Income Tax I - Textbook 2010

-

Upload

anhhao1971 -

Category

Documents

-

view

950 -

download

1

Transcript of Income Tax I - Textbook 2010

2010

© H&R Block Canada, Inc. 2010 All Rights Reserved

Copyright is not claimed for any material secured from official government sources.

No part of this book may be reproduced or transmitted in any form or by any means,

electronic or mechanical, including photocopying, recording, or by any storage or retrieval system,

without permission in writing from H&R Block Canada, Inc.

Income Tax I – Textbook i

© 2010 H&R Block Canada, Inc.

Table of Contents

Foreword ............................................................................................................. 1

Chapter 1 – Preliminaries .................................................................................... 7

Evolution of the Canadian Income Tax System ........................................................ 9 Canadian Income Taxes Today ............................................................................. 10

Residence ................................................................................................................10 Self-Assessment System ...........................................................................................11 Progressive Tax System ............................................................................................11 Provincial Taxes ........................................................................................................11

Filing Requirements .............................................................................................. 12 Due Dates for Returns ..............................................................................................13

Income Subject to Tax .......................................................................................... 13 What is Income? ......................................................................................................13 Calculation of Income on a Tax Return .....................................................................15 Calculation of Federal Tax ........................................................................................15

The T1 Return ...................................................................................................... 16 The T1 General ........................................................................................................16 The T1 Special .........................................................................................................17 Making Correct Entries ............................................................................................18

Electronic Filing .................................................................................................... 18 EFILE........................................................................................................................19 TELEFILE ..................................................................................................................19 NETFILE ...................................................................................................................19

Records and Receipts ........................................................................................... 21 Identification ........................................................................................................ 21

Information about your residence .............................................................................22 Information about you .............................................................................................23 Information about your spouse or common-law partner ...........................................23

Elections Canada ................................................................................................. 24 Goods and Services/Harmonized Sales Tax (GST/HST) Credit Application ............... 25 Foreign Property .................................................................................................. 25 Summary ............................................................................................................. 27

Chapter 2 – Income from Employment ............................................................ 29

Introduction ......................................................................................................... 31 Employment Income ............................................................................................ 31 Information Slips .................................................................................................. 31

T4 Slips ....................................................................................................................32 Other Employment Income ......................................................................................36

Total Income ........................................................................................................ 40 Summary ............................................................................................................. 41

Chapter 3 – Employment Deductions and Credits .......................................... 43

Registered Pension Plan Contributions ................................................................. 45 Fully Deductible Contributions ..................................................................................45 Pre-1990 Past Service Contributions .........................................................................45

Annual Union, Professional or Like Dues .............................................................. 46

ii Income Tax I – Textbook

© 2010 H&R Block Canada, Inc.

Moving Expenses ................................................................................................. 46 Distance Requirement ............................................................................................. 47 Net Earnings Limit ................................................................................................... 47 Purpose of Move ..................................................................................................... 47 Other Rules ............................................................................................................. 47 Deductible Moving Expenses ................................................................................... 48 Non-Deductible Moving Expenses ............................................................................ 49 Claiming the Deduction ........................................................................................... 49

Other Employment Expenses ................................................................................ 54 Repayment of Employment Income .......................................................................... 54

Employee Home Relocation Loan Deduction ........................................................ 55 Canadian Forces Personnel and Police Deduction ................................................. 55 Security Options Deductions ................................................................................ 56 Calculation of Net Income and Taxable Income .................................................... 58 Canada Pension Plan Contributions ..................................................................... 58

Employer Withholding ............................................................................................. 59 Underpayments, Overpayments, and Refunds .......................................................... 60 Proration Requirements ........................................................................................... 62

Employment Insurance Premiums ......................................................................... 64 Maximum Premiums ................................................................................................ 64 Employer Withholding ............................................................................................. 64

Provincial Parental Insurance Plan ......................................................................... 65 Canada Employment Amount .............................................................................. 66 Summary ............................................................................................................. 66

Chapter 4 – Dependants ................................................................................... 67

Personal Amounts ............................................................................................... 69 Dependants ......................................................................................................... 70

Support of Dependant ............................................................................................. 70 Definition of “Child” and “Parent” .......................................................................... 71 Definition of “Spouse” and “Common-law Partner” ................................................ 71 Same-Sex Partners ................................................................................................... 74

Basic Personal Amount ........................................................................................ 74 Spouse or Common-law Partner Amount ............................................................. 74 Amount for an Eligible Dependant ....................................................................... 75

Marital Status .......................................................................................................... 76 Support................................................................................................................... 76 Relationship ............................................................................................................ 76 Residency ................................................................................................................ 77 Under Eighteen or Infirm (Except for Parents or Grandparents) ................................. 77 Residing In and Maintaining the Dwelling ................................................................ 78 One Claim per Dwelling ........................................................................................... 78 Other Restrictions .................................................................................................... 78 Claiming the Amount .............................................................................................. 79

Amount for Children Under 18 ............................................................................ 80 Amount for Infirm Dependants Age 18 or Older .................................................. 81

Meaning of Infirmity ................................................................................................ 81 Restrictions ............................................................................................................. 81 Claiming the Amount .............................................................................................. 82

Caregiver Amount ............................................................................................... 83 Claiming the Amount .............................................................................................. 83

Income Tax I – Textbook iii

© 2010 H&R Block Canada, Inc.

Public Transit Passes Amount ............................................................................... 84 Claiming the Amount ..............................................................................................85

Children’s Fitness Amount ................................................................................... 86 Children with Disabilities ..........................................................................................86

Federal Non-Refundable Tax Credits ..................................................................... 87 Goods and Services Tax/Harmonized Sales Tax Credit Application ......................... 87

Eligibility ..................................................................................................................88 Applying for the Credit ............................................................................................88 Calculating the Credit ..............................................................................................88 Determining the Credit ............................................................................................90

Canada Child Tax Benefit ..................................................................................... 91 Eligibility ..................................................................................................................91 Qualifying Children ..................................................................................................92 Family Income ..........................................................................................................92 Basic Benefit ............................................................................................................92 National Child Benefit Supplement ...........................................................................93 Child Disability Benefit Supplement ..........................................................................93 Application ..............................................................................................................93

Universal Child Care Benefit ................................................................................. 94 Repayment of UCCB Amounts .................................................................................94

Summary ............................................................................................................. 95

Chapter 5 – Calculation of Tax and Credits ..................................................... 97

Calculation of Tax ................................................................................................ 99 Federal Tax .......................................................................................................... 99

Federal Non-refundable Tax Credits ..........................................................................99 Federal Tax on Taxable Income ............................................................................... 100 Net Federal Tax ...................................................................................................... 101 Federal Political Contribution Tax Credit ................................................................. 101 Labour-Sponsored Funds Tax Credit ....................................................................... 102

Provincial Tax ..................................................................................................... 103 Refund or Balance Owing .................................................................................. 103

Calculation of Total Payable ................................................................................... 103 Calculation of Total Credits .................................................................................... 103 Total Income Tax Deducted .................................................................................... 104 Canada Pension Plan Overpayment ........................................................................ 104 Employment Insurance Overpayment ..................................................................... 104 Refundable Medical Expense Supplement ............................................................... 104 Working Income Tax Benefit (WITB) ....................................................................... 104 Employee and Partner GST/HST Rebate................................................................... 104 Tax Paid by Instalments .......................................................................................... 105 Provincial or Territorial Credits ................................................................................ 105 Refund or Balance Due .......................................................................................... 105 Professional Tax Preparers ...................................................................................... 105 Direct Deposit ........................................................................................................ 105

Summary ........................................................................................................... 108

Chapter 6 – Investment Income ..................................................................... 109

Schedule 4 and Schedule 3 ................................................................................ 111 Dividends from Taxable Canadian Corporations ................................................. 111

Dividends Received from Corporations ................................................................... 113 Dividends Allocated from an Employees’ Profit Sharing Plan (EPSP) .......................... 113

iv Income Tax I – Textbook

© 2010 H&R Block Canada, Inc.

Dividends Allocated by Trusts and Estates .............................................................. 114 Dividends Not Paid in Cash .................................................................................... 114 Election to Include Spouse’s or Common-law Partner’s Dividends in Income ........... 116

Interest and Other Investment Income ................................................................ 117 Interest from Trust, Bank, or Other Deposits .......................................................... 117 Long-Term Investment Contracts ........................................................................... 118 Other Interest Income ............................................................................................ 118 Investments Made Before 1990 ............................................................................. 118 Record Keeping ..................................................................................................... 119 Change of Method ................................................................................................ 119 Canada Savings Bonds........................................................................................... 119 Regular Interest Bonds ........................................................................................... 119 Compound Interest Bonds ..................................................................................... 119 Interest on Treasury Bills ........................................................................................ 120 Foreign Investment Income .................................................................................... 121

Capital Gains ..................................................................................................... 122 Mutual Funds ........................................................................................................ 123

Attribution Rules ............................................................................................... 124 Transfers of Property to a Spouse or Common-law Partner ..................................... 125 Transfers of Property to Minor Children ................................................................. 126 Interest on Canada Child Tax Benefit and/or Universal Child Care Benefit Payments 126

Carrying Charges and Interest Expenses ............................................................. 127 Carrying Charges .................................................................................................. 127 Interest Expenses ................................................................................................... 127

Summary ........................................................................................................... 129

Chapter 7 – Social Benefits and Other Amounts .......................................... 131

Workers’ Compensation and Social Assistance ................................................... 133 Workers’ Compensation Payments......................................................................... 133 Social Assistance Payments .................................................................................... 134

Canada Pension Plan Benefits ............................................................................ 135 Lump-Sum CPP Benefits ........................................................................................ 136

Employment Insurance Benefits ......................................................................... 137 EI Benefits Repaid .................................................................................................. 138

Social Benefits Repayment ................................................................................. 139 Employment Insurance Clawback ........................................................................... 139 Clawback Calculation ............................................................................................ 139

Charitable Donations ......................................................................................... 140 Qualifying and Non-Qualifying Donations............................................................... 141 Gifts of Property .................................................................................................... 142 Gifts of Cultural Property ....................................................................................... 142 Artists ................................................................................................................... 142 Eligible Amount of Donations ................................................................................ 143 Donations Made By Spouse or Common-law Partner .............................................. 143 Members of Religious Orders ................................................................................. 143 Claiming Charitable Donations .............................................................................. 143

Legal Expenses .................................................................................................. 145 Additional Deductions ....................................................................................... 146

Income Exempt under a Tax Treaty ........................................................................ 146 Vow of Perpetual Poverty ...................................................................................... 146

Other Income .................................................................................................... 146 Death Benefits ...................................................................................................... 147

Income Tax I – Textbook v

© 2010 H&R Block Canada, Inc.

Apprenticeship Incentive Grants (AIG) .................................................................... 147 Apprenticeship Completion Grant (ACG) ................................................................ 147 Gains from Theft or Embezzlement ........................................................................ 147 Other Amounts ...................................................................................................... 147

Working Income Tax Benefit .............................................................................. 148 Eligibility ................................................................................................................ 148 Eligible Spouse or Common-Law Partner ................................................................ 149 Eligible Dependant ................................................................................................. 149 Amount of Benefit ................................................................................................. 149 Working Income .................................................................................................... 149 Disability Supplement ............................................................................................. 149 Calculation of WITB benefit.................................................................................... 150 Prepayment ........................................................................................................... 152 Application for Prepayment .................................................................................... 152 Who Must Claim ................................................................................................... 152

Home Renovation Tax Credit .............................................................................. 153 Summary ........................................................................................................... 154

Chapter 8 – Taxpayers and Health ................................................................. 155

Disability Amount .............................................................................................. 157 Cumulative Effects of Significant Restrictions .......................................................... 158 Life-Sustaining Therapy .......................................................................................... 158 Dietary Disorders ................................................................................................... 158 Federal Disability Amount ...................................................................................... 171 Provincial Disability Amount ................................................................................... 171

Disability Amount Transferred from a Dependant ............................................... 171 Provincial Disability Transfer ................................................................................... 173

Amounts Transferred from Your Spouse or Common-law Partner ....................... 173 Provincial Disability Transfer to a Spouse or Common-law Partner ........................... 174

Registered Disability Savings Plans (RDSPs) .......................................................... 175 DTC-Eligible Individual............................................................................................ 175 Contributions ........................................................................................................ 175 Qualifying Individuals ............................................................................................. 175 Disability Assistance Payments ................................................................................ 176 Director of the Plan ................................................................................................ 176 Non-taxable Portion of RDSP Payments................................................................... 176 Plan Sustainability .................................................................................................. 177 Repayments ........................................................................................................... 177 Withholding taxes .................................................................................................. 177 Borrowing to Contribute ........................................................................................ 177 Income .................................................................................................................. 177 Withdrawal ........................................................................................................... 177 Government Support ............................................................................................. 177 Canada Disability Savings Grant (CDSG) ................................................................. 178 Canada Disability Savings Bond (CDSB) ................................................................... 178 Attribution Rules .................................................................................................... 178 Tax Free Rollovers .................................................................................................. 178 Repayment ............................................................................................................ 178

Medical Expenses ............................................................................................... 179 General Rules ........................................................................................................ 179 Qualifying Expenses ............................................................................................... 180 Non-Qualifying Expenses ........................................................................................ 183

vi Income Tax I – Textbook

© 2010 H&R Block Canada, Inc.

Medical Expenses for Disabled Persons ................................................................... 184 Receipts and Documentation ................................................................................. 184 Claiming Medical Expenses .................................................................................... 184

Disability Supports Deduction ............................................................................ 186 Refundable Medical Expense Supplement .......................................................... 189 The Disability Amount and Nursing Home or Attendant Care ............................. 191 Gasoline Excise Tax Rebate ................................................................................ 193 Summary ........................................................................................................... 194

Chapter 9 – Registered Plans ......................................................................... 195

Registered Retirement Savings Plans .................................................................. 197 RRSP Contributions ............................................................................................ 197

Deduction Limit ..................................................................................................... 198 Past Service Pension Adjustment (PSPA) ................................................................. 200 Claiming the RRSP Deduction ................................................................................ 201 Undeducted RRSP Contributions ............................................................................ 201 RRSP Excess Contributions ..................................................................................... 202 Withdrawal of Undeducted Contributions .............................................................. 203 Spousal or Common-law Partner RRSPs ................................................................. 204 Canada Savings Bonds........................................................................................... 205 RRSP Transfers ...................................................................................................... 205

The Home Buyers’ Plan ...................................................................................... 205 Home Buyers’ Plan Withdrawals ............................................................................ 205 RRSP Contributions Made Within the Withdrawal Period ........................................ 207 Repayments .......................................................................................................... 209

First-time Home Buyers’ Tax Credit ..................................................................... 210 Lifelong Learning Plan........................................................................................ 211 Tax-Free Savings Accounts ................................................................................. 212

Withdrawals .......................................................................................................... 213 TFSA Investments .................................................................................................. 213

Summary ........................................................................................................... 214

Chapter 10 – Taxation and Family Situation ................................................. 215

Getting Married or Establishing a Common-law Relationship ............................. 217 Separation in the Year ....................................................................................... 217 Support Payments ............................................................................................. 218 Taxable/Deductible Support Payments ................................................................ 218

Written Agreement ............................................................................................... 219 Prior Payments ...................................................................................................... 219 Fixed and Periodic Payments .................................................................................. 220 Specific-Purpose and Third-Party Payments............................................................. 220 Ordering of Deductible/Non-deductible Support Payments ..................................... 221 Support Payments and Personal Amounts .............................................................. 222 Repayments of Support ......................................................................................... 223 Legal Fees ............................................................................................................. 223

Adoption Expenses ............................................................................................ 223 Adoption Period .................................................................................................... 224 Eligible Adoption Expenses .................................................................................... 224

Child Care Expenses .......................................................................................... 225 Purpose of Child Care ........................................................................................... 225 Eligible Child ......................................................................................................... 225

Income Tax I – Textbook vii

© 2010 H&R Block Canada, Inc.

Eligible Payments ................................................................................................... 225 Eligible Claimants................................................................................................... 227 Form T778 ............................................................................................................. 228 Part A – Total child care expenses ........................................................................... 228 Part B – Basic limit for child care expenses deduction .............................................. 229 Part C – Are you the person with the higher net income? ....................................... 229 Part D – Are you enrolled in an educational program in 2009? ................................ 233 Child Care and the Canada Child Tax Benefit ......................................................... 234 Child Care and the Disability Supplement ............................................................... 234 Child Care Receipts ................................................................................................ 234 Child Care Expenses and Children’s Fitness Amount ............................................... 234 Child Care and Marital Status Change .................................................................... 235 Putting the Rules into Practice ................................................................................ 236

Personal Amounts .............................................................................................. 237 Spouse or Common-law Partner Amount ............................................................... 237 Amount for an Eligible Dependant ......................................................................... 239

Amount for Children Under 18 .......................................................................... 241 Caregiver Amount and Amount for Infirm Dependants 18 or Over .......................... 242 Amounts Transferred from Your Spouse or Common-law Partner (Schedule 2)........ 242

GST/HST Credit .................................................................................................. 242 Canada Child Tax Benefit ................................................................................... 243 Universal Child Care Benefit ............................................................................... 243 Summary ........................................................................................................... 244

Chapter 11 – Students .................................................................................... 247

Income .............................................................................................................. 249 Scholarships, Fellowships, Bursaries, and Achievement Prizes .................................. 249 Training Allowances ............................................................................................... 250 Registered Education Savings Plan Payments .......................................................... 250 Canada Education Savings Grant ............................................................................ 251 Canada Learning Bond ........................................................................................... 252 Lifelong Learning Plan ............................................................................................ 253

Student Loan Interest ......................................................................................... 253 Tuition Fees ....................................................................................................... 254

Deemed Residents ................................................................................................. 255 Receipts ................................................................................................................. 256 Claiming the Tuition Credit .................................................................................... 256

Education and Textbook Amounts ..................................................................... 258 Designated Educational Institution.......................................................................... 259 Information Slips .................................................................................................... 259 Claiming the Education and Textbook Amounts ..................................................... 260

Schedule 11 Federal Tuition, Education and Textbook Amounts ......................... 260 Transfer of Tuition, Education and Textbook Amounts ....................................... 260

Designated Person ................................................................................................. 260 Transfer Amount ................................................................................................... 262 Provincial Tuition Fees and Education Amounts ....................................................... 264

Moving Expenses ............................................................................................... 264 Adult Basic Education Assistance ........................................................................ 264 Summary ........................................................................................................... 265

viii Income Tax I – Textbook

© 2010 H&R Block Canada, Inc.

Chapter 12 – Senior Citizens .......................................................................... 267

Old Age Security Benefits ................................................................................... 269 Repayment of Old Age Security Benefits ................................................................ 270

CPP Retirement Benefits .................................................................................... 271 Division of CPP Benefits between Spouses or Common-law Partners....................... 272

Pension Income ................................................................................................. 273 RPP Income ....................................................................................................... 274

RPP Periodic Payments ........................................................................................... 274 RPP Lump-sum Payments ....................................................................................... 274

DPSP Income ..................................................................................................... 275 DPSP Annuity or Instalment Payments .................................................................... 275 DPSP Lump-sum Payments..................................................................................... 275

Foreign Pensions ................................................................................................ 275 RRIF Income ....................................................................................................... 276

Spouse or Common-law Partner as Beneficiary of the RRIF ..................................... 277 Other Payments from a RRIF .................................................................................. 278

Unregistered Annuities ...................................................................................... 278 Income-Averaging Annuity Contracts ................................................................. 279 Retirement Compensation Arrangements........................................................... 279 RRSP Income ..................................................................................................... 280

RRSP Annuity Payments ......................................................................................... 280 Other Payments from an RRSP ............................................................................... 281

Retiring Allowances ........................................................................................... 283 Transfers to Registered Plans .............................................................................. 284

Direct Transfers ..................................................................................................... 285 Indirect Transfers ................................................................................................... 287 Retiring Allowances ............................................................................................... 287

Non-Refundable Credits .................................................................................... 289 Age Amount ......................................................................................................... 289 Pension Income Amount ........................................................................................ 289 Amounts Transferred from Your Spouse or Common-law Partner ........................... 290 Provincial Credits ................................................................................................... 292

Pension Income Splitting .................................................................................... 293 Eligible Income for Pension Income Splitting ........................................................... 293 Making the Election .............................................................................................. 293 Benefits of Pension Income Splitting ...................................................................... 297 Drawbacks of Pension Income Splitting .................................................................. 297 Net and Total Family Income Effects ....................................................................... 298

Instalment Payments .......................................................................................... 298 Liability ................................................................................................................. 298 Instalment Dates ................................................................................................... 298 Interest and Penalty on Instalments ........................................................................ 298 Instalment Amounts .............................................................................................. 299 Current Year Method ............................................................................................ 299 Prior Year Method ................................................................................................. 299 Instalment Reminder Method ................................................................................ 300 Making Instalment Payments ................................................................................. 301 Claiming Instalment Payments ............................................................................... 301

Summary ........................................................................................................... 301

Income Tax I – Textbook ix

© 2010 H&R Block Canada, Inc.

Chapter 13 – Administration .......................................................................... 303

Submitting the Return ........................................................................................ 305 What Happens after Filing? ................................................................................ 305

Processing the Return ............................................................................................ 305 Amending a Return............................................................................................ 307

Form T1-ADJ ......................................................................................................... 307 Assessment, Objections, and Appeals ................................................................. 310 Interest and Penalties ......................................................................................... 310 Refunds ............................................................................................................. 311 Elections ............................................................................................................ 311 Summary ........................................................................................................... 312

Glossary ........................................................................................................... 313

Index ................................................................................................................ 321

Income Tax I – Textbook 1

© 2010 H&R Block Canada, Inc.

Foreword

Introduction Welcome to the 2010 H&R Block Income Tax Course. This introductory income tax course presents in-depth coverage of the information needed to prepare the majority of individual income tax returns for residents of Canada. The knowledge you acquire in this course will be valuable to those of you who want to prepare your own tax returns, as well as to those of you who want to become tax return preparers.

At the conclusion of this course, you will be able to:

Complete most basic personal income tax returns.

Income Tax I – Textbook 3

© 2010 H&R Block Canada, Inc.

About This Course Income Tax I is the core segment of the introductory Income Tax Course. Chapters 1 through 5 focus on how to complete very simple tax returns. Chapters 6 through 12 go through the tax return again, this time dealing with more complex tax situations. Finally Chapter 13 deals with important administrative issues related to tax return preparation. If you have no previous experience with personal income tax return preparation, this organization offers a systematic progression through the most important topics. Alternatively, if you have some familiarity with tax returns, this course will clarify your knowledge, expanding on concepts you already know. This course does not deal with advanced tax subjects, but some are examined briefly as they relate to the material you are studying. Greater knowledge of these tax matters can be obtained through experience, independent research and study, and, if you work for H&R Block, by taking some or all of the more advanced courses. Because 2010 tax forms are not released until late in the year, and the current budget proposals on which 2010 returns will be based are subject to change, the course is based on 2009 returns and rules. However, confirmed changes in tax rates and other amounts for 2010 are provided in the TTS Reference Book. As a result, when you have completed the course you will be conversant with both 2009 and 2010 tax information. Your Income Tax I course materials include: Income Tax I text book (this book); Income Tax I exercise book (containing questions and answers for each chapter in

the text); TTS Reference Book; and the provincial/territorial supplement for your province or territory. Income Tax I focuses on federal tax, and contains examples and figures that clarify the tax theory presented. The exercise book provides a series of questions, along with the answers to those questions, so that you can check both your progress and understanding of the material. The TTS Reference Book provides specific facts and figures, such as credits and deductions that relate to specific years. It also contains charts, federal tax forms, and copies of various information slips with instructions on how to handle amounts reported on them. You will find it a useful reference tool. The provincial/territorial supplement focuses on provincial and territorial tax. As you progress through the text, your instructor will point out where the provincial or territorial tax rules or amounts for your jurisdiction differ from the federal rules or amounts. Consequently, at the end of this course, you will be able to calculate both federal and provincial tax.

4 Foreword

© 2010 H&R Block Canada, Inc.

The course materials are yours to keep. Therefore, you should feel free to highlight, underline, and reorganize to suit your own needs. For example, some students prefer to have all the Chapter 1 materials together (text, exercises, answers), followed by Chapter 2, etc. Some find it helpful to add index tabs to divide the book into sections so that it is easier to find information. Do whatever helps you to learn better or faster. To help you in your study, at the end of each chapter you will find a summary that outlines the important concepts in the chapter. The text book also contains a glossary of tax terms, in case you need to refresh your memory as to the meaning of a specific tax term, as well as an index, to help you locate information quickly. Occasionally, you will find references to CRA material that corresponds to material covered in the text. These references are denoted by the following symbol:

2009 General Income Tax and Benefit Guide, page x

The text also makes references to forms, slips, or charts in the TTS Reference Book. These references are indicated as follows:

T4 slip

Periodically you will see the statement

Complete QX to QY before continuing to read.

This statement directs you to questions relating to the material you have just studied. The questions are found in the first section of the exercise book. Some are designed to draw attention to an important rule. Others invite you to think through a procedure or rule and put it to use. You are invited to answer these questions, using the text book as a reference, and then compare your responses with the answers found in the second section of the exercise book. This will enable you to find out immediately whether or not you understand the material you are studying. You will obtain the greatest benefit if you complete each question before looking at the answer: merely copying the answers is not generally helpful. If you are unable to answer a question, study the answer in the exercise book to clarify the material. If you are still uncertain about the material, reread the text, then attempt the question again. Finally, note whatever questions you have and ask your instructor for assistance at the next class meeting.

Chapter Review Problems A Chapter Review Problem is furnished for each chapter except Chapter 1. The review problems for the next six chapters present you with the opportunity to analyze a tax situation and then complete part or all of a tax return. The review problems for the last six chapters concentrate on tax theory. You will obtain the greatest benefit from these problems if you attempt to complete them before they are discussed in class. In doing so, be sure to refer to your text, to other sources of information, such as the Canada Revenue Agency (CRA) tax guides, or to your class notes. Each review problem concentrates on the material in the chapter just studied, but also draws on information from preceding chapters.

Income Tax I – Textbook 5

© 2010 H&R Block Canada, Inc.

In addition, many chapters have an Optional Review Problem. Similar in design to the Chapter Review Problems, they offer you the opportunity for additional practice.

Assignments and Homework At the end of each class meeting, the instructor will tell you what material will be covered in the next session, and may suggest passages of particular interest or importance. If at all possible, you should try to read some or all of the material suggested and, if time permits, complete the related exercise questions. Although there are no minimum homework requirements for this course, the amount you learn will, nevertheless, be partly dependent upon the time and effort you put forth. To gain the most from the course, therefore, we recommend that you arrange time to read and study the text on a regular basis. Plan each study period so that you can complete a specific group of questions, since the questions provide convenient stopping places.

Grading Two self-tests provided during the course will help you evaluate your progress and your understanding of the course material. There are two application problems to be submitted for marking and a final exam at the end. The exam will be open book, which means that you need not memorize information. Instead, you should concentrate on understanding tax theory, and on knowing where and how to find specific tax information when you need it. The course grade will be calculated as follows: 20% for each marked assignment, and 60% for the final exam grade.

Evaluations H&R Block hopes that you will find the Income Tax Course rewarding and enjoyable. So that we will know your feelings about what we are doing right and what we can improve, we ask that you complete the Student Evaluation Form at the end of the exercise book. Please write down your comments as you proceed through the course. At the end, your instructor will collect the evaluation forms and forward them to the District Manager for review.

Income Tax I – Textbook 7

© 2010 H&R Block Canada, Inc.

Chapter 1 – Preliminaries

Introduction This chapter introduces you to the Canadian personal income tax system.

At the conclusion of this chapter, you will be able to:

Explain the evolution of levying personal income taxes in Canada, and what it is like today;

Determine who is required to file a tax return and why some individuals should file even though not required to do so;

Determine what income is subject to tax; Differentiate between total income, net income and taxable income; Explain the due date and the four available methods for filing an individual’s tax

return; and Complete the identification area of an individual’s tax return.

Glossary Before you read this chapter, review the following terms in the glossary: Non-refundable tax credits; Refundable tax credits; Taxable income; and Taxation year.

Income Tax I – Textbook 9

© 2010 H&R Block Canada, Inc.

Evolution of the Canadian Income Tax System Before Confederation, most government revenue came from customs and excise duties. As early as 1650, for example, Louis XIV of France levied export taxes of 50% and 10%, respectively, on beaver pelts and moose hides leaving his northern American colonies. A century later, Nova Scotia imposed customs duties on sugar, bricks, lumber, and billiard tables. Excise taxes were levied on tea, coffee, and playing cards. The British North America Act gave the newly formed Canadian Parliament unlimited power of taxation. The power remained largely unused, however, since customs and excise duties still provided for most Dominion expenses. In 1867, the new government simply increased excise duties on liquor and imposed a tax on beer, malt, cigarettes, cigars, and snuff. In 1870, existing taxes were raised and new import duties on vinegar, wheat, and grain were levied. At Confederation, provinces were given the power to impose direct taxes for provincial purposes. Over the next fifty years, the provinces taxed horses, dogs, cars, gasoline, salmon, canaries, race-tracks, foxes, circuses, traveling shows, restaurants, bowling alleys, and poolrooms. British Columbia levied an income tax and a land tax; Québec imposed corporation taxes; Ontario imposed succession duties; and Prince Edward Island levied both a property tax and an income tax. In 1914, Canada declared war against Germany. At that time, customs and excise duties still provided 90% of total Dominion government revenue. To finance the war effort, the federal government in 1916 imposed a corporation tax known as the Business Profits War Tax. In 1917, the Income War Tax Act, described by the Borden government as a temporary measure, was introduced, much to the dismay of the provinces that had come to believe that only they, and not the federal government, had the right to impose direct taxes. Unfortunately, the end of the war did not end the need for additional revenue: hospitals for the wounded, homes for the permanently disabled, and pensions for veterans all had to be funded. In addition, the railway that the government had acquired as a result of the war now had to be operated on a much larger scale in order to better serve the national economy. As a result, the new taxes remained in place. A decade later, in 1927, the government created the Department of National Revenue to administer the growing tax system. In 1930 only three provinces levied taxes on personal income. However, during the 1930’s provincial responsibilities were increased by a variety of court decisions, but no corresponding new sources of revenue were provided. The unsurprising result was that by 1939, seven provinces imposed personal income taxes. For some taxpayers, the provincial taxes were just as high as the federal taxes, which themselves had risen during the decade. The recommendations of the Rowell-Sirois Commission, set up in 1937 to define the responsibilities of the provincial and federal governments and to reorganize the tax system, were still under discussion when World War II began.

10 Chapter 1 – Preliminaries

© 2010 H&R Block Canada, Inc.

With the outbreak of World War II, the federal government found that its expenditures greatly exceeded its revenue. In 1941, the provinces surrendered personal and corporate income tax collection to the federal government for the duration of the war plus one year. In exchange, the provinces received fixed annual “rental payments” from the federal government. “Pay as you earn” tax deductions began in 1942. This meant that employers withheld tax from their employees’ pay and remitted it to the government. Self-employed taxpayers were required to pay their tax by instalments. On January 1, 1949, the Income War Tax Act was repealed and the Income Tax Act came into effect. Since then, the Income Tax Act has undergone some major reforms and many small revisions, but its basic structure has remained intact.

Canadian Income Taxes Today The federal and provincial governments still have the authority to impose direct taxes. Income tax is, in fact, levied on taxable individuals by the federal government and the governments of all ten provinces and three territories. In 1962, the federal and provincial governments established the Tax Collection Agreements, which allow the provinces to impose their own individual income taxes and to accept federal tax collection and administration of the tax system. The result is that, in all provinces except Quebec (which has operated its own personal income tax system since 1954), taxpayers complete only one income tax return each year. On November 1, 1999, Revenue Canada was replaced by the Canada Customs and Revenue Agency (CCRA). The purpose of the change was to streamline the federal and provincial systems to reduce the overlap and duplication of various programs. In December 2003, the CCRA, which was responsible for customs as well as revenue, was split into the Canada Border Services Agency which deals with customs and the Canada Revenue Agency (CRA) which is responsible for administration of the tax laws. As a result of this change, many tax programs that were previously administered by the provinces are now administered by the CRA. The Income Tax Act is still administered by the Department of National Revenue with the minister of that department remaining accountable to parliament for the administration of the CRA. In addition to collecting federal tax payable, the CRA continues to collect tax payable to all the provinces and territories (except Quebec) and turns those amounts over to those jurisdictions.

Residence The Canadian Income Tax Act, unlike the equivalent legislation in a number of other countries, uses residence, not citizenship, as a criterion to determine how an individual’s income is taxed. For income tax purposes, an individual is either: a full-year resident (resident throughout the year); a non-resident (not resident at any time during the year); or a part-year resident (resident for part of the year and not resident for part of the

year).

Income Tax I – Textbook 11

© 2010 H&R Block Canada, Inc.

This course, Income Tax I, deals only with the preparation of tax returns for full-year residents. Non-residents and part-year residents are covered in other courses.

Self-Assessment System In many countries, tax calculations and deductions are made strictly at source by employers or government tax collectors, and no tax return is filed at the end of the year. Canada, however, has a self-assessment income tax system which requires taxpayers to determine their own tax liability each year. Under our self-assessment income tax system, taxable individuals are required to determine their taxable income for each taxation year, and then calculate their tax payable. This amount is compared with tax already paid and if the total credits exceed tax payable, the excess is refunded; if the total credits are less than the amount payable, the taxpayer must pay the balance owing. These calculations must be carried out on an income tax return that must be filed with the government.

Progressive Tax System Canada’s present system is called a “progressive” tax system because it imposes low rates of tax on low incomes and progressively higher rates of tax on higher incomes. For 2009, the federal tax rates were 15% on income of $40,726 or less; 22% on income between $40,726 and $81,452; 26% on income between $81,452 and $126,264; and 29% on income over $126,264. Underlying the system of progressive taxation is the belief that low-income persons should pay relatively less tax because they are obligated to spend a relatively high proportion of their income on the necessities of life; high-income persons, on the other hand, have more discretionary income with which, among other things, they can pay tax. One of the problems with our current progressive system, however, is that it levies tax individually, not on a family basis. As a result, a family in which one spouse earns $80,000 will pay several thousand dollars more in tax than a family in which each spouse earns $40,000, even though the gross family income is the same in each case. This is because, in the first situation, about half the income is taxed at a federal rate of 15%, and the rest at 22%, while in the second situation, all the income is taxed at 15%.

Provincial Taxes Outside Québec, provincial/territorial taxes and credits are calculated on special forms, and then added to the federal totals, so that the refund/balance due calculated on the federal return includes both federal and provincial taxes. In Québec, however, provincial tax is calculated on a special return that is filed with the Québec government, so the refund/balance due on the federal return includes only federal taxes. In this book, we focus on federal taxes only. However, you will receive a special supplement that covers provincial/territorial tax for your jurisdiction. As you progress through the course, your instructor will point out where the provincial/territorial tax rules and calculations differ from the federal tax rules and calculations.

12 Chapter 1 – Preliminaries

© 2010 H&R Block Canada, Inc.

Complete Q1 to Q4 before continuing to read.

Filing Requirements The Income Tax Act defines a “taxpayer” as “any person whether or not liable to pay tax.” It defines “person” to include “any body corporate and politic, and the heirs, executors, administrators or other legal representatives of such person.” Therefore human beings, corporations, and trusts can be taxpayers, and a taxpayer might or might not in fact have any tax to pay. This course deals only with taxation of individuals; taxation of corporations and trusts are dealt with in other courses. An individual taxpayer must file a tax return for a taxation year if he or she: has tax owing; disposed of capital property or had a taxable capital gain; is required to repay all or a portion of any Old Age Security benefits or

Employment Insurance benefits received; has withdrawn amounts under the Lifelong Learning Plan or the Home Buyers’

Plan that have not been repaid; is required to make Canada Pension Plan contributions because pensionable

wages and/or self-employment earnings total more than the basic CPP exemption ($3,500 for 2009);

received a demand from the CRA to file a return; claimed a capital gains reserve on last year’s return; incurred a non-capital loss and wants to be able to apply it to other years; wants to carry forward unused amounts from the current year return, such as

tuition fees, education amount or RRSP contributions; wants to claim a refund; wants to report income in order to keep his or her RRSP deduction limit up to

date (even in the case of children); wants to apply for the goods and services tax credit or harmonized sales tax

credit; wants to continue receiving the Canada Child Tax Benefit (in this case, if the

individual is married or living common-law, the individual’s spouse must also file a return); or

applied for and received advanced Working Income Tax Benefit payments in 2009 or wants to apply for advance payments in 2010.

As a practical matter, even if none of the above circumstances apply, a taxpayer may still benefit from filing a return. For example, if any doubt exists as to whether a person owes tax, filing a return will avoid a possible late-filing penalty. Self-employed taxpayers and persons with rental income should file to maintain a continuity of tax information both for themselves and for the CRA. Other individuals may wish to file returns to expedite application for income-dependent benefits, such as provincial income supplements for seniors and student loans.

Income Tax I – Textbook 13

© 2010 H&R Block Canada, Inc.

Due Dates for Returns For individuals, the taxation year is always the calendar year, January 1 through December 31. Tax returns for a given taxation year are ordinarily due on or before April 30 of the following year. Any tax owing must also be paid by that date, or interest will be charged on the unpaid amount from that date forward. The filing due date is extended to June 15 for self-employed taxpayers and spouses or common-law partners of self-employed taxpayers. In spite of the extended deadline, however, interest will still be charged on any balance that is not paid by April 30.

2009 General Income Tax and Benefit Guide, page 5

Illustration 1.1

Caroline is self-employed. Therefore, the due date for her 2009 return is June 15, 2010. However, if she has tax owing, she should pay it by April 30, 2010, to avoid interest charges.

Complete Q5 to Q7 before continuing to read.

Income Subject to Tax Amounts of income from all sources inside or outside Canada — whether received in cash, as goods, or as services — are taxable to a resident of Canada unless specifically exempt.

What is Income? The Concise Oxford Dictionary (7th ed., 1982) defines income as “periodical receipts from one’s business, lands, work, investments, etc.” The Gage Canadian Dictionary (1983) defines income as “what comes in from property, business, work, etc.; receipts; returns.” These general definitions are made more specific for use in taxation. In a somewhat roundabout way, the Income Tax Act defines income as the aggregate of amounts that are: 1. income from an office or employment; 2. income from a business or property; 3. capital gains; and 4. other sources of income as specified by the Income Tax Act (pension benefits or

the Universal Child Care Benefit, for example). This definition is the basis of our discussion of income reportable for income tax purposes.

14 Chapter 1 – Preliminaries

© 2010 H&R Block Canada, Inc.

Amounts Not Included in Income Although the above definition of income is fairly comprehensive, there are some types of income which the Income Tax Act explicitly states are not to be included when computing a taxpayer’s income for the year. In addition, there are other types of income that are not included simply because they do not fall under any of the broad categories of income described in the Income Tax Act. These types of income are never entered anywhere on the tax return. Commonly encountered amounts of this kind include: gifts and inheritances; lottery winnings; winnings from betting or gambling for simple recreation or enjoyment; strike pay; compensation paid by a province or territory to a victim of a criminal act or a

motor vehicle accident; certain civil and military service pensions; war disability pensions; RCMP pensions or compensation paid in respect of injury, disability, or death; scholarship, fellowship and bursary income for a program for which the taxpayer

is eligible to claim the education amount income of First Nations people, if situated on a reserve; profit from the sale of a taxpayer’s principal residence; provincial child tax credits or benefits and Québec family allowances; the goods and services tax or harmonized sales tax credit (GST/HST credit); the Canada Child Tax Benefit; and beginning in 2009, investment income earned from a Tax-Free Savings Account

(TFSA).

2009 General Income Tax and Benefit Guide, page 11

Income Tax I – Textbook 15

© 2010 H&R Block Canada, Inc.

Calculation of Income on a Tax Return The calculation of income on a tax return proceeds in an orderly way, as described below:

Total Income Income from all sources is entered on the return, except for those types of income that are not reportable for tax purposes (such as the ones listed above). In most cases, gross income from a source is entered (for example, employment income); in a few cases both gross and net from a source are entered (for example, gross and net rental income); and in rare cases, only net income from a source is entered (for example, research grants). The sum of income from all reportable sources comprises total income for tax purposes.

Net Income Net income is what the Income Tax Act refers to as a taxpayer’s “income for the year.” It is a person’s total income from all reportable sources, minus specified allowable deductions. Net income is important because it is used to calculate eligibility for many tax credits and social benefits, such as the GST/HST credit, personal amounts for dependants, and the Canada Child Tax Benefit.

Taxable Income Taxable income is the income on which tax is levied. This may not be the same as net income, since the Income Tax Act allows certain deductions from net income to arrive at taxable income. Two of these, the employee home relocation loan deduction and the security options deductions, you will learn about in Chapter 3. In addition, the following types of non-taxable income are deducted after the net income line: worker’s compensation payments; social assistance payments; net federal supplements; and income exempt by tax treaty. Such non-taxable amounts are discussed in more detail in Chapters 7 and 12. Taxable income is the net result found after subtracting all the applicable deductions from net income.

Calculation of Federal Tax Federal tax is calculated as a percentage of taxable income. The federal tax rates are 15%, 22%, 26%, and 29%, and they increase as taxable income increases. The resulting tax is then reduced by the taxpayer’s non-refundable credits to arrive at net federal tax. Non-refundable credits are based on the taxpayer’s personal and family situation and serve to reduce tax owing. However, they are not refunded to the taxpayer if they exceed the tax owing. Refundable tax credits are then used to offset tax owing; however, unlike non-refundable credits, if they exceed the tax owing, any excess amount is refunded to the taxpayer.

16 Chapter 1 – Preliminaries

© 2010 H&R Block Canada, Inc.

Complete Q8 to Q12 before continuing to read.

The T1 Return A “tax return” is the form prescribed by the CRA for the reporting of income, and is designed to provide the information necessary to assess a person’s liability for tax. The tax return for individuals is called a T1 Income Tax and Benefit Return. The CRA presently produces two versions of the T1: The T1 General and the T1 Special. This course focuses on the preparation of the T1 General return since anyone who can prepare it can prepare the other.

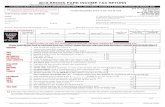

The T1 General There are several variations of the T1 General for ordinary residents of Canada; each one is unique due to provincial regulations. In this text, we will use the generic T1 General for most of Canada, since the focus is on federal tax only. Your instructor will provide you with information on the minor variations applicable to your specific province or territory, where applicable. The T1 General can be used to calculate the tax payable by individuals with any type of income, deduction, or credit. It is divided into the following sections: Identification; Elections Canada questions; Goods and services tax/harmonized sales tax (GST/HST) credit application; Foreign property question; Total income; Net income; Taxable income; and Refund or balance owing. Study the T1 General (shown in the TTS Reference Book) to see the role each section plays as you read through this section.

T1 General, page 1

Taxpayers are asked to enter identifying information about themselves, their residences, and their spouses or common-law partners (if applicable). They are then asked to respond to the Elections Canada questions, and whether they wish to apply for the GST/HST credit (this credit is discussed in Chapter 4).

T1 General, page 2

At the top of page 2, the taxpayer is required to disclose foreign property holdings with a total cost of more than $100,000. Next, in the “Total income” section, taxpayer’s are required to itemize and add their income from all sources to arrive at their total reportable income for tax purposes.

Income Tax I – Textbook 17

© 2010 H&R Block Canada, Inc.

T1 General, page 3

The “Net income” section allows taxpayers to deduct specified items from total income to arrive at net income. The “Taxable income” section allows taxpayers to deduct still other items to arrive at taxable income.

T1 General, page 4

The last page involves the calculation of refund or balance due. Federal tax payable is determined by applying the appropriate tax rate(s) and subtracting non-refundable tax credits. This calculation is done on a separate schedule and the result is entered on page 4 of the T1 jacket, along with provincial tax (in provinces other than Québec). After entering the tax deducted or paid by instalments, along with other refundable credits, the total credits are compared to the total tax payable, resulting in either a balance owing or a refund.

Other Forms and Schedules The T1 General has eleven supplementary schedules (twelve in Quebec) that are used to itemize various types of income or deductible expenses, or to calculate various taxes or tax credits. Only those schedules relating to an individual’s particular tax situation should be filed with the T1 General. Many other forms are also produced by the CRA, relating to various types of income, credits or deductions. These should also be completed and attached to the return as required by circumstances. Taxpayers outside Québec must complete the provincial or territorial tax form(s) for the province or territory in which they reside on December 31, and include the resulting amounts on page 4 of the T1 General. Taxpayers in Québec must complete a special provincial return (called the TP-1) which is submitted separately to the government of Québec. The completion of these forms is covered in the provincial/territorial supplement you received as part of this course.