JOURNAL OF INVESTMENT MANAGEMENT...

Transcript of JOURNAL OF INVESTMENT MANAGEMENT...

JOIMwww.joim.com

JOURNAL OF INVESTMENT MANAGEMENT, Vol. 6, No. 2, (2008), pp. 1–29

© JOIM 2008

WHERE DO ALPHAS COME FROM?: A MEASURE OFTHE VALUE OF ACTIVE INVESTMENT MANAGEMENT∗

Andrew W. Lo†

The value of active investment management is traditionally measured by alpha, beta,volatility, tracking error, and the Sharpe and information ratios. These are essentiallystatic characteristics of the marginal distributions of returns at a single point in time,and do not incorporate dynamic aspects of a manager’s investment process. In this paper,I propose a measure of the value of active investment management that captures bothstatic and dynamic contributions of a portfolio manager’s decisions. The measure is basedon a decomposition of a portfolio’s expected return into two distinct components: a staticweighted-average of the individual securities’ expected returns, and the sum of covariancesbetween returns and portfolio weights. The former component measures the portion of themanager’s expected return due to static investments in the underlying securities, while thelatter component captures the forecast power implicit in the manager’s dynamic investmentchoices. This measure can be computed for long-only investments, long/short portfolios,and asset allocation rules, and is particularly relevant for hedge-fund strategies where bothcomponents are significant contributors to their expected returns, but only one should garnerthe high fees that hedge funds typically charge. Several analytical and empirical examplesare provided to illustrate the practical relevance of this decomposition.

∗I thank Nicholas Chan, John Cox, Arnout Eikeboom, LisaGoldberg, Mark Grinblatt, Stephanie Hogue, Rajnish Kamat,Philippe Luedi, Sara Salem, Nils Tuchschmid, an anonymousreferee, and participants at the Le Club B 2006 Conferenceand the JOIM 2007 Spring Conference for their helpful com-ments and discussion. Research support from AlphaSimplexGroup is gratefully acknowledged.†Harris & Harris Group Professor, MIT Sloan School ofManagement, and Chief Scientific Officer, AlphaSimplexGroup, LLC. AlphaSimplex Group, One Cambridge Center,Cambridge, MA 02142.

1 Introduction

With the growing popularity of hedge funds andother absolute-return investment strategies, thereis a widening gap between the performance met-rics of traditional investment management andalternatives. While alpha, beta, volatility, track-ing error, the Sharpe ratio, and the informationratio have become the standard tools for gaugingthe value-added of long-only portfolio managers,

THIRD QUARTER 2008 1

2 ANDREW W. LO

they have not had as much impact among investorsof absolute-return strategies. Part of this gap isno doubt cultural in origin; the growth of themutual-fund industry was accelerated by the broadacceptance of portfolio theory and the benefitsof diversification. This, in turn, led to the pushfor indexation and benchmark-based performanceattribution, from which many of the current per-formance measures emerged.

However, another possible reason for the lack ofimpact of traditional performance measures foralternative investments is the fact that such mea-sures are static, and do not capture the dynamicand predictive nature of active investment strate-gies. Specifically, measures such as alpha, beta,tracking error, and the information ratio are allfunctions of parameters of the portfolio-return andbenchmark-return distributions at a single point intime, e.g., expected returns, covariances, and vari-ances. None of these measures involves the relationbetween returns at multiple points in time, yet suchmulti-point statistics are often the central focus ofactive investment strategies. For example, the mostadmired portfolio managers of our time are reveredfor their ability to foresee certain market trends wellin advance of the public, or to detect mispricedsecurities and exploit them ahead of the market, orto enter and exit certain investments before oth-ers recognize the opportunities. In every case, theseinvestment skills involve forecasts or predictions,yet the standard performance measures listed abovedo not depend explicitly on the forecast power ofthe portfolio manager.

In this paper, I propose an explicit measure ofthe economic value of active management—anactive/passive or “AP” decomposition—that takesinto account forecast power explicitly. Using aninsight that first appeared in studies by Grin-blatt and Titman (1989, 1993), I decomposethe expected return of a portfolio into two com-ponents: one that depends only on the average

values of portfolio weights and asset returns, andanother that depends on the correlation betweenportfolio weights and returns. It is this latter com-ponent that measures directly the value of activemanagement—the portfolio weights of a success-ful manager will generally be positively correlatedwith returns, yielding a positive contribution tothe portfolio’s expected return. This correlation isdirectly affected by the manager’s forecasting abil-ities because portfolio weights are functions of themanager’s prior information. Therefore, the correla-tion between portfolio weights and returns at date tis a measure of the predictive power of the infor-mation used by the manager to select his date-tportfolio weights. In short, it is a measure of themanager’s asset-timing ability.

Of course, it is possible to generate positive expectedreturns without any variability in portfolio weights:a fixed-weight strategy in assets with positive riskpremia such as the S&P 500 will yield a positiveexpected return. In this case, the active componentdescribed above will contribute nothing to the port-folio’s expected return, hence the portfolio can besaid to be passive. This is a novel definition of pas-sive and active investing, and has little to do withthe standard definitions involving deviations froma benchmark portfolio. I show that a more naturaldefinition for a passive portfolio is one where theportfolio weights are uncorrelated with returns. Ifweights have no forecast power, then active man-agement is adding no value and the only source ofexpected return is risk premia, which can usually begenerated by a buy-and-hold portfolio.

The AP decomposition is a simple consequenceof the definition of covariance, and is triv-ial for active managers to implement. In fact,position-level information is not necessary—onlyaverage portfolio weights and individual-asset aver-age returns are needed to perform the decomposi-tion. Moreover, because the decomposition is basedon an identity, the empirical version holds exactly,

JOURNAL OF INVESTMENT MANAGEMENT THIRD QUARTER 2008

WHERE DO ALPHAS COME FROM?: A MEASURE OF THE VALUE OF ACTIVE INVESTMENT MANAGEMENT 3

allowing us to attribute realized or ex-post perfor-mance accurately and exhaustively to active andpassive components.

Finally, if asset returns are assumed to satisfy alinear K -factor model such as the Capital AssetPricing Model (CAPM), the Arbitrage Pricing The-ory (APT), or any other linear pricing model, theAP decomposition yields several additional insights.In particular, a portfolio’s expected return can bedecomposed into three distinct components whenreturns exhibit a linear factor structure: securityselection, factor-timing ability, and risk premia.The first two components may be interpreted asthe result of active management, and the last com-ponent is passive. This decomposition provides oneexplanation for the seemingly persistent differencesbetween long-only and alternative investments—the long-only constraint imposes a limit to theamount of factor timing that can be accomplished,and this limit may be a severe handicap in environ-ments where factor risk premia change sign, i.e.,periods of time-varying expected returns. A factor-based AP decomposition also addresses a recentconcern of many institutional investors, that theyare paying hedge funds for alpha but are gettingbeta instead. The relevant question is whether thebeta exposure is time-varying or fixed—if it is theformer, then it may be considered a genuine sourceof active value, but if it is the latter, it may be possi-ble to achieve the same exposures in a more passivemanner.

I begin in Section 2 with a brief review of the perfor-mance attribution literature, and present the mainresults of the paper in Section 3. I provide severalanalytical examples in Section 4, and then show howto implement the decomposition in Section 5. Sec-tion 6 contains a detailed empirical example of theAP decomposition applied to a statistical arbitragestrategy using daily data for NASDAQ size-decilesfrom January 2, 1990 to December 29, 1995. Iconclude in Section 7.

2 Literature review

The origins of performance attribution can betraced back to the Capital Asset Pricing Model ofSharpe (1964) and Lintner (1965), who deriveda linear relation between the excess return of aninvestment and its systematic risk or market beta,i.e., the security market line:

Rpt − Rf = βp(Rmt − Rf ) + εpt , E[εt |Rmt ] = 0.(1)

Departures from this linear relation were genericallytermed “alpha,”

Rpt − Rf = αp + βp(Rmt − Rf ) + εpt (2)

and Treynor (1965), Sharpe (1966), and Jensen(1968, 1969) applied this measure to gauge theeconomic value-added of mutual-fund managers.Since then, a variety of related measures have beenproposed, including

E[Rpt ] − Rf

σp= Sharpe Ratio (3)

E[Rpt ] − Rf

βp= Treynor Ratio (4)

αp

σ(εpt )= Information Ratio, (5)

where σp and σ(εpt ) denote the standard devia-tions of Rpt and the residual εpt in (2), respectively.Graham and Harvey (1997) and Modigliani andModigliani (1997) have derived risk-adjusted trans-formations of these basic measures, and Sharpe(1992) has proposed a constrained-regressionframework for performing style analysis.

All of these measures are essentially static innature because they are based on characteristics ofthe marginal distributions of returns at a singledate t , e.g., means, variances, and contempo-raneous covariances of the portfolio and market

THIRD QUARTER 2008 JOURNAL OF INVESTMENT MANAGEMENT

4 ANDREW W. LO

returns.1 Even Sharpe’s (1992) regression-baseddecomposition—which is a conditional measureby construction—is static, because the condition-ing information is contemporaneous to portfolioreturns at date t . None of these measures cap-tures the time-series dependence between dates tand t + 1, which should be the central focusof any forecasting measure of investment skill.Moreover, Dybvig and Ross (1985a, 1985b) raiseadditional doubts about whether deviations fromlinear pricing relations like the CAPM security mar-ket line can truly distinguish superior performancefrom luck.

In contrast to these static measures, Treynor andMazuy (1966) were among the first to propose adynamic measure of active management. To pickup market-timing skills, Treynor and Mazuy (1966)augmented the linear framework of (1) with aquadratic term (Rmt − Rf )2. Formally, this is still acontemporaneous regression, hence its parametersdo not involve any time-series properties, but themotivation—to detect asymmetries in up and downmarkets—is distinctly dynamic.

In a recent comment on the fundamental index-ation approach of Arnott et al. (2005), Treynor(2005) does focus on the covariance between port-folio weights and returns, but only in the specificcontext of explaining the potential improvements offundamental indexation over market-capitalizationweights. The AP decomposition described in thispaper provides a considerably more general frame-work for thinking about the benefits and costs ofany indexation algorithm.

A more explicit measure of market-timing skill isgiven by Merton (1981), Henriksson and Merton(1981), and Henriksson (1984), who showed thatperfect market-timing is equivalent to a buy-and-hold investment in the market that is fully protectedby put options on the market with a riskless-ratestrike. Imperfect market-timing skill may then be

modeled as a partially insured investment in themarket. Although this measure may also seem likea static one because it involves parameters at asingle point in time of the multivariate distributionof market returns and corresponding put-optionprices, it is, in fact, dynamic due to the multi-period nature of options prices.2 In other words, thedynamics of market-timing have been compressedinto the put-option price, which is then used asthe “numeraire” for market-timing skill in Merton’s(1981) framework.

Two other related studies are by Brinson et al.(1986) and Brinson et al. (1991), in which theydecompose the realized return of a portfolio intothree components: a benchmark return, the returnfrom asset allocation (measured by the productof returns and the deviations of the portfolio’sasset-class weights from the benchmark’s asset-class weights), and the return of security selection(measured by the product of returns and the devi-ations of individual portfolio weights from thebenchmark’s portfolio weights within each assetclass):

Rpt = Rbt + Rat + Rst . (6)

Although this decomposition seems to be simi-lar in spirit to the one proposed in this paper,there is an important difference: the definitions of“security selection” and “asset allocation” in Brin-son et al. (1986) are measures defined with respectto a benchmark, not time-series measures of amanager’s forecast power in each of these cate-gories. However, by taking expectations of (6) andusing the decomposition described in Section 3,it is possible to extend the framework of Brinsonet al. (1986) to yield measures of forecast powerfor security-selection and asset-allocation decisionsseparately. Another difference between (6) andthe approach described in this paper is the criti-cal dependence of (6) on the benchmark, whichmay be appropriate for managers whose invest-ment mandates specify such benchmarks explicitly,

JOURNAL OF INVESTMENT MANAGEMENT THIRD QUARTER 2008

WHERE DO ALPHAS COME FROM?: A MEASURE OF THE VALUE OF ACTIVE INVESTMENT MANAGEMENT 5

but is less natural for absolute-return strategiessuch as those of hedge funds and other alternativeinvestments.

Grinold and Kahn (2000, Chapter 17) describea bottom-up approach to performance attributionwithin a linear-factor model framework in whichbenchmark-timing is a component. Although theydo not focus explicitly on the covariance betweenportfolio weights and returns, it is implicit in theirtime-series expression of “active benchmark timingreturn,”3 and in a footnote, they acknowledge thatthe same type of decomposition can be applied toindividual securities.4

However, the most relevant study for our approachis by Grinblatt and Titman (1993), in whichthey observe that the covariance between port-folio weights and returns should be positive foran informed investor, who can “profit from thesechanging expected returns by tilting his portfolioweights over time in favor of assets with expectedreturns that have increased, and away from assetswith expected returns that have decreased.” Ratherthan using the covariance to decompose expectedreturns, they propose the following “PortfolioChange Measure” to measure performance5:

Portfolio Change Measure

=∑

j

∑t

[Rjt (ωjt − ωjt−k)]/T .

Although this measure does not capture the sameinformation as the covariance between weights andreturns, they were clearly aware of the possibil-ity of decomposing expected returns using thiscovariance.6

The measure of active management proposed inSection 3 is a more direct version of these last twonotions of market timing, in which each portfo-lio weight is viewed as a bet on the future returnof a given asset, and bets that yield positive profits

over time, i.e., asset-timing ability, are indications ofinvestment skill. Moreover, we show that a portfo-lio’s total expected return is completely determinedby the sum of these bets and the passive returns fromeach asset’s expected returns weighted by its averageportfolio weight, hence there are no other sourcesof expected return besides these two.

3 The AP decomposition

Consider a portfolio P invested in n securitiesindexed by i = 1, . . . , n, and defined by its weights{ωit } in those securities at date t . Denote by Rpt theportfolio’s return between dates t − 1 and t , whichis given by:

Rpt =n∑

i=1

ωit Rit , (7)

where Rit is the date-t return of security i. Assum-ing that the means, variances, and covariances ofindividual securities’ returns are well-defined, themain result of the paper follows almost immedi-ately from the definition of expected return, and ispresented in Section 3.1. This very general resultimplies a new way of defining passive and activeinvesting, which is described in Section 3.2. Andby imposing additional structure on asset returns—a linear factor structure, in particular—we show inSection 3.3 that our decomposition provides a newway of distinguishing between alpha and beta.

3.1 The general result

We start with the following assumptions:

(A1) The returns {Rit } for each security i form a sta-tionary and ergodic stochastic process with finitemoments up to order 4.

(A2) Date-t portfolio weights {ωit } are stationary andergodic stochastic processes that are functions ofstate variables Xt−1.

THIRD QUARTER 2008 JOURNAL OF INVESTMENT MANAGEMENT

6 ANDREW W. LO

Assumption (A1) is standard, and implies thatthe means, variances, and covariances for all assetreturns are well-defined, and that estimators ofthose parameters will have well-behaved limitingdistributions with finite variances, which is usefulfor conducting statistical inferences.

Assumption (A2) requires more discussion. Begin-ning with Markowitz (1952), much of the invest-ments literature has assumed that portfolio weightsare non-stochastic. The motivation for this start-ing point is the focus on portfolio optimization, inwhich the portfolio weights are the choice variableswith respect to which a mean–variance objectivefunction is optimized. From this perspective, theexpected return of a portfolio is simply a weightedaverage of the expected returns of each componentsecurity, weighted by the fraction of the portfoliodevoted to that security.

But in practice, portfolio weights are not fixedparameters—they represent decisions taken by aportfolio manager, and, as such, depend on anumber of inputs. Therefore, from an investor’sperspective, the statistical properties of a portfolio’sreturn is determined not just by the return distri-butions of the component securities, but also bythe characteristics of the portfolio weights. In fact,the investor in an active investment product paysdearly for the services of the portfolio manager,and is paying largely for that manager’s portfolioweights! Accordingly, unless a manager’s portfolioweights depend on inputs that are non-stochasticand known to us, and we have complete knowl-edge of the functional relationship between inputsand weights, we must view portfolio weights asrandom variables. And if portfolio weights are ran-dom variables, it is not surprising that the stochasticrelation between weights and returns can have sig-nificant implications for the properties of theirproduct, which we shall demonstrate shortly inProposition 1.

Assumption (A2) provides a simple but impor-tant set of restrictions for the kind of randomnessthat a well-defined set of portfolio weights canexhibit. Perhaps the most important restriction isthe fact that the date-t weights {ωt } can depend oninformation only prior to date t , otherwise unlim-ited arbitrage opportunities will abound. To seewhy, suppose that we remove this restriction. Thenconsider the following portfolio:

ωit = Max[0, Rit ]∑nj=1 Max[0, Rjt ] ,

Rpt =n∑

i=1

ωit Rit ≥ 0

(8)

which places positive weight at date t on onlythose securities with positive return at date t .This is clearly an arbitrage if returns are notall degenerate. Assumption (A2) eliminates suchpossibilities, and is equivalent to ruling out“look-ahead” bias in the construction of portfolioweights.

Given these assumptions, we have the followinggeneral decomposition for a portfolio’s expectedreturn:

Proposition 1 Under assumptions (A1)–(A2), theexpected return of any portfolio P satisfies the followingdecomposition:

E[Rpt ] =n∑

i=1

E[ωit Rit ]

=n∑

i=1

(Cov[ωit , Rit ] + E[ωit ]E[Rit ]

)(9)

=n∑

i=1

Cov[ωit , Rit ] +n∑

i=1

E[ωit ]E[Rit ]

≡ δp + νp, (10)

JOURNAL OF INVESTMENT MANAGEMENT THIRD QUARTER 2008

WHERE DO ALPHAS COME FROM?: A MEASURE OF THE VALUE OF ACTIVE INVESTMENT MANAGEMENT 7

where

δp ≡n∑

i=1

Cov[ωit , Rit ] (Active Component)

νp ≡n∑

i=1

E[ωit ]E[Rit ] (Passive Component)

θp ≡ δp

δp + νp(Active Ratio). (11)

Proposition 1 is a simple decomposition of aportfolio’s expected return into two components:the sum of the covariances between portfolioweights and returns, and the sum of the prod-ucts of expected portfolio weights and expectedreturns. Although this active/passive or “AP”decomposition follows trivially from the defi-nition of covariance, it has some surprisinglyuseful implications for identifying the relativecontributions of active and passive investmentmanagement.

The motivation for attributing the covariance termsδp in (10) to active management is the fact that,by definition, “active” implies a conscious decisionon the part of the portfolio manager to buy, sell,or avoid a security—summarized in the portfolioweights {ωit }—and the impact of those decisionson a portfolio’s total expected return E[Rpt ] is cap-tured by the covariances in (10). In particular, if amanager has positive weights when security returnsare positive and negative weights when securityreturns are negative on average, this implies positivecovariances between portfolio weights and returns,and will have a positive impact on the portfolio’sexpected return. In effect, the covariance term cap-tures the manager’s timing ability, asset by asset,and while perfect timing of the sort described in(8) is not possible, imperfect timing certainly is (seeGrinblatt and Titman, 1989, and 1993 for furtherdiscussion).

However, there is another source of positiveexpected return that has nothing to do withasset timing: the manager may be holding passivelong positions in securities with positive expectedreturns, and passive short positions in securitieswith negative expected returns. For example, buy-and-hold investors in the S&P 500 should expecta positive expected return over time because ofthe equity risk premium. This passive source ofexpected return is captured by the second term νpin (10), which has no timing component whatso-ever, but involves only the first moments of themarginal distributions of returns and weights. Sim-ilarly, a dedicated shortseller whose sole investmentmandate is to identify and short over-valued compa-nies faces a significant challenge from the negativeequity risk premium implicit in any passive shortequity position.

The distinction between timing and risk premia ismore obvious from a slightly modified version ofthe AP decomposition (10):

E[Rpt ] =n∑

i=1

σ(ωit )σ(Rit )Corr[ωit , Rit ]

+n∑

i=1

E[ωit ]E[Rit ]. (12)

If the portfolio weights {ωit } are constant throughtime, it is difficult to argue that such a portfolio isbeing actively managed, and (12) supports this intu-ition: a constant portfolio implies zero variance forthe portfolio weights, which implies no active com-ponent according to (12). Nevertheless, constantportfolios can still generate positive expected returnssimply by holding securities with positive expectedreturns, as captured by the passive component. But(12) shows that the larger the correlation betweenweights and returns, and the larger the variancesof returns and weights, the bigger the contributionfrom active management.

THIRD QUARTER 2008 JOURNAL OF INVESTMENT MANAGEMENT

8 ANDREW W. LO

Alternatively, (12) implies that negative cor-relation between weights and returns detractsfrom a portfolio’s expected return, and higherreturn- and weight-volatility make this worse.This suggests one possible approach to improv-ing the active component of a portfolio strat-egy: decreasing (increasing) the volatility ofweights for those securities where the correla-tions between weights and returns are negative(positive).

The quantity θp defined in (11)—which we call the“active ratio”—provides a useful summary statis-tic for the degree to which a portfolio is activelymanaged. Unlike the traditional static measures ofactive performance such as the Sharpe or informa-tion ratios (see Section 2), θp is dynamic, unit-free,and independent of the choice of benchmark. Thedynamic nature of θp is clear from the decompo-sition (12)—the time series properties of returnsaffect θp directly, in contrast to static performancemeasures.

The fact that θp is unit-free is obvious from a simpledimensional analysis of this ratio: both the numer-ator and denominator are defined as returns perunit time, hence the ratio is invariant to any unitof measurement. In other words, if θp is estimatedto be 28%, then this is the fraction of the portfo-lio’s return due to active management, irrespectiveof whether we estimate θp with daily, weekly, ormonthly data. Contrast this with the informationratio—if an investment has an IR of 0.28, it mat-ters a great deal whether this is a daily, monthly, orannual estimate.

Finally, θp requires no benchmark for its defini-tion, although certainly it is trivial to computeθp relative to a benchmark by simply applying(10) to the excess returns of a portfolio. However,one of the most important implications of (10)is that active investment management is not sim-ply adding value in excess of a passive benchmark,

which can be done passively by taking on non-benchmark factor exposures in a multi-factor world.We shall return to this issue in Section 3.3when we impose a linear factor structure on assetreturns.

It is worth emphasizing that because (10) is anidentity—both in theory and in sample—it musthold for all portfolios at all times, and that thereare no sources of expected return other than thetwo identified in (10). In this sense, the AP decom-position is a complete and exhaustive measure ofinvestment performance.

3.2 A new definition of passive investing

The AP decomposition (10) implies that con-stant portfolios have no active component, butwhat about portfolios with time-varying weightsthat are traditionally considered to be passive? Forexample, a value-weighted portfolio of all securi-ties is clearly a passive portfolio, yet the portfolioweights change according to the market values ofthe component securities hence σ(ωit ) is generallypositive for all securities in this case. Does thisportfolio’s expected return have a non-zero activecomponent?

The answer is no, as long as the individual secu-rities’ returns are serially independent, i.e., as longas the Random Walk Hypothesis holds for all secu-rities. To see why, let Pit and Sit denote the priceand shares outstanding of asset i at date t , respec-tively, and observe that the value-weighted portfoliois given by:

ωit = Pit−1Sit−1∑nj=1 Pjt−1Sjt−1

= Pit−2(1 + Rit−1)Sit−1∑nj=1 Pjt−2(1 + Rjt−1)Sjt−1

, (13)

JOURNAL OF INVESTMENT MANAGEMENT THIRD QUARTER 2008

WHERE DO ALPHAS COME FROM?: A MEASURE OF THE VALUE OF ACTIVE INVESTMENT MANAGEMENT 9

which depends on returns at date t − 1. Ifreturns are serially independent, then the correla-tions Corr[ωit , Rit ] are all zero, hence the activecomponent in (12) is zero despite the fact that thevolatilities of the weights are nonzero.

If, on the other hand, returns are not seriallyindependent, then it is possible for the AP decom-position to yield a nonzero active component to abuy-and-hold portfolio. This is a sensible outcomebecause the presence of serial correlation impliesthat past returns do contain forecast power forfuture returns; hence, a portfolio strategy withweights that change as a function of past returns maybenefit from (or be hurt by) such serial correlation.

This suggests a broader but more precise definitionfor a passive portfolio:

Definition 1 A passive portfolio is any portfo-lio with weights ωit that are uncorrelated with itscorresponding returns Rit for all i = 1, . . . , n.7

Under this definition, a portfolio is passive if itsweights do not contain any information relatedto future returns. Whether or not the portfoliois benchmarked is irrelevant. For example, con-sider a portfolio with a market beta of 1.00,achieved through S&P 500 futures contracts, thatalso happens to include a diversified buy-and-hold basket of commodities.8 The expected returnof such a portfolio is likely to exceed the S&P500 because of the positive risk premium associ-ated with the commodities component, but shouldthe excess return be attributed to active manage-ment? Using traditional performance measures, thisportfolio is likely to exhibit positive “alpha,” butthe AP decomposition will yield a very differentconclusion.

Definition 3.2 can be refined by distinguish-ing between portfolios that are intentionally

uncorrelated with returns and those that areunintentionally uncorrelated.9 Consider, forexample, a completely unsuccessful active man-ager who attempts to exploit information thathas already been impounded into asset returns.Although the AP decomposition will correctly cap-ture the fact that the active component of thismanager’s portfolio is zero, it would be mislead-ing to conclude that this manager is passive. Todistinguish between intentionally and unintention-ally passive portfolios, we must obviously rely onthe manager’s stated intentions. The main thrustof Definition 3.2 is not so much to characterizeunintentionally passive portfolios, but rather tobroaden the notion of passive to include portfo-lios with time-varying weights but where the timevariation is not information-based. One example ofsuch a passive portfolio is the “life-cycle” or “target-date” fund that is designed for a specific cohortof investors according to their planned retirementdate.10 Such target-date funds are not static, butneither are they actively managed, and the lackof correlation between their portfolio weights andasset returns is the key characteristic that suggeststhat they are passive, i.e., their portfolio weightscontain no incremental information about futurereturns.

Alternatively, the crucial characteristic of an activeportfolio is the deliberate and successful use of infor-mation for forecasting returns—this is usually whatwe have in mind when we speak of “investmentskill.” In the next section, we sharpen the distinctionbetween alpha and other sources of expected returnby assuming a linear factor structure for individualasset returns.

3.3 Alpha vs. beta

To distinguish explicitly between alpha andbeta, we have to impose additional structureon the return-generating processes for individual

THIRD QUARTER 2008 JOURNAL OF INVESTMENT MANAGEMENT

10 ANDREW W. LO

assets:

(A3) For each asset i, the return Rit satisfies a linearK -factor model11:

Rit = αi + βi1F1t + · · · + βiK FKt + εit

(14)

0 = E[εit |F1t , . . . , FKt ], (15)

where the factors Fkt are stationary and ergodicstochastic processes.

Although the linear K -factor structure is presentedas an assumption, several authors have derived the-ories to support such a specification, includingMerton’s (1973) Intertemporal Capital Asset Pric-ing Model, Ross’s (1976) Arbitrage Pricing Theory,and Lo and Wang’s (2006) dynamic equilibriummodel of returns and trading volume. However, inAssumption (A3), we leave room for the presenceof an intercept αi , which most other equilibriumasset-pricing models rule out because the presenceof nonzero αi may create arbitrage opportunities.12

Since the AP decomposition is considerably moregeneral than any particular asset-pricing model orlinear factor structure, for our purposes, we remainagnostic about whether or not αi is zero for allassets, and merely leave it as a possibility within ourframework.

Under Assumption (A3), the return Rpt of anarbitrary portfolio of assets may be written as:

Rpt =n∑

i=1

ωit Rit (16a)

=n∑

i=1

ωitαi +(

n∑i=1

ωitβi1

)F1t + · · ·

+(

n∑i=1

ωitβiK

)FKt +

n∑i=1

ωitεit (16b)

= αpt +K∑

k=1

βpk,t Fkt + εpt , (16c)

where

βpk,t ≡n∑

i=1

ωitβik ,

αpt ≡n∑

i=1

ωitαi .

(16d)

Armed with this return decomposition, the corre-sponding AP decomposition for expected returnsfollows immediately:

Proposition 2 Under Assumptions (A1)–(A3), theexpected return of any portfolio P satisfies the followingdecomposition:

E[Rpt ] =n∑

i=1

αiE[ωit ] +K∑

k=1

Cov[βpk,t , Fkt ]

+K∑

k=1

E[βpk,t ]E[Fkt ]

= Security Selection + Factor Timing

+ Risk Premia, (17)

where

Security Selection ≡n∑

i=1

αiE[ωit ] (18a)

Factor Timing ≡K∑

k=1

Cov[βpk,t , Fkt ] (18b)

Risk Premia ≡K∑

k=1

E[βpk,t ]E[Fkt ] (18c)

and

E[βpk,t ] =n∑

i=1

βikE[ωit ], k = 1, . . . , K

(19a)

JOURNAL OF INVESTMENT MANAGEMENT THIRD QUARTER 2008

WHERE DO ALPHAS COME FROM?: A MEASURE OF THE VALUE OF ACTIVE INVESTMENT MANAGEMENT 11

Cov[βpk,t , Fkt ] =n∑

i=1

βikCov[ωit , Fkt ],

k = 1, . . . , K . (19b)

Proposition 2 provides a more refined decomposi-tion than Proposition 1, thanks to the linear K -factor structure assumed in (A3). Expected returnsare now the sum of three components: a security-selection component (18a) that depends on theαi ’s, a factor-timing component (18b) that dependson the covariance between the portfolio betas andfactors, and a risk-premia component (18c) thatrepresents the expected return from passive expo-sures to factor risks. The first two componentscan be viewed as active sources of expected return,with the third being the passive component as inProposition 1.

This factor-based AP decomposition clarifies severalissues surrounding the measurement of active man-agement. The first is the well-known implicationof any multi-factor model that expected returns inexcess of a benchmark need not be due to invest-ment acumen, but may simply be passive exposuresto non-market risk factors (see, for example, Merton(1973) and Ross (1976)). For example, if a portfo-lio with unit market-beta has a passive credit-factorbeta of 0.5 (in other words, no time-variation inthis beta), then (18c) shows that this portfolio willyield half the risk premium of the credit factor inaddition to the equity risk premium. Such outper-formance can be achieved purely through passivemeans.

A second issue that Proposition 2 resolves is thehistorical disparity between the expected returnsof long-only investments and hedge funds. Somehave argued that the distinction is due to theoutsize rewards from hedge-fund fee structures,which tend to draw the most talented portfoliomanagers from the long-only world, along withtheir alpha sources. Whether or not this exodus of

talent from mutual funds to hedge funds is real isdebatable, but (17) provides another explanationwhich is at least as compelling: the long-only con-straint is a severe handicap from the perspectiveof expected returns, because it hampers a portfo-lio manager’s ability to engage in factor timing.By allowing weights to be negative, a hedge-fund manager can create negative factor-betas forhis portfolio, which will yield positive expectedreturns if the corresponding factor risk-premia arenegative. Long-only managers cannot easily dothis if factor-betas are largely positive, hence onesource of positive expected return is unavailableto them. Therefore, we should not expect long-only managers to be able to generate the level ofexpected returns that unconstrained managers canproduce.

A third issue on which Proposition 2 sheds signifi-cant light is the recent concern of many institutionalinvestors that they are paying hedge funds for alphabut are getting beta instead. Proposition 2 showshow to assess the value-added of hedge funds thatmake directional bets: check the covariances of theirportfolio betas with the factors. If hedge fundspossess factor-timing ability or “allocation alpha”(Leibowitz, 2005a, 2005b), this should be viewedas legitimate “alpha” or active management. But ifthe beta exposures are being generated passively, i.e.,not with covariances (18b) but with relatively stableweights in (18c), then there are cheaper alterna-tives such as the “beta grazers” in Leibowitz (2005a,2005b), the “swing assets” in Leibowitz and Bova(2005), or the futures-based hedge-fund beta repli-cation strategies described in Hasanhodzic and Lo(2006). This suggests the following definition ofpassive investing in the context of a linear K -factormodel:

Definition 2 A portfolio is said to have passivefactor exposure to factor k if its portfolio beta βpk,tis uncorrelated with the factor Fkt .

THIRD QUARTER 2008 JOURNAL OF INVESTMENT MANAGEMENT

12 ANDREW W. LO

Note that Definition 3.3 leaves open the possibilitythat a portfolio is passive with respect to one factorbut active with respect to another. This is particu-larly important for the hedge-fund industry whichis extraordinarily heterogeneous, and where highlyspecialized investment expertise can and shouldthrive.

Of course, passive beta exposures to non-traditionalbetas such as credit, liquidity, volatility, and yield-curve twists may be more difficult to generate andmanage for a typical pension plan sponsor than S&P500 beta, in which case higher management feesmay be justifiable. But unless the manager is pro-viding some form of active management — uniquesources of αi ’s or factor-timing ability — thereshould be downward pressure on the correspond-ing management fees, and certainly incentive feescannot be justified.

One final insight provided by Proposition 2 isthat investment expertise can manifest itself in twodistinct formats: identifying untapped sources ofexpected return (the αi ’s) and creating additionalexpected return through factor timing (the time-varying βpk,t ’s). Even if all αi ’s are zero, as someacademic studies claim, there can still be substan-tial value-added from active management as longas risk premia vary over time and as functions ofmarket conditions.

4 Some analytical examples

In this section, I provide three examples of theAP decomposition where active and passive com-ponents can be evaluated analytically. Section 4.1contains a simple numerical example that high-lights the basic computations involved in thedecomposition. In Section 4.2, I consider mean-reversion and momentum strategies, and in Sec-tion 4.3, I provide an analysis of a stop-lossstrategy.

4.1 A numerical example

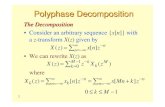

Consider a portfolio of two assets, one which yieldsa monthly return that alternates between 1% and2% (Asset 1) and the other which yields a fixedmonthly return of 0.15% (Asset 2). Let the weightsof this portfolio, called A1, be given by 75% inAsset 1 and 25% in Asset 2. The chart and tablein Figure 1 illustrates the dynamics of this portfolioover a 12-month period, where the expected returnof the portfolio is 1.16% per month, none of whichis due to the active component. Therefore θp = 0%in this case.

Now consider portfolio A2, which differs fromA1 only in that the portfolio weight for Asset1 alternates between 50% and 100% as Asset1’s return alternatives between 1% and 2% (seethe chart in Figure 2). In this case, the totalexpected return is 1.29% per month, of which0.13% is due to the positive correlation betweenthe portfolio weight for Asset 1 and its return.This yields an active ratio θp of 9.71%. Notethat this ratio does not depend on the samplinginterval of the returns, in contrast to the figures1.29% and 0.13%, both of which are monthlyreturns.

Finally, consider a third portfolio A3 which alsohas alternating weights for Asset 1, but exactly inthe opposite direction to Asset 1’s returns: whenthe return is 1%, the portfolio weight is 100%, andwhen the return is 2%, the portfolio weight is 50%.This is obviously counterproductive, and Figure 3confirms this intuition. Portfolio A3 loses 0.13%per month from its active component, and its activeratio θp = −12.05%.

Note that in all three cases, the passive componentsare identical at 1.16% per month because the aver-age weight for each asset is the same across all threeportfolios. The only differences among A1, A2, andA3 are the dynamics of the portfolio weights, and

JOURNAL OF INVESTMENT MANAGEMENT THIRD QUARTER 2008

WHERE DO ALPHAS COME FROM?: A MEASURE OF THE VALUE OF ACTIVE INVESTMENT MANAGEMENT 13

Month ω 1 R 1 ω 2 R 2 R p

1 75% 1.00% 25% 0.15% 0.79%

2 75% 2.00% 25% 0.15% 1.54%

3 75% 1.00% 25% 0.15% 0.79%

4 75% 2.00% 25% 0.15% 1.54%

5 75% 1.00% 25% 0.15% 0.79%

6 75% 2.00% 25% 0.15% 1.54%

7 75% 1.00% 25% 0.15% 0.79%

8 75% 2.00% 25% 0.15% 1.54%

9 75% 1.00% 25% 0.15% 0.79%

10 75% 2.00% 25% 0.15% 1.54%

11 75% 1.00% 25% 0.15% 0.79%

12 75% 2.00% 25% 0.15% 1.54%

Mean: 75.00% 1.50% 25.00% 0.15% 1.16%

SD: 0.00% 0.52% 0.00% 0.00% 0.39%

Corr[ω,R]:

Cov[ω ,R]: + = 0.00%

E[ ω ]E[R]: + = 1.16%

Total: 1.16%

θ: 0.00%

Strategy A1

0.00% 0.00%

1.13%

0.00% 0.00%

0.04%

0%

20%

40%

60%

80%

100%

1 2 3 4 5 6 7 8 9 10 11 12

Po

rtfo

lio

We

igh

t 1

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

Ass

et R

etu

rn 1

Weight 1 Asset Return 1

Figure 1 The expected return of a constant portfolio does not contain any active component.

these differences give rise to different values for theactive component δp and the active ratio θp.

4.2 Mean reversion and momentum strategies

Consider a simple asset-allocation example whereone asset is the risk-free asset that yields Rf and theother is a risky asset with return Rt that satisfies

a stationary autoregressive process with one lag orAR(1):

Rt = µ + ρ(Rt−1 − µ) + εt ,

εt IID WN(0, σ2ε ) (20)

ωt = γ1 + γ2Rt−1 (21)

Rpt = ωt Rt + (1 − ωt )Rf . (22)

THIRD QUARTER 2008 JOURNAL OF INVESTMENT MANAGEMENT

14 ANDREW W. LO

Month ω1 R 1 ω2 R 2 R p

1 50% 1.00% 50% 0.15% 0.58%

2 100% 2.00% 0% 0.15% 2.00%

3 50% 1.00% 50% 0.15% 0.58%

4 100% 2.00% 0% 0.15% 2.00%

5 50% 1.00% 50% 0.15% 0.58%

6 100% 2.00% 0% 0.15% 2.00%

7 50% 1.00% 50% 0.15% 0.58%

8 100% 2.00% 0% 0.15% 2.00%

9 50% 1.00% 50% 0.15% 0.58%

10 100% 2.00% 0% 0.15% 2.00%

11 50% 1.00% 50% 0.15% 0.58%

12 100% 2.00% 0% 0.15% 2.00%

Mean: 75.00% 1.50% 25.00% 0.15% 1.29%

SD: 26.11% 0.52% 26.11% 0.00% 0.74%

Corr[ω,R]:

Cov[ω,R]: + = 0.13%

E[ω ]E[R]: + = 1.16%

Total: 1.29%

θ: 9.71%

Strategy A2

0.13% 0.00%

1.13%

100.00% 0.00%

0.04%

0%

20%

40%

60%

80%

100%

1 2 3 4 5 6 7 8 9 10 11 12

Po

rtfo

lio

We

igh

t 1

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

Ass

et R

etu

rn 1

Weight 1 Asset Return 1

Figure 2 The portfolio weights are positively correlated with returns, which adds value to the portfolioand yields a positive active component.

The asset-allocation strategy (21) is a simple linearfunction of last period’s return plus a constant, andcovers two important cases: a mean-reversion strat-egy (γ2 < 0), and a momentum strategy (γ2 > 0).The expected return of this strategy can be easily

derived as:

E[Rpt ] = Cov[ωt , Rt ] + E[ωt ]E[Rt ]+ (1 − E[ωt ])Rf (23a)

JOURNAL OF INVESTMENT MANAGEMENT THIRD QUARTER 2008

WHERE DO ALPHAS COME FROM?: A MEASURE OF THE VALUE OF ACTIVE INVESTMENT MANAGEMENT 15

Month ω1 R 1 ω2 R 2 R p

1 100% 1.00% 0% 0.15% 1.00%

2 50% 2.00% 50% 0.15% 1.08%

3 100% 1.00% 0% 0.15% 1.00%

4 50% 2.00% 50% 0.15% 1.08%

5 100% 1.00% 0% 0.15% 1.00%

6 50% 2.00% 50% 0.15% 1.08%

7 100% 1.00% 0% 0.15% 1.00%

8 50% 2.00% 50% 0.15% 1.08%

9 100% 1.00% 0% 0.15% 1.00%

10 50% 2.00% 50% 0.15% 1.08%

11 100% 1.00% 0% 0.15% 1.00%

12 50% 2.00% 50% 0.15% 1.08%

Mean: 75.00% 1.50% 25.00% 0.15% 1.04%

SD: 26.11% 0.52% 26.11% 0.00% 0.04%

Corr[ω,R]:

Cov[ω,R]: + = -0.13%

E[ ω ]E[R]: + = 1.16%

Total: 1.04%

θ: -12.05%

Strategy A3

-0.13% 0.00%

1.13%

-100.00% 0.00%

0.04%

0%

20%

40%

60%

80%

100%

1 2 3 4 5 6 7 8 9 10 11 12

Po

rtfo

lio

We

igh

t 1

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

Ass

et R

etu

rn 1

Weight 1 Asset Return 1

Figure 3 The portfolio weights are negatively correlated with returns, which subtracts value to the portfolioand yields a negative active component.

= γ2ρVar[Rt ] + (γ1 + γ2µ)µ

+ (1 − γ1 − γ2µ)Rf . (23b)

This expression shows that the passive componentis a weighted average of the two assets using the

expected values of the weights ωt and 1−ωt . Onthe other hand, the active component is a functionof γ2, ρ, and the return variance of the risky asset.These three parameters represent the sum total ofthe information content in the strategy (21). If γ2

THIRD QUARTER 2008 JOURNAL OF INVESTMENT MANAGEMENT

16 ANDREW W. LO

is of the same sign as ρ, then the active compo-nent is positive—the strategy will be a momentumstrategy when returns exhibit momentum (ρ >

0) and will be a mean-reversion strategy whenreturns exhibit mean reversion (ρ < 0). If, onthe other hand, γ2 is of opposite sign to ρ, thenthe active component will subtract value becausethe strategy will be exactly out of phase with therisky asset. And as the variance of Rt increasesthe active component becomes larger in absolutevalue, magnifying both positive and negative timingability.

4.3 A stop-loss policy

Suppose that a portfolio manager implements astop-loss policy on an existing portfolio strategywith return Rt so that if the strategy’s return fallsbelow a threshold ζ at date t − 1, the entire port-folio will be invested in the riskfree asset at date t ,and if the strategy’s return is greater than or equal toζ, the entire portfolio will be invested in the strat-egy. Assuming that the strategy’s return-generatingprocess is an AR(1), we can specify the dynam-ics Rpt of the combined portfolio-plus-stop-lossstrategy as:

Rt = µ + ρ(Rt−1 − µ) + εt , εt IID N (0, σ2ε )

(24)

ωt ={

1 if Rt−1 > ζ

0 if Rt−1 ≤ ζ(25)

Rpt = ωt Rt + (1 − ωt )Rf , (26)

where we have assumed that εt is Gaussian so thatwe can solve for expected return in closed form.Under these specifications, the expected return ofRpt is given by:

E[Rpt ] = Cov[ωt , Rt ] + E[ωt ]E[Rt ]+ (1 − E[ωt ])Rf

= ρσφ

(α − µ

σ

)+ µ

(1 −

(α − µ

σ

))

+ Rf

(α − µ

σ

). (27)

The first term in (27) is the active component,and the second two terms are the passive compo-nent. As long as ρ > 0, implying momentum forthe risky asset, the active component will increasethe expected return of the portfolio. This resultmakes intuitive sense because the stop-loss policy(25) activates when past returns fall below ζ, and alower past return implies lower future returns whenρ ≥ 0. If, however, ρ < 0, then the stop-loss pol-icy (25) becomes counterproductive because returnsare mean-reverting, hence the time to switch to theriskless asset is after a very large positive return inthe most recent past.

Table 1 provides a numerical illustration of theAP decomposition for various values of the twoparameters ζ and ρ. When ρ = −25%, the activecomponent is negative regardless of the threshold ζ,although higher values of ζ make the active compo-nent more costly because more upside is eliminatedby the stop-loss policy. When ρ = 0, the activecomponent is 0 because returns follow a randomwalk in this case, and any portfolio strategy basedon prior returns will be uncorrelated with currentreturns. And when ρ is positive, the active compo-nent becomes positive as well, and as predicted by(27), the larger the threshold and the larger the ρ,the more valuable is the stop-loss, and the larger isthe active ratio.

See Kaminski and Lo (2007) for a more detailedanalysis of the performance of stop-loss policies.

5 Implementing the AP decomposition

The AP decomposition in Section 3 is a simplefunction of means, variances, and covariances of

JOURNAL OF INVESTMENT MANAGEMENT THIRD QUARTER 2008

WHERE DO ALPHAS COME FROM?: A MEASURE OF THE VALUE OF ACTIVE INVESTMENT MANAGEMENT 17

Table 1 Measures of the value of a stop-loss policy for a portfolio with monthly returnsthat follow an AR(1), and monthly parameter values Rf = 5%/12, E[Rt ] = 10%/12,and Var[Rt ] = (20%)2/12.

Annualized (%)

α (%) ρ (%) E[Rpt ] Active Passive %Active E[ωt ] 1 − E[ωt ]−1.0 −25 1.6 −6.6 8.1 −423.1 62.5 37.5−0.5 −25 1.2 −6.7 8.0 −547.6 59.1 40.9

0.0 −25 0.9 −6.8 7.8 −720.9 55.7 44.30.5 −25 0.7 −6.9 7.6 −962.5 52.3 47.71.0 −25 0.5 −6.9 7.4 −1290.0 48.8 51.2

−1.0 0 8.1 0.0 8.1 0.0 62.5 37.5−0.5 0 8.0 0.0 8.0 0.0 59.1 40.9

0.0 0 7.8 0.0 7.8 0.0 55.7 44.30.5 0 7.6 0.0 7.6 0.0 52.3 47.71.0 0 7.4 0.0 7.4 0.0 48.8 51.2

−1.0 25 14.7 6.6 8.1 44.7 62.5 37.5−0.5 25 14.7 6.7 8.0 45.8 59.1 40.9

0.0 25 14.6 6.8 7.8 46.8 55.7 44.30.5 25 14.5 6.9 7.6 47.5 52.3 47.71.0 25 14.3 6.9 7.4 48.1 48.8 51.2

−1.0 50 21.3 13.1 8.1 61.8 62.5 37.5−0.5 50 21.4 13.5 8.0 62.8 59.1 40.9

0.0 50 21.5 13.7 7.8 63.7 55.7 44.30.5 50 21.4 13.8 7.6 64.4 52.3 47.71.0 50 21.3 13.8 7.4 65.0 48.8 51.2

portfolio weights and returns, hence its implemen-tation is a straightforward exercise in estimatingunconditional first and second moments. In fact,in Section 5.1 we show that the properly definedsample moments of portfolio weights and returnsare related in exactly the same way as their pop-ulation counterparts in (10), hence the decom-position must hold exactly as an identity whenapplied to the data. However, there is one sub-tlety in implementing (10) that is not addressedby the population version, which is the selectionof the sampling interval, and this is considered inSection 5.3.

5.1 Population vs. sample moments

Assumptions (A1) and (A2) are generally sufficientto ensure that the usual sample means, variances,and covariances of portfolio weights and returnswill be well-behaved estimators for their populationvalues (see, for example, White (1984)). Therefore,implementing the fundamental decomposition (10)involves nothing more challenging than estimat-ing first and second moments. Moreover, the factthat sample moments are related to each other inthe same way that population moments are relatedmakes the application of (10) to the data almost

THIRD QUARTER 2008 JOURNAL OF INVESTMENT MANAGEMENT

18 ANDREW W. LO

trivial. For example, consider the sample covariancebetween portfolio weights and returns for asset i:

1

T

T∑t=1

(ωit − ωi)(Rit − Ri)

= 1

T

T∑t=1

(ωit Rit − ωiRit − ωit Ri + ωiRi)

(28a)

= 1

T

T∑t=1

ωit Rit − ωi

T

T∑t=1

Rit

− Ri

T

T∑t=1

ωit + ωiRi (28b)

= 1

T

T∑t=1

ωit Rit − ωiRi . (28c)

Therefore,

1

T

T∑t=1

ωit Rit = 1

T

T∑t=1

(ωit −ωi)(Rit −Ri)+ωiRi

(29)which is the sample-moment counterpart to (10)for a single asset i. Repeated applications of (28c)to the sample average of a portfolio will result inthe sample version of (10), hence the AP decom-position must also hold in-sample. With properlydefined first and second moments, (10) is an iden-tity for sample moments as well as for populationmoments.

However, there is an even simpler approach to esti-mating the AP decomposition that eliminates theneed for second moments altogether, and that isto infer the active component by subtracting thepassive component from the total expected return:

δp = E[Rpt ] − νp. (30)

Because the right side of (30) involves only firstmoments, the active component δp and the active

ratio θp may be computed solely from the averageweights and average returns of the portfolio, hence:

δ̂p = 1

T

T∑t=1

Rpt −n∑

i=1

ωiRi , (31)

where

ωi ≡ 1

T

T∑t=1

ωit , Ri ≡ 1

T

T∑t=1

Rit

θ̂p = δ̂p

1T

∑Tt=1 Rpt

. (32)

In particular, it is not necessary for a manager toprovide position-level transparency to give investorsa clear sense of the value of his investment pro-cess. This is a particularly important characteris-tic of the fundamental decomposition (10) whenapplied to hedge-fund strategies because of secrecysurrounding such strategies. Few hedge-fund man-agers should balk at divulging average weights andreturns, unless, of course, the manager’s averageweights do not vary much over time, in which casethe investors should reconsider paying hedge-fundfees to such a manager.

5.2 GMM estimation

The simplicity of the estimators (31) and (32) maysuggest that statistical inference is not needed, butthere is still the issue of assessing the accuracyof these estimators to address. Fortunately, givenAssumptions (A1) and (A2), it is possible to derivethe asymptotic distributions of (31) and (32) underfairly general conditions. These results are summa-rized in the following proposition (see the Appendixfor a proof ):

Proposition 3 Under (A1) and (A2), the active com-ponent δp and active ratio θp of any portfolio P may

JOURNAL OF INVESTMENT MANAGEMENT THIRD QUARTER 2008

WHERE DO ALPHAS COME FROM?: A MEASURE OF THE VALUE OF ACTIVE INVESTMENT MANAGEMENT 19

be estimated consistently by their sample counterparts(31) and (32), and both estimators are asymptoticallynormal with variances that may be consistently esti-mated via the Generalized Method of Moments.

5.3 The sampling interval

One important practical issue surrounding theimplementation of the AP decomposition is thechoice of sampling interval for weights and returns.This obviously does not affect the population ver-sion of the decomposition, but is of critical impor-tance in practical applications. However, even forthe population version, the relevance of the sam-pling interval can be understood in the context oftime aggregation. Consider a portfolio strategy inwhich the weights {ωit (Xt−1)} vary each period,but we only observe portfolio weights and returnsevery q periods. If we now apply the AP decompo-sition to this subset of weights and returns, wouldwe arrive at the same values for δp and νp, appro-priately scaled? The answer is no. To see why, wemust first define the precise set of observables ateach q-period interval, and then ask whether theseobservables satisfy the same relation (10) as theirone-period counterparts.

First, consider aggregating the portfolio return Rptover q periods and ignore the effects of compound-ing for simplicity:

Rpt =n∑

i=1

ωit Rit (33)

Rpτ(q) =τq∑

t=(τ−1)q+1

Rpt =τq∑

t=(τ−1)q+1

n∑i=1

ωit Rit

(34)

=n∑

i=1

τq∑t=(τ−1)q+1

ωit Rit . (35)

Then the expected value of the q-period portfolioreturn is given by:

E[Rpτ(q)] =n∑

i=1

τq∑t=(τ−1)q+1

E[ωit Rit ] (36)

=n∑

i=1

qE[ωit Rit ] from stationarity

(37)

=n∑

i=1

qCov[ωit , Rit ]

+n∑

i=1

qE[ωit ]E[Rit ]. (38)

The equality (38) shows that (10) aggregates lin-early over time, so that the q-period expected returnof a portfolio is equal to the sum of q times the activecomponent and q times the passive component.

However, the question we started with is whether(10) remains the same with q-period inputs, and(38) has q-period returns only on the left side. Toaddress our original problem, let us rewrite the rightside of (34) with q-period variables as well:

Rpτ(q) =n∑

i=1

τq∑t=(τ−1)q+1

ωitRit

Riτ(q)Riτ(q) (39)

=n∑

i=1

ωiτ(q) Riτ(q)

where

ωiτ(q) ≡τq∑

t=(τ−1)q+1

ωitRit

Riτ(q). (40)

In (40), the q-period portfolio return Rpτ(q) isshown to be equal to the product of q-period assetreturns Riτ(q) and q-period weights ωiτ(q), butnote that these weights are not simply averages ofωit over q periods, but are return-weighted aver-ages. In fact, the only set of q-period portfolioweights that, when multiplied by q-period asset

THIRD QUARTER 2008 JOURNAL OF INVESTMENT MANAGEMENT

20 ANDREW W. LO

returns, will yield the same q-period portfolio returnas the time-aggregated portfolio return Rpτ(q) isthe return-weighted average defined in (40). Nowwe are prepared to answer the question we firstposed regarding the effect of time aggregation on(10). Suppose we apply the decomposition to q-period weights and returns—will we arrive at ascaled version of the one-period decomposition?The q-period version is given by:

E[Rpτ(q)] =n∑

i=1

E[ωiτ(q)Riτ(q)] (41)

=n∑

i=1

Cov[ωiτ(q), Riτ(q)]

+n∑

i=1

E[ωiτ(q)]E[Riτ(q)] (42)

and from (42) it is easy to see that the q-periodversion does not reduce to q times the one-periodversion as in (40). In particular, the covariances ofq-period weights and returns involve complex cross-products of one-period weights and returns withinthe q-period interval, and even the expected valueof q-period weights involve co-moments betweenweights and returns across the interval. In fact,much of the complexity of (42) is an artifact ofthe time aggregation, and has little to do with theunderlying investment process.

For this reason, it is critical that the sampling inter-val be at least as fine as the finest decision intervalof the investment process (see Figures 4a and 4b).If portfolio decisions are made on a weekly basis,then (10) must be implemented with data sampledat least once a week. If, on the other hand, the strat-egy employs daily information, then weekly datawill not suffice (see Figure 4c).

Sampling more finely than the finest decision inter-val is always acceptable because an unchangedportfolio weight may always be viewed as an activedecision to maintain a position, i.e., “let it ride.”

Figure 4 Illustration of all possible configurationsof sampling and decision intervals: (a) matchedsampling and decision intervals; (b) more fre-quent sampling intervals; (c) less frequent samplingintervals.

Although Warren Buffett changes his portfolioweights rather slowly over time, this is quite deliber-ate and not due to lethargy or inertia. However, oneuseful implication of this longer decision interval isthat we are unlikely to be misled by applying ourdecomposition to the monthly returns and weightsof his portfolio, whereas the same cannot be saidfor the legendary day-trader Steven Cohen of SACCapital (see Figure 5).

JOURNAL OF INVESTMENT MANAGEMENT THIRD QUARTER 2008

WHERE DO ALPHAS COME FROM?: A MEASURE OF THE VALUE OF ACTIVE INVESTMENT MANAGEMENT 21

Month ω 1 R 1 ω 2 R 2 R p

1 50% 1.00% 50% 0.15% 0.58%

2 50% 2.00% 50% 0.15% 1.08%

3 50% 1.00% 50% 0.15% 0.58%

4 50% 2.00% 50% 0.15% 1.08%

5 50% 1.00% 50% 0.15% 0.58%

6 50% 2.00% 50% 0.15% 1.08%

7 50% 1.00% 50% 0.15% 0.58%

8 100% 2.00% 0% 0.15% 2.00%

9 100% 1.00% 0% 0.15% 1.00%

10 100% 2.00% 0% 0.15% 2.00%

11 100% 1.00% 0% 0.15% 1.00%

12 100% 2.00% 0% 0.15% 2.00%

Mean: 70.83% 1.50% 29.17% 0.15% 1.13%

SD: 25.75% 0.52% 25.75% 0.00% 0.57%

Corr[ω,R]:

Cov[ ω,R]: + = 0.02%

E[ ω ]E[R]: + = 1.11%

Total: 1.13%

θ: 1.85%

Strategy A4

0.02% 0.00%

1.06%

16.90% 0.00%

0.04%

0%

20%

40%

60%

80%

100%

1 2 3 4 5 6 7 8 9 10 11 12

Po

rtfo

lio

We

igh

t 1

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

Ass

et R

etu

rn 1

Weight 1 Asset Return 1

Figure 5 Sampling more frequently than the decision interval does not create any biases in the active ratioestimator.

Moreover, random shifts in portfolio weights inbetween decision intervals may add noise to theestimates (31) and (32), but will not affect the con-sistency of the estimators since, by definition, the

noise is independent of returns (if they are corre-lated with returns, then they are considered partof the information in portfolio weights and willcount toward the active component). Therefore,

THIRD QUARTER 2008 JOURNAL OF INVESTMENT MANAGEMENT

22 ANDREW W. LO

more finely sampled data is always preferred, butat a minimum, the data must be sampled at leastas finely as the investment decision interval, oth-erwise the AP decomposition may not accuratelyreflect the true active and passive contributions ofthe manager.

6 An empirical application

To develop a better understanding of the charac-teristics of the AP decomposition, we apply ourframework to a specific market-neutral equity trad-ing strategy that, by construction, is particularlydynamic. The strategy, first proposed by Lo andMacKinlay (1990), is an example of a “statisti-cal arbitrage” program, consisting of buying losersand selling winners in proportion to their under-or over-performance relative to the cross-sectionmean. Specifically, let:

ωit = −1

n(Rit−1 − Rt−1),

Rt−1 ≡ 1

n

n∑i=1

Rit−1,(43)

which implies that the weights sum to 0 at each datet , hence these are arbitrage portfolios. The fact thatthese weights are so directly tied to returns impliesvery active trading, and the fact that the weights sumto 0 implies very little market-beta exposure. Thesetwo implications suggest that much of this portfo-lio’s return should be due to active management,and that θ should be quite large.

6.1 Trading NASDAQ size-deciles

We apply this strategy to the daily returns of thefive smallest size-decile portfolios of all NASDAQstocks, as constructed by the University of Chicago’sCenter for Research in Security Prices (CRSP), fromJanuary 2, 1990 to December 29, 1995.13 Table 2reports the cross-autocorrelations of these five decile

Table 2 First-order cross-autocorrelation matrixof the daily returns of the five smallest CRSP-NASDAQ size deciles, from January 2, 1990 toDecember 29, 1995. Decile 1 is the smallest-capitalization decile.

R1t+1 R2t+1 R3t+1 R4t+1 R5t+1

R1t 10.0% 21.5% 15.8% 18.1% 16.7%R2t 23.4% 15.4% 20.2% 19.7% 15.8%R3t 26.2% 25.0% 15.2% 23.9% 21.6%R4t 25.4% 27.0% 24.3% 18.2% 18.7%R5t 25.4% 26.6% 26.5% 26.2% 19.4%

returns, and the lead/lag pattern that emergesfrom this table—the fact that larger-decile returnstoday are more highly correlated with smaller-decilereturns tomorrow than smaller-decile returns todaywith larger-decile returns tomorrow—underscoresthe likely profitability of the contrarian strategy(43). Of course, trading NASDAQ size-deciles isobviously unrealistic in practice, but our purposeis to illustrate the performance of our expected-return decomposition (10), not to derive an imple-mentable trading strategy.

Figure 6 illustrates the remarkable performance ofthe contrarian strategy (43) over the 1990 to 1995sample period, and Table 3 contains summary stat-istics for the daily returns of the five deciles andthe strategy. With an annualized average return of31.4% and standard deviation of 7.9%, this strat-egy’s performance is considerably better than thatof any of the five deciles, which is one indicationthat active management is playing a significant rolein this case.

This intuition is confirmed by the AP decom-position of the strategy’s expected return intoactive and risk-premia components in Table 4. Onan annualized basis, the active component yields32% which exceeds the strategy’s total expected

JOURNAL OF INVESTMENT MANAGEMENT THIRD QUARTER 2008

WHERE DO ALPHAS COME FROM?: A MEASURE OF THE VALUE OF ACTIVE INVESTMENT MANAGEMENT 23

0

1

2

3

4

5

6

7

19900103 19910103 19920103 19930104 19940103 19950104

Cu

mu

lati

ve R

etu

rn

Figure 6 Cumulative return of a daily mean-reversion strategy of Lo and MacKinlay (1990) applied tothe five smallest CRSP-NASDAQ size deciles from January 2, 1990 to December 29, 1995.

Table 3 Summary statistics of the daily returns of the five smallest CRSP-NASDAQ size deciles,and the daily returns of a mean-reversion strategy of Lo and MacKinlay (1990) applied to thosedecile returns, from January 2, 1990 to December 29, 1995. Decile 1 is the smallest-capitalizationdecile.

Statistic Decile 1 Decile 2 Decile 3 Decile 4 Decile 5 Rpt

Mean*250 27.4% 17.5% 14.0% 13.7% 12.8% 31.4%SD*sqrt(250) 12.2% 9.8% 8.9% 9.1% 9.5% 7.9%SR*sqrt(250) 2.25 1.78 1.58 1.50 1.35 3.95Min −2.9% −2.7% −2.7% −3.3% −3.5% −2.2%Median 0.1% 0.1% 0.1% 0.1% 0.1% 0.1%Max 6.7% 3.6% 2.0% 2.1% 2.3% 2.4%Skew 0.6 0.0 −0.5 −0.7 −0.9 −0.1XSKurt 5.1 2.4 2.1 3.1 3.9 1.7ρ1 10.0% 15.4% 15.2% 18.2% 19.4% 4.7%ρ2 10.3% 7.7% 10.1% 13.9% 10.5% 0.9%ρ3 5.7% 4.2% 7.5% 9.2% 11.0% 7.5%

THIRD QUARTER 2008 JOURNAL OF INVESTMENT MANAGEMENT

24 ANDREW W. LO

Table 4 GMM estimates of the active ratio θ (in percent) of the dailyand monthly returns of a mean-reversion strategy of Lo and MacKinlay(1990) applied to the five smallest CRSP-NASDAQ size-decile returns,from January 2, 1990 to December 29, 1995. Daily estimates employ atruncation lag of 6 in the computation of the Newey-West asymptoticstandard errors, and monthly estimates employ a truncation lag of 3.

Statistic Estimate (%) SE (%) t -stat

DailyPortfolio Mean*250 31.4 0.3 91.00Risk Premia*250 −0.6 3.5 −0.17Active Component*250 32.0 3.5 9.24Active Ratio 101.9 0.3 354.40

MonthlyPortfolio Mean*12 −4.0 1.0 −3.98Risk Premia*12 0.1 4.0 0.03Active Component*12 −4.1 4.1 −1.01Active Ratio 102.6 11.8 8.66

return of 31.4%, implying an active ratio of101.9% and a slightly negative risk-premia compo-nent. In this case, more than all of the strategy’sexpected return is coming from active manage-ment, and the risk-premia component is subtractingvalue. The explanation for this rather unusualphenomenon was provided by Lo and MacKinlay(1990, Section 5.3.1), who observed that becausethe contrarian strategy holds losers and shorts win-ners, on average it will be buying the low-meanassets and shorting the high-mean assets. There-fore, the risk-premia component—which is thesum of average portfolio weights multiplied byaverage returns—will consist of positive averageweights for low-mean stocks and negative aver-age weights for high-mean stocks for this strat-egy. Fortunately, the positive correlation betweenweights and returns is more than sufficient to com-pensate for the negative risk-premia, as Table 4confirms.

6.2 Daily vs. monthly transparency

To illustrate the importance of the sampling inter-val in the measurement of the active ratio, supposethat we are given only the following monthly infor-mation for this daily strategy: month-end portfolioweights, and the monthly returns of each of the fivedeciles. Table 5 shows that the strategy’s expectedreturn cannot be correctly computed from thisinformation because much of the return comesfrom daily bets that are not captured by month-end portfolio weights. The decomposition of theincorrect expected return of −4.0% is reportedin the lower panel of Table 4 and also has nobearing to the daily strategy—the estimates implythat the active component yields −4.1%, which isclearly false. By observing only month-end weightsand cumulative returns, we have no way of infer-ring the profitability of decisions made at a dailyfrequency.

JOURNAL OF INVESTMENT MANAGEMENT THIRD QUARTER 2008

WHERE DO ALPHAS COME FROM?: A MEASURE OF THE VALUE OF ACTIVE INVESTMENT MANAGEMENT 25

Table 5 Summary statistics of the monthly returns of the five smallest CRSP-NASDAQ sizedeciles, and the monthly returns of a mean-reversion strategy of Lo and MacKinlay (1990)applied to those decile returns, from January 1990 to December 1995. Decile 1 is thesmallest-capitalization decile.

Statistic Decile 1 Decile 2 Decile 3 Decile 4 Decile 5 Rpt

Mean*12 27.5% 17.4% 13.9% 13.7% 12.8% −4.0%SD*sqrt(12) 20.6% 17.7% 15.6% 15.0% 15.9% 8.8%SR*sqrt(12) 1.34 0.98 0.89 0.91 0.80 −0.45Min −8.0% −11.3% −9.0% −9.7% −11.4% −6.6%Median 1.6% 1.0% 1.2% 1.0% 1.5% −0.5%Max 26.4% 21.5% 18.1% 16.8% 16.2% 9.7%Skew 1.2 0.9 0.7 0.5 0.1 1.2XSKurt 3.3 3.0 2.1 2.0 1.2 4.7ρ1 36.4% 43.7% 43.2% 41.4% 45.0% 8.2%ρ2 17.3% 16.6% 18.9% 10.1% 13.7% 15.7%ρ3 −5.6% −2.7% −3.1% −7.8% −7.0% −3.2%

7 Conclusion

The investment management industry has devel-oped a series of measures to gauge the performanceof portfolio managers. Most of these measures arebased on characteristics of the marginal distribu-tions of asset and portfolio returns at a single pointin time. Also, the typical statistical procedures usedto estimate these characteristics implicitly assumethat the data are independently and identicallydistributed, which eliminates any possibility ofdynamic effects such as intertemporal correlationsand forecast power.

In contrast to these static measures, the AP decom-position and active ratio—which are based on thedefinition of covariance—are multi-point statisticsthat capture the very essence of active management:time-series predictability. A successful portfoliomanager is one whose decisions are more often rightthan wrong, but “right” and “wrong” have spe-cific meanings in this context: positive correlationbetween portfolio weights and returns. Given that

portfolio weights are functions of a manager’s priorand proprietary information, positive correlationbetween weights and returns is a clear indication offorecast power and, consequently, active investmentskills.

This definition of active management providesa natural dichotomy between active and passiveinvesting. A passive portfolio has no forecast power,and can therefore be implemented more easily thanan active portfolio. This is a sensible generalizationof the standard definition of a passive portfolio, i.e.,a constant mix of liquid benchmarks.

If asset returns are assumed to satisfy a linear multi-factor model, the AP decomposition shows thata portfolio’s expected returns can be decomposedinto three components: deviations from the lin-ear factor model or “alpha,” positive correlationbetween portfolio betas and factor realizations or“factor timing,” and static factor exposures timesrisk premia. This decomposition provides a clearand simple framework for resolving the question of

THIRD QUARTER 2008 JOURNAL OF INVESTMENT MANAGEMENT

26 ANDREW W. LO

whether hedge-fund investors are paying for alphaand getting beta from their investments. Moreover,the AP decomposition provides one explanation forthe historical differences in performance betweenlong-only and long/short portfolios: the long-onlyrestriction severely limits a manager’s factor-timingability, which can be a substantial performance dragduring periods where risk premia change sign.

Finally, because the AP decomposition is an identityin any given sample of data, it can be used to con-duct detailed performance attributions, factor byfactor, and asset by asset. By separating the activeand passive components of a portfolio, it should bepossible to study and improve the performance ofboth.

Appendix

Throughout the Appendix, the following conven-tions are maintained: (1) all vectors are columnvectors unless otherwise indicated; (2) vectors andmatrices are always typeset in boldface, i.e., X andµ are scalars and X and µ are vectors or matrices.

GMM estimators for the AP decomposition

Denote by Xt the vector of period-t portfo-lio weights and returns [ω1t · · · ωnt R1t · · · Rnt ]′,and let {Xt } be a stochastic process that satisfies thefollowing conditions:

(H1) {Xt : t ∈ (−∞, ∞)} is stationary andergodic.

(H2) γ o ∈ � is an open subset of �k .(H3) ∀γ ∈ �, ϕ(·, γ ) and ϕγ (·, γ ) are Borel-

measurable and ϕγ (X, ·) is continuous on �

for all X.(H4) ϕγ is first-moment continuous at γ o,

E[ϕγ (X, ·)] exists, is finite, and is of fullrank.

(H5) Let ϕt ≡ ϕ(Xt , γ o) and

vj ≡ E[ϕ0|ϕ−1, ϕ−2, . . .]− E[ϕ0|ϕ−j−1, ϕ−j−2, . . .]

and assume:

(i) E[ϕ0ϕ′0] exists and is finite.

(ii) vj converges in mean square to 0.(iii)

∑∞j=0 E[v ′

j vj]1/2 is finite.

which implies E[ϕ(Xt , γ o)] = 0.(H6) Let γ̂ solve 1

T

∑Tt=1 ϕ(Xt , γ ) = 0.

Then Hansen (1982) shows that:

√T (γ̂ − γ o)

a∼ N (0, Vγ ), Vγ ≡ H−1�H−1′,

(A.1)where

H ≡ limT →∞ E

[1

T

T∑t=1

ϕγ (Xt , γ o)

](A.2)

� ≡ limT →∞ E

[1

T

T∑t=1

T∑s=1

ϕ(Xt , γ o)ϕ(Xs , γ o)′]

.

(A.3)

and ϕγ (Rt , γ ) denotes the derivative of ϕ(Rt , γ )

with respect to γ .14 Specifically, let ϕ(Rt , γ ) denotethe following vector function:

ϕ(ωt , Rt , γ ) ≡ [ω1t − µω1 · · · ωnt − µωn

R1t − µ1 · · · Rnt − µn]′, (A.4)

where γ ≡ [µω1 · · · µωn µ1 · · · µn]′. The GMMestimator of γ , denoted by γ̂ , is given implicitly bythe solution to:

1

T

T∑t=1

ϕ(ωt , Rt , γ ) = 0, (A.5)

which yields the standard estimatorsωi and Ri givenin (31). For the moment conditions in (A.4), H is

JOURNAL OF INVESTMENT MANAGEMENT THIRD QUARTER 2008

WHERE DO ALPHAS COME FROM?: A MEASURE OF THE VALUE OF ACTIVE INVESTMENT MANAGEMENT 27

given by:H = −I, (A.6)

where I is a (2n × 2n) identity matrix. There-fore, Vγ = � and the asymptotic distribution ofthe active ratio estimator θ̂ follows from the deltamethod: √

T (θ̂ − θ)a∼ N (0, VGMM),

VGMM = ∂g∂γ

�∂g∂γ ′ ,

(A.7)

where ∂g/∂γ is given by:

∂g∂γ

= [µ1 · · · µn µω1 · · · µωn]. (A.8)

An estimator for ∂g/∂γ may be obtained by sub-stituting γ̂ into (A.8), and an estimator for �

may be obtained using Newey and West’s (1987)procedure:

�̂ = �̂0 +m∑

j=1

ω( j, m)(�̂j + �̂′j), m T

(A.9)

�̂j ≡ 1

T

T∑t=j+1

ϕ(Rt , γ̂ )ϕ(Rt−j , γ̂ )′ (A.10)

ω( j, m) ≡ 1 − jm + 1

(A.11)

and m is the truncation lag, which must satisfythe condition m/T → ∞ as T increases with-out bound to ensure consistency. An estimator forVGMM can then be constructed as:

V̂GMM = ∂g (γ̂ )

∂γ�̂

∂g (γ̂ )

∂γ ′ . (A.12)

Notes

1 Of course, data spanning many dates are used to esti-mate these parameters, but the parameters themselves aresingle-point statistics, as opposed to multi-point statisticssuch as autocorrelations. Moreover, the estimates for thestandard performance metrics are almost always computed

under the assumption that the data are independently andidentically distributed, which rules out any non-random-walk behavior, the starting point of any active investmentstrategy.

2 In particular, one of the option-pricing parameters is thematurity date, which renders the option price a multi-point statistic.

3 Equation (17.27) of Grinold and Kahn (2000, p. 504) isproportional to the covariance between factor betas andreturns, and is the sample counterpart to (18b).

4 See footnote 9 of Grinold and Kahn (2000, p. 504). I amgrateful to Lisa Goldberg for this citation.

5 See Grinblatt and Titman (1993, p. 51), Eq. (4b).6 Part of the motivation for this less direct performance mea-

sure is to relate it to the “Event Study Measure” fromthe prior literature by Cornell (1979) and Copeland andMayers (1982). See also Grinblatt and Titman (1989) foradditional theoretical motivation for their measure.

7 We define constant-weight portfolios to be uncorrelatedwith returns since their covariances with returns are zero,even though in this case the correlation coefficient isundefined because the variance of the portfolio weight iszero.

8 Commodities have historically exhibited very little corre-lation to the S&P 500, hence including a buy-and-holdportfolio of commodities is unlikely to affect the overallmarket beta of the portfolio.

9 I thank the referee for raising this distinction.10 For example, the investment policy of the Vanguard Target

Retirement 2015 Fund (VTXVX) is summarized by thefollowing passage (see http://www.vanguard.com):

The fund invests in Vanguard mutual funds usingan asset allocation strategy designed for investorsplanning to retire between 2013 and 2017. Thefund’s asset allocation will become more conser-vative over time. Within seven years after 2015,the fund’s asset allocation should resemble that ofthe Target Retirement Income Fund. The underly-ing funds are: Vanguard Total Bond Market IndexFund, Vanguard Total Stock Market Index Fund,Vanguard European Stock Index Fund, VanguardPacific Stock Index Fund, and Vanguard EmergingMarkets Stock Index Fund.

11 For notational simplicity, we omit the riskless rate Rf fromthis specification, but without any loss in generality, somereaders may prefer to interpret both the asset return Rit

and the factor returns Fkt as excess returns, in excess of Rf .12 In particular, if the magnitudes of αi are too large, or

there are too many assets with nonzero αi , then it may be

THIRD QUARTER 2008 JOURNAL OF INVESTMENT MANAGEMENT

28 ANDREW W. LO

possible to construct a portfolio that has no factor risksand no idiosyncratic risk but a nonzero intercept, whichimplies arbitrage.

13 We selected this time period purposely because of the emer-gence of day-trading in the early 1990’s, an importantsource of profitability for statistical arbitrage strategies.

14 See Magnus and Neudecker (1988) for the specific defini-tions and conventions of vector and matrix derivatives ofvector functions.

References

Arnott, R., Hsu, J., and Moore, P. (2005). “FundamentalIndexation.” Financial Analysts Journal 61, 83–99.

Brinson, G., Hood, R., and Beebower, G. (1986). “Determi-nants of Portfolio Performance.” Financial Analysts Journal42, 39–48.

Brinson, G., Singer, B., and Beebower, G. (1991). “Determi-nants of Portfolio Performance II: An Update.” FinancialAnalysts Journal 47, 40–48.