James O'Connell Platts Coal Bangkok 2012

-

Upload

alex-metal -

Category

Documents

-

view

221 -

download

0

Transcript of James O'Connell Platts Coal Bangkok 2012

-

7/30/2019 James O'Connell Platts Coal Bangkok 2012

1/38

Coal Trading in Asia

Bangkok, November2012

James OConnellPlatts

-

7/30/2019 James O'Connell Platts Coal Bangkok 2012

2/38

Over 100 years of facilitating efficient and transparentmarkets

-

7/30/2019 James O'Connell Platts Coal Bangkok 2012

3/38

Our Profile

Platts is the worlds largest energy information provider

Platts brings transparency to the markets through spot

prices and published assessment methodology

Every month, more than US$10 billion in trading activityand term contract sales are based on Platts benchmarks

Platts provides in-depth analysis on market breakingnews, helping our subscribers to make business decisions

-

7/30/2019 James O'Connell Platts Coal Bangkok 2012

4/38

Platts: part of the McGraw-Hill Companies

platt

s

-

7/30/2019 James O'Connell Platts Coal Bangkok 2012

5/38

Presentation overview

International trading platforms

Role of indices in market transparency

Rising production costs & volatile international prices

Is coal buying strategy changing in Asia ie short termcontracts versus long term arrangements

-

7/30/2019 James O'Connell Platts Coal Bangkok 2012

6/38

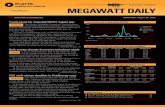

globalCOAL NEWC Index what is it?

An index based on the spot (prompt 3 months) price for thermalcoal delivered on an FOB basis in Newcastle, NSW, Australia,basis 6,000Kcal/Kg NCV NAR

globalCOAL NEWC Index used for settling ICE Futures Europefutures contract and OTC derivatives in Asia. Approx 250 million

tonnes traded in 2011. Widely used benchmark reference point for Asian coal and

underpins the vast majority of index linked physical coal salescontracts in Asia.

17th June 2012

1 hour trading window introduced: Encourage market to post all bids & offers between 08.00 09.00 London time

Designed to increase participation during Asian hours

Price collar introduced: To safeguard against human error and potential market distortion

-

7/30/2019 James O'Connell Platts Coal Bangkok 2012

7/38

Volume and frequency of Phys NEWC tradesincrease since window

Size denotesTransaction Volume

60

70

80

90

100

110

120

130

23-Dec 11-Feb 1-Apr 21-May 10-Jul 29-Aug 18-Oct 7-Dec

PriceU

S$

Source: globalCOAL

NEWC TradingWindow Introduced

-

7/30/2019 James O'Connell Platts Coal Bangkok 2012

8/38

0

10

20

30

40

50

60

70

80

90

100

3-Jan 3-Feb 3-Mar 3-Apr 3-May 3-Jun 3-Jul 3-Aug 3-Sep 3-Oct 3-Nov

Numberofbids&offers

# of Bids & Offers

Volume of Index qualifying Phys NEWC bids& offers increases post window

Source: globalCOAL

NEWC TradingWindowIntroduced

-

7/30/2019 James O'Connell Platts Coal Bangkok 2012

9/38

9

Value: a function of time

Drop of $3.20/barrel(or $22.50/mt)

in 40 minutes

M

O

C

4.02.00pm: After Brent fall s $1 in 3

minutes (33 cents a minute for three

minutes) Platts crude, products and

aromatics editors all ra iseincrementability to $2/mt or 20

cents/barrel per minute: eWindow,

manual processes and headlines all

move at same time

4.27.00pm: Fall slows and prices

rise moderately. Platts crude,

products and a romatics editors

reinstate incrementability at

$1/mt or 10 cents/barrel per

minute: eWindow, manual

processes and headlines all

move at same time

Brent futures during Platts Asia MOC May 25, 2008

-

7/30/2019 James O'Connell Platts Coal Bangkok 2012

10/38

10

Windows, e-Windows have standard increment guidelines

-

7/30/2019 James O'Connell Platts Coal Bangkok 2012

11/38

11

MOC: Increments and Repeatability in action

-

7/30/2019 James O'Connell Platts Coal Bangkok 2012

12/38

12

Window makes the market transparent

-

7/30/2019 James O'Connell Platts Coal Bangkok 2012

13/38

13

Platts eWindow screenshot Market on Close (MOC)

-

7/30/2019 James O'Connell Platts Coal Bangkok 2012

14/38

14

Windows participation is subject to vetting procedures

Business profile (history, registration, ownership, documents ofincorporation etc.)

Financial standing

Creditworthiness (bank references and credit lines, or evidence ofability to issue LC against first class bank in the absence of credit

lines Market reputability

Trade performance history

Counterparty acceptance

Adherence to Platts Editorial guidelines

Adherence to operational and logistical market standards (forbest endeavor basis performance)

-

7/30/2019 James O'Connell Platts Coal Bangkok 2012

15/38

Coal cash costs by country 2011

. Thermal Coal: cash costs of production , by country

US$/t fob

50th centile 38.6

75th centile 48.1

90th centile 59.6

spot 72

-10

10

30

50

70

90

110

130

150

0 100 200 300 400 500

cashcostofproduction

(US$/tfob).

cumulative production (Mt)

50th 75th90th spot: 7-Sep-122011 cash cost curve

Indonesia

Australia

South

Africa

Colombia

Shanxi cash costs 2011$46/mt

FOB Kalimantan5,900 - $70.25/mt

5,000 - $55/mt4,200 - $38.40/mt

-

7/30/2019 James O'Connell Platts Coal Bangkok 2012

16/38

Volatility in Asian coal prices since 2002

Qinhuangdao - RedNewcastle 6000 - BlackRichards Bay 6000 - Green

Kalimantan 5900 - BlueNewcastle 5500 - Pink

-

7/30/2019 James O'Connell Platts Coal Bangkok 2012

17/38

Kalimantan and Newcastle relationship?

FOB Kalimantan5,900 - $70.25/mt5,000 - $55.00/mt4,200 - $38.40/mt

Newcastle 6,000Newcastle 5,500Japan strike dealFeb 7 - $21/mt spreadMar 13 - $11.65/mt

Jun 15 - $4.20/mt

Aug 14 - $22.10/mt

4,200 GAR steady in

$38-42/mt range

5,000 GAR in $70-78.30/mt range

-

7/30/2019 James O'Connell Platts Coal Bangkok 2012

18/38

Platts FOB Newcastle 5500 Vs 6300 GAR

Newcastle 5500 NAR vs. Newcastle 6300 GAR

85

90

95

00

05

10

15

20

25

30

1-

Aug-

11

8-

Aug-

11

15-

Aug-

11

22-

Aug-

11

29-

Aug-

11

5-

Sep-

11

12-

Sep-

11

19-

Sep-

11

26-

Sep-

11

3-

Oct-

11

10-

Oct-

11

17-

Oct-

11

24-

Oct-

11

31-

Oct-

11

7-

Nov-

11

14-

Nov-

11

21-

Nov-

11

28-

Nov-

11

5-

Dec-

11

12-

Dec-

11

19-

Dec-

11

26-

Dec-

11

Platts Newcastle 5500 NAR Platts Newcastle 6300 GAR

$20.25

$15.25

$19.90

-

7/30/2019 James O'Connell Platts Coal Bangkok 2012

19/38

Newcastle 5500 NAR vs 6300 GAR

Japan annual talks

$23.45/mtspread

Japan utilities strike deal

March 13 - $11.45/mt

spread

Octoberterm deal

June 15 - $7.50/mtspread

June 26$16.95/mtspread

June term talks

August 9$22/mt spread

-

7/30/2019 James O'Connell Platts Coal Bangkok 2012

20/38

Asian benchmark???

.

0

1

2

3

4

5

6

7

8

9

10

2009 2010 2011 2012proj

Mt

Physical New castle trades

-58%YoY

-

7/30/2019 James O'Connell Platts Coal Bangkok 2012

21/38

Long-term pricing systems are inefficient

The benchmark system of annual contract setting leads to hugeprice distortions

Large annual rises / falls in price have a dramatic effect on balancebooks downstream, and on bilateral relationships

Since annual contracts dont reflect market value throughout theyear, price takers and givers take on board significant market risk

Term contracts which price off daily spot prices would enable

consumers to accurately hedge with financial derivatives

This is a natural trend observed in oil, gas, petchems, steel andthermal coal markets already

S t i h l t d ith t l t t

-

7/30/2019 James O'Connell Platts Coal Bangkok 2012

22/38

Spot prices have correlated with quarterly contractsettlements

-

7/30/2019 James O'Connell Platts Coal Bangkok 2012

23/38

Utilities adopt the short term tender: CTI Aug 14

-

7/30/2019 James O'Connell Platts Coal Bangkok 2012

24/38

Kosep late July tender for September delivery

-

7/30/2019 James O'Connell Platts Coal Bangkok 2012

25/38

Kospo spot tender (CTI Sep 13)

-

7/30/2019 James O'Connell Platts Coal Bangkok 2012

26/38

FOB Kalimantan 4,200 GAR

.

-

7/30/2019 James O'Connell Platts Coal Bangkok 2012

27/38

Platts FOB Newcastle 5500 NAR

1

2

-

7/30/2019 James O'Connell Platts Coal Bangkok 2012

28/38

Platts response to import trends

-

7/30/2019 James O'Connell Platts Coal Bangkok 2012

29/38

Platts FOB Newcastle 5500 NAR ash differential

-

7/30/2019 James O'Connell Platts Coal Bangkok 2012

30/38

Friday, October 19, 2012

Ash differential per 1% ash = $0.62

17% ash = $71.50/mt + ash differential = $73.36/mt

18% ash = $71.50/mt + ash differential = $72.74/mt

19% ash = $71.50/mt + ash differential = $72.12/mt

Newcastle 5500 20% ash = $71.50/mt

21% ash = $71.50/mt - ash differential = $70.88/mt

22% ash = $71.50/mt - ash differential = $70.26/mt

23% ash = $71.50/mt - ash differential = $69.64/mt

FOB Newcastle 5500 NAR 17-23% ash

-

7/30/2019 James O'Connell Platts Coal Bangkok 2012

31/38

Tuesday, October 19, 2012

FOB Newcastle 5,500 NAR 20% ash = $71.50/mtAsh differential per 1% ash = $0.62

Ash normalization process:5,700 NAR 20% ash is $74.10/mt ($71.50 / 5500 X 5700)

19% ash = $74.10/mt + ash differential = $74.72/mt

18% ash = $74.10/mt + ash differential = $75.34/mt

17% ash = $74.10/mt + ash differential = $75.96/mt

FOB Newcastle 5500 NAR (5300-5700)

-

7/30/2019 James O'Connell Platts Coal Bangkok 2012

32/38

Indonesian exports to China (to Sept 2012 YoY)

.

0

5,000,000

10,000,000

15,000,000

20,000,000

25,000,000

30,000,000

35,000,000

40,000,000

Lignite Steam Other coal

2012

2011

-

7/30/2019 James O'Connell Platts Coal Bangkok 2012

33/38

China thermal imports to July 2012

Indonesia

32%

Australia

37%

Colombia

3%USA

5%Canada

1%

Russia

9%

South Africa

13%

Other

23%

China thermal imports to July

-

7/30/2019 James O'Connell Platts Coal Bangkok 2012

34/38

Republic of Koreas 2011 Total Imports by Country

-

7/30/2019 James O'Connell Platts Coal Bangkok 2012

35/38

Richards Bay Coal Terminal 2012 exports

-

7/30/2019 James O'Connell Platts Coal Bangkok 2012

36/38

Richards Bay exports to Sep 2012 (million mt)

-

7/30/2019 James O'Connell Platts Coal Bangkok 2012

37/38

37

Meet the Coal team at Platts

James OConnell, Editor in Chief

Michael Cooper - Editor, Australia

Cecilia Quiambao, Associate Editor,Indonesia & North Asia

Deepak Kannan, Associate Editor

Indonesia & Freight Reggie Le, Associate Editor - China

Sapna Dogra, Assistant Editor - India

Gareth Carpenter, Team Leader,Europe

Jacqueline Holman, Associate Editor,Europe Jaime Concha, Associate Editor,

Europe

Regional correspondents Chris Bishop, South Africa

Toby Muse, Colombia

Chris Kraul, Colombia

Anita Nugraha, Indonesia

Sunil Saraf, India Jayanta Sarkar, India

Sarah Cottle, Editorial Director EMEA

Vandana Hari, Asia Editorial Director

Larry Foster, Editorial Director, Global Power

Jorge Montepeque, Global Editorial Director,Price Group

-

7/30/2019 James O'Connell Platts Coal Bangkok 2012

38/38

James OConnell,

Editor-in-Chief,Platts Coal Trader International

Platts International Coal [email protected]

mailto:[email protected]:[email protected]:[email protected]:[email protected]