Income Tax A.Y. 2013-2014 _ Five Heads of Income

-

date post

14-Sep-2014 -

Category

Economy & Finance

-

view

964 -

download

3

description

Transcript of Income Tax A.Y. 2013-2014 _ Five Heads of Income

Income Tax

From CA Sshailesh L. Prajapati

1Sshailesh L. Prajapati CA, MBA ( Finance)

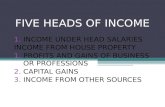

Contents of the Course

Framework & Basic PrinciplesHeads of IncomeExempt Income ( Section 10 )Taxability of Income from Salaries ( Sec 15 to 17 )Taxability of Income from House Property(Sec 22 to 27 )Taxability of Income from Business & Profession(Sec 28to44 )Taxability of Income from Capital Gain ( Sec 45 to 55A )Taxability of Income From Other Sources ( Section 56 )Set off and Carried forward of Losses ( Section 72 )Deductions & Exemptions ( Sec 80, Sec 10 )

Sshailesh L. Prajapati CA, MBA ( Finance) 2

Section 4 as charging section

- In com e- S cop e o f In com e

- S ch em e o f th e A c t

Tax on In com e

-P erson-A ssessee

of a p erson

-A ssessm en t Y ear-P reviou s Y ear

ch arg ed an n u a lly

In com e Tax

Sshailesh L. Prajapati CA, MBA ( Finance) 3

Person & Assessee

Individual Hindu Undivided Family Company Firm AOP/BOI Local Authority For Income Tax these all are – An Assessee

Sshailesh L. Prajapati CA, MBA ( Finance) 4

Previous Year

Generally◦ 1st April to 31st March

In case of new business◦ Start of business to 31st March

Assessment Year vs. Previous Year◦ AY 2013-2014 PY 01-04-2012 to 31.03.2013◦ TDS and Advance Tax to pay in Previous Year◦ Assessment, filing of Return and S.A. Tax in the Assessment Year.

Sshailesh L. Prajapati CA, MBA ( Finance) 5

Charged annually

Each year an independent year Common Financial Year Assessment Year

◦ period of twelve months starting from the 1st April of every year and ending on 31st March of the next year

◦ Denoted as 2013-2014, etc◦ For our Syllabus the A.Y. is 2013-2014

Sshailesh L. Prajapati CA, MBA ( Finance) 6

Person – Individual, HUFs, AOP/BOI

For the Assessment year 2013-2014Slab-wise Tax Rates

◦ First Rs. 2,00,000/- Nil◦ > Rs. 200,000/- but < Rs. 5,00,000/- 10%◦ > Rs. 500,000/- but < Rs. 10,00,000/- 20%◦ > Rs. 10,00,000/- 30%◦ No Surcharge◦ Education cess- 2% of Income Tax◦ SHEC – 1% of Income Tax

Sshailesh L. Prajapati CA, MBA ( Finance) 7

Person – Individual (Senior Citizen > 60 years)For the Assessment year 2013-2014Slab-wise Tax Rates

◦ First Rs. 2,50,000/- Nil◦ > Rs. 2,50,000/- but < Rs. 5,00,000/- 10%◦ > Rs. 5,00,000/- but < Rs. 10,00,000/- 20%◦ > Rs. 10,00,000/- 30%◦ No Surcharge◦ Education cess- 2% of Income Tax◦ SHEC – 1% of Income Tax

Sshailesh L. Prajapati CA, MBA ( Finance) 8

Person – Individual (Senior Citizen > 80 years)

For the Assessment year 2013-2014Slab-wise Tax Rates

◦ First Rs. 500,000/- Nil◦ > Rs. 500,000/- but < Rs. 10,00,000/- 20%◦ > Rs. 10,00,000/- 30%◦ No Surcharge◦ Education cess- 2% of Income Tax◦ SHEC – 1% of Income Tax

Sshailesh L. Prajapati CA, MBA ( Finance) 9

Person – HUF - Concept

Mr. A - Mrs. A◦ Mr B (son) & Mrs. B

Mr C (grandson) & Mrs. C Mr D (greatgrandson) & Mrs D

Mr E (greatgreatgrandson) & Mrs E

Ms. F (unmarried grand-daughter)

Karta – Mr. A (manages the property & business)

Co-parceners – B, C & D

Sshailesh L. Prajapati CA, MBA ( Finance) 10

Person – CompanyDistinct entity from shareholders/ directorsDirectors’ remuneration deductible Dividend liable for double taxation (DDT)Flat rate of tax

◦ Domestic companies 30%◦ Foreign companies 50% on specified royalties & fees for technical services 40% on Other IncomeSurcharge : Applicable if the Net Income is more than Rs. 1 Crore.

In Case of Domestic Company 5% and Foreign Companies it is @ 2% EC =2% on Tax and Surcharge and SHEC will be 1% on Tax and Surcharge.

Sshailesh L. Prajapati CA, MBA ( Finance) 11

Company- MAT If book Profit does not exceeds Rs. 1 crore

◦ IT- 18.50% of Book Profit + EC- 2% and SEC- 1%◦ Effectively it is 19.055%

If book Profit exceeds Rs. 1 crore◦ IT- 18.50% of Book Profit ◦ Surcharge 5% on MAT Tax◦ EC- 2% on MAT and Surcharge and SEC- 1% on MAT and

Surcharge. Book Profit is as per the calculation under section 115JA.

Sshailesh L. Prajapati CA, MBA ( Finance) 12

Person – Firm/ LLP

Distinct entity for taxation but no separate legal status“Agreement” & “Business” are necessary conditionsPayments to partners deductible subject to conditionsFlat Firm Tax Rate 30% Share of profits exempt in hands of the partner [Sec. 10(2A)]No Surcharge is leviable for assessees other than companiesEC and SEC will be 2% as well as 1%.

Sshailesh L. Prajapati CA, MBA ( Finance) 13

Income/Revenue Receipts & Capital Receipts Revenue Receipts are always considered as Income Chargeable to Tax

unless specified exempted. ( Eg. Salary, Interest, Rent etc) Capital Receipts are not chargeable to Tax except when specifically

provided in Law. (eg. Compensation etc) Illustrative list of “Income” under Section 2(24)

◦ Profit and Gains, Dividend, Exports Incentives, Any Capital Gain;◦ Profits of Insurance Business, Banking Business, Winning from lotteries◦ Crossword Puzzles, Races, Income from gambling or betting,◦ Any sum received under a keyman insurance policy◦ Any sum of money, movable or immovable property received as gifts;

Sshailesh L. Prajapati CA, MBA ( Finance) 14

Scope of IncomeParticulars R &

ORR & NOR

Non- Resident

Income Received or deemed to be received in India

Taxable

Taxable

Taxable

Income accruing or arising or deemed to accrue or arise in India

Taxable

Taxable

Taxable

Income accruing or arising outside India from :a)Business controlled in India or Profession set up in Indiab)Any other Source

Taxable

Taxable

TaxableNotTaxable

NotTaxableNotTaxable

15Sshailesh L. Prajapati CA, MBA ( Finance)

Residential Status – Individuals- Section 6

Basic Conditions: To satisfy atleast one condition. 1. He is in India in the P.Y for 182 day or more OR 2. He is in India for 60 day or more in the P.Y. and 365 days in 4 years

immediately preceding the P.Y. Exceptions:- extended period from 60 to 182 days

◦ Indian citizens taking employment abroad or as a crew of an Indian Ship◦ Indian citizens/PIO visiting India during the P.Y.

Resident but Ordinary Resident◦ He has been in India for a period of 730 days or more in 7 years AND◦ He has been resident in India in at least 2 out of 10 years immediately

preceding the relevant previous year.

Sshailesh L. Prajapati CA, MBA ( Finance) 16

Residential Status – Individuals- Section 6

Resident but Not ordinary Resident:◦ An Individual who satisfies at least one of the basic conditions but

does not satisfy the two additional conditions is treated as RNOR.◦ An Individual who satisfies at least one of the basic conditions but

does satisfy the only one or none of the two additional conditions is treated as RNOR.

Non- Resident:◦ An Individual is NR if he satisfy none of the basic conditions.

Additional Conditions are not relevant.

Sshailesh L. Prajapati CA, MBA ( Finance) 17

Residential Status – HUF : Section 6(2)

Residential Status depends on ;The Location of control and Management;Residential Status of Karta of the HUF

Resident : If control and Management of its affairs is wholly or partly situated in India

Non- Resident : If control and Management of its affairs is wholly situated outside India

Resident and Ordinarily Resident: This depends on the Residential status of Karta.

Sshailesh L. Prajapati CA, MBA ( Finance) 18

Residential Status - Others

Companies : Sec 6 (3)◦ Indian companies

Always resident in India◦ Other companies

Resident in India if control & management wholly in IndiaFirm, AOP and other Assessees

◦ Resident in India if control & management is wholly or partly in IndiaControl & Management:

◦ Head and Brain, which directs the policy, finance, disposal of profits, and vital things concerning the Mgt of a Co.

Sshailesh L. Prajapati CA, MBA ( Finance) 19

Scope of Income

Income Accrued in India : It is chargeable to tax in all cases irrespective of the Residential Status of the Assessee.

Income Received in IndiaIncome Deemed to accrue or arise in India

(Section 9)

Sshailesh L. Prajapati CA, MBA ( Finance) 20

Income Deemed to be received: Sec-7

Following income shall be deemed to be received in Previous Year;Employer’s contribution to recognised Provident Fund in excess of

12% of SalaryInterest credited to the RPF balance in excess of 9.5% p.a.The transferred balance from URPF to RPF ( Employer’s contribution

and Interest thereon)The contribution made by any employer in the previous year to the

account of an employee under a pension scheme (sec 80CCD)

Sshailesh L. Prajapati CA, MBA ( Finance) 21

Income Deemed to Accrue or Arise in India: Sec- 9

Certain Income are deemed to accrue or arise in India even though they may actually accrue or arise outside India◦ Income from Business Connection in India◦ Property, Asset, Source in India◦ Salaries earned in India◦ Salary paid by Government to Indian citizen◦ Dividend by Indian company◦ Interest◦ Royalties◦ Fees for Technical Services

Sshailesh L. Prajapati CA, MBA ( Finance) 22

Income TaxIncome From Salaries

Sshailesh L. Prajapati CA, MBA ( Finance) 23

Salaries: The beginners...

Test: Employer – Employee Relation Basis of Charge: Accrual or Receipt whichever is earlier Contract of Service and Contract for service Person Acting as an Agent, no relation of Master and Servant, Director of a Company, E-E relationship can not be assumed by should

be ascertained based on the AOA. Salaries to MP and MLAs ? Income from Salary or IFOS Commission paid to Managing Director? Income from Salary?

Sshailesh L. Prajapati CA, MBA ( Finance) 24

Salaries: The beginners... Year of Chargeability

◦ Either on due basis or on receipt basis whichever is earlier◦ Salary received in Advance is taxable even if it is not due◦ Arrears of Salary received during the P.Y is taxable◦ Advance against Salary is not taxable ◦ Loan taken from employer is not taxable

Place of Accrual◦ Is where the services are rendered;◦ Salary paid to NR outside India in respect of Services rendered in India is

Taxable in India by virtue of Section 9 Surrender of Salary and profit in lieu of Salary is Taxable

Sshailesh L. Prajapati CA, MBA ( Finance) 25

Deductions : Section 16

Entertainment allowance : Sec 16 (ii) It is not eligible for exemption but it only qualifies for deduction It is first included in gross salary and then deduction is allowed. Exemption only to Government employees and to the extent of

following:◦ 1/5th of salary (Basic Salary and excludes allowances, benefits or

other perquisites. Even dearness allowance should not be included though it may be provided in the terms of employment)

◦ Rs. 5,000/-◦ Actual Receipt

Profession Tax paid by the employee (Section 16 (iii)

Sshailesh L. Prajapati CA, MBA ( Finance) 26

Exemptions : Section 10(5) to 10 (14 ) Leave Travel concession : Section 10 (5) Gratuity : Section 10 (10) Pension : Section 10 (10A) Leave Salary : Section 10 (10AA) Retrenchment compensation : Section 10 (10B) Voluntary Retirement Scheme : Section 10 (10C) Recognized Provident Fund : Section 10 (12) Approved Superannuation Fund : Section 10 (13)

Sshailesh L. Prajapati CA, MBA ( Finance) 27

Leave Travel concession : Section 10 (5) Value of Travel concessions or assistance ( read with Rule 2B) Fare

◦ Based on the mode of travel for self or family

◦ Spouse, children*, Parents, brothers, sisters of the individual wholly or mainly dependant on the individual.

For travel to any place in India For 2 journeys in a block of 4 calender years

◦ From 1998-2001 ( Jan- Dec )◦ From 2002-2005◦ From 2006-2009◦ From 2010- 2013

Sshailesh L. Prajapati CA, MBA ( Finance) 28

Leave Travel concession : Section 10 (5)

Exemption shall not be available to > 2 surviving Children ( born after 01/10/1998). Not applicable for multiple births after one child.

Quantum of Exemption; Restricted to Actual Amount Spent◦ Air : Economy fare of the national carrier ( IA or AI) by shortest

route◦ Rail : Not exceeding the AC FC rail fare by shortest route◦ Rail service not available and no recognized transport available,

an amt. equivalent to Rail fare ACFC with Shortest Route.◦ Rail service not available and recognized transport available, an

amount not exceeding the FC or DC on such transport with Shortest Route to the Place of destination.

Sshailesh L. Prajapati CA, MBA ( Finance) 29

Gratuity : Section 10 (10)

Government Employees – Wholly Exempt

Covered by the Payment of Gratuity Act ◦ Exemption is to the extent of least of the following

◦ Rs. 10,00,000/-◦ 15 days * last drawn salary for each completed year of service

or part of the year in excess of 6 months ◦ Actual Receipt

◦ Salary= Basic +DA

Sshailesh L. Prajapati CA, MBA ( Finance) 30

Gratuity : Section 10 (10)

◦ Covered by the Payment of Gratuity Act, cont…

◦ Salary of 15 days is calculated by dividing salary last drawn by 26 i.e maximum number of working days

◦ Length of Service- If period of service is 6 months or less than 6 months, it shall be ignored for this purpose.

◦ Conversely if period is more than 6 months it shall be taken as a one full year.

Sshailesh L. Prajapati CA, MBA ( Finance) 31

Gratuity : Section 10 (10)Not Covered by the Payment of Gratuity Act

◦ The least of above shall be exempt,

Rs. 10,00,000/- ½ months ‘average salary’ for each completed year of service Actual Receipt

◦ Salary= Basic + DA if terms of employment provides, Commission if fixed % of Turnover

◦ Average monthly salary= Average salary of 10 months immediately preceding the month in which an employee is retired.

◦ Only fully completed year of service is to be considered.Sshailesh L. Prajapati CA, MBA ( Finance) 32

Gratuity : Section 10 (10) Gratuity received during the period of service is always Taxable Gratuity received from two or more employers:

Gratuity received from two or more employers in the same Year then, aggregate amount of gratuity exempt from tax cannot exceed the limits prescribed.

Gratuity received in any earlier years from his former employer and receives gratuity from another employer in a later year, the Limit of Rs. 10 Lacs will be reduced by the amount of gratuity exempt from tax in any earlier year

Sshailesh L. Prajapati CA, MBA ( Finance) 33

Pension : Section 10 (10A)

Uncommuted Pensions◦ Periodic payment received by the employee◦ Received by the retired employee Taxable as Salaries for both

Govt and Non Govt employees◦ Received by the legal heir Taxable as Income from other Sources

Commuted Pensions on retirement◦ Lumpsum amount taken by commuting full or part of Pension◦ Remaining portion will be periodically received.

Sshailesh L. Prajapati CA, MBA ( Finance) 34

Pension : Section 10 (10A)

For Government employees, totally exempt For Non-Government employees:

◦ If employee is in receipt of gratuity: 1/3rd of the amount of commuted pension which he would

have received had he commuted whole (100%) of the pension.◦ If employee is not in receipt of gratuity:

1/2 of the amount of commuted pension which he would have received had he commuted whole (100%) of the pension.

Sshailesh L. Prajapati CA, MBA ( Finance) 35

Leave Salary : Section 10 (10AA)◦ Govt Employees : Exempt

◦ Non Govt Employees : Least of following is exempt.◦ Cash equivalent of Leave ( on the basis of 10 months salary) to the

credit of the employee at the time of retirement ( calculated at 30 days credit for each completed year of service); or

◦ Amount specified by the Government Rs. 300000/-; or

◦ 10 months’ salary ( on the basis of last 10 months salary); or

◦ Leave encashment actually received.Sshailesh L. Prajapati CA, MBA ( Finance) 36

Leave Salary : Section 10 (10AA)◦ Non Govt Employees :

◦ Leave salary received during the service is always Taxable to both Govt and Non-Govt Employees;

◦ Leave Salary received from more than 2 employers (Refer treatment shown in gratuity);

◦ Salary= Basic + DA if terms of employment provides, Commission if fixed % of Turnover.

Sshailesh L. Prajapati CA, MBA ( Finance) 37

Other Retirement BenefitsRetrenchment Compensation Sec 10 ( 10 B)

◦ Rs. 5,00,000 ◦ Amount calculated under Industrial Disputes Act

15/26 X Ave Salary of Last 3 Months X Completed year of Service* * Part of the year in excess of 6 Months will be considered as full year.

◦ The amount received◦ Lower of the above is exempt from tax

Voluntary Retirement Compensation Sec 10 ( 10 C)◦ Least of following is exempt:◦ Last drawn salary X 3 X completed years of service or Last drawn salary X remaining

months of service, whichever is higher; or◦ Rs. 5,00,000; or◦ Actual compensation received.

Sshailesh L. Prajapati CA, MBA ( Finance) 38

Voluntary Retirement compensation.. Applies to an employee of the company who has completed 10 years

of service or completed 40 years of age ( not applied to Public sector company);

Applies to all employees whatever name called except directors; Scheme should be drawn to reduce the overall strength of Team; Vacancy should not be filled up; Retiring employee shall not be employed in any of the concern

belonging to the same management; If question does not provide he information of Last drawn salary or

the year of service completed etc, one can take other two factors into consideration.

Salary= Basic + DA if terms of employment provides, Commission if fixed % of Turnover

Sshailesh L. Prajapati CA, MBA ( Finance) 39

Recognised Provident Fund : Section 10 (12)

Accumulated balance due and become payable to an employee shall be exempt in following Cases◦ Rendered continuous service for a period 5 years or more;◦ Termination of services due to ill-health, or discontinuation of the

employer’s business or cause beyond control of the employee;◦ Transfer of RPF account from one company to another company

on account of Transfer of Job◦ Unrecognised PF is the PF which is not recognised by Income Tax

Department.

Sshailesh L. Prajapati CA, MBA ( Finance) 40

Table showing distinction – For Employee

Particulars Recognised Provident Fund

Unrecognised Provident Fund

Employer’s Contribution

> 12% is Taxable Not Taxable at the time of contribution

Employee’s Contribution

Eligible for deduction under section 80C

Not eligible for any deduction

Interest Credited In excess of 9.5% p.a. Taxable

On own contribution is Taxable under IFOS

Amount received on Retirement

Fully exempt u/s 10 (12)

Employer’s Contribution and interest on same is taxable as Salary.Sshailesh L. Prajapati CA, MBA ( Finance) 41

Approved Superannuation Fund: Section 10 (13)

Any Payment from an ASF is exempt if it is made;◦on death of a beneficiary; or◦to an employee on retirement or becoming

incapacitated◦by way of refund of contribution on death of a

beneficiary; ◦by way of refund of contribution on his leaving the

service otherwise than by retirement or becoming incapacitated.

Sshailesh L. Prajapati CA, MBA ( Finance) 42

House Rent Allowance : Section 10(13A) (read with Rule 2A)

HRA is exempt to the extent of the least of the following:◦ Excess of Rent Paid over 10% of Salary for relevant period◦ 50% of salary for metro cities, 40% for other cities due for relevant

period◦ Actual allowance received for the relevant period.

Salary means ◦ Basic, DA(if it forms a part of retirement benefits) & Commission as a

% of Turnover achieved by the employee for relevant period. ◦ Relevant period means the period during which the said

accommodation was occupied by the assessee during P.Y.

Sshailesh L. Prajapati CA, MBA ( Finance) 43

Special Allowance : Section 10(14)- Rule 2BB

Following are the Allowances prescribed by CBDT as exempt to the extent or specified as below:◦ Expenditure to perform duties ( travelling, conveyance, helper etc;)◦ Allowance granted to an employee working in transport company to

meet his personal expenses –Least of 70% of allowance or Rs.10000/- ◦ Transport Allowance – Rs. 800/- per month◦ Children Education Allowance- Rs. 100/- per month per child up

maximum of two children.◦ Any allowance granted to an employee to meet the Hostel

Expenditure of his child is exempt up to Rs. 300 per month per child upto maximum of two children

Sshailesh L. Prajapati CA, MBA ( Finance) 44

Special Allowance : Section 10(14)- Rule 2BB

Hill Area Allowance Border Area Allowance Tribal Area Allowance Allowance for Transport

Employees Compensatory Field Area

Allowance Compensatory Modified

Area Allowance

Underground Allowance High Altitude Allowance Active Field Allowance Island Duty Allowance

The above allowance has different limits on which the exemptions will be allowed.

Sshailesh L. Prajapati CA, MBA ( Finance) 45

Valuation of Perquisites: Section 17 (2 ) & Rule 3

◦ Value of rent-free accommodation provided to the employee by employer;

◦ Value of any concession, in case of accommodation provided at confessional rate;

◦ Value of any benefit or amenity granted or provided free of cost or at concessional rate to a specified employee

◦ Any sum paid by the employer in respect of any obligation of the employee which otherwise would have been payable by the employee.

Sshailesh L. Prajapati CA, MBA ( Finance) 46

Valuation of Perquisites: Section 17 (2 ) & Rule 3

◦ The Value of any specified security or sweat equity shares allotted or transferred to employees by an employer free of cost or any concessional rate. section 17 (2) (vi)

◦ Any contribution to an approved superannuation fund by the employer in respect of the employee, to the extent it exceeds Rs. 1 Lacs- section 17 (2) (vii)

◦ The value of any other fringe benefit or amenity as may be prescribed by the CBDT- section 17 (2) (viii).

◦ Sum payable by the employer to effect an assurance on life of the assessee or to effect a contract for an annuity- section 17 (2) (v)

Sshailesh L. Prajapati CA, MBA ( Finance) 47

Specified Employees

Following are the specified Employees for the purpose of Section 17 (2) (iii);◦ A Director employee of the company; or◦ An Employee who has substantial interest ( 20% voting rights) in

the company;or◦ An Employee whose income under the head “Salaries” excluding

the value of all non-monetory benefits, exceeds Rs. 50,000/-

Sshailesh L. Prajapati CA, MBA ( Finance) 48

Valuation of Perquisites

Rent Free/ Concessional Accommodation◦ Central and State Government Employees:

VOP= License Fees determined by SG minus Rent actually paid by Employee

◦ Private Sector Employees : ( Accommodation owned by Employer ) 7.5% of salary ( Population <= 10 Lakhs ) 10% of Salary ( Population >10 Lakhs upto 25 Lacs ) 15% of Salary ( Population > 25 Laks ) If employee is paying some rent, deduct from the value In respect of the period during which the said accommodation was occupied

by the employee during the previous year.

Sshailesh L. Prajapati CA, MBA ( Finance) 49

Valuation of Perquisites

Rent Free/ Concessional Accommodation◦ Private Sector Employees : ( Accommodation taken on Lease or

Rent by Employer and provided to Employee)◦ Value of Perquisites would be the Lower of the following:◦ Actual Amount of lease rental paid or payable by the employer or◦ 15% of Salary◦ This would be reduced by the rent, if any, actually paid by the

employee◦ SALARY= Basic+ DA which forms part of salary, taxable

allowances, bonus, commission payable monthly or any monetary benefits by whatever name called.

Sshailesh L. Prajapati CA, MBA ( Finance) 50

Valuation of Perquisites

Rent Free/ Concessional Furnished Accommodation◦ Value of Unfurnished accommodation as above◦ Add : Value of Furniture

If owned by employer : 10% p.a. of Original Cost If hired from third party : Actual hire charges borne by the employer

◦ Less: Any charges paid or payable by employees◦ Note – furniture includes T.V., radio set, refrigerators, other

household appliances, A.C. etc.

Sshailesh L. Prajapati CA, MBA ( Finance) 51

Valuation of Perquisites

Obligation of an employee paid by the employerPayment for Gas, Electric Energy, Water Supply for

house hold consumption;Payment to Domestic Servant, Sweeper, Gardner;Member of Household shall include:-SpouseChildren and their Spouses:ParentsServants and dependants

Sshailesh L. Prajapati CA, MBA ( Finance) 52

Valuation of Perquisites

Service of Sweeper, Gardner, watchman or personal attendant :◦ Not taxable if the employee is a non- specified employee◦ VOP= Actual Cost to the employer as reduced by any amount

recovered /paid by the employeesSupply of Gas, electricity or water for household

purposes◦ Not taxable if the employee is a non- specified employee◦ VOP= Actual Cost to the employer as reduced by any amount

recovered /paid by the employees

Sshailesh L. Prajapati CA, MBA ( Finance) 53

Valuation of Perquisites

Education facility to employees family members◦ Not taxable if the employee is a non- specified employee◦ Providing free education facility to and training of the employee

is not taxable◦ Payment of School fees or reimbursement of school fees is

taxable.◦ There would be no perquisites if the cost of education does not

exceeds Rs. 1000/- p.m.◦ Fixed Education Allowance and Hostel Expenses is exempt to the

extent of Rs.100/- and Rs. 300/- per child per month ( maximum upto two children) respectively

Sshailesh L. Prajapati CA, MBA ( Finance) 54

Valuation of Perquisites

The value of any other fringe benefit or amenity as may be prescribed by the CBDT

Interest Free/ Concessional Loans◦ Simple Interest (as charged by SBI as on the first day of the

relevant previous year ) on maximum outstanding monthly balance except in following cases:

◦ Medical Loan for specified diseases Nil◦ Petty Loans upto Rs. 20000/- Nil

Sshailesh L. Prajapati CA, MBA ( Finance) 55

Valuation of Perquisites

Mode of valuation Perquisites in respect of use of Movable Assets

Computer/ Laptop or Car Any other Assets

Owned by

EmployerTaken on hire by

Employer

Step :1- Find out cost to the employer Nil 10% p.a. of AC

Amount of Rent paid or Payable

Step: 2- Less: Amount recovered from the employee Nil

Recovery from Employee

Recovery from Employee

Taxable value of the perquisites ( Step 1- Step 2 Nil

Balancing positve amount

Balancing positive amount

Sshailesh L. Prajapati CA, MBA ( Finance) 56

Valuation of Perquisites

Mode of valuation Perquisites in respect of sale of Movable Assets

Electronic Items/ Computers Motor Car Any other Asset

Step :1- Find out cost of the Asset to the employer

Actual Cost to the employer

Actual Cost to the employer Actual Cost to the employer

Step: 2- Less: Normal Wear and tear for completed years

50% for each completed year by Reducing balance Method

20% for each completed year by Reducing balance Method

10% for each completed year by SLM

Step 3 - Less: Amount recovered from the employee

Consideration received from the employee

Consideration received from the employee

Consideration received from the employee

Taxable value of the perquisites ( Step 1- Step 2- Step 3 )

Balancing positive amount

Balancing positive amount Balancing positive amount

Sshailesh L. Prajapati CA, MBA ( Finance) 57

Valuation of Perquisites

Fixed Medical Allowance is always taxableMedical Facilities Exempt if

◦ In a hospital maintained by the employer◦ In a Government hospital◦ In an approved hospital for prescribed diseases◦ Mediclaim Premium 80D , ◦ Other Medical Treatment upto Rs. 15000/-◦ Overseas Medical Treatment

Treatment Cost ( to the extent approved by RBI ) Cost of Travel & Stay for self & family Cost of Travel & Stay for one attendant Cost of Travel exempt only if gross income < 2 lakhs

Sshailesh L. Prajapati CA, MBA ( Finance) 58

Valuation of Perquisites

Free Meals◦ Actual Cost◦ Exempt if

Meals/ Refreshments during office hours at office premises Non Transferable Meal Vouchers Cost not exceeding Rs. 50 per meal

Gifts◦ At Cost◦ Exempt if in kind and amount is below Rs. 5000/- per annum

Sshailesh L. Prajapati CA, MBA ( Finance) 59

Valuation of Perquisites

Club Membership◦ Actual Payments ◦ Exemption for initial corporate membership fees ◦ Not a perquisite if for official purposes

Credit Cards◦ Actual Payments◦ Not a perquisite if for official purposes

Sshailesh L. Prajapati CA, MBA ( Finance) 60

Valuation of Perquisites

Valuation of perquisites in respect of traveling, touring, accommodation◦ Where such facility is available uniformly to all employees

Expenditure incurred by employer less recovery from employees

◦ Where such facility is not available uniformly to all employees Value at which such facilities are offered by other agencies to

the public Less recovery from the employee

Sshailesh L. Prajapati CA, MBA ( Finance) 61

Valuation of Perquisites

Motor Car used for official purposes is not a perquisiteMotor Car used for personal purposes – actual cost to

employer including driver’s salary and normal wear and tear @ 10% of the actual cost

Motor Car used for both the purposes◦ Proportionate based on log book or presumptive amounts◦ More than one car, only one for mixed use, others for private use

Sshailesh L. Prajapati CA, MBA ( Finance) 62

Motor Car PerquisiteCar is owned by the employer

Car is owned by the employee◦ Actual expenditure (-) amounts specified above

Sshailesh L. Prajapati CA, MBA ( Finance)

< 1600 c.c. > 1600 c.c.

Driver

Expenses by the employer 1800 2400 900

Expenses by the employee 600 900 900

63

Computation Taxable Salary- General Format Basic Salary (including Advance Salary ) YYYY Profit in Lieu of Salary YYYY Fees, Commission etc, YYYY Taxable Allowances YYYY Perquisites (as valued) YYYY Retirement Benefits (to the extent not exempt) YYYY

◦ Gross Salary YYYY Less : Profession Tax YY Less: Entertainment Allowance YY

◦ Taxable Salary YYYY

Sshailesh L. Prajapati CA, MBA ( Finance) 64

Income Tax

Income from House Property

65Sshailesh L. Prajapati CA, MBA ( Finance)

Chargeability

Annual Value of Property Consisting of any Building or lands appurtenant thereto, of which The assessee is owner, Is chargeable to tax under the head Income from House property Section 22.

Sshailesh L. Prajapati CA, MBA ( Finance) 66

Three Conditions

The property should consist of any building or lands appurtenant thereto

The assessee should be the owner of the property The property should not be used by the owner for the purpose of

any business or profession carried on by him, the profits of which are chargeable to tax.

Sshailesh L. Prajapati CA, MBA ( Finance) 67

Deemed owner

Property transferred to spouse ( not being a transfer in connection with an arrangement to live apart or minor child ( not being a married daughter ) without adequate consideration.

Holder of impartible estate Property held by a member of co-op Society/company/AOP Property acquired under a POA transaction.

Sshailesh L. Prajapati CA, MBA ( Finance) 68

Certain typical cases

House Property in a Foreign Country◦ ROR- Taxable under H.P.◦ RNOR- Taxable under H.P. but rent must be received in India◦ NR- Taxable under H.P. but rent must be received in India

Disputed Ownership◦ The Income shall be taxable in the hands of recipients. But

Department has a power to decide whether the assessee is the owner and is chargeable to tax under section 22

Sshailesh L. Prajapati CA, MBA ( Finance) 69

Certain typical cases

Property held as stock in trade◦ It will be charged as House Property Income

Splitting up of a composite Rent◦ If it is separable than rent will be covered in H.P. Head and

other Facilities income covers in Other Sources Head.◦ If it is not separable:-Than all receipt will be cover in other

sources head.

Sshailesh L. Prajapati CA, MBA ( Finance) 70

Property Income Exempt from tax Income from Farm house Sec.10(1) One place of an ex-ruler. Sec.10(19)A Property income of a local authority Sec.10(20) Property income of an approved Scientific research association Sec.10(21) Property income of an Education Institution and Hospital Sec.10(23)C Property income of a Trade Union. Sec.10(24) Property income of a Political party Sec.13A Property held for Charitable purpose Sec.11 Property Income of a Political Party Property used for own business or profession One Self Occupied Property

Sshailesh L. Prajapati CA, MBA ( Finance) 71

Computation of Income from a let out property

Gross Annual Value …………Less: Municipal Taxes …………Net Annual Value …………Less: Deduction under Sec.24 …………Standard Deduction …………Interest on borrowed capital ………… =======Income from house property =======

Sshailesh L. Prajapati CA, MBA ( Finance) 72

Reasonable Expected Rent

Compute Reasonable Expected RentFind out Municipal Valuation (a)

◦ Periodical Survey of Municipal AuthorityFind out Fair Rent (b)

◦ It can be determined on the basis of a rent fetched by a similar property in the same locality

Standard Rent under Rent Control Acts (c)◦ SR is the maximum rent which a person can legally recover from

his tenant under a Rent Control Act.The higher of (a) and (b), subject to maximum of (c) is

Reasonable expected rent.Sshailesh L. Prajapati CA, MBA ( Finance) 73

Actual Rent Received/Receivable

Find Rent actually Received or receivable◦ It does not include rent of the period for which the property

remains vacant◦ Rent of a previous year ( or Part of the year) for which the

property is available for letting out to work out◦ Less: Unrealised Rent ( if few conditions are satisfied )◦ Less: Rent of Vacant period◦ The resultant figure is Rent recd/receivable

Sshailesh L. Prajapati CA, MBA ( Finance) 74

Steps for determining Annual Value

Sshailesh L. Prajapati CA, MBA ( Finance) 75

Gross Annual Value- Different possible cases1. Property let out throughout the year2. Let out Property vacant for part of the year3. Self Occupied Property4. House property let –out for part of the year and self occupied for

part of the year5. Deemed to be Let out Property 6. House Property, a portion let out and a portion self occupied

Sshailesh L. Prajapati CA, MBA ( Finance) 76

Unrealised Rent

Conditions:◦ The tenancy is bonafide◦ The defaulting tenant has vacated or steps have been taken to

compel him to vacate the property◦ The defaulting tenant is not occupation of any other property of

the assessee◦ Taken all reasonable steps to institute legal proceedings for

recovery of the unpaid rent or satisfies A.O. that the same is use less.

Sshailesh L. Prajapati CA, MBA ( Finance) 77

Municipal Taxes

Deduct Municipal Taxes from GAV Deductible only if

◦ These taxes are borne by the owner◦ And actually paid by him during the previous year

The remaining amount left after deduction is NET ANNUAL VALUE

Sshailesh L. Prajapati CA, MBA ( Finance) 78

Deduction under Section 24

Standard deduction:◦ 30% of NAV is deductible irrespective of any expenditure incurred

by the tax payer. Interest on borrowed capital

◦ It is allowed only if capital borrowed for purchase, construction, repair, renewal or reconstruction of the property.

Sshailesh L. Prajapati CA, MBA ( Finance) 79

Interest borrowed on capital

Deductible on accrual basisEven though it is not actually paid during the yearInterest on unpaid interest is not deductibleNo deduction for brokerage on LoanNo ceiling limit ( in case of let out )Interest of pre-construction period is deductible in 5

equal installment commencing from the previous year in which the house is constructed.

Sshailesh L. Prajapati CA, MBA ( Finance) 80

Income from SOP

Property occupied for own business purpose – no income is chargeable under IFHP.

When more than one property is occupied for own residential purposes, one house of his choice shall be considered as deemed to be let out.

No Standard deduction, No Municipal taxes. Interest on borrowed capital is allowed.

Sshailesh L. Prajapati CA, MBA ( Finance) 81

Interest on Borrowed capital

Capital is borrowed after April 1, 1999The acquisition or construction should be completed with

in three yearsThe maximum limit is Rs. 1.50 LacsIf amount used for repairs, reconstruction, then the limit is

Rs. 30,000/-Loan taken prior to April 1, 1999, will carry deduction of

Rs. 30000/-Interest on Unpaid interest is not deductible.

Sshailesh L. Prajapati CA, MBA ( Finance) 82

Arrears of Rent

The tax payer is or was the owner of the propertyReceived amount by way of arrears, not charged to

income tax for any prev. yearAmount received (after deducting 30% shall be deemed

to be the income chargeable under IFHPTaxable in the year in which it is receivedTaxable even if the assessee is not the owner of that

property in the year in which he has received arrears of rent

Sshailesh L. Prajapati CA, MBA ( Finance) 83

Income TaxIncome from Business & Profession

84Sshailesh L. Prajapati CA, MBA ( Finance)

Taxability of Business Income

Tax on Net Income from BusinessNet Income = (+) Gross Receipts (-) ExpensesRole of Accounting for both (+) & (-)Net Income is therefore as determined by the books of

accounts & method of accounting followedExpenses related to non-taxable businesses cannot be

adjusted against incomes of taxable businesses

Sshailesh L. Prajapati CA, MBA ( Finance) 85

Computation of Income under Business & Profession

Net Profit as per Profit & Loss AccountAdd:

◦ Items debited but not allowed◦ Items not credited but taxable

Less:◦ Items credited but exempt/ taxable elsewhere◦ Items not debited but allowed

Taxable Income

Sshailesh L. Prajapati CA, MBA ( Finance) 86

Depreciation u/s 32

It is mandatory. Hence allowed even if the assessee has not taken. Assessee must be the owner of the asset

◦ Exception: Tenant can capitalise the Major repairs as Building Asset must be used for the purpose of carrying on the business. Asset must be used during the relevant previous year. Asset must be used under the eligible class of assets viz:

◦ Building, Machinery, Plant & Machinery etc.◦ Know-how, patent, copyrights, trademark & license etc

Sshailesh L. Prajapati CA, MBA ( Finance) 87

Block of Assets

Block of Assets means class of assets falling within a class of assets comprising of:

Tangible Assets like Building, Machinery, Plant , Vehicle or furniture of a particular percentage.

Intangible Assets like Know how, patents , copyrights, trademarks etc of a particular percentage.

Depreciation is to be calculated based on Block of Assets. Addition and Sale of Assets to be taken as per the Block. Profit or Loss on Sale of Assets to be calculated based on BOA.

Sshailesh L. Prajapati CA, MBA ( Finance) 88

Actual Cost : Section 43 (1)

Cost of Purchase or Construction XXXX Less: Subsidy /grant XXXX Add: Interest on Loan payable till the date of Acquisition of Assets XXXX Add: Expenses incurred for Acquiring Assets XXXX Add: Expenses incurred for installation and Commissioning of the Assets XXXX

Actual Cost XXXX

Sshailesh L. Prajapati CA, MBA ( Finance) 89

Written down value (WDV)

Opening value of Block at the beginning of P.Y. XXXX Add: Actual Cost assets added during P.Y. XXXX Less: Moneys payable in respect of any asset is sold/ destroyed/discarded, demolished XXXX WDV for the purpose of Calculation of Depreciation XXXX Depreciation @ % prescribed XXX Closing Value of Block XXXX

Sshailesh L. Prajapati CA, MBA ( Finance) 90

Rates of Depreciation

Residential Building 5% Building other than above 10% Temporary structure 100% Furniture 10% Motor car 15% Motor Buses/Lorries/Taxis used in Business 30% Computers & Softwares 60% Energy saving devices 100% Intangible Assets 25% If Asset purchased after 180 days the above rates will be 50%

Sshailesh L. Prajapati CA, MBA ( Finance) 91

Additional Depreciation

It is 20% on additions to Plant and Machinery Asset purchased after 180 days additional Depreciation will be 10% Not applicable for

◦ Used Machines ( Domestic or Imported)◦ Any Equipment installed in office or Guest House◦ Road Transport vehicles◦ Any Machinery or Plant where the whole of the amount is

allowed as deduction in any other section.

Sshailesh L. Prajapati CA, MBA ( Finance) 92

Expenses specifically allowed :Amortizations

Telecom License Fees (over license period) Preliminary Expenditure : Section 35D

◦ Ceiling Prescribed Non Company assessee: 5% of cost of Project Company Assessee : 5% of Cost of Project or 5% of Capital Employed

at the option of the Company.◦ Qualifying amount deduction over a period of 5 years

Merger Expenditure (over 5 year period) VRS Payments : Section 35DDA (over 5 year period)

Sshailesh L. Prajapati CA, MBA ( Finance) 93

Expenditure on Scientific Research : Section 35 Expenditure on Scientific Research

◦ In-house research Revenue Expenditure Capital Expenditure

◦ In case of companies in Specified business- Section 35 (2AB) Payment to Outsiders

An Approved Research Association undertaking of Scientific Research related or unrelated to business of Assessee

An Approved University or College or Institution for the use of Scientific Research related or unrelated to business of Assessee.

An approved University or College or Institution for the use of research in Social Science or statistical research related or unrelated to business of Assessee

Contribution to an approved national laboratory {35(2AA)}

Sshailesh L. Prajapati CA, MBA ( Finance) 94

Expenditure on Scientific Research : Section 35

In-house research ( Allowed 100%)◦ Revenue Expenditure

Allowed only if expenses relates to the business Pre commencement period expenses incurred but within 3

years immediately before commencement of business, allowed as an expense in the year in which business commenced

◦ Capital Expenditure Whole of expenses incurred is allowed ( Except cost of

acquisition of Land) Pre commencement period expenses - as above.

Sshailesh L. Prajapati CA, MBA ( Finance) 95

Expenditure on Scientific Research : Section 35

In case companies in Specified business: Sec. 35 (2AB)◦ Weighted deduction (200% )

The Tax payer is a company It is engaged in the business of bio-technology or in a business of mfg

or production of any drugs, pharmaceuticals, electronic equipments, computers, telecommunication equipments as notified by board

Cost can be Revenue or Capital ( Not being on Land and building) The deduction shall not be allowed w.e.f. A.Y. 2013-1014 The above expenses is incurred on R &D facility upto 31/03/2012

Sshailesh L. Prajapati CA, MBA ( Finance) 96

Expenditure on Scientific Research : Section 35 Payment to Outsiders : Contribution to

An Approved Research Association undertaking of Scientific Research related or unrelated to business of Assessee. Deduction of 175%

An approved University or College or Institution for the use of Scientific research related or unrelated to business of Assessee. Deduction of 175%

An approved University or College or Institution for the use of research in Social Science or statistical research related or unrelated to business of Assessee. Deduction of 125%

Contribution to an approved national laboratory {35(2AA)} Deduction of 200%

Sshailesh L. Prajapati CA, MBA ( Finance) 97

Other Class of Expenses

Donations to associations for :◦ Promoting economic & social welfare◦ Carrying out rural development programmes◦ Conservation of natural resources

Family Planning Expenditure◦ Allowable as deduction◦ Capital Expenditure is allowed 1/5th for the previous year, balance in

next four yearsExpenditure on Advertisement published by a political party

not allowed.

Sshailesh L. Prajapati CA, MBA ( Finance) 98

Expenses specifically allowed

Insurance Premiums ◦ for stocks & employees health

Bonus & Commission to employeesInterest on Borrowed Capital

◦ Used for the purposes of businessContributions to Recognized Provident Fund,

Superannuation Fund, Gratuity Fund, Staff Welfare Scheme

Rent, rates, taxes, repairs and insurance of building

Sshailesh L. Prajapati CA, MBA ( Finance) 99

Expenses specifically allowed

Bad Debts◦ There must be a debt◦ Debt must have been taken into account in computing assessable

income◦ If income already considered/ loan in ordinary course of money-

lending business◦ Written off in books of accounts◦ Subsequent Recovery taxable

Sshailesh L. Prajapati CA, MBA ( Finance) 100

Amounts not deductible

Income Tax/ Wealth Tax/FBT/Tax on Perquisites Payments to members of AOP/BOI Provisions made for non statutory employee welfare funds Payments to partners by a partnership firm

◦ Remuneration in excess of limits◦ Interest on capital in excess of 12% p.a.

Sshailesh L. Prajapati CA, MBA ( Finance) 101

Remuneration to Partners - Limits

Professional Firm Maximum Allowable

On First Rs. 3,00,000/- or In case of Loss

90% or Rs. 1.50 Lacs whichever is higher

Balance 60%

Sshailesh L. Prajapati CA, MBA ( Finance)

Minimum Allowable Remuneration in case of loss or no profits is Rs. 1,50,000/-

102

Book Profit and its Computation

Steps : Find Out the Net Profit of the firm as per Profit and Loss Account Add: Remuneration to Partners if debited to Profit and Loss Account. Add: Interest paid to Partner and debited to P/L account ( Add only

Excess paid more than 12%) Make an adjustments ( Add/Less) as provided u/s. 28 to 44DB. Resultant figure is “Book Profit” Income Chargeable to any other head will not be part of Book Profit Deduction u/s. 80 C to 80 U to be ignored while calculating Book Profit.

Sshailesh L. Prajapati CA, MBA ( Finance) 103

Amounts not deductible

Payments to Relatives : Section 40A Payments to relatives in excess of fair value Relatives defined to include: spouse, brother, sister, lineal ascendant and descendant Receipts not covered Overseas Payments : Section 40 (a) (i) Overseas Payments are deductible only if the applicable taxes are

deducted at source and paid If the payments are disallowed in the current year because the taxes

are not deducted or paid, they shall be allowed in the year of payment

Sshailesh L. Prajapati CA, MBA ( Finance) 104

Cash Expenditure : Section 40 (A) (3)

Expenditure above Rs. 20000/- to be made by account payee cheque otherwise a disallowance of 100% is attracted

A Payment ( or aggregate of payments made to a person in a day) exceeds Rs. 20000/-

Exceptions carved out in genuine cases like◦ Payments to Government Agencies, payments on a bank holiday,

payments in a village not serviced by a bank, etc.

Sshailesh L. Prajapati CA, MBA ( Finance) 105

Depreciation: Written Down Value

Opening WDV (a)xx

Add : Actual Cost of Assets Purchased◦ Used > 180 days (b) xx◦ Used < 180 days (c) xx

Less : Sale Price of Assets Sold (d)xx

Closing WDV (e) = ( a + b + c - d)xx

Sshailesh L. Prajapati CA, MBA ( Finance) 106

Depreciation : WDV (Contd.)

If Closing WDV is negative ◦ Treat the amount as Short Term Capital Gain

Adjustable against business losses to the extent of depreciation written off

◦ No Depreciation will be available even if there are other assets in the block

If Closing WDV is positive but there are no assets in the block◦ Treat the amount as Short Term Capital Loss◦ No Depreciation will be available even though the WDV is

positive

Sshailesh L. Prajapati CA, MBA ( Finance) 107

Depreciation : WDV (Contd.)

If Closing WDV is positive and there are assets in the block◦ Do not calculate profit or loss but provide depreciation on (e)◦ If e > c

Depreciation = full * (a+b-d) + half * c◦ If e < c

Depreciation = half * e

Sshailesh L. Prajapati CA, MBA ( Finance) 108

Depreciation: Power Units

Undertaking engaged in generation and distribution of power Can claim depreciation in respect of assets acquired after

31.03.1997 Two Methods

◦ SLM◦ WDV

Once the option is exercised, it shall be final and shall apply to all the subsequent years

Sshailesh L. Prajapati CA, MBA ( Finance) 109

Depreciation: Power Units

Terminal Depreciation ( Loss on Transfer)◦ Find out WDV of the depreciable assets on the first day of P.Y. in

which asset is sold, discarded, demolished or destroyed◦ Find out SC ( Receipts + Scrap Value if any )◦ If SC<WDV, then deficiency is deductible as TD.

If the asset is sold in the P.Y in which it is put to use, any loss there from is not to be allowed as TD but as Capital Loss.

TD is allowed only if it is actually written off in the books of the assessee.

Sshailesh L. Prajapati CA, MBA ( Finance) 110

Depreciation: Power Units

Balancing Charge◦SC>WDV, then ◦The amount equal to the depreciation already claimed is

taxable as balancing charge u/s 41 (2) as Business Income◦The remaining surplus if any is taxable according to the

provision of section 45 as capital gain.◦ If the asset is sold in the P.Y in which it is put to use, any

profit there from will not be chargeable as balancing charge but will be treated as capital gain.

Sshailesh L. Prajapati CA, MBA ( Finance) 111

General Deductions Sec 37 (1)

It should Not be in the nature of capital expenditureNot be personal expenditure of assesseehave been incurred in the previous yearBe in respect of business carried outHave been expended wholly and exclusive for businessNot have been incurred for any purpose which is

prohibited by Law.

Sshailesh L. Prajapati CA, MBA ( Finance) 112

General Deductions Sec 37 (1)

Interest on Delayed Payment to Micro Small and Medium Enterprises not deductible

Amount spent by Assessee in connection with the inaugural function of its new project can not be in the nature of capital expenses

Amount spent for exhibition can be allowed as a deduction in the year in which it is done irrespective of its benefits.

Sshailesh L. Prajapati CA, MBA ( Finance) 113

Disallowance in case of all assessees : Sec 40 (a) (ia)

The amount will be disallowed if Such Tax has not been deducted; or Such Tax, after deduction, has not been paid-

◦ On or before the due date specified in section 139 (1), in a case where the tax was deductible and was so deducted during the last month (i.e. March) of the previous year;

◦ On or before the last day of the previous year, in any other case

Sshailesh L. Prajapati CA, MBA ( Finance) 114

Disallowance in case of all assessees : Sec 40 (a) (ia)

In case the tax is deducted in any subsequent year or has been deducted

During the last month (i.e march) of the previous year but paid after the due date specified u/s. 139 (1); or

During any other month ( i.e April to February of the previous year but paid after the end of the previous year,

Such sum shall be allowed as deduction in computing the income of the previous year in which such tax has been paid.

Sshailesh L. Prajapati CA, MBA ( Finance) 115

Miscelleneous Provisions

Gratuity : Section 40A (7)◦ No Deduction will be allowed in respect of provision made.◦ Contribution to any Gratuity fund will be allowed.

Recovery of Bad debts: Section 41(4)◦ Taxable in the year of Receipt

Sshailesh L. Prajapati CA, MBA ( Finance) 116

Amounts not deductible : Unpaid Statutory Dues

Items covered Payment to be made by

Effect of late pymt.

Tax, duty or cess

Bonus/Commission to employees

Interest on Loan of financial institutions

Int. on term loan of scheduled bank

Leave Salary to employee

Due date of filing the return of income

Deduction allowable in the year of payment

Contribution to PF/ESIC/PT Due Date under the respective Act

Deduction never allowed

Sshailesh L. Prajapati CA, MBA ( Finance) 117

Books of Accounts and Audit of Accounts

Books of Accounts to be maintained by each category of Person who are into Business or Profession.

The above is not mandatory for those who are following presumptive Taxation.

Audit of Accounts is compulsory ◦ if total Sales, turnover/Gross Receipts exceeds Rs. 60 Lacs for

those who carrying on business;◦ If gross receipts exceeds Rs. 15 Lacs for those who carrying on

profession,.

Sshailesh L. Prajapati CA, MBA ( Finance) 118

Income TaxIncome from Capital Gain

119Sshailesh L. Prajapati CA, MBA ( Finance)

Meaning of Capital Assets Property of any kind Held by an assessee Whether or not connected with his business or profession. Certain exclusions

Sshailesh L. Prajapati CA, MBA ( Finance) 120

Capital Asset

Wide definitionCannot however cover

◦ Stock in trade◦ Personal assets & privileges◦ Agricultural Rural Land (Population < 10000)◦ Certain Bonds

Classification as short term & long term◦ Equity/Preference Shares, Other listed securities & units – 12

months◦ Other Assets – 36 months

Sshailesh L. Prajapati CA, MBA ( Finance) 121

Transfer

Extended Definition of Transfer◦ Sale, Exchange, ◦ Extinguishment of Rights◦ Compulsory Acquisition◦ Conversion into Stock in trade◦ Giving Possession under Part Performance

Sshailesh L. Prajapati CA, MBA ( Finance) 122

Transfer

Exclusions from Definition◦ Distribution of Assets by HUF◦ Gift, Will, Irrevocable Trust◦ Holding/Subsidiary Transactions◦ Mergers/De-mergers – company/holders◦ Conversion of debentures / bonds in to shares◦ Conversion of Firm into company◦ Conversion of Proprietary concern into a company◦ Distribution of Assets in kind by a company to its shareholders at

the time of liquidation

Sshailesh L. Prajapati CA, MBA ( Finance) 123

Profit/Loss..

Sales Consideration Less: Expense on Transfer Deductions

◦ Cost of Acquisition◦ Cost of Improvement ( Expenses incurred after 1.4.1981 )◦ Deduct the exemptions ( Section 54 Series )

Balancing amount is CG Indexation to be done for Long Term Capital gain

Sshailesh L. Prajapati CA, MBA ( Finance) 124

Conditions for Capital Gain

There should be a Capital AssetsIt is transferred by AssesseeTransfer takes place during the previous yearProfit or Gain arises as a result of transferExemptions are available under sections:

◦54,54B,54D,54EC, 54F, 54G, 54GA.

Sshailesh L. Prajapati CA, MBA ( Finance) 125

Special Considerations apply: Depreciable Assets : Section 50

◦ Gains will always be SHORT TERM Immoveable Properties

◦ Reference to Stamp Duty Valuation under Section 50C Self Generated Asset Goodwill of a Business (excluding Profession, CIT Vs B.C. Shrinivasa setty); Right to manufacture, produce, or process any article or thing or right to carry on

any business. Treatment

◦ Full Value of Consideration will be taken on Actual basis. ◦ Cost of Acquisition &/ or Improvement will be taken as Nil. ◦ Expenses on transfer will be deductible on Actual basis.

Sshailesh L. Prajapati CA, MBA ( Finance) 126

Cost of Acquisition of Bonus shares If original shares and bonus shares are acquired before April1, 1981 : Cost : Original shares : Actual cost or fair market value on April 1, 1981 whichever is

more Bonus Shares : Fair Market Value on April 1, 1981 If Original Shares acquired before April 1, 1981 but bonus shares are allotted

after April 1, 1981 : Cost : Original shares : Actual cost or fair market value on April 1, 1981 whichever is

more Bonus Shares : Nil If Original shares and Bonus Shares are acquired after April 1, 1981 Cost : Original shares : Actual cost Bonus Shares : Nil

Sshailesh L. Prajapati CA, MBA ( Finance) 127

Cost Inflation Index

Financial Year 1981-1982 100 Financial Year 2012-2013 852 Financial Year 2013-2014 939 It may be computed as under: Assets acquired before April 1,1981 Assets acquired on or after April 1 1981 Assets acquired on or after April 1, 1981 in one of the

circumstances specified in sec 49(1) and originally acquired by the previous owner before April 1, 1981

Assets acquired on or after April 1, 1981 in one of the circumstances specified in sec 49(1) and originally acquired by the previous owner on or after April 1, 1981

Sshailesh L. Prajapati CA, MBA ( Finance) 128

Cost Inflation Index

Sshailesh L. Prajapati CA, MBA ( Finance) 129

A. Indexed Cost of Acquisition

Cost of Acquisition or FMV as on 01/04/1981 as the case may beIndex Factor for the base year 1981-82 or for the first year in which the Asset was held by assessee, whichever is later

B. Indexed Cost of Improvement

Cost of Improvement ( Incurred only after 01/04/1981 )Index Factor for the year in which Improvement was made to the asset

X Index Factor for the year of Transfer

X Index Factor for the year of Transfer

Special cases in computation of Period of holding

Sec.49(1) - Previous owner: If the capital asset is acquired by the assessee through any of

the ways/modes specified U/S.49(1), then the period for which the previous owner held the asset should also be included for computing the period of holding of the assessee/person who sold it.

i.e. the word “held by assessee” means “held by the assessee and by the previous owner”

Sshailesh L. Prajapati CA, MBA ( Finance) 130

Special cases in computation of Period of holding

Property acquired by Gift, Will etc Property acquired on Partition of HUF Amalgamation, Demerger, Business Re organisation Right Renouncement ( Period to be taken from Date of offer to

Right Renouncement)

Sshailesh L. Prajapati CA, MBA ( Finance) 131

Special cases in computation of cost of acquisition

If the assets acquired in any mode in Section 49 (1) , then cost of the Acquisition shall be taken as the cost to the Previous owner.

If the assessee or previous owner whose cost has to be adopted, as the case may be, acquired the assets before 01/04/1981, then FMV as on 01/04/1981 or the cost paid whichever is higher

Cost of Improvement in any property done before 1.4.1981 is to be taken as Nil.

Cost of Improvement in any property done after 1.4.1981 is to be taken with Cost of Indexation.

Sshailesh L. Prajapati CA, MBA ( Finance) 132

Certain Special Cases

Capital Gain in the case of conversion of capital Assets into Stock in Trade (Sec 45 (2))◦Event: Conversion of a capital asset into stock in

trade.◦Year of Chargeability: The year in which such stock-

in-trade was sold.◦Consideration: FMV as on the date of conversion.◦Indexation Facility is available only up to the year of

conversion.

Sshailesh L. Prajapati CA, MBA ( Finance) 133

Certain Special Cases

In the year in which such SIT is sold both Capital gains and business profits will result.◦Capital Gain = FMV- Indexed Cost of Acquisition◦Business Income= Sales Consideration- FMV

Capital Gain in the case of Land and Building (Section 50 (C) )◦For Sales Consideration, MV or the Agreement value

whichever is higher is to be taken.

Sshailesh L. Prajapati CA, MBA ( Finance) 134

Certain Special Cases

Capital Gain in case of compulsory acquisition of an asset ( Section 45 (5 ))◦ Event: Transfer of a Capital Asset by way of Compulsory

Acquisition, under any law.◦ Year of Chargeability: In the previous year in which

compensation is received (Full/Part).◦ Consideration: Compensation. ◦ Indexation is available only up to the year of transfer. ◦ If the Compensation is received by the legal representative of the

deceased person from whom the Asset was acquired, the recipient shall be chargeable to tax.

Sshailesh L. Prajapati CA, MBA ( Finance) 135

Certain Special Cases

Capital Gain in case of compulsory acquisition of an asset ( Section 45 (5 ))◦ Enhanced compensation/consideration: Fully Taxable as a

Capital Gain in the year in which it is received.◦ The cost of acquisition and Improvement thereto will be taken as

“Nil” since it is already has been deducted at the time of computation of Capital Gain of Initial compensation.

◦ Interest on enhanced compensation is chargeable under Income from other sources.

◦ Expenses incurred for getting the enhanced compensation is allowable as expenditure.

Sshailesh L. Prajapati CA, MBA ( Finance) 136

Certain Special Cases

Procedure to be followed at the time of conversion of debentures / bonds into shares.◦ Nothing is taxable at the time of Conversion.◦ COA of Bonds/debentures will become the COA of Shares◦ To find out Gain is Short Term or Long Term, Period of holding

shall be counted from date of allotment of Shares.◦ The benefit of indexation is available from date of allotment of

shares.◦ If Shares are LTCA and STT is paid on sales, CG is exempt u/s.10

(38).

Sshailesh L. Prajapati CA, MBA ( Finance) 137

Certain Special Cases

Procedure to be followed for sale of Right SharesThe cost of acquisition (C.O.A.) of original shares –

◦ Amount actually paid.The C.O.A. of the right shares –

◦ Amount actually paid.Right Renouncements –

◦ While computing capital gains C.O.A. to be taken as N I L. Cost to the purchaser of right shares:

◦ Amount paid to the company for acquiring the shares + the amount paid to the owner towards rights renouncement.

Sshailesh L. Prajapati CA, MBA ( Finance) 138

Capital Gain Exempt from TaxCG arising from transfer of residential House [Section 54]CG arising from transfer of land used for agricultural

purpose. [Section 54B]CG arising from compulsory acquisition of Land and Buildings

forming part of Industrial undertaking. [Sec 54D]CG not to be charged on Investment in certain Bonds.

[Section 54EC]CG on transfer of long term capital asset other than a house

property [Section 54EF]

Sshailesh L. Prajapati CA, MBA ( Finance) 139

Rates of Tax for capital Gain

Long Term Capital Gain : 20% Short Term Capital Gain- Add to the normal Income Long Term Capital Gain :

◦ Listed equity shares and subject to STT : Nil u/s. 10 (38)◦ Non Listed Equity Shares 20%

Short Term Capital Gain on sale of :◦ Equity shares or Units of Mutual Fund,◦ Transaction of Sales is on or after 01.04.2004◦ Such Transaction is subject to STT◦ It will be taxable @ 15%

Sshailesh L. Prajapati CA, MBA ( Finance) 140

Income TaxIncome from Other Sources

141Sshailesh L. Prajapati CA, MBA ( Finance)

Income From Other Sources

Last and residual head of IncomeDividend under section 2 (22) (e)Winning from LotteriesInterest on securitiesRental Income of Machinery, Plant or furnitureRental Income of Machinery, Plant or furniture and

building and the same is not separableSum received under Key Man Insurance PolicyGift

Sshailesh L. Prajapati CA, MBA ( Finance) 142

Winning from Lotteries, crossword puzzles, horse race, card game etc Taxable Receipt is chargeable @ 30% ( +SC +EC +SHEC) Taxable in the year of receipt Gross up if net winning is given after TDS TDS is applicable if winning is more than Rs. 10000 except in the

case of horse race where it is Rs. 5000/-

Sshailesh L. Prajapati CA, MBA ( Finance) 143

Interest on Securities

Security of Central Government or State Government Taxable on receipt basis if the books are maintained on cash basis

otherwise on accrual basis Interest exempt from tax u/s. 10 (15) to exclude Grossing up of Interest if TDS is deducted.

Sshailesh L. Prajapati CA, MBA ( Finance) 144

Income from Machines, Plant or Furniture let on hire

Taxable if the same is not chargeable under business income Composite Letting is taxable under this head This rule is applicable even if the sum receivable for the two lettings

is fixed separately. If the Letting out of Building and Machinery and two lettings are

separable then, letting out of Machinery will be taxed here. If the Letting out of Building and other amenities like AC etc , then

generally Letting out of Building is taxable under IFHP and amenities under IFOS.

If building is let out but other assets like machine, furniture are not given on rent, then it is not chargeable under this section.

Sshailesh L. Prajapati CA, MBA ( Finance) 145

Receipts without consideration (Sec 56 (2))

The recipient is an individual or HUFA sum of money/ Property is received without consideration

on or after 01/10/2009;◦A Sum of Money / Property is received without

consideration or with inadequate consideration.◦Chargeable to Tax in the hands of Recipients under the

Head Income From Other Sources. Entire amount is chargeable to tax in the hands of recipient.

Sshailesh L. Prajapati CA, MBA ( Finance) 146

Receipts without consideration (Sec 56 (2))

“Property” means; a) Land or Building or both; b) Shares and Securities; c) Jewellery; d) archaeological collection; e) drawings; f) Paintings; g)sculptures; h) any work of art; i) Bullion w.e.f 01/06/2010.

Sshailesh L. Prajapati CA, MBA ( Finance) 147

Five categories chargeable to Tax

A receipt of sum of money or property without consideration or with inadequate consideration is chargeable to tax if it satisfies the following conditions:◦ It is received by an Individual or HUF.◦ It is received on or after 01/10/2009.◦ Sum of money or Property falls any of the Five Categories ( given

in next slide)◦ It does not fall in the exempted category.

Sshailesh L. Prajapati CA, MBA ( Finance) 148

Five categories chargeable to Tax

Categories Tax Treatment Ceiling Rs.50K

Any sum of Money ( Gift in cash or by DD or by cheque)

If aggregate amount of sum of Money received by Individual or HUF without any consideration from one or more persons exceeds Rs. 50000/-. Whole of such amount Chargeable to Tax.

All Transactions

Immovable Property without Consideration

If any IP (without consideration) is received and the stamp duty value of Property Transferred is more than Rs. 50000, Stamp duty value will be chargeable to tax.

Single Transaction

Sshailesh L. Prajapati CA, MBA ( Finance) 149

Five categories chargeable to Tax

Categories Tax Treatment Ceiling Rs.50K

Immovable Property for a consideration which is < the Stamp duty value (from A.Y. 2014-2015)

If IP received for a consideration which is < the stamp duty value of the property by an amount exceeding Rs. 50000., then difference between stamp duty value and consideration is chargeable to tax

Single Transaction

Movable Property without consideration

If aggregate value of MP received without consideration exceeds Rs. 50000, the whole of aggregate FMV of MP will chargeable to Tax

All Transactions

Sshailesh L. Prajapati CA, MBA ( Finance) 150

Five categories chargeable to Tax

Categories Tax Treatment Ceiling Rs.50K

Movable Property for a consideration which is less than Fair Market Value.

If MP is received for a consideration which is < the aggregate MV of the Property/ies by an amount exceeding Rs. 50000, then the difference between aggregate FMV and consideration is chargeable to Tax.

All Transactions

Sshailesh L. Prajapati CA, MBA ( Finance) 151

Exempted Categories

While Calculating the monetary limit of Rs. 50000, any sum of money or property received from the following shall not be considered:◦ Received from a relative◦ Received on the occasion of the marriage of individual◦ Received by way of will/inheritance◦ Received in contemplation of death of the payer◦ Received from local authority◦ From university or education institution as mentioned in section

10 ( 23C)◦ From charitable institute registered under section 12AA.

Sshailesh L. Prajapati CA, MBA ( Finance) 152

Other relevant Points

The Value of Movable Property shall be the FMV as on the date of receipt in accordance with the method prescribed.

In case of Immovable Property, the value of the property shall be the stamp duty value of the property.

Relative means ( as defined in the next slide ) The Provision covers only a receipt by an individual or HUF Gift on occasion of marriage is not chargeable to tax Gifts on other occasion ( Birthday etc.) will be chargeable to tax. Marriage gift may be received from relatives, friends or any other

person.

Sshailesh L. Prajapati CA, MBA ( Finance) 153

Other relevant Points

The provisions is applicable whether recipient is a resident or non-resident.

Gift received by Non-resident in India is chargeable to tax. The provisions is applicable whether the donor is resident or non-

resident. If Individual/HUF gets a gift of agricultural land situated in a rural

area in India, it is not chargeable to tax in the hands of recipient, as rural agricultural land is not treated as “capital asset” under section 2 (14).

Sshailesh L. Prajapati CA, MBA ( Finance) 154

Relative means:-

Relatives If Tax Payers is X,

1. Spouse of the Individual Mrs. X

2. Brother or sister of the Individual Brothers/sisters of X

3. Brother or sister of spouse the Individual

Brothers/sisters of Mrs. X

4. Brother or sister of either of the parents of the Individual

Brothers/sisters of father or mother of Mr. X

5. Any lineal ascendants or descendants of the Individual.

Lineal ascendants or descendant of X

6. Any lineal ascendants or descendants of spouse of the Individual.

Lineal ascendants or descendant of X

7. Spouse of the person referred to in ( 2) to ( 6 )

Spouse of aforesaid personsSshailesh L. Prajapati CA, MBA ( Finance) 155

Valuation Rules

Different Properties Valuation of Properties

Immovable Property Stamp duty value of the property

Jewellery, archaeological collections, drawings, paintings, sculptures or any work of art

If purchased from Registered Dealer: Invoice value = Market ValueIn any other case : The price which would fetch if sold in the open market. ( FMV or certified value from registered dealer.)

Quoted Shares and securities (received by any recognized Stock exchange in India)

The transaction value as recorded in such stock exchange

Quoted Shares and securities (not being received by any recognized Stock exchange in India)

Lowest price of such shares quoted on any recognised stock exchange in India on Valuation date or immediately preceding date in case not traded on valuation date.

Sshailesh L. Prajapati CA, MBA ( Finance) 156

Valuation Rules

Different Properties Valuation of Properties

Unquoted Equity Shares (Option 1 ) Net worth/Number of Shares= Per Share value

Unquoted Equity Shares (Option 1 )Under section 56 (2 ) (vii)

FMV shall be determined by a Merchant banker or by accountant as per DCF method.

Other Unquoted Shares and securities

FMV shall be estimated to be the price it would fetch if sold in Open market on valuation date

Sshailesh L. Prajapati CA, MBA ( Finance) 157

Valuation Rules…. Contd…

Where the date of agreement fixing the value of consideration for the transfer of Immovable property and date of registration are not same, Stamp duty value may be taken as on the date of agreement for transfer and not as on the date of registration for such transfer.

Exception in case of Money received before the date of agreement other than cash.

Sshailesh L. Prajapati CA, MBA ( Finance) 158

Deductions in case of IFOS

Any other expenses for earning income◦ Spent wholly and exclusively for earning income◦ Must not be in a capital nature◦ Must not be in a personal nature◦ Spent in related previous year and not in any prior year

Commission for realizing dividend or interest on security Repairs, depreciation, insurance premium in the case of letting out

of plant, machines, furniture, building Standard deduction in the case of family pension - Rs. 15000/- or

33-1/3 of such income whichever is less ( paid to a person by the employer in event of death.)

Sshailesh L. Prajapati CA, MBA ( Finance) 159

Income TaxSet off and carried forward of Losses

160Sshailesh L. Prajapati CA, MBA ( Finance)

Set off and Carried forward of Losses

Step :1 :Inter – Source adjustment under the same head of Income Step :2: Inter head adjustment in the same assessment year. This is

applied only if a loss can not be set off under step 1. Step : 3: Carry forward of loss. This is applied only if a loss cannot be

setoff under step 1 and step 2

Sshailesh L. Prajapati CA, MBA ( Finance) 161

Inter – Source Adjustment

Loss of any Source can be adjusted against the income of any other source for the same A.Y.

Exceptions:◦ Loss from speculation business- Same Income◦ Loss from the activity of owning and maintaining race horses-

Same Income◦ Loss can not be set off against winning from lotteries, crossword

puzzles, horse races etc◦ Loss from an exempt income cannot be set off against Profit from

Taxable source of Income.

Sshailesh L. Prajapati CA, MBA ( Finance) 162

Inter – Source Adjustment Sec 70

Other points◦ Loss from a H.P. can be set off against the income from any other

house property◦ Loss from Non- speculation business can be set off against income

from speculation or non-speculation business◦ STCL can be set off against any capital gain ( whether

short term or long term)◦ LFOS except exceptions, can be setoff against any income other

than winning from lotteries etc..◦ Loss of any source can not be adjusted against exempt income.◦ LTCL against LTCG◦ STCL against LTCG/STCG

Sshailesh L. Prajapati CA, MBA ( Finance) 163

Inter – Head Adjustment Sec 71

◦ Net result of computation in respect of any head of income (excluding CG) is a loss, the same can be set off against the income from other heads ( including CG)

Exceptions◦ Loss in speculation business◦ Loss from activity of owning and maintaining race horses◦ Loss can not be set off against winnings from lotteries etc.◦ Loss under capital Gain can not be set off against any other head◦ Business loss ( including unabsorbed depreciation )can not be set

off against Salary.

Sshailesh L. Prajapati CA, MBA ( Finance) 164

Inter – Head Adjustment Sec 71

Other PointsSection 71 to follow only after Section 70Except exceptions mentioned, any loss can be setoff against

income under other heads for the same year. Eg. Hp Loss against specu. Profits

No order of priority is given. One should set off those loss for which there is no carried fwd.

No option is available to not to set off the loss.Loss of any head can not be adjusted against exempt income

Sshailesh L. Prajapati CA, MBA ( Finance) 165

Carried forward of Loss

Loss under Head “IFHP” Loss under Head “ Profit and gains of business or profession

whether speculative or non Speculative Loss under Head Capital Gain (ST and LT) Loss from the activity of owning and maintaining race horses. Return of Loss should be filed before due date

Sshailesh L. Prajapati CA, MBA ( Finance) 166

Order of set off

Order of Set off If profit is insufficient◦ Current Scientific research expenditure◦ Current Depreciation◦ Brought forward Business Losses◦ Unabsorbed Family Planning promo expenses◦ Unabsorbed depreciation◦ Unabsorbed Scientific Research Capital Expenditure◦ Unabsorbed development allowance◦ Unabsorbed Investment allowance

Loss from exempt Income can not be carried forward

Sshailesh L. Prajapati CA, MBA ( Finance) 167

Income TaxDeductions from Gross Total Income

168Sshailesh L. Prajapati CA, MBA ( Finance)

Deductions

Generally available only to residents Subject to the existence of income Broad Categories

◦ For certain payments ◦ For certain incomes◦ In certain situations

Sshailesh L. Prajapati CA, MBA ( Finance) 169

Deductions from GTI

Deduction in respect of insurance premia, contribution to PF, PPF etc.. ( Section 80 C)◦ Available from GTI ◦ Only to an Individual or HUF◦ Only on qualified Investments◦ Maximum amount should not exceed > Rs. 100000/- together with

80C, 80CCC, 80CCD Deduction in respect of Pension Fund(80CCC) Contribution to Pension scheme of Central Government or notified by Central

Govt. (80CCD) Contribution to Infrastructure Fund Rs. 20000/- u/s. 80CCF

Sshailesh L. Prajapati CA, MBA ( Finance) 170

Medical Insurance Premia (Sec 80D)

Individual or HUFPaid by any other mode other than cashRental Income of Machinery, Plant or furniturePaid out of the income chargeable to taxOn the health of Taxpayer, spouse, dependant parents

and dependant children or member of HUF.Deduction : Rs. 15000/- for self and family ( Rs. 5000/-