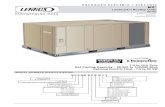

Lenox PWM Brochure

description

Transcript of Lenox PWM Brochure

Lenox AdvisorsPrivate Wealth Management Group

WelcomeAchieving fi nancial success does not always simplify life. In fact, affl uence

generally increases the complexity of the decision-making process. The

greater one’s wealth, the more time and knowledge must be invested in

maintaining its growth, protection and ultimate distribution.

Attorneys, accountants, insurance professionals and fi nancial planners can

offer invaluable advice, but because most offer services independent of one

another, it is often up to their clients to sift through the individual recom-

mendations, evaluating each to determine which are the most appropriate.

The ideal solution is a wealth management fi rm that can help defi ne and

achieve each client’s unique, long-term goals through a comprehensive,

holistic program of investments, tax planning, asset allocation, risk manage-

ment, insurance, retirement planning and estate planning.

Lenox Advisors helps provide that solution... in an independent, objective

and integrated fashion.

A Single Source

Lenox Advisors is a unique Wealth Advisory fi rm focusing on high net worth individuals,

including corporate executives, business owners and entrepreneurs. Most of our clients

retain us to be their “personal CFO.” We coordinate all aspects of their fi nancial lives,

including retirement planning, asset management, risk management, estate planning,

insurance, children’s college education, etc.

In Lenox’s Private Wealth Management Group, highly-skilled fi nancial planning professionals,

CFP® practitioners, CPAs and others, craft the strategies and engineer the follow-through to

help ensure continued fi nancial success as part of the Lenox CFO™ Program. Concurrently,

asset management strategists have the ability to access institutional money managers

matched to clients’ specifi c objectives.

Working in tandem allows each team member to become familiar with each client’s individual

needs and more effi ciently integrate solutions into the overall fi nancial plan. This reduces

the complexity in clients’ fi nancial lives, which helps to increase clients’ fi nancial security.

Comprehensive StrategiesLENOX ADVISORS OFFERS: ○ Private Wealth Management

○ Fee-Based Financial Planning/Lenox CFO™

○ Asset Management ○ Insurance Brokerage

○ Life Insurance ○ Disability Income Insurance ○ Long Term Care Insurance ○ Annuities

○ Lenox Corporate Benefi ts ○ Group Insurance Benefi ts ○ Corporate Executive Carve-Out Insurance Programs

○ Lenox RPC™ (Retirement Plan Consultancy) Platform

Secure

SimplifyAs their wealth grows, most affl uent individuals express concern that their

fi nancial lives are increasingly complex. They face a wide array of compli-

cated decisions every day:

• How can they secure their fi nancial future, including estate planning, retire-

ment, insurance and asset management?

• How do they best allocate their assets to match their short and long-term

needs, while addressing their philanthropic goals?

• How can they afford to help care for aging parents, while minimizing the

fi nancial impact on their family?

As a single-source fi nancial advocate— their personal CFO—Lenox works

collaboratively with clients’ advisors to create a focused, integrated strategy

that drives all present and future fi nancial-related decisions. The Lenox

CFO™, the fi rm’s proprietary platform for simplifying the fi nancial planning

process, enables Lenox to coordinate each client’s fi nancial matters—from

risk management and estate planning* to asset management and insurance.

Lenox CFO™

Lenox CFO™

“We help our clients realize their dreams by integrating and

overseeing virtually every aspect of their fi nancial lives.”

Michael Book, Managing Partner, Lenox Advisors

○ Cash Flow/Retirement Planning ○ “What if” Scenarios ○ Expense Modeling ○ Retirement Income and Distribution Strategies ○ Tax Minimization Strategies

○ Balance Sheet/Net Worth Statements ○ Estate Planning Strategies ○ Risk Management/Insurance Audits ○ Asset Allocation Strategies ○ Account Aggregation ○ Education Funding ○ Lenox Vault for all Personal Documents ○ Lenox Money-Smart Kids™ Program

○ Financial Literacy Resources ○ Age-Based Lesson Plans for Children

Lenox CFO™

What sets Lenox apart is the comprehensive nature of what we can accomplish as your

personal CFO, streamlining the fi nancial planning process, with a focus on advice rather

than products.

Our technology gives Lenox Advisors and our clients the ability to organize information

from all their advisors and consolidate them in one place. The data is encrypted, secure

and automatically updated daily. This frees the client from the smallest (but often the most

critical) details of wealth management, giving them the freedom to devote more time and

attention to other important aspects of their lives.

Streamline

Organize and Consolidate

“Managing your wealth can be an intimidating process. We turn

anxiety into empowerment by becoming our clients’ personal CFO

and developing a set of fi nancial goals and a game plan for

achieving them.”

Rick Van Benschoten, CFP®, Managing Partner, Lenox Advisors

A key differentiator of Lenox is our values-based approach to wealth management and

how it threads throughout your relationship with Lenox. All our recommendations are

sourced through your “Personal Money Constitution,” a document reflecting your (and

your family’s) relationship to money.

For example, what are the values you grew up with and what do you want to pass on to

your children? What values do you and your spouse agree and disagree on? What would

we have to do together over the next fi ve years for you to believe we’ve succeeded in

managing your fi nancial affairs?

Realizing that wealth management is often a family issue, Lenox developed a proprietary

platform, the Lenox Money-Smart Kids™ Program, to help parents communicate their fi nan-

cial values and educate their children about money and philanthropy. Lenox knows preserv-

ing generational wealth cannot be accomplished without preserving values.

Communicate

Financial Values

Lenox CFO™

StrategizeSuccessful asset management is a process, not an event. Securing one’s

fi nancial future, particularly in an uncertain economic environment, requires

continuous oversight by an integrated team of fi nancial professionals who

are able to provide insightful advice and timely execution against agreed-

upon fi nancial goals. Such oversight provides strategic perspectives on

specifi c issues, including: What asset allocation is appropriate for your level

of risk tolerance? Where should you own specifi c investments in order to

maximize after-tax returns? When should one overweight versus under-

weight certain asset classes?

Lenox Asset Management

Lenox Asset Management

○ Access to Separately Managed Accounts ○ Municipal and Taxable Bond Portfolios ○ Equities ○ Alternative Investments ○ Mutual Funds ○ Variable Annuities ○ Exchange Traded Funds ○ Real Estate Investment Trusts ○ Commodities-Based Funds ○ Oil and Gas Partnerships

Lenox Asset Management

Lenox Advisors takes the time to listen to clients and understand how they accumulated

their wealth. Was it success in a self-made business, inherited money, a concentrated

stock holding in a public company? Lenox then develops an investment strategy based on

each client’s particular fi nancial goals including their spending needs, multi-generational

estate planning goals, retirement and future philanthropic aspirations. We believe success-

ful asset management should be part of overall estate, business and fi nancial planning.

ASSET ALLOCATION

Lenox Advisors takes an institutional approach to individual investing, encouraging clients

to approach their portfolio asset allocation similar to a college endowment or charitable

foundation. We believe global, multi-asset class portfolios of stock, bond, and alternative

investments have the best potential to protect assets and generate strong returns while

minimizing risk. Emphasizing asset classes and investment vehicles that have little or no

correlation over a market cycle helps to increase success.

INVESTMENT VEHICLES

Lenox Advisors has no proprietary products, and utilizes an open architecture approach

through consulting fi rms that assist in the initial and ongoing reviews of institutional

money managers. Lenox implements portfolios through some of the best money manag-

ers and private fi rms available, as well as utilizing passive investments where appropriate.

ASSET OWNERSHIP

Often overlooked, asset ownership is an important aspect of investment planning. For

example, tax-ineffi cient investments (including some alternative investments) could be

moved to tax-deferred accounts. This type of investment detail, keeping in mind the under-

lying performance of the investment, could yield far more in returns than market timing or

investment selection. These decisions become even more important when potential tax

increases may be on the horizon.

Access

Analysis and Planning

“The one certain way to improve investment returns is to reduce

expenses, and the greatest expense in most investment portfolios

is taxes. We believe wealth is amassed by focusing on after-tax

returns, not pre-tax returns.”

Greg Olsen, CFP®, Partner, Lenox Advisors

Lenox Asset Management

PERFORMANCE AND PORTFOLIO MONITORING

Specifi c goals and monetary aspirations can change over time. Likewise, the cycles of the

global markets and the structure of the world economy evolve and change through the

years. Lenox Advisors meets regularly with clients to update their recommended asset

allocation, rebalance the overall portfolio, or replace or add an investment vehicle or man-

ager. Any modifi cation is made based on a clear understanding of each client’s current

situation and future goals, and on up-to-date economic and investment vehicle analyses.

WHAT SETS US APART ○ Lenox provides a team of planning and investment specialists, all integrated in one Private

Wealth Management group, who are compensated based on servicing current clients, not

fi nding new ones. ○ Lenox has access to some of the best managers that do not participate on large wire-

house platforms. ○ We help develop infl ation-protected, tax-effi cient portfolios focused on capital preservation

for the long-term investor. ○ Client portfolios are monitored regularly to manage risk, respond to client needs, and quickly

take advantage of market conditions. ○ Portfolios are fi ltered through a customized optimizer, to create effi cient portfolios that

balance risk and return. ○ Because we have no proprietary products, we are free to fi nd who we believe to be the best

managers in each asset class. ○ We also understand risk management/ insurance and how it can creatively help your

portfolio.

Integrate

Diversifi ed Investing

OVERSIGHT

Client portfolios are monitored regularly to manage risk, respond to client needs, and quickly take advantage of market conditions.

TEAM

Lenox provides a team of plan-ning and investment specialists, integrated in one Private Wealth Management group, who are compensated based on servic-ing current clients, not finding new ones.

DESIGN

Portfolios are filtered through a customized optimizer to create effi cient portfolios that balance risk and return.

ACCESS

Lenox has access to some of the best managers not on large wirehouse platforms.

PORTFOLIOS

We help develop inflation-pro-tected, tax-efficient portfolios focused on capital preservation for the long-term investor.

Lenox Advantage

“It’s no surprise that our business is built almost entirely on

referrals from clients, accountants and attorneys.”

Tom Henske, CFP®, Partner, Lenox Advisors

INDEPENDENCE, OBJECTIVITY AND INTEGRATION

It takes the combined expertise of a team of trusted advisors—attorneys, accountants,

insurance brokers and fi nancial planners—working in concert, collaboratively and seam-

lessly, to help assure fi nancial security. Lenox Advisors integrates fi nancial security

into fi nancial success by delivering an unprecedented level of specialized expertise and

personalized service entirely focused on helping our clients grow, protect and distribute

their wealth.

Lenox Advisors’ approach is founded on building a deep understanding of the unique

needs of each client. It is Lenox’s mission to become aware of the changes in clients’ life

circumstances in order to anticipate and respond creatively to new risks and emerging

opportunities. The end result is a coordinated fi nancial plan, updated regularly, that will

help meet each client’s individualized wealth management goals.

Lenox is a part of National Financial Partners (NFP), a publicly traded company focused on

the distribution of fi nancial services to high net worth individuals and growing entrepre-

neurial companies. This gives Lenox the ability to offer its clients the benefi ts of objective,

independent advice together with all the resources of a leading national organization.

For further information, call Lenox Advisors at (212) 536-8700, email them at

[email protected] or visit the firm’s website at www.lenoxadvisors.com.

Collaborate

Expertise and Service

Select Screen Shots from the Lenox CFO™

Corporate Headquarters530 Fifth AvenueNew York, NY 10036

Two Stamford Plaza281 Tresser BoulevardSuite 1004Stamford, CT 06901

20 North Clark StreetSuite 550Chicago, IL 60602

535 Pacifi c Avenue 2nd FloorSan Francisco, CA 94133

* Estate planning is done in conjunction with your estate planning attorney, tax attorney and/or CPA.

Asset allocation does not guarantee a profi t or protect against loss in declining markets. There is no guarantee that a diversifi ed portfolio will outperform a non-diversifi ed portfolio or that diversifi cation among asset classes will reduce risk.

Fee-based fi nancial planning services offered through Lenox Advisors, Inc. Lenox Advisors, Inc., offers access to securities and asset management services through MML Investors Services, Inc., 530 5th Avenue, 14th Floor, New York, NY 10036, 212-536-6000, mem-ber SIPC. Investment adviser representatives of Lenox Advisors, Inc. offering fee-based fi nancial planning services may also be registered representatives and investment adviser representatives of MML Investors Services, Inc. for purposes of offering securities and asset management services, as applicable. Lenox Advisors, Inc. is a wholly owned subsidiary of National Financial Partners Corp. (NFP). Lenox Advisors, Inc and NFP are not affi liates or subsidiaries of MML Investors Services, Inc. Services offered through Lenox Advisors, Inc. as an Independent Registered Investment Advisor are not sponsored or offered through MML Investors Services, Inc. CRN201210 - 136659