Lecture C (BCG Matrix)

-

Upload

sumitmamtani -

Category

Documents

-

view

246 -

download

0

Transcript of Lecture C (BCG Matrix)

-

8/8/2019 Lecture C (BCG Matrix)

1/18

12/05/1012/05/10 11

StrategicStrategic Business UnitsBusiness UnitsDivisions within multi-product companies composed of keyDivisions within multi-product companies composed of key

businesses with specific managers, resources, objectives, businesses with specific managers, resources, objectives,competitors.competitors.

It can also be a company division or a product line - it allIt can also be a company division or a product line - it all

depends on how the company is organised.depends on how the company is organised. SBUs possess:SBUs possess:a distinct missiona distinct missiontheir own managerstheir own managersidentifiable customer segmentsidentifiable customer segmentsspecific competitorsspecific competitorsability to be planned independentlyability to be planned independently

-

8/8/2019 Lecture C (BCG Matrix)

2/18

12/05/1012/05/10 22

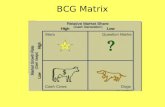

Market Share/Market GrowthMarket Share/Market GrowthMatrixMatrix

Question MarksQuestion Marks - products with low market share in- products with low market share inindustries with high growth potentialindustries with high growth potential

convert to Star, or convert to Star, or Exit marketExit market

StarsStars - products with high market share in industries- products with high market share in industries

with high growth potentialwith high growth potentialmake heavy investment because of sales/profitmake heavy investment because of sales/profitpotentialpotential

-

8/8/2019 Lecture C (BCG Matrix)

3/18

12/05/1012/05/10 33

Market Share/Market Growth MatrixMarket Share/Market Growth Matrix

Cash CowsCash Cows - products with high market share in- products with high market share inindustries with low market growth potentialindustries with low market growth potential

maintain status as long as possiblemaintain status as long as possible

products produce strong, positive cash flows products produce strong, positive cash flows

Cash Cows support other SBUs because of their goodwill and market share.Cash Cows support other SBUs because of their goodwill and market share.

DogsDogs - products with low market share in industries with- products with low market share in industries withlow market growth potentiallow market growth potential

minimize positionminimize position

withdrawwithdraw

-

8/8/2019 Lecture C (BCG Matrix)

4/18

12/05/1012/05/10 44

The Boston Consulting GroupsThe Boston Consulting GroupsGrowth-Share MatrixGrowth-Share Matrix

3

?

Marketgrowth rate

Relative market share

Stars

Cash cow

Question marks

Dogs

? ? ?

5

4

2

1

68

7

HIGH LOW

HIGH

LOW

-

8/8/2019 Lecture C (BCG Matrix)

5/18

12/05/1012/05/10 55

Model Use and ApplicabilityModel Use and Applicability

The Boston Consulting Group identified four major The Boston Consulting Group identified four major strategic thrusts in terms of market share.strategic thrusts in terms of market share.

Once the products have been plotted, the planner then hasOnce the products have been plotted, the planner then hasto decide on a strategy for that product. There are 4 major to decide on a strategy for that product. There are 4 major strategies that can be followed.strategies that can be followed.

BuildBuild

HoldHold

HarvestHarvestDivestDivest

-

8/8/2019 Lecture C (BCG Matrix)

6/18

12/05/1012/05/10 66

BuildBuildThe product or SBUs market share needs to be increased toThe product or SBUs market share needs to be increased tostrengthen its position.strengthen its position. Invest in one or more SBUs toInvest in one or more SBUs tobuild a share .build a share . This strategy is suited toThis strategy is suited to Question Marks

Question Marks ..

HoldHold The objective is to maintain the current share position and thisThe objective is to maintain the current share position and this

strategy is often used for strategy is often used for Cash CowsCash Cows so that they continue toso that they continue togenerate large amounts of cash.generate large amounts of cash.

Invest just enough to maintain a share in the market.Invest just enough to maintain a share in the market.

-

8/8/2019 Lecture C (BCG Matrix)

7/18

12/05/1012/05/10 77

HarvestHarvestHere management tries to increase short-term cash flows as far asHere management tries to increase short-term cash flows as far as

possible (e.g. price increase, cutting costs). possible (e.g. price increase, cutting costs).It is a strategy suited toIt is a strategy suited to weak Cash Cowsweak Cash Cows or Cash Cows that are in aor Cash Cows that are in amarket with amarket with a limited futurelimited f uture ..Harvesting is also used for Harvesting is also used for Question MarksQuestion Marks where there is nowhere there is no

possibility of turning them into Stars, and for Dogs. possibility of turning them into Stars, and for Dogs.

DivestDivestThe objective of this strategy is to rid the organisation of theThe objective of this strategy is to rid the organisation of the

products or SBUs that are drain on profits and to utilize these products or SBUs that are drain on profits and to utilize these

resources elsewhere in the business where they will be of greater resources elsewhere in the business where they will be of greater benefit. benefit.This strategy is typically used for This strategy is typically used for Question MarksQuestion Marks that will notthat will not

become Stars and for become Stars and for Dogs Dog s ..

-

8/8/2019 Lecture C (BCG Matrix)

8/18

12/05/1012/05/10 88

Summary of the BCG Matrix / Growth Share MatrixSummary of the BCG Matrix / Growth Share Matrix

The BCG matrix was introduced in the late 1960s and itThe BCG matrix was introduced in the late 1960s and itattempted to facilitate the allocation of resources for aattempted to facilitate the allocation of resources for a

portfolio of companies, SBUs or products. portfolio of companies, SBUs or products.

Cash cows are cash generators and require an invest or holdCash cows are cash generators and require an invest or holdstrategy while maximizing cash flow.strategy while maximizing cash flow.

Stars are potential cash cows and require adequate funding toStars are potential cash cows and require adequate funding toestablish a dominant position before the market growth rateestablish a dominant position before the market growth rate

slows down and they become cash cows.slows down and they become cash cows.

-

8/8/2019 Lecture C (BCG Matrix)

9/18

12/05/1012/05/10 99

Question marks do not have market share on their side. TheyQuestion marks do not have market share on their side. Theyare found in growing markets and require funding if they areare found in growing markets and require funding if they areto become stars. If not withdrawal is possible.to become stars. If not withdrawal is possible.

Dogs are neither cash generators nor in many instances cashDogs are neither cash generators nor in many instances cash

drains. They can be left alone or removed from the portfolio.drains. They can be left alone or removed from the portfolio.

The aim is to achieve a balanced portfolio, sustaining or The aim is to achieve a balanced portfolio, sustaining or holding the Cash Cows, investing in the Stars and some selectholding the Cash Cows, investing in the Stars and some selectQuestion Marks and divesting or holding Dogs.Question Marks and divesting or holding Dogs.

If necessary, Questions marks could also be divested if they doIf necessary, Questions marks could also be divested if they donot have a chance of becoming a Star.not have a chance of becoming a Star.

-

8/8/2019 Lecture C (BCG Matrix)

10/18

12/05/1012/05/10 1010

Cash Positions of VariousCash Positions of VariousBusinessesBusinesses

SL. NO.

BUSINESS TYPE CASHSOURCE

CASHUSE

NET CASHBALANCE

1. COW MORE LESS Funds available, somilk and deploy

2. STAR MORE MORE Build Competitive position and grow

3. DOG LESS LESS Divest and redeploy proceeds

4. QUESTIONMARK

LESS MORE Funds needed to investselectively tocompetitive position

-

8/8/2019 Lecture C (BCG Matrix)

11/18

12/05/1012/05/10 1111

Market Attractiveness/BusinessMarket Attractiveness/BusinessStrength MatrixStrength Matrix

Also Known as GE/Mc Kinsey MatrixAlso Known as GE/Mc Kinsey MatrixA portfolio analysis technique that ratesA portfolio analysis technique that rates

SBUs according to:SBUs according to:

market attractivenessmarket attractivenessthe organizations strengthsthe organizations strengths

Useful diagnostic tool for identifying SBUsUseful diagnostic tool for identifying SBUswith greatest and least potentialwith greatest and least potential

-

8/8/2019 Lecture C (BCG Matrix)

12/18

12/05/1012/05/10 1212

Industry Attractiveness is determined by factorsIndustry Attractiveness is determined by factors

such assuch as ::Market Growth RateMarket Growth Rate

Market SizeMarket Size

Demand VariabilityDemand VariabilityIndustry ProfitabilityIndustry Profitability

Industry RivalryIndustry Rivalry

Global OpportunitiesGlobal Opportunities

Macro Environmental Factors (PEST)Macro Environmental Factors (PEST)

-

8/8/2019 Lecture C (BCG Matrix)

13/18

-

8/8/2019 Lecture C (BCG Matrix)

14/18

12/05/1012/05/10 1414

SBUs are portrayedSBUs are p ortrayedin a circle wherebyin a circle whereby

- The size of the circlesThe size of the circlesrepresents the marketrepresents the marketsizesize

- The size of the pieThe size of the pierepresents the marketrepresents the marketshare of the SBUsshare of the SBUs

- Arrows represents theArrows represents thedirection and thedirection and themovement of SBUs inmovement of SBUs inthe futurethe future

StrongStrong MediumMedium Weak Weak

StrongStrong

MediumMedium

Weak Weak

-

8/8/2019 Lecture C (BCG Matrix)

15/18

12/05/1012/05/10 1515

Mc Kinsey/ GE Matrix

-

8/8/2019 Lecture C (BCG Matrix)

16/18

12/05/10 16

The Green Zone consists of the three cells in the upper left corner.If your enterprise falls in this zone you are in a favorable position withrelatively attractive growth opportunities. This indicates a "green light"to invest in this product/service.Best Strategy: INVEST FOR GROWTH

The Yellow Zone consists of the three diagonal cells from thelower left to the upper right. A position in the yellow zone is viewed ashaving medium attractiveness. Management must therefore exercisecaution when making additional investments in this product/service.The suggested strategy is to seek to maintain share rather than growingor reducing share.Best Strategy: INVEST FOR EARNINGS

TheRed Zone

consists of the three cells in the lower right corner. A position in the red zone is not attractive. The suggested strategy is thatmanagement should begin to make plans to exit the industry.Best Strategy: HARVEST or DIVEST

High Attractiveness LEADER High Attractiveness GROWTH High Attractiveness IMPROVE/QUIT

-

8/8/2019 Lecture C (BCG Matrix)

17/18

12/05/1012/05/10

1717

High Attractiveness LEADERStrong Competitive PositionStrategies:

provide maximum investmentdiversifyyour position to focus your resourcesaccept moderate near-term profits to build share

High Attractiveness GROWTHAverage Competitive PositionStrategies:

build selectively on strengthdefine the implications of challenging

for market leadershipfill weaknesses to avoid vulnerability

High Attractiveness IMPROVE/QUIT Weak Competitive PositionStrategies

ride with the market growthseek niches or specializationseek an opportunity to increasestrength through acquisition

Medium Attractiveness TRY HARDERStrong Competitive PositionStrategies:

invest heavily in selected segmentsestablish a ceiling for the market share youwish to achieveseek attractive new segments to applystrengths

Medium AttractivenessAverage Competitive PositionStrategies:

segment the market to find a moreattractive position

make contingency plans to protectyour vulnerable position

PROCEED WITH CARE

Medium Attractiveness PH.WDLWeak Competitive Position

Strategies:act to preserve or boost cash flow as

you exit the businessseek an opportunistic saleseek a way to increase your

strength

Low Attractiveness CASH GENERATION Strong Competitive PositionStrategies:

defend strengthsshift resources to attractive segmentsexamine ways to revitalize the industrytime your exit by monitoring for harvest or

divestment timing

Low Attractiveness PH. WDLAverage Competitive PositionStrategies:

make only essential commitmentsprepare to divestshift resources to a more attractive

segment

Low Attractiveness WITHDRAWAL Weak Competitive PositionStrategies:

exit the marketprune the product line

-

8/8/2019 Lecture C (BCG Matrix)

18/18

12/05/1012/05/10

1818

STRATEGIESSTRATEGIESBUSINESS STRENGTHBUSINESS STRENGTH

Strong Medium Weak

PROTECT POSITIONInvest to grow at max.digestible rate.

Concentrate effort onmaintaining strength.

INVEST TO BUILDChallenge for leadershipBuild selectivity onstrengths

Reinforce vulnerableareas

BUILD SELECTIVITYSpecialize around ltd strengthsSeek ways to overcome

weaknessesWithdraw if indications of sustainable growth are lacking

BUILD SELECTIVITYInvest heavily in mostattractive segmentsBuild up ability to counter competitionEmphasize profitability byraising productivity

SELECTIVITY/ MANAGEFOR EARNINGSProtect existing programConcentrate investmentsin segments where profit-ability is good and risks

are relatively low .

LIMITED EXPANSION ORHARVEST Look for ways to expand

without high risks elseminimize investment

PROTECT AND REFOCUSManage for current earningsConcentrate on attractivesegmentsDefend strengths

MANAGE FOR EARNINGSProtect position in mostprofitable segments

Upgrade product lineMinimize investment

DIVESTSell at time that will maximizecash value

Cut fixed costs and avoidinvestments meanwhile