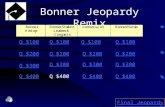

Jeopardy RhymingColorsShapesMath Opposites Q $100 Q $200 Q $300 Q $100 Q $200 Q $300 Final Jeopardy.

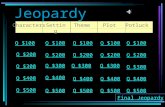

Jeopardy 1 2 3 4 Q$100 Q$200 Q$300 Q$400 Q$500 Q$100 Q$200 Q$300 Q$400 Q$500 5 Q$100 Q$200 Q$300.

-

Upload

timothy-gregory-kennedy -

Category

Documents

-

view

243 -

download

0

description

Transcript of Jeopardy 1 2 3 4 Q$100 Q$200 Q$300 Q$400 Q$500 Q$100 Q$200 Q$300 Q$400 Q$500 5 Q$100 Q$200 Q$300.

Jeopardy 1 2 3 4

Q$100

Q$200

Q$300

Q$400

Q$500

Q$100

Q$200

Q$300

Q$400

Q$500

5

Q$100

Q$200

Q$300

$100 Question from 1

Time covered by a salary payment.

$100 Answer to 1

What is a pay period?

$200 Question from 1

Where a period’s payroll information is recorded.

$200 Answer to 1

What is a Payroll Register?

$300 Question from 1

A deduction from total earnings for each person legally supported by a taxpayer, including the employee.

$300 Answer to 1

What is Withholding Allowance?

$400 Question from 1

Amount due for a pay period before deductions.

$400 Answer to 1

What are Total Earnings.

$500 Question from 1

Taxes based on a business’s payments to employees.

$500 Answer to 1

What are payroll taxes?

$100 Question from 2

Tax for government funded medical insurance.

$100 Answer to 2

What is Medicare Tax.

$200 Question from 2

Old age, survivors, and disability tax insurance.

$200 Answer to 2

What is Social Security Tax?

$300 Question from 2

A tax payment for unemployed workers.

$300 Answer to 2

What is state unemployment tax (SUTA).

$400 Question from 2

A tax supporting administrative expenses of unemployment programs.

$400 Answer to 2

What is federal unemployment tax (FUTA)?

$500 Question from 2

Total amount earned by all employees in a period.

$500 Answer to 2

What is a Payroll?

$100 Question from 3

Shows details related to payments to an employee.

$100 Answer to 3

What is an Employee Earnings Record?

$200 Question from 3

Money paid for employee services.

$200 Answer to 3

What is a Salary?

$300 Question from 3

Maximum earnings a tax applies to.

$300 Answer to 3

What is a Tax Base?