Marico

-

Upload

angel-broking -

Category

Economy & Finance

-

view

207 -

download

1

Transcript of Marico

Please refer to important disclosures at the end of this report 1

(Rs cr) 1QFY11 1QFY10 % yoy Angel Est % Diff

Revenue 790.1 696.7 13.4 756.7 4.4

EBITDA 105.5 96.5 9.3 118.1 (10.6)

OPM (%) 13.3 13.8 (50bp) 15.6 (225bp)

PAT 73.7 60.0 22.8 78.8 (6.5)

Source: Company, Angel Research Marico posted healthy top-line growth of 13% yoy, above estimates, led by 16% volume growth, with Parachute and Saffola registering ~14% and 17.5% volume growth, respectively. The international business registered 22% yoy growth (in constant currency terms) whereas Kaya disappointed posting only 3% yoy growth. Recurring earnings grew 27% yoy (adjusted for excise duty provisioning), despite margin contraction, led by 950bp decline in tax rate. We have revised our estimates upwards by ~2-3% and upgrade the stock from Reduce to Neutral. Strong volume growth, low tax boost earnings: For 1QFY2011, Marico posted steady top-line growth of 13.4% yoy to Rs790cr led by strong 16% volume growth. However, price cuts taken in core brands in 2HFY2010 led to negative value growth. The core brands Parachute and Saffola posted volume growth of 14% and 17.5%, respectively. Marico’s international business continued to post steady growth of 29% yoy (22% yoy adjusted for currency movement). Kaya posted muted growth of 3% yoy However, including Rs5.1cr revenue from the recently acquired Derma Rx (Singapore), Kaya posted total revenues of Rs50.6cr, a growth of 14% yoy. In terms of earnings, Marico posted a growth of 32% yoy to Rs73.7cr on a reported basis, boosted largely by a 951bp decline in tax rate. However, on a recurring basis, adjusted for provisioning of Rs8.8cr (Rs4.8cr) for excise duty on CNO packs up to 200ml, earnings grew ~27% yoy to Rs82.5cr, ~5% above our estimates. Outlook and Valuation: At the CMP of Rs125, the stock is trading at 22.2x FY2012E earnings, (in line with its historical valuations). We upgrade the stock from Reduce to Neutral (modeling in our upward revision in estimates by ~2-3%) with a fair value of Rs124 (Rs115) based on a P/E multiple of 22x FY2012E earnings.

Key Financials (Consolidated) Y/E March (Rs cr) FY2009 FY2010 FY2011E FY2012E

Net Sales 2,388 2,661 3,121 3,586

% chg 25.4 11.4 17.3 14.9

Net Profit (Adj) 203.8 241.5 288.7 343.5

% chg 28.6 18.5 19.6 19.0

EBITDA (%) 12.7 14.1 13.7 13.8

EPS (Rs) 3.3 4.0 4.7 5.6

P/E (x) 37.5 31.6 26.5 22.2

P/BV (x) 16.8 11.7 8.5 6.4

RoE (%) 53.0 43.6 37.3 33.0

RoCE (%) 35.7 32.5 30.5 30.3

EV/Sales (x) 3.3 2.9 2.5 2.2

EV/EBITDA (x) 26.0 21.2 18.4 15.5 Source: Company, Angel Research

Marico Performance Highlights

1QFY2011 Result Update | FMCG

July 29, 2010

NEUTRAL CMP Rs125 Target Price -

Investment Period -

Stock Info Sector FMCG

Market Cap (Rs cr) 7,638

Beta 0.4

52 Week High / Low 136/78

Avg. Daily Volume 178,076

Face Value (Rs) 1

BSE Sensex 17,992

Nifty 5,409

Reuters Code MRCO.BO

Bloomberg Code MRCO@IN

Shareholding Pattern (%) Promoters

63.5

MF / Banks / Indian Fls

7.3 FII / NRIs / OCBs

23.2

Indian Public / Others 6.0

Abs. (%) 3m 1yr 3yr

Sensex 2.8 18.6 18.1

Marico 16.9 44.2 127.3

Anand Shah 022 – 4040 3800 Ext: 334

Chitrangda Kapur 022 – 4040 3800 Ext: 323

Marico |1QFY2011 Result Update

July 29, 2010 2

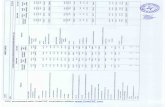

Exhibit 1: Quarterly Performance (Consolidated)

Y/E March (Rs cr) 1QFY11 1QFY10 % yoy FY2010 FY2009 % chg

Net Sales 790.1 696.7 13.4 2,660.8 2,388.4 11.4

Consumption of RM 403.3 350.1 15.2 1,261.6 1,277.9 (1.3)

(% of Sales) 51.0 50.3

47.4 53.5

Staff Costs 54.0 48.8 10.8 190.1 165.8 14.7

(% of Sales) 6.8 7.0

7.1 6.9

Advertising 93.8 84.9 10.4 351.1 242.6 44.7

(% of Sales) 11.9 12.2

13.2 10.2

Other Expenses 133.5 116.4 14.7 482.8 398.2 21.2

(% of Sales) 16.9 16.7

18.1 16.7

Total Expenditure 684.7 600.3 14.1 2,285.6 2,084.4 9.7

Operating Profit 105.5 96.5 9.3 375.1 304.0 23.4

OPM (%) 13.3 13.8

14.1 12.7

Interest 7.0 8.6 (18.8) 25.7 35.7 (28.1)

Depreciation 12.0 9.9 21.3 60.1 35.8 67.8

Other Income 4.4 3.1 41.3 18.3 12.2 49.7

PBT (excl. Extr. Items) 90.9 81.0 12.1 307.7 244.7 25.7

Extr. Income/(Expense) 0.0 (4.1)

(9.8) (15.0)

PBT (incl. Extr. Items) 90.9 77.0 18.0 297.9 229.6 29.7

(% of Sales) 11.5 11.1

11.2 9.6

Provision for Taxation 16.2 21.0 0.0 64.3 40.9 57.2

(% of PBT) 17.8 27.3

21.6 17.8

Minority Interest 1.0 0.0

1.9 (0.0)

Reported PAT 73.7 56.0 31.7 231.7 188.7 22.8

PATM 9.3 8.0

8.7 7.9

Equity shares (cr) 60.9 60.9

60.9 60.9

Reported EPS (Rs) 1.2 0.9 31.7 3.8 3.1 22.7

Adjusted PAT 73.7 60.0 22.8 241.5 203.7 18.5

Source: Company, Angel Research

Volume growth strong at 16% led by core brands, Kaya disappoints Marico posted steady top-line growth of 13.4% yoy to Rs790cr (Rs697cr), above our estimates, led by strong 16% volume growth. However, price cuts taken in core brands in 2HFY2010 (to pass on deflation in key inputs) led to negative value growth curtailing overall top-line growth. The core brands, Parachute and Saffola, posted volume growth of 14% and 17.5% respectively, for the quarter. Marico’s international business continued to post steady growth of 29% yoy (22% yoy adjusted for currency movement). Kaya posted a muted growth of 3% yoy to Rs46cr as the company closed down six clinics in India during the quarter. However, including Rs5.1cr revenue from the recently acquired Derma Rx (Singapore), Kaya posted total revenues of Rs50.6cr, a growth of 14% yoy.

Marico |1QFY2011 Result Update

July 29, 2010 3

Exhibit 2: Top-line growth picks up driven by 16% volume growth

Source: Company, Angel Research

Recurring earnings up 27% yoy, beat estimates aided by lower tax-rate In terms of earnings, Marico posted a growth of 32% yoy to Rs73.7cr (Rs60) on a reported basis, below our estimates, boosted largely by a 951bp decline in tax rate due to production from manufacturing facilities in tax free zones and higher contribution from international business. Management has guided for a ~20% tax rate over FY2011-12E. However, on a recurring basis, adjusted for Rs4.1cr loss in 1QFY2010 due to sale of Sundari and provisioning of Rs8.8cr (Rs4.8cr) for excise duty on CNO packs up to 200ml, earnings grew ~27% yoy to Rs82.5cr, ~5% above our estimates. OPM down 50bp yoy as gross margins contract 80bp yoy/711bp qoq Marico witnessed contraction in gross margin by 80bp yoy/711bp qoq as copra, rice bran oil and HDPE prices were higher 4%, 1% and 22%, respectively. However, prices of safflower oil trended lower by 12% yoy during the quarter. Moreover, price cuts undertaken in recruiter packs of Parachute and promotional offers on core brands undertaken during the quarter put further pressure on gross margins. Hence, OPM contracted by 50bp yoy to 13.3% despite the 16bp yoy and 32bp yoy reduction in staff costs and advertising spends, resulting in muted 9.3% yoy growth in EBITDA to Rs106cr. Adjusted for provisioning of Rs8.8cr (Rs4.8cr) for excise duty on CNO packs up to 200ml during the quarter, OPM was flat at ~14.5%.

Exhibit 3: Earnings growth sustained at ~20%+ levels

Source: Company, Angel Research

Exhibit 4: Input costs on uptrend, OPM contracts

Source: Company, Angel Research

-

5.0

10.0

15.0

20.0

25.0

30.0

35.0

-

100

200

300

400

500

600

700

800

900

1QFY09 3QFY09 1QFY10 3QFY10 1QFY11

(yoy

%)

(Rs

cr)

Top-line (LHS) YoY growth (RHS)

(20.0)

-

20.0

40.0

60.0

80.0

100.0

120.0

10

20

30

40

50

60

70

80

1QFY09 3QFY09 1QFY10 3QFY10 1QFY11

(yoy

%)

(Rs

cr)

PAT (LHS) YoY growth (RHS)

12.7 12.2 12.7 13.3 13.8 13.7 14.8 14.1 13.3

45.9 45.9 44.9 49.6 49.7

52.9 52.7 56.1 49.0

-

10.0

20.0

30.0

40.0

50.0

60.0

1QFY09 3QFY09 1QFY10 3QFY10 1QFY11

(%)

OPM Gross Margin

Marico |1QFY2011 Result Update

July 29, 2010 4

Strong growth in core brands led by promotional offers and price cuts Parachute coconut oil in rigid packs recorded volume growth of 14% yoy during the quarter aided by price cuts in recruiter packs (reduced retail price of Parachute’s 50ml pack from Rs12 to Rs10 in November 2009 and 100ml pack from Rs21 to Rs20 in January 2010). However, Marico has increased prices of 200ml pack from Rs39 to Rs40 and is planning another 4-5% hike in the near term to tackle rising input costs (copra prices up ~4% yoy, management expects ~7-10% inflation for FY2011E). Overall growth in Parachute was 11% during the quarter as non-focus component (flexi-packs comprising 25%) reduced in volume terms.

Saffola franchise registered a strong growth of 17.5% yoy during the quarter aided partially by consumer offer on select SKUs. No price changes were implemented in Saffola during the quarter. During 4QFY2010, Saffola Arise (packaged rice) was launched and has been accepted well (Rs400cr market, growing at over 20% in modern trade). Further, in June 2010, Marico launched Saffola Oats (Oats is a Rs120-140cr market, growing at 40%) in modern retail. Marico is targeting Rs30-35cr revenue between these two brands in FY2011E.

Exhibit 5: Parachute volumes pick up due to price cuts

Source: Company, Angel Research

Exhibit 6: Volume growth in Saffola at ~15-20%

Source: Company, Angel Research

Hair oils grow 27%, plans to enter cooling oils on track During the quarter, all Marico’s hair oils brands recorded healthy growth with hair oils portfolio in rigid packs registering ~27% yoy growth led by market share gains (up 150bp yoy to 21.6% in volume terms). Shanti Badam Amla registered a strong 92% yoy growth in volumes led by ongoing promotional offers (price cut). Marico’s plans to enter cooling oils (~18% of hair oils market in volume terms) are on track with its two prototypes – Nihar Natural Coconut Cooling Oil in Bihar and Parachute Advansed Coconut Cooling Oil in Andhra Pradesh doing well.

International business registers strong 29% growth

The company’s international FMCG business grew a strong 29% yoy (22% yoy adjusted for currency movement) during the quarter led by 17% volume growth and 12% price led growth. It now comprises around 23% of the group’s turnover. In Bangladesh, Parachute commanded a volume share of about 76%. Hair dye code has established itself as the second largest hair dye brand in Bangladesh. During the quarter, Marico launched Saffola in Bangladesh. In the Middle East, both Parachute Cream and Parachute Gold hair oil experienced healthy growth. Marico’s business in Egypt achieved healthy growth. Parachute Hair Cream was launched during the quarter along with the scale up of Parachute Gold hair oil. New plant in Egypt is now fully operational and ready to serve the GCC market. South Africa registered robust growth of 20% yoy.

8

12

9 9 9 10

8 10

14

-2 4 6 8

10 12 14 16

1QFY

09

2QFY

09

3QFY

09

4QFY

09

1QFY

10

2QFY

10

3QFY

10

4QFY

10

1QFY

11

(%)

28

9

(3)

11 13

22 18

13 18

(5)

-

5

10

15

20

25

30

1QFY

09

2QFY

09

3QFY

09

4QFY

09

1QFY

10

2QFY

10

3QFY

10

4QFY

10

1QFY

11

(%)

Marico |1QFY2011 Result Update

July 29, 2010 5

Exhibit 7: 29% yoy in international business led by 17% volume growth

Source: Company, Angel Research

Kaya undergoes consolidation, same clinic growth declines 5%

During the quarter, Marico acquired the aesthetics business (essentially skin care products and services business) of Singapore based Derma Rx for a purchase consideration slightly above Rs100cr. Products constitute >50% of Derma Rx’s revenues of around Rs50cr. Over a period of 18-24 months, management plans to introduce Derma Rx products in India increasing contribution from products in Kaya revenues to ~20% from ~13% currently. Kaya recorded a turnover of Rs50.6cr (including Rs5.1cr from Derma Rx). On a standalone basis, Kaya recorded a turnover of Rs45.5cr (3% yoy growth) and a loss of Rs4.7cr during the quarter. Kaya continues to experience a decline in same clinic revenue in India which declined 5% during the quarter. During the quarter, Marico closed down 6 clinics in India. It now runs 99 clinics – 81 in India, 13 in the Middle East and 1 in Dhaka and 4 in Singapore/Malaysia through Derma Rx. During FY2011, while Kaya plans to add 4-5 clinics in the Middle East, it is unlikely to open any new clinics in India.

Exhibit 8: Kaya disappoints with 3% yoy, 1% qoq growth

Source: Company, Angel Research

37

59

44 45

63

49

24

16

29

-

10

20

30

40

50

60

70

1QFY

09

2QFY

09

3QFY

09

4QFY

09

1QFY

10

2QFY

10

3QFY

10

4QFY

10

1QFY

11

(%)

-

10.0

20.0

30.0

40.0

50.0

60.0

70.0

80.0

-

10

20

30

40

50

60

1QFY09 3QFY09 1QFY10 3QFY10 1QFY11

(yoy

%)

(Rs

cr)

Top-line (LHS) YoY growth (RHS)

Marico |1QFY2011 Result Update

July 29, 2010 6

Investment Rationale

Steady volumes in core brands, new prototypes promising: We expect Marico’s core brands, Parachute and Saffola, to deliver sustainable volume growth of 6-8% and 12-15% respectively, during FY2010-12E. Moreover, Marico’s entry into cooling oils (~18% of hair oils market in volume terms) via Nihar Natural Coconut Cooling Oil/Parachute Advansed Coconut Cooling Oil coupled with initial success of Saffola Arise and introduction of Soffola oats (management expects Rs30-35cr revenues in FY2011E from rice and oats) looks promising.

Robust growth in international business: Strong presence in emerging markets coupled with series of acquisitions (Egypt, South Africa, Malayasia) has helped Marico post strong growth in international business revenues, which now contribute ~23% to consolidated revenues. We have modeled in a robust 21% CAGR in international revenues over FY2010-12E and expect high incremental contribution to overall profitability (better margins and lower tax rates).

Kaya’s long term potential intact, near term consolidation: Over the last several

quarters, Marico has consolidated its Kaya operations in India post dip in same store sales growth due to service tax imposition and economic downturn. However, post consolidation (6 clinics closed in India), we believe profitability is likely to improve in Kaya and revenue traction is likely to pick up on low base. Moreover, acquisition of Derma Rx (Rs50cr revenue) is likely to be EPS accretive and holds synergistic benefits for Kaya in India (management expects the same to help product revenues increase from ~13% to 20% in Kaya). Over FY2010-12E, we have modeled in 13% CAGR in standalone Kaya revenues and 26% CAGR including Derma Rx revenues.

Outlook and Valuation Post the strong results, we have upgraded our top-line estimates for Marico by ~2-3% to model in: 1) revenue accretion from the recent acquisition of Derma Rx, 2) higher volume growth in core brands of Parachute/Saffola, and 3) promising new prototypes – Saffola Arise, Saffola Oats and cooling oil variants. While our margin estimates remain intact, we have revised upwards our earnings estimates by ~2-3% in line with our revision in top-line and lower tax rate.

Exhibit 9: Change in Estimates

Old Estimate New Estimate % chg

(Rs cr) FY11E FY12E FY11E FY12E FY11E FY12E

Revenue 3,058 3,484 3,121 3,586 2.1 2.9

OPM (%) 13.7 13.8 13.7 13.8 (0) 0

EPS (Rs) 4.6 5.5 4.7 5.6 2.2 3.2

Source: Company, Angel Research

At the CMP of Rs125, the stock is trading at 22.2x FY2012E earnings, (in line with its historical valuations). Hence, we upgrade the stock from Reduce to Neutral (modeling in our upgrade in estimates by ~2-3%) with a fair value of Rs124 (Rs115) based on P/E multiple of 22x FY2012E earnings.

Marico |1QFY2011 Result Update

July 29, 2010 7

Exhibit 10: Key Assumptions

Sales (Rs cr) FY2009 FY2010 FY2011E FY2012E Focus Brands 1,926 2,128 2,519 2,910 Parachute (Rigids) 572 564 617 670 Nihar (CNO) 86 91 99 108 Hair Oils (Incl Nihar) 336 363 435 514 Saffola 334 351 407 468 International FMCG 427 578 711 848 Kaya (Incl Derma Rx from FY11) 157 182 249 303

Non Focus Brands 462 533 603 677 Total Revenue 2,388 2,661 3,121 3,586

YoY % Growth Focus Brands 24.1 10.5 18.4 15.5 Parachute (Rigids) 7.3 (1.6) 9.5 8.5 Nihar (CNO) 16.0 6.0 9.0 9.0 Hair Oils (Incl Nihar) 33.0 8.0 20.0 18.0 Saffola 23.0 5.0 16.0 15.0 International FMCG 38.2 35.5 23.1 19.2 Kaya (Incl Derma Rx from FY11) 57.6 15.7 36.8 21.6

- - - - Non Focus Brands 30.4 15.2 13.2 12.3 Total Revenue 25.3 11.4 17.3 14.9

Source: Company, Angel Research

Marico |1QFY2011 Result Update

July 29, 2010 8

Exhibit 11: Peer Valuation

Company Reco Mcap CMP TP* Upside P/E (x) EV/Sales (x) RoE (%) CAGR # (Rs cr) (Rs) (Rs) (%) FY11E FY12E FY11E FY12E FY11E FY12E Sales PAT Asian Paints Accumulate 25,153 2,622 2,773 5.7 27.7 23.6 3.2 2.7 40.8 37.8 17.5 17.4

Colgate Reduce 11,475 844 798 (5.4) 26.8 23.3 4.9 4.2 117.3 108.8 14.3 7.8

Dabur Neutral 16,943 196 195 (0.9) 30.1 25.2 4.2 3.5 39.9 39.1 17.4 16.0

GSKCHL Reduce 7,529 1,790 1,622 (9.4) 27.5 23.2 3.0 2.5 27.7 27.8 17.8 18.8

GCPL Accumulate 11,253 348 397 14.1 24.3 19.3 3.5 2.9 34.2 30.1 44.5 27.9

HUL Reduce 55,852 257 237 (7.6) 25.9 22.8 2.7 2.4 73.0 72.8 10.8 7.9

ITC Neutral 116,572 310 310 0.2 24.6 22.0 5.3 4.6 31.4 30.1 14.4 15.2

Marico Neutral 7,676 125 124 (1.0) 26.5 22.2 2.5 2.2 37.3 33.0 16.1 19.3

Nestle Neutral 28,550 2,961 2,955 (0.2) 36.3 30.1 4.7 4.1 118.2 118.6 16.5 20.4

Source: Company, Angel Research, Note: # denotes CAGR for FY2010-12E, * In case of Neutral recommendation, TP = Fair value

Exhibit 12: Angel v/s Consensus estimates Top-line (Rs cr) FY2011E FY2012E EPS (Rs) FY2011E FY2012E Angel estimates 3,121 3,586 Angel estimates 4.7 5.6 Consensus 3,056 3,521 Consensus 4.8 5.7 Diff (%) 2.1 1.9 Diff (%) (1.3) (1.6)

Source: Bloomberg, Angel Research

Exhibit 13: Absolute returns of Marico v/s Sensex

Source: Company, Angel Research

Exhibit 14: One-yr forward P/E band

Source: Company, Angel Research

Exhibit 15: One-yr forward P/E chart

Source: Company, Angel Research, Note: Red-line indicates 5-year average

Exhibit 16: One-yr forward Premium v/s Sensex chart

Source: Company, Angel Research, Note: Red-line indicates 5-year average

0%

50%

100%

150%

200%

250%

Apr

-07

Jul-

07

Oct

-07

Jan-

08

Apr

-08

Jul-

08

Oct

-08

Jan-

09

Apr

-09

Jul-

09

Oct

-09

Jan-

10

Apr

-10

Jul-

10

Sensex Marico

-

20

40

60

80

100

120

140

Apr

-05

Jul-

05O

ct-0

5Ja

n-06

Apr

-06

Jul-

06O

ct-0

6Ja

n-07

Apr

-07

Jul-

07O

ct-0

7Ja

n-08

Apr

-08

Jul-

08O

ct-0

8Ja

n-09

Apr

-09

Jul-

09O

ct-0

9Ja

n-10

Apr

-10

Jul-

10

Shar

e Pr

ice

(Rs)

16x 19x 22x 25x

-

5.0

10.0

15.0

20.0

25.0

30.0

35.0

Apr

-02

Aug

-02

Jan-

03Ju

n-03

Nov

-03

Apr

-04

Sep-

04Fe

b-05

Jul-

05D

ec-0

5M

ay-0

6O

ct-0

6M

ar-0

7A

ug-0

7D

ec-0

7M

ay-0

8O

ct-0

8M

ar-0

9A

ug-0

9Ja

n-10

Jun-

10

-60%

-40%

-20%

0%

20%

40%

60%

80%

100%

Apr

-02

Aug

-02

Jan-

03Ju

n-03

Nov

-03

Apr

-04

Sep-

04Fe

b-05

Jul-

05D

ec-0

5M

ay-0

6O

ct-0

6M

ar-0

7A

ug-0

7D

ec-0

7M

ay-0

8O

ct-0

8M

ar-0

9A

ug-0

9Ja

n-10

Jun-

10

Marico |1QFY2011 Result Update

July 29, 2010 9

Profit & Loss Statement (Consolidated) Y/E March (Rs cr) FY2007 FY2008 FY2009 FY2010 FY2011E FY2012E

Gross sales 1,559 1,907 2,390 2,662 3,123 3,588

Less: Excise duty 2 2 2 1 2 2

Net Sales 1,557 1,905 2,388 2,661 3,121 3,586

Total operating income 1,557 1,905 2,388 2,661 3,121 3,586

% chg 36.1 22.4 25.4 11.4 17.3 14.9

Total Expenditure 1,358 1,659 2,084 2,286 2,695 3,092

Cost of Materials 804 981 1,278 1,262 1,537 1,779

Advertising Exp 212 244 243 351 390 445

Personnel 91 127 166 190 222 251

Others 251 307 398 483 546 617

EBITDA 199 246 304 375 426 495

% chg 37.7 24.0 23.4 23.4 13.6 16.2

(% of Net Sales) 12.8 12.9 12.7 14.1 13.7 13.8

Depreciation& Amortisation 52 31 36 60 59 66

EBIT 147 215 268 315 367 429

% chg 47.2 47.1 24.5 17.5 16.5 16.9

(% of Net Sales) 9.4 11.3 11.2 11.8 11.8 12.0

Interest & other Charges 21 31 36 26 24 20

Other Income 10 10 12 18 21 26

(% of PBT) 7.5 4.9 5.0 5.9 5.8 5.9

Share in profit of Associates 0 0 0 0 0 0

Recurring PBT 136 195 245 308 365 434

% chg 38.8 43.0 25.8 25.7 18.5 19.1

Extraordinary Expense/(Inc.) (14) (11) 15 10 0 0

PBT (reported) 150 205 230 298 365 434

Tax 37 36 41 64 73 87

(% of PBT) 27.3 18.5 16.7 20.9 20.0 20.0

PAT (reported) 113 169 189 234 292 348

Add: Share of associates 0 0 0 0 0 0

Less: Minority interest (MI) 0 0 (0) 2 3 4

PAT after MI (reported) 113 169 189 232 289 344

ADJ. PAT 99 158 204 241 289 344

% chg 13.8 60.3 28.6 18.5 19.6 19.0

(% of Net Sales) 6.3 8.3 8.5 9.1 9.2 9.6

Basic EPS (Rs) 1.6 2.6 3.3 4.0 4.7 5.6

Fully Diluted EPS (Rs) 1.6 2.6 3.3 4.0 4.7 5.6

% chg 13.8 60.3 28.6 18.5 19.6 19.0

Marico |1QFY2011 Result Update

July 29, 2010 10

Balance Sheet (Consolidated) Y/E March (Rs cr) FY2007 FY2008 FY2009 FY2010 FY2011E FY2012E

SOURCES OF FUNDS

Equity Share Capital 61 61 61 61 61 61

Preference Capital 0 0 0 0 0 0

Reserves& Surplus 131 254 393 593 833 1,126

Shareholders Funds 192 315 454 654 894 1,187

Minority Interest 0 0 0 13 13 13

Total Loans 251 358 374 446 392 337

Total Liabilities 443 673 828 1,112 1,298 1,537

APPLICATION OF FUNDS 250 315 414 468 568 651

Gross Block 139 163 203 242 306 377

Less: Acc. Depreciation 111 151 210 226 262 274

Net Block 23 65 58 113 85 78

Capital Work-in-Progress 76 126 128 146 176 181

Goodwill 0 0 12 83 83 83

Investments 115 98 64 62 62 62

Current Assets 400 528 670 897 1,137 1,439

Cash 43 75 90 111 192 312

Loans & Advances 72 106 130 190 219 251

Other 286 347 450 596 726 876

Current liabilities 283 295 314 414 506 580

Net Current Assets 118 233 355 483 631 860

Misc Exp 0 0 0 0 0 0

Total Assets 443 673 828 1,112 1,298 1,537

Cash Flow Statement (Consolidated) Y/E March (Rscr) FY2007 FY2008 FY2009 FY2010 FY2011E FY2012E

Profit before tax 150 205 230 298 365 434

Depreciation 52 31 36 60 59 66

Change in Working Capital (6) (89) (75) (135) (95) (131)

Interest / Dividend (Net) 21 28 30 15 12 6

Direct taxes paid 37 36 41 64 73 87

Others 10 14 2 39 28 23

Cash Flow from Operations 189 153 182 212 295 312

Inc./ (Dec.) in Fixed Assets (300) (155) (95) (149) (102) (81)

Inc./ (Dec.) in Investments 23 0 (12) (71) 0 0

Cash Flow from Investing (277) (155) (107) (219) (102) (81)

Issue of Equity 145 0 0 18 0 0

Inc./(Dec.) in loans 11 107 16 72 (54) (55)

Dividend Paid (Incl. Tax) 47 45 47 47 47 50

Interest / Dividend (Net) 21 28 30 15 12 6

Cash Flow from Financing 89 35 (60) 28 (113) (111)

Inc./(Dec.) in Cash 1 32 15 21 81 120

Opening Cash balances 41 43 75 90 111 192

Closing Cash balances 43 75 90 111 192 312

Marico |1QFY2011 Result Update

July 29, 2010 11

Key Ratios Y/E March FY2007 FY2008 FY2009 FY2010 FY2011E FY2012E

Valuation Ratio (x)

P/E (on FDEPS) 77.3 48.2 37.5 31.6 26.5 22.2

P/CEPS 50.5 40.3 31.9 25.3 22.0 18.7

P/BV 39.7 24.3 16.8 11.7 8.5 6.4

Dividend yield (%) 0.5 0.5 0.5 0.5 0.6 0.6

EV/Sales 5.0 4.1 3.3 2.9 2.5 2.2

EV/EBITDA 39.5 32.1 26.0 21.2 18.4 15.5

EV / Total Assets 17.7 11.8 9.6 7.2 6.0 5.0

Per Share Data (Rs)

EPS (Basic) 1.6 2.6 3.3 4.0 4.7 5.6

EPS (fully diluted) 1.6 2.6 3.3 4.0 4.7 5.6

Cash EPS 2.5 3.1 3.9 4.9 5.7 6.7

DPS 0.6 0.7 0.7 0.7 0.7 0.7

Book Value 3.2 5.2 7.4 10.7 14.7 19.5

Returns (%)

RoCE 31.0 38.6 35.7 32.5 30.5 30.3

Angel RoIC (Pre-tax) 50.7 54.2 49.6 43.0 41.1 43.5

RoE 43.6 62.5 53.0 43.6 37.3 33.0

Turnover ratios (x)

Asset Turnover 3.9 5.0 4.9 4.6 4.6 4.6

Inventory / Sales (days) 52 50 52 61 64 66

Receivables (days) 15 17 17 21 22 23

Payables (days) 63 49 43 46 48 48

Net working capital (days) 18 30 41 51 51 56

Marico |1QFY2011 Result Update

July 29, 2010 12

Research Team Tel: 022 - 4040 3800 E-mail: [email protected] Website: www.angeltrade.com

Disclaimer

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment.

Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly.

Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information.

Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement Marico 1. Analyst ownership of the stock No 2. Angel and its Group companies ownership of the stock No 3. Angel and its Group companies' Directors ownership of the stock No 4. Broking relationship with company covered No Note: We have not considered any Exposure below Rs 1 lakh for Angel, its Group companies and Directors. Ratings (Returns) : Buy (> 15%) Accumulate (5% to 15%) Neutral (-5 to 5%) Reduce (-5% to 15%) Sell (< -15%)