Information Classification: General...Ancillary Income (e.g. Admin, Late Fees)-Tenant Insurance...

Transcript of Information Classification: General...Ancillary Income (e.g. Admin, Late Fees)-Tenant Insurance...

Information Classification: General

Information Classification: General

Self-Storage Valuation in Today’s Mystifying Market

Presented by:Mike Mele, Vice Chairman,Self-Storage Advisory Group, Cushman & Wakefield

Information Classification: General

July 13-16, 2021The Mirage, Las Vegas

#ISSWorldExpoissworldexpo.com

Download This PresentationPlease note that all seminar-track PowerPoint presentations, including this one, are available for download in PDF format.

Please visit www.issworldexpo.com/seminars to access these supplementary education materials.

Information Classification: General

July 13-16, 2021The Mirage, Las Vegas

#ISSWorldExpoissworldexpo.com

AgendaI. Self-storage investment highlightsII. Buyers and sellers in today’s marketIII. Leading U.S. marketsIV. ValuationV. Recent transactionsVI. Conclusion

Information Classification: General

July 13-16, 2021The Mirage, Las Vegas

#ISSWorldExpoissworldexpo.com

Section I:Self-Storage

Investment Highlights

Information Classification: General

July 13-16, 2021The Mirage, Las Vegas

#ISSWorldExpoissworldexpo.com

Why Self-Storage?Strong Industry Dynamics The self-storage industry performed well despite the economic

headwinds faced by the COVID-19 pandemic (counter-cyclical). Demographic tailwinds supporting continued growth in the

self-storage sector:o Strong housing marketo Flexible work conditionso Migration patternso Aging Baby Boomer generation (downsizing)o Strong and continued storage demand from Millennials

Buyers chasing sustainable yield; 6% to 8% stabilized pro forma Plenty of operating leverage, as many stores across the country

can streamline their systems/processes

Information Classification: General

July 13-16, 2021The Mirage, Las Vegas

#ISSWorldExpoissworldexpo.com

Self-StorageAsset Types

Core-plusCore

Value-addLease-up/

Certificate of OccupancyDevelopment

What Are Buyers Looking for?

Buyers are chasing yield in secure assets, and many are finding it with the success of the storage sector.

We are seeing buyer interest across the self-storage asset spectrum from ultra-premium core-plus facilities to ground-up developments.

Information Classification: General

July 13-16, 2021The Mirage, Las Vegas

#ISSWorldExpoissworldexpo.com

Stabilized Defined as a facility whose physical occupancy is 92% and economic occupancy is 85% Trading at compressed going-in capitalization rates around 5.5% Target levered IRR around 10%

Lease-up/Value-add

Completed facilities with less than 92% physical and 85%economic occupancy Operators increase occupancy by optimizing their operating efforts

(i.e., increased ad spend, new onsite management, etc.). These types of deals commonly require bridge financing. Target levered IRR around 15%

Development Use construction budget and land value to derive present value Use the site plan to develop revenue forecast and comparables

to develop operating expense forecast. Facility should be stable by Year 4. Typically require construction loans Target IRR around 20%

Deal Types

Information Classification: General

July 13-16, 2021The Mirage, Las Vegas

#ISSWorldExpoissworldexpo.com

Section II: Buyers and Sellersin Today’s Market

Information Classification: General

July 13-16, 2021The Mirage, Las Vegas

#ISSWorldExpoissworldexpo.com

Seller BreakdownBuyers have been paying premiums to acquire self-storage

assets due to their stable growth and consistent cash-flowing abilities. Private operators, large and small, are disposing assets

at premium sale prices.

Seller Groups DescriptionLocal owners/operators

Many local owners/operators are selling to large-scale investment firms at compressed capitalization rates.

Developers Many developers look to exit at Certificate of Occupancy or during/after lease-up.

Investment funds/companies

Common to see these sellers trade properties to distribute capital to their equity holders (often within specified, contractual timeframes).

Large private operators

The largest players in self-storage and commercial real estate are consolidating the self-storage industry through large-scale private storage acquisitions.

Information Classification: General

July 13-16, 2021The Mirage, Las Vegas

#ISSWorldExpoissworldexpo.com

Buyer Breakdown

We are seeing the buyer pool widen with interest from atypical storage investors.

The industry is experiencing large capital inflows from leaders in the commercial real estate investment industry because of the attractive,risk-adjusted returns thespace offers.

Buyer GroupsREITs

Investment funds/companies

Family offices/trustsPrivate storage operators

Private individuals

Information Classification: General

July 13-16, 2021The Mirage, Las Vegas

#ISSWorldExpoissworldexpo.com

Section III: Leading U.S. Markets

Information Classification: General

July 13-16, 2021The Mirage, Las Vegas

#ISSWorldExpoissworldexpo.com

Leading Primary Markets

Information Classification: General

July 13-16, 2021The Mirage, Las Vegas

#ISSWorldExpoissworldexpo.com

Attractive Secondary Markets

Information Classification: General

July 13-16, 2021The Mirage, Las Vegas

#ISSWorldExpoissworldexpo.com

Section IV: Valuation

Information Classification: General

July 13-16, 2021The Mirage, Las Vegas

#ISSWorldExpoissworldexpo.com

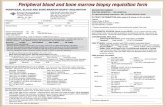

REVENUE Adj. T - 1Scheduled Base Rental 1,178,100 Physical Occupancy 80%Economic Occupancy 75%

Ef fect ive Gross Rental Income 884,886 Merchandise Income - Cost of Goods Sold - Ancillary Income (e.g. Admin, Late Fees) - Tenant Insurance Income - Truck Rental Income 34,943 Other Income -

EFFECTIVE GROSS INCOME 919,829

OPERATING EXPENSESTaxes 86,418 (Costs for) On-site Management 90,000 Off Site Management 45,991 Insurance 29,467 Advert ising 18,417 Repairs and Maintenance 25,784 Reserve for Capital Improvements 11,050 Ut ilit ies 82,833 Administ rat ion 22,100 Bank Charges 12,073 Telephone 2,947 Professional Fees 3,500 Other - Non-Operat ing Expense -

OPERATING EXPENSES 430,580 Operat ing Expense Rat io 47%

NET OPERATING INCOME 489,249

ADJ. T-1ect ive Gros EGI 919,829al Operat in (EXP) 430,580

NOI 489,249

$/ NRSF PRICE CAP122 9,000,000 5.44%

120 8,850,000 5.53%

118 8,700,000 5.62%

116 8,550,000 5.72%

114 8,400,000 5.82%

112 8,250,000 5.93%

110 8,100,000 6.04%

108 7,950,000 6.15%

MA

RK

ET R

AN

GE

Self-Storage ValuationConsiders the market value of the subject property by analyzing the facility’s historical net operating income

and its future earning potential.The purchase (sales) price is the net operating income

divided by the direct capitalization rate.In industry, we derive the present value by forecasting

future cash flow based on a stabilized scenario.Important metrics to analyze are levered IRR, equity

multiple, and cash-on-cash return.

Information Classification: General

July 13-16, 2021The Mirage, Las Vegas

#ISSWorldExpoissworldexpo.com

NET OPERATING INCOME 489,249 556,147 631,697 670,316 692,282 714,987 Pro Forma Cap Rate 5.62% 6.39% 7.26% 7.70% 7.96% 8.22%

DEBT SERVICE YR 1 YR 2 YR 3 YR 4 YR 5

Beginning Balance 6,090,000 6,090,000 5,940,089 5,784,458 5,622,890 5,455,158

Interest 225,816 225,816 220,097 214,159 207,995 201,596

Debt Service (375,727) (375,727) (375,727) (375,727) (375,727) (375,727)

Ending Balance 5,940,089 5,940,089 5,784,458 5,622,890 5,455,158 5,281,027 NET INCOME AFTER DEBT 113,522 180,420 255,970 294,589 316,555 339,260

DSCR 1.30 1.48 1.68 1.78 1.84 1.90Debt Yield 8% 9% 11% 12% 13% 14%

DISPOSITION ANALYSIS YR 1 YR 2 YR 3 YR 4 YR 5Disposit ion Cap Rat e 5.63% 6.00% 6.10% 6.20% 6.30% 6.40%Sales Price 8,697,761 9,269,124 10,355,689 10,811,549 10,988,604 11,171,677

Levered IRR - 20.3% 33.5% 29.6% 25.8% 23.6%Unlevered IRR - 8.7% 13.5% 12.7% 11.7% 11.1%Cash-on-Cash Return - 6.9% 9.8% 11.3% 12.1% 13.0%

Note: In practice, we perform a 10-year cash-flow forecast. To comply with lender requirements, deals should have a debt

service coverage ratio greater than 1.20x-1.25x. Levered IRR and cash-on-cash return are important pricing

and return metrics.

Information Classification: General

July 13-16, 2021The Mirage, Las Vegas

#ISSWorldExpoissworldexpo.com

Section V:Recent Transactions

Information Classification: General

July 13-16, 2021The Mirage, Las Vegas

#ISSWorldExpoissworldexpo.com

Lease-up portfolio (2) Management synergies

East Coast of Florida Recent property improvements

$123 per square foot 1,300-plus units

Information Classification: General

July 13-16, 2021The Mirage, Las Vegas

#ISSWorldExpoissworldexpo.com

Stabilized facility One competitor within 1 mileLocated in the Tampa /

St. Petersburg / Clearwater MSA 811 Units

Densely populated area Expansion potential and upside

Information Classification: General

July 13-16, 2021The Mirage, Las Vegas

#ISSWorldExpoissworldexpo.com

Lease-up facility Excellent upsideLocated in the Phoenix MSA Positive net migration

Limited competition Strong operating results

Information Classification: General

July 13-16, 2021The Mirage, Las Vegas

#ISSWorldExpoissworldexpo.com

Stabilized facility 3-mile median income more than $81,000

Located in the San Joaquin Valley Opportunity to push ratesExcellent frontage and visibility Expansion opportunity

Information Classification: General

July 13-16, 2021The Mirage, Las Vegas

#ISSWorldExpoissworldexpo.com

Section VI: Conclusion

Information Classification: General

July 13-16, 2021The Mirage, Las Vegas

#ISSWorldExpoissworldexpo.com

ConclusionSelf-storage market has been extremely active. Some drivers of activity are: Industry consolidation Strong demographic and demand drivers Low-interest-rate environment Demand for all types of self-storage assets in various

markets throughout the U.S. Widening buyer pool with growing appetite for assets Bullish performance outlook for 2021

(limited industry headwinds)

Information Classification: General

July 13-16, 2021The Mirage, Las Vegas

#ISSWorldExpoissworldexpo.com

Mike MeleVice Chairman, Self-Storage Advisory GroupCushman & Wakefield813.462.4220mike.mele@cushwake.comwww.cushmanwakefield.com

Contact the Presenter