MARKET MAPPING OF MODERN COOKING APPLIANCES, …

Transcript of MARKET MAPPING OF MODERN COOKING APPLIANCES, …

MARKET MAPPING OF MODERN COOKING APPLIANCES, BANGLADESH

Utpal Bhattacharjee, Consultant, Practical Action, Bangladesh

March 2021

2

www.mecs.org.uk

1 Executive Summary

Bangladesh is on the transition pathway with a vision of attaining middle-income status by 2021. With an increase in access to electricity and economic upliftment, households across rural, peri-urban and urban areas are more inclined to make use of modern energy cooking appliances. This representative market mapping report has been prepared as a component of Practical Action’s ongoing socio-market assessment on modern cooking appliances funded by the Modern Energy Cooking Services (MECS) programme hosted by Loughborough University, UK.

Throughout the research process, a participatory and interactive approach was implemented to identify key stakeholders such as product importers, manufactures, distributors and retailers of the major divisions and selected districts. Whilst the COVID-19 pandemic and subsequent lockdowns meant that a large number of stakeholder interviews needed to be conducted by telephone or e-mail, we were able to meet several senior officials of multiple renowned local consumer electronics brands in-person. By combining top-down and bottom-up approaches, we were able to identify the modern cookstove market players, their distribution channels, and after sales product warranties and services. Though the market is largely import based, it has been found that a number of local corporations have secured significant investment along with innovative product and service development approaches to secure a place in the market. Alongside the imported home appliances brands and the presence of local manufacturers within the market, a growing ‘no-brand’ market has been developed by small distributors and individual retailers over the last two decades. Information availability on this market in the secondary sources is limited and, thus, we rely on market information shared by shop owners, small importers and retailers.

Using a bottom-up approach, we prepared and circulated a structured set of data questionnaires to collect market and product-related information from the local importers, manufacturers and distributors. The Household Energy Planform (HEP) of the Sustainable and Renewable Development Authority (SREDA), a partner of this initiative, supported us in reaching out to prominent market players by issuing an official data request letter. We followed Practical Action’s Participatory Market System Development (PMSD) strategy to evaluate the market of current modern energy cookstoves available in Bangladesh.

The Bangladesh Crockery Merchants Association (BCMA) noted that ‘2.5 million units of gas-burner[s], 4.0 million cookers and 2.0 million units of non-stick frying pans were sold in 2017’. Concurrently, primary market research by Light Castle Partners revealed a Home Appliances market of USD 251.41 in 2017. According to this study, the rising Middle and Affluent Class (MAC) consumers have played a pivotal role in the growth of the consumer appliances industry in Bangladesh. The market is dominated with imported products, where only a few local electronics brands namely Pran-Rfl, Walton, Hamko and Kiam starting their own production facilities, with limited number of Stock Keeping Units (SKUs) such as pressure cooker and gas stoves etc., but the majority still relies on Original Equipment Manufacturers (OEM) strength to develop and sell cooking appliances in the market. Imported cookstoves are predominantly imported from OEM suppliers located in China and India.

The OEM facilities available in country produce kitchen appliances such as pressure cookers (mechanical), rice cookers, auto-fire single/double burners LPG/NG gas cooker etc. They have already developed a full chain of raw materials for these products and are capable of delivering finished products ordered by local companies. The primary reason for switching to local OEM suppliers for the above products is mainly to avoid high import duties and to ensure standard profit margins from selling those products. Alongside, local electronics companies and importers are also selling modern cooking appliances such as electric pressure cookers, induction and infrared cookers, microwaves and electric ovens, multicookers and hotplates of international brands like

3

www.mecs.org.uk

Toshiba, Sharp, Panasonic, Hawkins, Samsung, LG etc. They see huge potential to expand the modern cooking appliances market in peri-urban and rural areas. However, a lack of awareness and poor customer perceptions of modern cooking appliances have been identified as significant barriers in the scaling-up dissemination of these appliances from the current level.

As previously mentioned, local companies have already developed a full range of cookstoves in the market. Due to fierce competition, the prices of induction and infrared cookers, rice cookers and gas stoves have been significantly reduced in the last couple of years, which has led to increased sales of these cookstove products specifically in peri-urban and rural areas.

Due to a lack of information and the dispersed business nature of the non-brand cookstove market, we could not map those products. However, we discussed these products with a number of non-brand product importers and sellers located at New Market in Dhaka City. From these discussions, it was ascertained that the non-brand market is booming because of price sensitivity in the peri-urban and rural areas, and the sales volume of this market already exceeds the combined kitchen appliances market of local and international brand products. Based on data obtained from popular local electronic brands, we have attempted to evaluate the sales of four selected products over the past three years and show total sales estimates of the tested product categories by these companies through a linear projection up to 2024. As these companies represent a large market share of those products, we believe that our testing will reflect market-specific data to readers.

This market mapping study should not be treated as a conclusive assessment on the modern cookstoves market in Bangladesh, but rather be seen as a preliminary landscaping to understand the market progression of selected modern cookstove technology. Further research efforts are necessary to contemplate the current, as well future, market scenarios of modern cookstoves for different market segments, and especially understand the barriers around customer perceptions to uptake. Modern cookstoves are clean cooking solutions and do not emit any noxious gases into the household. Thus making it safer and cleaner – especially for women and children who are more often associated with the daily tasks of collecting fuels and cooking. The present rate of electricity access also favourably supports the wide scale dissemination of electric cookstoves as a clean cooking solution for the peri-urban and rural population.

4

www.mecs.org.uk

Table of Contents

1 EXECUTIVE SUMMARY ......................................................................................................................................... 2

2 TERMINOLOGY .................................................................................................................................................... 5

3 INTRODUCTION ................................................................................................................................................... 6

OBJECTIVES OF THE MARKET STUDY ........................................................................................................................... 7

4 APPROACH AND METHODOLOGY ......................................................................................................................... 8

APPROACH .......................................................................................................................................................... 8 METHODOLOGY .................................................................................................................................................... 9

5 MODERN COOKSTOVES MARKET OF BANGLADESH ............................................................................................. 10

MECS MARKET OUTLOOK..................................................................................................................................... 12 COMPETITIVE LANDSCAPE ...................................................................................................................................... 17 AVAILABLE ELECTRIC COOKING APPLIANCES AND PRICE RANGE ........................................................................................ 17 VALUE CHAIN ACTORS .......................................................................................................................................... 20 MARKET SYSTEM ACTORS AND STRUCTURE ................................................................................................................ 21 PRODUCTS SELECTED FOR DETAILED ASSESSMENT ........................................................................................................ 22

6 MARKET ASSESSMENT OF THE SELECTED MODERN COOKSTOVES ........................................................................ 22

MARKET ASSESSMENT OF MODERN COOKSTOVES ........................................................................................................ 22 AVAILABILITY OF SELECTED COOKSTOVES PRODUCTS ...................................................................................................... 29

7 STATUS OF THE IMPROVED COOKSTOVES MARKET ............................................................................................. 31

OVERVIEW OF BANGLADESH ICS MARKET .................................................................................................................. 32 ICS MARKET ASSESSMENT ..................................................................................................................................... 33

8 WAY FORWARD ................................................................................................................................................. 35

9 CONCLUSION ..................................................................................................................................................... 37

10 REFERENCES .................................................................................................................................................... 37

ANNEXURE 1: DATA COLLECTION TEMPLATE ........................................................................................................................ 38 ANNEXURE 2: LIST OF CONTACTS: HOME APPLIANCES MANUFACTURERS/DISTRIBUTERS .................................................................. 46 ANNEXURE 4: DATA RECEIVED FROM THE LEADING HOME APPLIANCES IMPORTERS/MANUFACTURERS................................................ 50 ANNEXURE 5: BIOMASS BASED IMPROVED COOKSTOVES PRODUCT & MARKET INFORMATION .......................................................... 77

5

www.mecs.org.uk

2 Terminology

• Cooking solution: Any combination of technology and fuel used for cooking.

• Traditional cooking solutions: Baseline cooking technologies that employ no functional considerations for fuel and/or thermal efficiency. Examples include open clay or mud stoves and unvented coal stoves.

• Improved cooking solutions: Cooking solutions that improve, however minimally, the adverse health, environmental, or economic outcomes from cooking with traditional solid fuel technologies. This definition encompasses clean cooking solutions and the entire range of improved biomass cookstoves.

• Improved biomass cookstoves: Biomass stoves that improve on traditional baseline biomass technologies in terms of fuel savings via improved fuel efficiency. Some improved cookstoves also lower particulate emissions through improved efficiency of combustion, but the critical distinction from “clean” cooking solutions is that “improved” stoves may not reach sufficiently low emissions levels to generate meaningful health benefits. Examples include basic chimney improved cookstoves (ICS), basic portable ICS and intermediate ICS.

• Clean cooking solutions: Cooking solutions with low particulate and carbon monoxide emissions levels (IWA ISO Tier 3-4 for the indoor emissions indicator and WHO’s emission rate targets). These include stoves based on petro-chemical fuels (Liquefied Petroleum Gas (LPG), natural gas), electric stoves and electromagnetic induction cookstoves. Biofuel cookstoves powered by ethanol and other plant-based liquids, oils or gels, and biogas cookstoves are included in this category. Solar cookers and retained-heat cooking devices are also considered clean cooking solutions.

Source: Adopted from the draft National Action Plan for Clean Cooking in Bangladesh 2020-2030.

6

www.mecs.org.uk

3 Introduction

Bangladesh is on the transition pathway with a vision to become a middle-income country by 2021. Due to economic upliftment and increased electricity access, people not only in urban areas but in peri-urban and rural areas are getting used to cook with different modern home appliances and cookstoves such as microwave oven, electric oven, electric kettle, toaster, induction and infrared cookstoves, auto fire and mechanical gas stoves, hot plate, multicookers and rice cookers etc. Alongside use of long practiced traditional and improved version of biomass based cookstoves, people even in rural areas of Bangladesh now have access to modern clean cooking appliances (such as rice cookers, auto fire and manual gas/LPG stoves etc.) to serve their daily cooking needs. This representative market mapping study has been conducted to support Practical Action (PA’s) ongoing socio-market assessment on modern cookstoves. In this report we will share our detailed findings on the market of home appliances mainly cookstoves, map of the availability, sales channels, after sales and services of the modern cookstove products in all major divisions of Bangladesh and also in 5 selected districts: Gazipur, Barguna, Gaibandha, Cox’s Bazar and Faridpur.

To understand the market of cookstoves, we tried to collect relevant information on some of the key demographic indicators of Bangladesh. Bangladesh is a country with a population of 165.57 million and a poverty rate of 21.8%.1 On an average, 1,116 people live in a square kilometre area, which makes Bangladesh the eighth most populated country in the world. About 63.4% of the people in Bangladesh live in the rural areas. The current population growth rate is 1.09%2 and the total population is expected to be 245 million by year 2050, with average life expectancy of 78.9 years.

Demographic Indicators of Bangladesh

Key Indicators Values

Population (1st January 2019 estimate) 165.57 million

Population Growth Rate 1.09%

Sex Ratio (Male: Female) 100.2

Literacy Rate 73.2%

Life Expectancy at Birth 72.3 years

Electricity access 90.1% Urban Population 36.6%

Source: Bangladesh Sample Vital Statistics 2018 and CIA World Fact book, Bangladesh 2018

Bangladesh has been going through a demographic transition,3 where the average age of population is now 27.1 years. The increasing number of the working age group are making significant contribution in the economic developments of Bangladesh. The rural to urban migration is heavily concentrated in the capital city Dhaka. These demographic shifts also affect people’s preferences in lifestyle and necessities toward modern home appliances.

We also tried to collect necessary information on household sizes in rural and urban areas from Bangladesh Bureau of Statistics (BBS) Yearbook 2019 (new). From 2000-2016, the Household sizes of National level reduced

1 Bangladesh Bureau of Statistics (2018) Bangladesh Sample Vital Statistics 2018

2 CIA World Fact book, Bangladesh (2018) https://www.cia.gov/library/publications/the-world-factbook/geos/bg.html (accessed on 11 November 2019)

3 The "Demographic Transition" is a model that describes population change over time.

7

www.mecs.org.uk

from 5.18 to 4.40, where Rural level reduced from 5.19 to 4.5 and Urban level reduced from 5.13 to 3.93. It shows a gradual reducing trend of Household population numbers and the sources of Fuels in terms of locations shown in following tables.

Population, Household nos. and sizes

Year Parameter National Rural H/H Urban H/H

2011 (2011 HIE Survey)

Population 143,896,023 110,433,312 33,462,710

H/H No. 32,173,630 24,671,590 7,502,040

H/H Size 4.4 4.5 4.4 2020 H/H Size 4.50 4.53 4.41

2016 H/H Size 4.06 4.11 3.93

2010 H/H Size 4.50 4.53 4.41 2005 H/H Size 4.84 4.88 4.72

2000 H/H Size 5.18 5.19 5.13 Source: BBS Yearbook-2019 (new) and HIES 2020

Distribution of Household by Sources of Fuel and Locality, 2016-2018 (Fuel in %)

Source: SVRS, 2018, BBS

We can see from the above trend that the domestic consumption of Gas (piped natural gas supply + LPG) is increasing gradually. Because of increased electricity access, the use of electricity for cooking is also increasing. It is clear from the above stats that both natural gas and LPG has substituted or replaced the consumption of wood and bamboo for cooking in urban as well as in the rural areas.

Objectives of the Market Study

The market mapping study has been conducted to support the ongoing Modern Energy Cooking Services (MECS) programme. Practical Action Bangladesh and United International University in Dhaka have been on-board to meet the following study objectives in the clean cooking context of Bangladesh.

• To make an availability mapping of the cooking appliances in Bangladesh both in urban and rural areas

• To test available cooking appliances in the laboratory to assess their performance

• To assess the performance of the clean cooking appliances with cooking diaries in comparison with conventional cooking systems.

8

www.mecs.org.uk

The market assessment component has been undertaken to deliver the following objectives:

Stock checking for types of products/appliance both imported and manufactured locally and their availability in the market.

Assess the size of the market annually by each type/manufacturers and trend analysis. Design, organize and facilitate market mapping workshop to identify value chain actors, relationships,

value additions, system for after sales services etc. Assess strategy for market promotion, customers feedback. Identification of barriers limiting market and how it can be addressed.

4 Approach and Methodology Approach

We have followed a participatory and interactive approach with the identified stakeholders such as product importers, manufactures, distributors and retailers of the major divisions and selected districts throughout the market mapping study. This was intended to gather relevant market and product information on available modern cookstoves to conduct the market mapping study. However due to COVID-19 pandemic and lockdown situation, most of the stakeholders preferred to communicate and discuss on the subject matter over phone or e-mail. However, we have been able to meet several senior officials of renowned local consumer electronics brand in-person and interviewed them with a structured set of pre-circulated questionnaire.

We followed a combination of top-down and bottom-up approaches to identify modern cookstoves market, players and their distribution channels, after sales product warranty and services etc. Electrical appliances are a fast-growing market in Bangladesh. Though the market is largely import based, but a number of local conglomerates came forward with significant investment along with innovative product and service development approaches to address this market. Besides imported home appliances brands and significant local manufactures market presence, a huge non-brand market has been developed by small distributors and individual retailers in the last two decades. Information availability on this market in the secondary sources is practically nil and hence we had to rely on market information shared by the shop owners, small importers and retailers. Also in many cases and to avoid high import custom tariff, they usually import key pieces and accessories of home appliances separately in Complete Knock Down (CKD) and Semi Knock Down (SKD) format and finally bolt all these pieces and accessories together in simple assembly set-up to produce final products such as Rice Cookers, Hot-pot, Boiling Ring, Gas Stoves etc.

Under bottom-up approach and because of limited available information on modern cookstoves market in the secondary sources, we prepared and circulated a structured set of data questionnaires to collect market and products related information from the local importers, manufactures and distributors. Household Energy Planform (HEP) of Sustainable and Renewable Development Authority (SREDA), a partner of this initiative came forward and supported us to reach out to prominent market players with an issued official data request letter. Because of limited time and budget of this study, we were not able to reach out all small distributors and retailers in both brand and non-branded market segment and hence we contacted National Board of Revenue officials to collect information of the imported cookstoves. We termed it as top-down approach to understand the market size of different categories of imported cookstoves. We are particularly lucky to have access to imported cookstoves data, earlier collected by SREDA to support the development of National Action Plan for Clean Cooking in Bangladesh 2020-2030.

9

www.mecs.org.uk

Methodology

We followed Practical Action’s Participatory Market System Development (PMSD) methodology to assess the market of modern energy cookstoves available in Bangladesh. PMSD methodology prescribed several components such as literature review, market mapping meetings, individual interviews etc. to develop an overall understanding on the market. Despite the COVID-19 pandemic situation and long lockdown period, we extended our level best effort to arrange all the necessary meetings and individual interviews not only to collect data/information but to validate our observations and findings on the modern cookstoves market by the market players.

Literature review

Many research and market studies already been conducted on biomass based improved cookstoves (ICS) with an exclusive focus on rural households. But very few studies analysed the market of modern cookstoves, product technologies and mapping of this huge market in the context of Bangladesh. Literature review was essential to develop understanding on this modern cookstoves market, its value chain, players and mapping of products in all the eight divisions and also in five selected districts to further assess the modern cookstove products availability and distribution channels. Due to absence of relevant previous works, we had to rely on literatures that gave us at least some outlook and insights on this particular product market. Relevant data/ information of those studies has been used in this report (Section 8).

Market mapping meeting

Due to the COVID-19 pandemic and lockdown situation, we were not able to arrange any formal focused meeting on market mapping with the identified manufacturers, value chain actors like distributers/retailers and customers of the modern cookstoves. However, we have been able to organize individual meeting with several importers/manufactures and distributors/retailers active in the selected districts. To capture their response and feedback in an articulated manner, a questionnaire was developed and circulated among the targeted companies officially from Household Energy Platform (HEP) of SREDA.

Individual Interview

We have already discussed why we had to rely mainly on individual interviews to collect market, sales and product distribution channel information of the modern energy cookstoves of Bangladesh. Most of the participants of individual interview represent reputed local importers and manufacturers. We selected several reputed local electronics brand companies having significant focus on modern cookstoves business for the collection of data/information on their market share, product sales, operation and distribution channel etc. We have prepared a contact list with the top executives of those companies and some of them were initially contacted to form the basis for the current best-selling stoves on the market, especially in peri-urban and rural areas. We have annexed a list of contacts (Annexure 2) of those companies in this report.

10

www.mecs.org.uk

Questionnaires for data collection

In order to collect information from the selected electronics companies in a systematic manner, a questionnaires set has been developed and sent out officially from SREDA well before individual interviews. The intention was to allow them with sufficient time so that they will be able to gather up Stock Keeping Unit (SKU) and model wise sales data of induction & infrared cookstoves, rice cooker, pressure cooker and auto-fire and manual gas stoves and information regarding their distribution channels and after sales services for the customers. As we are trying to develop a representative market mapping of the selected modern cookstoves countrywide, the questionnaire was provisioned to capture information on 8 major divisions and 5 selected districts of Bangladesh. The questionnaire template is attached in the Annexure 1 of this report. However, after many rounds of in-person and over phone follow up, 6 out of 10 companies finally responded and provided total not SKU wise sales and channel information in accordance with the template. We have also included the completed data that we received from the companies in the Annexure 4. The data/information on sales we obtained from these companies were used to assess the countrywide sales, product availability and distribution channels of these products in different segments of the cookstove market.

5 Modern Cookstoves Market of Bangladesh

After even a rigorous search, we were not able to find any exclusive market assessment study on modern cookstoves in Bangladesh. However, we were able to identify a close primary market research on consumer electronics conducted earlier by Light Castle Partners. On the ground of relevancy with our assessment, we felt it important to include their key findings on the home appliances market here (Bijon Islam, December 25,2016).

The rising Middle and Affluent Class (MAC) consumers have been playing a pivotal role in this extraordinary growth story of the consumer industry in Bangladesh. According to a recent study by BCG (2015) (Light Castle was the local partner), the Middle and Affluent class (monthly household income of around $400 or greater, known as MAC) is expected to quadruple in size to 34 million within 2025.

Factors that are affecting consumption patterns are demographic dividend – a younger population depicts there is strong demand for goods like fast food, coffee and other beverages and consumer durable item; increasing urban population and the nuclear families – 19% of total population living in urban areas in 1990s has increased to 30%+ in 2016; Rising literacy rate, growing middle class and white collar culture, and globalization – thanks to the advent of information technology/social media. Due to growing economic prosperity across the board, MAC population residing in smaller cities increasingly have spare capital to invest in consumer durables.

This MAC population tend to have higher demand for different items including consumer durables. Urban areas have seen a rise in the number of nuclear family structure and many working couples, which has influenced demand for refrigerators and other home appliances. Alongside, growing electrification rate has spearhead demand in the rural markets. Although many local brands are entering the electronics market, majority of consumers still prefer international brands over local ones, due to perceived quality parameters. However, consumers in the low-income households, in general, are more price sensitive, and are willing to purchase local brands at affordable pricing, in lieu of longer warranty period and reliable after-sales services. With rising income, demand for consumer durables will be increasing and the current industry growth of 15% is projected to increase further. Alongside, with ease of making hire purchase and new electricity connections across the country, demand for consumer durables is expected to increase in the near future.

11

www.mecs.org.uk

The market for Consumer Electronics consists of a number of segments, each of which has a significant share in the total market size. In order to get a comprehensive understanding of the market, the consumer durables market has been classified into 4 major categories.

• Television

• Refrigerators

• Air Conditioner

• Home Appliances (includes Washing Machines, Microwaves and Kitchen Appliances).

Market Size

The continually growing market is currently stands at USD 1.38 Billion as of 2017.

• Television: USD 414.22 Million

• Refrigerators: USD 549.11 Million

• Air Conditioner: USD 164.57 Million

• Home Appliances: USD 251.41 Million

According to the Bangladesh Crockery Merchants Association (BCMA), “2.5 million units of gas-burner, 4.0 million cookers and 2.0 million units of non-sticky frying pan were sold in 20174.Local manufacturers are now steadily expanding their kitchenware lines such as pressure cooker, rice cooker, non-sticky frying pan and gas-burner, reducing dependence on import of such items. Some companies even have been exporting kitchenware after meeting the domestic demand, said insiders. Some companies even have been exporting kitchenware after meeting the domestic demand, said insiders. Rising income of the booming middle class has greatly contributed to the modernisation of kitchens over the last two decades. This upgrade has helped make a Tk 60 billion crockery market in the country over this period with a 10-12 per cent growth rate year on year, according to the Bangladesh Crockery Merchants Association (BCMA). This upgrade has helped make a Tk 60 billion crockery market in the country over this period with a 10-12 per cent growth rate year on year, according to the Bangladesh Crockery Merchants Association (BCMA).”

4 https://www.thefinancialexpress.com.bd/trade/local-brands-dominate-kitchenware-market-1538194273

12

www.mecs.org.uk

Trends

Growing MAC coupled with declining cost of durables and purchase friendly terms is driving demand.

• The Rise of Nuclear Families and Working Women: Due to the increase in number of working women and nuclear families in today’s urban culture, the demand for automation in household chores has increased and as a result, there is a sharp increase in the demand for consumer electronics.

• Growing Demand in Peri Urban and Rural Markets: With the increase in household income and large-scale electrification, demand for consumer electronics has increased in the peri urban and rural areas that cover 70% of the country’s households.

• Credit Facility: The consumer electronics products that were once considered as ‘high-end luxury products’ are now considered as regular household necessities. This has become possible since the companies provide the consumers with offers like EMI (Equal Monthly Instalments) and banks

provide credit card schemes with 0% interest loans.5

MECS Market Outlook

After our rigorous assessment on cooking appliances market of Bangladesh, the following findings have been identified and mapped in a diagram, labelled as “Modern Cooking Appliances Market Outlook (BD)” below. While preparing this market outlook report, consulted with the senior management officials of reputed local brands such as Miyako, Nova, Pran-Rfl, Walton and Minister electronics. Their views and market insights on different categories of cooking appliances are furnished below.

• Modern cooking appliances market has been experiencing significant growth since 2010 primarily because of the increased economic condition and disposable income of the urban as well as rural people.

• The market is dominated with imported products, where only few local electronic brands – namely Pran-rfl, Walton, Hamko and Kiam – have started their own production facilities with limited number of SKUs such as pressure cooker and gas stoves etc., but majority still relies on Original Equipment Manufacturers (OEM) strength to develop and sell cooking appliances in the market. They source imported cookstove products mainly from different OEM suppliers located in China and India. As per specifications of the importers, the OEM suppliers labelled products in their brand names.

• There are 2/3 OEM facilities available in the country to produce kitchen appliances like pressure cooker (mechanical), rice cooker, auto-fire single/double burner LPG/NG gas cooker etc. They have already developed a full chain of raw materials for these products and are capable to deliver finish products as per the order of the local companies. However, discussants were hesitant to disclose their names and mentioned it as their trade secret.

• The primary reason for switching to local OEM supplier for the above products was to avoid high import duty and to ensure standard profit margin from selling those products.

• Kitchen appliances such as induction and infrared cooker, hot plate, electric pressure cooker, microwave and electric oven are largely imported by the local companies from their counterpart Chinese OEM companies.

5 https://databd.co/profiles/industries/profile-consumer-electronics

13

www.mecs.org.uk

• Alongside, local electronics companies and importers are also selling modern cooking appliances such

as pressure cooker, induction and infrared cooker, microwave and electric oven, multicooker and hotplate of international brands like Toshiba, Sharp, Panasonic, Hawkins, Samsung, LG etc.

• Most of the companies have strong presence in major cities like Dhaka and Chittagong. They have reasonable number of active dealers, distributors and retailers base at district and upazila level.

• They see huge potentials to expand modern cooking appliances market at peri-urban and rural areas, however lack of awareness and customer perception about modern cooking appliances have been identified as the significant barriers by the local companies to scale-up dissemination of these appliances from current level.

• However, they all expressed in favour of appliance products such as mechanical pressure cooker, rice cooker, induction cooker and infrared cooker, auto-fire and manual gas stoves as market ready for the rural people considering their significant economic upliftment and the ongoing expansion of grid electricity and LPG distribution network in the rural areas of Bangladesh. They also informed in last couple of years, the demand for these products at peri-urban and rural level have significantly increased. We tried to cross-check their argument and assessment with a number of retailers and district level home appliance outlet managers. We have provided a summary information matrix that we are able to receive from the retailers located in the districts of Gaibandha, Faridpur, Gazipur, Cox’s Bazar and Barguna.

The Modern Cooking Appliances Market Outlook (BD) below has been mapped considering the presence of local as well international brands active in the local market. The cookstove products have been labelled as imported brands, OEM and locally manufactured by the different companies and their presence in different layers of market segments. One-page view of the map may look not fully legible as a good number of players had to be accommodated in two major categories – imported vs locally manufactured cookstoves products. However, we split the whole product market map in two major segments – imported vs locally manufactured cookstoves products and furnished in the next two pages.

15

www.mecs.org.uk

As we see, local companies have already developed a full range of cookstoves market and most of the products are imported as OEM products from China. Due to fierce competition, price of induction and infrared cookers, rice cookers and gas stoves are significantly reduced in last couple of years. As a result, they are experiencing sales increase of these cookstove products in the peri-urban and rural areas of Bangladesh. On the other hand, international brands like Panasonic, Sharp, Philips, Samsung, LG, Simper, Hitachi, Palson, Siemens and Toshiba have local exclusive agents to sell their products. As we can see, none of the international brands have full range of cookstove products like the local brands and the price of these high-end products are still not affordable to the rural customers. So, their presence is limited in the major urban cities.

16

www.mecs.org.uk

On the other hand, companies like Walton, Pran-rfl, Miyako, Nova, Jamuna, have already established connection with some of the local OEM facilities to manufacture rice cookers, auto-fire gas stoves etc. Kiam, sharif electronics and Hamko gone extra miles and already established own manufacturing facilities and catering major demand of pressure cookers and other types of basic kitchen appliances. Among the local brands, Pran-rfl and Walton are particularly successful to secure a significant market share of auto-fire and manual gas stoves throughout the country.

Due to information unavailability and dispersive business nature of non-brand cookstove products, we could not map those products. However, we held discussions with a number of non-brand product importers and sellers at New Market of Dhaka City. From those discussions, we came to know non-brand market is booming because of price sensitive market especially in the peri-urban and rural areas. The sales volume of this market already exceeded the combined market of local and international brand products. Most of the shop owners in New Market, Mitford and Nawabpur areas of Dhaka City are small importers of either complete form non-brand products or accessories under Complete Knock-Down (CKD) and Semi Knock-Down (SKD) arrangement. The duty of the complete cookstoves products is reasonably high. The present import duty applicable for these products is as follows:6

To avoid huge import duty, non-brand product suppliers import accessories of these products from unknown origins and assemble those products in simple basic layout facilities to give full form of product look with attractive packaging.

6 http://www.bangladeshcustoms.gov.bd/trade_info/duty_calculator

17

www.mecs.org.uk

Competitive Landscape

Consumer electronics is a competitive market in Bangladesh with wide-ranging products from both international and local players. Due to the brand image and credibility, the international brands have strong top of mind association. However, the local players are dominating the market in terms of sales volume, mainly due to competitive pricing.

Product Category Local Brand International Brand

Rice Cookers & Multi cookers

Walton, Vision, Singer, MyOne, Miyako, Nova, Minister etc,

Panasonic, Toshiba, Sharp, LG, Singer, Butterfly etc.

Induction and Infrared cookers

Walton, Vision, Singer, MyOne, Miyako, Nova, Minister etc,

LG, Hitachi, Singer, Panasonic, Palson etc.

Pressure Cookers (mechanical & electrical)

Kiam, Hamko, Walton, Vision etc.

Hawkins, Prestige etc.

Auto and manual gas stoves

Walton, Vision, Singer, MyOne, Miyako, Nova, Minister etc,

Hitachi, Simper, Siemens etc.

As we have already discussed, due to significant emergence of non-brand products with cheaper price, international brands have already restricted their product categories and presence esp. in the urban markets. Several local companies are following aggressive market and sales strategies to expand their operation at the remote rural areas of Bangladesh.

Available Electric Cooking Appliances and Price Range

In this section, we have shown the Electric Cooking Appliances available in the local market. Also, we tried to collect information about price range of mainly 4 types of international, local and non-brand Electric Cooking Appliances from the reliable sources and furnished those prices in a table below.

Product Categories Appliances Product Picture

• Electrical Cookstoves

Induction Cooker

18

www.mecs.org.uk

Product Categories Appliances Product Picture Infrared Cooker

Hot plate

Rice cooker

• Mechanical Cookstoves

Auto-fire (single/double/multiple burners) metal/Glass Top LPG/NG cookstoves

Traditional-Mechanical (single/double burner) metal LPG/NG cookstoves

• Cookstove substitutes-Electrical

Microwave oven

19

www.mecs.org.uk

Product Categories Appliances Product Picture

Electric oven

Electric pressure cooker

Electric boiling ring

• Cookstove substitutes-Mechanical

Mechanical pressure cooker

Mechanical Gas boiling ring

20

www.mecs.org.uk

Price Range of Electric Cooking Appliances

Product Categories

Name of the Cookstove Appliances

Brand Product Price Range (imported) Taka

Local Brand products Price Range (imported as OEM product +locally manufactured) Taka

Non-branded Products Price (Imported +locally assembled) Taka

Electrical Cookstoves

Induction Cooker 4500-5000 2500-3000 1800-2700

Infrared Cooker 3500-4500 2200-2800 1800-2500

Hot plate

Rice cooker 2500-8000 1800-3500 800-1800 Mechanical Cookstoves

Auto-fire (single/double/multiple burners) metal LPG/NG cookstoves

600-12000 2200-5200 1800-3500

Traditional-mechanical (single/double burner) metal LPG/NG cookstoves

Do not sell 800-1200 500-100

Pressure Cooker Mechanical Pressure Cooker

Do not sell 1200-3000 1000-2000

Electrical Pressure Cooker

Do not sell 4000-5000 Do not sell

Source of information: Representative MRP price of different Electric Cooking Appliances

Value Chain Actors

According to PMSD market assessment methodology, it is important to identify market actors, their business structure and distribution channels, product availability and the segments of market they serve. Based on our extensive interactions with reputed home appliance companies, their district level outlets, and retailers and a number of non-brands cookstove importers, the following modern cookstoves product delivery framework has been developed. We have covered the whole business landscape in mainly five dimensions: 1) mode of manufacturing; 2) market presence; 3) distribution channels; 4) after sales service; and 5) customer segments. As we know, in Bangladesh, peri-urban and rural markets are price sensitive. Hence, international brands already limited their sales operation in the urban city level. They have sales outlet in all major divisions and have dealers/distributors on the other major cities.

If we look at the operation portfolios of the local brands, they have their own sales outlet in all major cities of Bangladesh. To cater to the peri-urban and rural market they have expanded their sales operation and appointed many distributors and dealers to supply home appliances products to the upazila and thana level retailers. Many of these companies are also offering their products using third party online platform to reach out individual customers. Companies like Walton and Pran-rfl are pretty aggressive to supply their home appliance products even at the remotest part of the country.

21

www.mecs.org.uk

On the other hand, it is difficult to identify business and products availability of non-brand products, because they do not follow any systematic market-based approach, like brand companies, to reach out customers. Most of the non-brand product importers are based out in Dhaka City and they mainly operate in three sales hubs: New Market, Mitford Market and Nawabpur market, but have dealers and retailers dispersed throughout the country. Moreover, they have established online products sales channels to take orders from individual as well as dealers.

These non-brand players have reasonably lower operational overheads than the local and international brands present in the market. Due to their low import cost because of CKD/SKD arrangement, they can offer significantly lower price than the brands. As a result, non-brand products have significant market share in the rural space and they are becoming more aggressive to cater to this market with price competitive and innovative home appliances products.

When it comes to customer service after products sales, they are not performing anywhere near to the local and international brands. Local brand companies have established after-sales support centres in almost all the major districts. They provide prompt after-sales support to the customers as per the warranty or guarantee condition of the sold products. International brands have established organized process and facility to handle after sales customer services. Non-brand products are less accountable to customer complaints and after-sales service. In many cases they only ensure service warranty but not anything related to replacement of faulty parts and accessories of the cookstoves within warranty period.

Market System Actors and Structure

Customer

Segments Urban Peri-urban Rural

22

www.mecs.org.uk

Products Selected for Detailed Assessment

Selected Cookstove Products

Induction and Infrared Cookers; Rice Cookers; Electrical & Mechanical Pressure Cookers; Auto-fire/mechanical metal LPG/NG gas cookstoves.

Reasons for Selection

Initial discussion/feedback of the reputed manufactures/importers on the scalability of the selected products especially in the peri-urban and rural market segment;

Socio-economic context of peri-urban and rural set-up; Price sensitivity of the rural market; level of skills and literacy necessary to operate some specific high-end modern cookstove products by

the rural customers; Energy requirement/efficiency of the cookstoves.

More product specific information from the manufactures/importers are necessary to develop a representative countrywide market map of the selected modern cookstoves.

6 Market Assessment of the Selected Modern Cookstoves

In section 2 it was stated that we followed a combination of top-down and bottom-up approach to understand the size of the selected modern cookstove products, sales at divisional as well as in the 5 selected districts of Bangladesh. Based on the received information from 6 reputed local electronics brands, we tried to assess the sales of the selected products in the last three years and show an estimated total sale of those products by these companies up to 2024 following a linear projection. As these six companies represent a significant market share of these products, we believe our assessment will portray market reflective information to the readers.

Market Assessment of Modern Cookstoves

In the top-down approach, as we were given access to the information collected by SREDA during the preparation of National Action Plan For Clean Cooking in Bangladesh 2020-2030, we used some of the pertinent analysis compiled in the CAP Review Data Info Report, 2018. They collected import information on mainly electric cookstoves (induction + infrared + rice cooker) from the NBR record. The problem is NBR maintain one Harmonized System (HS) Code and it is applicable for all types of electric cookers (industrial + households + laboratory grades) import. However, it gives us an idea about total electric cookstoves import on a calendar year. The major limitation of NBR record is that they do not keep import figures of the stoves in order of the stove categories, so it is difficult to understand the true level of import of a particular category of electric cookstoves. The snapshot of the relevant analysis on electric and LPG imports from the CAP Review Data Info Report (2018) is furnished here to facilitate our bottom-up analysis:

23

www.mecs.org.uk

With gradual wide coverage of reliable grid connected electricity throughout the country, the use of electricity for cooking by Induction and Infra-red is increasing exponentially. The advantage of electricity is that it is fully clean (no scope of any pollution in kitchen), quick and at present not much costly compared to the cost of other alternative cooking fuels like LPG, Kerosene, Biomass etc.

We contacted NBR for import figure of Induction heaters under HS Code 8514.20.00. But the received data was for big size induction furnaces for laboratory use. Currently, these cook stoves are imported and marketed by some reputed electrical appliances companies. But there are hundreds of small importers also. As such it is very difficult to get accurate statistics of its market growth. One reputed local company (RFL) informed that currently they are importing and marketing about 1500 Induction and Infrared cookers monthly under HS Code 8516.60.00. For getting accurate import data we contacted NBR officials again and requested repeatedly to provide import data of homestead induction cookers as per above mentioned HS Code 8516.60.00 item. We finally received that information which is shown in Table below. This data shows that there is an upward trend of import volume during 2015-16 to 2016-17. But it went down in 2017-18 which appears unrealistic. In fact, there is a gradual increase of market penetration of different types and sizes of electric ovens over time like all other electric household appliances. One reason might be due to gradual increase of local manufacture/ assembly (decreasing the import quantity) of electric cookers. But no such information was available from any source yet.

Source: CAP Review Data Info Report, 2018

Trend of imports of different kind of electrical induction/ resistive cook stoves

Based on the data received from five local electronics companies, we see an upward sales trend of induction and infrared cookers of all the companies. Their combined sales hit around 50,000 mark in 2019 and it is expected to reach at 80,000 level if current level of market growth is maintained.

24

www.mecs.org.uk

37186 35990

49700

0

10000

20000

30000

40000

50000

60000

2017 2018 2019

Nu

mb

ers

Year

Sales of Induction & Infrared cookers by the leading local Electronics companies

Walton Pran Rfl

Miyako Nova

Minsiter Total sales (Induction +Infrared)

37186 35990

4970053473

5973065988

7224578502

0

10000

20000

30000

40000

50000

60000

70000

80000

90000

2017 2018 2019 2020 2021 2022 2023 2024

Projection of total Induction & Infrared cooker sales of the local leading Electronics Companies upto 2024

Total sales (Induction +Infrared) Future Estimated sales

Linear (Total sales (Induction +Infrared))

25

www.mecs.org.uk

Based on the data received from five local electronics companies on their rice cookers sales, we see a sharp upward sales trend of the total sales from 2018. Their combined sales hit around 85,000 mark in 2019 and it is expected to reach at 1.7 million level if current level of market growth is continuing to persist.

500060

596600

842000

0

100000

200000

300000

400000

500000

600000

700000

800000

900000

2017 2018 2019

Sales of Ricecookers by the leading local Electronics companies

Walton Pran Rfl

Miyako Nova

Minsiter Total sales (Rice Cooker)

500060596600

842000988160

11591301330100

15010701672040

0

500000

1000000

1500000

2000000

2017 2018 2019 2020 2021 2022 2023 2024

Projection of total Rice Cooker sales of the local leading Electronics Companies upto 2024

Total sales (Rice Cooker) Future Estimated sales

Linear (Total sales (Rice Cooker))

26

www.mecs.org.uk

The sale of LPG stoves depends on the supply of gas from local production and import of LPG by the private companies. The demand for LPG gas is increasing sufficiently every year and Bangladesh Government has approved LPG import license to the 13 national and international companies. Due to rapid permit increase (Annexure 4) by Bangladesh Energy Regulatory Commission (BERC) for all the private companies, there is significant increase of LPG import observed in the year 2018 and 2019. Please see the LPG import record of NBR below.

Source: CAP Review Data Info Report, 2018

Also, the future LPG demand forecast by the two major players indicates significant import increase from current level of 760 Thousand MT to 2500 Thousand MT by the year 2025. Please see the LPG demand projections below.

Source: CAP Review Data Info Report, 2018

27

www.mecs.org.uk

All the companies are trying hard to expand LPG market in the areas where these is no possibility to reach natural gas. They have already appointed many dealers not only in urban areas, but in peri-urban and rural areas as well. Due to aggressive marketing strategies of these companies the LPG stoves sales significantly increased in recent year. We will see the LPG cookstoves sales trend of the major companies in the bottom-up analysis.

Based on the data received from five local reputed companies on their auto-fire and manual cookstove sales, we see a sharp upward total sales trend from 2018 and onward. Their combined sales hit around .75 million mark in 2019 and it is expected to reach at 1.75 million level if current level of LPG stoves sales growth is going to persist.

344035

513170

746200

0

100000

200000

300000

400000

500000

600000

700000

800000

2017 2018 2019

Sales of Gas Stoves by the leading local Electronics companies

Walton Pran Rfl Miyako

Nova Minsiter Total sales (Gas Stoves)

28

www.mecs.org.uk

Electric Pressure Cookers are a popular cookstove substitute in Bangladesh. In the last couple of years, two local companies; Kiam and Hamko developed significant local capacity base and are catering major demand of the market. As a result, import dependency of the metal pressure cooker from India has been significantly reduced. As we can see from the analysis below, these two companies are experiencing significant sales growth in recent times and the total sales of these companies are expected to reach at 1.2 million from current level of sales of 0.74 million pieces by 2024. Please see the bottom-up sales analysis and forward projection of estimated sales of the assessed companies below.

344035513170

746200936634

11377161338799

15398821740965

0

500000

1000000

1500000

2000000

2017 2018 2019 2020 2021 2022 2023 2024

Projection of total Gas Stove sales of the local leading Electronics Companies upto 2024

Total sales (Gas Stoves) Future Estimated sales

Linear (Total sales (Gas Stoves))

454700

558000

670000

0

100000

200000

300000

400000

500000

600000

700000

800000

2017 2018 2019

Sales of Pressure Cookers by the leading local companies

Walton Miyako Hawkins Kiam Total sales (Pressure Cooker)

29

www.mecs.org.uk

Availability of selected cookstoves products

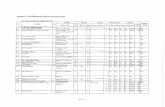

We tried to cross-check the market and sales information provided by the major companies through an independent assessment. In this regard, we interviewed a number of retailers and distributors located at Gaibandha, Gazipur, Faridpur, Cox’s Bazar and Barguna districts. We have compiled their feedback in the table below. Most of the participants agreed in favour of sales increase of rice cookers and gas stoves in the peri-urban and rural areas. Although induction and infrared cookers are still slow-moving products but they see a good potential of these electric cookstoves as Government utilities already extended electricity supply in many rural areas of Bangladesh. They also observed significant gas stove sales growth due to expansion of LPG gas cylinder in the peri-urban and rural areas in recent years.

454700558000

670000776200

883850991500

10991501206800

0

200000

400000

600000

800000

1000000

1200000

1400000

2017 2018 2019 2020 2021 2022 2023 2024

Projection of total Pressure Cooker sales of the local leading Electronics Companies upto 2024

Total sales (Pressure Cooker) Future Estimated sales

Linear (Total sales (Pressure Cooker))

30

www.mecs.org.uk

District level Outlets/Distributors/Retailers interviewed

Products sold-2019

Name of the shop/outlet

District Location & contacts

Products Rice Cooker

Induction cooker/infrared cooker

Pressure cooker

Gas Stoves Observation/comments

Vision Emporium

Barguna In Front of Pourosova, Sadar Road, Barguna

Retail outlet of Pran-Rfl electronics

400 100 50 Auto 200 pcs Manual 500 pcs

Demand for gas stoves and rice cookers are reasonably higher than other form of cookers

Ms. Brothers Electronics

Barguna Sadar Road Barguna

Exclusive agent of Walton

720 50-100 pcs 150 840 Price sensitive market and infrared has good prospects over induction cooker as customers can use any utensils to cook on it

Best Electronics

Gaibandha

D.B. Road Gaibandha, Best Electronics

A district outlet of Best Electronics retail chain and sell imported Home Appliances

500 400 (mostly infrared cooker)

Do not sell

100 (Auto Fire)

Infrared/Induction cookers slow moving items but have huge prospects as Government has extended electricity in many rural areas of Gaibandha

Marcel (Ahna) Electronics

Gaibandha

A sister concern of Walton Electronics D.B. Road Gaibandha

Distributor/Retailer of Marcel Electronics and sell all sorts of home appliances of Marcel

200 100 50 100 Market price sensitive and customers are less aware to modern cookstoves like induction/infrared cookers

Walton Plaza

Gaibandha

Gaibandha Main Road, Gaibandha,

A district outlet of Walton Electronics retail chain and sell imported Home Appliances

1000 200 100 1000 (Auto+manual)

Rice cooker & Gas stoves are widely sold appliances in Gaibandha. They are hopeful about Infrared cooker

Best Electronics

Cox's Bazar

Jhautala Main Road, Cox's Bazar

A district outlet of Best Electronics retail chain and sell imported Home Appliances

1000 50-100 Do not sell

200

Demand for Gas stove and Rice Cooker has been significantly increased in recent years

31

www.mecs.org.uk

Products sold-2019

Name of the shop/outlet

District Location & contacts

Products Rice Cooker

Induction cooker/infrared cooker

Pressure cooker

Gas Stoves Observation/comments

Vision Emporium

Cox's Bazar

Kazi Market, Jhautala, Cox's Bazar

A district outlet of Pran-Rfl Electronics retail chain and sell imported Home Appliances

600 200 360 600

Market is price sensitive. Rural customers need more awareness and knowledge support on the usability of Electric cookstoves

Vision Emporium

Gazipur BIDC Road, Gazipur

A district outlet of Pran-Rfl Electronics retail chain and sell imported Home Appliances

1000 75 Do not sell

200

They provide products orientation support to customers so that rural people can use rice cooker and infrared cookstove easily

Walton Plaza

Gazipur Gazipur Sadar Retail outlet of Walton

400 50-100 pcs 180 500

Customers need more orientation and awareness support regarding modern electric cookstoves

Vision Emporium

Faridpur

Khashbahar, house 31/1, Hazratola, Faridpur

Retail outlet of Pran-Rfl Electronics

500

100-150 pcs mostly infrared cookers

50-60 pcs 300

Rice Cooker and Gas stoves already seen significant market growth in the rural areas

7 Status of the Improved Cookstoves Market

We briefly assessed biomass-based improved cookstoves (ICS) market as part of this modern market mapping study. We also assessed availability of stove technologies; awareness of different technologies; accessibility of these technologies; affordability of different stove technologies; and acceptability from consumers of individual technologies. The table below sets out a preliminary assessment of the market, based solely on discussions with local stakeholders.

32

www.mecs.org.uk

Prerequisites Assessment

Availability Does the technology exist?

Increasing number of Tier 3 thermal efficiency technologies available, but more testing on emissions needed to determine if low-emission stoves are available.

Awareness Does the market know about the technology?

Low awareness of the benefits and solutions for clean cooking, requiring more coordinated communications efforts.

Accessibility Does the market have easy access to the technology?

Good reach through IDCOL and BBF programs, however there is less accessibility to alternative fuels such as pellets, which can impact accessibility of clean cookstoves.

Affordability Is the technology affordable?

Becoming more affordable, however better performing products are still too expensive for most consumers.

Acceptance Are the form, fit and function of the technology acceptable?

Still too low and could be improved for some technologies – fuel switching is a barrier.

Overview of Bangladesh ICS Market

Many important initiatives have been implemented to make cookstoves more affordable and available, including developing a country strategy, bringing key stakeholders together, building capacity and training for improved cookstoves manufacturers, raising awareness, and incentivizing purchase of these stoves. Together, the government of Bangladesh, donor organizations, and local stakeholders have pushed the market toward cleaner technologies. The Country Action Plan for Clean Cookstoves presents a strategy to achieve a target of 100% of households in Bangladesh cooking with clean and efficient stoves by 2030. The Plan lays out approaches to achieve sector harmonization through priority interventions on the demand and supply sides and is currently being updated.7

In 2014, the Clean Cooking Alliance (CCA)8 signed an MOU with the Sustainable Renewable Energy Development Authority (SREDA) to collaborate on the dissemination of 30 million cookstoves by 2030 through the Household Energy Platform (HEP).9 HEP, a public-private partnership hosted by SREDA, serves as sector coordinator allowing different stakeholders to discuss the issues and provide recommendations to the government and other partners to move the sector forward. The Platform hosts representatives from relevant government agencies, major development partners, private sector, civil society, academic institutions and others. In addition to HEP, the CCA has also supported a behavioural change communication campaign to drive awareness and adoption of cleaner cookstoves and provide grants to local businesses working in the sector. The government

7 Bangladesh Country Action Plan for Clean Cookstoves, http://www.sreda.gov.bd/d3pbs_uploads/files/policy_5_cap_final.pdf 8 Formerly known as Global Alliance for Clean Cookstoves 9 Bangladesh launch of household energy platform, http://cleancookstoves.org/about/news/06-22-2016-bangladesh-launch-of-household-energy-platform.html

33

www.mecs.org.uk

of Bangladesh has also implemented a 10% reduction of import duty on improved cookstoves, making cooking technologies more affordable to consumers.10

Through these different efforts and investments, the national cookstoves market has seen a transformation from 0.5 million improved cookstoves in 201111 to 5.5 million in 2018,12 which is equal to about 41% growth annually. Despite this growth the penetration rate of improved cookstoves still stands at 21%, which is still relatively low.

The CCA has developed definitions for ‘clean’ and ‘efficient’ as per the International Water Association (IWA) Tiers, to track progress towards their target of 100 million households adopting clean and efficient stoves and fuels by 2020:

• Stoves that meet Tier 2 for efficiency or higher will be counted as efficient.

• Stoves that meet Tier 3 for indoor emissions or higher will be counted as clean, as it relates to potential health impacts; and

• Stoves that meet Tier 3 for overall emissions or higher will be counted as clean, as it relates to potential for environmental impacts.

• Tier 4 is always the highest performing and most likely to achieve the greatest health or environment benefits.13

ICS Market Assessment

Improved cookstoves are primarily disseminated by two large cookstoves programmes managed by Infrastructure Development Company Limited (IDCOL) and the Bangladesh Bondhu Foundation (BBF). The IDCOL programme, supported by the World Bank, has installed around 1.6 million improved cookstoves to date and plans to install an additional 5 million improved cookstoves by 2021.14 The BBF programme, supported through GIZ EnDev (Energizing Development) and other funders, has already installed 2.59 million stoves15 in Bangladesh. The remaining 1.3 million improved cookstoves have been promoted and distributed by smaller programmes and local manufacturers such as Grameen Shakti, Rahimafrooz Renewable Energy Ltd., Venus, Filament Engineering Ltd., and others.

10 http://cleancookstoves.org/country-profiles/focus-countries/6-bangladesh.html 11 Bangladesh Country Action Plan for Clean Cookstoves, http://www.sreda.gov.bd/d3pbs_uploads/files/policy_5_cap_final.pdf 12 This data was collected during the interviews with stakeholders in October-November 2018. 13 How does the Alliance define “clean” and “efficient”? http://cleancookstoves.org/technology-and-fuels/standards/defining-clean-and-efficient.html 14 This data was collected during the interviews with stakeholders in October-November 2018. 15 This data was collected during the interviews with stakeholders in October-November 2018.

34

www.mecs.org.uk

CAP Review Data Info Report, 2018 shows the total number of ICS installations in last five years. Table and figure below show the total ICS installations over a period from 2014 to 2018.

IDCOL ICS Installation Map: Source, IDCOL

35

www.mecs.org.uk

Total number of ICS installation in last 5 years

Source: CAP Review Data Info Report, 2018

During the preparation of Building a Foundation for Cookstoves Standards Implementation in Bangladesh by CLASP, USA, back in 2018, a comprehensive ICS products database was developed. In order to provide necessary products and market related data/information on ICS, the relevant part of that database is being annexed in this report (Annexure 5). The database was developed in 2018 contains comprehensive information on the different higher tier ICS models, manufacturers, their distribution channel, product feature and yearly sales.

8 Way forward

SREDA has updated the previous version of Country Action Plan (CAP) and now it is named as National Action Plan for Clean Cooking in Bangladesh 2020-2030. Based on recent market movement of different cookstoves technology and the rapid supply enhancement of LPG gas, the targets and goals of CAP is also been revised. Please see below the revised clean cooking dissemination targets and goals of Bangladesh Government in the following table.

36

www.mecs.org.uk

Targets for Different Cooking Technologies within year 2030 (cumulative number)

Phase I Preparation

Phase II: Implementation

Mid Term Review

Phase III: Implementation

Type of Fuel

(Cumulative Total)

Type of Clean Cooking Technology

2019

/20

Act

ual

P

erce

nta

ge

%

20/2

1

21/2

2

22/2

3

23/2

4

24/2

5

25/2

6

26/2

7

27/2

8

28/2

9

29/3

0

Per

cen

tage

%

Biomass Traditional

(Residuals)

30.2 75 29.9 29.7 29.0 27.1 24.2 20.6 16.3 11.6 5.5 0.0 0

ICS 2.7 7 3.1 3.8 4.6 5.8 7.4 9.6 12.1 14.6 17.9 19.0 45

Other (Renewable, Pellets/

Briquette/Biogas etc.)

Different Stoves

0.1 0 0.1 0.2 0.2 0.3 0.4 0.5 0.7 0.9 1.5 2.1 5

Fossil Fuel (Natural Gas, LPG)

Natural Gas Stoves

4.4 11 4.5 4.6 4.7 4.8 4.9 5.0 5.1 5.3 5.4 5.5 13

LPG LPG Stoves 3.3 8 3.6 4.2 5.2 7.0 9.2 11.6 14.1 18.0 22.0 25.0 60

Mixed Induction & electricity (Rice cooker)

1.0 2 1.1 1.2 1.4 1.5 1.8 2.1 2.5 2.9 3.4 3.5 8

TOTAL with Stacking 41.7 103 42.3 43.7 45.1 46.5 47.9 49.4 50.8 52.3 53.7 55.1 131

TOTAL Household Level Cooking Technologies

40.5 100 75 40.8 41.0 41.2 41.3 41.5 41.6 41.8 42.0 42.0 100

Source: National Action Plan for Clean Cooking in Bangladesh, 2020-2030

As we see from the revised targets, sufficient attention has been given to disseminate LPG (60%), NG (13%) and electric cookstoves (8%). This indicates the Government’s intention to switch to more clean cooking solutions while reducing dependency on traditional and hazardous biomass based cookstoves.

It gives clear signal to market players of LPG and electric cookstoves to capitalize this opportunity by implementing appropriate product and market development strategy. In order to do that, comprehensive products and countrywide assessment on different modern cookstoves sales information are necessary to devise appropriate business strategy.

37

www.mecs.org.uk

9 Conclusion

This market mapping study should not be treated as a conclusive assessment on modern cookstoves market of Bangladesh, but rather as a starting point to develop an understanding on the market progression of selected modern stoves technology. Further research is necessary to contemplate the current, as well future, market scenario of modern cookstoves for different market segments.

Modern cookstoves are clean cooking solutions and do not emit any harmful gases in the cooking environment. So, it is clean for everyone in the household who is exposed. It gives health and safety benefits for all. Additionally, the present rate of electricity access also supports in favour of wide-scale dissemination of electric cookstoves as a handy clean cooking solution for the urban, peri-urban, and rural populations.

However, customer perception remains a challenge. Cooks have identified concerns around the taste of food cooked on electrical appliances, and high prices as being significant barriers to uptake. Additionally, poor after sale services is a further deterrent in continued use. Whilst local companies are committed to addressing perceptions by reducing prices of appliances and making them more accessible over the last few years, these barriers will need to be key considerations in any transitionary process.

10 References

1. “Factors affecting Bangladesh home appliance retailers purchase decision” by Dr. Naveed Ahmed (February 2019).

2. Report on “Electronics Sector in Bangladesh” prepared for High Commission of India, Dhaka, prepared by MRC Bangladesh Ltd. (December 2017).

3. “The Appliance Market in Bangladesh”, by Efficiency for Access Coalition (September 2019). 4. “Home Appliance Market in Bangladesh with Special Reference Best Electronics” by Rafique Mohammad,

MBA Department, BRAC Business School, BRAC University (July 2018). 5. “Draft National Action Plan for Clean Cooking in Bangladesh 2020-2030” by Sustainable and Renewable

Energy Development Authority (SREDA), Ministry of Power, Energy and Mineral Resources, Government of the People’s Republic of Bangladesh (December 2019).

6. “Collection of Information and Data to Support the revision of the Bangladesh Country Action Plan (Cap) For Clean Cookstoves” by Engr. Md. Mustafizur Rahman with support of GIZ-EnDev.

7. “Promotion of Improved Cookstove in Rural Bangladesh” by (Arif et al, 2011). 8. “Clean and Efficient Cooking Technologies and Fuels” by WINROCK International, September 2017. 9. “Building a Foundation for Cookstoves Standards Implementation in Bangladesh: Recommendations”,

CLASP, 2018.

Annexure 1: Data Collection Template

Please fill-out the following tables with appropriate information for the Kitchen Appliance-Induction Cooker & Infrared Cooker

Product Name Power (watts)

Distribution Channel for each of the division

Total Sales in numbers-Model wise if possible (2017)

Total Sales-Model wise if possible (2018)

Total Sales (2019) Model wise if possible

Sales in Major Divisions- Model wise if possible

Barishal Ctg. Dhaka Mymensingh Khulna Raj. Rang pur

Sylhet

Induction & Infrared cooker

Country of origin/locally manufactured-please select the appropriate

Please select the appropriate- Own depot/dealers/ retailers

SKUs/model number and MRP

Model1:

Model2:

Model3:

39

www.mecs.org.uk

Please indicate the total sales (if possible, model wise) for the following districts

Product Name Distribution channel

Gazipur Distribution channel

Barguna Distribution channel

Gaibandha

Distribution channel

Cox’s bazar

Distribution channel

Faridpur

Induction cooker Please select the appropriate- Own depot/dealers/retailers

SKUs/model number

Model1:

Model2:

Model3:

40

www.mecs.org.uk

Please fill-out the following tables with appropriate information for the Kitchen Appliance-Rice Cooker

Product Name Capacity (Ltr.)

Power (watts)

Distribution Channel for each of the division

Total Sales in numbers-Model wise if possible (2017)

Total Sales-Model wise if possible (2018)

Total Sales (2019) Model wise if possible

Sales in Major Divisions- Model wise if possible

Barishal Chtg. Dhaka Mymen. Khulna Raj. Rang pur

Sylhet

Rice cooker

Country of origin/locally manufactured-please select the appropriate

Please select the appropriate- Own depot/dealers/ retailers

SKUs/model number and MRP

Model1:

Model2:

Model3:

41

www.mecs.org.uk

Please indicate the total sales (if possible, model wise) for the following districts

Product Name Distribution channel

Gazipur Distribution channel

Barguna Distribution channel

Gaibandha

Distribution channel

Cox’s bazar

Distribution channel

Faridpur

Rice cooker Please select the appropriate- Own depot/dealers/retailers

SKUs/model number

Model1:

Model2:

Model3:

42

www.mecs.org.uk

Please fill-out the following tables with appropriate information for the Kitchen Appliance-Pressure Cooker (Electrical & Manual)

Product Name

Capacity (Ltr.)

Power (watts)

Distribution Channel for each of the division

Total Sales in numbers-Model wise if possible (2017)

Total Sales-Model wise if possible (2018)

Total Sales (2019) Model wise if possible

Sales in Major Divisions- Model wise if possible

Barishal Chtg. Dhaka Mymen. Khulna Raj. Rang pur

Sylhet

Pressure cooker (Electrical & Manual)

Country of origin/locally manufactured-please select the appropriate

Please select the appropriate- Own depot/dealers/ retailers

SKUs/model number and MRP

Model1:

Model2:

Model3:

43

www.mecs.org.uk

Please indicate the total sales (if possible, model wise) for the following districts

Product Name Distribution channel

Gazipur Distribution channel

Barguna Distribution channel

Gaibandha

Distribution channel

Cox’s bazar

Distribution channel

Faridpur

Pressure cooker Please select the appropriate- Own depot/dealers/retailers

SKUs/model number

Model1:

Model2:

Model3:

44

www.mecs.org.uk

Please fill-out the following tables with appropriate information for the Kitchen Appliance-Gas Cookstoves (Auto-fire & Manual)

Product Name Efficiency (%)

Distribution Channel for each of the division

Total Sales in numbers-Model wise if possible (2017)

Total Sales-Model wise if possible (2018)

Total Sales (2019) Model wise if possible

Sales in Major Divisions- Model wise if possible

Barishal Chtg. Dhaka Mymen. Khulna Raj. Rang pur

Sylhet

Gas Cookstoves

Country of origin/locally manufactured-please select the appropriate

Please select the appropriate- Own depot/dealers/ retailers

SKUs/model number and MRP-Please tick as appropriate

Model1 (Auto, LPG, Single/Double):

Model2 (Auto, NG, Single/Double):

Model3 (manual, single/double, NG):

45

www.mecs.org.uk

Please indicate the total sales (if possible, model wise) for the following districts

Product Name Distribution channel

Gazipur Distribution channel

Barguna Distribution channel

Gaibandha

Cox’s bazar

Faridpur

Gas stoves Please select the appropriate- Own depot/dealers/retailers

SKUs/model number

Model1:

Model2:

Model3:

46

www.mecs.org.uk

Annexure 2: List of contacts: Home Appliances Manufacturers/Distributers

Dr. Mohammad Naveed Ahmed Managing Partner Miyako Electronics CELL NUMBER: 01711645629 e-mail: [email protected] HASIB ELECTRONICS 68 EXTENSION SUPER MARKET BAITUL MUKARRAM, DHAKA PHONE : +880-2-9561782, 9571954