Investments Portfolio Theory - Perspective...Combine Risk-Free Asset and a Risky Asset Standard...

Transcript of Investments Portfolio Theory - Perspective...Combine Risk-Free Asset and a Risky Asset Standard...

Portfolio Theory Prof. Lalith Samarakoon

Opus College of Business, University of St. Thomas St. Paul, Minnesota

Investments

Risk Aversion

Portfolio theory assumes that investors are

averse to risk

Given a choice between two assets with

equal expected rates of return, risk averse

investors will select the asset with the lower

level of risk

It also means that a riskier investment has to

offer a higher expected return or else

nobody will buy it

2

Markowitz Portfolio Theory

Derives the expected rate of return for a

portfolio of assets and an expected risk

measure

Markowitz demonstrated that the variance of

the rate of return is a meaningful measure of

portfolio risk

The portfolio variance formula shows how to

effectively diversify a portfolio

3

Portfolio Expected Return

Weighted average of expected returns (Ri) for

the individual investments in the portfolio

Percentages invested in each asset (wi) serve

as the weights

n

1i

iiport RW)E(R

4

Portfolio Expected Return

5

Risk of an Asset

Standard deviation of returns: a average

measure of the variation of possible rates of

return Ri, from the expected rate of return

[E(Ri)]

6

n

i 1

2

ii 1)-(n/ )]E(R-R[

Relation between Returns of Two Assets

Covariance measures the extent to which two

variables move together

A positive relationship between two assets

gives a positive covariance

A negative relationship between two assets

gives a negative covariance

1-n

)E(RR)E(RR

Cov

n

1t

jjii

ij

7

Covariance

8

Correlation Coefficient

Correlation Coefficient measures the degree of

linear relationship between two variables

Covij= covariance of returns for securities i and j

i = standard deviation of returns for security i

j = standard deviation of returns for security j

ji

ij

ijσσ

Covr

jiijij σσrCov

9

Portfolio Standard Deviation

The portfolio standard deviation is a function

of: The variances of the individual assets that make up the

portfolio

The covariances between all of the assets in the portfolio

The larger the portfolio, the more the impact

of covariance and the lower the impact of the

individual security variances

10

Portfolio Standard Deviation

• For two assets, the equation can be written

as

211,221

2

2

2

2

2

1

2

1port σσrw2wσwσwσ

n

1i

n

1iijj

n

1ji

2

i

2

iportCovwwσwσ

11

Implications for Portfolio Formation

Combining assets that are not perfectly

positively correlated lowers the portfolio risk Negative correlation reduces portfolio risk greatly

Combining two assets with perfect negative correlation

reduces the portfolio standard deviation to nearly zero

As long as correlation is less than +1, combining assets

will reduce portfolio risk

12

Investment Opportunity Set

13

Investment Opportunity Set

14

Efficient

Portfolios

Inefficient

Portfolios

Standard Deviation of Return

E(R)

The Efficient Frontier

The set of portfolios with

the maximum rate of return for every given level

of risk or

the minimum risk for every level of return

Frontier will be portfolios of investments

rather than individual securities Exceptions being the asset with the highest return and the

asset with the lowest risk

15

The Efficient Frontier

16

Standard Deviation of Return

E(R)

Selecting an Optimal Portfolio

Any portfolio that plots “inside” the efficient

frontier is dominated by portfolios on the

efficient frontier

Would we expect all investors to choose the

same efficient portfolio? No, individual choices would depend on the level of risk

aversion

17

Capital Market Theory: An Overview

Capital market theory extends portfolio theory and seeks to

develop a model for pricing all risky assets based on their

relevant risks.

Capital asset pricing model (CAPM) allows for the

calculation of the required rate of return for any risky asset

based on the security’s beta.

18

Introduce the Risk-Free Asset

What is a risk-free asset?

An asset with zero standard deviation

Provides the risk-free rate of return

Intercept of the portfolio graph between expected return

and standard deviation

zero correlation with all other risky assets

19

Relation between Risk-Free and Risky Asset

Covariance between the risk-free asset (RF) and a risky asset

(j):

Because the returns for the risk free asset are certain, RRF =

E(RRF), and RRF - E(RRF) = 0, which means that the covariance

between the risk-free asset and any risky asset or portfolio will

always be zero.

Similarly, the correlation between any risky asset and the risk-

free asset will be zero too since rRF,j= CovRF, j /σRFσj

)1)]/(nE(R-)][RE(R-[RCovn

1i

jjRFRFjRF,

20

Combine Risk-Free Asset and a Risky Asset

Combine a risk-free asset (RF) with a risky portfolio, M

Expected return: weighted average of the two returns

))E(RW(1-(RFR)W)E(R MRFRFport

MRF w )w(1 where,

21

Combine Risk-Free Asset and a Risky Asset

Standard deviation: Applying the two-asset standard deviation

formula, we have

Since σRF =0, σport =(1-WRF) σM

Standard deviation of a portfolio that combines the risk-free

asset with the risky market portfolio is the proportion invested

in the market portfolio times the risk of the market portfolio.

MRFM RF,RFRF

2

M

2

RF

2

RF

2

RF

2

port σσ)rw-(12wσ)w(1σwσ

22

Risk and Returns of a Combined Portfolio

23

An investor wishes to construct a portfolio consisting of a

70% allocation to a stock index and a 30% allocation to a

risk free asset. The return on the risk-free asset is 4.5% and

the expected return on the stock index is 12%. The standard

deviation of returns on the stock index 6%. Calculate the

expected return and the risk of the portfolio.

24

With these results, we can develop the risk–return relationship between E(Rport) and σport

This relationship holds for every combination of the risk-free

asset with any collection of risky assets.

However, when the risky portfolio, M, is the market

portfolio containing all risky assets held anywhere in the

marketplace, this linear relationship is called the Capital

Market Line (Exhibit 8.1)

]σ

RFR)E(R[σRFR)E(R

M

Mportport

The Capital Market Line (CML)

Exhibit 8.1

25

The Market Portfolio

The Market Portfolio (M)

Lies at the point of tangency

Everybody will want to invest in Portfolio M and borrow or lend to be somewhere on the CML

Includes ALL RISKY ASSETS

Since the market is in equilibrium, all assets in this portfolio are in proportion to their market values

Because it contains all risky assets, it is a completely

diversified portfolio, which means that all the unique risk

of individual assets (unsystematic risk) is diversified

away

26

Risk-Return Possibilities with Leverage

One can attain a higher expected return than is available at point M

One can invest along the efficient frontier beyond point M, such as point D

With the risk-free asset, one can add leverage to the portfolio by borrowing money at the risk-free rate and investing in the risky portfolio at point M to achieve a point like E

Clearly, point E dominates point D

Similarly, one can reduce the investment risk by lending money at the risk-free asset to reach points like C (see Exhibit 8.2)

Risk and Returns with Leverage

27

Exhibit 8.2

8-

28

Risk Aversion and Portfolio Selection

• Greater levels of risk aversion lead to larger proportions of the

risk free rate

• Risk averse investors will lend part of the portfolio at the

risk-free rate and invest the remainder in the market

portfolio (points left of M)

• Lower levels of risk aversion lead to larger proportions of the

portfolio in the risky portfolio

• Aggressive investors would borrow funds at the RFR and

invest everything in the market portfolio (points to the right

of M)

29

Separation Theorem

The CML leads all investors to invest in the M portfolio

Individual investors should differ in position on the CML

depending on risk preferences

How an investor gets to a point on the CML is based on

financing decisions

Risk averse investors will lend at the risk-free rate while

investors preferring more risk might borrow funds at the RFR

and invest in the market portfolio

The investment decision of choosing the point on CML is

separate from the financing decision of reaching there through

either lending or borrowing

30

Example of a Lending Portfolio

31

Expected return on the market portfolio is 15%. Risk of the

market portfolio is 22%. Expected return on the risk-free

asset is 4%. Proportion invested in risk-free asset is 25%.

Calculate the expected return and the risk of the combined

portfolio.

Example of a Borrowing Portfolio

32

Expected return on the market portfolio is 15%. Risk of the

market portfolio is 22%. Expected return on the risk-free

asset is 4%. Borrow 50% and invest 150% in M. Calculate

the expected return and the risk of the combined portfolio.

Components of Risk of an Asset

Total risk = Systematic risk + Unsystematic risk

Systematic risk (Market risk)

Variability in all risky assets caused by common factors

Common factors include macro factors such as economic

growth, inflation, interest rates, exchange rates etc.

Risk that cannot be eliminated.

33

Components of Risk of an Asset

Unsystematic risk (Unique risk)

Variability due to factors unique to a given firm.

Examples include strikes, production problems,

lawsuits, loss of major contracts / orders, management

changes etc.

Risk that can be eliminated (diversified away).

34

Exhibit 8.3

35

The Capital Asset Pricing Model

The existence of a risk-free asset resulted in deriving a

capital market line (CML).

However, CML cannot be used to measure the expected

return on an individual asset or portfolio.

For an individual asset, the relevant risk measure is the

asset’s systematic risk.

The systematic risk is measured beta which is equal to the

covariance of the asset with the market portfolio divided by

the variance of the market portfolio.

M

iiM

2

M

MiiMi

σ

σr

σ

σσrβ

36

The CAPM Equation

RFR)-(RβRFR)E(R Mii

E(Ri) = Required return on security i

RFR = Risk-free rate

ßi = Beta of security i

RM = Return on the market portfolio

37

Exhibit 8.5

The SML is a graphical representation of the CAPM

38

CAPM Application

Risk-free rate is 5% and the market return is 9%. Calculate

the required return for each stock.

Stock A B C D E

Beta 0.70 1.00 1.15 1.40 -0.30

39

Value of an Asset and the CAPM

In equilibrium, all assets and all portfolios of assets should

provide the required return as per CAPM.

Any security with an estimated return more than the required

return is underpriced.

Any security with an estimated return less than the required

return is overpriced.

40

Valuation Application

41

Given the following estimated returns, which stocks are

undervalued?

Stock A B C D E

Estimated return 8.0% 6.2% 15.2% 5.2% 6.0%

Alpha is the difference between the estimated return and the

required return

Positive α :

Estimated return > Required return

Negative α :

Estimated return < Required return

Security’s Alpha

42

Alpha Calculation

43

Given the following previous required and estimated

returns, determine the alpha of each stock.

Exhibit 8.8

44

45

The formula

The characteristic line

• A regression line between the returns to the security (Rit)

over time and the returns (RMt) to the market portfolio

• The slope of the regression line is beta

• See Exhibit 8.10

M

iiM

2

M

MiiMi

σ

σr

σ

σσrβ

εRβαR tM,iiti,

Calculating Beta

Beta Calculation

The standard deviation of stocks A and the market portfolio

are 20% and 28%. The correlation of returns between stock

A and the market 0.8. What is the beta of stock A?

The Covariance between stocks A and the market portfolio is

448. The standard deviation of returns of stocks A and the

market are 20% and 28%. What is the beta of stock A?

46

Exhibit 8.10

47

CAPM Application

You expect the risk-free rate (RFR) to be 3 percent and the market return

to be 8 percent. You also have the following information about three

stocks.

What are the expected (required) rates of return for the three stocks (in the

order X, Y, Z)?

What are the estimated rates of return for the three stocks (in the order X, Y,

Z)?

What the alpha for each stock?

What is your investment strategy concerning the three stocks?

48

CURRENT EXPECTED EXPECTED

STOCK BETA PRICE PRICE DIVIDEND

X 1.25 $20 $23 $1.25

Y 1.50 $27 $29 $0.25

Z 0.90 $35 $38 $1.00

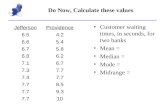

Beta Calculation

Compute the beta for RA Computers using (a) the equation

for beta and (b) using the regression method.

49

Rates of Return %

Year RA Computers Market Index

1 13 17

2 9 15

3 11 6

4 10 8

5 11 10

6 6 12