“Is European Football the Most Interesting Under-the-Radar ...

Transcript of “Is European Football the Most Interesting Under-the-Radar ...

MAPFRE AM

The Ben Graham Centre’s 1st EuropeanValue Investing Conference

“Is European Football the Most Interesting

Under-the-Radar Value Investing Story at the Moment?”

2

Presentation Outline.

I. About MAPFRE AM.

II. About the MAPFRE AM Behavioral Fund.

III. Deconstructing the 5 traditional reasons for NOT investing in football clubs.

IV. Sizing the opportunity: Is football undervalued?

V. Still a lot of room to go.

VI. Why do we invest in Ajax, Olympique Lyon and Borussia Dortmund?

3

Presentation Outline.

I. About MAPFRE AM.

II. About the MAPFRE AM Behavioral Fund.

III. Deconstructing the 5 traditional reasons for NOT investing in football clubs.

IV. Sizing the opportunity: Is football undervalued?

V. Still a lot of room to go.

VI. Why do we invest in Ajax, Olympique Lyon and Borussia Dortmund?

4

About MAPFRE AM.

Long term investments

Experts in Asset Allocation

Investment in iliquid or liquid and alternative assets

Investment centers in Madrid, Sao Paolo, Boston and Paris

150 professional investors

More than 50 years of experience

Present on the 5 continents

35.000 employees all over the world

EUR 61 bn in assets under management

5

Our Strategic Partners

6

Our Investment Process

7

Our Investment Process

8

Sustainable Investment

9

10

Presentation Outline.

I. About MAPFRE AM.

II. About the MAPFRE AM Behavioral Fund.

III. Deconstructing the 5 traditional reasons for NOT investing in football clubs.

IV. Sizing the opportunity: Is football undervalued?

V. Still a lot of room to go.

VI. Why do we invest in Ajax and OLG?

11

About the MAPFRE AM Behavioral Fund.

MAPFRE AM Behavioral Fund is managed according to three core principles.

(1)Value Investing

Builds Long-

Term Wealth

(2)Concentrated

Portfolios

Outperform

(3)Investor Biases

are Predictable

& Exploitable

We invest in attractively valued companies with:

o Low leverage.

o Aligned incentives.

o Track record of shareholder value creation.

Portfolio concentration encourages many virtues:

o A high level of conviction.

o A high threshold for inclusion (the 30-35 best stocks in Europe).

o A high degree of competition for capital (existing positions must continually “earn” their spot).

Investors are people who behave in predictably irrational ways:

o Over-reaction.

o Under-reaction.

o Availability bias.

o Recency bias.

12

About the MAPFRE AM Behavioral Fund.

Buy discipline

Sell discipline

o Competition for capital: We sell when we identify a use of funds with a better risk / reward.

o Behavioral self-awareness: We manage risk from the anchoring effect by using valuation ranges as opposed to a single price objective and adjust according to new information and market conditions.

MAPFRE AM Behavioral Fund applies behavioral finance concepts to identify

investments.

1 DeBondt, W. F., & Thaler, R. (July 1985). “Does the Stock Market Overreact?” The Journal of Finance, Vol XL, No 3, 793-805.2 Brandt, M.W., R. Kishore, P. Santa-Clara, M. Venkatachalam. (2008). “Earnings announcements are full of surprises”. Working paper, Duke University.3 Joel Greenblatt (1997), “You Can Be a Stock Market Genius: Uncover the Secret Hiding Places of Stock Market Profits”, Fireside Ed.4 Chancellor, Edward (Ed.) (2015). “Capital Returns: Investing Through the Capital Cycle: A Money Manager's Reports 2002-15“, Palgrave Macmillan.5 Cohen, L., Malloy, C., Pomorski, L., (2012). “Decoding inside information”. Journal of Finance 67, 1009—-1043.

Over-

reaction1

Under-

reaction2

Spin-offs3

Industry

cycles4

Under-

followed

Insider

buying5

Investor

sentiment

13

About the MAPFRE AM Behavioral Fund.

MAPFRE AM Behavioral Fund has an advisory board composed of experts in

behavioral economics, neuroscience, and organizational leadership.

The Advisory Board optimizes our investment process and improves decision making.

o Composed of experts from diverse fields outside of the asset management industry.

o Monitor latest research on behavioral economics and neuroscience and incorporate best practices into our core value investing process.

o Analyze individual behavioral biases and team dynamics to improve internal decision making.

Pedro Bermejo, MDNeurologist

Natalia Cassinello, PhD Professor at ICADE

Pedro Rey Biel, PhDProfessor at ESADE

Guillermo LlorenteSub director at MAPFRE

14

Presentation Outline.

I. About MAPFRE AM.

II. About the MAPFRE AM Behavioral Fund.

III. Deconstructing the 5 traditional reasons for NOT investing in football clubs.

IV. Sizing the opportunity: Is football undervalued?

V. Still a lot of room to go.

VI. Why do we invest in Ajax, Olympique Lyon and Borussia Dortmund?

15

Deconstructing the 5 traditional reasons for NOT investing in football clubs.

1) Football clubs do not make any money.

2) Investing in football clubs is like sports betting.

3) The football industry is too cyclical.

4) A couple of bad seasons can ruin my investment.

5) Football clubs are just toys for rich people.

16

Reason #1: Football clubs do not make any money.

Fact I: Bottom-line result has improved by > €1.8bn since introduction of

UEFA Financial Fair Play (FFP).

Deconstructing the 5 traditional reasons for NOT investing in football clubs.

-1,163

-1,634 -1,670

-1,076

-792 -789

-460-324

579

140

2009 2010 2011 2012 2013 2014 2015 2016 2017 2018

Aggregate European net profits (EUR mn)

Introduction of FFP

Source: UEFA.

17

Reason #1: Football clubs do not make any money.

Fact I: Bottom-line result has improved by > €1.8bn since introduction of FFP.

Deconstructing the 5 traditional reasons for NOT investing in football clubs.

“We have always said we want investors in football. Of course we want good investors in football. (…) We have to build on the strength of financial fair play and we have to look into how we can make investment possible but with reasonable, sustainable, appropriate

guarantees.”

Gianni InfantinoFIFA’s President &

Former UEFA’s General Secretary

18

Reason #1: Football clubs do not make any money.

Fact II: What about LaLiga? Almost every team is now profit making.

Deconstructing the 5 traditional reasons for NOT investing in football clubs.

Source: Palco 23 based on 2019-20 budgets and company data. Source: Palco 23 based on 2019-20 budgets and company data.

0 200 400 600 800 1,000

CA Osasuna

RCD Mallorca

CD Leganés

SD Eibar

Real Valladolid

Granada CF

RC Celta de Vigo

Deportivo Alavés

Levante UD

Real Sociedad

Getafe CF

Villarreal CF

RCD Espanyol

Real Betis

Athletic Club

Sevilla FC

Valencia CF

Atlético de Madrid

Real Madrid

FC Barcelona

Revenue in 2019-20(EUR mn)

0 10 20 30 40 50

CA Osasuna

RCD Mallorca

CD Leganés

SD Eibar

Real Valladolid

Granada CF

RC Celta de Vigo

Deportivo Alavés

Levante UD

Real Sociedad

Getafe CF

Villarreal CF

RCD Espanyol

Real Betis

Athletic Club

Sevilla FC

Valencia CF

Atlético de Madrid

Real Madrid

FC Barcelona

Net profit in 2019-20(EUR mn)

19

Reason #1: Football clubs do not make any money.

Fact II: What about LaLiga? Debt with public authorities has disappeared.

Deconstructing the 5 traditional reasons for NOT investing in football clubs.

0

100

200

300

400

500

600

700

Jan-13 Sep-14 Sep-15 Sep-16 Sep-17 Dec-17 Jun-20

Debt with public authorities (EUR mn)

Source: Senn Ferrero.

20

Reason #2: Investing in football clubs is like sports betting.

Fact: This depends absolutely on which is your time horizon.

Deconstructing the 5 traditional reasons for NOT investing in football clubs.

8

10

12

14

16

18

20

22

24

Dec-17 Jul-18 Feb-19 Aug-19

Evolution of AFC AJAX share price (EUR/share)

UEFA Champions League 2018-2019

Semifinals

Source: Bloomberg.

21

Reason #3: The football industry is too cyclical.

Fact I: Revenues have been growing quite steadily, without decline.

Deconstructing the 5 traditional reasons for NOT investing in football clubs.

Source: Statista.

0

2,000

4,000

6,000

8,000

10,000

12,000

14,000

16,000

18,000

20,000

1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020

Revenue of the biggest European soccer leagues (EUR mn)

England Italy Germany Spain France

22

Reason #3: The football industry is too cyclical.

Fact II: Football clubs can help to diversify your portfolio risk.

Deconstructing the 5 traditional reasons for NOT investing in football clubs.

70

90

110

130

150

170

190

Stoxx Football Index vs Stoxx 600 (Base 100)

Stoxx Football Index

Stoxx 600 Index

Source: Bloomberg

23

Reason #3: The football industry is too cyclical.

Fact II: Football clubs can help to diversify your portfolio risk.

Deconstructing the 5 traditional reasons for NOT investing in football clubs.

8

58

108

158

208

258

Apr-02 Oct-04 Apr-07 Oct-09 Apr-12 Oct-14 Apr-17 Oct-19

Stoxx Football Index vs Stoxx 600 (Base 100)

Stoxx Football Index

Stoxx 600 Index

Source: Bloomberg.

24

Reason #4: A couple of bad seasons can ruin my investment.

Fact I: Football clubs have significantly diversified their sources of revenues.

Deconstructing the 5 traditional reasons for NOT investing in football clubs.

37%

22%

15%

10%

8%

7%

Club revenue by source 2018

Domestic broadcasting Sponsorship Gate receipts Revenue from UEFA Commercial Other revenue

Source: UEFA.

25

Reason #4: A couple of bad seasons can ruin my investment.

Fact II: Hidden asset value de-risks the investment.

Buy clubs

that own

real estate

Avoid

excessive

leverage

Look for

Skin in the

Game

1 2 3

Deconstructing the 5 traditional reasons for NOT investing in football clubs.

26

Reason #5: Football clubs are just toys for rich people.

Fact I: The industry is attracting more and more sophisticated investors.

Deconstructing the 5 traditional reasons for NOT investing in football clubs.

27

Reason #5: Football clubs are just toys for rich people.

Fact II: The quality of management teams has increased significantly.

Deconstructing the 5 traditional reasons for NOT investing in football clubs.

From local real estate developers… …to global business school graduates.

28

Presentation Outline.

I. About MAPFRE AM.

II. About the MAPFRE AM Behavioral Fund.

III. Deconstructing the 5 traditional reasons for NOT investing in football clubs.

IV. Sizing the opportunity: Is football undervalued?

V. Still a lot of room to go.

VI. Why do we invest in Ajax, Olympique Lyon and Borussia Dortmund?

29

Football is a stable and attractive (but stigmatized) business.

As a product, football has a compelling value proposition for fans:

Sizing the opportunity: Is football is undervalued?

Importance to the

Consumer

Low High

Cost to the

Consumer

High

Low

30

How do we value a football club?

A conceptual framework for understanding the key value drivers.

Sizing the opportunity: Is football is undervalued?

1 2 3

Media /

Content

Business

Real

Estate

Assets

Net

Transfer

Revenue

31

Are European football clubs undervalued by the market?

A quick look at their relative valuation vs US sport franchises would

suggest that they are… big time. (I)

Sizing the opportunity: Is football is undervalued?

OLGAJAX

BVB

0

1,000

2,000

3,000

4,000

5,000

6,000

-100 -50 0 50 100 150 200 250 300 350 400

En

terp

ris

e v

alu

e (

US

D m

n)

EBITDA (USD mn)

Source: Forbes and MAPFRE AM estimates.

32

Are European football clubs undervalued by the market?

A quick look at their relative valuation vs US sport franchises would

suggest that they are… big time. (II)

Sizing the opportunity: Is football is undervalued?

0x

10x

20x

30x

40x

50x

60x

Los

Ange

les

Clip

pers

Los

Ang

eles

Char

gers

Los

Ange

les

Ram

sM

iam

i D

olp

hin

sB

roo

kly

n N

ets

Gre

en B

ay P

ackers

Bost

on R

ed S

ox

Real M

adri

dC

aro

lina

Pan

thers

Seatt

le S

eah

aw

ks

San F

ran

cis

co G

iants

Chic

ago

Cub

sIn

dia

nap

olis

Colt

sK

ansa

s C

ity

Chie

fsLos

Ang

eles

Dodge

rsG

old

en S

tate

Warr

iors

Jack

sonv

ille

Jagu

ars

St. L

ouis

Card

inals

Pitts

burg

h S

teele

rsA

rizona

Car

din

als

Chic

ago

Bears

San F

ran

cis

co 4

9ers

Bost

on C

eltic

sM

inneso

ta V

ikin

gsN

ew

Yo

rk K

nick

sW

ashi

ngt

on R

edsk

ins

Los

Ang

eles

Lake

rsD

enver B

roncos

Bal

tim

ore

Rav

ens

Phila

delp

hia

Eagle

sB

ayern

Munic

hA

tlan

ta F

alco

nsD

alla

s M

averi

cks

Houst

on R

ock

ets

New

Yo

rk G

iants

New

Yo

rk Jets

Ars

enal

Chels

ea

Chic

ago

Bulls

New

Orl

ean

s Sa

ints

Houst

on T

exan

sLiv

erp

ool

New

Engla

nd P

atri

ots

Man

chest

er

City

Man

chest

er

United

Bosu

ssia

Do

rtm

und

Dalla

s C

ow

boys

Aja

xO

LG

EV/EBITDA of global sports franchises

Source: Forbes and MAPFRE AM estimates.

33

Case Study: Operating leverage in the NFL

Like many media businesses, professional sports have high fixed costs.

Revenue per team doubled from 2008 to 2018, while EBITDA tripled.

Sizing the opportunity: Is football is undervalued?

0%

5%

10%

15%

20%

25%

30%

0

50

100

150

200

250

300

350

400

450

500

2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018

Average NFL Team Financial Performance(USD mn)

Average Revenue Average EBITDA margin

34

Case Study: Operating leverage in the NFL

NFL teams generated strong incremental margins on revenue growth beyond

$250mn, consistent with what leading European football clubs earn today.

Sizing the opportunity: Is football is undervalued?

YearsAvg.

Revenue

Avg.

EBITDA

Avg.

Margin

Incremental

Margin

2007-10 $242 $30 13% --

2011-14 $302 $54 18% 39%

2015-18 $427 $98 23% 35%

35

Are we seeing the beginning of a similar trend in European football?

We think so: revenue growth with margin expansion leads to higher valuations.

Sizing the opportunity: Is football is undervalued?

Source: Forbes.

0

500

1,000

1,500

2,000

2,500

3,000

3,500

2008 2010 2012 2014 2016 2019

Average value of sports franchises in the US(USD mn)

NHL MLB NBA NFL

36

Presentation Outline.

I. About MAPFRE AM.

II. About the MAPFRE AM Behavioral Fund.

III. Deconstructing the 5 traditional reasons for NOT investing in football clubs.

IV. Sizing the opportunity: Is football undervalued?

V. Still a lot of room to go.

VI. Why do we invest in Ajax, Olympique Lyon and Borussia Dortmund?

37

The structure of the revenue stream have been evolving in the recent years,

with broadcasting being now the main source of income for big clubs.

Still a lot of room to go : New sources of revenues.

Source: Deloitte.

0

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

4,500

2013/2014 2014/2015 2015/2016 2016/2017 2017/2018 2018/2019

Revenue growth of top 20 clubs in Europe(EUR mn)

Matchday Broadcast Commercial

38

Broadcasting revenues are still far below the NBA, the NFL or the MLB,

while the interest in football in the US and China just keeps growing.

Still a lot of room to go: An industry at an early stage.

0

5,000

10,000

15,000

20,000

25,000

30,000

35,000

40,000

NFL NBA MLB European football

Comparison of broadcasting

rights through sports(EUR mn)

0

500

1,000

1,500

2,000

2,500

3,000

3,500

Trend in television rights,

European football(EUR mn)

2007-08 2017-19 2019-21

Source: PledgeSports and MAPFRE AM estimates. Source: Premier League.

39

Fewer than 20% of European clubs own their own stadium but this is

becoming a very relevant source of income.

Still a lot of room to go: An industry at an early stage.

Source: UEFA

12%

2%

4%

14%

51%

17%

Top-division clubs' stadium ownership

Owned directly by the club

Owned by municipality or state but considered a club asset (long-term finance lease)

Owned by another entity within group (association, parent or subsidiary) and included as a club asset

Partially included as a club asset (leasehold improvements)

Stadium owned by municipality or state and not reported on club's balance sheet

Owned by another party and not included on club´s balance sheet

74

62

2527

18

13

22

Stadium projects by capacity (2020-2019)

45%

Source: UEFA

40

Only 15% of all top-division clubs have stadium naming rights partners, so

there is room to increase clubs’ revenues in this front.

Still a lot of room to go: An industry at an early stage.

0

5

10

15

20

25

30

35

50% or more 25%-50% 0%-25% None

Nu

mb

er o

f le

agu

es

% of stadiums with naming rights by league in Europe

Source: UEFA

41

Just over a third of clubs own their main training facilities, which will be

another area of investments in the coming years.

Still a lot of room to go: An industry at an early stage.

Source: UEFA

26%

10%

44%

9%

11%

Ownership of clubs' training facilities

Owned directly by the club Private owner related to club

Municipal authorities Government

Owned by another party

Source: UEFA

5%3%

11%14%

17%

50%

More than

EUR10mn

EUR5mn to

EUR10mn

EUR2mn to

EUR5mn

EUR1mn to

EUR2mn

EUR500.000

to EUR2mn

Less than

EUR500.000

Last improvement work on

training facilities(Distribution by amount spent)

42

Presentation Outline.

I. About MAPFRE AM.

II. About the MAPFRE AM Behavioral Fund.

III. Deconstructing the 5 traditional reasons for NOT investing in football clubs.

IV. Sizing the opportunity: Is football undervalued?

V. Still a lot of room to go.

VI. Why do we invest in Ajax, Olympique Lyon and Borussia Dortmund?

43

What kind of clubs are we looking for? Let’s use the same criteria that we apply to other companies in our portfolio. We are interested in clubs that…

Why do we invest in Ajax, Lyon and Dortmund?

Have great management

teams

Make net profits in the transfer

market

1 2

Have low financial leverage

Own a stadium, preferably multiuse

3 4

Are significantly undervalued by

the market

5

RIGHTPEOPLE

CAPITAL ALLOCATION

BALANCESHEET

GOODASSETS

AT ADISCOUNT

0

200

400

600

800

1,000

1,200

1,400

1,600

Market cap of listed clubs in European exhanges (EUR mn)

44

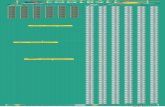

The are currently just 22 football clubs listed in European stock exchanges.

Ajax, OL and Borussia Dortmund are the ones that better fit our criteria.

Why do we invest in Ajax, Lyon and Dortmund?

Source: Bloomberg.

45

Both clubs share a series of common characteristics: net-sellers in the

players’ transfer market, solid balance sheets and great management.

Why do we invest in Ajax, Lyon and Dortmund?

5.5% 2.5% 2.0%

46

Thank you