India 2012: Telecom growth continues · 2015-02-23 · This includes industry analysts, Telecom...

Transcript of India 2012: Telecom growth continues · 2015-02-23 · This includes industry analysts, Telecom...

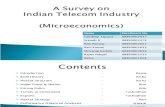

India 2012: Telecom growth continues

Confederation of Indian Industry

“The report by Ernst & Young on ‘India 2012: Telecom growth continues’ is based on very exhaustive research and rational analysis. The key challenges impacting the growth of the sector has also been very constructively identified. I am confident that this very valuable report would provide the gateway for understanding telecom in India.”

Nripendra Misra, Chairman, TRAI unveils CII- Ernst & Young report “India 2012: Telecom growth continues,” at the CII Roundtable Conference—India Telecom Landscape 2012 on 28 November 2008.

From left - Ambrish Bakaya, Director, Corporate Affairs, Nokia India Pvt. Ltd., Nripendra Misra, Chairman, TRAI, Rajat Mukarji, Chief Corporate Affairs Officer, IDEA Cellular Ltd, Prashant Singhal, Telecommunications Leader, Ernst & Young Pvt Ltd and Sujith Haridas, Director, ICT & Defence, Confederation of Indian Industry (CII).

Unveiling India 2012: Telecom growth continues

Nripendra MisraChairman, TRAI

India 2012: Telecom growth continues2

Foreword

The Telecom sector in India has witnessed unparalleled growth by global standards. In a little over a decade of wireless telephony, India has moved from a subscriber base of zero to becoming the second-largest market in the world after China. This growth would continue provided we have progressive policies that shall provide impetus to free flow of investment, ideas and technology that facilitate growth and evolution of this sector. The progress in the sector has been something to be proud of and it is often viewed as ample testimony to the India growth story.

Several developments in the industry are afoot, which will be crucial to defining the state of this industry in times to come. Additional 2G spectrum has been recently allotted, allowing the entry of several new players — wherein a majority of them are also acquiring strategic international partners, commencing the globalization of Indian Telecom. The rollout of 3G, which could potentially transform the bouquet of services extended to consumers from vanilla voice and basic data to rich entertainment and far more, is poised for a take-off with the impending auction of the 3G spectrum. Broadband — conventional as well as wireless — is poised for a major leap. In the wake of such developments, a concerted effort must be made between the industry and the Government (as the prime mover and regulator on policies in Telecom) on ensuring that policies, regulations and laws are formulated in a manner that creates systematic growth and harnesses the full potential of this industry for the Indian consumer.

CII, in collaboration with Ernst & Young, has put together this report, which brings out the current status of the industry with a brief perspective on how that growth has been achieved, and sets the context for the landscape in 2012. It focuses on current issues and the envisaged future concerns and potential points of debate, which would need to be jointly addressed by the industry and the Government in order to enable this industry to continue on its already-impressive growth trajectory, and become the cynosure of the Telecom world.

Anil SardanaChairmanNational Committee on Telecom & BroadbandConfederation of Indian Industry

3India 2012: Telecom growth continues

Introduction

Welcome to Ernst and Young - CII industry report “ India 2012: Telecom growth continues”. We are very excited to release this report in association with the Confederation of Indian Industry (CII) for its Roundtable Conference on “India Telecom Landscape 2012.”

This report aims to capture the developments witnessed in the Telecom sector over the last few years and analyze historical performance to estimate growth over the next four years. It is targeted at stakeholders in the Telecom industry, including operators, industry practitioners, the Government, content providers, infrastructure builders and equipment vendors. In the report, we examine and evaluate the buoyancy of the Indian Telecom sector through to 2008 and map the key variables that will be the primary drivers for India’s Telecom growth story in 2012.

Only change seems to be constant in the Indian Telecom sector. Fixed lines were the main stay till 2004 – which were substituted by wireless services that led to steep growth in urban areas. From 2008 to 2012, we will witness wireless expansion in the rural areas. We are also going to see a data revolution triggered by 3G and WiMax and supported by content, towards the latter half of this period.

We have endeavored to present a holistic view of the growth that the sector is likely to witness in the next four years. To meet this objective, we have undertaken primary and secondary research and have also incorporated inputs from key opinion leaders in the Indian Telecom sector ranging from vendors and operators to industry bodies and the Government.

We hope you find the report interesting and informative. We would like to extend our gratitude to the industry leaders who participated in the report and the CII for giving us the opportunity to present the evolving perspectives in the sector.

Prashant Singhal Telecommunications Leader Ernst & Young Pvt. Ltd.

4 India 2012: Telecom growth continues

India 2012: Telecom growth continuesWe value special contribution of:

To give a first-hand perspective, we are delighted that senior executives from a range of Telecom companies participated in the study. This includes industry analysts, Telecom company executives and members of telecom industry bodies.

We conducted in-depth interviews with all the participants, supported by research, analysis and insights from our global team and industry professionals.

Tata Teleservices Limited ►Anil Sardana Managing Director

Cellular Operators Association of India ►►T. V. Ramachandran Director General

Ericsson India Private LimitedP. Balaji Vice PresidentMarketing and Strategy

Bharat Sanchar Nigam Limited►S. D. SaxenaDirector - Finance

Nokia Siemens Networks India Private LimitedSandeep BhargavaHead - Corporate Finance

Association of Unified Telecom Service Providers of India►S. C. KhannaSecretary General

Telecom Equipment Manufacturers Association of IndiaBharat Bhatia President

Bharti Airtel Limited►►Manoj KohliChief Executive Officer and Joint Managing Director

Tata Communications Limited►►►Srinivasa AddepalliSenior Vice President— Corporate Strategy

Tata Teleservices Maharashtra Limited ►►►Madhav Joshi Chief Regulatory Officer

International Telecommunication UnionPawan K. GargMember - Radio Regulations Board

5India 2012: Telecom growth continues

6 India 2012: Telecom growth continues

Telecom growth continues

• In perspective

• Mobility for every other Indian

• New growth areas for 2012

• Broadband — a key driver

• Operators to target for larger “share of the wallet”

• Telecom sector — resilient or impacted by economic slowdown?

• In conclusion

7India 2012: Telecom growth continues

8 India 2012: Telecom growth continues

In perspective

India 2012: Telecom growth continues

In the last few years, robust growth in the sector has been driven by several factors:

►In India, the reduction in average • revenue per user (ARPU) is mitigated by an increase in the subscriber base that contributes to healthy revenue growth. In addition, declining tariffs are made up by an increase in the minutes of usage.

►Operators are reducing operating costs • and hiving off infrastructure elements such as towers into separate entities, thus inviting significant investment. Passive infrastructure sharing has benefited the Indian mobile industry and its customers, reducing the cost burden of each operator and speeding the rollout of mobile services.

In the last three to five years, initiatives • such as network cost optimization, outsourcing of non-core activities, as well as low-cost business models have improved operator returns at low ARPUs.

On the regulatory front, the nodal body — the Telecom Regulatory Authority of India (TRAI) — mandated National Long Distance operators (NLD) to discontinue charging a monthly roaming rental fee and to cut roaming tariffs by over 50% in February 2007 — a move that led to tariff reduction, increased competitiveness and transparency as well as rationalization of excessive roaming costs. The spread of Telecom services in India between 2006 and 2008 was aided by a significant decrease in international call charges, reduction in interconnect

Telecom sector: the power performer in the Indian economy

Telecommunications continues to be one of India’s biggest success stories. In recent years, the Telecom sector has been delivering strong returns on investments and steady subscriber additions.

This growth has been built on the wireless revolution. The sector has charted an impressive growth trajectory, adding nearly 9 million subscribers per month. Despite this, the overall tele-density was recorded at 31.5% at the end of October 2008. The current wireless subscriber base of over 325 million is expected to exceed the half billion mark by 2010. Even at this growth, India has one of the world’s lowest mobile penetration levels at about 28% and one of the highest minutes of usage (MOU) per subscriber per month, at more than 400 minutes.

Multiple factors — planned and unplanned, anticipated and unanticipated — have coalesced to produce a remarkable decade of continued success. These include low tariffs, low handset prices, effective Government regulation, higher incomes and changes in customer behavior. The Indian economy has recorded GDP growth of over 8% for 12 successive quarters since 2005. The Telecom sector is expected to perform even better: its contribution to the nation’s GDP is expected to increase from 2% in 2006 to an estimated 3.6% in 2010.*

* From Emerging to Surging - India Telecom: 2010, Ernst & Young report, page 22

9India 2012: Telecom growth continues

charges, introduction of feature-rich low cost handsets and the roll out of micro-prepaid and lifetime validity schemes. The Access Deficit Charge is being phased out in 2008, while a further reduction

There are positive enablers for the sector

The addition of each new subscriber lowers average revenues. Despite this, Indian Telecom companies continue to post better results than investor estimates. Indian Telecom market will continue to grow till 2012 at a robust pace.

Telecom landscape in 2012, how will it look?

• I►n 2012, the total Telecom subscriber base is expected to reach approximately 690 to 700 million to include about 640 to 650 million wireless users and approximately 45 to 50 million fixed line users, driven by a rise in communications demand from semi-urban and rural India.

• I►n 2012, the internet subscriber base is expected to rise to approximately 45 million. Despite 25 to 30 million broadband subscriptions, the broadband penetration is still likely to reach approximately 2.3%. However broadband could see a 30% to 40% increase from the said projections if WiMax services gain traction and entry barriers for customers are significantly lowered through cheaper devices and services. The wireless internet base is estimated to rise to approximately 196 million from the current 76 million.

• I►n 2012, the total Telecom penetration is expected to reach 58% to 60%. Approximately 40% of rural users are estimated to own a phone. Nearly everyone in the urban constituencies in India will have a Telecom connection. Circle B and C would experience the highest growth and would contribute to about 60% of the total mobile subscribers.

• I►n 2012, India’s Telecom services industry revenues are projected to reach USD54 billion, as compared with USD31 billion in 2008. (Conversion rate used USD1 = INR40)

• T►he blended ARPU is expected to stabilize at approximately INR150 to INR155 by 2010, while MOU per subscriber per month is projected to stabilize at approximately 520 to 530 minutes in 2012.

• F►rom early to mid part of 2009 to 2012, most of the Telecom circles are expected to have approximately 12 operators(based on state boundaries and socio-economic parameters). However, by the latter half of this period, consolidation activity is imminent and would reduce the potential players to five to seven operators.

• 3G and WiMax are likely to be auctioned in early part of calendar 2009, initially concentrating on top 20 cities in India. Based on this, 3G subscriber base could reach 25 to 30 million by 2012 and 3G revenues would reach around USD4

to USD5 billion by 2012. WiMax on the other hand, could attract about 8 to 10 million subscribers and could account for about USD1 to USD1.5 billion by 2012. This is based on the assumption that low cost devices and data cards are available and services are affordable. These numbers could see a further upside if the operators innovate to offer more attractive and refined value added services.

• MNP is essential for the Indian Telecom Industry. It would provide ease of switching to the subscriber. To create an impact, MNP will need to be spread across the country and there should be easy and affordable porting. Globally, number portability has not induced much churn, however, depending upon aforementioned factors, MNP could lead to some impact in the Indian telecom market.

• The entry of MVNOs will help achieve growth faster by targeting niche customer segments. Between 2008 and 2012, entry of MVNO is expected in a 12 operator telecom market. With almost 4 to 5 operators being new, entry of MVNOs would help achieving growth faster. Globally, successful MVNOs are those which already have a distribution network and brand image and India would be no exception. We could also witness some existing brands with customer reach launching into this space – which would fuel further growth in the sector.

of license fees and a lowering of the Universal Service Obligation (USO) fund contribution by operators are also expected.

10 India 2012: Telecom growth continues

Key challenges impacting the growth of the Telecom sector by 2012

Even as, positive trends in the Telecom sector and the economy reinforced each other in a virtuous cycle and caused a sharp acceleration in the demand for Telecom services, there are significant challenges for growth in 2012. Most of the significant global Telecom players are either present in the Indian Telecom market or are seeking entry through a partnership with an existing or start up Telecom operator. They have been attracted to the strong growth potential of the sector. But there are some focus areas that will need attention in order to maintain a positive outlook for 2012:

Rural Telecom will be the new growth • constituency: Rural market will be the next growth driver for operators with the near saturation of urban markets. To capitalize on the growing population and disposable income of rural India, Telecom operators will have to explore and expand into hitherto “uncovered” geographies. By 2012, we see the rural base accounting for nearly half the total subscribers who will have access to communications services. The Government can capitalize on rural Telecom growth to boost economic development across rural India which could also help the growth of the country’s gross domestic product. The next engine of Telecom growth is clearly rural India and there will need to be strong partnership between the Government and the private operators as well as an effective and optimum utilization of investments from of the USO fund to ensure that India surpasses 55% to 60% penetration by 2012.

Emphasis on data revenues to • provide additional “buffer”: The launch of 3G services will drive data revenues. India’s data revolution is

going to be fuelled by 3G and WiMax. However, for the expansion of data services and for it to gain scale and momentum, customized and vernacular content catering to the diverse masses needs to be developed coupled with low device costs. Better upload/download speed for data services backed by customized content and lower voice prices should augur well for subscribers. The growth of 3G and WiMax would be the key for telecom companies to maintain growth and/ or enhance profitability in the low tariff regime especially when significant part of subscriber additions would emerge from rural areas in India.

Focus on strategy to lower operators’ • capital expenditure: To achieve a subscriber base of approximately 700 million by 2012, Telecom industry in India will need capex investment of approximately USD18 billion to USD20 billion in this period. Sharing of passive and active infrastructure and intra-circle roaming, would be some ways to bring down the capex requirements. Most importantly, to attract further capital into the country, it is very important for the Government to provide a stable regulatory regime to maintain the confidence of the key stakeholders and investors in the Telecom sector.

Need to revisit the high levies on the • Telecom sector: The Indian Telecom sector is one of the highest taxed sectors in the developing world. This is through levies, which comprise service tax, revenue share, spectrum cess and value added tax totaling to approximately 25% of the total levies payable by operators apart from income tax on their profits, which ranges from 10% to 33% of profits depending on the eligibility of tax concession for some of the operators. Revisiting high duties and levies in the

11

sector would help reduce costs and the benefits can eventually be passed on to the customers by further lowering of tariffs.

Most importantly, an urgent need • for clear roadmap vis-à-vis telecom regulations: There is an urgent need for stable policies and a conducive and consultative regulatory environment to improve investor optimism in the sector. A clear roadmap for future spectrum allocation has to be drawn, whether it is a 2G or 3G platform. The allocation of adequate spectrum is an urgent requirement for new and existing operators. Operators should be careful in bidding for spectrum and should not end up overpaying. While there is significant interest between the incumbents and the new players, interest from new international entrants may be muted, in part by the global economic outlook. The prospect of paying the Universal Access Service License (UASL) fee without any guarantee on the timeline for getting the 2G spectrum, coupled with the advantages that incumbents enjoy with an established infrastructure, may act as a deterrent for the entry.

Enhance the skill - sets of personnel • for employment in the Telecom sector: This sector will require specialist resources to support and sustain growth over the next four to five years. The pressure on talent is expected to increase with the rollout and deployment of 3G and WiMax services. The private sector will need to reorient its focus on talent development through training schools and facilitation programs that cater to the needs of the Telecom industry for 2012.

Uncertainty in the global economic • scenario: The current financial crisis could have a low-to-medium impact on the Telecom sector in terms of rising cost of capital and reduction in discretionary spending on the part of customers, among other determinants. A range of factors – decline in average revenue per minute, stabilizing minutes-of-use, peaking subscriber adds, spiraling network expansion costs, large deployment in the untapped rural areas — could also result in margin pressure.

Looking ahead, in order to ensure strong growth rates, the Government and the regulator will need to put in place comprehensive directions and companies will need to consistently innovate to effectively manage revenues and costs.

12 India 2012: Telecom growth continues

Mobility for every other Indian in 2012India’s wireless base increased from 1.6 million1 at the beginning of 2000 to over 325 million2 in October 2008. It has been achieved with successive years of sharp subscriber growth — 69% in 2004, 58% in 2005, 97% in 2006 and 57% in 2007.3 Since wireless penetration is approximately 28% in 2008,4 there is still large potential for future growth.

The rising wireless base is reflected in the growing share of mobility of the total Telecom base. From just 5% of the country’s Telecom base of 32 million5 in March 20006, it has increased to 87% of the 300 million Telecom subscribers in March 2008.7

Source: COAI, AUSPI, CII-Ernst & Young analysis

1 http://coai.in/statistics.php?val=1997-20042 TRAI press release No. 89/2008, 24 November 20083 TRAI press release No. 6/2007,15 January 2007 and TRAI press release No. 11/2008, 22 Jan 2008 4 TRAI press release No. 86/2008, 24 October 2008 5 International Telecommunications Union: World Telecommunications/ICT Indicators Database,

December 20006 http://coai.in/statistics.php?val=1997-20047 TRAI press release No. 43/2008, 25 April 2008, Page 2 8 CII-Ernst & Young analysis

We see some trends in mobility

over the next few years:

• The growth of the wireless subscriber base will continue at a robust pace. However, this will be primarily driven by rural subscribers.

• We expect another round of mergers and acquisitions (M&A) in the market. As new operators roll-out networks, there could be 10 to 12 operators in each circle. However, by end 2012, M&A activity will result in about five to seven large

wireless operators.

• In 2012, 3G services will have just begun to spread in India and mobile entertainment and mobile banking are likely to

become popular services.

By end 2012, there are expected to be about 640 to 650 million wireless subscribers, accounting for about 90% of the total Telecom base. By then, wireless penetration would have exceeded the 50% mark.8 We do not see any major slowdown in growth in the immediate future due to the global economic slowdown. India’s operators have still not exhausted the full potential of the domestic Telecom market. Large parts of rural India will have the need and will be able to afford Telecom services. Operators will need to significantly invest in network expansion for 2G services till 2010 to 2011. Towards latter part of this period, a large part of the capital expenditure will also be required for the launch of 3G services.

Wireless on a roll

233

345

445

533594

648

39 39 40 42 45 49

272

384

485

575639

697

0

200

400

600

800

2007 2008F 2009F 2010F 2011F 2012F

Su

bs

(M

ns)

Mobile Fixed Total F = Forecast

13India 2012: Telecom growth continues

9 http://geography.about.com/cs/worldpopulation/a/mostpopulous.htm10 Wireless Intelligence, Subscriber Statistics, December 200711 CII-Ernst & Young analysis 12 TRAI press release No. 11/2008, 22 January 2008 and TRAI press release No. 86/2008, 24 October 200813 CII-Ernst & Young analysis

It is to be noted that eight of the 10 most populous countries9 -China, India, the US, Indonesia, Brazil, Pakistan, Russia, and Japan— are among the top 10 wireless markets.10 Similarly, in India, the most populous states are expected to have the maximum wireless subscribers.

Rising rural spread We expect wireless growth to increasingly emerge from rural India. In December 2007, tele-density in metropolitan circles was close to 75%, rural tele-density was still below 10%. In 2012, rural subscribers will account for almost half the total wireless base.11

It has been noted that the net wireless addition in Circle C has begun to exceed metropolitan cities. In the first nine months of 2008, while the four metros added 10.3 million subscribers, Circle C had an addition to 11.3 million subscribers.12 This trend is expected to continue till 2012.

Next wave of growth from Circle B and Circle C

In 2012, the majority of new wireless subscribers will emerge from Circle B and Circle C.13 Based on analysis, Circle C will garner approximately 102 million subscribers and will exceed metros, which will have approximately 62 million subscribers.

Projected circle wise wireless subscribers (in millions)

Service area December2007 2012 F Growth (%) No. of states

Metros 41 62 8.6 4

A 83 207 20.1 5

B 83 276 27.2 8

C 23 102 35.2 6

Total 230 648 23.0 23

F = Forecast Source: CII-Ernst & Young Analysis

14 India 2012: Telecom growth continues

ARPUs will stabilize; data services to have a positive impact

As the subscriber base continues to increase in India, operator ARPUs have steadily declined. However, there is likely to be a level of stabilization in the average revenues per subscriber for the Indian operator over the next couple of years. Blended ARPU is likely to stabilize at INR 150 to155 by 2012,14 while MOU per subscriber per month would stabilize at approximately 520 to 530 minutes per subscriber.

Even though declining ARPUs have been a concern to operators, they have been offset by increasing MOU and staggering subscriber growth. When subscriber growth starts slowing, and when MOUs start becoming inelastic, the downward

pressure on ARPU becomes even more significant. Operators will have to work on the twin front of increasing ARPUs through data and value-added services as well as by lowering costs through innovative business models.

Data, driven by 3G and WiMax services, will exert a positive impact on ARPUs. Mobile internet, mobile entertainment and mobile banking are expected to gain significant traction with the introduction of 3G and WiMax services.

Wireless phones: the emerging conduit for banking

As mobile operators are looking to introduce mobile banking, the Reserve Bank of India (RBI) has come up with guidelines for implementing it.15 While security is definitely an issue, today there are more wireless phones than savings bank accounts in India.16

Source: CII-Ernst & Young analysis, TRAI Performance Indicators December 2007, AUSPI-CDMA Statistics 2007

14 CII-Ernst & Young analysis15 http://rbidocs.rbi.org.in/rdocs/notification/PDFs/87664.pdf16 http://www.rbi.org.in/scripts/BS_SpeechesView.aspx?Id=342

ARPUs and MOU to stabilize

236209

188 169 160 152

527522511496473442

-

100

200

300

400

500

2007 2008F 2009F 2010F 2011F 2012F

F = Forecast

INR

0

200

400

600

800

Min

utes

Blended ARPU (INR) Blended MOU

15India 2012: Telecom growth continues

17 “The Rise of Network Sharing”, Oliver Wyman, www.oliverwyman.com, Page 218 Grivolas, J., “Sharing to Save”, Ovum Research, 8 September, 200819 “The Rise of Network Sharing”, Oliver Wyman, www.oliverwyman.com, Page 2

The wireless phone will emerge as a new means for banks to tap the “un-banked” masses. This would enable banks to get more business from users who do not approach a bank today. This is clearly a multi-faceted opportunity to be tapped.

Macro-economic and social conditions coupled with the status of infrastructure in India can provide an excellent eco-system for the growth of mobile banking.

Network sharing is a new frontier of growth

On the cost front, the first step is network sharing. Network costs account for 60% to 80% of the capital expenses and about 20% of the operating expenses.17

Characteristics Detail

Standard of living (Rural economy)

• ►High cost of the access to the banking services/ High transaction costs

• ►Banks are mainly in big cities, hence difficult to access

Poorly developed transport and financial sector

• ►Geographies like hills and deserts

• ►Limited transport services

• ►Weak and not very accessible banking environment for the population

Telecom Infrastructure: strong penetration rate of the mobile compared to fixed telephone

• ►Domination of mobile phones

• ►Very low fixed line penetration between 1% to 2%

• ►Less expensive to develop a mobile network

• ►Dwellings unsuitable for the fixed line

Joint families • ►Family gathers in a single place

• ►India: concept of the “joint family” relates to 70% of population

Illiteracy • Average rate of illiteracy varies between 50% and 80%

Socio-economic characteristics that enable mobile banking

Economic

Sociological

Operators are already sharing their passive infrastructure such as towers, diesel generating sets, battery back-up, fuel, air-conditioning and all civil support and partners share all costs related to acquiring a site. This results in fewer sites and less equipment to maintain. Subsequently, operators will engage in active infrastructure sharing that could include network sharing. There the spectrum would be owned separately and capital and operating savings would be available even in the Radio Access Network (RAN)components.18 Sharing parts of the networks with competitors helps operators to reduce capital expenses as well as lower their operating expenses. It is estimated that by sharing, operators can reduce a third of all 3G network costs and a fourth of 2G network costs.19

“The growth in mobility

is not driven just by low

prices. It also includes

deeper network coverage,

better distribution network,

and affordable handsets.”

Senior executive,

leading Telecom

operator in India

16 India 2012: Telecom growth continues

As networks expand, big operators will aim to acquire the smaller players. Currently, there are seven or eight wireless operators (four to five GSM and three CDMA operators) in each of the Telecom circles. But with five more operators rolling out their networks, customers will be able to choose among 12 or more operators by early 2010. However, M&A activity could lower the number of operators to five to seven by 2012.

20 Telecom Services Performance Indicators, April-June 2008, TRAI, 7 October 2008, Page 2321 CII-Ernst & Young analysis

By then, the internet and mobile entertainment will also begin to make an impact. As of June 2008, there were about 76 million subscribers who accessed the internet over their wireless phones.20 This is likely to rise to approximately 196 million21 by 2012 - positioning India among the leading wireless internet markets. This is, in part, likely to be aided by rollout of 3G and WiMax services.

17India 2012: Telecom growth continues

New growth areas for 2012

Data revolution to be fuelled by 3G and WiMax

In August 2008, the government announced the auction guidelines for both 3G and WiMax. In September 2008, it followed up with amendments on certain issues based on queries and requests from the industry. As per latest industry information, the WiMax auction is expected to occur on 10 January 2009 and 3G auction will take place on 9 February 2009. The detailed information memorandum is expected on 8 December 2008. 3G and WiMax services are expected to commence by latter half of 2009.

Key focus areas relating to 3G and WiMax

While there is significant interest • between the incumbents and the new players, interest from new international entrants may be muted, in part because of the global economic outlook. The prospect of paying the UAS license fee without any guarantee on the timeline for getting the 2G spectrum, coupled with the advantages that incumbents enjoy with an established infrastructure may act as a deterrent for the entry. Metros and Circle A are likely to be keenly contested in the auction and have chances of witnessing aggressive bidding.

►Regulatory clarity is one key step in • ensuring competitive interest in the bidding process, from incumbents,

new domestic entrants and international entrants.

►Spectrum remains a key issue in the • auctions. There are a few Circles like West Bengal, Delhi, Gujarat that have between 2 and 3 slots of spectrum including one reserved for BSNL/MTNL. Only these slots will be auctioned in the first round. Vacating of spectrum by the Indian Armed Forces, is a key determinant to when operators can start rolling out services in these circles. Globally, 10MHz to 15MHz, i.e. 2 to 3 carriers have been awarded in 3G auctions, in India, it will be a single 5 MHz carrier. In the case of WiMax, there are concerns on the contiguity and interference levels of the spectrum bands.

►Clarity on spectrum charges, i.e., • whether it is to be calculated on total versus incremental AGR, or if it is different rates for incumbents and the new entrants will also have to be resolved before the auction.

►WiMax spectrum in the 2.3 and 2.5 • GHz (four slots of 20MHz)is likely to be auctioned before 3G. The reserve price, which was initially 25% of the 3G reserve price in each circle category, was doubled to 50%. The removal of “data only” from the services, implicitly gives successful bidders the option to provide voice services on WiMax. However, the business case for mobility based voice on WiMax remains to be proven globally.

18 India 2012: Telecom growth continues

Critical factors that will enable a data revolution in India

3G and WiMax should provide enhanced services through high speed data backed by compelling content. In the case of 3G, ability to offer a full suite of high bandwidth multimedia applications may be hampered by the availability of a single 5MHz carrier.

India’s data revolution is going to be fuelled by 3G and WiMax. However, for the data revolution to gain scale and momentum, customized and vernacular content catering to the diverse masses needs to be developed. In our view, entertainment and banking are likely to be the biggest drivers of data services. Several operators in India have experience of running 3G and WiMax services globally. They are going to significantly use this experience to retain their customers and capture a greater share of their wallets.

►Services would have to be affordable • to drive penetration. Global experience has shown that expensive data pricing contributes to poor user experience and adoption levels. Flat rate plans with unlimited data usage has resulted in significant data volume. However, given

the price sensitive nature of the Indian market, operators will have to combine global experience with the Indian 2G experience.

Handset and end use equipment • affordability would also be critical to drive penetration. 3G services would require cost effective phones and data cards, while WiMax will require low cost PC/laptops and customer premise equipment. This is especially true in the case of WiMax where the eco-system is not as developed as compared to 3G.

►3G and WiMax will, in our view, are • complementary technologies serving different markets. 3G will cater to full mobility voice and data while WiMax will cater to fixed or limited mobility broadband and voice services. This could change once the business case for mobility based WiMax is proven across the globe and there is significant development of eco-system around it. However, it could take a minimum of 2 to 3 years for this to happen.

The incumbents will have to ensure their presence on the 3G front in order to retain their high ARPU 2G subscribers (the primary target group for 3G), who

Key drivers for adoption of 3G and WiMax in India

Regulatory clarity

Availability and contiguity (WiMax) of spectrum �Spectrum fee for 3G (incremental vs. total), Broadband Wireless Access (BWA)for existing playersForeign players timing of joint venture formation

Improved dataspeeds backed by superior content

�Improved data speeds providing enhanced user experience�Customized, vernacular and compelling content catering to the interest of the diverse masses

Affordable services��Affordable data and voice pricing plans leading to higher adoption levels�Affordable content

Affordable handsets/customer premise equipment

��Affordable 3G handsets�Affordable PC/laptops, other customer premise equipment

►►

►

►

►

►

►

►►

19India 2012: Telecom growth continues

Dynamic MVNO activities in mature mobile markets, December 2007

0%

50%

100%

150%MVNO No MVNO

Sin

gapo

re

Hon

g K

ong

New

Zea

land

Aus

tral

ia

Taiw

an

Sou

th K

orea

Mal

aysi

a

Jap

an

Tha

iland

Phi

lippi

nes

Chi

na

Indo

nesi

a

Vie

tnam

Indi

a

Mob

ile P

enet

rati

on %

Source: International Telecommunications Union: World Telecommunications/ICT Indicators Database, December 2007

will otherwise churn to 3G operators. Operators would have to incorporate this value erosion due to subscriber churn in their 3G bid pricing. In spectrum starved circles, 3G will also be used by the incumbents to provide better quality voice services. On the flip side, the new entrants would try to capture a good part of this churn. Incumbents, who do not manage to get 3G spectrum will have to think of ways to reduce this churn. Providing enhanced Enhanced Data for Global Evaluation (EDGE) based data services could be one such strategy.

Auctions of WiMax and 3G are likely to happen in January 2009 and February 2009 respectively. Rollout of services is likely to commence by latter part of 2009 and will be limited to top 20 cities in India. Initially data services are likely to take off. As services become further customized and network coverage becomes wider, we anticipate nearly 25 to 30 million subscribers adopting 3G by 2012. 3G revenues will touch USD 4 billion to USD5 billion. WiMax, on the other hand, could attract about 8 million to 10 milion subscribers and account for about USD1 billion to USD1.5 billion by 2012. (These projections will be dependent on the kind of services offered, the availability of handsets and network coverage).

Moving towards MVNO

There is renewed interest in virtual play in the country as the Indian regulator released recommendation to allow MVNOs (Mobile Virtual Network Operator) in India, soon after the release of 3G and BWA policy. TRAI defines MVNO as a “licensee in any service area that does not have spectrum of its own for access service, but can provide wireless services to its customers through an agreement with the existing providers”. Around the world, MVNOs begin operations when 3G services are launched. As subscribers migrate to 3G services, capacity is available on the 2G network. This is when operators begin to host MVNOs as it helps monetize the investment made to launch 3G services. The MVNO allows operators to utilize their infrastructure effectively. If, on the one hand, this could lead to increased collaboration between players, then on the other hand, there are questions around sustainability of the MVNO business case in a highly competitive 6 to 7 player, low tariff, emerging Telecom market.

TRAI has also identified MVNOs as a distinct service provider with its own licensing and regulatory framework, while

20 India 2012: Telecom growth continues

allowing the virtual operators to decide upon their business model on the basis of strategies and capabilities. In summary, the key TRAI recommendations relating to MVNOs are:

License service area of MVNO shall be • same as that of parent MNO and their mutual agreement would be driven by market forces

Entry fee would be 10% of that of the • MNOs, subject to a maximum of INR 5 Crore (USD1.2 Million) for Metro/Category A, INR3 Crore (USD0.7 Million) for Category B and INR1 Crore (USD0.2 Million) for Category C service areas

►No spectrum charges and roll-out • obligations would be applicable to the MVNOs; annual license fees shall be same as that of MNO in the particular service area

►No limit on the number of MVNOs • attached to a MNO; however an

agreement between the MVNO and MNO needs to be submitted at the time of the license issue

Foreign Direct Investment (FDI), M&A • restrictions shall be the same as that of the MNO

There are two ways in which MVNOs could attempt targeting the Indian market:

1. MVNOs that follow the budget approach: MVNOs that could specifically aim to serve the needs of niche segment, competing solely on voice and SMS pricing would reduce ARPUs and focus on volumes-play. The appeal could be limited to a portion of the market, leading to diversifying into value-added services.

2. MVNOs that serve the needs of a niche segment: On the other hand, niche MVNOs have the ability to increase ARPUs by creating appealing differentiation in terms of content, customer service, information services and promotional offers

Source: Ernst & Young analysis and Yankee Group

Industry group Strength/competency Examples in Asia

Retailers Strong brands; extensive and efficient distribution network

7-Eleven, FamilyMart (Taiwan)

Media/content providers Well-recognized brands and ownership of multimedia contents

Virgin Mobile (Australia)

Mobile resellers and distributors

Knowledge of local mobile markets; existing customer base

Aurora, Arcoa (Taiwan)

Mobile network operators Excellent communication service brands; strong customer and network control; customer care and billing experience

PLDT (Philippines), China Unicom (Hong Kong)

Cable operators Entertainment and communication service integration; bundling capability

Jupiter (Japan), MiTV (Malaysia)

Fixed operators Fixed mobile convergence; bundling capability

AAPT (Australia)

Banks and financial services

Large customer base, emergence of electronic credit card; wallet and cash applications

Merchantrade (Malaysia), KFTCI (Korea)

Private equity Strong financial position Tune Talk (Malaysia)

Prospective MVNO groups

21India 2012: Telecom growth continues

2001 2003

Hong Kong (48)

United Kingdom (15)

• Spain (31)

• Sweden (55)

• Switzerland (36)

• Australia (61)

• Denmark (72)

• Italy (85)

• Norway (80)

• France (68)

• Finland (97)

• Portugal (101)

• South Korea (72)

• USA (56)

• Belgium (74)

• Germany (72)

• Brazil (37)

• Japan (68)

Country wise penetration at the time of MNP implementation (in %)

1998 2000

1999

2002 2004

Source: CII - Ernst & Young analysis

and the beauty of the model then lies in the endless possibilities of customer segmentation where the targeted segments can go beyond the obvious break-down of youth, enterprises, sports fans, low-spending groups and regional communities.

Critical success factors for an MVNO player in the India market

► MVNO operator will need to have a • strong distribution network, effective customer service channel and strong financial fundamentals.

► Leading business houses could be • better enabled with their spread across retail sector, financial services, media, aviation, handset distribution and the hospitality sector. Globally, there has been an emergence of non-telcos as significant players in this space. They are best positioned to leverage upon their existing strengths of customer know-how and reach.

► New players will need to leverage • their existing strengths to create a niche through content tie ups and/ or through customer segmentation.

► Foreign Telecom operators could • leverage this opportunity to becoming a part of the India Telecom growth story. However success would largely be dependent on their ability to combine with the overall strengths of an Indian enterprise.

► Finally, the long-run triumph of the • concept at large would rest upon clear definitions of licensing, spectrum and regulatory restrictions.

Full potential of Mobile Number Portability guidelines yet to be realized

While most countries implemented the Mobile Number Portability (MNP) guidelines at a mature stage of penetration, Indian policymakers formulated them at a time when the industry is still seeking a solution to some key regulatory hurdles. MNP is essential for the Indian Telecom Industry. It would provide ease of switching to the subscriber. To create an impact, MNP will need to be spread across the country and there should be easy and affordable porting. Globally, number portability has not induced much churn, however, depending upon aforementioned factors, MNP could lead to some impact in the Indian telecom market.

22 India 2012: Telecom growth continues

In India, as is elsewhere in the globe, the biggest gainers from portability will be end customers. Indian customers will be able to change service providers, while retaining their mobile numbers — something akin to an individual’s identification these days. But there are some issues that need to be addressed before India is ready to embrace MNP.

►India at its 28%22 plus mobile penetration level could be considered relatively young for this phenomenon. At the same time, it is important to consider the full implementation of number portability for all service areas.

There are some potential risks and challenges that will need to be overcome for the launch of MNP:

►Cost-conscious customers could be • deterred by the porting charge that could be applied when a customer switches to another operator.

►Switching between CDMA and GSM-• based technologies may also result in an operational challenge of changing handsets.

►Operators, for their part, must be • prepared to factor in various porting and non-porting costs. Porting costs may constitute the set-up, management, administration and transport costs. Non-porting costs may include the cost of promotions, customer service and value-added services.

While MNP may promise a significant upside for some operators (those with lower market share), it could also pose serious challenges for others if the risks involving regulatory, operational and revenue assurance are not carefully managed. MNP also has a potential for increasing customer acquisition and retention costs.

Hence, in order to ensure the successful implementation of this regime, various stakeholders of the industry, including the licensor, regulator, operators and industry associations, would need to work closely for an effective rollout of this service.

22 TRAI press release No. 89/2008, 24 November 2008

Broadband — a key driver

In October 2004, India’s wireless subscribers exceeded the fixed line base.23 Four years later, there are eight24 wireless connections for each fixed line. As the wireless growth continues, the fixed line base has been gradually declining.

By end-September 2008, the fixed line base declined to 38.4 million25 from an all-time high of 41.5 million in March 2006.26 Yet, India’s fixed line network is the seventh-largest globally.27

The fall in fixed lines is not unique to India. China’s fixed line base has declined by a substantial 11.6 million from January 2008 to August 2008 to 354.1 million subscribers.28 But the difference is that fixed tele-density in China is substantially higher at 27% against India’s tele-density of 3.4%.

In the first nine months of 2008, the fixed line base declined by 0.9 million in India. While state-owned Bharat Sanchar Nigam Limited (BSNL) and Mahanagar Telephone Nigam Limited (MTNL) together lost 1.61 million fixed line subscribers, private operators managed to add 0.7 million new lines.29 Starting 2010, we see a rise in fixed lines due to a rise

in demand for fixed broadband services among small and medium enterprises and home users. We estimate the fixed line base to be approximately 45 million to 50 million in 2012.30

The Government has waived the license fee on rural fixed lines.31 The immediate gainer will be BSNL, which has 36.6% of its fixed line subscribers in rural areas.32 While this is a good beginning, it is not enough. To realize the fixed line growth, this waiver needs to be extended throughout the country.

Broadband subscribers are expected to grow from approximately 3 million subscribers in 2007 to 25 million to 30 million subscribers in 2012 whereas internet subscribers are expected to grow from 10 million subscribers in 2007 to 45 million subscribers in 2012. However broadband could see a 30% to 40% increase from the said projections if WiMax services gain traction. Though WiMax is unlikely to replace existing wireline broadband, it is going to drive broadband subscriber additions especially in areas where quality last mile infrastructure is not available.

23India 2012: Telecom growth continues

23 TRAI press release No. 74/2004, 8 November 200424 TRAI press release No. 79/2008, 24 September 200825 Ibid.26 TRAI press release No. 89/2006, 12 September 2006 27 International Telecommunication Union; World Telecommunications Indicators/ ICT Indicators Database28 Ibid.29 TRAI press releases No. 86/2008; TRAI press release No. 11/2008 30 CII-Ernst & Young analysis31 “Amendment in license Agreement for Basic Telephone Services/UAS license agreements with respect to license

fees”, Department of Telecommunication, Government of India, 29 August 200832 Telecom Services Performance Indicators April to June 2008, TRAI, 7 October 2008, Page 60

Compared to smaller countries such as the Netherlands and Turkey, India is much behind in global ranking relating to broadband subscribers. In contrast, China

Source: CII - Ernst & Young Analysis

Note: Internet subsriber base is inclusive of broadband subscribers

Broadband growth to pick up in India

10.4

15.2

20.3

26.6

34.8

45.4

3.15.8

9.4

14.4

21

27.3

0

5

10

15

20

25

30

35

40

45

50

2007 2008F 2009F 2010F 2011F 2012F

Internet subscribers Broadband subscribers

Sub

s (

Mn

s)

F= Forecast

with 76 million broadband subscribers is marginally behind the US that registers 77 million broadband subscribers.33

33 Vanier, F., Point Topic, World Broadband Statistics, September 2008, Page 22

Source: CII-Ernst & Young Analysis

Wireless Internet use on the rise

5887

123148

179196

648594

533

445

233

345

0

100

200

300

400

2007 2008F 2009F 2010F 2011F 2012F

Wir

eles

s In

tern

et S

ubs

(M

ns)

0

200

400

600

800

Tota

l Mob

ile S

ubs

(M

ns)

Wireless Internet Subs (Mns) Total Mobile Subs (Mns) F = Forecast

24 India 2012: Telecom growth continues

India. The first sign of a rise in broadband subscriber base is visible. During the first nine months of 2008, the broadband base has grown by 1.8 million.34 This is nearly three times than the 0.6 million broadband subscribers added during the same period of 2007 (designated the “Year of Broadband”). Net broadband additions this year rose by 56.5%, as opposed to the 52.7% growth achieved in all of 2007.35 While broadband growth

Source: CII India’s Broadband Economy: Vision 2010

Raising the stakes Broadband is defined as an “always on” data connection that is able to support interactive services, including internet access and has the capability of minimum download speed of 256 kilo bits per second (kbps) to an individual subscriber.

The surge in broadband penetration is expected to be the driver for the next phase of Telecommunications growth in

25India 2012: Telecom growth continues

34 TRAI press release No. 79/2008, 24 September 2008 35 Ibid.

S. no. Area Benefits of broadband Quantification

1 Growth in national output (present value of estimated additional growth in the 2010-2020 period) due to ubiquitous broadband deployment in India

Overall Approx USD90 billion

Labour productivity improvement of existing workforce

Approx USD49 billion

Output growth due to e-literacy programs in secondary schools

Approx USD14 billion

Output growth due to e-education in vocational / higher secondary schools

Approx USD27 billion

2 National Employment Opportunity Creation by 2020

Through increase in employment of rural youth and improvement in labour participation of urban women through teleworking and distributed computing

59 million full time equivalents (approximately 68 million people including part-time teleworkers)

3 Broadband as a new Industry by 2020

Revenues of the entire industry value chain USD25 billion

Industry value chain - total employment potential

1.9 million

4 Education Improved accessibility, flexibility and quality for all

100% connected villages can have a virtual primary, secondary, adult literacy and distance education through the village kiosks

5 Health Real time professional medical attention / care available for all

Every village broadband kiosk can act as a telemedicine centre

6 Governance and citizen empowerment

Real time interface between every citizen and the relevant government agency; virtual single window service

Every enterprise, home connection and urban/ rural kiosk can act as a single window government interface

Table 4: Economic impact of broadband

seems to have begun, India is still way behind target. Against a target of 20 million broadband subscribers by 201036, we expect to close at approximately 14 million.37

Though broadband additions are better than ever before, penetration is a marginal 0.3%38 against the global average of 6.1%.39

Despite the current challenges, India is expected to rise up in the ranks in subscriber numbers over the next few months.40 It would feature among the top 10 broadband markets by subscribers in 2013.41 However, this may be a long haul as far as penetration levels are concerned. The growth of broadband continues to be hampered by inadequate last mile network coupled with low personal computer/laptop penetration.

One of the problems that broadband providers face is the multiplicity of approvals needed before laying an optic fibre backbone. Indian states need to proactively look at providing a single window approach to Telecom operators to gain the benefit of faster connectivity.

Wireless internet subscriber base to post strong growth

India is a unique market as far as the internet subscriber base is concerned. As of June 2008, there were 11.7 million internet users. There were an additional 75.9 million users who accessed the internet on their wireless phones.42 This

Broadband penetration continues to be very low

7776

2820

16 16 1511 9 8 8 5 5 5 4 5 3

2426

25

30

18

26

18

4

26

3

33

64

20

22

5

24

0

20

40

60

80

US

A

Chi

na

Jap

an

Ger

man

y

UK

Fran

ce

S K

orea

Ital

y

Can

ada

Spa

in

Bra

zil

Aus

tral

ia

Rus

sia

Net

herl

ands

Turk

ey

Mex

ico

Taiw

an

Indi

a

Sub

s (

Mns

)

0

10

20

30

40

Pen

etra

tion

%

Broadband subs (Mns) Broadband population penetration (%)

Source: World Broadband statistics June 2008, Point Topic

26 India 2012: Telecom growth continues

36 Broadband Policy 2004, Government of India; Ministry of Communication of Information Technology;

Department of Telecommunications, Page 637 CII-Ernst & Young analysis38 Ibid.39 Ibid.40 Ibid.41 http://point-topic.com/content/dslanalysis/bbaforecast081119.htm42 Telecom Services Performance Indicators April-June 2008, TRAI, 7 October 2008, Page 23

figure is expected to rise to 196 million in 2012.43 The share of wireless internet users will rise from 26.5% to 30% of the total mobile subscribers in June 2008 to 30% in 2012.44

The arrival of 3G and WiMax will drive the uptake of wireless broadband.

It is estimated that India and Japan will be the largest markets for WiMAX in the Asia-Pacific region by 2012, with an estimated 35.7%, and 16.9% share, respectively, of the total regional market, followed by Pakistan and China.45 On the WiMax front, India’s market leadership will be fostered by ambitious investment plans by Telecom operators and the replacement of ageing or legacy fixed-line broadband infrastructure.

Critical success factors for broadband growth

The Government needs to implement key initiatives for broadband on fixed lines to take-off:

The local loop needs to be unbundled. • Although TRAI recommended local loop unbundling (LLU) in 2004, it has still not been implemented. It is time a decision is taken and LLU is allowed.

There is a need to redefine the speed • of conventional fixed line broadband. It should be hiked from the current 256 kbps to at least 2 mbps. The broadband

divide among nations is apparent. In Japan, South Korea and Hong Kong, the minimum advertised broadband speed is more than the maximum speed in Cambodia, Bangladesh and Laos.46

For broadband penetration to • increase, tariffs need to reduce. In India, a subscriber is offered unlimited downloads on a 256 kbps line for a minimum of INR999. However, a subscriber in Singapore gets unlimited 8mbps fixed broadband, 2 mbps wireless broadband and access at some 800 Wi-Fi hotspots for just INR1,575 per month.47 This differential reflects the urgency to revise the tariff structure to see a considerable breakthrough in achieving optimum broadband penetration levels.

There is a need to develop content • that meets the need of the Indian consumer. While the immediate benefits of broadband will be for business users, the real gains will be for rural India in applications such as telemedicine, e-commerce, e-education and e-governance. The prices have to be lowered to popularize broadband services among the rural masses. The availability of content that caters to the needs of the rural population might be as important as low tariffs for this consumer group.

27India 2012: Telecom growth continues 27

43 CII-Ernst & Young analysis44 Ibid.45 “Laying the Foundation: WiMAX in Asia/Pacific 2008”, Springboard Research, July 200846 http://www.itu.int/newsroom/press_releases/2008/25.html47 Ibid.

28 India 2012: Telecom growth continues

Operators to target for larger “share of the wallet” Every Telecom service provider is looking beyond the basic voice services by offering a composite bouquet of bundled offerings. For example, nearly all the leading operators, including incumbents, are in the testing phase to launch commercial IPTV services. Indian operators are at the nascent stage in terms of offering “quad-play” using the existing network infrastructure for data, voice, video and basic communication services. Consumers can get all these services from the same Telecom operator and enterprises can also access virtual private networks (VPN), video-conferencing, enterprise solutions, mobility and fixed telephony from the same integrated Telecom service provider.

But what happens after that? In a market where the ARPU is already at USD5 to USD649 and still declining, operators are looking at ways and means to boost revenues. After all, once the subscriber growth begins to slow down, operators will need other ways to sustain revenue growth and profitability.

Operators have diversified the strategy to focus on the customers’ composite “share of the wallet” in addition to the traditional voice revenues. Thus, the approach should be to aim at total customer spend as opposed to just the spend on communications.

Consumer spend on communications doubled from 1.2% in 1999 to 2000 to 2.7% in 2006 to 2007 replicating the global spending patterns. “It is estimated that in 2025, the consumer spend on communications will be 6%. Communications is expected to be one of the fastest expanding categories with a growth of over 13% a year on an aggregate basis.”50

Telecom operators increasing stake across industries

While global operators are clearly focused on Telecom, Indian operators are typically a part of large, diverse business groups that offer variety of goods and services. For example: business groups with Telecom operations in India have ventures that include insurance services, retail outlets and multiplexes, among others. Thus Indian operators are at an initial stage of rolling out schemes and strategies to target the “customers’ wallet.” A key stakeholder in the industry suggested that “over the next few months, subscribers could be offered a series of bundled offers and schemes.” Thus, it will be beneficial for companies as there will be significant scope to cross-sell by way of product offerings and service solutions. For example: on taking up a new insurance plan, a subscriber could be

48 As quoted by, Mukesh Ambani, erstwhile Reliance Group Chairman at the launch of Reliance Infocomm in 2002 in “Ambani to make Reliance Info ‘the Maruti of the Telecom world”, Rediff.com, 28 December 2002

49 Telecom Services Performance Indicators April- June 2008, TRAI, 7 October 2008, Page 2150 The Bird of Gold: The Rise of India’s Consumer Market, McKinsey Global Institute, May 2007, Page 16

“Now the fundamental

framework of business

is to take a share of the

wallet of an individual. We

think that information,

communication and energy

are essential for every

individual living in today’s

world. That is what we are

really pursuing!”48

29India 2012: Telecom growth continues

offered free talk time. Further, there could be schemes to offer subscribers free talk time based on incurring a minimum spend at select retail outlets. The idea behind such bundled offers is to ensure that the operators’ network is fully utilized. A high usage customer could be provided free passes for movies or a car company could provide the first years’ insurance at a discounted price. This could be a key differentiator to acquire or retain customers with high usage.

51 Ernst & Young interviewed the CEO of a leading Telecom company in India as part of primary data collection for this report

A primary stakeholder

in a leading Telecom

company said, “We are

building a common IT

back-end distribution and

shared services system.

Once that is done, the

other businesses will

be integrated with the

Telecom operations.”51

However, there might be implementation issues in order to provide these bundled services. Telecom operators need to integrate their network with various other related operations.

Since bundling ensures that business groups manage to generate additional revenues from a household unit, this trend of providing bundled services further intensifies competition for new entrants and potential international operators in the future.

30 India 2012: Telecom growth continues

The current global financial crisis could have a low-to-medium impact on the telecom sector in terms of rising cost of capital and reduction in discretionary spending on part of the customers. However, we expect no adverse impact on basic mobile and internet service revenues.

Even though the global liquidity crunch is likely to take a toll in the short-term mergers, the interest shown by global Telecom operators in the domestic Indian Telecom market has been encouraging. Recently, Japan’s leading Telecom operator, NTT DoCoMo invested USD2.7 billion for a 26% stake in Tata Teleservices.52 Norway-based Telecom company Telenor acquired a 60% stake over USD1 billion in Unitech Wireless in India, which has a nation-wide 2G mobile license.53 And UAE-based Etisalat has invested USD900 million for a 45% stake in Mumbai-based Swan Telecom, which has licenses for 13 Telecom circles.54 This will help channelize investment in 2G, and in some cases, even 3G services. This is also the time for leading Indian Telecom operators “to shop” for assets abroad. It is an opportunity to build a truly global presence. A few of these players have already announced that they are looking at global expansion.

The impact on the investments made by foreign operators in Indian Telecom companies is likely to be muted as

Telecom sector — resilient or impacted by economic slowdown?

leading Indian Telecom operators are mildy leveraged. Network expansion is expected to continue during 2009 and 2010 to meet the rising demand for wireless connectivity.

“Auction of 3G spectrum in 2009”55 will be a principal arbiter to judge the resilience of the Telecom sector. The global financial outlook may be a deterrent for international operators to participate in the auctions. However, the Government may modify auction guidelines by allowing successful bidders to make payments on a staggered basis — to pay the reserve price upfront and pay the remainder cost in easy instalments. This should make it attractive for international operators to enter India’s Telecom market. However, beyond the spectrum, operators will adopt a conservative stance on spending for the launch of 3G services. It will take time for 3G to gain traction in the market. Besides, the immediate focus of the 3G bid winners will be providing data services in the top 20 cities.

Despite the global slowdown, the demand for new mobile connections in India is expected to be robust, backed by the strong monthly net additions. As India is largely a price-sensitive market, there is likely to be a reduction in discretionary spending on the replacement of handsets at the consumer level. This may also adversely impact the value-added services offered by content providers as demand for such services may decline.

52 Tata Teleservices press release, 12 November 2008 or http://www.tataindicom.com/pressroom.aspx53 “Unitech: Telenor to acquire 60% stake in Unitech Wireless; will revisit valuations post quarterly results”,

Kotak Institutional Equities Research, 31 October 200854 “Swan Telecom: Stake sale to Etisalat for USD 900 mn”, Edelweiss Securities Research, October 200855 “India to allocate 3G spectrum by end-Jan–govt”, Thomson Reuters 2008, 4 November 2008

31India 2012: Telecom growth continues

In conclusion

Wireless subscriber growth is estimated • to continue till 2012 as India is projected to garner about 640 million to 650 million mobile subscribers. Fixed line subscriber base is expected to reach 45 million to 50 million, largely driven by broadband growth.

Nearly half of the projected mobile • subscriber additions are likely to emerge from rural areas.

The lack of availability of adequate • spectrum could become a hurdle for future wireless growth.

Mergers and acquisitions are expected • to reduce the number of operators to five to seven key players by 2012.

3G and WiMAX services are expected • to gain popularity, initially in the top 20 cities and gradually in the rest of the country. Mobile entertainment and mobile banking are likely to emerge as key data services. By 2012, India is likely to have 25 million to 30 million 3G subscribers and 8 million to 10 million WiMax subscribers.

The entry of MVNOs will help achieve • growth faster by targeting niche customer segments. For MVNOs to grow in the Indian Telecom market, a strong brand and well spread-out distribution network will be the key differentiators for success.

MNP is essential for the Indian Telecom • Industry. It would provide ease of switching to the subscriber. To create an impact, MNP will need to be spread across the country and there should be

easy and affordable porting. Globally, number portability has not induced much churn, however, depending upon aforementioned factors, MNP could lead to some impact in the Indian telecom market.

Finally in 2012, India will have a • broadband subscriber base of 25 million to 30 million and an internet subscriber base of 45 million. The mobile is deemed to emerge as the principal means to access the internet in the next stage of evolution of Telecom services.

The entry of MVNOs will help achieve • growth faster by targeting niche customer segments. Between 2008 and 2012, entry of MVNO is expected in a 12 operator telecom market. With almost 4 to 5 operators being new, entry of MVNOs would help achieving growth faster. Globally, successful MVNOs are those which already have a distribution network and brand image and India would be no exception. We could also witness some existing brands with customer reach launching into this space – which would fuel further growth in the sector.

Looking ahead, the growth momentum will continue in the Indian telecom sector over the period 2008 to 2012. The nature of this growth will however undergo a major transformation. Rural telecom and data services will be the principal drivers of this growth. Policy and regulation will become increasingly important to support and guide this growth and transformation.

32 India 2012: Telecom growth continues

The Confederation of Indian Industry (CII) works to create and sustain an environment conducive to the growth of industry in India, partnering industry and government alike through advisory and consultative processes.

CII is a non-government, not-for-profit, industry led and industry managed organisation, playing a proactive role in India’s development process. Founded over 113 years ago, it is India’s premier business association, with a direct membership of over 7500 organisations from the private as well as public sectors, including SMEs and MNCs, and an indirect membership of over 83,000 companies from around 380 national and regional sectoral associations.

CII catalyses change by working closely with government on policy issues, enhancing efficiency, competitiveness and expanding business opportunities for industry through a range of specialised services and global linkages. It also provides a platform for sectoral consensus building and networking. Major emphasis is laid on projecting a positive image of business, assisting industry to identify and execute corporate citizenship programmes. Partnerships with over 120 NGOs across the country carry forward our initiatives in integrated and inclusive development, which include health, education, livelihood, diversity management, skill development and water, to name a few.

Complementing this vision, CII’s theme “India@75: The Emerging Agenda”, reflects its aspirational role to facilitate the acceleration in India’s transformation into an economically vital, technologically innovative, socially and ethically vibrant global leader by year 2022.

With 64 offices in India, 8 overseas in Australia, Austria, China, France, Japan, Singapore, UK, USA and institutional partnerships with 271 counterpart organisations in 100 countries, CII serves as a reference point for Indian industry and the international business community.

National Committee on Telecom and BroadbandConfederation of Indian IndustryIndia Habitat CentreCore 4A, 4th Floor, Lodi RoadNew Delhi - 110 003, IndiaWebsite: www.cii.in

Ernst & Young is a global leader in assurance, tax, transaction and advisory services. Worldwide, our 135,000 people are united by our shared values and an unwavering commitment to quality.

We make a difference by helping our people, our clients and our wider communities achieve their potential.

About Ernst & Young Pvt. Ltd.

About Confederation of Indian Industry (CII)

For further information, please contact:

Sujith HaridasDirector, ICT & DefenceConfederation of Indian IndustryTel: +91-11-41504514 - 19Email: [email protected]

Prashant SinghalTelecommunications LeaderErnst & Young Pvt. Ltd.Tel: + 91 124 4644167Email: [email protected]

Ernst & Young offices

AhmedabadShivalik Ishan Building2nd Floor Beside Reliance Petrol Pump Ambavadi Ahmedabad - 380 015Tel: + 91 79 6608 3800Fax: + 91 79 6608 3900

Bengaluru“UB City”, Canberra Block12th & 13th FloorNo. 24, Vittal Mallya RoadBengaluru 560 001Tel: + 91 80 4027 5000Fax: + 91 80 2210 6000

ChennaiTPL House, 2nd FloorNo 3, Cenotaph RoadTeynampetChennai 600 018Tel: + 91 44 2431 1440Fax: + 91 44 2431 1450

Gurgaon

Golf View Corporate Tower - BNear DLF Golf CourseSector 42Gurgaon - 122 002Tel: + 91-124 464 4000Fax: + 91-124 464 4050

Hyderabad205, 2nd FloorAshoka Bhoopal ChambersSardar Patel RoadSecunderabad 500 003Tel: + 91 40 2789 8850Fax: + 91 40 2789 8851

Kolkata22, Camac StreetBlock ‘C’, 3rd FloorKolkata 700 016Tel: + 91 33 6615 3400Fax: + 91 33 2281 7750

Mumbai6th floor & 18th floor Express TowersNariman PointMumbai 400 021Tel: + 91 22 6657 9200 (6th floor) + 91 22 6665 5000 (18th floor)Fax: + 91 22 6630 1222

Jolly Makers Chambers II15th floor, Nariman PointMumbai 400 021Tel: + 91 22 6749 8000Fax: + 91 22 6749 8200

Jalan Mill Compound95, Ganpatrao Kadam MargLower Parel, Mumbai 400 013Tel: + 91 22 4035 6300Fax: + 91 22 4035 6400

15th Floor, Earnest House

Nariman Point

Mumbai 400 021, India

Tel: + 91 22 4017 5454

Fax: + 91 22 4017 5400

New Delhi6th Floor, HT House18-20 Kasturba Gandhi Marg New Delhi 110 001Tel: + 91 11 4363 3000 Fax: + 91 11 4363 3200

PuneC-401, 4th FloorPanchshil Tech ParkYerwada (Near Don Bosco School)Pune 411 006Tel: + 91 20 6601 6000Fax: + 91 20 6601 5900

Ernst & Young Pvt. Ltd.

Assurance | Tax | Transactions | Advisory

About Ernst & YoungErnst & Young is a global leader in assurance, tax, transaction and advisory services. Worldwide, our 135,000 people are united by our shared values and an unwavering commitment to quality. We make a difference by helping our people, our clients and our wider communities achieve their potential.

For more information, please visitwww.ey.com/india

Ernst & Young refers to the global organization on member firms of Ernst & Young Global Limited, each of which is a separate legal entity.Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients. Ernst & Young Private Limited is one of the Indian client serving member firms of Ernst & Young Global Limited.

Ernst & Young Pvt. Ltd. is a company registered under the Companies Act, 1956 having its registered office at 22 Camac Street, Block C, 3rd Floor, Kolkata- 700016

© 2008 Ernst & Young Pvt. Ltd.All Rights Reserved.

Information in this publication is intended to provide only a general outline of the subjects covered. It should neither be regarded as comprehensive nor sufficient for making decisions, nor should it be used in place of professional advice. Ernst & Young Pvt. Ltd. accepts no responsibility for any loss arising from any action taken or not taken by anyone using this material.

0092.India 2012 08/11. Artwork by Jayanta Ghosh

The Confederation of Indian Industry (CII) works to create and sustain an environment conducive to the growth of industry in India, partnering industry and government alike through advisory and consultative processes.

CII is a non-government, not-for-profit, industry led and industry managed organisation, playing a proactive role in India’s development process. Founded over 113 years ago, it is India’s premier business association, with a direct membership of over 7500 organisations from the private as well as public sectors, including SMEs and MNCs, and an indirect membership of over 83,000 companies from around 380 national and regional sectoral associations.

CII catalyses change by working closely with government on policy issues, enhancing efficiency, competitiveness and expanding business opportunities for industry through a range of specialised services and global linkages. It also provides a platform for sectoral consensus building and networking. Major emphasis is laid on projecting a positive image of business, assisting industry to identify and execute corporate citizenship programmes. Partnerships with over 120 NGOs across the country carry forward our initiatives in integrated and inclusive development, which include health, education, livelihood, diversity management, skill development and water, to name a few.

Complementing this vision, CII’s theme “India@75: The Emerging Agenda”, reflects its aspirational role to facilitate the acceleration in India’s transformation into an economically vital, technologically innovative, socially and ethically vibrant global leader by year 2022.

With 64 offices in India, 8 overseas in Australia, Austria, China, France, Japan, Singapore, UK, USA and institutional partnerships with 271 counterpart organisations in 100 countries, CII serves as a reference point for Indian industry and the international business community.

Confederation of Indian Industry

Website: www.cii.in