Cash investment option are always calculated after fees and tax have been applied. It’s also worth remembering that if you have an Income account, no tax applies to your investment returns.

As with any of QSuper’s investment options, you can switch your money to a different investment option at any time, and as an Income account holder you can generally access your money whenever you need it.

As term deposits are not traded, they are not market valued. You agree a return with the provider before you choose to invest and this return applies for the fixed term of your investment. The returns offered by term deposits fluctuate with the cash rate dictated by the Reserve Bank. This means that when the cash rate is high, as it was a couple of years ago, returns can jump to 6% per annum and over. When the cash rate drops though, so does the rate of return the banks offer.

Any returns from a term deposit have to be declared in your annual tax return so that any applicable tax can be charged – so depending on your age and circumstances you could be paying tax up to your marginal tax rate.

With a term deposit you are essentially locking your money away for a specified period of time. If you do request early access to your money, you will generally be penalised.

A term deposit is an investment vehicle generally offered by a bank or similar financial institution to personal investors that allows you to deposit money for a fixed term at an interest rate which is agreed on up-front. Any money invested can only be withdrawn after the term has ended, or by giving a pre-determined number of days notice.

Striking the right balanceWhat both of these types of investments do have in common is that they are designed to offer stable returns over the long-term. That means lower risk, but also lower returns. To help get the best investment mix for your super, you may wish to seek expert financial advice, and as a QSuper member you have access to affordable financial advice from QInvest.2 Call 1800 643 893 or see qinvest.com.au to find out more.

Differences at a glance

Retu

rns

Acc

ess

Tax

1 Past performance is not a reliable indicator of future performance. 2 Fees apply.

At QSuper we have always been committed to offering our members a range of investment options, because we know there’s no such thing as one size fits all. Currently we offer our Income account members eight investment options covering a wide range of asset classes. Alternatively you can create your own strategy by building your own mix using our single asset class Your Choice options – Cash, Diversified Bonds, Australian Shares and International Shares.

An exciting new optionWe know that some of our members are seeking to have greater control over their super. In response to this, QSuper is launching a new online and easy-to-use direct investment option called QSuper Self Invest. From September 2014, members will have the opportunity to

take a more active and hands on approach to managing their super in the Income account.

You can choose to invest a portion of your funds directly in a range of term deposits, Australian shares (S&P/ASX300) and exchange traded funds (ETFs) from the convenience of your personal computer or mobile device.

In July we’ll be making the Self Invest Guide available on our website, which will contain all the information you need to make a decision on whether this option is right for you. In July we’ll also send you more information about QSuper Self Invest with your benefit statement.

9Super Scoop March 2014

Investment solutions to suit you

Sign up for email updates about QSuper Self Invest at qsuper.qld.gov.au/selfinvest

ADVERTISEMENT

QSuper members now have access to a special rate on a Challenger Guaranteed Term Annuity.1

Considering an annuity?

4 Gives you the option to diversify your retirement income

4 Competitive rates exclusive to QSuper members

4 Easy application process

4 Access through QSuper - the fund you know and trust

To find out more call QSuper or visit our website.

1 This product is issued by Challenger Life Company Limited (ABN 44 072 486 938) (AFSL 234670) (“Challenger”). You should consider the appropriateness of the product for your circumstances and read the product disclosure statement (PDS) before deciding whether to acquire this product. You can download the PDS from challenger.com.au/guaranteedtermannuity.htm, or call QInvest on 1800 643 893. The QSuper Board and QSuper Limited are not licensed to provide financial product advice about this product. You should consider obtaining financial advice before making a decision about this product.

1300 360 750 qsuper.qld.gov.au/annuity

10 Super Scoop March 2014

For more choice, control and convenience log in now at qsuper.qld.gov.au

Check out the new, improved Member Online. The enhanced features are too good to miss!

Log in miss out Log in :) or miss out :(

4 Track your super 4 Update your payment details 4 Manage your investments

scoopWhat’s the?Here’s the latest round-up of what’s new at QSuper, and for the super industry.

We’re introducing fortnightly paymentsWe’re always looking for ways we can better meet your needs. That’s why we’ve introduced the option for you to have your Income account payments made fortnightly. This is in addition to the existing annual, half-yearly, quarterly and monthly payment cycles. You can request a change to the frequency of your payments through Member Online or by completing an Update an Income Account form.

Removal of Indexed Mix investment optionWe closed the QSuper Indexed Mix option on 16 December 2013. The primary reason for this move was the number of similarities with the QSuper Balanced option, which is lower risk than the QSuper Indexed option and carries a similar return objective. If you were formerly in the QSuper Indexed Mix option you would have been transferred to the QSuper Balanced option, unless you chose to transfer to a different option.

Change to QSuper Board structure There’s been a number of changes to our Board of Trustees following recent amendments to the QSuper Act. The number of trustees has been reduced from twelve to nine and trustees can now only serve a maximum of nine years. The Board now comprises of four employer representative trustees, four member representative trustees and one independent trustee. As part of these changes, Karl Morris was appointed as Chairman of the Board on 1 January 2014. For a full list of changes visit qsuper.qld.gov.au/board.

Unlimited investment switchesWe’ve removed the limit on the number of investment switches you can make for Accumulation and Income accounts, giving you greater control and flexibility to choose how your super is invested. You’re also able to make a switch online at any time using Member Online.

QSuper caps administration feeQSuper is committed to providing great value to our members. That’s why we’re capping administration fees effective from the 2013/2014 financial year. This means that if you pay more than $1,540 in administration fees in a financial year (totalled across all your Accumulation or Income accounts) you will receive a rebate for this excess amount back into your QSuper account/s.

Some important points to note about the rebate:

4 It will be paid to your QSuper account/s in July of the next financial year – with the first payment in July 2014 – although to be eligible you must still hold an Income or Accumulation account at the time the rebate is paid.

4 Any rebate that relates to fees paid on your Accumulation account will have an amount deducted from it for tax purposes.

4 If the value of the rebate paid to an account is 5% or more of your account balance on the day it’s paid, it will count towards your concessional contributions cap.

For more information about the administration fee cap and rebate, please see qsuper.qld.gov.au/feecap.

Important information from the QSuper Board

11Super Scoop March 2014

QSuper has a range of investment options, each with different strategies, objectives and risk profiles. We publish a standard risk measure1 (SRM) that estimates the probability of negative annual returns over a given period. However the level of investment risk that’s right for you is very individual, and the risks associated with different asset classes can change over time. In this new regular feature our Investments Team provides details of how current market conditions could impact our investment options over the coming two to three years.

Understanding the potential impacts of market conditions on QSuper’s investment options

Risk OutlookTHE INVESTMENT

MARCH 2014

Past performance is not a reliable indicator of future performance. 1 The Standard Risk Measure (SRM) is based on industry guidance which allows members to compare investment options that are expected to deliver a similar number of negative annual returns over any 20 year period. The SRM is not a complete assessment of all forms of investment risk, for instance it does not detail what the quantum of a negative return could be or the potential for a positive return to be less than a member may require to meet their objectives. Further, it does not take into account the impact of administration fees and tax on the likelihood of a negative return. For more information, please refer to the Investment Choice Guide, available on our website or call us and we can send you a copy. 2 Average annual return for the QSuper Cash option for the last ten years has been 4.13% per annum.

YOU

R CH

OIC

E O

PTIO

NS

(inve

sted

in a

sing

le a

sset

cla

ss)

REA

DY

MA

DE

OPT

ION

S (d

iver

sified

acr

oss a

sset

cla

sses

)

Talk to an expert If you want advice on an investment strategy that is right for you, contact QInvest today.

1800 643 893 qinvest.com.au

Log in miss out Log in :) or miss out :(

Potential for lower returns than normal.2 Lingering effects of the GFC have seen major central banks around the globe lower their cash rates to record lows in an effort to stimulate economic growth. While Australia’s cash rate has not dropped to the extreme lows seen elsewhere, at 2.50% it is still below the average for the last decade, and in fact the lowest it has been since the 1960s. With Australian mining investment expected to continue to decline further in the short term, and to continue to weigh on near-term economic and employment growth prospects, market pricing suggests the cash rate will remain low for a while longer.

Returns likely to be lower than recent strong returns. Another result of low cash rates is lower bond yields. For example the yield on Australian Government 10-year bonds is currently around 4.2% per annum, which is considerably lower than the rate of 6.5% seen as recently as 2008. As yields have fallen significantly, it has brought about some capital gains for bonds in recent years, consequently boosting returns for this option. However, such high returns are unlikely to continue in the years ahead, particularly as major offshore central banks normalise monetary policy as economic growth recovers further.

Slow growth and continuing volatility. There are currently a number of issues around the globe creating uncertainty for major share markets. Among them is the impact on economic growth, global liquidity and asset prices as the US Federal Reserve unwinds its quantitative easing program. Partly owing to this, sentiment toward Emerging Markets (EMs) has capitulated over the financial year to date. This, in turn, has question-marked the potential growth rate (and future earnings potential) of the EM region more broadly, which may also carry implications for the economic recovery currently underway for some developed economies. Meanwhile, questions around the ability of ‘Abenomics’ to reflate the Japanese economy remains an ongoing source of uncertainty, and in Europe, the growth recovery remains in its infancy. While returns for International Shares over the last year have been strong, the uncertain outlook for this option means that it is likely to experience ongoing volatility.

Global volatility and Chinese growth create uncertainty. While this option is impacted by the global economic issues outlined above, additional factors including rising unemployment and high household debt, an uncertain path for the still-elevated Australian dollar and a structural slowdown in Chinese economic growth, could all affect the returns of the Australian Shares option in the coming years. There is a high concentration of mining and banking stocks in the Australian share market that are sensitive to the evolution of these economic outcomes, as well as others not listed here. Despite recent strong share market returns, higher volatility for this option is likely in the foreseeable future.

Managing risk through diversification. Our Ready Made options consist of various mixes of the asset classes discussed above, as well as having a degree of exposure to property, infrastructure and alternatives. Because of this, many of the potential market risks already discussed will apply to our Ready Made options (see our website for current asset allocations). For example, the QSuper Moderate option has significant exposure to cash, so the challenges associated with cash will be a significant consideration for this option. However the risks posed to both the International and Australian Share options will be of more relevance for the QSuper Aggressive option, as it is dominated by equity risk.

The QSuper Socially Responsible and QSuper Balanced options, also have significant equity risk, so they will be impacted by the global economic issues discussed above. These options also invest in bonds, so having exposure to both may have the effect of reducing overall volatility in these options.

A challenging outlook. Our investment specialists manage our options within ranges set by the QSuper Board, and constantly monitor markets in order to manage risk and identify emerging opportunities.

However the current investment environment poses a number of challenges, highlighting the importance of taking a diversified approach to your investments in order to protect against the risk of too much exposure to any single asset class.

QSuper Balanced

QSuper Moderate

QSuper Socially Responsible

QSuper Aggressive

Cash

Diversified Bonds

International Shares

Australian Shares

Report CardAs at 28 February 2014

Contacting QSuperContact Centres70 Eagle Street Brisbane63 George Street BrisbanePh 1300 360 750+617 3239 1004 (international) Fax 1300 241 602+617 3239 1111 (international)Monday to Friday 8.30am to 5.00pm AESTGPO Box 200 Brisbane Qld 4001qsuper.qld.gov.au

Find us on:facebook.com/qsuperfundtwitter.com/qsuperfundyoutube.com/qsuperfund

SuperRatings does not issue, sell, guarantee or underwrite this product.Chant West has given its consent to the inclusion in this edition of Super Scoop of the references to Chant West and the inclusion of the logos and ratings or awards provided by Chant West in the form and context in which they are included. The Chant West ratings logo is a trademark of Chant West Pty Limited and used under licence. It is only current at the date awarded by Chant West. The rating and associated material is only intended for use by Australian residents within the jurisdiction of Australia and is not permitted to be considered or used by a party outside of Australia.

Important information This information is provided by the fund administrator, QSuper Limited (ABN 50 125 248 286 AFSL 334546) which is ultimately owned by the QSuper Board (ABN 32 125 059 006) as trustee for the QSuper Fund (ABN 60 905 115 063). This information has been prepared for general purposes only without taking into account your objectives, financial situation, or needs and should not be relied on as legal or taxation advice, nor does it take the place of such advice. Any statements of law or proposals are based on our interpretation of the law or proposals as at the time of printing. As a result, you should consider the appropriateness of the information for your circumstances and read the product disclosure statement (PDS) before deciding whether to acquire, or continue to hold, a product. You can obtain a PDS at qsuper.qld.gov.au or by calling us on 1300 360 750. Unless stated otherwise, all products are issued by the QSuper Board as trustee for the QSuper Fund. Where the term ‘QSuper’ is used in this document, it represents the QSuper Board, the QSuper Fund and QSuper Limited, unless expressly indicated otherwise. If you do not wish to be contacted except when required by legislation, please call us. QInvest Limited (ABN 35 063 511 580, AFSL and Australian Credit Licence number 238274) (QInvest) is ultimately owned by the QSuper Board (ABN 32 125 059 006) as trustee for the QSuper Fund (ABN 60 905 115 063), and is a separate legal entity which is responsible for the financial services and credit services it provides.

QSuper investment options1 year% p.a.

Yearto date

3 year% p.a.

5 year% p.a.

10 year% p.a.

Investment returnsQSuper Income account

Ready Made options

QSuper Moderate 7.39% 8.22% 7.47% 8.62% 6.82%

QSuper Balanced 11.32% 12.00% 9.88% 12.42% 8.47%

QSuper Socially Responsible

12.75% 15.26% 9.94% 11.52% n/a

QSuper Aggressive 15.98% 18.96% 11.69% 14.78% 8.78%

Your Choice options

Cash 1.62% 2.53% 3.54% 3.96% 4.67%

Diversifi ed Bonds 5.36% 4.94% 7.53% 8.60% n/a

International Shares 18.11% 25.49% 13.88% 20.56% n/a

Australian Shares 19.01% 14.75% 10.55% 16.58% n/a

Past performance is not a reliable indicator of future performance. Returns may vary considerably over time. Each of the options has a different objective, risk profile and asset allocation. Visit the Investment options page on the website for more detailed information. Changes to inflation, fees, asset allocations, option objectives and risk play a significant part in the return of any investment option.

QSuper feesQSuper is committed to keeping the fees for our investment options among the lowest in Australia. For information on the fees for all our investment options, see qsuper.qld.gov.au/fees.

© QSuper Board of Trustees 2014. 6557 03/14 Pension12 Super Scoop March 2014

Investment

UpdateemailSubscribe now to our quarterly email update to receive all the latest investment and economic news affecting your super.

Subscribe nowqsuper.qld.gov.au/qusignup

Exclusive QSuper Member Competition

Fancy being the face of our upcoming publications and campaigns? Visit qsuper.qld.gov.au/realmembers to leave your details and attach a recent photo.

You’ll automatically be in with a shot at winning a digital SLR camera kit.

The promoter of this photographic competition is QSuper Limited (ABN 50 125 248 286). Full terms and conditions are available on our website.

Send us your super selfies and win yourself a great prize!