IP_Riley_Wolitarsky_Los Angeles Retail Team_HQ

-

Upload

austin-wolitarsky -

Category

Documents

-

view

93 -

download

2

Transcript of IP_Riley_Wolitarsky_Los Angeles Retail Team_HQ

CAPITAL MARKETS // INVESTMENT PROPERTIES

LOS ANGELES RETA I L T EAM

Leaders in Retail Investment Properties

DAN RILEYSenior Vice President Lic. 1057519+1 310 363 4899 [email protected]

For more information, please contact:

AUSTIN WOLITARSKYAssociateLic. 01957206+1 310 363 [email protected]

FRANK CASTANON Desktop Publisher / Researcher+1 818 907 4728 [email protected]

Agoura Design Center Agoura Hills, CA

Abbot Kinney Portfolio Venice, CA

Pacifi c Palisades Village Pacifi c Palisades, CA

Sylmar Town CenterSylmar, CA

Knowledge – Integrity – Results

TEAM OVERV IEW

DAN RILEYDan Riley focuses exclusively on shopping center sales throughout the Western United States with emphasis in greater Los Angeles & Ventura Counties area, with transactions ranging from $2 million to $100 million. An expert in the disposition and acquisition of lifestyle, regional, community, neighborhood, and strip shopping centers, Mr. Riley helps his clients to: maximize asset value, minimize risk, qualify and select the best buyer or best property and ensure a high certainty of closing.

AUSTIN WOLITARSKYAustin Wolitarsky is an Associate with CBRE’s Los Angeles Retail Team. Partnered with Dan Riley, Austin focuses on Due Diligence, Underwriting, Marketing, and Investor Relations. Austin joined the fi rm as a member of the 2014 CBRE “Wheel Program” where he gained experience in multiple aspects of Retail Investment Sales. Austin is a graduate of Loyola Marymount University with a Bachelor’s degree in Entrepreneurship.

DAN RILEYTeam Leader

Primary Contact Client / BuyerStrategy DevelopmentPricing / Underwriting

Property ToursNegotiations

Escrow Management

FINANCIAL CONSULTING

GROUP

CBRE BROKERAGERETAIL

MARKETING DEBT & STRUCTURED FINANCE

ECONOMETRICS INTERNATIONALDESK

After thorough due diligence and input FCG Underwrites and Analyzes assets using Argus to capture maximum

future value for clients

Local Market Knowledge and Expertise

Develops sophisticated marketing campaigns, requests for proposals and team marketing

Buyer Qualifi cationCertainty of Financing ExecutionExtensive Lender Relationships

Formulates market information to support

underwriting and defend assumptions

CBRE International Desk connects foreign capital/investors to United States investment opportunities

AUSTIN WOLITARSKYAssociate

Transaction ManagementPricing / Underwriting

Due Diligence CoordinationMarketing Management

FRANK CASTANONDesktop Publisher / Researcher

Market ReportsOffering Memorandum

E-mail Campaign / Web MarketingComparable Transactions

ACQUSITIONS

REPOSITIONINGS

PORTFOLIOEVALUATIONS

DISTRESSED PROPERTIES

REO/TRUSTEE SALES

FOCUS COMMITMENT DIFFERENCE RESULTS*

*Numbers based since 2000

» Western United States

» Retail Investment Properties

» Dispositions

» Acquisitions

» Strategic Partner

» Maximize Value

» Minimize Risk

» Extensive Experience

» Proven Trusted Advisors

» Collaborative Visionary Approach

» Focused Execution to Close

» 200 Properties Sold

» 12 States

» 2.5 B in Consideration

THE MOST ACTIVE RETAIL INVESTMENT SALES TEAM BASED IN LOS ANGELES

EXPERTISE

DISPOSITIONS

Agoura Design CenterAgoura Hills, CA

Sylmar Town CenterSylmar, CA

Knowledge – Integrity – Results

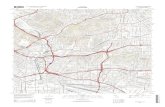

RANGE AND REACH

3 PROPERTIES

2 PROPERTIES

181 PROPERTIES

1 PROPERTY

1 PROPERTY

2 PROPERTIES

2 PROPERTIES 2 PROPERTIES

1 PROPERTY

3 PROPERTIES

1 PROPERTY 1 PROPERTY

$2.5Bin Consideration

Since 2000

12States Since 2000

200Properties Sold

Since 2000

TRANSACTIONS RECENTLY CLOSED OR IN ESCROW

CLIENTS REPRESENTED

PRIVATE CLIENTS

Caruso Affi liated Holdings

Ezralow Companies

M & H Realty

Primestor Development

Scanlan Kemper Bard

Village Properties

Zinkin Development

100 + Private Individuals/ Developers

INSTITUTIONAL CLIENTS

American Realty Advisors

Burnham Pacifi c

Center Trust

Macerich

MetLife

The Praedium Group

Prudential

Transwestern Investment Company

Weingarten

VENTURA RD & CHANNEL ISLANDS BLVD CENTER133,087 SF | Oxnard, CAIn Escrow

SYLMAR TOWN CENTER148,236 SF | Sylmar, CASold Nov. 2014

PACIFIC PALISADES CLOCK TOWER10,203 SF | Pacifi c Palisades, CASold May 2014

BJ’S RESTAURANT & BREWHOUSE17,000 SF | Woodland Hills, CAIn Escrow

COLLEGE PARK SHOPPING CENTER53,321 SF | Oxnard, CASold Dec. 2014

AGOURA DESIGN CENTER119,306 SF | Agoura Hills, CA Sold Sept. 2014

PACIFIC PALISADES VILLAGE53,321 SF | Oxnard, CASold Dec. 2014

Knowledge – Integrity – Results

RANGE AND REACH

REGIONAL AND GROCERY ANCHORED CENTERS

Sylmar Town CenterSylmar, CA | 148,236 SF

The Village at Indian WellsIndian Wells, CA | 104,589 SF

Kern Valley Plaza Lake Isabella, CA | 131,903 SF

Villaggio Shopping CenterFresno, CA | 176,542 SF

SINGLE TENANT NNN OR NET LEASE

MULTI-TENANT STRIP CENTER

HIGH STREET / HIGH PROFILE RETAIL

Family ChristianPalmdale, CA | 5,500 SF

Palisades Clock TowerPacifi c Palisades, CA | 10,390 SF

The Strand & Pier AveHermosa Beach, CA | 13,970 SF

Walgreens Coronado, CA | 9,490 SF

Bank of America San Diego, CA | 4,800 SF

The Courtyard at the CommonsCalabasas, CA | 89,074 SF

Woodside PlazaCamarillo, CA | 11,891 SF

Abbot Kinney PortfolioVenice | 20,831 SF

Solair St. Collection (retail)Los Angeles, CA | 41,000 SF

Knowledge – Integrity – Results

MARKET ING PROCESS

1

2

3

4

PRE-MARKETING DUE DIL IGENCE / FINANCIAL UNDERWRITINGPrior to putting the property on the market, the Team performs extensive underwriting, reading of the leases and creating detailed rent roll and lease notes, and prepares a cash fl ow analysis using Argus or Excel with the help of the CBRE Financial Consulting Group. This process is designed to ensure probability of receiving sound offers. This allows the Seller to negotiate from a position of strength while reducing the chance of price renegotiations and other unforeseen problems. The Team also conducts an extensive due diligence investigation of the property, reading and abstracting all pertinent documents, to ensure that every aspect of the property is presented in the best possible light to achieve a favorable sales price and high certainty of closing.

OFFERING MEMORANDUMA comprehensive offering memorandum is created and made available in electronic and printed form. The typical OM includes a marketing story with property overview and investment highlights, detailed fi nancial analysis, rent roll, lease notes, area overview, photographs, aerials, tenant profi les, site plan and a property improvements section. The focus of the Offering Memorandum is to provide an accurate assessment of the investment opportunity and compelling reasons to buy the property.

DATABASE – CBRE 360The CBRE LA Retail Team contributes to and has access to a nationwide database called CBRE 360, which contains over 120,000 active investors and 35,000 agents. Investor information is updated in real-time by investors and brokers searching for properties, and the 90 Investment Properties teams in over 50 markets around the country. The database allows investors and brokers to customize their investment criteria to receive information on properties that meet their specifi c needs.

EMAIL CAMPAIGN

An email blast with highlights on the investment opportunity, property overview, pictures of the property, and electronic link to the offering memorandum is mailed to all investors and brokers in CBRE 360 who have indicated an interest in the property type.

5

6

7

9

10

8

WEBSITE – pcgl is t ings.com, cbre.com/invlaretai l , loopnet .comThe property is placed on www.pcglistings.com, a CBRE proprietary listing service. Listing information on the website is maintained by CBRE professionals ensuring accurate and timely property information on over $4.0 billion in listing opportunities. The site is open to private and institutional investors, and brokers. Properties can be searched for by product type, deal size, and location. The website provides an overview of the property, pictures, and contact information. In order to download the offering memorandum, an investor or broker must register and sign a confi dentiality agreement online. In addition to www.pcglistings.com , the property is also placed on www.cbre.com/invlaretail (the CBRE LA Retail Team Web Page) and www.loopnet.com. Listings are periodically advertised in journals, newspapers, and magazines.

PROPERTY HOTSHEET

A monthly email is sent out to investors and brokers with acquisition needs matching the property specifi cs.

PERSONAL CONTACT AND FOLLOW-UP

Websites and emails are sophisticated tools which aid in fast and wide distribution of marketing material. But they are just tools. Obtaining the highest price and achieving certainty of close require interaction and personal attention from experienced brokers.

a. Senior team members contact known potential investors for the property when the deal is fi rst brought to the market.

b. A team member follow up with investors and brokers who have downloaded the offering memorandum and have expressed interest in the property; plus, investors known to have interest in acquiring retail properties.

DETAILED MARKET INFORMATION/PROPERTY TOURS

As part of our in depth offering, Senior Team Members and/or CBRE Local Market Experts will provide buyers with detailed market and tenant information as well as provide any necessary property tours - all tours are closely managed to ensure tenants are not disturbed in any capacity.

BROKER COOPERATION

The CBRE LA Retail Team encourages participation by all brokers and interested parties in the selling process. We actively cooperate with and reach out to outside brokers and other professionals in the commercial real estate industry who have access to potential investors, providing them with marketing materials and other pertinent deal information. This includes mortgage brokers, lenders, 1031 exchange accommodators, appraisers, attorneys, title representatives and escrow offi cers.

TRANSACTION MANAGEMENT AND DEAL CLOSING

In today’s uncertain capital markets environment, brokers must be experienced in all nuances of a real estate transaction in order to get the deal closed. The CBRE LA Retail Team has the proven experience and expertise to deal with all issues that arise during the escrow process. Finding the most qualifi ed buyer for a property raises the degree of certainty of closing. Pushing all participants to the ultimate goal of closing the deal, with a commitment to handling issues professionally and going the extra mile is the team’s methodology. Using a fi rm and professional manner with lenders, title and escrow offi cers, real estate attorneys, outside brokers, tenants, city offi cials, buyers and sellers, The CBRE LA Retail Team makes deals happen.

Knowledge – Integrity – Results

MARKET ING T IMEL INE

DISCOVERY & PRELIMINARY MARKETING

10 – 14 DAYS 21 – 40 DAYS 10 – 14 DAYS

Reduce buyer's due diligence & potential for retradeIbus dolora dolupta ectatiatur sinietur sima

Creates competitive environment/limits buyer contingencies

Maximize Value

MARKETING PROCESS INITIAL OFFERS BEST & FINAL

» Kickoff meeting

» Thorough property due diligence

» Detailed underwriting & evaluation

» Speculative physical due diligence (ALTA, structural & environmental)

» Announcement letter & email

» Set up weekly conference calls & marketing updates with client

» Distribute executive summary & confi dentiality agreements

» Broad based mass exposure to national & international investors

» Distribute comprehensive marketing package & Argus

» Continued discussion with buyers

» Create competitive environment

» Conduct property tours

» Team confi dentiality

» Collect initial offers

» Evaluate offers

» Distribution of due diligence materials

» Best & fi nal bid

» Buyer interviews

» Counter best & fi nal offers

1 2

3 4 5 6 7 8

9 10 11

11 12 13

12 13 14 15

16 17 18 19

(MONTH) (MONTH) (MONTH) (MONTH) (MONTH)

SELECT A BUYERINIT IAL OFFERS

HIGH STREET RETAIL

5 DAYS 21– 60 DAYS 15-30 DAYS

Seller controls terms of transaction Minimize seller's risk Successful transition to new ownership

CONTRACT BUYER'S DUE DILIGENCE/ LOAN ASSUMPTION (if necessary)

CLOSING PROCESS

» Modify seller's prepared purchase & sale agreement with buyers best & fi nal comments

» Open escrow upon delivery of contract & deposit

» Force signifi cant non-refundable deposit

» Overall property review including:– Title & survey– Zoning & city compliance– Environmental– Structural– Loan assumption assistance (if necessary)

» Coordinate transfer of funds & prorations

» Close of escrow

1 2

3 4 5 6 7 8

9 10 11

11 12 13

12 13 14 15

16 17 18 19

(MONTH) (MONTH) (MONTH) (MONTH) (MONTH)

SELECT A BUYER CLOSE OF ESCROWBUYER IS NON-REFUNDABLE

CA Net Leased PortfolioVarious, CA

Abbot Kinney PortfolioVenice, CA

Knowledge – Integrity – Results

VALUE PROPOS I T ION

With over 26 combined years of wide ranging retail real estate experience, the Los Angeles Retail Investment Team (Riley & Wolitarsky) draws upon extensive retail investment property knowledge to offer best in class real estate advisory services to clients ranging from private to institutional investors. We align our goals with our clients by listening, collaborating and executing with meticulous oversight from premarketing due diligence to successful close of escrow which has resulted in over $2 billion worth of closed transactions.

Courtyard at the CommonsCalabasas, CA

FASTER

Spee

d to

the

Mar

ket

» Asset to market in less than one week

» Multiple marketing efforts to local and out-of-state buyers

» Expeditious production of innovative marketing materials

» Create a managed bid process to maximize the seller’s proceeds, tighten due diligence timing and mitigate against any potential retrade

» Extensive exposure creates highest activity thus achieves the optimum value to the seller

» Unequaled access to “top tier” buyers

» Over 120,000 qualifi ed investors and over 35,000 agents in PCG’s shared national CBRE 360 database

» Premium LoopNet exposure

» 1031 exchange program

» Local, regional, and national promotions

FURTHER

Rea

ch t

o In

vest

ors

and

Brok

ers

HIG

HER

Valu

e an

d Pr

icin

g

Knowledge – Integrity – Results

COVERAGE

TRANSACTIONS

excludes 20 countries covered by affi liate offi cesexcludes 100 affi liate offi ces excludes approximately 4,325 affi liate employeesexcludes affi liate sales & leasing professionals; includes approximately 125 mortgage brokerage professionalsincludes 0.26 billion sq. ft. managed by affi liate offi ces

a.b.c.d.

e.

CBRE CORPORATE OVERV IEW

Corporate Locations

Affiliate Locations

2014 GLOBAL FOOTPRINT

includes loan sale advisoryincludes loans serviced by GEMSA, a joint venture between CBRE Capital Markets and GE Capital Real Estateincludes $0.9 billion of Long-Term Operating Assets (projects that have achieved a stabilized level of occupancy or have been held 18-24 months following shell completion or acquisition)includes $17.6 billion of projects that were in process as of December 31, 2014

f. g.

h.

i.

Countries a Offi ces b

SALES LEASING

Employees c

TOTAL TRANSACTION VALUE

ValueTransactions ValueTransactions$284.9B

37244 5 2 0 0,

3.7B SF 134,525$33.8B $144.7B $90.6B $5.4B $40.6B

20,975 $108.0B60,000$176.9B

Property &Corp Facilities

Managed e

Valuation & Advisory

Assignments

LoanOriginations f

LoanServicing g

InvestmentAssets UnderManagement

Developmentin Process h

ProjectManagement

Contract Value i

6,600 Sales & Leasing Professionals d

Only commercial real estate services fi rm included on the Forbes Global 2000 for third year in a row

Top real estate services company in “green” rankings

U.S. EPA 2014 ENERGY STAR for seven consecutive years

Named a World’s Most Ethical Company

Named to Honor Roll for seven consecutive years

All marks displayed on this document are the property of their respective owners.

Only commercial real estate services company in the Fortune 500

Highest ranked real estate services and investment company for four consecutive years

#1 brand for 13 consecutive years

#3 outsourcing company across all industries; #1 among real estate services fi rms for fi ve consecutive years

Global Real Estate Advisor of the Year two years in a row

Corporate Locations

Affiliate Locations

CORPORATE LOCATIONS

AFFILIATE LOCATIONS

GLOBAL RECOGNITION

©2015 CBRE, Inc. This information has been obtained from sources believed reliable. We have not verified it and make no guarantee, warranty or representation about it. Any projections, opinions, assumptions or estimates used are for example only and do not represent the current or future performance of the property. You and your advisors should conduct a careful, independent investigation of the property to determine to your satisfaction the suitability of the property for your needs. CBRE and the CBRE logo are service marks of CBRE, Inc. and/or its affiliated or related companies in the United States and other countries. All other marks displayed on this document are the property of their respective owners. Los Angeles Retail Team_v02HQ

DAN RILEYSenior Vice President Lic. 1057519+1 310 363 4899 [email protected]

For more information, please contact:

www.cbre.com/invlaretail

AUSTIN WOLITARSKYAssociateLic. 01957206+1 310 363 [email protected]

FRANK CASTANON Desktop Publisher / Researcher+1 818 907 4728 [email protected]