March 2019 The Resurgence of the Sale-Leaseback · A sale-leaseback occurs when a real estate asset...

Transcript of March 2019 The Resurgence of the Sale-Leaseback · A sale-leaseback occurs when a real estate asset...

HBRE, LLC632 FOGG STREET | NASHVILLE, TN | 37203

615-564-4133 | WWW.HBRE.US

March 2019 WWe hope that you find our monthly newsleer beneficial and relevant. We send this newsleer to our cli-ents and others that are commercial real estate owners or work in the commercial real estate industry.

IIn this month’s newsleer, we discuss The Resurgence of the Sale-Lease-back. Addionally, we also take A Look at the Medical Office Market for 2019.

Through our many services we pro-vide, our team shares relevant market informaon with our clients all over the country to help them maximize the value of their commercial proper-es with each phase of ownership. If you are looking to purchase, sell or lease commercial real estate, and would like to speak to a commercial real estate advisor about these or other needs you may have, feel free to reach out to us at hbre.us.

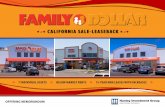

The Resurgence of the Sale-LeasebackRecently, a few high-profile sale-leaseback transacons have reminded com-mercial real estate owners of the incredible benefits of this strategy. During the first quarter of fiscal year 2019, Brinker Internaonal, best known for its ownership of Chili’s Grill & Bar Restaurants, completed a sale-leaseback on 141 Chili’s restaurant properes for a total amount of $455.7 million.

Another well-known company, WarnerMedia (formerly known as Time Warner, Inc.), owner of HBO, CNN and Warner Bros. film company, recently announced a proposed sale-leaseback of its new office building spaces at 30 Hudson Yards in Manhaan. The company owns its office space comprising the 16th through the 51st floors of the building, 1.4 million square feet or 60% of the total building. Construcon of the giant 90-story office tower, a 2.6 million square feet behemoth, will not be complete unl this summer. The tThe transacon is expected to raise over $2 billion to WarnerMedia, who, reportedly, will use the money from the transacon to take the real estate off its balance sheet and reduce debt.

A sale-leaseback occurs when a real estate asset is sold to a buyer who then leases the property back to the seller via a long-term lease agreement. Many sale-leaseback leases are wrien with longer than normal terms of at least 10-15 years, and in many cases, over 20 years in duraon.

The Resurgence of the Sale-Leaseback Cont.

The sale-leaseback is a desirable opon for many commercial real estate owners because it benefits the owner (seller) in various ways including:

• The sale of the real estate generates cash for the seller, who can then pay down debt, improve the balance sheet of the organizaon, and if structured correctly, may also be able to deduct all of the future rent pay ments instead of being limited to the interest poron of payments that would be otherwise paid to service the mortgage loan on the property.

• Because the sale-leaseback tradionally creates a long-term lease of 15-20 years or more with a triple-net lease ar lease arrangement, the seller may sll retain almost complete operaonal control over the property, including the ability to make improvements to the property.

• In addion to converng the equity of their property into cash, the seller may be able to receive, aer capital gains taxes, up to 100% of the value of the real estate compared to a tradional mortgage financing structure which usually only provides up to 60%-80% of the property’s value.

• If a building is in need of repairs and the current owners are planning on connuing to operate their business business for years to come, a sale-leaseback could be structured wherein the buyer purchases the real estate asset for a discounted price with the requirement that the buyer applies the discounted poron of the purchase price toward upgrades and improvements to the property, such as modernizing the lobby, or updang the restrooms. Through this type of transacon, the sellers cash out and get a renovated building in which to work for years to come.

AsAs with any real estate decision, including a sale-leaseback transacon, where the transacons are fact depend-ent and could present advantages and disadvantages to the seller or buyer depending on the specific situaon, you should consult an accounng, tax, legal or other competent professional.

Let HBRE become a trusted resource for all your commercial real estate needs. Reach out to us at 615-564-4133 or find us online at hbre.us.

hps://www.wsj.com/arcles/warnermedia-puts-its-stake-in-new-hq-building-up-for-sale-before-it-moves-in-11546956001hps://nypost.com/2019/01/08/warnermedia-looking-to-sell-lease-back-hudson-yards-hq/hps://irei.com/news/two-nyc-assets-sale-billion-dollar-price-tag/hps://www.globest.com/2019/02/08/why-sale-leasebacks-are-coming-back-strong/?kw=Why%20Sale-Leasebacks%20are%20Coming%20Back%20Strong&utm_source=email&utm_medium=enl&utm_campaign=naonalamalert&utm_content=20190208&utm_term=rem

Although the retail sector experienced a surge of transaconal acvity, the price growth for this sector was 2.0% year over year, although current retail pricing has sll not rebounded from the 2007 numbers.

When factoring inflaon, all property types show a 4% growth compared to the 2007 peaks.

2018 US Commercial Real Estate Pricing Growth Down Slightly From Previous Year

Recent Trend: Larger Medical Office Buildings More Valuable Than Their Smaller Counterparts

A Look at the Medical Office Market for 2019

A recent report idenfying MOB sales data that covers the two-year period of 2017 and 2018 shows that larger medical office buildings sold at lower capitalizaon rates (cap rates) than smaller MOBs during this period. However, buildings 20,000 SF and under did sale at a higher price per square foot, although at a higher cap rate compared to the larger size building groups.

For the fourth consecuve year, medical office building (MOB) sales in 2018 exceeded $11 billion in total transacons, showing that investment demand for this sector of commercial real estate connues to remain strong. The total was a decrease from the year prior’s record-se ng total of $15.8 billion, however that figure included the Duke Realty Corp.’s sale of its enre $2.5 billion MOB porolio.

The graph below gives a year by year overview of the total medical office sales since 2012.

WWW.HBRE.USSource: Revistamed.com

Source: Revistamed.com