Listing and delisting

-

Upload

shubham-jain -

Category

Law

-

view

204 -

download

2

Transcript of Listing and delisting

•Applicable Law •Over View about the Stock Exchanges in INDIA•Meaning Of Listing•Objective of Listing•Norms and Procedure of Listing•Annual legal Requirements •Merits & De-merits of Listing Security•Overview about the De-Listing•Meaning of De-Listing•Types of De-Listing and their respective procedure

• Securities Contract Regulation Act, 1956

• Securities Contracts (Regulation) Rules, 1957

• Companies Act, 1956 (Now Companies Act, 2013)

• Guidelines issued by SEBI and Rules

• Bye-laws and Regulations of respective stock excghange

There are 23 Stock Exchange in INDIA

Apart from the Bombay and National stock exchanges in Mumbai, there are stock exchanges in Ahmedabad, Bangalore,

Bhubaneswar, Kochi, Delhi, Guwahati, Hyderabad, Jaipur, Calcutta, Chennai, Ludhiana, Pune too have bourses.

Three Main Objective of listing

} Provide liquidity to shares

} Mobilize savings for economic development

} protect interest of investors by ensuring full disclosures by regulating dealings in securities

} Public Issues◦ Initial Public Offering◦ Further Public Offering◦ Preferential Issues◦ Indian Depository Receipts◦ Amalgamation◦ Qualified Institutions Placements

} A. In Respect of large Cap companies :-

Ø The Minimum paid-up capital shall be Rs.3 Cr.Ø The Minimum issue size shall be Rs. 10 Cr.Ø The Minimum market capitalization shall be Rs.25 Cr.Ø The Applicant, Promoters and/or group companies, shall not be in default in compliance of listing agreement.} *In respect of the requirement of paid-up capital and market capitalization, the issuers shall be required to include in the disclaimer clause forming a part of the offer document that in the event of the market capitalization requirement of BSE not being met, the securities of the issuer would not be listed on BSE.

B. In Respect of Small Cap companies :-Ø The Minimum paid-up capital shall be Rs. 3 Cr.Ø The Minimum issue size shall be Rs. 3 Cr.Ø The Minimum market capitalization of the company shall be Rs.5 Cr.Ø The Minimum income/turnover of the company should be Rs.3 cr in each of the preceding three Years.Ø The Minimum Number of public shareholders after the issue shall be 1,000.Ø A Due diligence study may be conducted.

Ø Take the Permission to Use the Name of BSE in Prospectus.Ø Submission of Letter of Application to all stock exchange.Ø Open a separate Bank account to kept amount received from issue.Ø Allotment of Securities with in 30 days of the date of closure of thesubscription list.Ø Obtain trading Permission from exchange within 7 working days of finalizationof the basis of allotment.Ø Requirement of deposit of 1% Security of the issue amount with the Exchange.Ø Compliance with the Listing Agreement (clause 49) .Ø Payment of Listing Fees including annual listing fees as per schedule.

Securities *other than Privately Placed Debt Securities and Mutual FundsSr. No. Particulars Norms1 Initial Listing Fees Rs. 20,000/-2 Annual Listing Fees(i) Upto Rs. 5 Crs. Rs. 15,000/-(ii) Rs.5 Crs. To Rs.10 Crs. Rs. 25,000/-(iii) Rs.10 Crs. To Rs.20 Crs. Rs. 40,000/-(iv) Rs.20 Crs. To Rs.30 Crs. Rs. 60,000/-(v) Rs.30 Crs. To Rs.100 Crs. Rs. 70,000/- plus Rs. 2,500/- for every increase of Rs. 5 crs or part thereof above Rs. 30 crs.

(vi) Rs.100 Crs. to Rs.500 Crs. Rs. 125,000/- plus Rs. 2,500/- for every increase of Rs. 5 crs or part thereof above Rs. 100 crs.(vii) Rs.500 Crs. to Rs.1000 Crs. Rs. 375,000/- plus Rs. 2,500/- for every increase of Rs. 5 crs or part thereof above Rs. 500 crs.(vi) Above Rs. 1000 Crs. Rs. 625,000/- plus Rs. 2,750/- for every increase of Rs. 5 crs or part thereof above Rs. 1000 crs.

Placed Debt Securities :-Sr. No. Particulars Norms1 Initial Listing Fees NIL2 Annual Listing Fees(i) Issue size up to Rs.5 Crs. Rs. 2,500/-(ii) Above Rs.5 Crs. and up to Rs.10 Crs. Rs. 3,750/-(iii) Above Rs.10 Crs. and up to Rs.20 Crs. Rs. 7,500/-(iv) Above Rs.20 Crs. Rs. 7,500/- plus Rs. 200/- for every increase Rs.1 Cr. or part thereof above Rs.20 crs.Subject to a maximum of Rs.30,000/- per instrument.

Sr. No. Particulars Norms1 Initial Listing Fees NIL2 Annual Listing Fee for tenure of the scheme Payable per 'month or part thereof'(i) Issue size up to Rs.50 Crs. Rs.1,000/-(ii) Above Rs.50 Crs.and up to Rs.100 Crs. Rs.2,000/-(iii) Above Rs.100 Crs.and up to Rs.300 Crs. Rs.3,600/-(iv) Above Rs.300 Crs.and up to Rs.500 Crs. Rs.5,900/-(v) Above Rs.500 Crs.and up to Rs. 1000 Crs. Rs.9,800/-(vi) Above 1000 Crs. Rs.15,600/-

Mutual Funds:-

Ø The paid up equity capital of the applicant shall not be less than Rs. 10 Cr.Ø The capitalisation of the applicant's equity shall not be less than Rs. 25 Cr.Ø Having atleast three years track record .Ø Provide a certificate to the Exchange in respect of the following:(i) The company has not been referred to the Board for Industrial and Financial Reconstruction (BIFR).(ii) The networth of the company has not been wiped out by the accumulated losses resulting in a negative networth(iii) The company has not received any winding up petition admitted by a court.Ø No disciplinary action by other stock exchanges and regulatory authorities in past three years.

Ø Discloser of Distribution of shareholding.Ø Discloser Details of Litigation pending.Ø Discloser of Track Record of Director(s) of the Company.Ø Submission of Memorandum and Articles of Association.Ø Approval of draft prospectus with NSE.Ø Submission of Application for admission of security to dealing on the NSE.Ø Requirement of deposit of 1% Security of the issue amount with the Exchange.Ø Payment of Listing Fees including annual listing fees as per schedule.

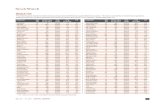

Particulars Amount ( )Initial Listing Fees 50,000Annual Listing Fees (based on paid up share capital)Upto 5 Crore 18,000Above 5 Crore and upto 10 Crores 31,500Above 10 Crore and upto 20 Crores 57,500Above 20 Crore and upto 30 Crores 90,000Above 30 Crore and upto 40 Crores 1,00,000Above 40 Crore and upto 50 Crores 1,05,000Above 50 Crores and upto 100 Crores 1,75,000Above 100 Crore and upto 150 Crores 2,00,000Above 150 Crore and upto 200 Crores 2,40,000Above 200 Crore and upto 250 Crores 2,75,000Above 250 Crore and upto 300 Crores 3,10,000Above 300 Crore and upto 350 Crores 3,40,000Above 350 Crore and upto 400 Crores 3,75,000Above 400 Crore and upto 450 Crores 4,35,000Above 450 Crore and upto 500 Crores 5,00,000

} A premier marketplace} Largest exchange} Unprecedented reach} Transaction speed} Broadcast facility for corporate

announcements} Fund Raising and exit route to investors

} Supervision and Control of Trading in Securities

} Better Corporate Practice} Benefits to the Public} Subdivision and Consolidation of Holdings

Stock Exchange Compliances Sr. No.

Compliances Time Period

1. Notice of Board Meeting to the Stock Exchange to consider the Annual Results

At least 7 clear days before the Meeting excluding the date of meeting and notice

2. Press release for Board Meeting (Eng.+Hindi)

At least 7 days before the Meeting

3. Board Meeting to consider the Qtr. Results

Within 30 days of end of Quarter (i.e. upto 29th )

4. Fax of Qtr. Result to SE Within 15 minutes of Board Meeting

5. Submission of Qtr. Result with photocopies of news paper cutting

With 2-3 days of Board Meeting

6. Publication of Qtr. Result (Eng.+Hindi) Within 48 hours of Board Meeting

ANNUAL LEGAL REQUIRMENTS OF LISTING

7. Shareholding Pattern to the Stock Exchange along with Free Float Indices under clause 35

Within 21 days of end of Quarter

8. Secretarial Audit Certificate from CA/PCS for reconciliation of physical share and demat shares

Within 30 days of end of Quarter

9. Clause 47C Certificate from a PCS –Half yearly Compliance Certificate

Within 1 month of end of half year and within 24 hours after signing of PCS

10. Quarterly Compliance Report on Corporate Governance under Clause 49

Within 15 days of end of Quarter

11. Annual Listing Fees Within 30 days 12. Annual Custodial fees to NSDL/CDSL Within 30 days

13. Uploading of Shareholding Pattern and Quarterly Results to SEBI EDIFAR website

Immediately whenever ready for submission to Stock Exchange

ANNUAL LEGAL REQUIRMENTS OF LISTING Contd…

} Who fixes the price of securities in an issue?} What is the difference between “Fixed price

issue” and “Book Built issue”?} What is a price band?} Can I change/revise my bid?} Can I cancel my Bid?} What proof can I request from a trading

member or a syndicate member for entering bids?

� “Delisting” is totally the reverse of listing. To delist means permanent removal of securities of a listed company from a stock exchange. As a consequence of delisting, the securities of that company would no longer be tradable at that stock exchange.

Delisting

Compulsory Delisting

Voluntary delisting from

all the exchanges

Voluntary delisting from few exchanges but remains listed on

at least one stock exchange having

nation wide terminals

Small Company (whether listed at

any of the Exchanges)

Exit opportunity No Exit

opportunityExit opportunity is

not compulsory

Voluntory Delisting

� Non-Payment of listing fees� Non-Compliance with regulations� Non-redressal of investor complaints� Unfair trading practices� Fake Certificate By Management� Reduction in number of public holders

� For delisting from all or any RSE� Not to apply to scheme sanctioned by BIFR if § Specific Procedure or§ Exit Option to existing holders

� Neither company shall apply nor RSE shall permit§ Pursuant to buy back§ Pursuant to preferential allotment§ Unless 3 years elapsed since listing§ Convertible instruments outstanding

§ No promoter or promoter group shall propose delisting if they sold equity shares in 6 months prior to BM� Promoter shall not employ funds to finance exit

oppurtunity� The acquirer, promoter or related entities shall not

engage any scheme, transaction or practice to fraud

� May delist without following Chapter- IV if§ Paid up Capital is upto 10 crore§ Net worth is upto 25 crore§ Not been suspended by any RSE for non-

compliance� Additional conditions:§ Appoint merchant banker§ Inform individually to all shareholder§ Receives 90% positive consent§ Finalise process within 75 days§ Make payment within 15 days

� Order by Recognised Stock Exchange� Decision by Panel� Notice in national daily� Consider representations� Exit oppurtunity not applicable� Inform other stock exchanges

Following shall not access securities market� The Company� Whole time Directors� Promoters� Any other company

• Board Approval. • Members Approval. • In-principal Application to Stock

Exchange. • Final Application to Stock Exchange.

• Public Announcement. • Escrow Account. • Letter of Offer. • Bidding Period. • Shareholders Right to Participate. • Offer Price • Minimum no. of Equity Shares.

• Compliance of Special Resolution. • Resolution of Investors Grievances. • Payment of Listing Fees. • Compliance with Listing Agreement. • Pending Litigations impacting shareholders. • Any Other Matter