Kristu Jayanti School of Management: Ventura 2K19 - An ... · Associates, andC Sivasankaran in the...

Transcript of Kristu Jayanti School of Management: Ventura 2K19 - An ... · Associates, andC Sivasankaran in the...

BENGALURU | WEDNESDAY, 5 JUNE 2019 ECONOMY 7<

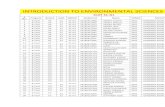

RAVI PARTHASARATHYThe formerchairman of IL&FSis accused of fraud with intentto injure the interests of thecompany, its shareholders,and lenders resulting inwrongful loss to thecompany. According to the

SFIO, Parthasarathy was heading the coteriecontrolling the day-to-day affairs of IFIN. In orderto avoid the accounts turning into an NPA, he kepton evergreening the loans. The loans wereultimately written off. The SFIO has chargedParthasarathy and others underSections 447,417, 420 read with 120B of the Indian PenalCode, among othercharges. Parthasarathy nowlives in London.

RAMESH BAWAPartof Parthasarthy's innercircle, the then MD and CEO ofIFIN is presently in judicialcustody. Bawa had notdisclosed his interestin AAAInfoSystems and AAABInfrastructure in which his

wife and daughterwere directors. Bawa will beprosecuted underSection 184 (4) of the CompaniesAct, 2013. AAAB Infa had entered into transactionsof approximately ~12 crore with Unitech, one of thedefaulting borrowers of IFIN.

UDAYAN SENFormer CEO of Deloitte andstatutory auditor of IFINcolluded with themanagement of IFIN andIL&FS and falsified the booksof accounts for the financialyears 2013-14 to 2017-18.

The members of the audit committee alsoconnived with the coterie and overlooked theirviolations of the norms, resulting in a loss for thecompany. Deloitte Haskins and Sells LLP, which isalso an accused, has denied all the allegations.

HARI SANKARANFormervice-chairman ofIL&FS is a co-accused withParthasarthy and is facingthe same charges. He iscurrently under judicialcustody. The otheraccusedare IL&FS directors Arun

Saha, Vibhav Kapoor, K Ramchand, and otherdirectors. The SFIO alleges that the accused tookseveral favours from defaulters, includingfurnishing of theirapartments in Brussels inreturn forapproving their loans.

KALPESH J MEHTAThe statutory auditor of IFINfailed to perform his dutiesdiligently and did not useprofessional scepticism toensure true and fairdisclosure of state of affairs ofthe company. The other

accused are: N Sampath Ganesh, Shrenik Baidalong with the otherauditing firm, BSR &Associates LLP. They, in fact, colluded withofficials of the company, to conceal thefraudulentactivities and thus failed in theirduties as required under Section 143 of theCompanies Act, 2013, the SFIO said. The auditorsare facing charges under Sections 143 and 147of the Act. BSR & Associates has denied theallegations.

C SIVASANKARANChennai-basedentrepreneur connived withthe management of the IFINand received wrongful gainin the form of loan from IFINwith intent to not repay thesame. The Siva group gave

dud shares of Tata Teleservices as collateral tokeep raising more money from IFIN.Sivasankaran has not responded to thisnewspaper's queries.

SHRIMI CHOUDHARYNew Delhi, 4 June

Trouble is mounting for audit firms asthe Enforcement Directorate (ED)issued summons to senior execu-

tives of Deloitte Haskins and Sells in con-nection with an ongoing money launder-ing probe against Infrastructure Leasing &Financial Services (IL&FS). According toenforcement sleuths, audit firms and audi-tors are likely to be called for probe soon.

Confirming the development, an EDofficial said Deloitte’s senior managementwas asked to appear before the agency onJune 12. “We have asked the audit firm toget relevant documents required in thecase and indicated that all the related firmsand individuals will be rounded up.”

Sources said those likely to be roundedup would include former auditors of IL&FSand its subsidiaries. An email sent toDeloitte remained unanswered.

The move comes after the ministry ofcorporate affairs (MCA) launched a prose-cution against Deloitte Haskins and Sells aswell as BSR and Associates LLP and theirformer auditors for their alleged role inperpetuating the fraud at IFIN, a subsidiaryof IL&FS.

The ministry also recommended debar-ment of these audit firms and their auditpartners. It sought interim attachment oftheir properties, including bank accountsand lockers.

ED is examining the charges put upagainst the audit firm in the Serious FraudInvestigation Office (SFIO) prosecutioncomplaint, filed last week. “We are cur-

rently looking at all aspects that led to afraud in the company. The agency willexamine the role of auditors in the pro-ceeds of crime and the complex structureallegedly created so that a fund could beeasily siphoned off,” said the official.

Last month, enforcement sleuths con-ducted search operations at the businesspremises and residences of four formerdirectors at IFIN.

These include Rajesh Kotian, formerexecutive director of IFIN; Shahzaad SirajDalal, who took IL&FS overseas, headedfunds floated by IL&FS InvestmentManagers, and financed some real estatedevelopers in India and Siddharth Mehta,one of the promoters of Bay Capital and

director at IL&FS Energy DevelopmentCompany.

IFIN director Manu Kochhar and for-mer managing director of IL&FSEngineering and Construction CompanyMukund Sapre were also searched by theprobe agency.

According to the sources, a statementhas been recorded of most of the individu-als searched so far. “We have come acrossstrong evidence with respect to seriousanomalies, multiple irregular transactions,and money involved. Based on the evi-dences, we are rounding up more peopleinvolved in the case,” the sources added.

The ED had earlier conducted similarsearches in February after it filed a moneylaundering case under the Prevention ofMoney Laundering Act.

Sources said the ED suspects proceedsof the crime to be over Rs 13,000 crore,involving several overseas deals. Sourcesadded the ED is probing instances of end-utilisation of loans, including money lentto borrowers of IFIN. There is evidenceshowing that advances were given to enti-ties linked with senior executives of IL&FSand IFIN.

The ED is examining whether the falsi-fication conducted by the auditors causedloss to the company and how much of itwas being diverted. The ED’s case is basedon a first information report filed before theeconomic offences wing of the Delhi Policein December last year. The director of aninfrastructure firm had filed the caseagainst officials of IL&FS Rail for allegedlytriggering Rs 70-crore loss to his companyby fraudulent means.

Startup India created 560,000 jobs since 2016: GovtSUBHAYAN CHAKRABORTYNew Delhi, 4 June

The Startup India initiative hascreated an estimated 187,004direct jobs since its inception in2016, with the number of relat-ed indirect jobs taking the totaltally to more than 560,000, thegovernment has claimed.

“Start-ups create valuablejobs. 187,004 jobs have beenreported by 16,105 Departmentfor Promotion of Industry andInternal Trade (DPIIT)-recog-nised start-ups, i.e., more than

11 direct jobs per start-up. Witheach direct job leading to 3xindirect jobs, the total jobs cre-ated by these start-ups are esti-mated at more than 560,000,”Ramesh Abhishek, DPIIT sec-retary, said on Tuesday.

However, the figures are selfreported by start-ups and notverified by the government.

This job growth has come ata rough cost of more than~2,500 crore disbursed by thegovernment to fund start-ups.

In 2016, the Centre hadestablished a ~10,000-crore

fund of funds under the SmallIndustries Development Bankof India (Sidbi) to meet thefinancial needs of start-ups.

“From the fund of funds,Sidbi has committed ~2,570crore to 45 venture funds,catalysing investments of morethan ~25,000 crore. 244 start-ups have received funding of~1,561 crore,” Abhishek tweet-ed.

Abhishek’s commentsassume significance as theNarendra Modi governmenthas received criticism for not

being able to shore up employ-ment. Last week, the first peri-odic labour force survey offi-cially showed theunemployment rate at a 45-year-high of 6.1 per cent in 2017-18.

The secretary added thatsince 2016, when the flagshipdigital initiative was launched,18,861 start-ups have beenrecognised. “In May 2019, 814start-ups have received recog-nition. This is more than onestart-up every hour. These enti-ties are spread across 513 dis-

tricts of 29 states and six UnionTerritories,” Abhishek tweeted.

But start-ups claim therecognition hasn’t increasedtheir chances of sourcing fundsfrom the market even as fewqualify for government invest-ments. Banks do not provideMudra loans or assistanceunder Startup India schemes toprivate limited companies thatare less than a year old. On theother hand, venture capitalistsand angel investors only fundprivate limited companies,”they had argued.

According to the officialwebsite of the Startup India ini-tiative, the certificate gives acompany income-tax exemp-tion for a period of three con-secutive years and exemptionon capital gains and invest-ments above fair market value.It provides for easy winding upof a firm within 90 days. It alsohelps fast-track up to 80 percent rebate on filing patents. Italso promises to help facilitatefunds for investments into start-ups through alternative invest-ment funds.

ED summons Deloitte brass in IL&FS money laundering case

The Serious FraudInvestigation Office(SFIO) has filed itsfirst charge sheetagainst the topofficials anddirectors of IL&FS,its auditors,Deloitte Haskins &Sells, BSR andAssociates, and CSivasankaran in theIL&FS FinancialServices (IFIN) fraudcase. Here is the listof key players andthe allegations theyare facing. None ofthem has beenconvicted by court.

THE DRAMATISPERSONAE OFIL&FS SCAM

Amit Shah sounds off GirirajSingh over offensive tweetThe BJP has decimated theopposition in the 2019 LokSabha polls, but intriguingdevelopments of the past fewdays suggest a possible churnin Bihar politics in the run up tothe state Assembly polls byOctober 2020.

On Tuesday, union minis-ter and BJP leader Giriraj Singhridiculed Bihar Chief MinisterNitish Kumar and others overtheir attending ‘iftaar’ parties.In turn, Kumar was dismissiveof Giriraj Singh’s commentsand said his government would

deliver on all its promises muchbefore the Assembly polls.

By evening, BJP sourcessaid Amit Shah has phonedGiriraj Singh and advised himto be careful about his com-ments, particularly on BJP'sallies.

"How beautiful would thepicture have emerged, had pha-laahaar (a fruit feast) beenorganized during Navaratrawith the same fervour withsplendid photographs taken.Giriraj Singh had commented.

ARCHIS MOHAN

MCA has launched a prosecutionagainst Deloitte Haskins and Sells,and BSR and Associates

Former auditors of IL&FS and itssubsidiaries may be asked to appear

Ministry also recommendeddebarment of these audit firms andtheir audit partners

TROUBLE FOR DELOITTE

Learning by doing is yet anoth-er channel of the Teaching &Learning methods of the

Kristu Jayanti School ofManagement that organizedVentura 2K19, an Intra collegiateBusiness plan contest. The MBAstudents of the school were givenan opportunity to brain storm andto kindle their creativity in briningvarious business ideas. The MBA2018-20 batch students weredivided into 56 teams. The teamswere expected to present a busi-ness idea to the internal jury. At the end of this firstround 31 teams were eliminated and the 25 teams thatwere shortlisted were asked to prepare the businessplan. The second round of the contest witnessed theenergetic, young minds from the 25 teams competingwith their intellectuals and their communication skills.Evaluated by an internal jury the second round conclud-ed with the elimination of 17 teams. The 8 shortlistedteams proceeded to the final round that was judged byan expert panel.

The expert panel was a blend of industry and aca-demia, comprising of Mr. Ajay Tiwari, Co-founder andCEO of Happylocate, Ms. Lakshmi Iyer, Professor of

Information Systems and Director of the Applied DataAnalytics Graduate Programs, Walker College ofBusiness, Appalachian State University, United States ofAmerica, Dr. Dinesh S Dave, Department Chair andProfessor, Department of Computer Information Systemand Supply Chain Management, John A Walker Collegeof Business, USA and Dr. Jamie Parson, AssistantProfessor, Department of Finance, Banking andInsurance at Appalachian State University, USA. The top3 teams were selected by the jury and were presentedwith the awards. Ventura 2K19 was a great learningexperience for the management student who learnt theconcepts and acquired key managerial skills by doing.

Kristu Jayanti School of Management: Ventura 2K19 - An Intra Collegiate Business Plan Contest