Inflation in viet nam 1990 2007 bui thi kim thanh ecd

-

Upload

tvvip741963 -

Category

Documents

-

view

1.239 -

download

1

description

Transcript of Inflation in viet nam 1990 2007 bui thi kim thanh ecd

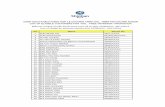

- 1. Graduate School of Development Studies INFLATION IN VIETNAM OVER THE PERIOD 1990-2007A Research Paper presented by: Bui Thi Kim Thanh (Vietnam)in partial fulfillment of the requirements for obtaining the degree ofMASTERS OF ARTS IN DEVELOPMENT STUDIES Specialisation:Economic of Development(ECD)Members of the examining committee: Dr. Karel Jansen Dr. Lorenzo Pellegrini The Hague, The NetherlandsNovember, 20081