[Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)

-

Upload

zhulkeflee-ismail -

Category

Education

-

view

388 -

download

0

description

Transcript of [Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)

![Page 1: [Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)](https://reader037.fdocuments.net/reader037/viewer/2022102902/558cf3acd8b42a690f8b45cd/html5/thumbnails/1.jpg)

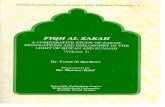

THE third PILLAR OF ISLAM IN PRACTICALIZING OBEDIENCE TO THE third PILLAR OF ISLAM IN PRACTICALIZING OBEDIENCE TO

THE MESSAGE OF THE ABSOLUTE ONENESS OF ALLAH (THE MESSAGE OF THE ABSOLUTE ONENESS OF ALLAH (TAUTAUHHEEDEED))

All Rights Reserved© Zhulkeflee Hj Ismail (2011)

IN THE NAME OF ALLAH,IN THE NAME OF ALLAH, MOST COMPASSIONATE,MOST COMPASSIONATE,MOST MERCIFULMOST MERCIFUL

EXTRACTED FROM FAARDHU ‘AIN COURSE FOR ADULTS

![Page 2: [Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)](https://reader037.fdocuments.net/reader037/viewer/2022102902/558cf3acd8b42a690f8b45cd/html5/thumbnails/2.jpg)

““A BEGINNERS’ COURSE ON A BEGINNERS’ COURSE ON ISLAM”ISLAM”

Lessons on Lessons on Fardhu ‘Ain in English for AdultsFardhu ‘Ain in English for Adultsconducted by Ustaz Zhulkeflee Hj Ismailconducted by Ustaz Zhulkeflee Hj Ismail

HADITH OF JIBRA-’IL

HADITH OF JIBRA-’IL

LESSON # 11

LESSON # 11

Using textbook & curriculum he has developed especially for Using textbook & curriculum he has developed especially for Muslim converts and young Adult English-speaking Muslims. Muslim converts and young Adult English-speaking Muslims.

““To seek knowledge is obligatory upon every Muslim (male & female)”To seek knowledge is obligatory upon every Muslim (male & female)”

IT CAN ALSO BE A IT CAN ALSO BE A REFRESHER COURSE REFRESHER COURSE

FOR MUSLIM FOR MUSLIM PARENTS, PARENTS,

EDUCATORS, IN EDUCATORS, IN CONTEMPORARY CONTEMPORARY

SINGAPORE. SINGAPORE. OPEN TO ALLOPEN TO ALL

2UPDATED APRIL 2011UPDATED APRIL 2011

Every Friday Every Friday night @ 8pm – night @ 8pm – 10pm10pmWisma Indah, Wisma Indah, 450 Changi 450 Changi Road, Road, #02-00 next to #02-00 next to Masjid KassimMasjid Kassim

All Rights Reserved© Zhulkeflee Hj Ismail (2011)

““ARKAAN AL-ISLAM”ARKAAN AL-ISLAM”Pillars of Islam (Submission)Pillars of Islam (Submission)

IN THE NAME OF ALLAH,IN THE NAME OF ALLAH, MOST MOST COMPASSIONATE,COMPASSIONATE,MOST MERCIFULMOST MERCIFUL

AZ-ZAKAHAZ-ZAKAH(TAX UPON WEALTH)(TAX UPON WEALTH)

![Page 3: [Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)](https://reader037.fdocuments.net/reader037/viewer/2022102902/558cf3acd8b42a690f8b45cd/html5/thumbnails/3.jpg)

In respecting the dominance of the followers, adherents of the In respecting the dominance of the followers, adherents of the

school of school of FiqhFiqh of of al-Mujtahid-mutlaq al-Imam Muhammad ibn Idrisal-Mujtahid-mutlaq al-Imam Muhammad ibn Idris

ash-Shafi-’ie rhm.aash-Shafi-’ie rhm.a.. here in this region, the practices in this here in this region, the practices in this

manual / lesson on manual / lesson on FIQHFIQH matters, shall subscribe and be in matters, shall subscribe and be in

conformity with this school of Islamic jurisprudence (conformity with this school of Islamic jurisprudence (madzhabmadzhab). ).

Yet, we hold to a healthy respect and tolerance (Yet, we hold to a healthy respect and tolerance (tasamuhtasamuh) towards ) towards

other other madzaahibmadzaahib and and ikhtilaafikhtilaaf (differences of opinion) amongst (differences of opinion) amongst

Islamic scholars. Islamic scholars.

The dominant schools of Islamic jurisprudence generally accepted The dominant schools of Islamic jurisprudence generally accepted

are the, are the, Ja’afari, Maliki, Hanafi, Shafi’e Ja’afari, Maliki, Hanafi, Shafi’e and and Hanbali.Hanbali.

All Rights Reserved© Zhulkeflee Hj Ismail (2011)

![Page 4: [Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)](https://reader037.fdocuments.net/reader037/viewer/2022102902/558cf3acd8b42a690f8b45cd/html5/thumbnails/4.jpg)

All Rights Reserved © Zhulkeflee Hj Ismail 2011

![Page 5: [Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)](https://reader037.fdocuments.net/reader037/viewer/2022102902/558cf3acd8b42a690f8b45cd/html5/thumbnails/5.jpg)

‘Zakah’ or ‘Zakat’ here is meant:

“ the compulsory tax upon a Muslim’s wealth, to be given out to certain categories of people, as commanded by Allah.”

All Rights Reserved © Zhulkeflee Hj Ismail 2011

![Page 6: [Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)](https://reader037.fdocuments.net/reader037/viewer/2022102902/558cf3acd8b42a690f8b45cd/html5/thumbnails/6.jpg)

Yet, it is interesting to note that the Arabic word

‘Zakah’ has the meaning of “to purify” as well as “to

make it grow”. Thus, Allah says:

All Rights Reserved © Zhulkeflee Hj Ismail 2011

![Page 7: [Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)](https://reader037.fdocuments.net/reader037/viewer/2022102902/558cf3acd8b42a690f8b45cd/html5/thumbnails/7.jpg)

Yet, it is interesting to note that the Arabic word

‘Zakah’ has the meaning of “to purify” as well as “to

make it grow”. Thus, Allah says:

All Rights Reserved © Zhulkeflee Hj Ismail 2011

![Page 8: [Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)](https://reader037.fdocuments.net/reader037/viewer/2022102902/558cf3acd8b42a690f8b45cd/html5/thumbnails/8.jpg)

We come into this world without any possession. Then we

begin to acquire for our needs, provision and possessions -

and begin accumulating and amassing wealth.

Our interaction with this world and material possessions

will have effect upon our self (Nafs), our hearts (Qolb), our

soul (Ruh).

Regarding our Self, or heart, Allah says:

All Rights Reserved © Zhulkeflee Hj Ismail 2011

FIRST REASONFIRST REASON

![Page 9: [Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)](https://reader037.fdocuments.net/reader037/viewer/2022102902/558cf3acd8b42a690f8b45cd/html5/thumbnails/9.jpg)

All Rights Reserved © Zhulkeflee Hj Ismail 2011

FIRST REASONFIRST REASON

![Page 10: [Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)](https://reader037.fdocuments.net/reader037/viewer/2022102902/558cf3acd8b42a690f8b45cd/html5/thumbnails/10.jpg)

““And a soul (And a soul (NafsNafs) and Him Who perfected it. ) and Him Who perfected it.

And inspired it (with conscience of) what is wrong for it And inspired it (with conscience of) what is wrong for it

and (what is) right for it. and (what is) right for it.

He is indeed successful who purify and causes it to He is indeed successful who purify and causes it to

grow, grow,

And he is indeed a failure who stunted it.”And he is indeed a failure who stunted it.”((Qur’an: ash-Shams: 91: 7-10Qur’an: ash-Shams: 91: 7-10) )

All Rights Reserved © Zhulkeflee Hj Ismail 2011

FIRST REASONFIRST REASON

![Page 11: [Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)](https://reader037.fdocuments.net/reader037/viewer/2022102902/558cf3acd8b42a690f8b45cd/html5/thumbnails/11.jpg)

All Rights Reserved © Zhulkeflee Hj Ismail 2011

FIRST REASONFIRST REASON

![Page 12: [Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)](https://reader037.fdocuments.net/reader037/viewer/2022102902/558cf3acd8b42a690f8b45cd/html5/thumbnails/12.jpg)

All Rights Reserved © Zhulkeflee Hj Ismail 2011

FIRST REASONFIRST REASON

![Page 13: [Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)](https://reader037.fdocuments.net/reader037/viewer/2022102902/558cf3acd8b42a690f8b45cd/html5/thumbnails/13.jpg)

All Rights Reserved © Zhulkeflee Hj Ismail 2011

Islam never totally reject the world nor does it

denies the importance to Muslims acquiring wealth.

Yet it knows what these can do to our spiritual

self. Thus, it is indeed crucial to avert corruption and

spiritual diseases from affecting our hearts and soul

(nafs) which wealth and material possessions may

bring e.g. Greed, possessiveness, miserliness,

avarice, corruption, oppression etc.

![Page 14: [Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)](https://reader037.fdocuments.net/reader037/viewer/2022102902/558cf3acd8b42a690f8b45cd/html5/thumbnails/14.jpg)

All Rights Reserved © Zhulkeflee Hj Ismail 2011

There is a saying:

““Love for the world (affection and attachment to Love for the world (affection and attachment to

material possession) is the head (root) of every material possession) is the head (root) of every

sins (wrong-doings,(mistakes, errors etc.)”sins (wrong-doings,(mistakes, errors etc.)”

![Page 15: [Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)](https://reader037.fdocuments.net/reader037/viewer/2022102902/558cf3acd8b42a690f8b45cd/html5/thumbnails/15.jpg)

All Rights Reserved © Zhulkeflee Hj Ismail 2011

![Page 16: [Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)](https://reader037.fdocuments.net/reader037/viewer/2022102902/558cf3acd8b42a690f8b45cd/html5/thumbnails/16.jpg)

All Rights Reserved © Zhulkeflee Hj Ismail 2011

““Verily We have created Man into toil and struggle. Verily We have created Man into toil and struggle.

Thinks he, that none hath power over him? He may Thinks he, that none hath power over him? He may

say (boastfully): "Wealth have I squandered in say (boastfully): "Wealth have I squandered in

abundance!” Thinks he that none beholds him? Have abundance!” Thinks he that none beholds him? Have

We not made for him a pair of eyes?― And a tongue, We not made for him a pair of eyes?― And a tongue,

and a pair of lips?― And shown him the two and a pair of lips?― And shown him the two

highways? “highways? “

((Qur’an: al-Balad: 90: 7-10Qur’an: al-Balad: 90: 7-10) )

![Page 17: [Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)](https://reader037.fdocuments.net/reader037/viewer/2022102902/558cf3acd8b42a690f8b45cd/html5/thumbnails/17.jpg)

All Rights Reserved © Zhulkeflee Hj Ismail 2011

Thus, Muslims not only needs to be reminded Thus, Muslims not only needs to be reminded

that:that:

[a] [a] possession and wealth are bestowals of Allah, possession and wealth are bestowals of Allah,

only as temporary trust (only as temporary trust (amanahamanah) for our use;) for our use;

[b] [b] it is how you get this and how you spent it that it is how you get this and how you spent it that

you shall be questioned by Allah s.w.t. – not how you shall be questioned by Allah s.w.t. – not how

much you accumulate!much you accumulate!

![Page 18: [Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)](https://reader037.fdocuments.net/reader037/viewer/2022102902/558cf3acd8b42a690f8b45cd/html5/thumbnails/18.jpg)

All Rights Reserved © Zhulkeflee Hj Ismail 2011

Thus, Muslims not only needs to be reminded Thus, Muslims not only needs to be reminded

that:that:

[c] [c] remember how innocent we were, until we began remember how innocent we were, until we began

to develop selfishness, greed, miserly, covetousness to develop selfishness, greed, miserly, covetousness

etc. etc.

Thus, Thus, ZakahZakah is to effectively and as practical is to effectively and as practical

reminder to be inculcated, so as not to allow such reminder to be inculcated, so as not to allow such

corruptions to occur in our Self/Soul.corruptions to occur in our Self/Soul.

![Page 19: [Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)](https://reader037.fdocuments.net/reader037/viewer/2022102902/558cf3acd8b42a690f8b45cd/html5/thumbnails/19.jpg)

All bestowals and wealth is from Allah. And He

would generally bestow upon many amongst

mankind more than what he needs, so that

through them these wealth would be shared with

the others who deserves it.

All Rights Reserved © Zhulkeflee Hj Ismail 2011

SECOND REASONSECOND REASON

![Page 20: [Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)](https://reader037.fdocuments.net/reader037/viewer/2022102902/558cf3acd8b42a690f8b45cd/html5/thumbnails/20.jpg)

There is no shortage of Allah’s bestowal upon

mankind regarding wealth and provision –

mankind's’ economic problem is only regarding its

distribution.

This is because living in this world is but a test –

especially in this case, test upon rich towards the

poor, the have towards those who have not.All Rights Reserved © Zhulkeflee Hj Ismail 2011

SECOND REASONSECOND REASON

![Page 21: [Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)](https://reader037.fdocuments.net/reader037/viewer/2022102902/558cf3acd8b42a690f8b45cd/html5/thumbnails/21.jpg)

Thus, Muslim regards part of what Allah gives him

to include what belongs to others, which becomes

his amanah (trust) to distribute them to its

rightful recipients.

All Rights Reserved © Zhulkeflee Hj Ismail 2011

SECOND REASONSECOND REASON

![Page 22: [Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)](https://reader037.fdocuments.net/reader037/viewer/2022102902/558cf3acd8b42a690f8b45cd/html5/thumbnails/22.jpg)

And because the Muslim regards his wealth to

includes what belongs to others. As long as these

are not given out to their rightful recipients, his

wealth is not totally regarded as his. Therefore by

giving out the zakat, it is like purifying the wealth

which is in his possession from what is not his and

forbidden for him to consume

All Rights Reserved © Zhulkeflee Hj Ismail 2011

SECOND REASONSECOND REASON

![Page 23: [Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)](https://reader037.fdocuments.net/reader037/viewer/2022102902/558cf3acd8b42a690f8b45cd/html5/thumbnails/23.jpg)

All Rights Reserved © Zhulkeflee Hj Ismail 2011

![Page 24: [Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)](https://reader037.fdocuments.net/reader037/viewer/2022102902/558cf3acd8b42a690f8b45cd/html5/thumbnails/24.jpg)

What is the real worth of our wealth? With death, What is the real worth of our wealth? With death,

these wealth looses all value for us, except those these wealth looses all value for us, except those

that has been spent in accordance towards what that has been spent in accordance towards what

Allah commanded us to – and He promises to Allah commanded us to – and He promises to

increase them, not only its amount, but its real increase them, not only its amount, but its real

value for us will be eternally enjoyed beyond our value for us will be eternally enjoyed beyond our

death.death.All Rights Reserved © Zhulkeflee Hj Ismail 2011

FIRST REASONINGFIRST REASONING

![Page 25: [Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)](https://reader037.fdocuments.net/reader037/viewer/2022102902/558cf3acd8b42a690f8b45cd/html5/thumbnails/25.jpg)

The promise reward is a minimum return of 1 : The promise reward is a minimum return of 1 :

700% (certainly a most generous investment 700% (certainly a most generous investment

returns for our hereafter).returns for our hereafter).

All Rights Reserved © Zhulkeflee Hj Ismail 2011

FIRST REASONINGFIRST REASONING

![Page 26: [Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)](https://reader037.fdocuments.net/reader037/viewer/2022102902/558cf3acd8b42a690f8b45cd/html5/thumbnails/26.jpg)

All Rights Reserved © Zhulkeflee Hj Ismail 2011

FIRST REASONINGFIRST REASONING

![Page 27: [Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)](https://reader037.fdocuments.net/reader037/viewer/2022102902/558cf3acd8b42a690f8b45cd/html5/thumbnails/27.jpg)

“ “ The likeness of those who spend their wealth in The likeness of those who spend their wealth in

Allah's way is as the likeness of a grain which grows Allah's way is as the likeness of a grain which grows

seven ears (cobs e.g. like corn), in every ear a hundred seven ears (cobs e.g. like corn), in every ear a hundred

grains. Allah gives increase manifold to whom He will. grains. Allah gives increase manifold to whom He will.

Allah is All-Embracing, All-Knowing.”Allah is All-Embracing, All-Knowing.”

((Qur’an: Baqarah: 2: 261Qur’an: Baqarah: 2: 261))

All Rights Reserved © Zhulkeflee Hj Ismail 2011

FIRST REASONINGFIRST REASONING

![Page 28: [Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)](https://reader037.fdocuments.net/reader037/viewer/2022102902/558cf3acd8b42a690f8b45cd/html5/thumbnails/28.jpg)

Wealth is measured, not by how much money is a

country, but by how it has been circulated and

how many times it is used. Thus a country’s

economy is measured by Gross Domestic Product

(GDP).

All Rights Reserved © Zhulkeflee Hj Ismail 2011

SECOND REASONINGSECOND REASONING

![Page 29: [Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)](https://reader037.fdocuments.net/reader037/viewer/2022102902/558cf3acd8b42a690f8b45cd/html5/thumbnails/29.jpg)

In society, there are people who do not have

spending power due to poverty or unemployment

etc. (which zakat is meant for). Providing for them

means injecting into the economy catalysts to

increase economic activity because of the

“multiplier effect” it generates.

All Rights Reserved © Zhulkeflee Hj Ismail 2011

SECOND REASONINGSECOND REASONING

![Page 30: [Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)](https://reader037.fdocuments.net/reader037/viewer/2022102902/558cf3acd8b42a690f8b45cd/html5/thumbnails/30.jpg)

Thus it is, that Zakat seems to ‘penalise’ unused

wealth, to discourage hoardings especially when

these wealth inevitably deprive those who are in

need from having means to spend even on basics.

All Rights Reserved © Zhulkeflee Hj Ismail 2011

SECOND REASONINGSECOND REASONING

![Page 31: [Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)](https://reader037.fdocuments.net/reader037/viewer/2022102902/558cf3acd8b42a690f8b45cd/html5/thumbnails/31.jpg)

Wealth when used or injected into the economy

would in fact generate work and incomes to these

various category of people, thus, by increasing

consumer demand (spending) increases national

products and services, whereas hoarding wealth

would stifle and retard the economy.

All Rights Reserved © Zhulkeflee Hj Ismail 2011

SECOND REASONINGSECOND REASONING

![Page 32: [Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)](https://reader037.fdocuments.net/reader037/viewer/2022102902/558cf3acd8b42a690f8b45cd/html5/thumbnails/32.jpg)

All Rights Reserved © Zhulkeflee Hj Ismail 2011

![Page 33: [Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)](https://reader037.fdocuments.net/reader037/viewer/2022102902/558cf3acd8b42a690f8b45cd/html5/thumbnails/33.jpg)

All Rights Reserved © Zhulkeflee Hj Ismail 2011

![Page 34: [Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)](https://reader037.fdocuments.net/reader037/viewer/2022102902/558cf3acd8b42a690f8b45cd/html5/thumbnails/34.jpg)

Agricultural Agricultural produceproduce

TYPES OF WEALTHTYPES OF WEALTH NISABNISAB HAULHAUL RATES OF ZAKATRATES OF ZAKAT

635 kg.635 kg.PerPer

harvestharvest

5% produce in 5% produce in case of irrigated case of irrigated land.land.

10% produce 10% produce from rain-fed from rain-fed land.land.

Reference: “Fiqhuz-Zakah” – Sheikh Dr. Yusuf al-QardhawiReference: “Fiqhuz-Zakah” – Sheikh Dr. Yusuf al-Qardhawi

All Rights Reserved © Zhulkeflee Hj Ismail 2011

![Page 35: [Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)](https://reader037.fdocuments.net/reader037/viewer/2022102902/558cf3acd8b42a690f8b45cd/html5/thumbnails/35.jpg)

Gold, silver or Gold, silver or ornaments of ornaments of gold and silvergold and silver

TYPES OF WEALTHTYPES OF WEALTH NISABNISAB HAULHAUL RATES OF ZAKATRATES OF ZAKAT

85 gm 85 gm (gold)(gold)

595 gm595 gm(silver)(silver)

One year

(lunar)

2.5% of the value

Reference: “Fiqhuz-Zakah” – Sheikh Dr. Yusuf al-QardhawiReference: “Fiqhuz-Zakah” – Sheikh Dr. Yusuf al-Qardhawi

All Rights Reserved © Zhulkeflee Hj Ismail 2011

![Page 36: [Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)](https://reader037.fdocuments.net/reader037/viewer/2022102902/558cf3acd8b42a690f8b45cd/html5/thumbnails/36.jpg)

Cash, in hand Cash, in hand or in the bankor in the bank

TYPES OF WEALTHTYPES OF WEALTH NISABNISAB HAULHAUL RATES OF ZAKATRATES OF ZAKAT

Value of Value of 595 gm595 gm(silver)(silver)

(MUIS)*S$5,226

as @ FEB 2011*Islamic Religious

Council of Singapore

One year

(lunar)

2.5% of the 2.5% of the amount of cash amount of cash in hand or in in hand or in bank bank

Reference: “Fiqhuz-Zakah” – Sheikh Dr. Yusuf al-QardhawiReference: “Fiqhuz-Zakah” – Sheikh Dr. Yusuf al-Qardhawi

All Rights Reserved © Zhulkeflee Hj Ismail 2011

![Page 37: [Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)](https://reader037.fdocuments.net/reader037/viewer/2022102902/558cf3acd8b42a690f8b45cd/html5/thumbnails/37.jpg)

Trading goodsTrading goods

TYPES OF WEALTHTYPES OF WEALTH NISABNISAB HAULHAUL RATES OF ZAKATRATES OF ZAKAT

One year

(lunar)

2.5% of the value of the goods

Reference: “Fiqhuz-Zakah” – Sheikh Dr. Yusuf al-QardhawiReference: “Fiqhuz-Zakah” – Sheikh Dr. Yusuf al-Qardhawi

All Rights Reserved © Zhulkeflee Hj Ismail 2011

Value of Value of 595 gm595 gm(silver)(silver)

(MUIS)*S$5,226

as @ FEB 2011*Islamic Religious

Council of Singapore

![Page 38: [Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)](https://reader037.fdocuments.net/reader037/viewer/2022102902/558cf3acd8b42a690f8b45cd/html5/thumbnails/38.jpg)

Cows and Cows and buffaloesbuffaloes

TYPES OF WEALTHTYPES OF WEALTH NISABNISAB HAULHAUL RATES OF ZAKATRATES OF ZAKAT

30 in numbers

- For every 30, a 1-year old calf; and so on.

Reference: “Fiqhuz-Zakah” – Sheikh Dr. Yusuf al-QardhawiReference: “Fiqhuz-Zakah” – Sheikh Dr. Yusuf al-Qardhawi

All Rights Reserved © Zhulkeflee Hj Ismail 2011

![Page 39: [Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)](https://reader037.fdocuments.net/reader037/viewer/2022102902/558cf3acd8b42a690f8b45cd/html5/thumbnails/39.jpg)

Goats and sheep

TYPES OF WEALTHTYPES OF WEALTH NISABNISAB HAULHAUL RATES OF ZAKATRATES OF ZAKAT

40 in numbers

- One sheep for first 40;

Two for 120; and so on.

Reference: “Fiqhuz-Zakah” – Sheikh Dr. Yusuf al-QardhawiReference: “Fiqhuz-Zakah” – Sheikh Dr. Yusuf al-Qardhawi

All Rights Reserved © Zhulkeflee Hj Ismail 2011

![Page 40: [Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)](https://reader037.fdocuments.net/reader037/viewer/2022102902/558cf3acd8b42a690f8b45cd/html5/thumbnails/40.jpg)

Produce of the Produce of the mines – all mines – all kinds of kinds of mineralsminerals

TYPES OF WEALTHTYPES OF WEALTH NISABNISAB HAULHAUL RATES OF ZAKATRATES OF ZAKAT

Any amount

- 20% of the value of produce

Reference: “Fiqhuz-Zakah” – Sheikh Dr. Yusuf al-QardhawiReference: “Fiqhuz-Zakah” – Sheikh Dr. Yusuf al-Qardhawi

All Rights Reserved © Zhulkeflee Hj Ismail 2011

![Page 41: [Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)](https://reader037.fdocuments.net/reader037/viewer/2022102902/558cf3acd8b42a690f8b45cd/html5/thumbnails/41.jpg)

Camels

TYPES OF WEALTHTYPES OF WEALTH NISABNISAB HAULHAUL RATES OF ZAKATRATES OF ZAKAT

5 numbers - 5 up to 24 : one sheep or goat for every 5 camels;

25 up to 35 : one 1-year old she camel; and so on

Reference: “Fiqhuz-Zakah” – Sheikh Dr. Yusuf al-QardhawiReference: “Fiqhuz-Zakah” – Sheikh Dr. Yusuf al-Qardhawi

All Rights Reserved © Zhulkeflee Hj Ismail 2011

![Page 42: [Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)](https://reader037.fdocuments.net/reader037/viewer/2022102902/558cf3acd8b42a690f8b45cd/html5/thumbnails/42.jpg)

In keeping with changing economic system (development), there In keeping with changing economic system (development), there

may be other types of wealth which contemporary Islamic jurists may be other types of wealth which contemporary Islamic jurists

may regard to be ‘zakatable’ by consensus (IJMA’) or in accordance may regard to be ‘zakatable’ by consensus (IJMA’) or in accordance

with acceptable scholarly exertion (IJTIHAD), be it analogous with acceptable scholarly exertion (IJTIHAD), be it analogous

deduction (QIYAS), preference (ISTIHSAN), needs (MASLAHAT ) etc.deduction (QIYAS), preference (ISTIHSAN), needs (MASLAHAT ) etc.

TYPES OF WEALTHTYPES OF WEALTH NISABNISAB HAULHAUL RATES OF ZAKATRATES OF ZAKAT

Reference: “Fiqhuz-Zakah” – Sheikh Dr. Yusuf al-QardhawiReference: “Fiqhuz-Zakah” – Sheikh Dr. Yusuf al-Qardhawi

All Rights Reserved © Zhulkeflee Hj Ismail 2011

Wa-Allaahu a’lam(IT IS ALLAH WHO KNOWS ALL)

![Page 43: [Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)](https://reader037.fdocuments.net/reader037/viewer/2022102902/558cf3acd8b42a690f8b45cd/html5/thumbnails/43.jpg)

““ASAANIF” ASAANIF” : THE CATEGORIES OF PEOPLE : THE CATEGORIES OF PEOPLE

UNTO WHICH ZAKAT MUST BE GIVEN TO.UNTO WHICH ZAKAT MUST BE GIVEN TO.

All Rights Reserved © Zhulkeflee Hj Ismail 2011

![Page 44: [Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)](https://reader037.fdocuments.net/reader037/viewer/2022102902/558cf3acd8b42a690f8b45cd/html5/thumbnails/44.jpg)

All Rights Reserved © Zhulkeflee Hj Ismail 2011

![Page 45: [Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)](https://reader037.fdocuments.net/reader037/viewer/2022102902/558cf3acd8b42a690f8b45cd/html5/thumbnails/45.jpg)

“ “ The alms are only for the poor and the needy, The alms are only for the poor and the needy,

and those who collect them, and those whose and those who collect them, and those whose

hearts are to be reconciled, and to free the hearts are to be reconciled, and to free the

captives and the debtors, and for the cause of captives and the debtors, and for the cause of

Allah, and (for) the wayfarer; a duty imposed by Allah, and (for) the wayfarer; a duty imposed by

Allah. Allah is Knower, Wise.” Allah. Allah is Knower, Wise.”

((Qur’an: Taubah: 9: 60Qur’an: Taubah: 9: 60))

All Rights Reserved © Zhulkeflee Hj Ismail 2011

![Page 46: [Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)](https://reader037.fdocuments.net/reader037/viewer/2022102902/558cf3acd8b42a690f8b45cd/html5/thumbnails/46.jpg)

All Rights Reserved © Zhulkeflee Hj Ismail 2011

![Page 47: [Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)](https://reader037.fdocuments.net/reader037/viewer/2022102902/558cf3acd8b42a690f8b45cd/html5/thumbnails/47.jpg)

All Rights Reserved © Zhulkeflee Hj Ismail 2011

![Page 48: [Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)](https://reader037.fdocuments.net/reader037/viewer/2022102902/558cf3acd8b42a690f8b45cd/html5/thumbnails/48.jpg)

““The Believers men and women, are (The Believers men and women, are (AWLIYA’AWLIYA’) )

protectors one of another: they enjoin what is just, and protectors one of another: they enjoin what is just, and

forbid what is evil: they observe regular prayers forbid what is evil: they observe regular prayers

((swolahswolah), practice regular charity (), practice regular charity (zakahzakah), and obey ), and obey

Allah and His Messenger. Allah and His Messenger.

On them will Allah pour His mercy: for Allah is Exalted in On them will Allah pour His mercy: for Allah is Exalted in

power, Wise.” power, Wise.”

((Qur’an: Taubah: 9: 71Qur’an: Taubah: 9: 71))

All Rights Reserved © Zhulkeflee Hj Ismail 2011

![Page 49: [Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)](https://reader037.fdocuments.net/reader037/viewer/2022102902/558cf3acd8b42a690f8b45cd/html5/thumbnails/49.jpg)

[1] The “poor; or those in poverty.” They are those who

do not possess any wealth, or whose income is less than

⅓ of what he needs to sustain livelihood for himself and

people under his guardianship.

All Rights Reserved © Zhulkeflee Hj Ismail 2011

FUQARA’ - FAAQIRFUQARA’ - FAAQIR

![Page 50: [Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)](https://reader037.fdocuments.net/reader037/viewer/2022102902/558cf3acd8b42a690f8b45cd/html5/thumbnails/50.jpg)

[2] These are the “needy; those in need” or (those

slightly better-off than the “faqir”) who may have

possessions and income, yet “whose income is still less

than ⅔ of what he needs to sustain livelihood for

himself and family under his care.”

All Rights Reserved © Zhulkeflee Hj Ismail 2011

MASAAKIN - MISKEENMASAAKIN - MISKEEN

![Page 51: [Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)](https://reader037.fdocuments.net/reader037/viewer/2022102902/558cf3acd8b42a690f8b45cd/html5/thumbnails/51.jpg)

[3] The full description is “[3] The full description is “those who are employed or those who are employed or

working upon it working upon it (collecting and distributing the zakah)”. (collecting and distributing the zakah)”.

This imply necessity for zakat institution be managed This imply necessity for zakat institution be managed

(efficiently) professionally; and to safeguard the honour (efficiently) professionally; and to safeguard the honour

of every Muslims from having to beg.of every Muslims from having to beg.

All Rights Reserved © Zhulkeflee Hj Ismail 2011

‘‘AAMILEEN – ‘AMILAAMILEEN – ‘AMIL

![Page 52: [Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)](https://reader037.fdocuments.net/reader037/viewer/2022102902/558cf3acd8b42a690f8b45cd/html5/thumbnails/52.jpg)

[4] The literal translation of this group is “those whose

hearts are reconciled (i.e. towards accepting Islam)”.

This is to ensure new Muslims’ every need is provided

for, even those who may be rich, they are entitled to

disbursement from the Islamic treasury.

All Rights Reserved © Zhulkeflee Hj Ismail 2011

MU-ALLAF MU-ALLAF

![Page 53: [Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)](https://reader037.fdocuments.net/reader037/viewer/2022102902/558cf3acd8b42a690f8b45cd/html5/thumbnails/53.jpg)

[5] From the word meaning “neck” – it refers to the

ransoming or free Muslims from slavery.

This shows that every Muslim must be freed from all forms

of slavery or from being under oppression. Their freedom

must be accorded for them (if need be) using the zakat funds.

Although chattel slavery no longer exist, yet Islamic scholars

are known to apply ‘qiyas’ (juristic analogy) for what may

constitute modern ‘slavery’.All Rights Reserved © Zhulkeflee Hj Ismail 2011

RI-QAABRI-QAAB

![Page 54: [Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)](https://reader037.fdocuments.net/reader037/viewer/2022102902/558cf3acd8b42a690f8b45cd/html5/thumbnails/54.jpg)

[6] These are “those who are indebted”.

We differentiate “debt” from “loan”. Loan is merely one

who can afford to repay what he owes, except that it be

deferred. He is not what we mean by “one who is indebted”.

“Those indebted” are akin to “faqir & miskin” but in a

temporary sense, because of unforeseen expenditure

incurred due to misfortune, sickness, accident, calamities etc.

All Rights Reserved © Zhulkeflee Hj Ismail 2011

GHAARIMEENGHAARIMEEN

![Page 55: [Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)](https://reader037.fdocuments.net/reader037/viewer/2022102902/558cf3acd8b42a690f8b45cd/html5/thumbnails/55.jpg)

[7] Literally, it means “those (fighting, striving) in the Way of

Allah”.

This is for those Muslim “Mujahideen” in the way of Allah,

during war as fighters; and In peace time, it include the

“Mujahid of Da’wah” i.e. those striving to “raise the kalimah

of Allah, to be highest” in the field of spreading the teachings

of Islam through Da’wah.

All Rights Reserved © Zhulkeflee Hj Ismail 2011

FEE-SABI-LILLAAHFEE-SABI-LILLAAH

![Page 56: [Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)](https://reader037.fdocuments.net/reader037/viewer/2022102902/558cf3acd8b42a690f8b45cd/html5/thumbnails/56.jpg)

[8] This refers to Muslim “travellers or wayfarer”.

A Muslim traveller in need, has rights to zakat funds,

wherever or whenever he encounters difficulty while

travelling in Muslim lands. In fact, there were times in history

that the Islamic state provided 3 days hospitality in

caravanserais (musafir-khana) managed by Islamic treasury

(bayt-ul-maal) , for every Muslim travellers.

All Rights Reserved © Zhulkeflee Hj Ismail 2011

IBNUS-SABEELIBNUS-SABEEL

![Page 57: [Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)](https://reader037.fdocuments.net/reader037/viewer/2022102902/558cf3acd8b42a690f8b45cd/html5/thumbnails/57.jpg)

All Rights Reserved © Zhulkeflee Hj Ismail 2011

![Page 58: [Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)](https://reader037.fdocuments.net/reader037/viewer/2022102902/558cf3acd8b42a690f8b45cd/html5/thumbnails/58.jpg)

All Rights Reserved © Zhulkeflee Hj Ismail 2011

![Page 59: [Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)](https://reader037.fdocuments.net/reader037/viewer/2022102902/558cf3acd8b42a690f8b45cd/html5/thumbnails/59.jpg)

““Fair in the eyes of men is the love of things they covet: Fair in the eyes of men is the love of things they covet:

women and sons; heaped-up hoards of gold and silver; women and sons; heaped-up hoards of gold and silver;

horses branded (for blood and excellence); and (wealth of) horses branded (for blood and excellence); and (wealth of)

cattle and well-tilled land. Such are the possessions of this cattle and well-tilled land. Such are the possessions of this

world's life; but in nearness to Allah is the best of the world's life; but in nearness to Allah is the best of the

goals (to return to).”goals (to return to).”

((Qur’an: Aali ‘Imran: 3:14Qur’an: Aali ‘Imran: 3:14))

All Rights Reserved © Zhulkeflee Hj Ismail 2011

![Page 60: [Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)](https://reader037.fdocuments.net/reader037/viewer/2022102902/558cf3acd8b42a690f8b45cd/html5/thumbnails/60.jpg)

All Rights Reserved © Zhulkeflee Hj Ismail 2011

![Page 61: [Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)](https://reader037.fdocuments.net/reader037/viewer/2022102902/558cf3acd8b42a690f8b45cd/html5/thumbnails/61.jpg)

"But seek, with the (wealth) which Allah has "But seek, with the (wealth) which Allah has

bestowed on thee, the Home of the Hereafter, nor forget bestowed on thee, the Home of the Hereafter, nor forget

thy portion in this world: but do thou good, as Allah has thy portion in this world: but do thou good, as Allah has

been good to thee, and seek not (occasions for) mischief been good to thee, and seek not (occasions for) mischief

in the land: for Allah loves not those who do mischief." in the land: for Allah loves not those who do mischief."

((Qur’an: Qasas: 28: 77Qur’an: Qasas: 28: 77))

All Rights Reserved © Zhulkeflee Hj Ismail 2011

![Page 62: [Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)](https://reader037.fdocuments.net/reader037/viewer/2022102902/558cf3acd8b42a690f8b45cd/html5/thumbnails/62.jpg)

All Rights Reserved © Zhulkeflee Hj Ismail 2011

![Page 63: [Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)](https://reader037.fdocuments.net/reader037/viewer/2022102902/558cf3acd8b42a690f8b45cd/html5/thumbnails/63.jpg)

“Who is he that will loan to Allah a beautiful loan,

(QARD’-HASANAH) which Allah will double unto his

credit and multiply many times? It is Allah that gives

(you) want or plenty and to Him shall be your return.”

(Qur’an: Baqarah: 2: 245)

All Rights Reserved © Zhulkeflee Hj Ismail 2011

![Page 64: [Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)](https://reader037.fdocuments.net/reader037/viewer/2022102902/558cf3acd8b42a690f8b45cd/html5/thumbnails/64.jpg)

All Rights Reserved © Zhulkeflee Hj Ismail 2011

Render not vain your almsgiving (swodaqat) by reproach and injury, (Q: Baqarah: 2: 264)

![Page 65: [Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)](https://reader037.fdocuments.net/reader037/viewer/2022102902/558cf3acd8b42a690f8b45cd/html5/thumbnails/65.jpg)

“ Those who spend their wealth in the cause of Allah and

follow not up their gifts with reminders of their generosity

or with injury,― for them their reward is with their Lord;

on them shall be no fear, nor shall they grieve. ”

(Qur’an: Baqarah: 2: 262)All Rights Reserved © Zhulkeflee Hj Ismail 2011

![Page 66: [Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)](https://reader037.fdocuments.net/reader037/viewer/2022102902/558cf3acd8b42a690f8b45cd/html5/thumbnails/66.jpg)

“ “ Kind words and the covering of faults are better Kind words and the covering of faults are better

than charity followed by injury. Allah is free of all wants, than charity followed by injury. Allah is free of all wants,

and He is Most Forbearing. ” and He is Most Forbearing. ”

((Qur’an: Baqarah: 2: 263Qur’an: Baqarah: 2: 263))

All Rights Reserved © Zhulkeflee Hj Ismail 2011

![Page 67: [Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)](https://reader037.fdocuments.net/reader037/viewer/2022102902/558cf3acd8b42a690f8b45cd/html5/thumbnails/67.jpg)

All Rights Reserved © Zhulkeflee Hj Ismail 2011

![Page 68: [Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)](https://reader037.fdocuments.net/reader037/viewer/2022102902/558cf3acd8b42a690f8b45cd/html5/thumbnails/68.jpg)

“ “ O ye who believe! Render not vain your almsgiving O ye who believe! Render not vain your almsgiving

(swodaqat) by reproach and injury, like him who spends his (swodaqat) by reproach and injury, like him who spends his

wealth only to be seen of men and believes not in Allah and wealth only to be seen of men and believes not in Allah and

the Last Day. His likeness is as the likeness of a rock the Last Day. His likeness is as the likeness of a rock

whereon is dust of earth; a rainstorm smites it, leaving it whereon is dust of earth; a rainstorm smites it, leaving it

smooth and bare. They have no control of aught of that smooth and bare. They have no control of aught of that

which they have gained. Allah guides not the disbelieving which they have gained. Allah guides not the disbelieving

folk. ” (folk. ” (Qur’an: Baqarah: 2: 264Qur’an: Baqarah: 2: 264))

All Rights Reserved © Zhulkeflee Hj Ismail 2011

![Page 69: [Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)](https://reader037.fdocuments.net/reader037/viewer/2022102902/558cf3acd8b42a690f8b45cd/html5/thumbnails/69.jpg)

“ “ The Satan threatens you with poverty and bids you to The Satan threatens you with poverty and bids you to

conduct unseemly. Allah promises you His forgiveness conduct unseemly. Allah promises you His forgiveness

and bounties and Allah cares for all and He knows all and bounties and Allah cares for all and He knows all

things.”things.”

((Qur’an: Baqarah: 2: 268Qur’an: Baqarah: 2: 268))

All Rights Reserved © Zhulkeflee Hj Ismail 2011

![Page 70: [Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)](https://reader037.fdocuments.net/reader037/viewer/2022102902/558cf3acd8b42a690f8b45cd/html5/thumbnails/70.jpg)

“ “ Whatever of good ye give benefits your own souls and ye Whatever of good ye give benefits your own souls and ye

shall only do so seeking the "Face" of Allah. Whatever shall only do so seeking the "Face" of Allah. Whatever

good ye give, shall be rendered back to you and ye shall good ye give, shall be rendered back to you and ye shall

not be dealt with unjustly. ”not be dealt with unjustly. ”

((Qur’an: Baqarah: 2: 272Qur’an: Baqarah: 2: 272))All Rights Reserved © Zhulkeflee Hj Ismail 2011

![Page 71: [Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)](https://reader037.fdocuments.net/reader037/viewer/2022102902/558cf3acd8b42a690f8b45cd/html5/thumbnails/71.jpg)

All Rights Reserved © Zhulkeflee Hj Ismail 2011

![Page 72: [Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)](https://reader037.fdocuments.net/reader037/viewer/2022102902/558cf3acd8b42a690f8b45cd/html5/thumbnails/72.jpg)

All Rights Reserved © Zhulkeflee Hj Ismail 2011

![Page 73: [Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)](https://reader037.fdocuments.net/reader037/viewer/2022102902/558cf3acd8b42a690f8b45cd/html5/thumbnails/73.jpg)

““And let not those who covetously withheld of the gifts And let not those who covetously withheld of the gifts

which Allah hath given them of His Grace think that it is which Allah hath given them of His Grace think that it is

good for them: nay it will be the worse for them: soon it good for them: nay it will be the worse for them: soon it

will be tied to their necks like a twisted collar on the Day will be tied to their necks like a twisted collar on the Day

of Judgment. To Allah belongs the heritage of the of Judgment. To Allah belongs the heritage of the

heavens and the earth; and Allah is well acquainted heavens and the earth; and Allah is well acquainted

with all that ye do.”with all that ye do.”

((Qur’an: Aali ‘Imran: 3: 180Qur’an: Aali ‘Imran: 3: 180))

All Rights Reserved © Zhulkeflee Hj Ismail 2011

![Page 74: [Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)](https://reader037.fdocuments.net/reader037/viewer/2022102902/558cf3acd8b42a690f8b45cd/html5/thumbnails/74.jpg)

All Rights Reserved © Zhulkeflee Hj Ismail 2011

![Page 75: [Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)](https://reader037.fdocuments.net/reader037/viewer/2022102902/558cf3acd8b42a690f8b45cd/html5/thumbnails/75.jpg)

““Allah hath heard the taunt of those who say: "Truly, Allah hath heard the taunt of those who say: "Truly,

Allah is indigent and we are rich!",― We shall certainly Allah is indigent and we are rich!",― We shall certainly

record their word and (their act) of slaying the Prophets record their word and (their act) of slaying the Prophets

in defiance of right, and We shall say: "Taste ye the in defiance of right, and We shall say: "Taste ye the

penalty of the Scorching Fire!. “penalty of the Scorching Fire!. “

((Qur’an: Aali ‘Imran: 3: 181Qur’an: Aali ‘Imran: 3: 181))

All Rights Reserved © Zhulkeflee Hj Ismail 2011

![Page 76: [Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)](https://reader037.fdocuments.net/reader037/viewer/2022102902/558cf3acd8b42a690f8b45cd/html5/thumbnails/76.jpg)

All Rights Reserved © Zhulkeflee Hj Ismail 2011

![Page 77: [Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)](https://reader037.fdocuments.net/reader037/viewer/2022102902/558cf3acd8b42a690f8b45cd/html5/thumbnails/77.jpg)

“O ye who believe! There are indeed many among the

priests and anchorites, who in falsehood devour the

wealth of men and hinder (them) from the Way of

Allah. And there are those who bury gold and silver and

spend it not in the way of Allah: announce unto them a

most grievous penalty.”

(Qur’an: Taubah: 9: 34)

All Rights Reserved © Zhulkeflee Hj Ismail 2011

![Page 78: [Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)](https://reader037.fdocuments.net/reader037/viewer/2022102902/558cf3acd8b42a690f8b45cd/html5/thumbnails/78.jpg)

All Rights Reserved © Zhulkeflee Hj Ismail 2011

![Page 79: [Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)](https://reader037.fdocuments.net/reader037/viewer/2022102902/558cf3acd8b42a690f8b45cd/html5/thumbnails/79.jpg)

All Rights Reserved © Zhulkeflee Hj Ismail 2011

““On the Day when heat will be produced out of that On the Day when heat will be produced out of that

(wealth) in the fire of Hell, and with it will be branded (wealth) in the fire of Hell, and with it will be branded

their foreheads, their flanks and their backs― "This is the their foreheads, their flanks and their backs― "This is the

(treasure) which ye buried for yourselves: taste ye, then (treasure) which ye buried for yourselves: taste ye, then

the (treasures) ye buried!" the (treasures) ye buried!"

((Qur’an: Taubah: 9: 35Qur’an: Taubah: 9: 35 ) )

![Page 80: [Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)](https://reader037.fdocuments.net/reader037/viewer/2022102902/558cf3acd8b42a690f8b45cd/html5/thumbnails/80.jpg)

All Rights Reserved © Zhulkeflee Hj Ismail 2011

![Page 81: [Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)](https://reader037.fdocuments.net/reader037/viewer/2022102902/558cf3acd8b42a690f8b45cd/html5/thumbnails/81.jpg)

All Rights Reserved © Zhulkeflee Hj Ismail 2011

““And spend something (in charity) out of the substance And spend something (in charity) out of the substance

which We have bestowed on you, before death should which We have bestowed on you, before death should

come to any of you and he should say "O my Lord! why come to any of you and he should say "O my Lord! why

didst thou not give me respite for a little while? I should didst thou not give me respite for a little while? I should

then have given (largely) in charity, and I should have then have given (largely) in charity, and I should have

been one of the doers of good." But to no soul will Allah been one of the doers of good." But to no soul will Allah

grant respite when the time appointed (for it) has come: grant respite when the time appointed (for it) has come:

and Allah is well-acquainted with (all) that ye do.”and Allah is well-acquainted with (all) that ye do.”

((Qur’an: Munafiun: 63: 10-11Qur’an: Munafiun: 63: 10-11 ) )

![Page 82: [Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)](https://reader037.fdocuments.net/reader037/viewer/2022102902/558cf3acd8b42a690f8b45cd/html5/thumbnails/82.jpg)

“ “Protect your wealth by paying the Protect your wealth by paying the ZakahZakah, and heal your , and heal your

sick by giving charity (sick by giving charity (sadaqahsadaqah)”)”

((Hadith of the Prophet Muhammad s.a.wHadith of the Prophet Muhammad s.a.w.).)

All Rights Reserved © Zhulkeflee Hj Ismail 2011

![Page 83: [Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)](https://reader037.fdocuments.net/reader037/viewer/2022102902/558cf3acd8b42a690f8b45cd/html5/thumbnails/83.jpg)

“ “There is no wealth which is mixed with (portions in There is no wealth which is mixed with (portions in

which) which) zakatzakat (is not paid) except that it will be cause of (is not paid) except that it will be cause of

destruction.)destruction.)

((Hadith of the Prophet Muhammad s.a.wHadith of the Prophet Muhammad s.a.w.).)

All Rights Reserved © Zhulkeflee Hj Ismail 2011

![Page 84: [Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)](https://reader037.fdocuments.net/reader037/viewer/2022102902/558cf3acd8b42a690f8b45cd/html5/thumbnails/84.jpg)

“ “If you fulfil (pay out) the If you fulfil (pay out) the zakat zakat upon your wealth with a upon your wealth with a

good heart (i.e. without feeling regret or sense of loss, or good heart (i.e. without feeling regret or sense of loss, or

being insincere, hypocritical etc.), then in reality you have being insincere, hypocritical etc.), then in reality you have

been saved from the evil (or harm which your wealth may been saved from the evil (or harm which your wealth may

bring upon you).”bring upon you).”

((Hadith of the Prophet Muhammad s.a.wHadith of the Prophet Muhammad s.a.w.).)All Rights Reserved © Zhulkeflee Hj Ismail 2011

![Page 85: [Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)](https://reader037.fdocuments.net/reader037/viewer/2022102902/558cf3acd8b42a690f8b45cd/html5/thumbnails/85.jpg)

All Rights Reserved © Zhulkeflee Hj Ismail 2011

![Page 86: [Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)](https://reader037.fdocuments.net/reader037/viewer/2022102902/558cf3acd8b42a690f8b45cd/html5/thumbnails/86.jpg)

““O Allah! Make sufficient for us our provision with O Allah! Make sufficient for us our provision with

what is lawful (halal) and not from what is forbidden what is lawful (halal) and not from what is forbidden

(haram). Enrich us with the bestowals from You (haram). Enrich us with the bestowals from You

alone, not from other than You.”alone, not from other than You.”

ALLA-HUM-MAK - FI-NAA BI-HA-LAA-LI-KA- ‘AN-HA-RAA-MIK, ALLA-HUM-MAK - FI-NAA BI-HA-LAA-LI-KA- ‘AN-HA-RAA-MIK, WA-ARGH-NI-NAA – BI – FADw -LI-KA – ‘AM-MAN –SI- WAAKWA-ARGH-NI-NAA – BI – FADw -LI-KA – ‘AM-MAN –SI- WAAK

All Rights Reserved © Zhulkeflee Hj Ismail 2011

![Page 87: [Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)](https://reader037.fdocuments.net/reader037/viewer/2022102902/558cf3acd8b42a690f8b45cd/html5/thumbnails/87.jpg)

ALLAA-HUM-MA - IN-NEE – A –’UU- DZU – BIKA - MINAL-ALLAA-HUM-MA - IN-NEE – A –’UU- DZU – BIKA - MINAL-

BUKH-LI, WA – A-’UU-DZU- BIKA - MINAL-JUBNI,BUKH-LI, WA – A-’UU-DZU- BIKA - MINAL-JUBNI,

WA-A-’UU-DZU - BIKA MIN- AN- URAD -DA – ILAA – WA-A-’UU-DZU - BIKA MIN- AN- URAD -DA – ILAA –

AR-ZA- LIL- ‘UMUR , WA –A-’UU-DZU- BIKA – MIN – FITNA-TID-DUN-AR-ZA- LIL- ‘UMUR , WA –A-’UU-DZU- BIKA – MIN – FITNA-TID-DUN-

YAA – WA – ‘A-DZAA-BIL – QAB-RIYAA – WA – ‘A-DZAA-BIL – QAB-RI

All Rights Reserved © Zhulkeflee Hj Ismail 2011

![Page 88: [Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)](https://reader037.fdocuments.net/reader037/viewer/2022102902/558cf3acd8b42a690f8b45cd/html5/thumbnails/88.jpg)

““‘‘O AllO Allaah, I seek refuge in You from miserliness and h, I seek refuge in You from miserliness and

cowardice, I seek refuge in You lest I be returned to the cowardice, I seek refuge in You lest I be returned to the

worst of lives “i.e. old age, being weak, destitute, worst of lives “i.e. old age, being weak, destitute,

incapable and in a state of fear, etc.”, and I seek incapable and in a state of fear, etc.”, and I seek

refuge in You from the trials and tribulations of this refuge in You from the trials and tribulations of this

worldly life and the punishment of the grave.”worldly life and the punishment of the grave.”All Rights Reserved © Zhulkeflee Hj Ismail 2011

![Page 89: [Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)](https://reader037.fdocuments.net/reader037/viewer/2022102902/558cf3acd8b42a690f8b45cd/html5/thumbnails/89.jpg)

O Allah! We ask that You be pleased with us and O Allah! We ask that You be pleased with us and

(grant us) the Paradise, and we seek refuge (in (grant us) the Paradise, and we seek refuge (in

You) from Your wrath and the Hell-fire.”You) from Your wrath and the Hell-fire.”

ALLA-HUM-MA IN-NAA NAS-A-LU-KA RI- DwAA -KA WAL JAN-NATA, ALLA-HUM-MA IN-NAA NAS-A-LU-KA RI- DwAA -KA WAL JAN-NATA, WA-NA-’UU- DzU- BI-KA MIN SA-KHA-TI-KA WAN-NAAR WA-NA-’UU- DzU- BI-KA MIN SA-KHA-TI-KA WAN-NAAR

All Rights Reserved © Zhulkeflee Hj Ismail 2011

![Page 90: [Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)](https://reader037.fdocuments.net/reader037/viewer/2022102902/558cf3acd8b42a690f8b45cd/html5/thumbnails/90.jpg)

““(May) Allah grant His Reward upon Muhammad, (May) Allah grant His Reward upon Muhammad,

salutations of Allah and Peace be upon him and his salutations of Allah and Peace be upon him and his

family, in accordance with what he deserves (in family, in accordance with what he deserves (in

Allah’s knowledge & estimation).”Allah’s knowledge & estimation).”

All Rights Reserved © Zhulkeflee Hj Ismail 2011

JAZALLAA-HU ‘AN-NAA MUHAM-MADAN SWOL-LAL-LAAHU JAZALLAA-HU ‘AN-NAA MUHAM-MADAN SWOL-LAL-LAAHU ‘‘ALAY-HI WA- AA-LIHI WA-SAL-LA-MA – MAA HU-WA AH-LUHU ALAY-HI WA- AA-LIHI WA-SAL-LA-MA – MAA HU-WA AH-LUHU

![Page 91: [Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)](https://reader037.fdocuments.net/reader037/viewer/2022102902/558cf3acd8b42a690f8b45cd/html5/thumbnails/91.jpg)

” ”Glory to thy Lord the Lord, of Honour and Glory to thy Lord the Lord, of Honour and

Power! (He is free) from what they ascribe (to Power! (He is free) from what they ascribe (to

Him)! And Peace on the Messengers! And Him)! And Peace on the Messengers! And

praise to Allah, the Lord and Cherisher of the praise to Allah, the Lord and Cherisher of the

Worlds.” Worlds.”

((Qur’an : Saffat: 37 : 180-182Qur’an : Saffat: 37 : 180-182))

All Rights Reserved © Zhulkeflee Hj Ismail 2011

![Page 92: [Jpeg]fardhu'ain lesson#11-arkaan-ul-islam(3)-zakah(april2011)](https://reader037.fdocuments.net/reader037/viewer/2022102902/558cf3acd8b42a690f8b45cd/html5/thumbnails/92.jpg)

http://an-naseehah.blogspot.com/

http://introductiontotauhid.blogspot.com/

http://oyoubelievers.blogspot.com/

http://al-amthaal.blogspot.com/

http://zhulkeflee-archive.blogspot.com/

http://criteriaforaholybook-quran.blogspot.com/

http://with-the-truthful.blogspot.com/

http ://muqaddam-nurul.blogspot.com/

92All Rights Reserved © Zhulkeflee Hj Ismail 2011

![[Slideshare] fardhu'ain-lesson#12 (pr 1)-arkaan-ul-islam(3)-zakah(23-june-2012)](https://static.fdocuments.net/doc/165x107/543c92978d7f7208118b4e37/slideshare-fardhuain-lesson12-pr-1-arkaan-ul-islam3-zakah23-june-2012.jpg)

![[Slideshare] fardhu'ain(feb-2013-batch)lesson# 10-arkaan-ul-islam-shahadatain-(3-may-2013)](https://static.fdocuments.net/doc/165x107/55bad1e6bb61eba14f8b4744/slideshare-fardhuainfeb-2013-batchlesson-10-arkaan-ul-islam-shahadatain-3-may-2013.jpg)

![[Slideshare] fardhu'ain(feb-2013-batch)-lesson #8-arkaan-ul-iiman--believe-in-hereafter-(19-april-2013)](https://static.fdocuments.net/doc/165x107/54514ad8af795902348b661f/slideshare-fardhuainfeb-2013-batch-lesson-8-arkaan-ul-iiman-believe-in-hereafter-19-april-2013.jpg)

![[Slideshare] fardhu'ain(feb-2013-batch)lesson# 12 -arkaan-ul-islam-zakah-welfare-tax upon-excess-wealth-(7-june-2013)](https://static.fdocuments.net/doc/165x107/54c182694a7959e3648b4586/slideshare-fardhuainfeb-2013-batchlesson-12-arkaan-ul-islam-zakah-welfare-tax-upon-excess-wealth-7-june-2013.jpg)

![[Slideshare] fardh'ain(aug-2015-batch#14)-#12-(arkaan-ul-islam)-zakah-welfare-tax-on-wealth--23-october-2015](https://static.fdocuments.net/doc/165x107/58a9d4ed1a28aba05b8b47dd/slideshare-fardhainaug-2015-batch14-12-arkaan-ul-islam-zakah-welfare-tax-on-wealth-23-october-2015.jpg)

![[Slideshare] fardhu'ain(feb-2013-batch)lesson#9-arkaan-ul-iiman-in-qadha' -qadr(26-april-2013)](https://static.fdocuments.net/doc/165x107/54514adcaf7959af2f8b6706/slideshare-fardhuainfeb-2013-batchlesson9-arkaan-ul-iiman-in-qadha-qadr26-april-2013.jpg)

![[Slideshare] fardhu'ain(feb-2013-batch)-lesson#6-arkaan-ul-iiman-in-his-books-(5-april-l2013)](https://static.fdocuments.net/doc/165x107/558cf264d8b42a82708b45fb/slideshare-fardhuainfeb-2013-batch-lesson6-arkaan-ul-iiman-in-his-books-5-april-l2013.jpg)

![[Slideshare]fardhu'ain lesson#14-arkaan-ul-islam(5)fastin gin-ramadhan-(3-feb-l2012)](https://static.fdocuments.net/doc/165x107/54bbc85f4a795929048b459a/slidesharefardhuain-lesson14-arkaan-ul-islam5fastin-gin-ramadhan-3-feb-l2012.jpg)

![[Slideshare] fardh'ain(august-2014-batch)#12-(arkaan-ul-islam)-zakah-welfare-tax-on-wealth-(12-december-2014)](https://static.fdocuments.net/doc/165x107/559b55e41a28ab1c298b45cf/slideshare-fardhainaugust-2014-batch12-arkaan-ul-islam-zakah-welfare-tax-on-wealth-12-december-2014.jpg)