Investment under uncertainty, competition and regulation

Transcript of Investment under uncertainty, competition and regulation

-

7/29/2019 Investment under uncertainty, competition and regulation

1/26

Investment under uncertainty, competition and regulation

Adrien Nguyen Huu1

McMaster University, Hamilton, Canada

Fields Institute for Research in Mathematical Sciences, 222 College Street, Toronto,

Canada

Abstract

We investigate a randomization procedure undertaken in real option games

which can serve as a raw model of regulation in a duopoly model of preemp-tive investment. We recall the rigorous framework of Grasselli and al. [7]and extend it to a random regulator. This model generalizes and unifies thedifferent competitive frameworks proposed in the literature, and creates anew one similar to a Stackelberg leadership. We fully characterize strategicinteractions in the several situations following from the parametrization ofthe regulator. Finally, we study the effect of the coordination game and un-certainty of outcome when agents are risk-averse, providing new intuitionsfor the standard case.

Keywords: real option game, preemption game, timing game, regulation,asymmetry, Stackelberg competition, Cournot competition

1. Introduction

A significant progress on the net present valuation method has been madeby real option theory for new investment valuation. The latter uses recentmethods from stochastic finance to price uncertainty and competition incomplex investment situations. Real option games are the part of this theorydedicated to the competitive dimension. They correspond to an extensivelystudied situation, where two or more economical agents face with time acommon project to invest into, and where there might be an advantage ofbeing a leader (preemptive game) or a follower (attrition game). On theseproblems and the related literature, Azevedo and Paxson [1] or Chevalier-Roignant and al. [5] provide comprehensive broad scopes. Real option

1corresponding email: [email protected]

Preprint submitted to a journal September 10, 2013

arXiv:1309.18

44v1[q-fin.PM]7Sep2013

-

7/29/2019 Investment under uncertainty, competition and regulation

2/26

games are especially dedicated to new investment opportunities following

R&D developments, like technological products, a new drug or even realestate projects. The regulatory dimension is an important part of suchinvestment projects, and the present paper attempts to contribute in thisdirection.

The economical situation can be the following. We consider an invest-ment opportunity on a new market for an homogeneous good, available fortwo agents labeled one and two. This investment opportunity is not con-strained in time, but the corresponding market is regulated by a supremeinstance. Both agents have the same model for the projects incomes, andboth have also access to a financial market with one risky asset and a risk-free asset, i.e., a bank account.

A simple approach to regulation is to consider that when an agent wantsto take advantage of such an opportunity, he must validate some non-financial criteria which are scrutinized by the regulator. Even though amodel of regulatory decision is at the heart of this matter, we will take themost simple and naive approach. We will just assume that the regulatorcan accept or refuse an agent to proceed into the investment project, andthat this decision is taken randomly. This extremely simple model finds itsroot in a widespread convenient assumption. In the standard real optiongame representing a Stackelberg duopoly, the settlement of leadership andfollowership is decided via the flipping of an even coin, independent of themodel. The procedure is used for example in Weeds [15], Tsekeros [12] orPaxson and Pinto [10] who all refer to Grenadier [8] for the justification,

which appears in a footnote for a real estate investment project:

A potential rationale for this assumption is that developmentrequires approval from the local government. Approval may de-pend on who is first in line or arbitrary considerations.

This justification opens the door to many alterations of the assumptioninspired from other similar economical situations.

Let us take a brief moment to describe one of those we have in mind.Assume that two economical agents are running for the investment in aproject with possibility of simultaneous investment, as in Grasselli and al.[7]. In practice, even if they are accurately described as symmetrical, they

would never act at the exact same time, providing that instantaneous actionin a continuous time model is just an idealized situation. Instead, they showtheir intention to invest to a third party (a regulator, a public institution) atapproximatively the same time. An answer to a call for tenders is a typicalexample of such interactions. Assume now that this arbitrator decides at last

2

-

7/29/2019 Investment under uncertainty, competition and regulation

3/26

on how to proceed and has some flexibility in his judgment. For example,

he can evaluate whose agent is the most suitable to be granted the projectas a leader regarding qualitative criteria. This situation might be illustratedin particular where numerous environmental or health exigences are in line.When simultaneous investment is impossible, the real estate market exampleof Grenadier [8] can also be cited again with in mind that safety constraints,but also aesthetic or confidence dimension, can intervene in the decision ofa market regulator. We emphasize here that the arbitrator is not explicitlyunfair, but that exogenous criteria might influence his decision. There is anasymmetry in the chance to be elected as a leader and perfectly informedagents should take into account this fact into their decision to invest orto differ. Those are some of the situations the introduction of a random

regulator can shed some light on.The naive approach we follow is also inspired from Fudenberg and Ti-role [6], Thijssen and al. [14] and Grasselli and al. [7] for providing rigorousmathematical grounds to real option game models. Our present model ap-pears to encompass in a continuous manner the Cournot competition settingof Grasselli and al. [11] and the Stackelberg competition of Grenadier [8].Other competitive situations are of course possible. As yet another study onthe standard real option game setting, we additionally provide new insightson the strategic interactions of players when they are risk-averse. Againstthe existing literature, the present contribution situates itself as a mathe-matically rigorous framework for the general duopoly game, and can thusbe seen as an addendum to Grasselli and al. [7].

Let us present how the remaining of the paper proceeds. Section 2 in-troduces the standard model and its extension to the random regulatoryframework. Section 3 provides the study of the model and optimal strate-gies in the general case. In Section 4, we present how the proposed modelencompasses the usual types of competition, and propose a new asymmet-rical situation related to the Stackelberg competition framework. Section 5introduces risk-aversion in agents evaluation to study the effect of a randomregulator and the uncertain outcome of a coordination game on equilibriumstrategies of two opponents.

2. The model

2.1. The investment opportunity

We assume for the moment that the regulator does not intervene. Theframework is thus the standard one that one shall find in Grasselli and al.[7]. Notations and results of this section follow from the latter.

3

-

7/29/2019 Investment under uncertainty, competition and regulation

4/26

We consider a stochastic basis (, F,F,P) where F := (Ft)t0 is the fil-

tration of a one-dimensional Brownian motion (Wt)t0, i.e., Ft := {Ws, 0 s t}. The project delivers for each involved agent a random continuousstream of cash-flows (DQ(t)Yt)t0. Here, Yt is the stochastic profit per unitsold and DQ(t) is the quantity of sold units per agent actively involved onthe market, when Q(t) agents are actively participating at time t. The incre-ments of (Q(t))t0 inform on the timing decision of agents, and consideringa perfect information setting, we assume that (Q(t))t0 is a F-adapted right-continuous process. It is natural to assume that being alone in the marketis better than sharing it with a competitor:

0 =: D0 < D2 < D1 , (1)

but we also assume these quantities to be known and constant. The process(Yt)t0 is F-adapted, non negative and continuous with dynamics given by

dYt = Yt(dt + dWt), t 0 , (2)

with (, ) R(0, +). We assume that cash-flows are perfectly correlatedto a liquid traded asset whose price dynamics is given by

dPt = Pt(dt + dWt) = Pt(rdt + dWQt ) (3)

where (, ) R (0, +), r is the constant interest rate of the risk-freebank account available for both agents, and WQt = Wt + t is a Brownianmotion under the unique risk-neutral measure Q P of the arbitrage-freemarket. The variable := ( r)/ in (3) is the Sharpe ratio. The presentfinancial setting is thus the standard Black-Scholes-Merton model [2] of acomplete perfect financial market.

2.2. The followers problem

In this setting, since DQ(t) takes known values, the future stream ofcash-flows can be evaluated under the risk-neutral measure under which

dYt = Yt(( )dt + dWQ) . (4)

Assume that one of the two agents, say agent one, desires to invest at time

t when Yt = y. If Q(t) = 1, then the available market for agent one is D2.The risk-neutral expectation of the projects discounted cash flows are thengiven by

VF(t, y) := EQ

ter(st)D2Ysds

=

D2y

( r)=

D2y

(5)

4

-

7/29/2019 Investment under uncertainty, competition and regulation

5/26

with := ( r). We assume from now on > 0. Now to price the

investment option of a follower, we recall that agent one can wait to investas long as he wants. We also recall the sunk cost K at time he invests. Inthe financial literature, this is interpreted as a Russian call option of payoff(D2Y/ K)

+. The value function of this option is given by

F(t, y) := supTt

EQ

er(t)

D2Y

K

+1{ YF,

(7)

with a threshold YF given by

YF :=K

D2( 1)(8)

and

:=

12

r 2

+

12

r 2

2+ 2r

2> 1. (9)

The behavior of the follower is thus quite explicit. He will differ invest-ment until the demand reaches at least the level YF = /( 1)K > Kwhich depends on the profitability of the investment opportunity, the latterbeing conditioned by > 0. We thus introduce

F := (YF) = inf{t 0 : Yt YF} . (10)

2.3. The leaders problem

Assume now that instead of having Q(t) = 1 we have Q(t) = 0. Agent

one investing at time t will receive a stream of cash-flows associated to thelevel D1 for some time, but he expects agent two to enter the market whenthe threshold YF is triggered. After the moment F, both agents sharethe market and agent one receives cash-flows determined by level D2. Theproject value is thus

5

-

7/29/2019 Investment under uncertainty, competition and regulation

6/26

VL(t, y) := EQ

ter(st)(D11{s

-

7/29/2019 Investment under uncertainty, competition and regulation

7/26

Definition 2.1. Fix t and Yt = y. For i = 1, 2, if j = 3 i is the index of

the opponent and j his time of investment, then agent i desiring to investat time t receives

Ri(t, y) :=

0 if = 0L(y)1{tj} + F(y)1{t>j} if = iF(y)1{t=j} if = jL(y)1{tj} if = S

. (13)

Let us discuss briefly this representation. According to (13), agent iis accepted if alternative i or S is picked up, and denied if 0 or j ispicked up. It is therefore implicit in the model that time does not affect theregulators decision upon acceptability. However Q(t) affects the position of

leader or follower. Probability P+

can thus be given by PA, and probabilityA given by the quartet {q0, q1, q2, qS}. However, as we will see shortly, thealternative 0 is irrelevant in continuous time. We assume q0 < 1. Since forthe unregulated model we assumed that agents are symmetrical, the generalstudy of the regulators parameters given by A will be chosen without lossof generality such that q1 q2.

An additional major change comes into the evaluation of payoffs. Agentsinformation is reduced to F, and therefore the final settlement is not evalu-able as in the complete market setting. We therefore make the assumptionthat agents are risk-neutral, i.e., they evaluate the payoffs by taking theexpectation of previously computed values under A.

Remark 2.2. Expectations of (13) are made under the minimal entropymartingale measure QA for this problem, meaning that uncertainty of themodel follows a semi-complete market hypothesis: if we reduce uncertaintyto the market informationF, then the market is complete. See Becherer [4]for details.

Once the outcome of is settled, the payoff then depends on Q(t), i.e.,j. We thus focus now on strategic interactions that determine Q(t).

2.5. Timing strategies

It has been observed since Fudenberg & Tirole [6] that real time t 0is not sufficient to describe strategic possibilities of opponents in a coordi-

nation game. If Q(t) = 0 and agents coordinate by deciding to invest withprobabilities pi (0, 1) for i = 1, 2, then a one-round game at time t impliesa probability (1 p1)(1 p2) to exit without at least one investor. However,another coordination situation appears for the instant just after and thegame shall be repeated with the same parameters.

7

-

7/29/2019 Investment under uncertainty, competition and regulation

8/26

The problem has been settled by Fudenberg & Tirole [6] in the determin-

istic case, and recently by Thijssen and al. [14] for the stochastic setting.We extend it to the existence of the regulator who adds a step into thegame. It consists in extending time t R+ to (t ,k,l) R+ N N. Thefiltration F is augmented via Ft,i,j = Ft,k,l Ft,i,j for any t < t

and any(i, j) = (k, l), and the state process is extended to Y(t,k,l) := Yt. Therefore,when both agents desire to invest at the same time t, we extend the timeline by freezing real time t and indefinitely repeating a game on natural timek. Once the issue of the game is settled, the regulator intervenes on naturaltime l = 1. If no participant is accepted, the game is replayed for l = 2, andso on.

Definition 2.2. A strategy for agent i {1, 2} is defined as a pair of F-

adapted processes (Gi(t,k,l), pi(t,k,l)) taking values in [0, 1]2 such that

(i) The processGi(t,k,l) is of the type Gi(t,k,l)(Yt) = G

it(Yt) = 1{t(y)} with

(y) := inf{t 0 : Yt y}.

(ii) The processpi(t ,k,l) is of the type pi(t ,k,l) = pi(t) = pi(Yt).

The reduced set of strategies is motivated by several facts. Since theprocess Y is Markov, we can focus without loss of generality on Markov sub-game perfect equilibrium strategies. The process Gi(t,k) is a non-decreasingcadlag process, and refers to the cumulative probability of agent i exercisingbefore t. Its use is kept when agent i does not exercise immediately theoption to invest, and when exercise depends on a specific stopping time ofthe form (Y), such as the follower strategy. The process pi(t,k,l) denotes theprobability of exercising in a coordinate game at round k, after l 1 denialsof the regulator, when = 0. It should be stationary and not depend onthe previous rounds of the game since no additional information is given.For both processes, the information is given by F and thus reduces to Yt attime t. Additional details can be found in Thijssen and al. [14].

3. Optimal behavior and Nash equilibria

3.1. Conditions for a coordination game

A first statement about payoffs can be immediately provided. A formalproof can be found in Grasselli and al. [7].

8

-

7/29/2019 Investment under uncertainty, competition and regulation

9/26

Proposition 3.1 (Prop. 1, [9]). There exists a unique point YL (0, YF)

such that

S(y) < L(y) < F(y) for y < YL,S(y) < L(y) = F(y) for y = YL,S(y) < F(y) < L(y) for YL < y < YF,S(y) = F(y) = L(y) for y YF .

(14)

Fix t and Yt = y. In the deregulated situation, three different cases arethus possible, depending on the three intervals given by 0 < YL < YF < +.It appears that in our framework, the discrimination also applies.

Consider the following situation. Assume Q(t) = 0 and t = 1 < 2:agent one wants to start investing in the project as a leader and agent twoallows it, i.e., (p1(t), p2(t)) = (1, 0). By looking at (13), agent one receives

L(y) with probability q1 + qS and 0 with probability q2 + q0. However,as noticed for the coordination game, if agent one is denied investment at(t, 1, 1), he can try at (t, 1, 2) and so on until he obtains L(y).

The situation is identical if 2 < 1. Our setting is then limited bythe continuous time approach and Proposition 3.1 applies as well as in thestandard case.

Corollary 3.1. Lett 0 and y > 0. Then for i = 1, 2

(d) if y < YL, agent i differs action until (YL);

(e) if y > YF, agent i exercises immediately, i.e., i = t.

Proof. (d) According to (14), if1 = 2, expected payoffs given to (13) verify

(qS + qi)L(y) < (qS + qi)F(y) and there is no incentive to act for agent i,i = 1, 2.

(e) Since S(y) = F(y) = L(y) and F = t, agents act with probability(p1(t), p2(t)) = (1, 1). Since q0 < 1, they submit their request as much asneeded and receive S(y) with probability (1 q0)

lN q

l0 = 1.

Corollary 3.1 does not describe which action is undertaken at (YL) orif y = YF. We are thus left to study the case where YL y YF. Thisis done by considering a coordination game. Following the reasoning of theabove proof, definition (13) allows to give the payoffs of the game. Let usdefine

(S1, S2) := 1

1 q0 (q1L + q2S+ qSS),

1

1 q0 (q2L + q1F + qSS)

. (15)

Proposition 3.2. For any q0 < 1, agents play the coordination game givenby Table 1 if YL < y < YF. Consequently, we can assume q0 = 0 withoutloss of generality.

9

-

7/29/2019 Investment under uncertainty, competition and regulation

10/26

Exercise Differ

Exercise (S1(y), S2(y)) (L(y), F(y))Differ (F(y), L(y)) Repeat

Table 1: Coordination game at t for = 0.

Proof. If = 0 after settlement at round k of the game, time goes from(t ,k,l) to (t, 1, l + 1) and the game is repeated. Therefore, according to(13), the game takes the form of Table 1 for a fixed l and is settled withprobability 1 q0, or canceled and repeated with probability q0. If (p1, p2) isa given strategy for the game at t and (E1(p1, p2), E2(p1, p2)) the consequentexpected payoff for agents one and two in the game of Table 1, then the totalexpected payoff for agent i at time t is

Ei(p1, p2)(1 q0)lN

ql0 = Ei(p1, p2) . (16)

The game is thus not affected by q0 < 1, which reduces the game to oneintervention of the regulator, i.e. l 1.

When 1 = 2, the probability that the regulator accepts agent i demandfor investment goes from qi + qS to (qi + qS)/(qi + qj + qS) with j = 3 i.We can thus settle q0 = 0 in full generality.

As for a single investor, continuous time implies strong limitations tothe issues of the game. The confrontation has three outcomes and the exit

of the repeated game without the investment of at least one player is notpermitted. It also implies that we can reduce the regulator intervention tothe only case of simultaneous investment. From now on q0 = 0. Lets turnto the solution to Table 1.

3.2. Solution in the regular case

We reduce the analysis here to the case where 0 < q2 q1 < 1 q2. Wecan now assume that

max(p1, p2) > 0 . (17)

We now introduce p0(y) := (L(y) F(y))/(L(y) S(y)) and two functions

Pi(y) :=p0(y)

qip0(y) + qS =L(y) F(y)

L(y) Sj(y) , i = j {1, 2}2 . (18)

The values ofPi strongly discriminates the issue of the game. Since q1 q2,if YL y YF, then S1(y) S2(y) according to (14) on that interval andP2(y) P1(y).

10

-

7/29/2019 Investment under uncertainty, competition and regulation

11/26

Lemma 3.1. The functions P2 and P1 are increasing on [YL, YF].

Proof. By taking d1(y) := L(y) F(y) and d2(y) := S(y) F(y), we get

Pi(y) =1

qi

d1(y)

d1(y) + i(d1(y) d2(y))

and

Pi (y) =1

qi

i(d1(y)d

2(y) d2(y)d

1(y))

(d1(y) + i(d1(y) d2(y)))2

where i := qS/qi 1 with i {1, 2}. We are thus interested in the sign ofthe quantity g(y) := d1(y)d

2(y) d2(y)d

1(y) which quickly leads to

g(y)

yD2=

y

YF

1

(D1 D2)(+

1

2

K

D2)

+

K

D2(D1 D2) .

Since > 1, (y/YF)1 is increasing in y. Since 0 < y YF, it suffices to

verify that (K)/D2 (+ 1/ 2 (K)/D2), which is naturally the casefor any , to obtain that g is non-negative on the interval.

We will omit for now the symmetric case and assume P1(y) < P2(y)for YL < y < Y F. Recall now that qi > 0 for i = 1, 2. Then Pi(YF) =1/(qi + qS) > 1 for i = 1, 2. Accordingly and by Lemma 3.1, there existsYL < Y1 < Y2 < YF such that

F(Y1) = q1L(Y1) + q2F(Y1) + qSS(Y1) = S1(Y1) ,F(Y2) = q2L(Y2) + q1F(Y2) + qSS(Y2) = S2(Y2) . (19)

Proposition 3.3. Assume YL < y < YF. Then solutions of Table 1 are ofthree types:

(a) If YL < y < Y1 the game has three Nash Equilibria given by two purestrategies (1, 0) and (1, 0), and one mixed strategy (P1(y), P2(y)).

(b) IfY1 1 < Y2, the game has one Nash Equilibrium given by strategies(1, 0).

(c) IfY2 y < YF, the game has one Nash Equilibrium given by strategies(1, 1).

Proof. For YL < y < Y1, we have P1 < P2 < 1. Fix an arbitrary constantstrategy (p1, p2) [0, 1]2. Considering the A-expected payoffs, agent onereceives L(y) at the end of the game with a probability

a1 := p1kN

(1 p1)k1(1 p2)

k =p1(1 p2)

p1 + p2 p1p2. (20)

11

-

7/29/2019 Investment under uncertainty, competition and regulation

12/26

Symmetrically, he receives F(y), and agent two receives L(y) with probabil-

itya2 :=

p2(1 p1)

p1 + p2 p1p2, (21)

and they receives (S1(y), S2(y)) with probability

aS :=p1p2

p1 + p2 p1p2. (22)

The expected payoff of the game for agent one is given by

E1(p1, p2) := a1L(y) + a2F(y) + aSS1(y)= (a1 + aSq1)L(y) + (a2 + aSq2)F(y) + aSqSS(y) .

(23)

A similar expression E2 is given for agent two. Now fix p2. Since E1 is acontinuous function of both variables, maximum of (23) depends on

E1p1

(p1, p2) =p2(L(y) F(y) + p

22(S1(y) L(y))

(p1(1 p2) + p2)2. (24)

One can then see that the sign of (24) is the sign of (p2 P2). A similardiscrimination for agent two implies P1.

(a) If YL < y < Y1, then according to (18) and (19), Pi < 1 for i = 1, 2.Three situations emerge:

(i) If p2 > P2, the optimal p1 is 0. Then by (24), E2 should not depend

on p2, and the situation is stable for any pair (0 , p2) with p2 in (P2, 1].(ii) Ifp2 = P2, E1 is constant and p1 can take any value. If p1 < P1, then

by symmetry p2 should take value 1, leading to case (i). If p1 = P1,E2 is constant and either p2 = P2, or we fall in case (i) or (iii). Theonly possible equilibrium is thus (P1, P2).

(iii) If p2 < P2, E1 is increasing with p1 and agent one shall play withprobability p1 = 1 > P1. Therefore p2 optimizes E2 when being 0, andE1 becomes independent of p1. Altogether, situation stays unchangedif p1 (P1, 1] or if p1 = 0. Otherwise, if p1 P1, we fall back intocases (i) or (ii). The equilibria here are (p1, 0) with p1 (P1, 1], andthe trivial case (0, 0).

Recalling constraint (17), we get rid of case (0, 0). Coming back to the issueof the game when k goes to infinity in (t,k, 1), three situations emerge fromthe above calculation. Two of them are pure coordinated equilibriums, of thetype (a1, a2) = (1, 0) or (0, 1), which can be produced by pure coordinated

12

-

7/29/2019 Investment under uncertainty, competition and regulation

13/26

strategies (p1, p2) = (a1, a2), settling the game in only one round. The third

one is a mixed equilibrium given by (p1, p2) := (P1, P2).(b) According to (19), S1(Y1) = F(Y1). Following Lemma 3.1, agent one

prefers being a leader for y Y1 and prefers a regulator intervention ratherthan the follower position, i.e. S1(y) F(y). Thus p1 = 1. For agent two,differing means receiving F(y) > F(Y1) and exercising implies a regulationintervention. Since y < Y2, q1F(y) + q2L(y) + qSS(y) < F(y) and differingis his best option: p2 = 0. That means that on (Y1, Y2), the equilibriumstrategy is (p1, p2) = (1, 0).

(c) On the interval [Y2, YF), the reasoning of (b) still applies for agentone by monotony, and p1 = 1. The second agent can finally bear the sameuncertainty ify Y2, and p2 = 1. Here, 1 P1(y) P2(y) and both agents

have greater expected payoff by letting the regulator intervene rather thanbeing follower. Equilibrium exists when both agents exercise.

Two reasons force us to prefer the strategy (P1, P2) on (1, 0) and (0, 1) incase (a). First, it is the only one which extends naturally the symmetric case.Second, it is the only trembling-hand equilibrium. Considering (P1, P2) inthe interval (a), (a1, a2, aS) follows according to (20), (21) and (22),

(a1, a2, aS) =

1 p02 p0

,1 p02 p0

,p0

2 p0

, (25)

If we plug (25) into (23), we obtain that the payoff of respective agents donot depend on (q1, q2, qS):

E1(P1, P2) = E2(P1, P2) =1 p02 p0

(L(y) + F(y)) +a0

2 p0S(y) . (26)

In the case qS > 0, they are equal to F. This recalls the rent equalizationprinciple of Fudenberg and Tirole [6]: in the preemption situation, agents areindifferent between playing the game and being the follower. In addition,asymmetry q1 q2 does not affect the payoffs and the final outcome ofthe game after decision of the regulator has the same probability as in thederegulated situation, see Grasselli and al. [7].

3.2.1. Endpoints and overall strategy

We have to study junctures of areas (d) and (a), and (c) and (e). Thetechnical issue has been settled in Thijssen and al. [14].

Lemma 3.2. Assume y = YL. Then both agents have a probability 1/2 tobe leader or follower, and receive L(YL) = F(YL).

13

-

7/29/2019 Investment under uncertainty, competition and regulation

14/26

0

0.2

0.4

0.6

0.8

1

0.4 0.6 0.8 1 1.2 1.4 1.6 1.8

(a) (b) (c)

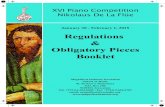

Figure 1: Values of equilibrium mixed strategies p1(y) (blue) and p2(y) (red) in the asym-metrical case (q1, q2, qS) = (0.5, 0.2, 0.3). Areas (a), (b) and (c) are separated by verticallines at Y1 = 0.53 and Y2 = 0.72 on [YL, YF] = [0.37, 1.83]. Area (d) is then at the left ofthe graph and (e) at the right of it. Note that p1 and p2 are right-continuous. Parametersset at (K,,,,,r,D1, D2) = (10, 0.01, 0.2, 0.04, 0.3, 0.03, 1, 0.35).

Proof. The juncture of [0, YL) with [YL, Y1] is a delicate point. At the left ofpoint YL, no agent wants to invest. We thus shall use the strategy Gi(YL) forboth agents. By right-continuity of this process, both agents shall exercisewith probability 1 at point YL. Each agent receives Ri(y) which takes valueL(y) = F(y) with probability q1 + q2 and S(y) with probability qS:

E1(y) = E2(y) = (q1 + q2)F(y) + qSS(y) . (27)

At the right side of point YL however, Pi converges to 0 when y converges toYL, for i = 1, 2. Therefore, so do (p1, p2) toward (0, 0). We cannot reconcileGi(YL)(YL) with (p1(YL), p2(YL)) = (0, 0) and shall compare the payoffs. Ashort calculation provides

limyYL

a1(y)

a2(y)= 1 and lim

yYLas(y) = 0 . (28)

Therefore at point YL, (a1(YL), a2(YL), aS(YL)) = (1/2, 1/2, 0). It is clear atpoint YL that the second option is better for both agents.

14

-

7/29/2019 Investment under uncertainty, competition and regulation

15/26

Remark 3.1. There is a continuity of behavior between (d) and (a) from the

fact that regulatory intervention does not impact the outcome of the game,from the point of view of discrimination between the two agents: simultane-ous investment is improbable at pointYL, and probabilityaS(y) is continuousand null at this point. Consequently, the local behavior of agents around YLis similar to the one given in Grasselli and al. [7].

Let us complete the strategic interaction of the two agents by summa-rizing the previous results in the following Theorem. As we will see in thenext section for singular cases, it extends Theorem 4 in [7].

Theorem 3.1. Consider the strategic economical situation presented in Sec-tion 2, with

min{q1, q2, qS} > 0 and q0 = 0 . (29)Then there exists a Markov sub-game perfect equilibrium with strategies de-pending on the level of profits as follows:

(i) If y < YL, both agents wait for the profit level to rise and reach YL.

(ii) At y = YL, there is no simultaneous exercise and each agent has anequal probability of emerging as a leader while the other becomes afollower and waits until the profit level reaches YF.

(iii) If YL < y < Y 1, each agent choses a mixed strategy consisting ofexercising the option to invest with probability Pi(y). Their expectedpayoffs are equal, and the regulator intervenes on the settlement ofpositions.

(iv) If Y1 y < Y2, agent one exercises his option and agent two becomesa follower and waits until y reaches YF.

(v) IfY2 y < YF, both agents express their desire to invest immediately,and the regulator is called. If one agent is elected leader, the other onebecomes follower and waits until y reaches YF.

(vi) If YF y, both agents act as in (v), but if a follower emerges, heinvest immediately after the other agent.

Few comments are in order. First, we shall emphasize that the regula-tor theoretically intervenes for any situation where y YL. However, asexplained at the beginning of this section, its intervention becomes mostly

irrelevant in continuous time when agents dont act simultaneously. Its im-pact is unavoidable to settle the final payoff after the game, but its influenceon agents strategies boils down to the interval (YL, Y2].

At point Y1, there is a strong discontinuity in the optimal behavior ofboth agents. For y < Y1, the mixed strategy used by agent two tends toward

15

-

7/29/2019 Investment under uncertainty, competition and regulation

16/26

a pure strategy with systematic investment. However at the point itself, the

second agent differs investment and becomes the follower. It follows fromthe fact that agent one is indifferent between being follower or letting theregulator decide the outcome at this point. He suddenly seeks, withouthesitation, for the leaders position, creating a discontinuity in his behavior.The same happens for agent two at Y2, creating another discontinuity in thestrategy of the latter.

4. Singular cases

The proposed framework encompasses in a natural way the two maincompetition situations encountered in the literature, namely the Cournotcompetition and the Stackelberg competition. By introducing minor changes

in the regulatory intervention, it is also possible to represent the situationof Stackelberg leadership advantage. Finally, our setting allows to study anew and weaker type of advantage we call weak Stackelberg leadership.

4.1. The Cournot and Stackelberg competitions

The Cournot duopoly refers to a situation when both players adjustquantities simultaneously. This is the framework of Grasseli and al. [7],involving the payoff S(y) if agents invest at the same time. Recalling Defi-nition 2.1, this framework corresponds to

(q1, q2, qS) = (0, 0, 1) . (30)

We notice that agents then become symmetrical. This appears from (18)which implies P1(y) = P2(y) = p0(y). Additionally, p0(y) (0, 1) if y (YL, YF), and is increasing on this interval according to Lemma 3.1.

The Stackelberg competition refers to a situation where competitors ad-just the level DQ(t) sequentially. In a pre-emptive game, this implies thatin the case of simultaneous investment, one agent is elected leader and theother one becomes follower. This setting implies an exogenous randomiza-tion procedure, which by symmetry is given by a flipping of a fair coin. Theprocedure is described as such in Grenadier [8], Weeds [15], Tsekeros [12] orPaxson and Pinto [10]. Recalling Definition 2.1, the setting is retrieved byfixing

(q1, q2, qS) = (1/2, 1/2, 0) . (31)The implication in our context is the following: by symmetry, P1(y) =P2(y) = 2. Therefore, the interval (YL, Y2) reduces to nothing, i.e., YL =Y1 = Y2, and the strategical behavior boils down to (i), (v) and (vi) inTheorem 3.1.

16

-

7/29/2019 Investment under uncertainty, competition and regulation

17/26

Remark 4.1. Notice that any combination q2 = 1 q1 (0, 1) provides

the same result as in (31), as Pi(y) = 1/qi > 1 for i = 1, 2. The strategicbehavior is unchanged with an unfair coin flipping. This is foreseeable asqiL(y) + (1 qi)F(y) > F(y) on (YL, YF). This will also hold for a convexcombination, i.e., for risk-averse agents.

Remark 4.2. Assume now symmetry in the initial framework, i.e., q :=q1 = q2 (0, 1/2). We have YS := Y1 = Y2, and the region (b) reduces tonothing. By recalling (19), we straightly obtain

limq1/2

YS = YL and limq0

YS = YF . (32)

Therefore, the regulation intervention encompasses in a continuous manner

the two usual types of games described above.

4.2. Stackelberg leadership

This economical situation represents an asymmetrical competition wherethe roles of leader and follower are predetermined exogenously. It can be jus-tified as in Bensoussan and al. [3] by regulatory or competitive advantage.However Definition 2.1 does not allow to retrieve this case directly. Instead,we can extend it by conditioning the probability quartet {q0, q1, q2, qS}. Inthis situation, the probability P+ depends on F-adapted events in the fol-lowing manner:

P+

(0|t < 1) = 1 and P+

(1|t 1) = 1 . (33)

This means that no investment is allowed until agent one decides to invest,which leads automatically to the leader position. The strategical interac-tion is then pretty different from the endogenous attribution of roles. SeeGrasselli and al.[7] for a comparison of this situation with the Cournot game.

4.3. The weak Stackelberg advantage

We propose here a different type of competitive situation. Consider theinvestment timing problem in a duopoly where agent one has, as in theStackelberg leadership, a significant advantage due to exogenous qualities.

We assume that for particular reasons, the regulator only allows one agentat a time to invest in the shared opportunity. The advantage of agent onethus translates into a preference of the regulator, but only in the case ofsimultaneous move of the two agents. That means that agent two can still,

17

-

7/29/2019 Investment under uncertainty, competition and regulation

18/26

in theory, preempt agent one. This situation can be covered by simply

setting(q1, q2, qS) = (1, 0, 0) . (34)

In this setting, the results of Section 3 apply without loss of generality.

Proposition 4.1. Assume (34). Then the optimal strategy for agents oneand two is given by (G1(YL), G

2(YF)).

Proof. It suffices to consider the game of Table 1 on the interval [YL, YF).The Nash equilibrium is given by (p1(y), p2(y)) = (1, 0) for any y [YL, YF].Corollary 3.1 applies for other values.

Remark 4.3. As in Remark 4.2, we can observe that this situation cor-

responds to strategy (iv) of Theorem 3.1 expanded to the interval [YL, YF).This situation can be obtained continuously with q1 converging to one.

Following Grasselli and al. [7], we compare the advantage given bysuch an asymmetry to the usual Cournot game. In Grasselli and al. [7],the positive difference between the Stackelberg leadership and the Cournotgame provides a financial advantage which is called a priority option. Bysimilarity, we call the marginal advantage of the weak Stackelberg advantageon the Cournot game a preference option.

Corollary 4.1. Let us assume q2 = q0 = 0. Let us denote E(q1,qS)1 (y) the

expected payoff of agent one following from Theorem 3.1 when (q1, qS) is

given, for a level y R+. Then the preference option value is given by0(y) := E

(1,0)1 (y) E

(0,1)1 (y) for all y R+. Its value is equal to

0(y) = (L(y) F(y))+ y R+ . (35)

Proof. The proof is straightforward and follows from (26), where E(0,1)1 (y) =

F(y) for y [YL, YF]. Following Proposition 4.1, agent one shall invest at(YL) if y YL at first. In this condition, his payoff is L(YL) = F(YL),which provides (35).

This option gives an advantage to its owner, agent one, without penal-izing the other agent, who can always expect the payoff F. A comparisonwith the priority option is given in Figure 2.

A very similar situation to the weak Stackelberg advantage can be ob-served if we take q2 = 0 but qS > 0. The economical situation howeverloses a part of its meaning. It would convey the situation where agent two

18

-

7/29/2019 Investment under uncertainty, competition and regulation

19/26

0

1

2

3

4

5

6

7

0 0.5 1 1.5 2 2.5 3

priority optionpreference option

Figure 2: Priority option value (red) and Preference option value (blue) in function ofy.Vertical lines at YL = 0.37, Y1 = 0.64, Y2 = 1.37 and YF = 1.83. Option values are equalon [Y1, Y2]. Same parameters as in Figure 1.

is accepted as investor only if he shares the market with agent one or be-come a follower. In this setting we can apply also the results of Section 3.

We observe from definition (19) that in this case, Y2 = YF and Y1 verifiesF(Y1) = q1L(Y1) + (1 q1)S(Y1). The consequence is straightforward: theinterval [Y1, Y2) expands to [Y1, YF). The fact that Y1 > YL for q1 < 1 hasalso a specific implication.

In that case, the equilibrium (p1(y), p2(y)) = (1, 0) is more relevantthan (p1(y), p2(y)) = (P1(y), P2(y)) on [YL, Y1). Indeed, if agent one investssystematically on that interval then agent two has no chance of being theleader since q2 = 0. Thus p2 = 0 and the payoffs become

(E1(y), E2(y)) = (L(y), F(y)) for y [YL, Y1) . (36)

In opposition of the trembling-hand equilibrium, this pure strategy can be

well figured by being called steady-hand Comparing (26) to (36), agent oneshall use the pure strategy, whereas agent two is indifferent between themixed and the pure strategy. Setting q2 = 0 thus provides a preferenceoption to agent one.

19

-

7/29/2019 Investment under uncertainty, competition and regulation

20/26

5. Aversion for confrontation

Although its action is purely random in the presented model, the reg-ulator represents a third actor in the game. We thus study an originaldimension we denote aversion for confrontation, which conveys the impactof risk aversion on the coordination game only.

5.1. Risk aversion in complete market

We keep the market model of Section 2. However, we now endow eachagent with the same CARA utility function

U(x) = exp(x) (37)

where > 0 is the risk-aversion of agents. The function U is strictly concaveand is chosen to avoid initial wealth dependency. Since the market is com-plete and free of arbitrage, both agents still price the leader, the follower andsharing positions with the unique risk-neutral probability Q. Thus, agentscompare the utility of the different investment option market prices, denotedl(y) := U(L(y)), f(y) := U(F(y)) and s(y) := U(S(y)). The si, i = 1, 2 aredefined the same way. When needed, variables will be indexed with tomake the dependence explicit. The definition of regulation is updated.

Definition 5.1. Fix t and Yt = y. For i = 1, 2, if j = 3 i is the index ofthe opponent and j his time of investment, then agent i receives utility

ri(t, y) :=

0 if = 0l(y)1{tj} + f(y)1{t>j} if = if(y)1{t=j} if = jl(y)1{tj} if = S

. (38)

From Definition 5.1, it appears that by monotonicity of U, the game isstrictly the same as in Section 2, apart from payoffs. Both agents differ fory < YL and both act immediately for y YF. Each agent uses now a mixedstrategy pi , in order to maximize a expected utility slightly different from(23) on (YL, YF):

E1 (y) = (a1 + a

sq1)l(y) + (a

2 + a

Sq2)f(y) + a

s qSs(y) (39)

Results of Section 3 thus hold by changing (L,F,S) for (l ,f ,s). It followsthat in that case

Pi,(y) =l(y) f(y)

qi(l(y) f(y)) qS(l(y) s(y))with i {1, 2} (40)

20

-

7/29/2019 Investment under uncertainty, competition and regulation

21/26

play the central role and that optimal strategic interaction of agents can be

characterized by the value of y, or equivalently on the interval [YL, YL] bythe values of P1,(y) and P2,(y). The question we address in this section ishow risk-aversion influences the different strategic interactions.

5.2. Influence of on strategies

First, aversion for confrontation is expressed through diminishing prob-ability of intervention with .

Proposition 5.1. Assume qS = 1, and y (YL, YS). Denote p(y) :=P1,(y) = P2,(y). Then p p0 and furthermore,

lim

0

p = p0 and lim

p = 0 . (41)

Proof. According to (40) with qS = 1, p(y) (0, 1) on (YL, YS). From (40)we get

p(y) =l(y) f(y)

l(y) s(y)=

eL(y) + eF(y)

eL(y) + eS(y)=

e(LF(y)) 1

e(LS(y)) 1. (42)

Since u(x) := 1 U(x) = ex 1 is a positive strictly convex functionon [0, ) with u(0) = 0, we have that

p(y) =u(L(y) F(y))

u(L(y) S(y)) 0. Let Y1, [YL, YF] be such

that P2,(Y1,) = 1, and Y2, [YL, YF] such that P1,(Y2,) = 1. Then fori = 1, 2, Yi, is increasing in and

lim

Yi, = YF . (45)

Proof. Consider i {1, 2}. First notice that along Lemma 3.1, Yi, isuniquely defined on the designed interval. Following Remark 5.1, Pi, isa concave non-decreasing functions ofp. It is then a decreasing function of. Since Pi,(y) is decreasing with , Yi, is an increasing function of : theregion (YL, Y1,) spreads on the right with . Adapting (19) to the presentvalues, Yi, shall verify:

qi(1 e(L(Yi,)F(Yi,))) + qS(1 e(S(Yi,)F(Yi,))) = 0and when goes to , following (44), we need L(Yi,) F(Yi,) to go to 0,so that Yi, tends toward YF.

With risk aversion, the region (a) takes more importance and the com-petitive advantage of agent one decreases with . Figure 3 resumes theevolution.

The interval (YL, Y1,) describing the case (a) is the more relevant interms of strategies, as the only one to involve mixed strategies. Propositions5.1 and 5.2 imply the following result on this interval.

Corollary 5.1. Assume y [YL, Y1,). Let (a1 , a

2 , a

S) be defined by (20),

(21) and (22) where (p1, p2) is replaced by (P1,, P2,). Then

lim

aS = 0 and lim

a1a2

= 1 . (46)

Proof. Denote pi := Pi, and p := (l(y) f(y))/(l(y) s(y)) the equivalentof p0 in the risk averse setting. From (22), a

S is a decreasing function of

both p1 and p2 , and the first limit is a straightforward consequence of (41).

Plugging (40) into ai , we obtain

ai =pi (1 p

j )

p1 + p2 p

1p

2

, i = j {1, 2}2 , (47)

and differentiating in p, we obtain that ai is increasing in . It also follows

thata1a2

=p1 p

1p

2

p2 p1p

2

=qS (1 q2)pqS (1 q1)p

1 . (48)

The second limit of (46) follows immediately from Proposition 5.1.

22

-

7/29/2019 Investment under uncertainty, competition and regulation

23/26

0.4

0.6

0.8

1

1.2

1.4

1.6

1.8

0 0.5 1 1.5 2 2.5 3 3.5 4

(a)

(b)

(c)

Figure 3: Values ofY1 (blue) and Y2 (red) as a function of risk aversion . Y-axis limited to[YL, YF] = [0.37, 1.83]. Limit values of (Y1, Y2) for going to 0 corresponds to (0.53, 0.72)of Figure 1. Same parameters as previous figures.

Remark 5.2. We can easily assert as in Proposition 5.1 that aS < aS forany > 0, where aS is the probability of simultaneous action in the game

for risk-neutral agents. Equivalently,

a1a2

=F(y) S1(y)

F(y) S2(y) 0 . (49)

The above results can be interpreted as follows. The parameter isan aversion for the uncertainty following from the coordination game andthe regulatory intervention. As expected, the higher this parameter, thelower the probability to act Pi, in the game. However the game beinginfinitely repeated until action of at least one agent, for values of Pi, lowerthan one, the game is extended to a bigger interval [YL, Y1,) with . Then,it naturally reduces simultaneity of investment, but tends also to an even

chance of becoming a leader for both agents. There is thus a consequence toa high risk-aversion : agents synchronize to avoid playing the game and theregulator decision. In some sense, the behavior in a Stackelberg competitionis the limit with risk-aversion of the behavior of competitors in a Cournotgame.

23

-

7/29/2019 Investment under uncertainty, competition and regulation

24/26

How does impact the outcome of the game? As above since we are

in complete market, the risk aversion makes no relevant modification to thecases where the coordination game is not played. On the interval (YL, Y1,)then, we need to compare the expected values of options L, F and S tohomogeneously quantities.

Proposition 5.3. For y [YL, Y1,), let E1 (y) be the expected utility of

agent one in the coordination game when strategies (P1,(y), P2,(y)) areplayed. Then the indifference value of the game for agent one is given by

e1,(y) := U1(E1 (y)) =

1

log

a1 l(y) a2f(y) a

Ssi(y)

. (50)

We define e2, similarly. Assume now qS > 0. For y [YL, Y1,), we havefor i = 1, 2 that

ei,(y) = Ei(y) = F(y) > 0 , (51)

with Ei(y) defined in (26).

Proof. Using (47), we can proceed as in the end of Section 3 to retrieve

a1,l(y) + a2,f(y) + aS,si(y) = f(y), i = 1, 2 , (52)

and (51) follows from the definition of ei,.

Risk-aversion in complete market has thus the interesting property tokeep the rent equalization principle of Fudenberg and Tirole [6]: agentsadapt their strategies to be indifferent between playing the game or obtainingthe followers position.

6. Critics and extensions

If real option games model are to be applied, the role of a regulatorshall be introduced for many applications. Indeed regulators often intervenefor important projects in energy, territorial acquisition and highly sensitiveproducts such as drugs. Despite its simplicity and its idealization, the pre-sented model has still something to say. One can see it as an archetypemodel, unifying mathematically the Stackelberg and the Cournot competi-

tion frameworks and leading to simple formulas. The model we proposedis a first attempt, and could be improved on several grounds. Three mainobjections can be raised.

As observed in Section 3, the continuous-time setting with perfect infor-mation as extended by Fudenberg and Tirole [6] has unrealistic and strongly

24

-

7/29/2019 Investment under uncertainty, competition and regulation

25/26

constrained implications. This is emphasized here where the regulator can

only intervene when agents simultaneously invest. A prioritize objectivewould be to propose a new setting for the standard game conveying a dy-namical dimension to strategies.

A realistic but involved complication is the influence of explicit param-eters on the law P+, parameters on which agents have some control. Thevalue of being preferred, introduced as a financial option in subsection 4.3,would then provide a price to a competitive advantage and to side effortsto satisfy non-financial criteria. Eventually, a game with the regulator as athird player appears as a natural track of inquiry.

Finally, the introduction of risk-aversion should not be restrained to thecoordination game. This issue is already tackled in Bensoussan and al. [3],

and Grasselli and al. [7] for the incomplete market setting. But as a funda-mentally different source of risk, the coordination game and the regulatorsdecision shall be evaluated with a different risk-aversion parameter, as weproposed in Section 5. An analysis of asymmetrical risk aversion as in Ap-pendix C of Grasselli and al. [7] shall naturally be undertaken.

Acknowledgement

This work was performed as at the Fields Institute for Research in Math-ematical Sciences in Toronto. The author thanks Matheus Grasselli for fruit-ful comments on a very first draft of the article. Remaining errors are theauthors responsibility alone.

References

[1] Azevedo, A. F., Paxson, D. A., 2010, in: Real options game models: Areview. Real Options 2010.

[2] Black, F. and Scholes, M. 1973. The pricing of options and corporateliabilities. In: The journal of political economy, 637-654.

[3] Bensoussan, A., Diltz, J. D. and Hoe, S. .2010. Real options gamesin complete and incomplete markets with several decision makers. In:SIAM Journal on Financial Mathematics, 1(1), 666-728.

[4] Becherer, D., 2003. Rational hedging and valuation of integrated risksunder constant absolute risk aversion. In: Insurance: Mathematics andeconomics, 33(1), pp.1-28.

25

-

7/29/2019 Investment under uncertainty, competition and regulation

26/26

[5] Chevalier-Roignant, B., Flath, C. M., Huchzermeier, A., Trigeorgis, L.

, 2011. Strategic investment under uncertainty: a synthesis. In: Euro-pean Journal of Operational Research, 215(3), pp.639-650.

[6] Fudenberg, D., & Tirole, J., 1985. Preemption and rent equalization inthe adoption of new technology. In: The Review of Economic Studies,52(3), pp.383-401.

[7] Grasselli, M., Leclere, V., & Ludkovski, M., 2013. Priority Option: TheValue of Being a Leader. In press: International Journal of Theoreticaland Applied Finance.

[8] Grenadier, S. R., 1996. The strategic exercise of options: Development

cascades and overbuilding in real estate markets. In: The Journal ofFinance, 51(5), pp.1653-1679.

[9] Grenadier, S. R. .2000. Option exercise games: the intersection of realoptions and game theory. In: Journal of Applied Corporate Finance,13(2), 99-107

[10] Paxson, D., & Pinto, H., 2005. Rivalry under price and quantity uncer-tainty. In: Review of Financial Economics, 14(3), pp.209-224.

[11] Smets, F., 1993. Essays on Foreign Direct Investment, Ph. D. Disserta-tion, Yale University.

[12] Tsekrekos, A., 2003. The effect of first-movers advantages on the strate-gic exercise of real options. In: Real R&D Options D. Paxson (Ed.),pp.185-207.

[13] Thijssen, J. J., 2010. Preemption in a real option game with a firstmover advantage and player-specific uncertainty. In:Journal of Eco-nomic Theory, 145(6), pp.2448-2462.

[14] Thijssen, J. J., Huisman, K. J., & Kort, P. M., 2002. Symmetric equi-librium strategies in game theoretic real option models. CentER DP,81.

[15] Weeds, H., 2002. Strategic delay in a real options model of R&D com-petition. In: The Review of Economic Studies, 69(3), pp.729-747.

26