Mauro Maia: GAD presentation 2011

-

Upload

mauro-maia -

Category

Business

-

view

117 -

download

1

description

Transcript of Mauro Maia: GAD presentation 2011

Global Airport Development Conference 2011

Italian Airport Industry

Dr. Mauro MaiaF2i, Senior Partner

Barcelona, 9 November 2011

Indice

2

1. F2i page

3

2. Gesac transaction page 12

3. Italian airport industry page16

4. New opportunities in the airport sector page 19

3

F2i

F2i position in the Italian infrastructure market

4

With a Fund Raising equal to €1.85 billions, F2i is the biggest Italian Private Equity Fund as well as one of the largest Country Focused Infrastructure Fund

The success of F2i proposition is supported by achievements on both sides: fund raising and investments

In raising capital, F2i was able to attract huge private and public amount of money notwithstanding the heavy international financial crisis (anti-cyclical and defensive concept)

In investing money, F2i is demonstrating to be seen as the flagship Italian Investor in strategic assets of the country

5

Investors 1/2

CDP

F2i – Fondo Italiano per

le Infrastrutture

2 Banks(1 Core Investor)

2 Major Italian Banks

19 Other Foundations (2 Core Investors)

1 International Bank

3 Insurance Companies(3 Core Investors)

10 Social Security Institutions & Pension Funds

(4 Core Investors)2 Institutional

Investors

2 Other Banks(1 Core Investor)

Italian Investors International Investors

7 Major Italian Foundations

2 Social Security Institutions

SGR’s Shareholders

(General Partners or Sponsors)

(Limited Partners)

F2i Investors 2/2

6

F2i Investors

Banks € 628.000.000,00 33,91%

Pension Funds € 449.000.000,00 24,24%

Banking Foundations € 442.000.000,00 23,87%

Insurance Companies € 175.000.000,00 9,45%

Sovereign financial Institutions (CDP) € 150.000.000,00 8,10%

Sponsor & Management € 8.000.000,00 0,43%

Investor Amounts % of the Fund

Totale F2i € 1.852.000.000,00 100,00%

Strong Capital Commitment and Endorsement

7

The two leading Italian banking groups, with more than 10,000 branches in Italy and total assets over €1,500bn

The Italian Government through CDP (70% owned by the Italian Government), leader in financing of local and regional governments in Italy, with 29% market share

International financial players with strong and recognized presence and experience in Italy

Qualified representatives of major institutional investors in Italy (banking foundations and professional pension funds)

Sponsors providing €938bn

Total commitments already reached €1.85bn

Combination of local relationships and global experience

F2i benefit from full endorsement of its Sponsors

F2i is the leading partner for infrastructure investments in Italy

7 Banking Foundations

2 Italian Pension Funds

Part of Group

A Leading Group of Sponsors:

Summary of Key Terms

8

Size: €1.85bn Duration: Up to 15 (+3) years (expected average life

7,5y) Investment Period: 4 (+2) year Legal Structure: Typical limited liability

partnership Management Company: F2i SGR

Greenfield limited to <20% of the fund Single assets limited to <15% of the fund

Italian infrastructure opportunitieso Ports and Airportso Motorwayso Power and gas infrastructureo Utilitieso Telecom infrastructureo Other infrastructure (PPP, water, railways, …)

Equity or quasi-equity Majority or influencing minority stakes

Fund Characteristics

Investment Focus

Diversification Rules

Return on investment

Minimum target return* (“hurdle rate”) : IRR = 8% gross per year (on average)

Effective target return: IRR = 12-15% gross per year (as indicated in the Business Plan of the fund)

Dividend guaranteed over the fund’s duration period

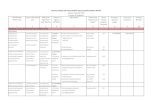

F2i Portfolio As of today the Fund has commetted 1.233 M€, representing 66% of the total amount, invested in 11

companies, by creating a structured groupImpegnato

(M€)Erogato

(M€)%

75% 85,2%

100%

100%

49%

100% 40,0%

100% 100% 70,0%

87,5% 60,9%

15,7%

100%

49,8%

26%

*Si intende compresa la partecipazione in Software Design. 1.171 683 58%

Partecipazione in Interporto Rivalta Scrivia dismessa

29 29

Transaction cost 33 33

TOTALE 1.233 745 60%

100%F2i

Reti Italia

ENELRete Gas 279 279

2i Gas 71 71 100%

G6 Rete Gas 68 68 100%

F2i Rete Idrica Italiana

Mediterranea delle Acque 235 2 1%

F2i AeroportiF2i Sistema

Aeroportuale Campano

GESAC* 88 28

F2i Reti TLC Metroweb 214 115 53%

F2i Renewables

HFV 50 25 50%

Infracis 53 31 58%

Alerion CleanPower 78 64 82%

31%

ENEL Stoccaggi 35 2 5%

GAS

ACQUA

AEROPORTI

TLC

RENEWABLES

TRASPORTI

Commetted€/mln

Payed out€/mln

Partecipation in Interporto RivaltaScrivia (realized)

TOTAL

* Includes 54% stake in Software Design

F2i profile

10

Acquire brownfield regulated assets, sold both Private and Public Entities

Ensure industrial management of the companies by promoting efficiency and managerial development

Promote aggregation processes, in very fragmented sectors with high growth potential

Involving companies’ management teams, as medium-term shareholders

F2i has an institutional profile that ensures a stable and long-term partnership without speculation. This make the Fund an ideal partner for both private and pubblic entities

Among others, F2i is able to:

Development through “industrial chain”

11

Italian infrastructure sectors are often characterized with a lack of overall strategy

In this respect, the infrastructure assets are managed by considering the needs of local (and political) context, without considering strategic function for the Country overall

For this reason a lot of infrastructure sectors are fragmented, expressing companies with weak financial profiles; such companies cannot compete in markets more and more internationalized

Moreover, the lack of Italian strategy in the infrastructure sectors, has often made national assets easy prey of foreign companies, “national champion” in referring Countries (E.On., GdF, EdF, ecc.)

Need to introduce the concept of “industrial chain” in each infrastructure sector

F2i operates as a “public company”: each investment is realized with the target of creating a chain in the specific segment in order to assure the cooperation among the companies belonging to the same chain

12

Gesac transaction

Gesac at a glance

13

Gesac is the management company of Napoli Capodichino Airport, by virtue of a concession expiring in 2043. Gesac is one of the first company that has obtained – at the end of 2009 – the approval of Contratto di Programma with Enac, by negotiating a 25% average increase in tariffs

Gesac was founded in 1980 by Municipality and Province of Naples (with equal stake of 47,5%) and Alitalia (5%). In 1997, as a consequence of privatization process, an equity stake of 70% of Gesac was sold to BAA group (acquired in 2006 by Spanish group Ferrovial)

With 5.6 M/pax in 2010 (+5.7% vs 2009), Capodichino is the second regional airport after Catania, by excluding Rome, Milan and Venice airport hubs. Capodichino has a large catchment area, with a density area comparable to cities like Tokyo and London

The airport ground covers an area of 234 ha, with a runway 2,628mt long and 45mt wide, capable to allow the landing of many different types of aircrafts, with 27 aircraft parking slots

The infrastructure has been consistently object of expansion and improvements; since 1996, Gesac has realized over € 200 mln investments, both self-financed and granted by the State

The capex plan for the 2010-2012 period envisages total expenditures for € 62.4 mln of which € 50.4 mln are self-financed and € 12 mln are financed through government grants (PON funds)

F2i investment in Gesac

14

On December 21th 2010 F2i has acquired from BAA Italia a 65% stake in Gesac and a 54% stake in Software Design – company specialized in airport software – for a total amount of € 150 mln in terms of Enterprise Value

As of March 2011 F2i holds 70% stake in Gesac, following the acquisition from SEA of 5% additional stake with a discount of 27% vs Ferrovial price

The transaction structure envisaged the acquisition by F2i through a newly incorporated company (“F2i Bidco”) wholly owned by F2i

In order to fund the transaction, F2i has used an appropriate mix of equity and debt financing that has included:

Acquisition Loan granted to F2i Bidco for a total amount of € 80 millions;

Capex Line granted to Gesac for a total amount of € 40 millions, to be used over the business plan period to fund the envisaged capex plan and Gesac financial requirements

Bridge to Equity of € 40 millions granted to F2i Aeroporti in order to coverage a portion of the remaining part of the price

F2i Aeroporti

F2i Bidco

Gesac

Acquisition loan(€ 80 mln)

Capex Line(€ 40 mln)

100%

70%

F2i

100%

Bridge to Equity(€ 40 mln)

Software Design

54%

Rational of Gesac investment

15

Gesac’s transaction has allowed F2i to enter in the airport sector, by acquiring a majority stake in a company characterized by significant track record and high growth potential

In long-term period F2i wants:

to promote business and infrastructural development and system rationalization and

to reach high profitability levels, also improving on social and economic system overall

Moreover, F2i has created an investment strategy draw to the creation of a network of regional airports: a strategy of “national network” rather than “runway”, that ensure an aggregation process

Ongoing privatization processes represent a driver for the development of this strategy, given the high presence of Public Entities in several airports

16

Italian airport industry

17

Italian airport industry

PMO

CTA

TRN

CUF MXP

VBS

LIN

BGY

BZO TSF

TRS

VCE VRN PMF FRL

FLR PEG

BLQ RMI

AOI

PSR

FCO CIA FOG BRI

GOA

NAP BDS

SUF CRV

TPS REG

AHOOO

OLB

CAG

PSA

SIE

Airports >10 mil pax

Airports > 5 < 10 mil pax

Airports > 2 < 5 mil pax

Airports > 0,25 < 2 mil pax

Airports < 0,25 mil pax

High density area

The Italian airport industry is characterized by:

High “public” presence in the shareholder structure of the airport management companies;

Small size of the airports (very fragmented, by region);

Low connectivity level in Europe and worldwide;

Considerably lower tariffs level compared to European tariffs

Lack of investments realized over the recent years

Italian airport sector trends

With over 140 millions passengers per year, Italy is among the major airport markets in Europe and among the top performers in terms of actual traffic growth rates

Over the last years Italian airport industry has been highly dynamic with a considerable growth in traffic volumes with the exception of a slight decrease between 2008 and 2009 as a consequence of the global recession which has heavily affected the industry on a worldwide basis

Current trends will lead to a reduction of the gap compared to other European countries drived by:

Ongoing privatization processes

General increase in tariffs following the introduction of the new tariff regulatory framework and the enforcement of Contratto di Programma (already signed by some airports in Italy such as Napoli, Pisa and Brindisi)

Increasing in capex to improve infrastructures

92 90 92 101

108 114

124

136 134 131 140

0

20

40

60

80

100

120

140

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010

2000-2010 Passengers’ trafffic in Italy

+ 4.2%CAGR 2000-2010

2010 +7.0%

18

19

New opportunities in the airport sector

Italian airport sector: current scenario 1/2

20

Local Entities, in quality of airport management companies majority shareholders, should finance airports’ development, but as of today they are in difficult financial situation:

Moreover, the same companies that managed the services have a lot of problems connected to their public nature:

Plurality of public shareholders (generally very small, without a reference shareholder)

Lack of financing resources necessary to realize significant capex programme for maintenance and development of managed assets

A very fragmented sector, because of lack of defined national development plan

Italian airport sector: current scenario 2/2

21

Financial troubles, difficulties in managing companies and infrastructural deficit caused a progressive reduction of Local Entities’ interest in the airport management companies

In fact, in this situation Local Entities are interested in carrying out privatization process of the managed assets…

..With a consequent need to identify the right private partner

F2i was born also for taking part to this new season of privatizations

Institutional profile of the Fund ensures a stable, long term partnership without speculations

Moreover, F2i strategy aims to:

Valorize companies’ internal professionals and the economic and industrial network

Give financial support for efficiency processes and investments plans

This makes F2i the ideal partner that can ensure a public company profile to privatized airport companies

22

SEA S.p.A. – Milan airports

SEA is the management company of Linate and Malpensa Milan airports by virtue of a concession expiring in 2041

SEA holds also a 30% stake in SACBO, the management company of Bergamo airport

The company is waiting for the final approval of Contratto di Programma by the end of 2011 (to last 10 years) that will set new tariffs level

With over 27 millions passengers per year, Milano airport is the second airport in Italy after Rome hub

Company Profile Traffic Data

Key Financial Data

27 26 25 26 28 29 31

34

28 26

27

0

5

10

15

20

25

30

35

40

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010

+ 3.41%CAGR 2000-2007

2010 +5.4%

- 12.6%CAGR 2007-2009

Shareholder structureMunicipality of Milan 84.56%ASAM (Province of MI) 14.56%Province of Varese 0.64%Other public shareholders 0.19%Private Shareholders (n. 514) 0.05%Total 100.00%

€/millions 2009 2010

Revenues 581 573EBITDA 140 132

Ebitda margin 24% 23%Net Income 55 63

Equity 325 394NFP 362 345

23

Milan airports: InfrastructureMalpensa Linate

Malpensa Terminal 1 and 2

9,000sq m. shopping area

7,815sq m. restaurant area

11,430 car parking slots

Runway: 2 parallel runways 3,940 mt long with a capacity of 26 millions in terms of passengers (70 movements/h)

Linate Terminal

2,715 sq m. shopping area

2,815 sq m. restaurant area

3 car parking areas: 7,300 slots

Runway: one runway 2,440 mt long with a capacity of 10 millions in terms of passengers (18 movements/h)

24

Milan airports: market opportunity

At the beginning of 2011 the company, supported by Mediobanca, Banca IMI and Morgan Stanley, has started IPO process in order to place a 30-35% stake to the public through a reserved capital increase

As of today, current market situation make difficult IPO process

On October 28th, F2i has submitted to Municipality of Milan a non binding offer for acquiring 20% stake in SEA and 18,6% stake in Milano Serravalle (motorway sector)

After F2i’s offer, Municipality of Milan has expressed intention to call for competitive tender (realized by the end of the year) for the sale of a minority stake in SEA individually or jointly with a minority stake in MI-Serravalle

25

Ali Trasporti Aerei S.p.A. – ATACompany Profile Traffic Data

Key Financial Data

Ali Trasporti Aerei S.p.A., a company belongs to Acqua Pia Antica Marcia Group, manages the general aviation airport infrastructure in Milano Linate Ovest by virtue of a sub-concession signed in 2008 and expiring in 2041

Moreover, ATA is in charge of handling activity in Linate Ovest and Roma Ciampino (through the subsidiary ATA Servizi)

With over 60 thousand passengers per year, Milano Linate Ovest is the first airport in Italy and the fourth in Europe in the segment of general aviation

13

26 24

25 27

28

32 30

34

28 28

0

5

10

15

20

25

30

35

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010

+ 13%CAGR 2000-2007

-1.8%CAGR 2007-2010

Shareholder structure

Società dell'Acqua Pia Antica Marcia 98.34%Private Shareholders 1.66%Total 100.00%

€/millions 2010

Revenues 16.7EBITDA 3.7

Ebitda margin 22.0%Net Income 2.7

Equity 14.2NFP -1.6

26

ATA: Infrastructure

Linate Ovest general aviation terminal covers an area of 130,000 sq m. It includes, among others:

8 hangars: 14,438 sq m. 3,516: office area4 fuel deposits330 sq m. warehouse area67,000 sq m.: airport ground Parking area: 300 slots

Company’s investment plan for the period 2011-2014 forecasts € 30 millions of capex, and includes, among others:

the development of new hangar of 8,000 sq m. new office area of 2,000 sq m. additional parking areaadditional terminal area

27

ATA: market opportunity

The group Acqua Pia Antica Marcia (Caltagirone Group) is concluding a debt restructuring plan in order to reduce its financial exposure by selling some group’s assets

In this context Rothschild, as Vendor’s advisor, has set a competitive auction for the sale of ATA Trasporti individually or jointly with its subsidiary ATA Servizi (handling)

F2i is interested in acquiring the company ATA Trasporti and has already submitted a non-binding offer to the Vendor

Press news report as possible buyers both airport operators (SAVE, Fraport Aèroports the Paris) and infrastructure investors (Rreef - Deutsche Bank, Venice European Investments)

As of today, it is not defined a deadline for submitting binding offer

28

Aeroporto di Genova S.p.A. - Genova AirportCompany Profile Traffic Data

Key Financial Data

Aeroporto di Genova S.p.A. manages the international airport of Genoa, by virtue of a total concession valid until 2027

Built on an artificial peninsula – equidistant from both centre and port of Genoa – the airport holds a strategic position both in Europe and in the local area

The airport serves both the commercial and the general aviation traffic. In 2010 the total passenger traffic amounted to 1.3 millions, recording an increase of 13.3% vs 2009, (growth mainly driven by the domestic traffic increase)

1,1 1,0 1,0 1,1 1,1

1,0 1,1

1,1 1,2

1,1

1,3

0

0,2

0,4

0,6

0,8

1

1,2

1,4

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010

+ 1.9%CAGR 2000-2010

Shareholder structure

Genoa Port Authority 60.00%Genoa Chamber of Commerce 25.00%A.D.R. Aeroporti di Roma 15.00%Total 100.00%

€/millions 2009 2010

Revenues 21.0 23.1EBITDA -0.1 2.1

Ebitda margin n.s. 9,1%Net Income -1.2 0.1

Equity 5.2 5.3NFP -8.1 -9.5

29

Genova Airport: Infrastructure

The terminal sized for an hourly flow of 1,500 passengers

The development plan of the terminal foresees:

the doubling of check-in desks

new dedicated area for Low Cost carriers and

new commercial areas in order to increase retail, F&B and advertising activities

The renovation will be done without affecting the present traffic and services to the passengers

Cargo terminal 6,000 sq m. warehouse area 3,150 sq m. of office area 4,000 sq m. lorry park

Passengers terminal 5 loading bridges 14 check-in desks 5 ticketing desks 8 snack bar and duty free 7 car rentals

30

Genova Airport: market opportunity

On June 22nd 2011, Genoa Port Authority has published a tender for the sale of 60% stake in the company, and at the beginning of September Virtual Data Room was opened

F2i, together with other bidders, has taken part to the procedure

Because of process delays, the deadline for the binding offer has been shifted from October 20th to December 19th 2011. At the moment other delays are expected

Press news show as possible buyers both national (local entrepreneur Aldo Spinelli) and international operators (MSC – shipping company; Limak Yatirim – Istanbul and Pristina airports; Vinci Airports)

31

SO.GA.ER. S.p.A. – Cagliari AirportCompany Profile Traffic Data

Key Financial Data

SO.GA.ER. S.p.A. is the management company of Cagliari airport by virtue of a concession expiring in 2047

SO.GA.ER. was built in 1990 by Cagliari Chamber of Commerce, that is still the majority shareholder

By excluding Rome, Milan and Venice hubs, Cagliari Airport, with over 3 millions passengers per year, is the seventh regional airport in terms of traffic

The process for the approval of Contratto di Programma (that will set new tariffs level) is underway

Given tourist attractions of the territory, the airport is directly connected with to main European capital cities

2,1 1,9

2,2 2,3 2,3 2,4

2,5 2,7

2,9

3,3 3,4

0

0,5

1

1,5

2

2,5

3

3,5

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010

+ 5.2%CAGR 2000-2010

Shareholder structure

Cagliari Chamber of Commerce 94.35%S.F.I.R.S. S.p.A. 3.43%Sardegna's Bank 1.05%Other Shareholders 1.17%Total 100.00%

€/millions 2009 2010

Revenues 27.5 29.0EBITDA 1.7 2.8

Ebitda margin 6,2% 9,7%Net Income -1.3 1.2

Equity 10.3 11.5NFP 7.7 6.1

32

Cagliari Airport: InfrastructureAir side Runway: 2,803 mt long and 45

mt wide Opening: 24h Airport ground: 296 ha Apron: 96,000 sq m. Aircraft parking slots: 16

Land side 37,000 sq m. terminal area 5,798 commercial area 14 gates 42 check in desks

In the last years the airport has been improved, by becoming one of modern infrastructure in Italia and in Europe

New terminal can underpin a flow of 4,5 millions passengers Investment realized include the following:New terminal;Additional roadsTwo parking areasNew runway

33

Cagliari Airport: market opportunity

On September 30th 2010 Cagliari Chamber of Commerce has published a tender for the sale of at least 40% stake of SO.GA.ER. After this announcement, the procedure has suffered many delays

The Virtual Data Room was opened on October 4th 2011, but it is not defined a deadline for the binding offer

F2i has submitted a call of interest and is taking part to the process

Press news show as possible buyers both airport operators (SAVE, Fraport, Flughafen Zurich, Aeroporto di Olbia) and financial investors (F2i, Dvr&C Private Equity e Axa Investment)