Ink World Magzine_Vol.19, No.3_2013-05

-

Upload

eugene-pai -

Category

Documents

-

view

223 -

download

0

Transcript of Ink World Magzine_Vol.19, No.3_2013-05

-

7/27/2019 Ink World Magzine_Vol.19, No.3_2013-05

1/52

http://www.inkworldmagazine.com/ -

7/27/2019 Ink World Magzine_Vol.19, No.3_2013-05

2/52

mailto:[email protected]://www.shamrocktechnologies.com/ -

7/27/2019 Ink World Magzine_Vol.19, No.3_2013-05

3/52

http://www.heubachcolor.com/ -

7/27/2019 Ink World Magzine_Vol.19, No.3_2013-05

4/524 www.inkworldmagazine.com May/June 2013

table of contents

departments

May/June 2013 Vol. 19, No. 3

Competition for European Pigment MarketContinues to Increase Sean MilmoTougher competition and regulations are causing pigment suppliers torethink their commitment to the European ink industry.

The Packaging Ink Market David SavastanoWhile the costs and availability of many raw materials have stabilizedduring 2012, there remains reasons for concern for prices andsupply during the coming year.

The Resin ReportDavid SavastanoResin manufacturers are looking forward to the upcoming year, and

they are developing new products for the market.

The Inkjet Ink ReportDavid Savastano

The Additives MarketDavid Savastano

NAPIM Convention Discusses Innovating toMeet the Needs of Customers David Savastano

Bill Miller 34 Doug Anderson - 36 Holly Anderson - 37

Pat Carlisle - 37 Pam Carney 38 Marc Castillo - 38

Janet Ciravolo - 39 Tom DeBartolo - 39 Dan DeLegge - 40

Ron Gallas 40 Lee Godina- 41 John Hrdlick - 41

Michael Podd - 42 Dale Pritchett - 42

William Neuberg Honored as MNYPIAs 2013Man of the Year David Savastano

cynora GmbH Poised to Make Inroads in OLED,OPV Markets David Savastano

fea

tures

Editorial

Fresh Ink

Market Watch

Calendar

Personnel

Industry News

Suppliers Corner

Classied

Ad Index

INK inc.

6

8

12

44

45

46

46

48

49

50

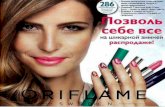

Cover: Laura Ragusa

14

18

24

27

30

43

50

24

18

27

http://www.inkworldmagazine.com/http://www.inkworldmagazine.com/http://www.inkworldmagazine.com/http://www.inkworldmagazine.com/http://www.inkworldmagazine.com/http://www.inkworldmagazine.com/http://www.inkworldmagazine.com/ -

7/27/2019 Ink World Magzine_Vol.19, No.3_2013-05

5/52

Introducing the Airase Structured Siloxane Defoamer Line.

The Airase Structured Siloxane Defoamer Line (SSDL) system from Air Products

is designed to provide a faster, easier way to choose a defoamer for water-based

coatings. Its the rst line of defoamers that structures the selection process,

providing a range of defoamers that can allow you to hone in on the mosteective defoamer/compatibility balance with minimal trial and error. For

free samples, call 1-800-345-3148. Or visit our website. And see for yourself

how less guesswork makes pinpointing the right defoamer less work.

tell me moreairproducts.com/airase

Solve foaming problems

with pinpoint accuracy.

2013 Air Products and Chemicals, Inc.

http://airproducts.com/airasehttp://airproducts.com/airase -

7/27/2019 Ink World Magzine_Vol.19, No.3_2013-05

6/52

editors desk

6 www.inkworldmagazine.com May/June 2013

EDITORDavid Savastano, [email protected]

VP/EDITORIAL DIRECTORTom Branna, [email protected]

ASSOCIATE EDITORBridget Klebaur, [email protected]

EUROPEAN EDITOR

Sean Milmo

ART DEPARTMENTMichael Del Purgatorio, [email protected]

EDITORIAL ADVISORY BOARDJoe Cichon - INX International

John Copeland - Toyo Ink AmericaLisa Fine - Joules Angstom U.V. Printing Inks

Norm Harbin - Flint GroupUrban S. Hirsch III - Ink Systems, Inc.

Penny Holland - Sun ChemicalJames La Rocca - Superior Printing Ink

Geo Peters - Wiko Color

RODMAN PUBLISHINGPRESIDENT

Rodman J. Zilenziger Jr., [email protected]

EXECUTIVE VICE PRESIDENTMatthew J. Montgomery, [email protected]

GROUP PUBLISHERDale Pritchett, [email protected]

ADVERTISING SALES (U.S.)Kim Clement Raerty, [email protected]

CLASSIFIED SALESPatty Ivanov, [email protected]

Phone: (631) 642-2048; Fax: (631) 473-5694

ADVERTISING SALES (HONG KONG, TAIWAN AND CHINA)Michael R. Hay, Ringier Trade Publishing Ltd.,

401-405 4/F New Victory House, 93-103 Wing Lok StreetSheung Wan, Hong Kong Phone:

(852) 2369 8788 Fax: (852) 2869 5919E-mail: [email protected]

EUROPEAN SALESBaudry Boisseau; Baudry Boisseau Associates, Rue J. Lebeau, 27,

B-1000, Brussels, BelgiumPhone: 32-2-513-06-47 Fax: 32-2-514-17-38

E-mail: [email protected]

PRODUCTION DIRECTORSharon Messner, [email protected]

PRODUCTION MANAGERPat Hilla, [email protected]

CIRCULATION MANAGERJoe DiMaulo, [email protected]

ONLINE DIRECTORPaul Simansky, [email protected]

INK WORLD

A Rodman Publication70 Hilltop Road Ramsey, NJ 07446 USATel: (201) 825-2552 Fax: (201) 825-0553

www.inkworldmagazine.com

Ink World (ISSN 1093-328X) is published bi-monthly by Rodman Media Corp., 70 Hilltop Road,Ramsey, NJ 07446-0555 USA. Phone (201) 825-2552. Fax (201) 825-0553. Periodical postage paid atRamsey, NJ 07446 USA and additional mailing ofces. Publications Mail Agreement No: 40028970.Return Undeliverable Canadian Addresses to Circulation Dept., P.O. Box 1051, Fort Erie, ON L2A6C7; [email protected]. POSTMASTER: Send address changes to Ink World, 70 Hilltop Road,Ramsey, NJ 07446-0555 USA. Subscription Rates or non-qualifed readers: U.S.one year, $75;two years, $105; Outside U.S. and overseasone year, $95 (U.S.); two years, $145 (U.S.); Foreign AirMail, $195 a year; single issues $12. Missing issues: Claims or missing issues must be made withinthree months o the date o the issue. Printed in the USA.

Send address changes to:[email protected]

Phone: 201 825 2552 x356 Fax: 201 825 6582

Authorization to photocopy items in Ink World or internal or personal use, or the internalor personal use o specifc clients is granted by Rodman Publishing, provided base ee oUS $1 per page is paid directly to: Copyright Clearance Center, 27 Congress St., Salem, MA01970 USA.

Packaging, Inkjet InkMarkets Continue

To Show Growth

There has been some good news or the ink industry during

the past year. Many ink manuacturers have reported that

their sales improved, although margins remain tight. For

the most part, raw material cost and supply have stabilized, albeit

at a higher level than beore.

During its 2013 annual convention, the National Association

o Printing Ink Manuacturers (NAPIM) released its State o the

Industry Report or the past year. While the survey shows that

printing ink sales increased by 0.9% rom 2011, volume declined

3.5%, mostly on the publication/commercial side. NAPIM reportsthat the ink industrys EBIT was 1.2%, which is a minor return;

raw material prices play a major role in that fgure.

The strongest sales growth is coming rom the packaging and

inkjet segments. In The Packaging Ink Market, starting on page 18,

ink industry leaders discuss the trends they are seeing in the pack-

aging feld. In The Inkjet Ink Report, which begins on page 27,

leading inkjet ink companies oer their thoughts on the growth

areas o the uture.

Makers o resins and additives confrmed that sales improved in

2012, and added that ink manuacturers are looking or improved

products. In The Resin Report, starting on page 24,and The Additives

Market, beginning on page 30,industry executives oer their insightsin their respective markets.

On a personal note, I am honored to welcome Penny Holland,

vice president, NAI marketing at Sun Chemical, to Ink Worlds

Editorial Advisory Board.

At Sun Chemical, Ms. Holland is responsible or setting and co-

ordinating a marketing strategy throughout the organization. She

has more than 20 years experience in the printing industry; prior

to joining Sun Chemical, she was Oc North Americas director,

business development, where she and her team were responsible

or managing the wide ormat product portolio. Beore Oc, Ms.

Holland held various fnancial positions at Xerox Corporation. Shereceived her undergraduate degree in fnance and her MBA rom

the Kellogg School o Management at Northwestern University.

I rely heavily on Ink Worlds Editorial Advisory Board or guid-

ance and advice, and with Ms. Hollands expertise, we will con-

tinue to provide our readers with the comprehensive inormation

they need during these changing times.

David Savastano

Ink World Editor

http://www.inkworldmagazine.com/http://www.inkworldmagazine.com/http://www.inkworldmagazine.com/http://www.inkworldmagazine.com/http://www.inkworldmagazine.com/http://www.inkworldmagazine.com/mailto:[email protected]:[email protected]:[email protected]:[email protected]:[email protected]:[email protected]:[email protected]:[email protected]:[email protected]:[email protected]:[email protected]:[email protected]:[email protected]:[email protected]:[email protected]:[email protected]:[email protected]:[email protected]:[email protected]:[email protected]://www.inkworldmagazine.com/mailto:[email protected]:[email protected]:[email protected]:[email protected]:[email protected]:[email protected]:[email protected]:[email protected]:[email protected]:[email protected]:[email protected]:[email protected]:[email protected]:[email protected]:[email protected]:[email protected]:[email protected]:[email protected] -

7/27/2019 Ink World Magzine_Vol.19, No.3_2013-05

7/52

In or out of water

Micro Powders waxes

make a critical difference.

Whether your products are waterborne or conventional, whether

you are looking for abrasion resistance, slip or other essential

qualities Micro Powders gives your formulas the properties you

want with total reliability, flexibility and creativity. For consistent

results, personal service and innovative ideas, nothing outperforms

Micro Powders specialty wax additives.

ISO Certified 9001

MICRO POWDERS, INC.

Visit our new website

www.micropowders.com

580 White Plains Road,Tarrytown, NY 10591 Telephone: 914.793.4058 Fax: 914.472.7098 Email: [email protected]

Ideal for waterborne products and all your formulations!

http://www.micropowders.com/mailto:[email protected]:[email protected]://www.micropowders.com/ -

7/27/2019 Ink World Magzine_Vol.19, No.3_2013-05

8/528 www.inkworldmagazine.com May/June 2013

fresh INK

Richard Bowles Appointed President

of Nazdar Ink TechnologiesNazdar announced the appointment o

Richard Bowles as president o Nazdar Ink

Technologies. In this role, Mr. Bowles will

develop strategic sales, marketing, manu-

acturing, R&D, customer care, quality and

continuous improvement plans to enable

Nazdar Ink Technologies to achieve objec-

tives or growth and proftability.

One o our top priorities is developing

Nazdars leadership team, said Mike Fox,Nazdar CEO. Richard plays a critical role

in leading Nazdar Ink Technologies into

the uture. Todays appointment is the re-

sult o his ability to think strategically on a

global scale, the respect he has earned rom

his peers, customers and partners, and his

signifcant contributions to our company.

Mr. Bowles joined Nazdar in 2002 as

vice president o marketing, and since 2005

has served as vice president and general

manager o Nazdar Ink Technologies.

Fernando Tavara NamedPresident of Sun ChemicalLatin AmericaFernando Tavara has been named president

o Sun Chemical Latin America. In this role,

Mr. Tavara will be responsible or all o Sun

Chemicals Central and South American

and Caribbean ink business.

Mr. Tavara brings 30 years o experi-

ence and knowledge to the position. Most

recently, he worked as the vice president

o sales at Sun Chemical Latin America,

where he managed all sales and operations

rom Mexico throughout Northern Latin

America, including the Andean Region, theCaribbean and Central America.

Fernando has a clear understanding o

the issues and challenges currently impact-

ing Sun Chemicals customers across Latin

America, said Rudi Lenz, president and

CEO, Sun Chemical. He is a tremendous

leader and will be able to make a positive

impact in the industry in Latin America. I

am confdent he will urther strengthen

our business and the partnerships with our

customers.

Prior to joining Sun Chemical in2004, Mr. Tavara worked or Cia. Impresora

Peruana S.A., one o the largest newspaper

chains in Peru, with printing acilities in

our locations, where he held several posi-

tions, rom production manager in 1983 to

general manager in 1989. He also worked

or 14 years in a leadership role at a com-

petitive ink company in Latin America.

Mr. Tavara replaces Gregory Lawson,

who will retire at the end o 2013 ater more

than 10 years at Sun Chemical. Mr. Lawson

has held a number o key positions at Sun

Chemical, including president o North

American Inks, head o purchasing, and

most recently, president o Sun ChemicalLatin America. Mr. Lawson will remain on

hand to help Mr. Tavara transition into his

new role.

Greg has accomplished a great deal or

Sun Chemical and his contributions over

the years have been unparalleled, Mr. Lenz

said. He will be missed when he retires, and

we wish him well in the years ahead.

Rick Westrom AddsNew Responsibilities

At INX InternationalRick Westrom, INX International InkCo.s senior vice president o strategic

sourcing, has been promoted and will take

on additional duties as senior vice president

R&D director.

Toyo Ink Acquires Arets International

By David Savastano

There has been much talk in recent years about

consolidation within the ink industry. Most o the discussion has

been centered on the largest international ink manuacturers,but the only sizable acquisitions have been o medium-sized

packaging ink manuacturers.

The April 25, 2013 announcement that Toyo Ink SC Holdings

Co. acquired Arets International NV, the holding company o

the Arets Group, a Niel, Belgian-based UV ink specialist, fts

this trend well. The UV ink market has been one o the stronger

perormers in recent years, and Toyo Ink has long looked to

expand its operations in Europe. This purchase allows Toyo Ink

to achieve both goals.

Toyo Ink Group paid 9 million (1.17 billion yen, or $11.8

million) to obtain all the outstanding shares in Arets International

NV, the holding company o the Arets Group. Arets, which was

owned by its shareholders Next Invest NV and Fortis Private

Equity Venture Belgium NV, had sales o 48,680,000 ($63.6

million) in 2012, although, ater taxes, the company recorded a

loss o 2,423,000 ($3,167,000).

With the acquisition o Arets, Toyo Ink expects to increase

its UV ink sales rom the current 15 billion ($150 million) to30 billion ($300 million) within three years.

According to a statement announcing the acquisition, Toyo

Ink Group is ocusing on globalization as its primary growth

initiative. To do this, Toyo Ink Group is developing its supply

chain by expanding sales and creating manuacturing bases

in Asia and emerging economies, its growth area. The recent

JV between Toyo Ink and Heubach to set up an organic pigment

plant at Ankleshwar, Gujarat, India would be an example o this.

Toyo Ink is also introducing ways o using existing products

and creating demand rom replacement with eco-riendly

products in Japan and Western countries, its mature areas.

UV-cured inks is well positioned or signifcant uture growth.

http://www.inkworldmagazine.com/http://www.inkworldmagazine.com/http://www.inkworldmagazine.com/http://www.inkworldmagazine.com/http://www.inkworldmagazine.com/http://www.inkworldmagazine.com/http://www.inkworldmagazine.com/ -

7/27/2019 Ink World Magzine_Vol.19, No.3_2013-05

9/52

who needs an innovative formulation for

energy curable dispersions for inkjet?

SpectraRAY UV IJ Dispersions

you do.

Delivering what you need as an UV ink developer

Fine particle size distribution

Stable to viscosity and filterability

Low coarse particle count

High chroma

High light fastness & chemical resistance

working for you.

Call us today! 1-800-543-2323

-

7/27/2019 Ink World Magzine_Vol.19, No.3_2013-05

10/5210 www.inkworldmagazine.com May/June 2013

resh INK

In his new position, Mr. Westrom takes

over the R&D acilities in West Chicago, IL.

He began working or INX International

in January 1988, and has served in manycapacities while earning several promo-

tions throughout the years. Mr. Westrom

also has earned recognition rom his peers

in the industry. In 2011, he was honored by

the Chicago Printing Ink Production Club

as its Ink Person o the Year.

Rick has done a antastic job or INX

International throughout his career, said

Rick Clendenning, president and CEO.

These two roles are very important, and

by having Rick handle the responsibilities

o these positions, it creates a great dealo synergy in two important areas within

our company. He is looking orward to his

new position and working with the best

R&D sta in the industry.

EFI Mourns Passing oCompany Founder Ef AraziEFI mourns the passing o its ounder and

rst CEO, Eraim E Arazi, who died

on his 76th birthday, April 14. Mr. Arazi

created his namesake company in 1988

ater a pioneering, 20-year career as theounder, president and CEO o the rst

Israeli high-tech rm, Scitex Corporation.

Mr. Arazi served as chairman, presi-

dent and CEO o Electronics or Imaging

(EFI) rom 1988 until 1994, guiding the

business rom modest beginnings, with 18employees in North Beach, San Francisco.

Under his leadership and technical guid-

ance, EFI launched Fiery, the printing

industrys rst color server, in 1991. The

product was an immediate success, lead-

ing to signicant OEM partner contracts

with the worlds leading color printer

manuacturers. Mr. Arazi completed an

initial public oering or EFI in 1992. In

1994, Fortune magazine named EFI the

nations astest-growing public company.

We are all deeply saddened by thepassing o our ounder and one o the

most infuential leaders in the history o

our industry, and we send our sympathies

and condolences to Es amily, said Guy

Gecht, the current CEO o EFI. Though

no longer with us, Es spirit o entrepre-

neurship, brilliant creativity and love o

innovation will always remain at EFI.

Mr. Arazi is widely considered to be

the ather o Israels high-tech industry

or his role with Scitex. In the late 1960s,

Mr. Arazi also worked with NASA whilestudying at MIT, developing the camera

used to broadcast the Apollo 11 moon

How can Iovercome printdefects whenformulating a

low-VOC, water-based inkfor nonporous substrates?

Ask the Expert

JeanineSnyderSenior

Development

Chemist

QApplying waterborneinks on dicult-to-coatsuraces such as plas-tics, lms and non-porous substrates

presents signicant challengesto ink ormulators. To maximizewetting and minimize craters, sh-eyes, orange peel and pinholes,the proper suractant is neededto promote substrate wettingand minimize oam generation.Dynol 810 suractant, developedwith a superior balance o prop-erties compared to traditionalsilicone and fuorosuractants, o-ers exceptional perormance ininks and a wide variety o otherwater-based coating applications.Based on Gemini technology, ithas the ability to reduce equilib-rium and dynamic surace tensionto levels not achieved with othersuractants. Dynol 810 suractant,specically designed or water-borne printing inks and overprintvarnishes, is an excellent alterna-tive or dicult-to-wet substratesrequiring good fow and levelingunder diverse application condi-

tions. It oers superior wettingand printability while maintainingexcellent oam control over tradi-tional organic, silicone and fuoro-based suractants when used toprint on lm substrates such as ori-ented polypropylene or high-slippolyethylene.

A

tell me more

www.airproducts.com/surfactants

Air Products and Chemicals, Inc., 2012 (34785) N16

Great Western InkAcquires Reno Ink

Great Western Ink announced the

successul acquisition o Reno Ink o

Reno, NV.

Eective immediately, Ken Oliver

will guide the Reno team during the

transition. Great Western Ink willacquire Reno Inks business.

We are excited to have Reno Ink

join our growing amily, said Keith

Voigt, president o Great Western Ink,

We think combining GWIs product

breadth and technical depth with Reno

Inks outstanding service reputation is

a winning combination or Reno Ink,

GWI, and most importantly the Reno

customers. As always, GWIs goal

is to humbly become the preerred

supplier to the independent printing

communities we serve and Reno Ink

will help us ulfll our mission in the

greater Reno area.

Great Western Ink has been a

great partner to us and it seemed a

logical next step or us. This change

will help strengthen Reno Inks span

o products, technical support and

overall service to our customers,said Ken Oliver, president o Reno

Ink. I have always respected their

products, their service, and their

conduct in the market. I look orward

to helping my current customers

take ull advantage o all GWI has to

oer. Keith has put together a strong

team that is dedicated to helping the

local community o printers. That is

what Reno Ink was all about. So this

is a natural ft.

http://www.inkworldmagazine.com/http://www.inkworldmagazine.com/http://www.inkworldmagazine.com/http://www.inkworldmagazine.com/http://www.inkworldmagazine.com/http://www.inkworldmagazine.com/http://www.airproducts.com/surfactantshttp://www.airproducts.com/surfactantshttp://www.airproducts.com/surfactantshttp://www.inkworldmagazine.com/http://www.airproducts.com/surfactants -

7/27/2019 Ink World Magzine_Vol.19, No.3_2013-05

11/52May/June 2013 www.inkworldmagazine.com 11

fresh INK

landing in 1969.

Ink, Narrow Web Industries

Mourn Louis WernekeLouis O. Werneke, Inky Lou, died onMarch 31 2013. Mr. Werneke was born

June 23, 1926 and was married to the late

June Louise Werneke. He is survived by

his two children, Matthew Werneke and

Lisa Werneke Nelson; he lived to see and

enjoy eight grandchildren. Mr. Werneke

was preceded in death by his wie, June,

in 2008, and his brother, Skip, in 2003.

Mr. Werneke was a successul busi-

nessman and the ounder o Werneke

Ink Company. He played a pivotal rolein shaping the narrow web tag and label

market, helping to build the industry as

it is today.

In 1973, Mr. Werneke began the de-

sign o the very rst water-based ink or

exographic printing. He then made the

decision to dedicate time and energy to

develop a water-based system or label

printing. Mr. Werneke built a success-

ul global business, which remains a key

acet o Flint Group today.

Siegwerk Invests in Futureof Siegwerk CanadaSiegwerk Canada announces the open-

ing o its new acility in the Greater

Toronto Area (GTA).

We are expanding our sales, technical

service and distribution ootprint in the

GTA to support growth, Dave Hiserodt

BU head, Flex Pack CUSA, said.

The new acility will allow Siegwerk

sales and service staf to provide a more

expedient service response or its exist-ing and potential customer base in the

GTA. There will be the addition o lo-

cal blending capabilities and enhanced

warehouse space to allow or growth

and investment in the region. The sales

and distribution center currently located

in Laval, Quebec will remain to serve

Quebec-based customers.

Sensient TechnologiesAnnounces Private

Placement Debt TransactionSensient Technologies Corporation

announced that it has entered into an

agreement with investors or the issu-

ance o $75 million and 38 million

in 10 year, ixed-rate, senior notes.The debt will mature in November

2023. Proceeds rom the oering will

be used to repay maturing notes and

bank debt.

This transaction allows the com-

pany to continue to strengthen its

capital structure, and do so at very

attractive rates, said Kenneth P.Manning, chairman and CEO o

Sensient Technologies. We think

this is a good time to issue long-term

debt.n

http://www.inkworldmagazine.com/http://www.inkworldmagazine.com/http://www.inkworldmagazine.com/http://www.inkworldmagazine.com/http://www.inkworldmagazine.com/http://www.inkworldmagazine.com/http://getscanlife.com/http://www.sartomer.com/siteregistration.asphttp://www.sartomer.com/http://www.inkworldmagazine.com/ -

7/27/2019 Ink World Magzine_Vol.19, No.3_2013-05

12/52

market watch

12 www.inkworldmagazine.com May/June 2013

Toyo Ink, EFI, Sensient and ALTANA Report Results

Toyo Ink SC Holdings Co., Ltd.

announced the third quarter nancial

results or the scal year ending March

31, 2013.

Net sales or the rst three quarters o

scal 2012 (rom April 1, 2012 to Dec. 31,

2012) were 187,189 million ($1.89 bil-

lion), a 0.9% over 2011s rst three quar-

ters. Operating income increased 25.9%

to 13,773 million ($139 million), whilenet income was 6,102 million ($61.7

million), an increase o 4.6% compared

to the rst three quarters o 2011.

Sales in the Printing and Inormation

Business decreased to 56,150 mil-

lion($568 million), down 2.1% year on

year, but operating income increased

to 2,440 million ($24.7 million), up

144.3% year on year, as a result o cost-

cutting measures and higher sales o ad-

vanced products. Demand or oset ink

in Japan remained stagnant, refecting thedelayed recovery o the economy as well

as a structural recession resulting rom

the progress o digitization. However,

compared with the same period in the

previous scal year, when business was

aected by voluntary advertising re-

straints due to the earthquake, demand

or commercial and newspaper printing

recovered.

Sales o advanced products increased,

including products with high UV sen-

sitivity and inks or rotary oset print-ing, grew. Meanwhile, a slowdown o

the economies in China and Southeast

Asia resulted in sluggish sales growth, and

earnings were hurt mainly by the escalat-

ing price competition and higher labor

costs.

Toyo Ink noted that sales in the over-

all Packaging Business were 42,607

million ($430.7 million), up 1.5% year

on year. Operating income was 1,876

million ($19 million), up 40.4% year on

year. Mainstay gravure inks or packag-ing remained sluggish, although they

recovered slightly in the second hal.

Sales o eco-riendly inks or packaging

increased in China and Southeast Asia

and demand or gravure inks or con-

struction materials remained strong in

North America.

Electronics For Imaging, Inc.

(EFI) announced its results or the rst

quarter o 2013.For the quarter ended March 31,

2013, the company reported rst quar-

ter record revenue o $171.4 million,

up 7% compared to rst quarter 2012

revenue o $160.1 million. First quarter

2013 non-GAAP net income was $15.8

million or $0.33 per diluted share, which

included an unavorable non-operational

currency impact o $0.04 per diluted

share, compared to non-GAAP net in-

come o $14.2 million or the same pe-

riod in 2012. GAAP net income was$8.4 million or $0.17 per diluted share,

compared to $6.2 million or the same

period in 2012.

The EFI team delivered a great rst

quarter with revenue growth above our

expectations, a solid increase in prot-

ability, and very strong cash generation,

said Guy Gecht, CEO o EFI.

Sensient Technologies Corporation

reported diluted earnings per share o 43

cents or the three months ended March31, 2013, which includes restructuring

costs o 19 cents per share. As adjusted,

to remove the impact o the restructur-

ing costs, diluted earnings per share were

62 cents, an increase o 6.9% over the 58

cents reported in the rst three months

o 2012, and a record or the rst quarter.

Consolidated revenue o $366 million

in the rst quarter was unchanged rom

the prior year. Operating income was

$36.3 million. The companys operating

margin, as reported, was 9.9%.I am very pleased with the companys

perormance in the rst quarter, said

Kenneth Manning, chairman and CEO

o Sensient Technologies. We will re-

main ocused on improving protability,

and our restructuring program will en-

hance this eort. I am very optimistic

about the companys uture.

The Color Group reported revenue

o $127.9 million in the rst quarter o

2013, compared to $132.3 million in thecomparable period last year. The Groups

operating margin or the rst quarter

increased to 20.3%, rom 19.5% in last

years rst quarter. Strong perormances

in industrial inks and the ood and bev-

erage businesses in Latin America and

Brazil contributed to the operating mar-

gin improvement.

ALTANA announced that it increased

its sales and earnings again in 2012.

ALTANA increased sales by 5% to1.7 billion in the business year 2012.

Earnings beore interest, taxes, depre-

ciation and amortization (EBITDA) also

grew by 5%, reaching 323 million. At

19%, the EBITDA margin remained at

a high level.

In 2012, we proved once again that

we are able to achieve protable growth,

even in a rapidly changing environment,

said Dr. Matthias Wolgruber, CEO o

ALTANA AG. This was possible be-

cause we have implemented our growthstrategy consistently and acted fexibly.

The BYK Additives & Instruments

division increased sales 6% to 618 mil-

lion in 2012. At 341 million, sales in the

ECKART Eect Pigments division was

2% down on the previous year.

The highest sales increase in 2012 was

achieved by the ACTEGA Coatings &

Sealants division. At 334 million, sales

were up 12% on the previous year. This

development was driven by the acquisi-

tion o the Colorchemie Group in mid-2011.n

http://www.inkworldmagazine.com/http://www.inkworldmagazine.com/http://www.inkworldmagazine.com/http://www.inkworldmagazine.com/http://www.inkworldmagazine.com/http://www.inkworldmagazine.com/ -

7/27/2019 Ink World Magzine_Vol.19, No.3_2013-05

13/52

Test print your ink and paper on a Little Joe Proof Press.

Check offset ink for printability, color, gloss, light fastness and fade, rub and scratch resistance, etc.

Print on any substrate: paper, board, plastic, or metal.

Essential for the offset ink, pigment, printing, and paper industries or any industry that must test

their product with a printed sheet.

Quick and simple to use.

Use Grind Gages more consistently.

The ADM Automatic Draw Down Machine from Little Joe Industries

provides the most consistent use of grind gages available.

Allows less operator training while providing more consistent results.

Smooth motorized scraper movement.

Consistent scraper angle.

Accurate scraper force.

Fast and easy to use.

ADM - 1

Automatic Draw Down Machine

OFFSET PROOFING PRESS

Little Joe Industries

10 Ilene Court, Suite 4

Hillsborough, NJ 08844

Tel: (908)359-5213

Fax: (908)359-5724

http://www.littlejoe.com/mailto:[email protected]:[email protected]://www.littlejoe.com/ -

7/27/2019 Ink World Magzine_Vol.19, No.3_2013-05

14/5214 www.inkworldmagazine.com May/June 2013

european report

BYSEAN MILMOEUROPEAN EDITOR

Competition for European Pigment

Market Continues to Increase

I

t is a dicult time or many manuacturers and distributors

o pigments to printing ink producers in Europe, not only

because o poor demand due to an economic slowdown inthe region but also increasing regulatory pressures.

At the same time, ink producers want higher and more con-

sistent standards in pigments because they themselves are hav-

ing to meet tougher requirements rom their customers or

improved quality controls.

Some pigment suppliers in Europe most o them based

in China and India or with production capacity in the two

countries are now acing the dilemma o whether to adapt to

harsher trading and regulatory conditions in Europe or to pull

out o the market altogether.

As a result, there is likely to be restructuring and more con-

solidation within the European printing inks pigments sector mainly in its commodity section.

The diculties among suppliers were evident at the recent

European Coatings Show (ECS) at Nuremberg, Germany, at

which printing ink pigment producers and distributors were

participants.

What was noticeable, however, was that a relatively large

number o Chinese and Indian producers are determined to

stay in the Europes printing ink pigments sector despite the

regions current economic troubles. Ironically, at a time o static

growth in demand, this has made the market or commodity-

type products even more stressul.

Sales are going down, yet the competition is getting evenmore intense, said one distr ibutor o Chinese printing ink pig-

ments at the exhibition. Only a ew years ago, it used to be

a comparatively easy market at least at the commodity end.

Now it has gotten much harder. A sizeable proportion o Asian

exporters want to stick it out. But they realize low prices are

not sucient and are trying to improve reliability and back up

services.

However, there also seems to be a number o Asian suppliers,

particularly those based in China, whose resolve is weakening

under the strain. They are looking to the option o concentrat-

ing on their ast growing domestic sector and to the rapidly

expanding regional markets in Southeast Asia and the Far East.You get the sense that changes in the structure o the

European market are imminent, said Samarjit Sathe, head o

marketing o Heubach Colour Pvt. Ltd., Baroda, India, a sub-

sidiary o Heubach GmbH. In the next ve years, a number osmaller Asian players in commodity pigments will pull out o

the region or merge with bigger producers.

Reacting to Market ChangesRestructuring moves are already being made by European

players. BASF announced in April that it is reorganizing its pig-

ments and resins business unit, which produces printing ink

pigments, mainly high perormance grades.

The company is scaling down some o its printing ink pig-

ment activities in Europe, particularly those based in Basel,

Switzerland, so that management o pigment product quality

and saety in Europe can be concentrated in BASFs headquar-ters at Ludwigshaen, Germany.

European producers are making their operations leaner in

response to a static domestic market. Demand in Europe has

been showing little or no growth or the last ew years, and is

unlikely to pick up signicantly in the near uture.

The printing ink pigments market in Europe was pretty

fat last year, and looks likely to continue to be fat through to

at least next year, said Philippe Verhelle, product and marketing

manager at Cappelle. There has been some small temporary

increases in demand over the last ew months when customers

can no longer rely on their own stocks and have to buy again.

There have also been some segments where there has beenunderlying growth, like inks or digital pr inting and packaging,

especially ood packaging.

These are segments where customers require high peror-

mance, oten innovative, pigments, which have been manuac-

tured in conditions o rigorous quality control. But even these

have been subject to fuctuations in demand.

Clariant reported that its pigment sales plummeted last year

to levels below those o 2008-09. There was even a decrease

in its sales o its pigments or digital inks, which the company

has pinpointed as a niche with a potential or growth due to

high technological barriers. Sales had been depressed by weak

demand and stock reductions among key customers, it said.Nonetheless, even in a year o relatively rail demand,

http://www.inkworldmagazine.com/http://www.inkworldmagazine.com/http://www.inkworldmagazine.com/http://www.inkworldmagazine.com/http://www.inkworldmagazine.com/http://www.inkworldmagazine.com/http://www.inkworldmagazine.com/ -

7/27/2019 Ink World Magzine_Vol.19, No.3_2013-05

15/52

http://www.printedelectronicsnow.com/ -

7/27/2019 Ink World Magzine_Vol.19, No.3_2013-05

16/5216 www.inkworldmagazine.com May/June 2013

european report

Clariants pigments operation was one o the companys most

protable businesses, with a sales margin o close to 17% last

year against 22% in 2011, based on earnings beore interest,

taxes, depreciation and amortization (EBITDA).BASF, another leading player in the upper end o the print-

ing ink pigments segment, has been continuing to ocus its

R&D on high perormance ink pigments, despite slimming

down some o its printing ink pigments operations,

The development o printing ink pigments will remain

interesting or us, said Stephan Suetterlin, head o BASFs pig-

ments business in Europe. The requirements regarding pu-

rity, color strength and particle size distribution o pigments

or digital printing are constantly increasing. For new pack-

aging technologies, heat resistance is becoming more impor-

tant. Thereore we believe that high-perormance pigments are

gaining share rom classical pigments.Some leading players have also been expanding in the eect

pigments sector, where there have been shits in demand due

to changes in consumer taste. There has, or example, been a

swing away rom the glittering, shimmering appearances to a

more muted, matte look, which requires changes in the shape

and size o metallic pigments.

Sun Chemical and its parent company DIC o Japan last

year acquired Benda-Lutz Werke GmbH o Austria. With pro-

duction plants in Austria, Poland, Russia as well as the U.S.,

the acquisition considerably strengthens Sun Chemicals global

position in eect pigments in the graphics markets.

This acquisition gives us more opportunities to dierenti-ate our printing ink pigments, which is even more important

in a at market, said Mehran Yazdani, vice president and gen-

eral manager, Sun Chemical Perormance Pigments, Electronic

Materials, and DIC International, at the ECS exhibition. We

have more exibility in our ability to meet customers require-

ments or tailor-made solutions and to respond to changes in

demand, like the need or matte nishes.

Except in some niche, high perormance segments, printing

ink pigment prices have been sotening in the ace o weak de-

mand. At the same time, however, protability has been urther

squeezed by a continued rise in raw materials costs.

Many o these increases stem rom economic and environ-mental trends in China, which has a virtual monopoly on the

supply o some key intermediates or production o bulk or-

ganic pigments. Market conditions in India, also a major pro-

ducer o some raw materials, also have had an impact on costs.

In its latest raw materials outlook, Flint Group warned that

stricter environmental laws, particularly those on treatment

o wastewater efuent, were pushing up raw material costs in

China and India.

Closure o capacity due to stricter environmental rules was

also causing shortages o key intermediates, like beta naphthol or

red pigments. The cost o intermediates or yellow pigments was

being pushed up by a combination o eedstock shortages andthe higher cost o basic raw materials like benzene and toluene.

Hikes in raw material costs are also aecting producers o

bulk inorganic pigments like titanium dioxide (TiO2), whose

prices, until last year, had been rising steeply in Europe and in

much o the rest o the world.For a while, higher TiO

2prices have been giving produc-

ers o the pigments their highest prots or many years. But

these have steadily been eroded over the last two years by rising

prices or the raw materials like titanium and ilmenite, mainly

because o a lack o adequate investment by mining companies

in their extraction.

Around the middle o last year, TiO2prices began to atten,

and even in the last months o 2012 started declining. But costs

o raw materials or the white pigment continued to go up.

Faced with the prospect o weakening selling prices and

persistent rises in raw material costs, some producers have been

deciding to pull out o the business.Sachtleben, Europes leading producer o specialty TiO

2

or printing inks and other niche sectors, which has been a

joint venture between Rockwood Holdings and Kemira, has

eectively been put up or sale. Rockwood last year bought

Kemiras minority stake in the company, although it had previ-

ously announced that TiO2was now a non-core business.

Rockwell last year recorded a 4% drop in TiO2

sales at

Sachtleben rom 784 million in 2011 to 731.5 million, but

the shrinking margins were reected in a 36% dive in EBITDA

rom 258 million to 165 million. By the ourth quarter, the

margins contraction had accelerated, with EBITDA prots

plunging by 90% despite a 14% rise in sales.

REACH on the HorizonIn addition to rising raw material costs, pigment producers and

suppliers are also having to ace higher costs o compliance

with tighter regulations in Europe.

The most prominent o these is REACH, the EUs legisla-

tion on the registration, evaluation and authorization o chemi-

cals, under which pigments and other substances or, i they are

compounds, their individual ingredients, have to be registered

with dossiers detailing their saety proles. I chemicals ail to

be registered, they have to be taken o the market.

A large number o pigment chemicals have had to be regis-tered over the last ew months to meet a deadline at the end o

May or the submission o dossiers. This is the second o three

registration deadlines, based on the total tonnages o chemicals

sold on the European market, with the last in mid-2018 or

chemicals with the lowest volumes.

Registration is expensive or us but even more expensive

or the smaller companies, said Mr. Yazdani. A lot o pro-

ducers, particularly Asian pigment exporters, will probably be

walking away rom the European market by not registering

their products because o the high costs.n

European Editor Sean Milmo is an Essex, UK-based writer special-izing in coverage of the chemical industry.

http://www.inkworldmagazine.com/http://www.inkworldmagazine.com/http://www.inkworldmagazine.com/http://www.inkworldmagazine.com/http://www.inkworldmagazine.com/http://www.inkworldmagazine.com/http://www.inkworldmagazine.com/ -

7/27/2019 Ink World Magzine_Vol.19, No.3_2013-05

17/52

http://www.inkworldmagazine.com/http://www.coatingsworld.com/ -

7/27/2019 Ink World Magzine_Vol.19, No.3_2013-05

18/5218 www.inkworldmagazine.com May/June 2013

Packaging Inks

BYDAVID SAVASTANOEDITOR

The Packaging Ink MarketThe market for packaging inks remains strong,with water-based, solvent-based, sheetfedand UV/EB inks all having their areas of growth.

The packaging eld remains the strongest area o growth

in printing, and the numbers o consultants and trade

associations appear to back this up. For example, in its

report, The Future o Packaging in North America to 2017,

Smithers Pira estimates that the North American packaging

industry had sales o $169.1 billion in 2012, with an estimated

growth to $186 billion by 2017.

In terms o segments, the Flexible Packaging Association

(FPA) estimates in its FPA Flexible Packaging Industry

Segment Prole Analysis that the U.S. exible packaging mar-

ket was $26.7 billion in 2012. By contrast, the FPA reportedthat 2001 exible packaging sales in the U.S. were $19.5 billion,

or a nearly 37% growth rate during the past 11 years.

For corrugated printing, the Association o Independent

Corrugated Converters puts corrugated packaging sales at $21

billion or 2012. On the olding carton side, the Paperboard

Packaging Council estimates North American sales at $8.8

billion, with an average annual growth rate o 2.4% in sales

through 2016.

PCI Films Consulting calculates the overall global

exible packaging market to be approximately

$80 billion.

In terms o printing ink, inits 2013 State o the Industry

Report, the National

Association o Printing

Ink Manuacturers

(NAPIM) estimated

the U.S. liquid ink

market to be ap-

proximately $1 bil-

lion in 2012, with

more than two-

thirds being exo

ink sales.In other words,

packaging continues to be a major business, and or the most

part, packaging ink manuacturers are seeing growth in their

business.

Felipe Mellado, chie marketing ocer, Sun Chemical, said

that Sun Chemical has seen moderate growth in 2012 and sim-

ilar growth in 2013 in the packaging market.

Sun Chemical will continue to see signicant growth in

the exible packaging segment, Mr. Mellado added. The

packaging market aces diferent challenges than other mar-

ket segments, such as migration, the push toward smaller pack-

age size, recyclability and other eforts to reduce the impact opackaging on the environment, but these challenges are great

opportunities or growth at Sun Chemical. Were working with

brand owners and major packaging groups to provide them

with solutions or specialized packaging or the uture.

The North American exible packaging volumes remained

at to slightly up compared to 2011, which could be character-

ized as resilient in the ace o decreasing GDP and consumer

condence as 2012 closed, said Deanna Whelan, global mar-

keting manager, packaging and narrow web

at Flint Group. With raw material

pricing coming back in line and

with the economic head-winds subsiding, we expect

growth in 2013 more in

line with generally ac-

cepted CAGRs or

this segment. The

North American

paper and board

segment was at

to slightly down

compared to

2011 or the

same reasonsbut with thePhoto courtesy of Wikoff Color.

http://www.inkworldmagazine.com/http://www.inkworldmagazine.com/http://www.inkworldmagazine.com/http://www.inkworldmagazine.com/http://www.inkworldmagazine.com/http://www.inkworldmagazine.com/mailto:[email protected]://www.inkworldmagazine.com/mailto:[email protected] -

7/27/2019 Ink World Magzine_Vol.19, No.3_2013-05

19/52

We createchemistry

that makespackaginglove UVcurable

systems.

Looking for UV curable systems for packaging applications? UV

inks and overprint varnishes formulated with Irgacure LEX 201

photoinitiator provide good cure speed, low odor, very low

migration and ease of use. At BASF, we create chemistry.

www.basf.us/dpsolutions

= REGISTERED TRADEMARK OF BASF CORPORATION.

http://www.basf.us/dpsolutionshttp://www.basf.us/dpsolutions -

7/27/2019 Ink World Magzine_Vol.19, No.3_2013-05

20/5220 www.inkworldmagazine.com May/June 2013

Packaging Inks

added complication o a growing con-

sumer preerence or the exible orm

actor.

Mark Hill, vice president o R&D orINX International Ink Co., said that pack-

aging was very strong overall in 2012, par-

ticularly on the ood side.

Food packaging was especially strong

with increased activity in that segment,

and it has carried over into the rst quar-

ter this year with positive results, Mr.

Hill said. The remaining markets, how-

ever, posted at results or showed slight

declines.

With improvement in the overall

economy, printers are busier and theirbacklogs are improving, said Daryl

Collins, vice president o sales and market-

ing or Wiko Color. They are using exist-

ing capacity to ll demand, but we do not

see capital investment in new presses pick-

ing up steam as yet. Our best growth this

year came in the label and exible packaging markets.

The packaging business is growing and is strong in the

U.S., said John Copeland, president and COO, Toyo Ink

America, LLC. Globally there is growth in the packaging are-

na and many opportunities. A number o third world countries

are in the initial phases o transormation rom non-packagedood to packaged products. Thats the good news.

It has been steady to slight growth, said Rob Calli, vice

president, BCM Inks.

Key Growth OpportunitiesPackaging encompasses a wide range o products, rom oods to

electronics and much more. Not surprisingly, ink manuactur-

ers see certain products growing aster than others. Ms. Whelan

noted that exible packaging and labels are strong growth areas.

The converted exible packaging segment is attractive and

growing, Ms. Whelan said. Within exible packaging, lami-

nation structures that oer improved protection and shel liewill grow above rates associated with the main segment. Label

markets like shrink, IML and heat transer (wide and narrow

web) are also estimated to grow at attractive rates.

Mr. Copeland also sees exible packaging as a strong growth

market.

Although relatively small at this moment, more pouch

printing will make inroads into the olding carton markets, Mr.

Copeland added. More companies are looking or innovation

in packaging, and exible packaging oers a variety o interest-

ing options.

Mr. Hill believes that ood packaging oers the best

opportunities.I think the biggest growth market will continue to be ood

packaging, Mr. Hill said. Paper and pa-

perboard packaging are stable in certain

markets, but plastic packaging is trending

upwards at a much aster rate. We are see-ing customers investing in equipment or

the exible packaging markets that were

not players in that segment previously.

We eel the graphic corrugated market

and digital print market oer tremendous

growth opportunities due to the growing

interest in brand color management and

short runs, Mr. Calli said.

Overall, we are seeing an increased o-

cus on the various regulatory legislations

worldwide that are driven by large CPGs,

such as Nestle and the Swiss Ordinanceadoption, said Tony Renzi, vice president,

product management packaging, North

American Inks, Sun Chemical.

In the near term, we expect continued

growth in the label, exible packaging, ink-

jet and export markets, Mr. Collins said.

Raw MaterialsThe ink industry has been heavily impacted by rising raw ma-

terial costs and supply concerns in recent years, but the past

year has seen a stabilization in these areas, albeit at a higher

level than beore.In general, raw material costs have stabilized, Ben Price,

director o purchasing or Wiko Color, said. Throughout

2010 and 2011, Wiko Colors raw material costs increased

drastically, and supply issues were numerous during this period.

There were shortages o titanium dioxide, nitrocellulose and

carbazole violet, to name a ew. Rosin resin prices were another

signicant concern during this time. In late 2011, prices or

most o our raw materials peaked, and we have experienced

moderate price decreases throughout 2012 and into early 2013.

Supply is not a concern or the majority o our raw materials

at this time.

For the most part, the raw materials have stabilized, Mr.Calli said. However, there is continued consolidation within

the supplier market, which will aect price and supply.

In general, at Sun Chemical we see a continuation o the

current moderation trend in the raw materials market this

year, said Ed Pruitt, chie procurement ofcer, Sun Chemical.

Although we have not recently experienced the widespread

shortages and allocations that plagued the industry two years

ago, the raw material supply chain is a continuing concern to

Sun Chemical. A sharp uptick in demand rom the emerging

markets or developed economies could quickly put products

like titanium dioxide, nitrocellulose, carbon black and some

pigments in very tight inventory positions. We also need to bemindul o the potential impact o global weather conditions

Produced by Star Packaging Corporation,

the Eco Ultra Motor Oil Pouch received the

FPAs 2013 Gold Award for Environmental

& Sustainability Achievement.

http://www.inkworldmagazine.com/http://www.inkworldmagazine.com/http://www.inkworldmagazine.com/http://www.inkworldmagazine.com/http://www.inkworldmagazine.com/http://www.inkworldmagazine.com/http://www.inkworldmagazine.com/ -

7/27/2019 Ink World Magzine_Vol.19, No.3_2013-05

21/52

We createchemistry

that makesflexiblepackaginglove ink.

Packaging gets noticed with Laroflex HS 9000 in your flexible film

lamination ink formulations. With improved print quality, high bond

strengths, stronger colors, higher opacity whites, and reduced

solvent usage, your food packaging will love flexible film inks

formulated with Laroflex HS 9000. At BASF, we create chemistry.

basf.us/dpsolutions

= REGISTERED TRADEMARK OF BASF CORPORATION.

http://basf.us/dpsolutionshttp://basf.us/dpsolutions -

7/27/2019 Ink World Magzine_Vol.19, No.3_2013-05

22/5222 www.inkworldmagazine.com May/June 2013

Packaging Inks

on such raw materials as gum rosin, etha-

nol and vegetable oils.

There has been some slowing to the

rise in raw material costs, but in generalthe trend in still going up, Mr. Hill said.

The price o oil and a tight intermediate

supply o raw materials are two reasons

or the price instability, and price uctua-

tions will likely continue this year.

Ms. Whelan said that 2012 appeared

more stable, but costs did continue up-

ward at a slower rate and continue to

work their way through the supply chain.

We do expect to see residual cost in-

creases along with some raw material in-

creases in 2013, Ms. Whelan said. And,o course, increasing transportation and

energy costs will always ace us. Acrylic-

based price increases that aect water-

based inks are starting to surace once again.

Raw material supplies continue to be a

major concern, Mr. Copeland said. Pricing

has been somewhat more stable this past year,

but is still not at a comortable level. In re-

cent years various suppliers have discontinued products, manu-

acturing sites and changed strategies, leaving the ink industry

scrambling or specic products rom time to time.

Solvent-Based, Water-Based and UV InksPackaging ink covers a wide range o inks, and the type o

packaging ink used depends upon the packaging. Typically,

solvent-based exo and gravure inks are used in exible

packaging, as water-based inks are difcult to dry on plastic

substrates. Water-based exo inks are ound on corrugated

and narrow web packages. Sheeted inks are used on olding

cartons. Meanwhile, UV-based inks are used throughout the

packaging segment.

Mr. Renzi noted that environmental advantages are driving

interest in water-based inks, while solvent- and UV/EB-based

inks have some specic perormance advantages.For specic product lines, there is growing interest or

water-based inks, especially with regard to high quality process

printing or pre-print corrugated, Mr. Renzi said. The use o

water-based systems continue to be o interest in an eort to

reduce waste and emissions. Were also seeing some renewed

interest in water-based inks or high perormance laminations

and one part systems or outdoor applications.

As printers continue to push toward higher press speeds,

were also seeing increased interest in solvent-based inks to de-

liver high quality print results with improved speeds and e-

ciencies, Mr. Renzi reported. There is increasing interest in

specialty inks (metallic, color shiting) as well as the use o HDplate technology in order to create a high quality, dierentiated

package. We are seeing growing interest in

our UV curing/energy curing oerings or

the packaging market and applications, es-

pecially EC products where product resis-tance perormance is a key criteria. There is

also growing interest in EB lamination in

combination with EC exo printing inks.

Mr. Calli sees growth in UV var-

nish, and sees opportunities ahead or UV

LED.

There has been a growing interest in

UV varnish, Mr. Calli said. We believe

the next trend will be UV LED.

Mr. Collins noted that EB curing ap-

pears to be picking up interest among ood

packagers.Due to concerns o using UV inks with

ood packaging, we see renewed interest in

EB curing inks vs. UV inks or ood pack-

aging, Mr. Collins said.

Some o the more interesting trends are

in the area o energy curable inks or the

label markets, Mr. Copeland said. We see

interest in UV, electron beam and LED tech-

nologies. There is also continued interest in solvent-based inks

due to perormance qualities and new and improved solvent

reclamation systems.

Ms. Whelan said that energy curing has enjoyed growth inrecent years.

In the converted exible packaging segment, we are see-

ing a renewed interest in water-based inks or shrink sleeve

and lamination, Ms. Whelan said. At the same time, energy

cure processes, especially EB, or lm substrates continues its

steady oray into exible packaging, but its potentially limited

by capital investment required.

In the narrow web tag and label market, the trend con-

tinues moving toward UV curable ink systems versus water-

based, added Ms. Whelan. The use o UV curable inks in the

packaging markets continues to grow - especially with the in-

troduction o low migration inks that support current globaland regional regulations. We also see an increasing interest in

UV LED curing technologies - this is a good move or printers

who have a ocus on economical and ecological sustainability.

I dont see any specic trends, but all ink types have a rm

grasp on certain markets, Mr. Hill concluded. Solvent has a

hold on plastic, whereas water is being used or paper and pa-

perboard, corrugated and labels, and UV is in use across several

markets. The markets that have adopted certain ink types ap-

pear to be sticking to those technologies more oten than not.

For more information on the packaging ink market, including

new technologies, see the online version of this story atwww.inkworldmagazine.com.n

Kraft YES Pack, produced by Exopack,

LLC, received FPAs 2013 Highest

Achievement Award, as well as the Gold

Award for Packaging Excellence.

http://www.inkworldmagazine.com/http://www.inkworldmagazine.com/http://www.inkworldmagazine.com/http://www.inkworldmagazine.com/http://www.inkworldmagazine.com/http://www.inkworldmagazine.com/http://www.inkworldmagazine.com/http://www.inkworldmagazine.com/http://www.inkworldmagazine.com/ -

7/27/2019 Ink World Magzine_Vol.19, No.3_2013-05

23/52

THIS COUPON GOOD FOR

NO FREE LUNCH.NO BASEBALL TICKETS.

NO BALLOONS.

NO HOT AIR.

JUST QUALITY AQUEOUS

DISPERSIONS AT VERY

COMPETITIVE PRICES.

888-ALEX COLOR

www.alexcolor.com

COLOR IS OUR MIDDLE NAME

http://www.alexcolor.com/http://www.alexcolor.com/ -

7/27/2019 Ink World Magzine_Vol.19, No.3_2013-05

24/5224 www.inkworldmagazine.com May/June 2013

The Resin Report

BYDAVID SAVASTANOEDITOR

The Resin ReportResin manufacturers are looking forward to the upcoming

year, as they develop new products for the market.

When it comes to ormulating inks, resins play a crit-

ical role. Resin suppliers reported that 2012 saw

improvements in sales, and they are optimistic that

2013 will continue this trend.

We predominately serve packaging ink manuacturers,

where there remained a sense o stability in 2012, compared

to slight and continued declines in publication and commer-

cial printing, said Rick Krause, business director, printing and

packaging North America at BASF.

Hydrite has ocused and will always ocus on developing

new products with input rom our customers, with eedback

rom our customers, said Terry Chomniak, director o sales- process organics or Hydrite Chemical. We have seen our

business gradually increase over the past 12 to 18 months, es-

pecially in the water-borne packaging inks and OPV market.

Recovery has been slow since 2010 and 2011, but it has been

consistently improving.

The resin market is stable but very competitive, said Jason

Huang, manager, Yuen Liang Industrial & Co. Ltd. From our

point o view, ink markets have very good potential or us.

The overall market was much improved in 2012, especially

when compared to the lows o 2008, 2009 and 2010, said Steve

Reiser, vice president sales and marketing, Specialty Polymers,

Inc. We serve several dierent ink markets and all showed in-creases last year. Market recovery is slow but steady. In 2013, we

are continuing to see the market recover.

Currently, business is steady and competition is strong, said

Matt Grodd o Kane International Corporation. Most resin

suppliers are aggressively pursuing existing opportunities with

competitive prices. Many international companies are pursuing

domestic opportunities as well.

Ink Industry NeedsWhat do ink manuacturers look or when they purchase res-

ins? Resin suppliers reported that new products and price con-

trols are two o the topics they hear rom their customers.Ink manuacturers as well as raw material suppliers need

to be cognizant o the new packaging designs and the new

technology being used to transer the ink to the substrate, Mr.

Chomniak said. Hydrite is working to introduce new prod-

ucts that will provide better resistance properties as well as bet-

ter runnability and print speeds.

Their main concerns are stable price support, better qual-

ity supply, sucient quantity oer and technical discussion/

exchange, Mr. Huang said.

There are two things we are hearing rom our custom-ers Mr. Reiser said. First, they want to lower the costs o their

resins, but need the same perormance. Everyone in the in-

dustry has seen their margins get squeezed and they are under

pressure to manage all their costs, including the cost o their

resins. Secondly, they are looking or new resins to meet their

specifc product perormance goals. The ink market contin-

ues to diversiy, requiring products with dierent perormance

characteristics. Customers are fnding o the shel products

dont provide the needed perormance. We are seeing an in-

crease in the number o customer requests or special resins,

designed specifcally or their unique requirements.

There is ongoing pressure to improve perormance o ni-trocellulose modiying resins to equal the higher perorming

Photo courtesy of Yuen Liang Industrial & Co. Ltd.

http://www.inkworldmagazine.com/http://www.inkworldmagazine.com/http://www.inkworldmagazine.com/http://www.inkworldmagazine.com/http://www.inkworldmagazine.com/http://www.inkworldmagazine.com/mailto:[email protected]://www.inkworldmagazine.com/mailto:[email protected] -

7/27/2019 Ink World Magzine_Vol.19, No.3_2013-05

25/52

###$

'$

'(#$

'"$

'$

#%#%

'##

'!

'!"

'

,).&.+/&.*+-%

$

-

7/27/2019 Ink World Magzine_Vol.19, No.3_2013-05

26/5226 www.inkworldmagazine.com May/June 2013

The Resin Report

non-nitrocellulose systems, Mr. Grodd said. Customers expect

exceptional value with low prices. There is a customer movement

in the PU market or higher solids resins without changing viscos-

ity. There is also an increasing demand to grind various types opigments in polyurethane resins.

Improved cost-in-use continues to be a recurring theme

rom our customers, printers and converters, Mr. Krause said.

Perormance balanced with value is also very critical. The contin-

ued evolution o ood packaging requirements, health, saety and

environmental standards and international regulatory compliance

places an ever-greater need or us to support our customers.

Major Challenges for Resin SuppliersResin manuacturers noted that the need to develop new tech-

nologies is a key challenge. Mr. Reiser said that the biggest chal-

lenge or the resin industry is the lack o product innovation.New technologies typically bring a higher value to the

customer, Mr. Reiser said. As the ink market looks or unique

applications, the demand or new technologies will grow.

Over the past ew years, the industry has experienced a

great deal o consolidation, Mr. Reiser added. As a result, there

are ewer raw material suppliers and ewer choices. In addition,

through plant and product rationalization, raw material suppli-

ers have taken products o the market. When a raw material

goes away, signifcant eort goes into product reormulation.

We continue to place an emphasis on improving our in-

dustry alignment with our customers, providing them a broad

portolio o resins, pigments and ormulating additives, said Mr.Krause. We continue to invest in new product development to

support the innovation eorts o our customers.

The main challenges o resin industry are to satisy dier-

ent quality requirements rom each customers and to assist each

customer, Mr. Huang said. We keep various sources o raw

materials to control our cost well.

Mr. Chomniak noted that regulatory concerns are a chal-

lenge or resin suppliers.

The resin industry, like our ink and coating customer base,is addressing the requirements and challenges presented by the

implementation o GHS, Mr. Chomniak said. As with all is-

sues related to regulatory compliance and saety, there will be

time, training and cost considerations to meet and we are ad-

dressing with several in-house initiatives.

Expectations for the Resin MarketResin manuacturers are looking orward to the upcoming

year, as they develop new products or the market.

Hydrite is looking to grow our graphic arts business in

2013 and into 2014 by developing new products, by listening

to our customers and meeting the needs o their customers,the printers, Mr. Chomniak said. Not only are we develop-

ing and promoting our new HydriPrint product line, we are

investing in our plant to meet our projected growth.

We are seeing more and more requests rom customers to

develop products that meet their specifc needs, Mr. Reiser

said. Over the past ew years, Specialty Polymers has expanded

both the sales and technical group and these olks enjoy work-

ing closely with our customers to understand their application

and perormance requirements.

We expect to see continued and modest improvement in

packaging ink and overprint varnish demand, particularly i

consumer confdence and spending continue to improve, Mr.Krause concluded.

For more information on the resin market, including raw materials and

new technologies, see the online version of this story atwww.inkworld-

magazine.com.n

http://www.inkworldmagazine.com/http://www.inkworldmagazine.com/http://www.inkworldmagazine.com/http://www.inkworldmagazine.com/http://www.inkworldmagazine.com/http://www.inkworldmagazine.com/http://www.inkworldmagazine.com/http://www.inkworldmagazine.com/mailto:[email protected]://www.ylresin.com/http://www.inkworldmagazine.com/http://www.inkworldmagazine.com/http://www.inkworldmagazine.com/ -

7/27/2019 Ink World Magzine_Vol.19, No.3_2013-05

27/52May/June 2013 www.inkworldmagazine.com 27

Inkjet Report

The digital printing sector continues to expand, as inkjet

gains market share in areas it already is strong in, while

moving into new printing segments. For inkjet ink

manuacturers, business continues to grow as well.

EFI reached a major milestone in 2012, when the company

surpassed the million liter sales mark.

We had another record year or ink sales in 2012, said

Stephen Emery, vice president, ink business, EFI. EFI hit a

milestone when, or the rst time, the company shipped more

than a million liters o digital UV ink in less than 12 months.

This represents a signicant amount o the total market or inkin the industries we serve.

Dr. Christophe Bulliard, commercial director or Sensient

Imaging Technologies SA, said that Sensient is concentrating its

developments in industrial inkjet printing applications.

As a leader in sublimation inkjet inks, we are taking ad-

vantage o all the driving orces operating in this segment:

the strong increase o the digital share o textile printing, the

growth o polyester vs. cotton as a substrate and the increasing

use o sublimation to print onto polyester as this technique

brings very high color gamut with a process respective o natu-

ral resources (no use o water), Dr. Bulliard said. During the

past year, we have launched sublimation solutions or very highproductivity printers equipped with Kyocera printheads (MS

Italy, Reggiani ReNOIR). These printers started to make their

way into printing paper, and Sensient was again a pioneer in

the development o suitable ink systems. Sensient also made

interesting in-roads with coding and marking inks with a new

set o high perormance products.

Ken Kisner, INX Digitals vice president and chie technol-

ogy ocer, said that the printing industry saw inkjet technol-

ogy take a big step orward.

At drupa 2012, there was a strong inkjet presence, and ev-

eryone could see the growth o digital in areas that always were

considered to be either ofset or lithography in the past, Mr.Kisner said. Industrial markets such as ceramic and textile are

showing steep increases in use. The signage market is continu-

ing to display signs o maturity as local manuacturers are be-

ginning to establish ground in price sensitive markets.

SunJet, the inkjet division o Sun Chemical, grew strong-

ly in the past year, and widened its product and technology

portolio to meet the demands o existing and emerging mar-

kets, said Peter Saunders, global sales and marketing manager,

Sun Chemical.The industry as a whole experienced signicant growth in

2012, and Nazdar made substantial contributions to the mar-

ketplace in all sectors, said Rich Dunklee, digital market seg-

ment manager - Americas at Nazdar.

Kristin Adams, marketing manager or Collins Ink

Corporation, said that Collins business continues to grow, as

does the printing industry, particularly in the high-speed inkjet

printing market.

Were seeing more and more customers rom the tradition-

al printing industry begin to integrate inkjet printheads into

their production, Ms. Adams added. I think weve all learned

that there is a certain threshold at which is doesnt make senseto use inkjet because the cost per page is simply too expensive.

The Inkjet Ink ReportAs digital printing expands into new applications and gainsmarket share in existing segments, inkjet ink suppliers areenjoying growth

BYDAVID SAVASTANOEDITOR

Photo courtesy of Bordeaux Digital Printink Ltd.

http://www.inkworldmagazine.com/http://www.inkworldmagazine.com/http://www.inkworldmagazine.com/http://www.inkworldmagazine.com/http://www.inkworldmagazine.com/http://www.inkworldmagazine.com/mailto:[email protected]://www.inkworldmagazine.com/mailto:[email protected] -

7/27/2019 Ink World Magzine_Vol.19, No.3_2013-05

28/5228 www.inkworldmagazine.com May/June 2013

Inkjet Report

However, or shorter runs with variable data, inkjet is the wayto go. Printhead manuacturers like Kyocera, HP, Ricoh, Xaar,

Spectra and others have nice systems that allow customers to

easily integrate water-based and UV curable digital printing

with traditional printing. A combination o the two seems to

be working or a lot o customers who battle with the tradi-

tional/digital threshold.

John Kaiser, product marketing manager - inkjet inks,

FUJIFILM North America Corporation, Graphic Systems

Division, said that the inkjet printing industry as a whole con-

tinued to expand last year as printers replaced traditional analog

equipment with digital inkjet technology, and more output was

produced utilizing digital inkjet equipment.Fujilm recorded signicant sales o digital inkjet equipment

this past year, and our inkjet ink business continues to grow signi-

cantly, Mr. Kaiser said. In the wide ormat segment, Fujilm in-

troduced new upgrades to the Onset series o UV atbed printers

with the introduction o the Onset S40i, introduced a new model

o the Uvistar series with the Uvistar Pro-8 and expanded the

Acuity series with the introduction o the Acuity Advance Select

and the Acuity LED 1600. These platorm introductions were ac-

companied by the launch o several new Uvijet ink ranges that

delivered enhanced perormance characteristics such as superior

adhesion to substrates and increased ink exibility.

In the sheeted and web segment, Fujilm recorded sales oboth the J Press 720 and J Press 540W inkjet digital platorms, Mr.

Kaiser added. These platorms utilize Fujilm VIVIDIA inkjet

inks or ecient production o high quality output primarily or

shorter run length jobs. Along with the introduction o equipment

and inks, the company dedicates much time and research to the

development o innovative new inkjet platorms and inks or both

existing markets and new markets, and expects to launch several

new platorms and inks in 2013.

Michael Andreottola, president, American Ink Jet Corporation,

said that 2012 was a good year or American Ink Jet.

We had modest gains in sales compared to 2011, Mr.

Andreottola said. Our increase was due to new activity in thirdparty cartridge remanuacturing and the development o inks

or new applications or inkjet printing. The additional applica-

tions are in circuit board printing and printing on novel materials.

Another part o our growth is in toll manuacturing or companies

developing inkjet inks but not having the manuacturing acilitiesto do so. In the past, where we manuactured inks or DuPont,

Rohm & Haas and Kodak, we are now producing inks or much

smaller companies that require inks or specic applications.

Moshe Zach, CEO o Bordeaux Digital Printink Ltd., said that

Bordeaux is a global company ofering high quality digital print-

ing inks, coatings and solutions and operates within the realm o

the global wide ormat and graphic arts printing niche.

As such, Bordeaux has a strong presence worldwide, backed

up by strong local distributors who claim to have a competitive

edge over other brands and continue to introduce new Bordeaux