Institutional-Quality Office Building | 90% Leased ......Security 8,784 SF Yellow Box Corporation...

Transcript of Institutional-Quality Office Building | 90% Leased ......Security 8,784 SF Yellow Box Corporation...

JANUARY 2020

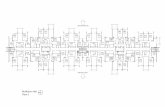

Institutional-Quality Office Building | 90% Leased | 121,092 SF$32,600,000 | $270 PSF | 6.00% Cap Rate

corporate plazabrea

ORANGE COUNTY, CALIFORNIA

EXECUTIVE SUMMARY

the offeringNewmark Knight Frank (NKF), as exclusive advisor, is pleased to present the exceptional, investment opportunity to acquire Brea Corporate Plaza (the Property), an institutional-quality, multi-tenant office building totaling 121,092 rentable square feet located in Brea, California.

Brea Corporate Plaza is a compelling opportunity to acquire a Class A office building at pricing well below estimated replacement cost, with the ability to enhance returns through rolling in-place tenants to market rents upon lease expiration (mark-to-market play) as well as the lease up of remaining vacancy.

The Property, built in 1982 and renovated in 2018, offers tenants contemporary interior finishes, ample and convenient surface parking, high corporate identity, and abundant walkable retail amenities. Brea Corporate Plaza is located within walking distance to the brand new, Village at La Floresta retail center which consists of more than 20 stores and restaurants, including Whole Foods Market, Slapfish, Urban Plates, Mendocino Farms, Capital Noodle Bar and Starbucks, to name a few.

This opportunity is being offered priced at $32,600,000 for the fee-simple interest in the building and land thereunder.

corporate plazabrea

3Stories

PROPERTY SUMMARY

3230 East Imperial Hwy Brea, CA 92821Address

121,092 SFRentable Area (BOMA 2017)

262,667 SF (6.03 Acres)Parcel Size

±477Surface Parking Spaces

336-531-22APN

±4.0/1,000 SFSurface Parking Ratio

1982/2018Year Built/Renovated

3Elevators

90%Occupancy

OFFERING SUMMARY

Fee-SimpleInterest Offered

$270Price PSF

$32,600,000Offering Price

6.00%In-Place Cap Rate

8.05%Year 3 Cap Rate (Fully Stabilized)

15.10%Year 3 Leveraged Cash-on-Cash Return (Fully Stabilized)

FINANCIAL SUMMARY

$2.33 PSF FSGAverage In-Place Rents

$2.60 PSF FSGMarket Rents

±11%Average In-Place Rents Below Market

±$1,961,556In-Place NOI

±3.7 YearsWeighted Average Lease Term Remaining

10%Vacancy

20Total Tenants

±$2,625,503Fully Stabilized (Year 3) NOI

MAJ

OR T

ENAN

T SU

MM

ARY

GSA - Social Security8,784 SF

Yellow Box Corporation15,414 SF

Sedgwick Claims Management20,430 SF

Coury & Buehler13,980 SF

% of Property17%13%12%7%

Ridgeline Telecom15,560 SF

13%

investment highlightsRARE, INSTITUTIONAL-QUALITY, MULTI-TENANT OFFICE BUILDINGBrea Corporate Plaza is a Class A, office building featuring abundant and free surface parking (±4.0/1,000 RSF), large window lines, tall ceiling heights, above-standard floor plates, and high corporate identity. The Property has been recently renovated with new lobbies, corridors, restrooms, landscaping and exterior paint. Office buildings of this size and quality rarely come to market, especially in the highly sought-after North Orange County office submarket, which boasts a direct office vacancy rate of only 7.6%.

STABLE IN-PLACE TENANCY WITH TREMENDOUS UPSIDEThe Property is currently 90% leased with 62% of the rental stream consisting of the five largest tenants (Sedgwick Claims, Coury & Buehler, Ridgeline Telecom, Yellow Box Corp. and GSA | Social Security) which provides a short term secure and stable income stream. Investment upside can be realized as 44% of the rental stream expires in the first three years, allowing an investor to quickly roll in-place tenants to market rents. The average current in-place rents are approximately 11% below market. Further upside can be achieved by the lease-up of the remaining vacancy (11,992 square feet).

ROBUST OFFICE MARKET FUNDAMENTALSFueled by increased tenant demand, the North Orange County office submarket has posted multiple years of positive net absorption and multiple quarters of positive rent growth. Currently, the office submarket vacancy rate stands at only 7.6%, one of the lowest vacancy rates in all of Southern California. Pent-up tenant demand and low vacancy will feed upward pressure on both rental rates and value appreciation, as the Property is currently valued well below its estimated replacement cost of $475 per square foot and well below prior peak market sale comparables.

OPPORTUNITY TO BOOST ATTRACTIVE RETURNS WITH ACCRETIVE FINANCINGThe Property is being offered free and clear of existing debt, allowing an investor to take advantage of today’s low interest rate environment and aggressive debt markets to boost already attractive returns. An investor has the ability to acquire up to 70% LTV financing and achieve a double-digit leveraged cash-on-cash return upon stabilization in Year 3.

SURROUNDED BY EXPANSIVE AMENITIES & NEW HOUSINGBrea Corporate Plaza is located within walking distance to the brand new, Village at La Floresta retail center which consists of more than 20 stores and restaurants including Whole Foods Market, Slapfish, Urban Plates, Mendocino Farms, Capital Noodle Bar and Starbucks, to name a few. Additionally, a short driving distance away are Brea Union Plaza, Imperial East Shopping Center and the Brea Mall, providing an abundance or retail and restaurant amenities. Within walking distance is a multitude of housing options including new apartments and executive housing. The Pearl at La Floresta is a brand new apartment community consisting of 204 units which was completed in 2019 and the average home value within the Brea city limits is $726,600, according to Zillow—well above the national average.

DIAMOND DIAMOND BARBAR

East Imperial Highway

East Imperial Highway

LA HABRALA HABRA

57

BREABREA

South Kraemer Boulevard

South Kraemer Boulevard

Valencia AvenueValencia Avenue

PEARL LA PEARL LA FLORESTA FLORESTA (multi-family)(multi-family)

BREA MALLBREA MALL

IMPERIAL EAST SHOPPING CENTERIMPERIAL EAST SHOPPING CENTER

BREA UNION PLAZABREA UNION PLAZA

VILLAGE AT LA FORESTAVILLAGE AT LA FORESTA

corporate plazabrea

The information contained herein has been obtained from sources deemed reliable but has not been verified and no guarantee, warranty or representation, either express or implied, is made with respect to such information. Terms of sale or lease and availability are subject to change or withdrawal without notice.

Corporate License #01355491

JANUARY 2020

Local Market ContactsRICK WARNERSenior Vice [email protected] CA RE Lic. #00645389

CHIP WARNERFirst Vice President [email protected] RE Lic. #01888851

TAYLOR FRIENDVice [email protected] CA RE Lic. #01885394

Financing ContactsDAVID MILESTONEVice [email protected] CA RE Lic. #01515842

BRETT GREENSenior Managing Director [email protected] RE Lic. #01892016

corporate plazabreaInstitutional Sales ContactsKEVIN SHANNONCo-Head, U.S. Capital Markets 310.491.2005 [email protected] CA RE Lic. #00836549

BRANDON WHITESenior [email protected] RE Lic. #01977278

PAUL JONESExecutive Managing Director 949.608.2083 [email protected] RE Lic. #01380218

BRUNSON HOWARDExecutive Managing [email protected] RE Lic. #01793925

Private Capital ContactsSEAN FULPExecutive Managing Director [email protected] CA RE Lic. #01389064

MARK [email protected] RE Lic. #02033871

MICHAEL [email protected] CA RE Lic. #01983788