Indian Coal Washing Industry - Present & Future Developments Key drivers with detailed profiles of...

-

Upload

infraline-energy -

Category

Business

-

view

972 -

download

1

description

Transcript of Indian Coal Washing Industry - Present & Future Developments Key drivers with detailed profiles of...

TM

Solution Driven

InfralineEnergy Publications

Indian Coal Washing Industry: Present & Future DevelopmentsKey drivers with detailed profiles of Coal Washeries

Coal is the key contributor to the Indian energy portfolio. It contributes to nearly half of commercial primary energy demand and one-third of total energy demand of the country. Although, India is one of the leading producers and consumer of coal, Indian coal has high ash content and embedded impurities, which needs washing and blending of coal for improving the quality of Run-of-Mine (ROM) coal. The steel sector needs coking coal with ash content of less than eighteen percent. Washing helps in reducing ash content by seven to eight percent. Quality and environmental concerns are causing a shift towards higher utilization of washed and blended coal. Presently nearly fifty-two commercial washeries with installed capacity of about 131 MTPA are operating in the country. In India, only about twenty percent of the coal produced is washed, as against the global average of over fifty percent. Coking coal preparation has long been in operation in India; however the trend of washing of non coking coal is also being seen. About twenty-three percent of the installed capacity is for coking coal and the rest is for non-coking coal. Further, as per the directives of MoEF, the power stations located at more than 1000 km away from coal mines and those located in sensitive areas are required to use coal containing not more than thirty-four percent of ash on annual average basis. The distance is expected to be reduced to 500 km as per draft notification released by MoEF in July 2012.Washing is carried out to reduce the ash content, and to lower the level of sulphur and unwanted minerals present in coal. Washed coal has higher calorific value than unwashed coal hence usage of washed coal helps in improving efficiency of steel, cement and power plants. Out of total of 104 coal-based thermal power plants, only thirty percent of power plants are using washed coal. Development of coal washeries is not keeping pace with the demand of coal. The preliminary study on coal washery market in India suggests that investment in coal washeries will increase exponentially in the coming years and host huge opportunities for private players. Keeping this view in the backdrop, InfralineEnergy is coming up with the report titled “Indian Coal Washing Industry: Present & Future Developments – Key drivers with detailed profiles of coal washeries”.

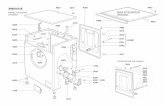

Figure: PESTEL Analysis of Coal Washery Industry

Setting ofCoal

WasheriesLegal Social

Government Initiatives and Support

Impact on Ecological Factors

Policies and Governing Laws

Cost Benefit Analysis

Impact on local population

Presently used and emerging technologies

Usage of washed coal

and washery rejects

ROM Coal

The report starts with the snapshot of coal washing industry in India with updated analytical information on coal washeries, global scenario and PESTEL analysis of macro-environment governing coal washeries. The report covers detailed analysis and profiling of more than seventy-five existing and upcoming coal washery projects developed by central, state and private sector players. A typical project profile gives information about promoter details, technological overview, description of coal supply linkage, development status, end-user plant status and other details. The report also includes profiles of major coal washery developers and equipment suppliers. The report would serve as an investment and information advantage to tap the future opportunities. The prospective business entities can formulate their plans, devise strategies and take proactive measures to position themselves suitably in the market.

Indian Coal Washing Industry

Key Highlights � Overview of Global scenario in coal washing

� PESTEL framework analysis governing coal washeries in India

� Developer wise profiling of over 75 coal washeries including existing and upcoming

� Challenges and opportunities in development of coal washeries

� Sources of raw coal & coal type � Details of washery developers & promoters

� Profiles of coal washery equipment manufacturers

� Success stories and business models of setting up of coal washeries and rejects based power plant

Key Questions Answered � What are the capacities of various Coal Washeries in India?

� Who are the major players in the Indian Coal Washing industry?

� What are the major technologies used in coal washeries across India?

� Who are the end-users of washed coal?

� How are Washery Rejects utilized? � What are the legal provisions and policies supporting coal washeries in India?

� What are the social & environmental benefits of coal washeries in India?

A Must Buy for � Coal Washery Developers � Equipment Manufacturers & Suppliers

� Financial Institutions & Banks � Private Equity Investors � Research and Consulting Agencies � Coal Traders � Government Bodies & Regulatory Agencies

� New Entrants in Mining Segments

For Sales & Support

Ravinder [email protected]+91 11 46250027+91 9873422453

For Research & Consulting

Isha [email protected]+91 11 43509481

Sample Coal Washery Profile

North Karanpura Coal Washery of M/s ACB (India) Limited

ACB (India) Limited has proposed a coal washery with an estimated capacity of about 5.00 MTPA in the North Karanpura area in Jharkhand. Raw coal for the project will be sourced from North Karanpura coal mines and the washed coal will be used for power generation projects.

Basic Information

Promoter/Developer ACB (India) Limited

Registered Office C-102 Lower Ground Floor, Surya Enclave, New Multan Nagar, New Delhi-110056

Project Location

Area Co-ordinates

Latitude : 24°0’36.89”N Longitude : 84°54’47.28”E

Address North Karanpura, District : Chatra

State Jharkhand

Coalfield North Karanpura

Detailed Information

Capacity (MTPA) 5.00

Type of Coal Non-Coking

Current Status Proposed

Year of Commissioning 2015 (Estimated)

Environment Clearance Status Pending

Land Acquisition Status Acquired (Partially)

Raw Coal

Source North Karanpura Coal Mines

Grade E*(G11)**

Ash% 38-41 %

Washed Coal

End Use/Off Takers Power Projects

Grade D,E* (G9,G10)**

Ash% 31-34%

Washery RejectsQuantity About 1.00 MTPA

End Use/ Off Takers CFBC based Thermal Power Plant

Technology Used Jig

Washery Equipment Supplier Bateman Engineering NV

Additional Information

Mechanism to transport washed coal By Rail

Distance from ROM to washery Within 50 km

Indicative Land Type Consisting of Agricultural, mild forest and wasteland

Nearby Water Bodies River Mohana, Amanat

*A-G: UHV based grading system for non-coking coal

**G1-G17: New GCV based grading system for non-coking coal effective from Jan 2012

SAHIBGANJ

GODDA

PAKUR

DEVGHARDUMKAGIRIDIH

JAMTARA

DHANBAD

CHAS

HAZARIBAG

RANCHI

East Singbhum

SARAIKELA

SIMDEGA

GUMLA

LOHARDAGA

PALAMAU

CHATRA

KODARMA

DALTENGANJ

GARHWA

West Singbhum

Sample Profile24°0’36.89”N84°54’47.28”E

Executive Summary 1. Introduction

Introduction to coal beneficiation process and Infraline approach to the research study

� Coal beneficiation � Overview to coal washery industry � Key drivers for coal washing � Objectives, scope, approach and methodology of the study

2. Global Coal Washing Scenario

Coal reserves, production and coal preparation scenario around the globe

3. Coal Washery Insights in India

Past, existing and future scenario of Indian coal washing industry

� History and current status – Washed coal production trends – Presently operating coal washeries – Capacity of coking coal washeries – Capacity of non-coking coal washeries

� Future outlook – Name of proposed coal washeries – Capacity of proposed coal washeries – Proposed business model – Proposed technology – Scheduled coal production

� Opportunities assessment for various stakeholders � Key challenges and issues

4. PESTEL Framework Analysis

Analysis of Indian coal washing industry from six dimensions

� Political support for coal washeries – Policies and initiatives by the government

� Economics of setting of coal washeries – Direct and derived economic benefits – Cost benefit analysis

� Social impact of coal washeries – Impact on local population – Corporate Social Responsibility

� Technological options for coal washing – Washability study – Technologies presently in use – Emerging technologies

� Environmental concerns – Impact on ecological factors – Reduction in ash content and benefits – Washery rejects usage and dumping

� Legal policies and guidelines – Factors affecting policy on coal washing – MoEF policy for power plants

5. Profiling of Major Coal Washery Developers

Highlights of key information regarding major coal washery developers in India

� Name of developer � Existing and proposed capacity � Major clients � Technology used

6. Profiling of Major Coal Equipment Suppliers

Insights into major coal washery equipment suppliers with their products & services

� Name of equipment supplier or manufacturer � Products and services � Major clients

7. Profiling of Existing Coal Washeries in India

Highlights of key information regarding raw coal characteristics, washed coal characteristics, rejects off-takers, etc

� Government - commercial and captive � Private - commercial and captive � Detailed analysis

8. Profiling of Upcoming Coal Washeries in India

Highlights of key information regarding proposed year of commissioning, proposed characteristics of raw and washed coal, etc

� Government - commercial and captive � Private - commercial and captive � Detailed analysis

9. Harnessing Washery Rejects Potential

Power generation from washery rejects with detailed illustrative profiles of thermal power plants using rejects as fuel

� Rejects disposal mechanism � Technologies available for generating power from washery rejects

� Illustrative profiles of thermal power plants using washery rejects

– Project developer – Capacity – Fuel mix – Source of washery rejects – Technology used

10. Business Success Stories

Successful business models of utilization of coal washery rejects and improvement in efficiency of power plant using washed coal

� Thermal power plant using washed coal � Coal washery rejects based power plant

Annexure

Draft Contents & Coverage

For more details, visit http://store.infraline.com

Pricing Options

Report - Hard Copy (courier charges extra for international clients) 50,000

Report - E-copy (Single User License) 1,00,000

Report - E-copy (Corporate License) 2,00,000

Note: TDS will not be deducted.

In case of payments to be made in USD, Euro, GBP , etc., the conversion rates on the date of purchase will be applicable.

Making the Payment

Payment in Indian Rupees (INR): We accept Cheques / Demand Draft. However, we prefer payment through RTGS.

Account Name Infraline Technologies India Pvt. Ltd

Account Type Current Account

Account No. 503011022657

Bank Branch IFSC Code VYSA0005030

Name of Bank ING Vysya

Address ING Vysya Bank Ltd. Ground Floor Narain Manzil, Barakhamba Road, New Delhi-110 001

Pricing Options

Payment through Cheques / Demand Draft: Payment should be made in favour of ‘Infraline Technologies(India) Private Limited’ through Cheques / DD payable at New Delhi (or ‘at Par’ cheques) and send it to thebelow mentioned address.

For Payments in Foreign Currency

Through Wire Transfer: The wire transfer instructions are available at http://www.infraline.com/WreTransferlnstructions.htm

Through Credit Card: We accept Visa, Master, Amex Cards and all major Net Banking cards. Additional 7% Gateway processing charge applicable along with additional shipping/courier charges.

14th Floor, Atmaram House, 1, Tolstoy Road, Connaught Place,New Delhi- 110001, IndiaTel +91 11 4625 0027 (D), 46250000, Fax +91 11 46250099 Email [email protected], [email protected]