Life cycle of financial planning 1.11.2.g1

-

Upload

crystalpullen -

Category

Documents

-

view

110 -

download

1

description

Transcript of Life cycle of financial planning 1.11.2.g1

Life Cycle of Financial Planning

Take Charge of Your Finances

© Family Economics & Financial Education – May 2010 – Introduction to Finance Unit – Life Cycle of Financial Planning – Slide # 2

Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

1.11.2.G1

Financial Planning

Financial planning is a tool used to achieve financial success based upon the

development and implementation of financial goals.

Many people follow a similar financial pattern during their life

BUTEveryone has an individualized

financial plan.

© Family Economics & Financial Education – May 2010 – Introduction to Finance Unit – Life Cycle of Financial Planning – Slide # 3

Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

1.11.2.G1

Financial Plan Influences

Financial planning is influenced by many factors:

These factors can be

expected and unexpected.

© Family Economics & Financial Education – May 2010 – Introduction to Finance Unit – Life Cycle of Financial Planning – Slide # 4

Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

1.11.2.G1

Financial Goals

• Financial goals are specific objectives to be accomplished through financial planning

• Financial goals should be SMART goals:– Specific– Measurable– Attainable– Realistic– Time Bound

An essential step to

creating a financial

plan

© Family Economics & Financial Education – May 2010 – Introduction to Finance Unit – Life Cycle of Financial Planning – Slide # 5

Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

1.11.2.G1

SMART Financial Goals

© Family Economics & Financial Education – May 2010 – Introduction to Finance Unit – Life Cycle of Financial Planning – Slide # 6

Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

1.11.2.G1

Lifestyle Conditions

© Family Economics & Financial Education – May 2010 – Introduction to Finance Unit – Life Cycle of Financial Planning – Slide # 7

Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

1.11.2.G1

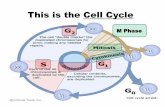

• There is a typical life cycle pattern that applies to most people

• Includes three stages • The amount of time it takes to

move through the financial life cycle varies for every individual

Financial Life Cycle

A life cycle is a series of stages in which an individual passes during his or her

lifetime

© Family Economics & Financial Education – May 2010 – Introduction to Finance Unit – Life Cycle of Financial Planning – Slide # 8

Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

1.11.2.G1

An Individual’s Financial Life Cycle

$

Approaching

Retirement

Years

Retirement Years

Single * Marriage * Start and Raise Family

0 20 30 40 50 60 70 80Years of Age

Stage 1: Basic Wealth Protection

Stage 3: Wealth

DistributionStage 2: Wealth Accumulation

© Family Economics & Financial Education – May 2010 – Introduction to Finance Unit – Life Cycle of Financial Planning – Slide # 9

Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

1.11.2.G1

An Individual’s Financial Life Cycle

© Family Economics & Financial Education – May 2010 – Introduction to Finance Unit – Life Cycle of Financial Planning – Slide # 10

Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

1.11.2.G1

Personal Financial Management Pyramid

Risk and Tax Management:goal setting, insurance, protection against

economic loss, income tax reduction

Building Long Term Wealth:

goal setting, retirement

planning, investments

Cash Management: goal setting, emergency, cash reserve, record

keeping, spending plans, net worth, and income-expense statements

EstatePlannin

g

Credit and Debt Management: goal setting, credit use, avoiding credit abuse,

debt reduction

Building Financial Security: goal setting, savings plan, home ownership, children’s

education

Wealth Distribution‘giving it to your

chosen ones’Wealth

Accumulation‘giving it to yourself’

Basic Wealth

Protection

‘quit giving it to others’

© Family Economics & Financial Education – May 2010 – Introduction to Finance Unit – Life Cycle of Financial Planning – Slide # 11

Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

1.11.2.G1

Life Cycle Events Activity

• People in certain age groups tend to have similar life cycle needs

• What activities and events require financial planning during each stage?– High School Ages 13-17– Young Adult Ages 18-24– Adult With or Without Children Ages 25-34 – Working Parent or Adult Ages 35-44 – Midlife Ages 45-54 – Pre-Retirement Ages 55-64 – Retired Ages 65 and older

Identify someone you

know in each

category

© Family Economics & Financial Education – May 2010 – Introduction to Finance Unit – Life Cycle of Financial Planning – Slide # 12

Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

1.11.2.G1

Traditional Age Group Financial Planning Needs

• High School Ages 13 – 17– Developing a plan for eventual

independence– Preparing for career– Evaluating future financial needs

and resources– Exploring financial systems –

banks, etc.– Developing a personal system of

record keeping

© Family Economics & Financial Education – May 2010 – Introduction to Finance Unit – Life Cycle of Financial Planning – Slide # 13

Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

1.11.2.G1

Traditional Age Group Financial Planning Needs

• Young Adult Ages 18 – 24– Establishing a household– Training for a career– Earning financial independence– Determining insurance needs– Establishing credit– Establishing savings– Creating a spending plan– Developing a personal financial identity– Developing a personal financial system

© Family Economics & Financial Education – May 2010 – Introduction to Finance Unit – Life Cycle of Financial Planning – Slide # 14

Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

1.11.2.G1

Traditional Age Group Financial Planning Needs

• Adult With or Without Children Ages 25 – 34– Child-bearing– Child-raising– Starting an education fund for children– Expanding career goals– Managing increased need for credit– Discussing and managing additional

insurance needs– Creating a will– Maximizing financial management by

all members of household

© Family Economics & Financial Education – May 2010 – Introduction to Finance Unit – Life Cycle of Financial Planning – Slide # 15

Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

1.11.2.G1

Traditional Age Group Financial Planning Needs

• Working Adult or Parent Ages 35 – 44– Upgrading career training– Building on children’s education fund– Developing protection needs for

head-of-household– Need for greater income due to

expanding needs– Establishing retirement goals

© Family Economics & Financial Education – May 2010 – Introduction to Finance Unit – Life Cycle of Financial Planning – Slide # 16

Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

1.11.2.G1

Traditional Age Group Financial Planning Needs

• Midlife Ages 45 – 54– Assisting with higher

education for children– Investing– Updating retirement plans– Developing estate plans

© Family Economics & Financial Education – May 2010 – Introduction to Finance Unit – Life Cycle of Financial Planning – Slide # 17

Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

1.11.2.G1

Traditional Age Group Financial Planning Needs

• Pre-Retirement Ages 55 – 64– Consolidating assets– Planning future security– Re-evaluating property transfer– Investigating retirement part-time

income or volunteer work– Evaluating expenses for retirement and

current housing–Meeting responsibilities of ageing parents

© Family Economics & Financial Education – May 2010 – Introduction to Finance Unit – Life Cycle of Financial Planning – Slide # 18

Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

1.11.2.G1

Traditional Age Group Financial Planning Needs

• Retired Ages 65 and older– Re-evaluating and adjusting living

conditions and spending as related to health and income

– Adjusting insurance programs for increasing risks

– Acquiring assistance in management of personal and financial affairs

– Finalizing estate plan– Finalizing will or letter of last

instructions

© Family Economics & Financial Education – May 2010 – Introduction to Finance Unit – Life Cycle of Financial Planning – Slide # 19

Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

1.11.2.G1

True or False?

Everyone has the same financial plan.