Ipsen Business and Strategy update

Transcript of Ipsen Business and Strategy update

IPSEN pour nom de la société - 07/04/2011 / page 1

Ipsen Business and Strategy update

Bryan, Garnier & Co Healthcare Conference

28-29 November 2013

2 Bryan, Garnier & Co Healthcare Conference

1

2

3

4

Franchise growth

US to reach profitability

Reinforced and delivering R&D platforms

Governance

Agenda for today

Franchise growth

4 Bryan, Garnier & Co Healthcare Conference

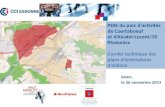

Other

Emerging

Markets³

~ 18%

Developped

Markets¹

~61%

Key

Emerging

Markets²

~21%

(1) of which G5, US, Australia, etc. – (2) Brazil, China, Russia – (3) of which Algeria, Poland,, etc.

Strong global presence Exchange rate headwind

Based on

9M 2013

sales Brazilian

Real

Russian

Ruble

Ipsen significantly impacted by FX in 2013

Australian

Dollar

-13.5%

-10.0%

-8.3%

-15,0%

-10,0%

-5,0%

0,0%

c.€15 million top-line FX impact in the first 9 months, partly flowing down to EBIT

YTD

evolution

vs. EUR

Source: Reuters, as of 18 November 2013

…

…

5 Bryan, Garnier & Co Healthcare Conference

6.0

29.4

48.7

92.2

10.7

12.5

42.3

186.3

186.6

222.9

Nisis /Nisisco

Forlax

Tanakan

Smecta

Hexvix

Increlex

Nutropin

Dysport

Somatuline

Decapeptyl

Specialty care

€661.3m

+3.0%

Primary care

€242.6m

(1.3%)

Drug sales

€903.9m

+1.8%

French primary care: (22.3%)

Drug Sales - 9M 2013

in million euros - % excluding foreign exchange impacts

Sp

ec

ialt

y c

are

P

rim

ary

ca

re

®

®

®

®

®

®

®

®

®

+7.1%

+10.5%

(3.5%)

(20.2%)

+12.0%

+6.8%

0.2% ®

®

Specialty care sales growth impacted by Decapeptyl® performance and Increlex® shortage

International primary care: +12.2%

+19.2%

(64.2%)

(41.4%)

6 Bryan, Garnier & Co Healthcare Conference

Decapeptyl® sales in 9M 2013 impacted by headwinds in China and Europe

231.1

222.9

(9.4)

(2.1)

3.3

Europe

Top 4 negative

contributors

China

Other

9M 2013 9M 2012

9M Decapeptyl Sales

in million euros at constant currency Poland: price cuts and patient co-payment

France: consequences of French PC restructuring plan

Greece: price cuts & aggressive competitive landscape

Italy: price cuts & contracting market

China below expectation, situation improving in Q3

Headwinds in Europe as anticipated

7 Bryan, Garnier & Co Healthcare Conference

Stabilizing Primary care driven by strong growth in emerging countries and slow down of French decline

-40%

-30%

-20%

-10%

0%

10%

Q1 2012 Q2 2012 Q3 2012 Q4 2012 Q1 2013 Q2 2013 Q3 2013

YoY growth rate

at current exchange rate

Evolution of quarterly Primary care sales

Annualization of French primary care decline

Global

France

Remaining French primary care overhang: Smecta® generic

8 Bryan, Garnier & Co Healthcare Conference

Bolt-on acquisitions to reinforce growth

platforms in emerging / US

Late-stage products (late phase III/

marketed)

External acquisition

Leverage geographical footprint External cooperation

Potential business development to accelerate growth

Contemplated scenarios

US to reach profitability

10 Bryan, Garnier & Co Healthcare Conference

US operations actively managed to rapidly reduce losses

US to reach profitability with significant growth opportunities ahead

Restructuring of commercial operations

New commercial model focused on key

account management

Adult Upper Limb spasticity phase III read

out in H1 2014

Endocrinology Business Unit profitable

despite Increlex® shortage

~ 50% market share in acromegaly

market(1)

Positive ELECT topline results

Positive CLARINET results

Dysport® Somatuline®

Expected breakeven in 2014(2) in current operational setting

Currently investigating NET commercialization options

(1) Somatuline® market share in acromegaly SSA market (2) Commercial contribution, excluding revenues from Valeant

Pharmaceuticals Intl Inc.

Reinforced and delivering R&D platforms

12 Bryan, Garnier & Co Healthcare Conference

Peptides

Toxins

Somatuline® CLARINET

PhIII results

Dysport® NG

Preliminary stability

data

Realized

Somatuline® ELECT

PhIII topline results

Dysport® NG

Cervical Dystonia

PhIII topline results

Upcoming in 2013

Dysport® AUL

spasticity

PhIII results

2014

R&D engine delivering, securing future franchise growth

tasquinimod

PFS and OS data

(preliminary

analysis)

Uro-Oncology

Endocrinology

Neurology Syntaxin acquisition /

Harvard partnership

13 Bryan, Garnier & Co Healthcare Conference

Demonstation of antiproliferative effect of Somatuline® in the treatment of non-functioning GEP-NETs

Lanreotide Autogel 120 mg

Placebo

0 3 6 9 12 18 24 27

0

10

20

30

40

50

60

70

80

90

100

Patients

aliv

e a

nd w

ith n

o p

rogre

ssio

n (

%)

Time (months)

62%

22%

CLARINET, the first global and differentiated study showing strong results in the treatment of GEP-NETs

62% of GEP-NET patients treated with

Somatuline® had not progressed or

died versus 22% with placebo

Disease progression or death was

reduced by 53%

Antiproliferative effect of Somatuline®

is: - statistically significant in midgut tumors

- clinically relevant in pancreatic NETs

- independent of the tumor grade and

hepatic tumor load

Key results

Note: P-value derived from stratified log-rank test; HR derived from Cox proportional hazard model. HR, hazard ratio; ITT, intention-to-

treat – Primary endpoint: PFS (ITT population, N=204)

14 Bryan, Garnier & Co Healthcare Conference

CLARINET and ELECT to significantly increase addressable market

Today Tomorrow’s potential

Symptom(*)

control

Tumor

control

Symptom(*)

control

Tumor

control

With Somatuline®, Ipsen on track to become first player with global label in GEP NETs

(*) Symptoms associated with carcinoid syndrome - (1) IMS 2012 and SmartAnalyst 2010

15 Bryan, Garnier & Co Healthcare Conference

From natural BoNT expertise…

Scale-up

Pharmaco-

logical Manufacturing

Pre-clinical /

Clinical Development

Established

network of

BoNT experts

Recombinant

technology

Toxin

engineering

Intellectual

property

Targeted

Secretion

Inhibitors

Ipsen

Syntaxin

Potential to

combine

toxins and

peptides

… to full recombinant potential

Highly complementary acquisition

Integration on track

Ipsen’s R&D toxin platform significantly reinforced by Syntaxin acquisition

16 Bryan, Garnier & Co Healthcare Conference

Tasquinimod, a new first-in-class anti-cancer therapy

A unique MoA that targets the tumor’s microenvironment

17 Bryan, Garnier & Co Healthcare Conference

mCRPC (10 TasQ 10) phase III pivotal (PFS + OS trend)

Phase II exploratory in maintenance mCRPC post docetaxel

2012 2013 2014 2015

Phase II exploratory in HCC, RCC, Gastric cancer & Ovarian cancer

2016+ 2011 2010

Prostate Cancer

Other solid tumors

Tasquinimod ongoing clinical studies

Note: mCRPC :metastatic Castrate Resistant Prostate Cancer; PoC: Proof of concept; HCC: Hepatocellular Carcinoma, RCC : Renal Cell Carcinoma

Final OS data

18 Bryan, Garnier & Co Healthcare Conference

Differentiated presentation to gain market share

ELECT Phase III NET w/ carcinoid syndrome (symptoms) (US)

Spasticity

Ph III in adult upper limb (US)

Dysport® Next Generation

Ph III in cervical dystonia (Europe)

tasquinimod

Ph III in mCRPC

(WW excl.US and Japan)

CLARINET Ph III GEP-NET antitumor effect (WW)

Somatuline®

tasquinimod

Dysport®

Product Growth drivers Corresponding addressable

market

[€1.3bn - €1.5bn](3)

[€200m - €300m](2)

[€400m - €600m](1)

Increased market opportunity in the context of fast growing markets

New indications / product candidates to significantly increase Ipsen’s market opportunity

(1) IMS 2012 and SmartAnalyst 2010 – (2) Ipsen analysis – (3) Decision Resources: in Ipsen territories and excl. GnRh analogs market

Governance

20 Bryan, Garnier & Co Healthcare Conference

Marc de Garidel, Chairman and CEO

Define corporate strategy

Focus on growing sales

Manage relationship with key

stakeholders

Christel Bories, Deputy CEO

Run operations

Transform the organization

Focus on profitability and cash

generation

Management

New governance and organization to accelerate execution of the new strategy

Dedicated organizations to leverage respective potential

New organization

Strengthening of Specialty care

Creation of two divisions:

- Franchises

- Commercial Operations

Area of focus for R&D efforts and

acquisition resources

Creation of a Primary care BU

Important contributor to company results

Significant growth driver in emerging

countries

Complementary roles and responsibilities

21 Bryan, Garnier & Co Healthcare Conference

Recurring adjusted(*)

operating margin Unchanged at around 16.0% of sales

– The Group continues to implement productivity measures while maintaining investment in R&D

– Benefits from the new organization of French primary care and US commercial operations

expected to materialize in 2014

2013 financial objectives confirmed

Primary care

Drug sales Decline of approximately -1.0% year-on-year

Specialty care

Drug sales Growth of approximately +3.0% year-on-year

– Realignment of the Decapeptyl® inventory situation in the distribution chain

– Launch of new Decapeptyl® local competitors

– Recent disruption in the Chinese market

Excluding further major deterioration of the Chinese and Middle Eastern markets

China

Middle East – Continued exceptional political situation in certain Middle Eastern countries

Note: the above sales growth objectives are set at constant currency. All the above objectives are set excluding major negative unforeseeable events, notably significant currency fluctuations in the context of

currency depreciation in certain emerging countries (*) Prior to non-recurring expenses

Thank You