Marketing BPS

-

Upload

cherine-cherie -

Category

Documents

-

view

221 -

download

0

Transcript of Marketing BPS

7/27/2019 Marketing BPS

http://slidepdf.com/reader/full/marketing-bps 1/8

37000 – Marketing Strategy – Orhun BPS Major Case Write-up

Authors:

Harvey, SuzanneHolt, MargaretLarson, PhilipVillalon, DanielWilhite, Nathan

Barco Projection Systems (BPS): Worldwide Niche

Marketing

We pledge our honor that we have not violated the Honor

Code during this examination or case write-up.

Suzanne Harvey, Margaret Holt, Philip Larson, Daniel Villalon, Nathan Wilhite Page 1

7/27/2019 Marketing BPS

http://slidepdf.com/reader/full/marketing-bps 2/8

37000 – Marketing Strategy – Orhun BPS Major Case Write-up

Barco Projection Systems (BPS)

ISSUES AND RECOMMENDATIONS:

BPS faces a significant threat to its current market share in both the mid- and high-end projector markets

(i.e., the data and graphics projector markets) and has lost its position as the leader in innovative projector

technology. This threat stems largely from Sony’s introduction of the 1270 projector, which is superior to BPS’s

current product line in terms of both performance and price. Additionally, despite rapid growth in the high-end

market segment,1 BPS has not released a new “graphics” projector in over two years. Further, by defining the

market based on a single product feature, scan rate2, rather than on the package of benefits consumers demand

(e.g., ease of use and better overall picture quality), BPS has failed to protect its market position.

BPS’s near-term product options are to: 1) continue developing the BD700, an inferior product to the

Sony 1270; 2) halt the production of the BD700 and develop the comparable but still inferior BG700; or 3) turn

immediately to the development of the superior BG800. Regarding pricing, BPS can preemptively reduce prices

on existing products to limit Sony’s ability to capture market share or it can wait to adjust pricing until final 1270

pricing is announced. Given this competitive landscape, we recommend that BPS: 1) stop development of the

BD700 and focus on developing the BG800 to reestablish its dominance at the high-end of the market; and 2) wait

to adjust pricing on existing products until Sony’s pricing is announced.

BPS must recapture its position as the leading innovator in the industrial projector market because: 1)

BPS’s competitive advantages in R&D (electronics) and distribution network (established relationships with

systems dealers) are only valued in the mid and high-end of the market; and 2) its current product and pricing

strategies are not sustainable. If BPS does not offer a competitive product to the 1270, it stands to lose significant

market share and profits, and its products will likely be rendered obsolete. Given BPS’s size in comparison to

Sony, BPS will not survive by competing purely on price.

PRODUCT:

Rolling out the BD700 as planned and introducing the BG800 in late 1990 is not a viable option because

every BPS data and graphics projector would immediately become obsolete and uncompetitive against the 1270.

1 See Figures 1 and 2 in the Appendix showing expected growth of the worldwide projector market by segment.2 See Figure 3 in the Appendix suggesting that, historically, scan rate has been the best predictor of projector price.

Suzanne Harvey, Margaret Holt, Philip Larson, Daniel Villalon, Nathan Wilhite Page 2

7/27/2019 Marketing BPS

http://slidepdf.com/reader/full/marketing-bps 3/8

37000 – Marketing Strategy – Orhun BPS Major Case Write-up

While this option poses the least execution risk because the R&D work and marketing efforts are already in

progress, BPS would lose, at a minimum, 73% of its 1990-1993 forecast profits3 and its position as a leading

innovator. BPS’s market share (and profits) would shrink drastically and it would no longer be able to invest in

new technology that would allow it to charge premium prices. Additionally, BPS could face significant attrition

in its distributor and dealer networks as resale and services revenue and margins for BPS product lines decrease.

BPS’s second product option (halt development on the BD700 and focus on the BG700) is also not

viable. The BG700 would have the same basic functions as the BD700 and would not outperform the 1270 on

any common industry measure (e.g. scan rate, resolution, lumens). As such, BPS would lose significant market

share under this option. Further, without premium features, the BG700 would have to be priced to compete with

the 1270. While this option poses minimal execution risk compared to option one (i.e., the BG700 could launch

in 2-3 months), BPS would lose, at a minimum, 85% of its 1990-1993 forecast profits4. This option would delay

the launch of a competitive projector even further and would severely damage BPS’s reputation for innovation.

Consumers would likely purchase the Sony 1270 rather than wait to purchase an inferior product from BPS.

BPS’s only viable strategy is to suspend other projects and devote all resources to developing the BG800,

which will command a price premium over the 1270 and reestablish BPS as the leading innovator in projector

technology. Under this approach, BPS bears supplier risk (i.e., ability to source the necessary lenses), risk to

company morale (e.g., R&D team and the overtime required), and risk related to the product launch (40% chance

the BG800 will be ready for Infocomm); however, these risks are necessary for BPS to compete with Sony and

save its position in the market. If the BG800 is launched by Infocomm, this approach will enable BPS to grow

revenues and profit margins to $57M and 24.2%, respectively, by 1993.5 This represents a 50% reduction to

BPS’s forecast profits from 1990-1994, however, this drop in profits is significantly less than the profit decline

under the other product alternatives and provides the best potential for future growth. Furthermore, this strategy

sends a positive signal to systems dealers who depend on BPS’s high-end market leadership for their resale and

services margins.

3 This estimate assumes only market share declines and no prices are lowered. Hence, this is the minimum loss. See Figure 4in the Appendix for further detail.4 This estimate assumes only market share declines and no prices are lowered. Hence, this is the minimum loss. See Figure 4in the Appendix for further detail.5 This is a conservative estimate due to assumptions on market share loss in other sectors. See Figure 4 in the Appendix.

Suzanne Harvey, Margaret Holt, Philip Larson, Daniel Villalon, Nathan Wilhite Page 3

7/27/2019 Marketing BPS

http://slidepdf.com/reader/full/marketing-bps 4/8

37000 – Marketing Strategy – Orhun BPS Major Case Write-up

In the long term, the 1270 is not BPS’s only threat. Electrohome, a similarly sized company operating in

the same high-end segment, will also need to position itself against the 1270. With similar positioning and a

distribution channel matched well to that of BPS, Electrohome might be worth engaging in merger discussions.

PRICING:

BPS may either preemptively lower the price of existing products (e.g. BG400 and/or BD600) or wait to

adjust prices until 1270 pricing is announced. A preemptive price drop has major risks and minimal upside. First,

as shown in the Appendix 4, if BPS drops prices immediately, while assuming no change to the planned product

rollout timeline, it will lose 83% of its projected profits over the 1990-1994 period.6 Second, the effect of price

cuts may be diluted by distributors and dealers and even price cuts that reached consumers would not substantially

increase volume sold. Demand from consumers who need projectors immediately is fairly inelastic. Consumers

without urgent needs, on the other hand, will likely hold off on purchasing a new projector until 1270 pricing

becomes available. Therefore, a price drop will not substantially increase volume sales and will only erode BPS’s

premium pricing position. Third, preemptive price cuts might tempt Sony to price the 1270 even lower. This

would further erode BPS’s revenues and could trigger a prolonged price war that BPS cannot win as Sony has

more engineers dedicated to projectors, a larger distribution network, a favorable source of raw materials and a

strong reputation. Fourth, a preemptive price cut could trigger retaliatory action from Sony that would affect

BPS’s supply chain. Sony could refuse to provide the 8” tubes BPS needs or significantly increase their price,

devastating BPS’s ability to release a competitive projector in the near-term. Additionally, Sony could use its

bargaining power to prevent their lens supplier from supplying lenses to BPS.

Waiting to adjust prices in all geographic segments until the 1270 pricing is announced is a better strategy

for BPS. At that time, BPS could cut prices on its old models without cannibalizing immediate sales and without

triggering a potential price war. Additionally, avoiding a steep price cut for the BG400 will help preserve BPS’s

ability to price the BG800 at a premium above the 1270 when it is ready for release. Prior to the BG800 launch,

BPS can then cut prices on its old models and communicate to the market that such price cuts are in anticipation

of the BG800 launch (not in response to Sony’s release of the 1270).

6 See Figure 4 in the Appendix.

Suzanne Harvey, Margaret Holt, Philip Larson, Daniel Villalon, Nathan Wilhite Page 4

7/27/2019 Marketing BPS

http://slidepdf.com/reader/full/marketing-bps 5/8

37000 – Marketing Strategy – Orhun BPS Major Case Write-up

PROMOTION / PLACE:

In addition to refocusing R&D efforts, this product strategy requires BPS to develop a promotional

program to compete with the Sony 1270. Sony’s massive investment in marketing and channel outreach creates

brand challenges for BPS. To ensure the BG800 has a successful launch, BPS should: 1) promote the BG800

heavily in North America and the Far East; 2) reach out to existing customers to highlight the unique benefits of

the BG800 (i.e., picture quality, digital technology and higher scan rate); and 3) offer financial incentives to

dealers and distributors who convert BD700 orders, existing customers and Sony 1270 customers to the BG800.

First, BPS should focus advertising and product rollout in North America and the Far East because the Sony 1270

will be heavily promoted in Europe. BPS will lose graphics market share in Europe but may be able to hold or

increase share in North America and the Far East, which are expected to grow faster over the next five years.

Second, to promote the BG800, BPS needs to communicate the benefits of the new BG800 to both existing

customers and customers with BD700 orders. Customers regularly buy more advanced technology than currently

required and BPS must communicate that the BG800 will be superior to the Sony 1270, making it worth the wait.

Third, BPS needs to train and educate dealers many of whom also sell Sony products on the benefits of the

BG800 and incentivize them with commissions and bonuses on each BG800 sold and on BD700 and Sony 1270

orders converted to the BG800. Sony has likely already begun accepting orders on the 1270, so these extra

commissions and bonuses are critical to ensure messages regarding the BG800 are passed along by the dealers,

many of whom may otherwise push the 1270 in the short term. If BPS fails to take these steps and communicate

the superiority of the BG800, it is likely to lose significant market share and its position as a leading innovator,

despite the accelerated roll-out of the BG800.

CONCLUSION :

BPS faces a significant threat to its current market share in both the mid- and high-end projector markets.

With the introduction of the 1270, Sony has surpassed BPS as the leader in innovative projector technology.

BPS’s future depends on regaining that position because it cannot maintain profitability over the long-term in the

low- to mid-market. To defend its position at the high end, BPS must introduce a superior product, the BG800, as

Suzanne Harvey, Margaret Holt, Philip Larson, Daniel Villalon, Nathan Wilhite Page 5

7/27/2019 Marketing BPS

http://slidepdf.com/reader/full/marketing-bps 6/8

37000 – Marketing Strategy – Orhun BPS Major Case Write-up

quickly as possible. While the execution and supply risks of this strategy are high, the risks of delay are even

higher.

Suzanne Harvey, Margaret Holt, Philip Larson, Daniel Villalon, Nathan Wilhite Page 6

7/27/2019 Marketing BPS

http://slidepdf.com/reader/full/marketing-bps 7/8

37000 – Marketing Strategy – Orhun BPS Major Case Write-up

Appendix

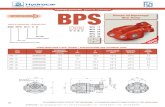

Figures1 and 2: Market for high-end projectors expected to grow rapidly while low-end

decreases. BPS projects sales growth of 12.3% and 25% growth in the data and

graphics market, respectively.

Figure 3: Scan rate is the best predictor of price in the projector market (R 2=.97 with

reasonable standard error). This suggests that BPS’s other technical differentiators are

undervalued.

Suzanne Harvey, Margaret Holt, Philip Larson, Daniel Villalon, Nathan Wilhite Page 7

7/27/2019 Marketing BPS

http://slidepdf.com/reader/full/marketing-bps 8/8

37000 – Marketing Strategy – Orhun BPS Major Case Write-up

Suzanne Harvey, Margaret Holt, Philip Larson, Daniel Villalon, Nathan Wilhite Page 8