Internship Report (Krishnav Ray Baruah)

-

Upload

krishnav-ray-baruah -

Category

Documents

-

view

35 -

download

1

Transcript of Internship Report (Krishnav Ray Baruah)

“A study on Treasury Management in the corporate environment with reference to Numaligarh

Refinery Limited”

Organizational Guide Institutional Guide Nandan RajBaruah Madhu Khurana Accounts Manager (Finance & Accounts)Numaligarh Refinery Limited

Submitted by:

Krishnav Ray BaruahSemester V (2013-2016)

Enrol. Number: A1833313043

To Whom It May Concern

This is to certify that Mr Krishnav Ray Baruah, is a bona fide regular

student of this institute for the session 2013– 2016

He have completed the project report titled “ A study on Treasury

Management in the corporate environment with reference to Numaligarh

Refinery Limited” under my supervision, as a part of summer internship

programme. His report is satisfactory and not copied from anywhere to the

best of my knowledge.

Date: 1.06.15

( Nandan Raj Barooah )Accounts Officer(F&A)

Project Supervisor

Page | 2

Acknowledgement

Sometimes words fall short to show gratitude, the same happened with me

during this project. The immense help and support received from

Numaligarh Refinery Limited overwhelmed me during the project.

At the very outset, I would like to thank my authorities at AIBS, Noida for

permitting me to undertake the summer project at Numaligarh Refinery

limited, Assam.

I am very much indebted to the management at Numaligarh Refinery

Limited for accepting my application to undergo the summer internship at

NRL.

I would like to offer my sincere gratitude to my organisational guide, Mr.

Nandan Raj Barooah, Accounts Officer (Finance & Accounts), for his

invaluable guidance and suggestions in spite of his busy schedule.

I would also like to thank Mr. A.K.Patra (F&A), for the constant guidance

and help.

Page | 3

Table of Contents

Chapter I. Executive Summary………………………… ………….. 6-9- Project Title …………………………………………………………...… 7

- Organisation ………………………………………………………........... 7

- Duration …………………………………………………………….......... 7

- Organizational Guide ……………………………………………….......... 7

- Institutional Guide ………………………………………………………... 7

Chapter 1. Numaligarh Refinery Limited – An organizational profile……………………………..11-26- About Numaligarh Refinery Limited ……………………………… 12

Chapter 2. Treasury Management………..……………………… 27-651. Definition …………………………………………………………… 28

2. Importance ………………………………………………………… 31

Chapter 4: Treasury Operations at Numaligarh Refinery Limited ………………………66-1021. Introduction………………………………………………………… 67

2. Objectives and Scope of Study…………………………………… 68

3. Use and Importance of Study……………………………………… 68

4. Research Methodology……………………………………………… 69

5. Findings……………………………………………………………… 69

6. Analysis of Findings………………………………………………… 99

7. Conclusions and Recommendations…………………………………101

Project Title

Page | 4

“ A study on Treasury Management in the corporate environment

with reference to

Numaligarh Refinery Limited”

Organization

Numaligarh Refinery Limited District: Golaghat, Assam

Duration

May-June, 2015 ( 6 weeeks)

Organizational Guide

Mr. Nandan Raj Barooah Accounts Officer ( F& A)

Numaligarh Refinery Limited

Institutional Guide

Madhu Khurana

Page | 5

Numaligarh Refinery Limited

An Organizational Profile

- About Numaligarh Refinery Limited

Page | 6

About Numaligarh Refinery Limited

NRL which was set up at Numaligarh in the district of Golaghat (Assam) in

accordance with the Assam Accord signed on 15th August 1985, has been

conceived as a instrument for speedy industrial and economic development

of the region. NRL, a Govt. of India enterprise, is one of the most

sophisticated and hi-tech refineries in India.

Page | 7

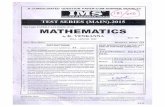

Scalar Chain

Director (Finance)

General Manager ( Finance)

Deputy General Manager Chief Manager (Finance & Business Development) (Finance &Accounts)

Manager Asst. Manager Asst. Manager(Fin. & Ac.) (Budget) (MIS)

Accounts AccountsOfficer Officer(Main Acc.) (Payroll)

Staff Staff Staff

Manager( Marketing Acc.) Deputy Manager (Treasury& Manager (Excise & Pricing) Service Tax)

Asst. Manager( Indirect Taxation) Staff

Accounts Officer Accounts Officer ( Pricing) (Treasury)

Staff

Treasury Management

Page | 8

1. Definition

Treasury management (or treasury operations) includes management of

an enterprise' holdings in and trading in government and corporate bonds,

currencies, financial futures, options and derivatives, payment systems and the

associated financial risk management. It stands for planning, monitoring and

managing high liquidity assets. It is a group of products and services,

performance of which is focused on control of cash and money at the bank,

receivables and liabilities as well as short-term borrowing and investing.

Cash is the life blood of a business firm; it is needed to acquire

supplies, resources, equipment, and other assets used in generating the

products and services provided by the firm. It is also needed to pay wages

and salaries to workers and managers, taxes to governments, interest and

principal to creditors, and dividends to shareholders. More fundamentally,

the cash is the medium of exchange, which allows management to carry out

the activities of the business firm from day to day. As long as the firm has

the cash to meet these obligations, financial failure is impossible. In short,

cash is the basic input required to keep the business running on a continuous

basis. It is also the ultimate output expected to be realised by selling the

service or product manufactured by the firm.

Page | 9

Treasury Operations at NRL

Page | 10

Business Operation

Information & Control

Cash Collection

Cash Payments

Surplus

Invest

Deficit

Borrow

Cash Management

Cycle

Fig.1

Introduction

1.Objectives and Scope of Study

2.Use and Importance of Study

3.Research Methodology

4.Findings

Introduction

Objective

Effective Cash Management Techniques at

Numaligarh Refinery Limited

Optimum Cash Balance

Investment of Surplus Funds

5.Analysis of Findings

6.Conclusions and Recommendations

1. Introduction

Page | 11

In the previous chapters we have come across the theoretical

aspects of our ambit of analysis. We’ve understood how and why the

management of cash and near cash items are so important for the financial

health of any firm. Nevertheless, to have an unambiguous comprehension of

the subject it is an imperative to be familiar with the applied aspects of the

subject in question. This chapter is an effort to substantiate the conceptual

pieces that we have already come across, through interface with the factual

environment. This study tries to corroborate the fundamentals of cash and

treasury management by taking the case of cash and treasury operations at

Numaligarh Refinery Limited.

By means of the information gathered through a six weeks long

internship at the refinery, the study tries to absorb the main functions of

treasury management practised in compliance with the industry-specific

demands and constraints.

The study is based on the facts and figures provided by the

employees of the finance department at Numaligarh Refinery limited

through questionnaires, one-one discussion and various published materials.

2. Objective and Scope of Study

Page | 12

The overall objective of the study is to develop a clear understanding

of the facets of cash or treasury managements with reference to a corporate

environment. The study makes an effort to focus on a three-fold objective:

Objective 1 An ‘au fait’ with the cash management techniques practised

at Numaligarh Refinery Limited.

Objective 2 To have an understanding of the banking functions aiding

treasury operations.

Objective 3 A study of the pattern of surplus fund investment and the

regulations that shape these investment decisions

This study is built up on the findings about the treasury operations at

Numaligarh Refinery Limited. Numaligarh Refinery, a subsidiary of Bharat

Petroleum Corporation Limited is designed to process 3.0 MMTPA of crude

oil. The refinery unit is at Pankarghat in Golaghat district of Assam. The

scope of this study includes the major treasury operations at the Finance and

Accounts Department at the refinery unit office.

3. Use and Importance of the Study

Page | 13

The importance of this study lies in its usefulness in aiding a proper understanding of the significance of treasury operations in a business entity. It is a reflection of the cash conservation efforts made at a profit-earning unit. Besides, this study guides through the industry-specific and categorical regulations that influence the field of operation within our ambit of analysis.

4. Research Methodology

The study was carried out in two phases:

Phase1: Exploratory Phase

In this phase, qualitative research was conducted through a series of

in-depth discussions with the Accounts Officer of treasury section of the

Finance & Accounts Department of Numaligarh Refinery Limited, who also

supervised this study. These discussions were conducted over a period of

month.

Phase2: Extended Exploratory Phase

A questionnaire was developed on the qualitative findings and the

theoretical knowledge base. The questionnaire consisted of descriptive

questions regarding the basic treasury operations at Numaligarh Refinery

Limited and was administered to the employees at the Finance and Accounts

Department of the organization. The basic objective of administering this

questionnaire was to collect the relevant basics from the employees who

where constrained by time limits. In this study the questionnaire was an aid

only to gather the qualitative information.

5. Findings

Page | 14

1. Departments at Numaligarh Refinery and their Functions

Numaligarh Refinery Limited is an oil refining and marketing company.

It is engaged in the refining and marketing of light, medium and heavy

distillates through its retail stations. The company’s area of operation is

spread across the Northeast region of India. The company is

headquartered in New Delhi and employs 718 people.The operations at

the refinery are divided into six divisions, viz.

Finance and Accounts

Personnel and Administration

The following includes, in brief, the major functions of the above mentioned departments at Numaligarh Refinery Limited.

1.1 Finance and Accounts Department:

The activities carried out under the different sections in the Finance &

Accounts department of NRL are as follows:

Pricing

Fixing of price for different finished goods for the refinery at

different locations and issue price circulars to concerned

departments in this regard.

Issue price circulars for the retail outlets at different locations

of the country.

Issue circulars on crude price.

Treasury and Insurance Section

Page | 15

Fund management (working capital management, investment

of surplus funds etc.)

Payment to vendors.

Liaison with bank for account opening.

Optimize the source pattern of fund to minimize interest cost.

Risk management of the company

Selection of insurer

Lodgements of claim

Coordination activity for claim settlement

Main Accounts

Preparation of monthly, quarterly, annual accounts.

Maintenance of books of accounts.

Ensure compliance of Accounting Standards and other statutory

compliances from the point of view of the books of accounts.

MIS, Budgeting and Costing

Generation of different MIS for management as well as outside

agencies.

Preparation of revenue budget and necessary coordination

activity in this regard.

Maintenance of costing records as per statutory

Vendor Monitoring and Crude Accounting Monitoring vendor balances like advances, deposits etc.

Handling the complete purchase cycle of crude from issuing

purchase order to raising goods receipt and valuation of crude

stock.

Page | 16

Payroll Section

Payroll processing for all the employees at all the locations of the

company.

Payment of tour and other advance and their settlement.

Marketing Finance

OMC and other customer sales accounting, balanced monitoring

etc.

Co-ordination with dealers in other states.

Ensuring legal companies like Sales Tax etc.

Department of Finance and Accounts & Treasury operation

The Finance and Accounts department at Numaligarh Refinery is headed by

the Director (Finance). The responsibilities are subsequently split

throughout the hierarchy as

- Finance & Business Development

- Finance & Accounts

- Marketing Accounts

- Treasury

- Pricing

- Taxation

- Main Accounts

- Payroll

- Budget

- MIS

1.2. Personnel & Administration:

Administration

Page | 17

Providing transport facility which is required for performing

different activities of the company.

Providing guest house facility to the guests.

Providing hospital and school facilities to offer best services to

employees and their families.

Security of the company is ensured through deployment of

Central Industrial Security Force (CISF)

Industrial Relation

Canteen facilities are provided to the employees.

Employees’ grievances are redressed without any delay.

Closely monitoring whether the Industrial Disputes Act and

Factories Act are followed in proper manner.

Benefit Management

Medical benefits are offered to the employees.

Loans are arranged for purchasing computers, furniture and for the

house building.

Payroll

Payment of salaries which includes bulks and allowances to the

employees.

Payment of performance linked incentives.

Payment of productivity linked incentives.

Recruitment of Employees

Page | 18

1. Advertisements in newspapers.

2. Through employment exchange

3. Campus recruitment.

Selection of Employees

The employees who are selected as trainee after they qualify

through a written examination and a personal interview.

The mid-level employees are generally selected through the

personal interview only.

2. Objectives The chief objectives of the Treasury Operations at Numaligarh Refinery

Ltd. are outlined below:

2.1. Management of funds :

To opt for the most favourable interest cost opportunity among

the alternatives. Out of all the available options the company

needs to weigh the benefits from debts and receivables to that

of costs of the external funds and subsequently resolve on the

best possible scheme.

Striking a right balance between Working Capital Demand

Loan (WCDL) & Cash Credit. The interest rates of cash credit

are higher than that of WCDL. So to save on the interest it

becomes imperative to strike the best permutation at any point

in time.

2.2. Ensuring timely payments related to different sections

Page | 19

The essential payments that the refinery needs to disburse are broadly of three types, viz.,

Raw materials

Taxes/ Duties

Salary

Essentially timely payments are ensured so as to avoid unnecessary penalty on delayed payments and subsequently evade a veiled opportunity cost.

2.3. Monitoring collections from Oil Marketing Companies and Direct

customers

Collections are equally important as payments. Collections come

from oil marketing companies like Essar Oil, Shell and Reliance,

other clients –BPCL, IOCL, HPCL, HINDALCO and NALCO and

retail outlets. A set a follow-up regime to adhered to, to keep track

of timely collections.

2.4. Repayment of loans and interests, TDS deductions and interest

payments

2.5. Monitoring working capital requirements

There are two facets to monitoring working capital requirements-

- Keep a watch on liquidation

- Investment of surplus

2.6. Daily physical verification of cash

Cash is a component that is highly vulnerable to any kind of

misappropriation. For this reason, an iterative regulation of cash

becomes indispensable. At NRL, hard cash verification is carried out

Page | 20

for the closing balance by the cashier which is subsequently cross-

verified by the Accounts Officer at the treasury section.

2.7. Fund transfer management

All public sector undertakings are required to make payments using National Electronic Fund Transfer (NEFT) to eliminate anomalies associated with manual handling. An important subprogram of the treasury operation is to minimise the costs associated with any transfers made throughout its localised offices. If projections suggest that a particular division or local office need not or rather can do with a balance lesser than the minimum balance, transfers are avoided. Therefore, transfers are made as and when they are called for.

I.2. Managing the Payment-Collection Cycle

The essential payments that the refinery needs to disburse are broadly of

three types, viz.,

Raw materials: The major payments incurred under raw

materials are made to ONGC and OIL for crude. The crude oil

that NRL consume is basically Assam Mix Crude, which is a

blend of OIL and ONGC Crude in weight ration of 40% OIL

and 60% of ONGC crude. In the accounting year 2007-08 raw

materials purchase amounted to Rs. 1853.06 million. Py-gas is

another input at NRL.

Taxes/ Duties: Payments also include duties and taxes like

- Excise Duty: Central excise duty or the “Kendriya Utpad

Sulka” is levied and collected by the Government of

India on production and manufacture.

Page | 21

- Entry tax and TDS: These are two other tax payments

made by NRL. Entry tax is levied and paid by the

importer of the goods into a local area from any place

outside.

Salary: Salary payments are yet another monthly payments that

arise on the last day of each month.

I.3. Banking activities aiding Treasury Operations

Banking facilities aid these operations in five major ways:

Meeting the working capital requirements: The working capital

fund requirements are managed and controlled by the SBI

commercial branch at Guwahati (Ganeshguri). Limits are set

and sanctioned by the above-mentioned branch. This limit is

then sub-divided into all the other branches simultaneously. For

example if the limit is Rs. 50 (say), then it is sub divided to

allow Rs. 10 at SBI Golaghat branch, Rs 20 at SBI Numailgarh

and so on. This provides the refinery with a huge option of

economical liquidity.

Fund transfer: Numaligarh Refinery Limited avails the

National Electronic Fund Transfer (NEFT) facility for

payments. NRL is tied up with HDFC for this facility. All

PSUs are compulsorily required to make use of these electronic

transfer facilities to prevent anomalies of manual intervention

while issuing cheques. Electronic transfers have also wiped out

the transit time taken by cheques. All the cheques that are

deposited into NRL’s account have to be cleared by the day-

Page | 22

end. As a result both payment float and collection float are

generally rooted out.

Value dated effect facility in transactions: Under this facility,

NRL gets the credit for any collection for the same date even if

the necessary bank advice for the same reaches the bank on a

future date. On the other hand, in case of any major payments

by NRL, it can advice the bank to debit its account and release

the payment on any future date. This helps NRL in optimizing

its cash conservation and also minimizing the interest cost.

In receiving collections: To receive payment from retail outlets

throughout the country on the same day NRL has availed the

Cash Management Product (CMP) facility offered by State

Bank of India. The retail outlets can make their payments at the

convenient and designated CMP enabled branch.

Foreign Transactions: The nature of activities that usually lead

to expenses having the foreign component are-

- Purchase of spares

- Maintenance

- Technical consulting

- Capital expenditure

- Foreign training expenses

3. Optimum Cash Balance

Page | 23

The preferred level of cash balance maintained at the cash

office does not exceed Rs. 2 lakhs

Separate levels of cash are maintained at the different offices at

four different locations. These levels depend upon the scale of

administrative operations at the respective locations.

Imprest requirements and tour advances are the factors taken

for ascertaining the cash balance level.

Abolishing cash payments to vendors

(casual/regular/contractual) by adopting Cheque/NEFT as

preferred mode of payments has induced to revise the cash

balance level at locations.

4. Investment of Surplus Cash

Cash in excess of the requirement of operating balance may be held

for two reasons :

To meet the fluctuating working capital requirements (owing to

seasonal and business cycles)

As buffer to meet unpredictable financial needs( precautionary

balances)

In case of Numaligarh Refinery Limited, which is a public

sector undertaking, has to abide by certain restrictions issued by the state

administration. The refinery has to stick to the guidelines issued by the

Department of Public Enterprises while parking its surplus funds.

Page | 24

6. Analysis of Findings

The following are the analysis of the findings made in the course of the

study:

Thus, we observe that Numaligarh Refinery Limited adheres to

a combination of both long-term and short-term cash

projection. It is one of the mainstay techniques that are used in

estimation of investments and deficits and for control in

treasury operations as a whole. Various stages of the refinery

witnessed varied methods of cash planning. During the

construction period of the refinery cash planning differed from

what it is being followed 9 years after its commissioning.

Project period saw no inflows of cash but only outflows. So,

patterns of cash planning were tailored to suit that situation for

example, fixed deposits were planned to provide the regular

liquidity. In the first few years of the refinery, it had to repay

its loans- which demanded a different kind of cash planning

approach. Today, the refinery enjoys a no-term-loan-

component position: and clearly a diverse approach of cash

scheduling suits its present form of operations. Therefore, cash

Page | 25

planning or forecasting needs and can be altered as per the

requirements of the firm.

If the details of the payment and receipt cycle are considered

then one can make out that:

Credit period given to clients by NRL is 15 days

Credit period that NRL enjoys is that of 21days

This is done to accelerate the receipt cycle and decelerate the

payment cycle. This technique enables NRL to conserve cash and reduce its

requirements for cash balance.

The bank aids the refinery to a huge extent in carrying out its

treasury operations. The various services like NEFT payments,

CMPs, cash credit and WCDL helps NRL to operate efficiently

and maximise its cash conservation and generation motives.

The recent advancements of electronic fund transfers have

totally wiped out the concept of collection float. Availing these

services has made management and control of treasury

operations more effective.

Based on the above-mentioned facts about investment of

surplus funds it can be analysed that the following decisive

factors are taken into account at NRL, while considering

investment opportunities:

(a) Safety: As per the guidelines the firm cannot expose its

funds to any speculative transactions. Therefore Fixed

Deposits ( for long term investments) or UTI debt

Page | 26

schemes (for short term investment) are the two

favourable investment avenues opted here at NRL.

(b) Liquidity: Though the guidelines suggest that PSUs, can

opt to deposit their surplus funds into term deposits for a

period of 3 years, NRL avoids such long term deposits.

The maturity of their deposits does not generally exceed

a period of 1 year. Besides, investing in UTI debt

schemes mutual funds are preferred for their daily

liquidity. Thus, at NRL liquidity is one factor that is

found to reign the decisions regarding parking of surplus

funds. The periods of the deposits are based on the

internal cash flow projections made by the company.

(c) Return: Until recently, NRL followed the procedure of

inviting quotations from banks for investing their surplus

funds. The placement of the Fixed Deposit was evaluated

based on the highest rate offered by the bank. Therefore

reasonable returns are another factor influencing

investment decisions.

Page | 27

7. Conclusions and Recommendations

The main purpose of this study was to develop a clear understanding

of treasury functions in corporate settings. Three major areas were delved

into to achieve this objective.

1. Cash Management Techniques:

This section helped to get an overview of the workings of the treasury

section of a live business unit. Among the gamut of techniques employed,

some are traditional, having a widespread usage and concurrent to the

theoretical roots. While, some are tailor-made to suit the prevalent situation

of working capital requirement and these are purely based on savings

(interest cost) motive and liquidity positions.

2. Banking Activities

This section analysed the variety of advantages that a firm can enjoy

by availing the updated services and offers served by the banks. The de-

centralised banking services have enabled NRL to speed up collections and

thereby conserve cash. Faster electronic transfers have also eradicated the

collection float- the major obstruction in cash inflows at one point of time.

Its formidable repute also puts NRL in a position to negotiate the best offers

from its major banks in lieu of maintaining the much desired symbiosis.

3. Investment of surplus funds

An interesting aspect can be gathered through the analysis of this

section- that is the significance of striking the right balance while weighing

the risk and return facets an investment opportunity for parking surplus

funds. Liquidity and return should be well-worked out to earn the desired

benefits to cover the projected working capital requirements.

Page | 28

However, the detailed exploratory discussions have revealed that –

Numaligarh Refinery Limited is deficient a policy documented

solely for the treasury operations. A legal framework structured

to control the treasury operations would give a better direction,

clarity and control in this area.

Numaligarh Refinery Limited may also consider the option of

analysing and evolving a credit list of all the investment

options available to it and update it from time to time. The

policy document as suggested above should guide the evolution

and evaluation of the list. Such a step would help NRL probe

more suitable and rewarding investment options efficiently.

BIBLIOGRAPHY

Page | 29

. Stephen A Ross, Randolph W Westerfield, Jefferey

Jaffe, Ram Kumar Kakani, Corporate Finance, Eight

edition, Tata McGraw Hill, New Delhi 2009.

R Narayanaswamy, Financial Accounting, Third Edition,

AsokeGhoshPublication,NewDelhi2009

. Annual reports of Numaligarh Refinery Limited 2007-

2008, 2008-2009, 2009-2010

. www.nrl.co.in

. www.investopedia.com

Page | 30

SUMMARY

After analyzing various aspects of Treasury Management at Numaligarh Refinery, the facts found can be summarized as below:

It is clear that the Treasury Management of Numaligarh Refinery in

sound position.

Treasury Management is not measurable by only current assets &

current liabilities but there are some other factors also that have an

influence on the working capital.

In current assets also, there are two most important factors, which

are

Debtors and Inventory which affect working capital.

In Numaligarh Refinery Inventory and Debtors are efficiently

managed to strengthen the position of the organization both in

short term and long terms.

After analyzing and interpreting the financial data of NRL with the

help

of Ratio Analysis, the following suggestions were given to the

organization for further betterment & improvement in the working

capital

The present status and levels of current assets is extremely good

and therefore it requires proper maintenance.

Current assets are increasing more than current liabilities.

Position of Debtors to Current Assets is average. This ratio

had increased showing a liberal credit policy followed by the

company.

Page | 31

Large part of working capital is involved in maintaining

inventory.

Inventory as a component of current assets is high as

compared to the other components.

From current ratio, overall ratio was above the accepted

norms of 0.5. So the company has to reduce the overall ratio

avoid the unnecessary cash kept in ideal.

The company has to make an effort to reduce the expenses

in order to increase profit.

The current percentage of inventory is too high which is not

good for operational efficiency and sound working capital

and thus, it need to be controlled by using various inventory

management techniques such as JIT

Cash balances have a lower percentage in current assets.

This requires some concern as cash and bank balances are

the most liquid of all current assets. To improve the cash

balances NRL needs to improve its average collection

period and also it should invest more money in marketable

securities.

Some other concepts such as receivable management

should be

adopted so that money can be collected more easily and the

working can be smoothening.

Numaligarh Refinery may also opt to hedge the crude

costs and save suitably from the fluctuating prices.

Page | 32

This will help them to reduce the cost of inventory n

thus cost of overall production.

The company has same credit period 21 days for its

creditors and debtors. Thus reducing the credit period

for debtors can result into more amounts of cash in

hand thus reducing their working capital requirement.

As the company has excellent investing opportunity

available in U.T.I debt funds.

It has been studied about the different items of Treasury

Management and how organizations can improve their

management of Treasury Management. IT was seen that the ideal

level of Treasury Management is difficult to calculate and will vary

from one organization to another depending upon the industry in

which they operate. What is essential is that a business avoids

both the situation of too little or too much working capital.

Page | 33

THE END

Page | 34