Market Bulletin 3rd Quarter 2010

-

Upload

ocupantes-corporate-real-estate -

Category

Documents

-

view

215 -

download

0

description

Transcript of Market Bulletin 3rd Quarter 2010

Market Bulletin3rd Quarter 2010 - São Paulo / Rio de Janeiro / ABCD and Alphaville

SÃO PAULO

The vacancy rate tightens for the 3rd consecutive quarter

RIO DE JANEIRO

Positive expectations

ABCD and ALPhAvILLE

A further drop in the Alphaville vacancy

SUCCESS STORIES

Client Satisfaction guarantees repeat business for Ocupantes

www.ocupantes.comRua Fernandes Moreira, 1.166, 4º andar

04716-003, São Paulo - SP, BrazilTel. (+55) 11 5182.3455

PRESENCE IN:in

form

atio

n co

ntai

ned

in th

is d

ocum

ent i

s a

resu

lt of

rese

arch

und

erta

ken

by O

cupa

ntes

, with

the

aim

of s

how

ing

trend

s in

the

corp

orat

e re

al e

stat

e m

arke

t. It

does

not

con

stitu

te a

lega

l doc

umen

t.

OUR SERvICESFor offices, industries or retail,our services are:

• Relocations• Rent Reviews and Lease Renewals• Lease Terminations• Management of Opportunities and Critical Dates• Valuations• Divestments• Build-to-Suit• Sale & Leaseback• Project Management

hIGhLIGhTS

SÃO PAULO

RIO DE JANEIRO

BELO HORIZONTE

GOIÂNIA

SALVADOR

RECIFE

ARACAJU

FLORIANÓPOLIS

Project, Europ Assistance sought Ocupantes in 2009 to once again help them expand. Ac-cording to Mr. Roger, the demand was for an additional 300 to 400 m², and Ocupantes was able to negotiate more space in the West Side, increasing the client’s leased space to five floors.

In 2010 Europ Assistance received notice from their landlord at the West Side, informing that the rent of the original lease of 2,200 m² was below market and that the amount would have to be reviewed. Although the landlord was within his legal right to ask for a review,

the news caught Europ As-sistance by surprise, since the proposal was for a 60% increase in the rent payable. Therefore, once again, Ocu-pantes was called, this time with the purpose of helping Europ in this renegotiation, to try and reach a viable so-lution for both parties.

“The client, with Ocu-pantes’ guidance, recognized that the rent paid was below market”, explains Alan Rog-er. “However, we needed a strategy to limit the rental

increase as little as possible in order that the client’s operation was not compromised, and at the same time renew the lease for a further five years, which was the client’s wish. Fol-lowing several negotiation rounds, and the pre-sentation to the landlord of market evidence, we obtained a 28% reduction in the price that the landlord was asking and managed a new 5-year contract.”

This is the third assignment that Ocupantes Corporate Real Estate concludes for the Europ Assistance Group. It started with a 2,200 m² lease in Alphaville in 2006, an expansion by an additional 400 m² in 2009, and a renewal of the whole 2,600 m² on five floors at the West Side building.

“The Europ Group is a loyal client, and for whatever they need in terms of real es-tate Ocupantes is always sought. We con-tinue working on assignments for them”, concludes Alan Roger.

Europ Assistance GroupConsistent confidence in Ocupantes

In 2006, when Ocupantes was still a young firm in the Corporate Real Estate market, and was seek-

ing clients, a directed research was undertaken to identify firms who might need expansion space. With the experience of the directors who had an accumulated knowledge of the market, Ocupantes was able to identify a potential re-quirement of Europ Assistance for more office space, approximately 2,200 m², in Greater São Paulo, at the time more specifically aimed at the ABCD region.

The pioneer, and one of the largest multinational firms in the Assistance mar-ket, in the travel, automobile, health sectors, among others, with diverse clients including banks, insurers, credit card operators, and many others, the Europ Assistance Group chose to hire Ocupantes.

“Having identified the requirement, we contacted the directors of the Europ Group. Following a very detailed search of the ABCD region, and later, by our suggestion, the Baru-eri region on the other side of town, we even-tually closed a deal in an excellent building in the Alphaville market of Barueri,” tells Alan Roger, Consultant at Ocupantes Corporate Real Estate, responsible for all negotiations for the Europ Assistance account.

The chosen building was the “West Side”, the tallest in Barueri, with 35 floors. The building was identified as the best op-tion in both the qualitative and financial comparisons prepared by Ocupantes, and Barueri offered the same tax incentives as the ABCD municipalities.

The support by Ocupantes was complete, since it covered technical issues of the build-ing, contractual discussions and documenta-tion analysis, leading to a level of comfort and trust within the Europ management that is evi-denced by repeat business.

Highly satisfied with the outcome of the

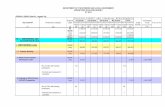

Net Absorption and Vacancy Rate (Graph 1) – Since 2005 the Vacancy Rate in São Paulo has been reducing, with only a few moments of slight increase. During the third quarter of 2007 there was a small increase in the vacancy of Class A* space due to the Bank Boston building becoming vacant. One year later, in the third quarter of 2008, another slight increase in the Vacancy Rate was measured, due to the delivery of 47,000 m² of space in that trimester. It was at the start of the Global Economic Crisis that in general had little impact on the Brazilian Real Estate Market, beating the pessimistic expectations. At the end of 2009, the Vacancy Rate showed another small in-crease due to much of the Morumbi Office Tower being vacated by the Votorantim Group, and who had in the previous quarter been in double occupa-tion as it fitted out new space in the Berrini sub-mar-ket, in the CEC João Domingues de Araújo building. The Vacancy Rate continues on a downward trend in this third quarter of 2010, down from 5.57% to 5.45% in the Class A segment, and from 3.79% to 3.35% in the “Others” segment (Classes B and C). The Class A segment had a net absorption of 21,738 m², contributing thereby to the fall in availability. There is a predicted delivery of 107,000 m² during the last quarter of 2010, and an increase in vacancy/availability is expected for the following quarter, yet constant demand may once again bring this down over 2011.

Vacancy Rate by District (Graph 2) – The biggest drop in Vacancy Rate in the Class A seg-ment in the 3rd quarter 2010 was in the Jardim São Luis sub-market, in the southern zone of São Paulo, due to the take-up of 8,500 m² in two of the blocks at Panamerica Business Park. In the Santo Amaro sub-market the Ja-tobá Buildings (otherwise known as the Birmann 22) was totally vacated by Brasilprev who moved to the nearby building where Dow Chemical had their headquar-ters for many years, and who in turn moved to the new Diamond Tower of the Rochaverá complex. The Itaim Bibi district, which in the previous quarter had been a highlight, had a small drop in its Vacancy Rate in the “Others” seg-ment, due to several leases.

Construction Activity (Graph 3) – Construction activity remains on the rise for the fourth consecutive quarter as new projects hit ground. Itaim Bibi continues to be a highlight, with ap-proximately 242,800 m² under construction, of which 50% are Class A and the remainder being good quality Class B space. Next is the Santo Amaro district, where approximately 115,000 m² is under construction, of which 98,000 m² falls in the Class A category. In total, the city of São Paulo has nearly 809,000 m² of office space under construction (the equivalent of eight times the Morumbi Soccer Stadium), with yet another 470,000 of projects in the hands of City Hall for approval.

New Stock (Graph 4) – Out of the 98,000 m² predicted for delivery in the 3rd quarter, only three buildings were actually delivered: Spazio Faria Lima (17.500 m²) in Itaim Bibi, Company Work Station (7.500 m²) in Santo Amaro, and Atrium Itapeva (4.905 m²) in Bela Vista, totaling nearly 30,000 m². Accordingly, the delivery of the remaining 68,000 expected, plus the 39,201 m² of new deliveries, totals 107,000 m²**.

* Class A: Buildings delivered after 1990, with a leasable area of 700 m2 per floor-plate, and high technical standards.** Ocupantes works with information supplied by constructors and developers.

0 %

4 %

8 %

1 2 %

1 6 %

2 0 %

-2 0 .0 0 0

3 0 .0 0 0

8 0 .0 0 0

1 3 0 .0 0 0

1 8 0 .0 0 0

2 3 0 .0 0 0

2 8 0 .0 0 0Forecast(sqm)

1st q

uarte

r 200

6

2nd q

uarte

r 200

6

3rd qu

arter

2006

4th qu

arter

2006

1st q

uarte

r 200

7

2nd q

uarte

r 200

7

3rd qu

arter

2007

4th qu

arter

2007

1st q

uarte

r 200

8

2nd q

uarte

r 200

8

3rd qu

arter

2008

4th qu

arter

2008

1st q

uarte

r 200

9

2nd q

uarte

r 200

9

3rd qu

arter

2009

4th qu

arter

2009

1st q

uarte

r 201

0

2nd q

uarte

r 201

0

4th qu

arter

2005

3rd qu

arter

2010

4th qu

arter

2010

Net Absorption - OthersNet Absorption - Class AVacancy Rate - OthersVacancy Rate - Class A

Graph 1 - Net Absorption and Vacancy Rate

4th qu

arter

2005

1st q

uarte

r 200

6

2nd q

uarte

r 200

6

3rd qu

arter

2006

4th qu

arter

2006

1st q

uarte

r 200

7

2nd q

uarte

r 200

7

3rd qu

arter

2007

4th qu

arter

2007

1st q

uarte

r 200

8

2nd q

uarte

r 200

8

3rd qu

arter

2008

4th qu

arter

2008

1st q

uarte

r 200

9

2nd q

uarte

r 200

9

3rd qu

arter

2009

4th qu

arter

2009

1st q

uarte

r 201

0

2nd q

uarte

r 201

00

1 0 0 .0 0 0

2 0 0 .0 0 0

3 0 0 .0 0 0

4 0 0 .0 0 0

5 0 0 .0 0 0

6 0 0 .0 0 0

7 0 0 .0 0 0

8 0 0 .0 0 0

9 0 0 .0 0 0

Graph 3 - Construction Activity Others

C la ss A

(sqm)

3rd qu

arter

2010

0

2 0 .0 0 0

4 0 .0 0 0

6 0 .0 0 0

8 0 .0 0 0

1 0 0 .0 0 0

1 2 0 .0 0 0

Others

C la ss AGraph 4 - New Stock

Forecast

4th qu

arter

2005

1st q

uarte

r 200

6

2nd q

uarte

r 200

6

3rd qu

arter

2006

4th qu

arter

2006

1st q

uarte

r 200

7

2nd q

uarte

r 200

7

3rd qu

arter

2007

4th qu

arter

2007

1st q

uarte

r 200

8

2nd q

uarte

r 200

8

3rd qu

arter

2008

4th qu

arter

2008

1st q

uarte

r 200

9

2nd q

uarte

r 200

9

3rd qu

arter

2009

4th qu

arter

2009

1st q

uarte

r 201

0

2nd q

uarte

r 201

0

3rd qu

arter

2010

4th qu

arter

2010

Market Indicators

Vacancy Rate

Net Absorption

New Stock

Construction Activity

THE VACANCY RATE TIGHTENS FOR THE 3rd CONSECUTIVE QUARTER

Market Bulletin is a quarterly publication about the office markets in São Paulo, ABCD region and Rio de Janeiro, prepared by Ocupantes’ departments of Research andMarketing. All rights reserved. Reproduction of this material in part or in its entirety is permitted as long the source is cited.

0 %

5 %

1 0 %

1 5 %

2 0 %

2 5 %

Graph 2 - Vacancy Rate by District Others

Class A

Others

São Paulo

-4 %

-2 %

0 %

2 %

4 %

6 %

8 %

1 0 %

-3 0 .0 0 0

-2 0 .0 0 0

-1 0 .0 0 0

0

1 0 .0 0 0

2 0 .0 0 0

3 0 .0 0 0

4 0 .0 0 0

5 0 .0 0 0

6 0 .0 0 0

7 0 .0 0 0(sqm)

Net Absorption - OthersNet Absorption - Class AVacancy Rate - OthersVacancy Rate - Class A

Graph 1 - Net Absorption and Vacancy Rate

1st q

uarte

r 200

6

2nd q

uarte

r 200

6

3rd qu

arter

2006

4th qu

arter

2006

1st q

uarte

r 200

7

2nd q

uarte

r 200

7

3rd qu

arter

2007

4th qu

arter

2007

1st q

uarte

r 200

8

2nd q

uarte

r 200

8

3rd qu

arter

2008

4th qu

arter

2008

1st q

uarte

r 200

9

2nd q

uarte

r 200

9

3rd qu

arter

2009

4th qu

arter

2009

1st q

uarte

r 201

0

2nd q

uarte

r 201

0

3rd qu

arter

2010

4th qu

arter

2010

Forecast

0

8 0 .0 0 0

1 6 0 .0 0 0

2 4 0 .0 0 0

3 2 0 .0 0 0

4 0 0 .0 0 0

Graph 2 - Construction Activity Others

Class A

1st q

uarte

r 200

6

2nd q

uarte

r 200

6

3rd qu

arter

2006

4th qu

arter

2006

1st q

uarte

r 200

7

2nd q

uarte

r 200

7

3rd qu

arter

2007

4th qu

arter

2007

1st q

uarte

r 200

8

2nd q

uarte

r 200

8

3rd qu

arter

2008

4th qu

arter

2008

1st q

uarte

r 200

9

2nd q

uarte

r 200

9

3rd qu

arter

2009

4th qu

arter

2009

1st q

uarte

r 201

0

2nd q

uarte

r 201

0

3rd qu

arter

2010

0

2 0 .0 0 0

4 0 .0 0 0

6 0 .0 0 0

8 0 .0 0 0

1 0 0 .0 0 0

1 2 0 .0 0 0

Graph 4 - New Stock Others

Class A

Forecast

1st q

uarte

r 200

6

2nd q

uarte

r 200

6

3rd qu

arter

2006

4th qu

arter

2006

1st q

uarte

r 200

7

2nd q

uarte

r 200

7

3rd qu

arter

2007

4th qu

arter

2007

1st q

uarte

r 200

8

2nd q

uarte

r 200

8

3rd qu

arter

2008

4th qu

arter

2008

1st q

uarte

r 200

9

2nd q

uarte

r 200

9

3rd qu

arter

2009

4th qu

arter

2009

1st q

uarte

r 201

0

2nd q

uarte

r 201

0

3rd qu

arter

2010

4th qu

arter

2010

Net Absorption and Vacancy Rate (Graph 1) – At the beginning of 2010, Rio de Janeiro was showing a considerable increase in construction activity; how-ever, the vacancy rate continued to drop. In the months of April, March and June there was a small increase in Net Ab-sorption, with the take-up of some Class A* space, more than in the “Others” segment. In the third quarter, as predicted, 53,000 m² was delivered at the Ventura Corporate Tower 2, which has increased the Vacancy Rate from 3.45% to 5.47% already counting with an immediate 60% occupation. The Net Ab-sorption was 36,470 m², of which 30,304 m² was of Class A quality. There is an expecta-tion that the Vacancy Rate will momentarily rise during the fourth quarter, due to the ex-pected delivery of more than 60,000 m² of New Stock.

Construction Activity (Graph 2) and Construction Activity by Administra-tive Region (Graph 3) – Construction Activity in Rio has had a slight decrease, as 53,000 m² of what was being built in Centro has now been delivered. Devel-opers, as well as investing in new projects, are in-vesting in retrofits. In Rio de Janeiro, Construction Activity in the Class A cat-egory is at approximately 220,000 m² and a further 22,400 m² in Class B, to-taling 242,000 m². Barra da Tijuca continues being the main target location for developers: this region alone has 174,000 m² un-der construction. It is notable that Construction Activity in Rio de Janeiro is approximately 30% of the activity in São Paulo (close to 810.500 m²), while the Office stock in Rio de Janeiro (6.831.249 m²) is 68% of the size of the São Paulo office market (at over 10 million m²). This indicates that Construction Activity in São Paulo is more intense than in Rio.

New Stock (Graph 4) – Despite the optimism that 100,000 m² was to come onto the market, only half was delivered: the expected peak in deliveries has not oc-curred in the 3rd quarter. The only delivery was the Ventura Corporate Tower 2, a Class A development in downtown Rio. Accordingly, the revised expectation for the 4th quarter of 2010 is a delivery of over 60,000 m² of office space. Today the total stock in Rio is 6.8 million m². **

* Class A: Buildings delivered after 1990, with a leasable area of 700 m2 per floor-plate, and high technical standards.** Ocupantes works with information supplied by constructors and developers.

Market Indicators

Vacancy Rate

Net Absorption

New Stock

Construction Activity

POSITIVE EXPECTATIONS

OCUPANTES is the first Brazilian Real Estate consulting firm to exclusively represent corporate end users in Brazil. It is composed of highly skilled professionals with ampleexperience representing Brazilian and multinational companies.

Market Bulletin3rd Quarter 2010

Past trends should not be taken as indication of future results; Ocupantes is not liable for decisions made on the basis of information herein.

Rio de Janeiro

CPS Color, leading supplier of tinting solutions, present in 11 countries, once again contacted Ocupantes Corporate Real Estate. In 2005, the company, specialized not only in colorants but in dis-pensing and mixing equipment, among other lines, had sought the services of Ocupantes to identify

and negotiate an industrial facility. As a result, at the time, CPS leased an industrial property of 1.600 m² at the Espace Center industrial park in Vila Anastácio, in the western region of the city of São Paulo.

Very satisfied with that first assignment, CPS Color did not hesitate to call Ocupantes’ specialist team of Corporate Representatives. CPS was expanding and needed to reduce their tax burden by moving outside São Paulo city into a neighboring town. The space was to have 2000 m² and accommodate 300 m² of office space.

Following the presentation of several alternatives in Greater São Paulo, Alphaville was the chosen location. CPS Color opted to lease an industrial facility that had in-deed 2000 m² Gross built area, including the desired Office space, located in a gated industrial complex.

To the client the final result exceeded expectations, since it generated a conside-rable overall economy over the next five years of operation. Additionally, the move coincided with the lease termination in Vila Anastácio.

SUCCESS STORIES

Client Satisfaction guarantees repeat business for Ocupantes

Over the last three months, the Alphaville market, which covers portions of Barueri and Santana de Parnaíba municipalities, showed a drop of 10% in the Vacancy Rate of Class A space and 5% in the other categories of space. Total stock did not increase but new deliveries are expected, and therefore an increase in Class A vacancy rate over the last quarter of 2010 is expected. Since Alphaville is still a relatively small market overall, the delivery of one or two buildings generates a peak in the graphs, yet it must be noted that, for many

occupiers seeking for alternative space, one or two buildings alone may not add sufficient choice. Despite a projected increase in va-cancy rate, choice may remain lim-ited in terms of floor-plate size and standard; Alphaville lacks in class B space. Construction activity is still growing though, and in 2011 more choice is expected.

The ABCD region, that in-cludes the municipalities of Santo André, São Bernardo, São Caetano and Diadema, has at present 36,910 m² which, although small, adds to what are still very small demand-driven markets.

Barueri - Alphaville

São Bernardo do Campo

Diadema

São Caetano do Sul

Santo André

São Paulo

ABCD and Alphaville

0 %

1 0 %

2 0 %

3 0 %

4 0 %

5 0 %

0

5 0 .0 0 0

1 0 0 .0 0 0

1 5 0 .0 0 0

2 0 0 .0 0 0

2 5 0 .0 0 0

3 0 0 .0 0 0

3 5 0 .0 0 0

4 0 0 .0 0 0

4 5 0 .0 0 0

Total Stock - O thers

Total Stock - C la ss A

Vacancy Rate - O thers

Vacancy Rate - C la ss A

Total Stock and Vacancy RateAlphaville

(sqm) Forecast

1st q

uarte

r 200

7

2nd q

uarte

r 200

7

3rd qu

arter

2007

4th qu

arter

2007

1st q

uarte

r 200

8

2nd q

uarte

r 200

8

3rd qu

arter

2008

4th qu

arter

2008

1st q

uarte

r 200

9

2nd q

uarte

r 200

9

3rd qu

arter

2009

4th qu

arter

2009

1st q

uarte

r 201

0

2nd q

uarte

r 201

0

3rd qu

arter

2010

4th qu

arter

2010

A FURTHER DROP IN THE ALPHAVILLE VACANCY

Múltiplo 1 - Alphaville

ABCD and Alphaville

TM