Impact of Subsidy Removal on Nigerian Economy

-

Upload

akindele-akinola -

Category

Documents

-

view

1.495 -

download

6

Transcript of Impact of Subsidy Removal on Nigerian Economy

IMPACT OF FUEL SUBSIDY REMOVAL ON

NIGERIAN ECONOMY

By

AKINDELE OLUSOLA AKINOLA

NOVEMBER, 2O11

INTRODUCTION

The regulation and control of domestic prices of petroleum products by government is peculiar in

developing nations of the world. Governments, in some cases focus their efforts on the direct

control of import levels, domestic distribution, and domestic prices while some give the private

sector the mandate to freely import and distribute petroleum products. However, the government

sets the domestic price ceilings and compensate the private sector distributors to cover ensuing

losses. Governments that directly control prices in most cases introduce price subsidies that keep

domestic prices below border prices. This is particularly the case when international fuel prices

increase sharply and governments are reluctant to pass these increases fully on to the domestic

prices of petroleum products.

Energy subsidies are found in virtually every country but it’s size varies; some are relatively high

while some are low compared to that of other countries. The justifications for the use of subsidy

vary from social welfare protection, job creation, the encouragement of new sources of energy

supply, and economic development to energy security. However, large energy subsidies in

countries also compete for limited resources that could otherwise be used to deliver other

essential services for the developmental projects in the economy.

Removing fuel subsidies is considered by many to be a win-win policy measure that would

benefit both the global economy and the environment and therefore a “no regret” option for

climate-change mitigation (Burniaux et al., 2009). In theory, eliminating fuel subsidies would

result in higher fuel prices in countries that currently subsidize consumer prices, which would

reduce consumption. At the same time, removing subsidies would remove a costly drain on the

government budget. Consequently, eliminating subsidies on fuel may be one of the most cost-

effective and least distortionary options available to governments for reducing the strains on their

budgets.

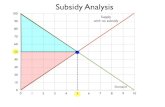

On a basic level, if a subsidy that is keeping fuel prices artificially low is removed, the prices

would rise. If producers were also receiving a subsidy, they will suffer a loss of their surplus and

may raise prices. If prices rise, demand will likely fall, resulting in decrease in the level of

consumption and loss of consumer welfare. If demand and producer surplus fall (in a closed

economy), production may fall as a result of higher cost, resulting in a loss of employment and

decrease in welfare. However, government expenditures on the subsidy will also fall, creating a

net government surplus, which could then benefit society through reductions in government

deficits and debts, or through improvements in government social programs. From the

environmentalists point of view, declines in consumption will automatically lead to decline in

emissions. The magnitudes of these changes will be determined by the price elasticities of supply

and demand (Von Moltke et al., 2004).

The primary focus of this paper is to evaluate and analyze the distribution of fuel subsidies, with

special emphasis on the likely impacts of their removal on firms and households and to proffer

alternative approaches to reduce the possible adverse effects.

LITERATURE REVIEW

It is pertinent to understand the concept of subsidy. The World Trade Organisation Agreement

on Subsidies and Countervailing Measures (ACMS) provides a definition of subsidy. Article 1 of

the Agreement states that a "subsidy" exists when there is a "financial contribution" by a

government or public body that confers a benefit. A "financial contribution" arises where:

a government practice involves a direct transfer of funds (e.g. grants, loans, and equity

infusion), potential direct transfers of funds or liabilities (e.g. loan guarantees);

government revenue that is otherwise due is foregone or not collected (e.g. fiscal

incentives such as tax credits);

a government provides goods or services other than general infrastructure, or purchases

goods; or

a government entrusts or directs a private body to carry out one or more of the above

functions. A "benefit" is conferred when the "financial contribution" is provided to the

recipient on terms that are more favorable than those that the recipient could have

obtained from the market.

Over the years, there has been divergent view on the removal of energy subsidy. Most authors

believe that the removal of subsidy is healthy for economic growth and development. This is

centered on their submission that paying actual cost reveals the true cost of consumption and

leads to a greater level of efficiency in the economy. However, appropriate measures are

considered necessary so as not to affect macroeconomic variables like inflation, unemployment,

economic growth, etc. It is worth knowing that there are costs associated with subsidy removal,

mostly in the short run.

According to Nwafor et al (2006), subsidy removal without spending of the associated savings

would increase the national poverty level. This is due to the consequent rise in input costs which

will be higher and a rise in selling prices of most firms and farms. The key sector that experience

increased nominal output is the refined petroleum products sector which provide income for an

extremely low number of households.

The findings of Coady et al (2006) shows that energy subsidies are badly targeted in all the

countries analyzed which are Bolivia, Ghana, Jordan, Mali, and Sri Lanka. This even holds true

for kerosene, for which subsidies are often promoted as a way of protecting the poor. Reflecting

this, the real income burden resulting from the withdrawal of energy subsidies is borne

disproportionately by higher-income households. They said lower income households do suffer

sizable real income decreases from subsidy removal, and any credible policy strategy therefore

needs to address the mitigation of these adverse effects.

O’Ryan et al (2003), analyzed the subject matter on Chile and concluded that removing oil

subsidies could have economic and distributional effects on the economy. This is mainly because

consumption of oil is relatively large compared to other forms of power. Also, the effects on the

sectors concerned, namely oil refining and coal production are much bigger in each case.

However, the environment clearly benefits from the removal of both coal and oil subsidies as the

level of emissions are much lower in both cases.

Ghana has been a small producer of oil, importing the bulk of its needs either in the form of

petroleum products or as crude oil to be processed in its domestic refinery. In 2004, as the world

oil price rose, the total cost of subsidies increased sharply. By 2005, fuel price increased by 50%

as a result of subsidy removal but series of mitigation measures were also introduced that were

transparent and easily monitorable. These included the immediate elimination of fees at

government‐run primary and junior‐secondary schools, and a programmes to improve public

transport. There was opposition to the increases but there was general acceptance of the policy

(Bacon and Kojima 2006).

FUEL SUBSIDY IN NIGERIA

In Nigeria, the government bears part of the production cost of fuel through subsidies basically to

alleviate the high cost on the masses and to reduce production cost of goods and services. The

local refineries in the country produce about 13 million liters of refined petroleum products

daily. However, daily domestic consumption is about 30 million liters. The shortfall of 17

million liters is imported so as to meet daily demand. The imported products are not sold at their

full landed cost as it is subsidized. In 2003, the government stated that for each liter of petroleum

products, N12 is spent as subsidy. This implies an explicit subsidy of N74 billion or about 1.42%

of GDP.

Expenditure on fuel subsidy has increased over the years. It cost the government N1.3 trillion

(about $8.38 billion) in the 2010 fiscal year, which accounts for about 25 per cent of the entire

budget expenditure for the year under review. By the end of the year, the approved amended and

supplementary budget amounted to N5.159 trillion (about $33.2 billion).

Investigations revealed that fuel subsidy incurred by the Federal Government may have exceeded

the N1 trillion mark by the end of the third quarter, with indications that payments to petroleum

products marketers may surpass 2010 levels at the end of the year.

Government regulates the sale of Premium Motor Spirit (PMS) and House Hold Kerosene

(HHK), selling both at N55 and N40.90k per litre, respectively at the depots of the Petroleum

Products Marketing Company (PPMC), a subsidiary of the state-owned Nigerian National

Petroleum Corporation (NNPC). The Petroleum Products Pricing and Regulatory Agency

(PPPRA) allots quarterly imports quotas to the NNPC and petroleum products marketers and pay

both parties the difference between the landed cost and the approved pump prices.

Checks however revealed that the petroleum products marketers have turned the subsidy

payment regime into a huge profiteering enterprise ripping the state of hundreds of billions each

year under bogus subsidy claims for petroleum products they neither imported nor delivered to

the pumps.

Three quarters through 2011, independent checks revealed that outstanding subsidy payments

amounts to over N1 trillion, while ongoing racketeering surrounding kerosene supply and

distribution appears set to raise subsidy payment claims to an increase by the end of the year.

According to the PPPRA pricing template, even though petrol is sold at N55.90k and N65 per

litre, ex-depot and pump price respectively; if deregulated, consumers would have to pay

N138.20k per litre. Essentially, the subsidy element on current petrol price is N82.30k per litre.

Similarly, although ex-depot and pump prices of HHK is N40.90k and N50 per litre respectively;

if deregulated, consumers would have to pay N151.15k per litre. Essentially, the subsidy element

on current kerosene price is N110.25k per litre.

It can be deduced from the literature that several countries were faced with the problem of

removing fuel subsidies at different times and some succeeded as a result of the strategies that

were adopted. If the proposed fuel subsidy removal is successful, prices of petroleum products

would increase in the short run. In the medium to long term, investments in development of

infrastructure would increase, jobs would be created, technology would be domiciled and under

such circumstance, the Gross Domestic Product (GDP) of the country will grow increasingly.

The success of this will however depend on the sincerity of the government and her ability to

channel the funds back into the economy for developmental projects.

METHODOLOGY

The events in an economy are shaped by the activities of the economic agents (government,

firms and household) in such economy.

The firm is the productive arm of the economy. Policies affecting the firm goes a long way in

determine the behavior of the economy. Hence, the impact of fuel subsidy removal on the

economy can be explained from the point of view of the firm. The model used for this purpose is

an extension of the theory of firm.

It is assumed that total output is a function of capital, labour and power. However, given the poor

state of electricity in the country, it is assumed that firms power their plants through Premium

Motor Spirit (PMS)

Q=F (K , AL , P) ……… (1)

Where Q is total output

K is capital

AL is effective labour (labour driven by knowledge)

P is PMS

Assuming a Cobb-Douglas production function, the total output function becomes:

Q=K α (AL)β Pε ……… (2)

Where α +β+ε=1

The quantity of total output that can be produced at a given time is determined by the budget

constraint (cost function).

Assuming a unit cost of capital to be r, per unit cost labour, w and a unit cost PMS to be z. The

cost function becomes:

C=rK+wL+ zP ……… (3)

However, z is not the consumer unit price of PMS as a result of subsidy. Demoting subsidy by s,

the consumer unit price of PMS (z) can be defined as the difference between the actual price (u)

and subsidy (s).

z = u – s ………(4)

Therefore, the cost function becomes:

C=rK+wL+(u−s) P ……… (5)

Firms seek to maximize total output subject to the cost constraint or minimize cost subject to the

production constraint.

Setting up a minimization problem for the firm using the Lagrangian multiplier, we have:

L=rK +wL+(u−s ) P−λ¿ ……… (6)

The first order condition yields the following equations:

Lk=r−λ∝K ∝−1 ( AL ) β P ε=0 ……… (7)

Ll=w− λβ K∝(AL)β−1 Pε=0 ……… (8)

Lp=(u−s )− λε K∝ ( AL )β P ε−1=0 ……… (9)

Lλ=Q−Kα ( AL )β P ε=0 ……… (10)

Solving for K, L and P in equations 7-10, yields the following:

K=Q (αwβr )

β

(∝(u−s)εr )

ε

………(11)

AL=Q( βr∝w )

1−β

(∝(u−s)εr )

ε

…....…(12)

P=Q (αwβr )

β

( (εr )α (u−s ))

1−ε

………(13)

Substituting equations 11-13 into equation 5,

C=Q(αwβr )

β

(α (u−s )εr )

ε

r ( 1α ) ..…… (14)

Note: See appendix for full workings.

INTERPRETATION

The effect of subsidy can be seen from equation 14 where s serves as a reducing value to the

numerator as can be deduced from its negative sign. The removal of subsidy makes s to be zero.

This implies that the numerator becomes relatively larger which consequently increases c (cost

of production). However, it should be noted that the magnitude of the impact of subsidy removal

on production cost will be determined (u-s), the difference between actual unit price of PMS and

the amount consumers pay for a unit of PMS.

The economic implication of the removal of subsidies can be analyzed through its impacts on the

firm, as given above and consequently its effects on households. The removal of subsidies on

fuel increases expenditures on power and transportation (movement of goods and people). This

will however lead to increases in prices of goods and services which could cause cost-push

inflation. This reduces purchasing power and increases the level of poverty.

SUMMARY

Efforts has been made to study the impact of fuel subsidy removal on the Nigerian economy. The

first section of the study dealt with the concept of subsidies and the rationale behind its

application.

Also, relevant literature was reviewed to establish the impacts subsidies has on economic growth

and development, the consequences of removing fuel subsidy on the economy and ways of

tackling the resulting crises posed by it.

Furthermore, the theory of the firm was adopted to study the impact on firms with the use of

Cobb Douglas production function with capital, effective labour and power (PMS). The presence

of subsidy on PMS was reflected in the firm’s cost function which was solved through

optimization.

Conclusions were drawn and policy recommendations were suggested on tackling the impending

fuel subsidy removal in Nigeria.

CONCLUSION

The removal of fuel subsidy will imply that consumers will be paying the actual price of the

commodity. This will remove all forms of distortions and lead to an improved level of efficiency

and effective operations in the economy. Literature has shown that subsidy removal is healthy

for an economy.

However, the removal of fuel subsidy removal will have a great impact on the Nigerian economy

as fuel has no competing close substitute and its demand is inelastic in nature due to its

importance in driving economic activities by households, firms and government.

Considering the present state of Nigeria’s economy, removal of fuel subsidy will have a negative

effect on the economy in the short run and possibly in the long run if adequate measure are not

taken. In the short run, there is a likely effect of inflation, increase in poverty level, high level of

social unrest, decrease in productivity level, unemployment, etc. The main reasons for these will

be due to poor infrastructures; in terms of good roads, power (electricity), rail system of

transportation; lack of political will and the high level of corruption. Another contributing factor

will be the inability of local refineries to operate at full capacity to cover local consumption of

refined crude oil.

If these shortfalls are met and the funds initially spent on subsidies are channeled back into

productive activities in the economy, the effect of the removal of fuel subsidy in the short run

will be minimal and will lead to considerable growth overtime.

POLICY RECOMMENDATIONS

The following measures are suggested for the government to take before removing subsidy on

fuel.

Firstly, the power sector should be developed so as to ensure constant electricity supply.

Secondly, efforts should be geared at restoring efficiency to the local refineries and building of

new ones by private investors.

Furthermore, the provision of basic infrastructures with the construction of electric rail systems.

Also, government should initiate the development of cheaper alternative sources of power. For

example, solar and gas.

Lastly¸ government needs to partner with the private sector to ensure the development of the real

sectors of the economy.

It must however be noted that economic growth and development in Nigeria can only be

achieved if there is strong implementation of policies, political will and the reduction of

corruption to the bearest minimum.

REFERENCES

Adenikinju A. ( 2000). Analysis of Energy Pricing Policy in Nigeria: An Application of a CGE

Model. Research for development. NISER

Background Paper for the World Bank Group Energy Sector Strategy (2010). Subsidies in the

Energy Sector: An Overview

Bacon, R. and Kojima, M. (2006). “Coping with Higher Oil Prices.” Energy Sector Management

Assistance Program, World Bank: Washington, DC.

Burniaux, J., Chanteau, J., Dellink, R., Duval, R. and Jamet, S. (2009). “The economics of

climate change mitigation: How to build the necessary global action in a cost-effective manner.”

Economic Department Working Papers No. 701.

Coady, D., El-Said, M., Gillingham, R., Kpodar, K., Medas, P. and Newhouse, D. (2006). “The

Magnitude and Distribution of Fuel Subsidies: Evidence from Bolivia, Ghana, Jordan, Mali and

Sri Lanka.” IMF Working Paper.

Ellis J (2010). “The Effects of Fossil-Fuel Subsidy Reform”: A review of modeling and

empirical studies. International Institute for Sustainable Development.

Nwafor M., Ogujiuba K., Asogwa R. (2006) “Does Subsidy Removal Hurt The Poor.”

Secretariat for Institutional Support for Economic Research in Africa (SISERA) Working Papers

Series.

O’Ryan R,. Miller S., Rogat J., Miguel C. Energy Subsidies: Lessons Learned in Assessing their

Impact and Designing Policy Reforms in Chile.

Von Moltke, A., McKee, C. and Morgan, T. (2004). Energy Subsidies: Lessons Learned in

Assessing their Impact and Designing Policy Reforms. Sheffield: Greenleaf Publishing.

APPENDIX

Q=F (K , AL , P) ……… (1)

Assuming a Cobb-Douglas production function, the total output function becomes:

Q=K α (AL)β Pε ……… (2)

Where α +β+ε=1

C=rK+wL+ zP ……… (3)

Where z = (u – s); hence,

C=rK+wL+(u−s) P ……… (4)

Setting up the lagrangian, we have:

L=rK +wL+(u−s ) P−λ¿ ……… (5)

The first order condition yields the following equation:

Lk=r−λ∝K ∝−1 ( AL ) β P ε=0 ……… (6)

Ll=w− λβ K∝(AL)β−1 Pε=0 ……… (7)

Lp=(u−s )− λε K∝ ( AL )β P ε−1=0 ……… (8)

Lλ=Q−Kα ( AL )β P ε=0 ……… (9)

From equation (6) and (7)

αβ

K(α−1−α)( AL)(β−β+ 1)= rw

α ( AL)βK

= rw

βrK=αw ( AL)

( AL)= βrKαw

……… (10)

From equation 6 & 8

αε( AL)(β−β) K (∝−1−∝)P(ε−ε+1)= r

u−s

αPεK

= ru−s

εrK=α (u−s ) P

P= εrKα (u−s)

……… (11)

Substituting equation 10 & 11 in equation 9, we have:

Q=K α( βrKαw )

β

( εrK∝(u−s))

ε

Q=K α+β+1( βrαw )

β

( εr∝(u−s))

ε

Q=K ( βrαw )

β

( εr∝(u−s))

ε

K=Q (αwβr )

β

(∝(u−s)εr )

ε

………(12)

Substitute equation 12 into 10

AL=Q( βrαw )(∝w

βr )β

(∝(u−s)εr )

ε

AL=Q ( βr1−β ) αwβ−1(∝(u−s)εr )

ε

AL=Q( βr∝w )

1−β

(∝(u−s)εr )

ε

……… (13)

Substituting equation 12 in equation 11

P= εrKα (u−s)

P= εrα (u−s)

Q (∝Wβr )

β

(∝(u−s)εr )

ε

P=Q (αwβr )

β

εr1−ε .∝(u−s)ε−1

P=Q (αwβr )

β

( (εr )α (u−s ))

1−ε

……… (14)

Inserting equation 12, 13 & 14 into the cost function, we are able to solve the cost function thus:

C=rK+wL+(u−s) P

C=r Q(αwβr )

β

(α (u−s)εr )

ε

+w Q( βrαw )

1−β

(α (u−s)εr )

ε

+(u−s)Q( αwβr )

β

¿¿

C=Q ¿¿

C=Q ¿¿

C=Q(αwβr )

β

¿

C=Q(αwβr )

β

¿

C=Q(αwβr )

β

(α (u−s )εr )

ε

¿

C=Q(αwβr )

β

(α (u−s )εr )

ε

¿

C=Q(αwβr )

β

(α (u−s )εr )

ε

r¿

C=Q(αwβr )

β

(α (u−s )εr )

ε

r ( 1α ) ……… (16)