Market Forecasting using (2D) 2 PCA + RBFNN BY: DANNY SANCHEZ.

-

Upload

madlyn-porter -

Category

Documents

-

view

217 -

download

0

Transcript of Market Forecasting using (2D) 2 PCA + RBFNN BY: DANNY SANCHEZ.

Market Forecasting using(2D)2PCA + RBFNNBY: DANNY SANCHEZ

Current Models (market forecasting)

Auto-regressive Moving Average (ARIMA) Univariate

Benchmark used for comparisons

Predictor based regression model Multivariate

Various types of neural networks used

“A Stock Market Forecasting Model Combining Two-Directional Two-Dimensional Principal Component Analysis and Radial Basis Function

Neural Network” Paper published: April 7, 2015 Authors: Zhiq Guo, Huaiqing Wang, Jie Yang, David J. Miller

Subject: Chinese DOW

Multivariate model Proposed:

(2D)2PCA + RBFNN

“The proposed (2D)^2 PCA+RBFNN model use (2D)^2 PCA to remove the noise from the input raw data, the feature will contain less noise information and serve as the input of the RBFNN to predict the value or movement of the next day’s closing price.”

Hardware:

2.30 GHz CPU + 2Gb RAM + MATLAB software

General Outline

Data Source (Open, High, Low, Adj. Close)

-> Create Predictor variables

-> Reduce noise/extract features ((2D)2PCA )

-> Use reduced matrix as input for RBFNN

Predictor Variables

Using market data (usually in .csv format) containing historical:

Open – High – Low – Adj. Close

Predictors created using common technical indicator formulas. For the this research study 36 predictors were used including: MACD – Stochastic – Relative

Strength Indicator

Three of the most commonly used momentum indicators by technical traders

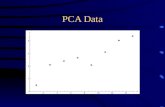

(2D)2PCA

Based on the idea of Principle Component Analysis Been used in signals processing for noise reduction for years

2D aims to reduce dimensionality while retaining usefulness of data by reducing variation

Ex.

RBFNN

Three-layered structure Input Layer -> Hidden Layer -> Output Layer

Results

“Replicating (2D)2PCA + RBFNN market forecasting model in R”

Authors: Danny Sanchez

Subject: S&P 500 (^GSPC) otherwise known as SPX

Multivariate model used: (2D)2PCA + RBFNN Similar to the original research but I have chosen my own predictor

variables based on market knowledge

Hardware: 2.30 GHz CPU + 2Gb RAM + MATLAB software

Predictor Variables

Using Yahoo Finance Historical data for S&P 500 & VIX (Volatility Index) containing:

Open – High – Low – Adj. Close

Based on previous trading knowledge, I chose 20 predictor vectors including: MACD – Stochastic – Relative

Strength Indicator

Three of the most commonly used momentum indicators by technical traders

Results

Results - Personal