MANSAX FUND FACT SHEET 2020 - SIB

Transcript of MANSAX FUND FACT SHEET 2020 - SIB

FUND INTRODUCTION

MANSAX FUND FACT SHEET 2020

Management, Securities Trading, Market Research, Investment Management and Corporate Finance.

FUND DESCRIPTION

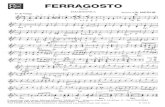

FUND OBJECTIVEThe primary objective of MansaX 0.00%

1.00%

2.00%

3.00%

4.00%

5.00%

6.00%

7.00%

4.98%

2.77%

4.86%

5.61%

Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 Q4 2020

2.36%

6.01%

5.11%

24-MONTH RETURN AFTER FEES - TO LAST QUARTER

Quarterly Performance

PORTFOLIO MANAGER

YEARS WITH FIRM YEARS OF EXPERIENCE

NAHASHON MUNGAI (ACI) 3.0 16

ASSET CLASSESS

The focus of the fund will be on the global markets. It invests in the following asset classes:

• Currencies

• Precious Metals

• Commodities

• Cash & Cash Equivalents

• Derivatives

• Single Stocks & Stock Indices

The fund will invest mainly in the currencies of the world’s major economies (G10 countries) as well as other currencies as the opportunities arise. It will also invest in CFDs of precious metals, commodities, stock indices and single stocks. The stock indices and single stocks will be of major global exchanges such as the S&P500, FTSE100, DAX, CAC 40, Nikkei and others.

PERFORMANCE GROWTH OF A KES 1,000,000 INVESTMENT FROM 15TH JANUARY 2019 TO 31ST DECEMBER 2020

GROWTH BY

31ST DECEMBER 2020

KES 1,467,286.72

(after fees)

SERVICE PROVIDERS & REGULATORS

Primary Custodian I&M Bank

Money Manager Standard Investment Bank

Regulator The Capital Markets Authority (Kenya)

Minimum Investment

Minimum Top up

KES. 250,000

KES. 100,000

0

Management Fee 5% pro-rated daily

Performance Fee 10% above hurdle rate

*Hurdle Rate is 25%

FUND PROFILEFEES

January 2019

Assets Under Management

KES 3.1 Billion

Base Currency KES

FUND OVERVIEW

JKUAT Towers (Formerly ICEA Building), 16th Floor, Kenyatta Avenue, Nairobi, Kenya.

Telephone: +254 777 333 000

*PAST PERFORMANCE IS NO GUARANTEE OF FUTURE PERFORMANCE

6.07%

E-mail: [email protected]

900000

1200000

1500000

31

Dec

20

20

30

Nov

20

20

31

Oct

20

20

30

Sep

20

20

31

Aug

20

20

31

Jul

20

20

30

Jun

20

20

31

May

20

20

30

Apr

20

20

31

Mar

20

20

29

Feb

20

20

31

Jan

20

20

15

Dec

20

19

15

Nov

20

19

15

Oct

20

19

15

Sep

20

19

15

Aug

20

19

15

Jul

20

19

15

Jun

20

19

15

May

20

19

15

Apr

20

19

15

Mar

20

19

15

Feb

20

19

15

Jan

20

19

MansaX is a regulated fund domiciled in Kenya that invests in the local and globalmarkets. The fund is a product of Standard Investment Bank, which is licensed asthe �rst Online Forex Trading Money Manager in Kenya, by the Capital MarketsAuthority, under the CMA Online Forex Trading Regulations, 2017.

MansaX is a Multi-Asset Strategy Fund with a long/short trading model, speci�callydesigned to optimize returns for clients even during turbulent market conditionswhile protecting their capital from downside risks. The fund achieves this by utiliz-ing complex portfolio allocation techniques while hedging capital exposure.

END

*Net Return 2019 : 19.01%Gross Return 2019 : 24.01%

*Net Return 2020 : 18.75%Gross Return 2020 : 23.75%

![Mutual Fund Fact Sheet Production Study [2014 Report]](https://static.fdocuments.net/doc/165x107/55ab01111a28ab9a288b47a3/mutual-fund-fact-sheet-production-study-2014-report.jpg)