iHomes & Buildings - Autumn 2012

-

Upload

rawlson-king -

Category

Documents

-

view

220 -

download

6

description

Transcript of iHomes & Buildings - Autumn 2012

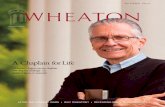

the magazine of the continentalautomated buildings associationautumn 2012 volume 9, number 3

Home automation for the Masses → 7

CaBa unveils New Market research Initiatives → 16

Integrated systems are a “Must Do”requirement → 18

the Future of the electric Grid – an Interdisciplinary MIt study → 5

the Future BuildingManagement systemJim Sinopoli asserts that the building management system of the future will be user-friendly and designed to handle escalated levels of system complexity.

PAGE 10

$25 usd www.caba.org/ihomesandbuildings

More Information available at:www.caba.org/estore

To purchase this and other available research reports or explore new research opportunities contact:George GrimesCABA Business Development Manager613.686.1814 x226 or [email protected]

Your Information Source ForHome & Building Automationwww.CABA.org

CABA’s Intelligent & Integrated Buildings Council (IIBC) focused on areas of research that address the needs and priorities of high performance and intelligent buildings. The IIBC identified two key areas of exploration in its 2011 Landmark Research study - the impact of smart grid development on intelligent buildings, and the progression of intelligent buildings towards net zero energy. There is a growing marketplace outlook that achieving energy sustainability and the growth of building intelligence are interdependent and exert a collective influence in the progression of high performance intelligent buildings. Consequently, CABA’s IIBC members focussed the research study on an investigation and assessment of the impact of the smart grid on the commercial buildings sector. Though still early in development and deployment, the research also examined the relationship of smart grids and the progression towards net zero energy output in intelligent buildings. The purpose of this study was to identify, define and size the principle business opportunities presented by the growth of smart grids, in relation to “intelligent buildings”. An examination of smart grid should yield immediate value to all stakeholders in the intelligent building industry, as smart grid and auto demand response holds more relevance in the industry today - with opportunities in existing buildings and new construction. Energy capacity/supply problems need to be addressed in the short-term, and made available in emerging tech-nology. This will serve to add to market education and understanding, and address market knowledge gaps. As well, open and interoper-able communication between energy suppliers and commercial energy users is an eventuality - which was further explored in relation to smart grid development and intelligent buildings. The purpose of these initiatives is two fold – an educational and validation exercise for industry participants and a means to drive public opinion and facilitate policy decisions at industry stakeholder, public authority and government organization levels.

RUBY SPONSOR

EMERALD SPONSORS

DIAMOND SPONSORS

The study was funded by these CABA members:

The research was undertaken by research and buildings technology consultancy, BSRIA, on behalf of CABA.

FeaturesLarge Building automation .......................................................................................................................................................... 10

The Future Building Management System by Jim SinopoliHome systems ....................................................................................................................................................................................... 7

Home Automation for the Masses by John Antonchick

COLuMNsPresident & CeO’s Message ........................................................................................................................................................... 3CaBa research Briefs ....................................................................................................................................................................... 5

The Future of the Electric Grid – An Interdisciplinary MIT Study The Potential of Smart Meter Enabled Programs to Increase Energy and Systems Efficiency:

A Mass Pilot ComparisonKen Wacks’ Perspectives............................................................................................................................................................... 12

International Standards for Smart Gridsresearch Viewpoints ....................................................................................................................................................................... 16

CABA Unveils New Market Research Initiatives by Rawlson O’Neil KingOpinion .................................................................................................................................................................................................... 18

Integrated Systems Are A “Must Do” Requirement by Frank Bisbee

DePartMe Nt sNew Members ......................................................................................................................................................................................... 4Industry Trends.................................................................................................................................................................................... 17Networking and Outreach .............................................................................................................................................................. 20Upcoming Events ............................................................................................................................................................................... 21

the magazine of the continentalautomated buildings associationautumn 2012 volume 9, number 3

CABA NewsBriefPlease go to the CABA Web site at www.caba.org tolearn how to freely subscribe and sponsor

iHomes & Buildings

Editorial Advisory BoardDr. Kenneth WacksKen Wacks Associates (Chair)

David LabuskesRTKL Associates, Inc.

Labib MattaNeXgen Advisory Group FZ-LLC

Daniel MichaudEnvironmental Systems Design

Harshad shahEagle Technology, Inc.

Managing EditorRonald J. Zimmer, CAE

EditorRawlson O’Neil King

ContributorsKen GallingerGeorge GrimesJohn Hall

Association OfficeContinental Automated Buildings Association1173 Cyrville Road, Suite 210Ottawa, Ontario, CanadaK1J 7S6

Tel: 613.686.1814; 888.798.CABA (2222)Fax: 613.744.7833

Further editorial use of the articles in this magazine is encouraged.

For subscriptions, circulation, and change of address enquiries email [email protected]. For editorial and advertising opportunities: www.caba.org/ihomesandbuildings

The views expressed in this magazine are not necessarily those held by the Continental Automated Buildings Association (CABA). CABA shall not be under any liability whatsoever with respect to the contents of contributed articles. The organization reserves the right to edit, abridge or alter articles for publication.

2

Join CABA Today!The Continental Automated Buildings Association provides more information about integrated systems and automation in homes and buildings than any other source.

www.caba.org

3autumn 2012

The CABA Board of Directors made an important decision approximately seven years ago. In their strategic planning efforts, they decided that CABA should become an in-ternational trade association. The reality then, as it is today, is that integrated systems for homes and buildings are rapidly expanding globally. Technology today is being devel-oped and deployed for connected homes and intelligent buildings worldwide. CABA’s efforts have evolved to ensure that the research and information, that is gathered and disseminated, is truly international. The CABA Research Library has grown to over 1,000 publications and is now the largest library of its kind in the world. Research material from virtually every continent is being gathered, reviewed by the CABA Infor-mation Council, and added to CABA. As a result, more than 25,000 industry professionals have access and utilize this research and information. More than 320 companies and organizations that are CABA members are not just North American, but many are multinational and their representa-tives are worldwide. Many more people access the free CABA Public Library, Web site and share info in the CABA Group on LinkedIn. CABA representatives are increasingly being invited and have presented industry re-search at many industry events, not just in the U.S. and Canada, but in countries such as: Mexico, Hong Kong, Estonia, Korea, China, Russia, Saudi Arabia, Taiwan, France and Netherlands. Most recently, CABA research was presented in Brazil at the SASBE 2012 and XI edição do Congresso Habitar. CABA collaborates and liaises with many

“sister” associations throughout the world in order to grow this sector faster. It was great to work with AURESIDE – Brazilian Home Automation Association and attend their conference, along with representatives from KNX and Z-Wave Alliance. CABA is truly an international trade association and will continue to help the industry grow!

Remember – CABA works for you and the industry!

CABA Board of Directors

ChairDr. satyen MukherjeePhilips

Vice-ChairDr. Morad atifNational Research Council Canada

Directorsscot adamsCadillac Fairview Corporation

Kris BowringBest Buy Co., Inc.

scott BurnettIBM

Brian CaseyHoneywell International, Inc.

Dr. Yong ChangSamsung Electronics, Co. Ltd.

Michael ClayVerizon Wireless

Jonathan ClutsMicrosoft Corporation

Larry ehlingerPella Corporation

Jeff HamiltonIngersoll Rand

Bill HorrocksComcast Communications

terrie IpsonDiebold Incorporated

elizabeth JacobsSiemens Industry, Inc.

shahram MehrabanIntel Corporation

Ian MilneRobinson Solutions

Mike NagerMetz Connect

stephen NardiRealView, LLC

Barry rogersSecurTek Monitoring Solutions

tom semlerHydro One Networks Inc.

alok singhSouthern California Edison Company

Dana “Deke” smithNational Institute of Building Sciences

CABA President & CEO’s Message

Ron Zimmer

Ron Zimmer, CABA President & CEO with Bent Sorensen of the Z-Wave Alliance, Heinz Lux, KNX Association and José Roberto Muratori of AURESIDE (left to right)

4 iHomes & Buildings

N e W M e M B e r s

The Continental Automated Buildings Association is a not-for-profit industry association that promotes advanced technologies for the automation of homes and buildings. CABA members benefit from timely, competitive intelligence on the integrated systems industry. Here is a sampling of our latest members.

anixter CanadaAnixter Canada is a leading global supplier of communications and security products, electrical and electronic wire and cable, fasteners and other small components.

Honda environmental Business Development OfficeThe Honda Environmental Business Development Office is responsible for Honda’s new environmental technology and business initiatives in the U.S.

LumenCacheLumenCache provides technology that replaces traditional 110V AC power distribution in buildings with a new standard more appropriate to the low power needs and digital capabilities of LED lights.

Qa GraphicsQA Graphics is an innovative graphic development company specializing in control system graphics for the building automation industry. The company is an industry leader in the design of system graphics, energy dashboards, 3-D design and animation, and drafting services.

tendril NetworksTendril is an energy platform company that delivers end-to-end consumer engagement products, applications and services.

trLabsTRLabs is Canada’s largest information and communications technology (ICT) research and development consortium. As an innovation performer, TRLabs fast tracks innovation to market by working with industry, government, and academic partners to discover, develop and commercialize technology.

A complete CABA member listing with both product and service information and Web links is available at:www.caba.org

Connect With Us at www.caba.org

5autumn 2012

the Future of the electric Grid – an Interdisciplinary MIt study This report, the fifth in the MIT Energy Initiative’s “Future of” series, aims to provide a comprehensive, objective portrait of the U.S. electric grid and the identification and analysis of areas in which intelligent policy changes, focused research, and data development and sharing can contribute to meeting the challenges the grid is facing. It reflects a focus on integrating and evaluating existing knowledge rather than performing original research. Authors hope it will be of value to decision makers in industry and in all levels of government as they guide the grid’s necessary evolution. The report identifies the challenges and suggests valuable recommendations for resolving them with an aim of a reliable, efficient, effective, scalable and customizable smart electric grid.

OperationsService

ProviderMarkets

BulkGeneration

Transmission Distribution

Customer

DomainElectrical FlowsSecure Communication Flows

Soure: National Institute for Standards and Technology, NIST Framework and Roadmap for Smart Grid Interoperability Standards, Release 1.0, special publication 1108 (Washington, DC: U.S. Department of Commerce, 2010), 33, http://www.nist.gov/public_affairs/releases/uploads/smartgrid_interoperability_final.pdf

Figure 9.1 – Diagram of the Future electric Grid, showing Communications and Power Flows

CaB a r esearCH BrIeFs

CABA Research Briefs provide a condensed synopsis of specific research papers available in the organization’s research libraries. CABA research libraries provide industry intelligence to the home and large building automation and integrated systems sector.

6 iHomes & Buildings

the Potential of smart Meter enabled Programs to Increase energy and systems efficiency: a Mass Pilot ComparisonThis report by VaasaETT Global Energy Think Tank summarizes the findings of 100 consumption reduction pilots in homes involving 450,000 consumers from Europe, USA, Canada, Japan and Australia. The report assessed these pilots in three general areas: energy conservation, peak clipping and bill reduction. In-house displays (IHD) are displays that hang on the wall or sit on a counter and provide close to real time infor-mation about household electricity consumption. They also provide a variety of other data. For example, the display provided in the “Electricity Smart Metering Customer Behavior Trials” (see figure below) allows people to set daily budgets for how much they want to spend, informs them of their success, what the current price of electricity is and provides information on how much they have spent so far this month.

IHDs provide households with real-time and historical information on their electricity usage and costs. Additional feedback-content that is sometimes offered on the IHD includes peer comparisons (showing the consumption rate of neighbors or consumers with similar conditions), and appliance specific consumption (breaking down the energy usage of individual appliances in the home). The home screen for the dynamic display unit is the key screen that the customer always sees when the device is switched on, while further information can be gained if desired through navigating to other screens.

Ambient displays differ from IHDs in that they do not provide specific consumption information but rather signal to the customer messages about their general level of consumption and/or a change in electricity prices. Many ambient displays have the attributes of being attractive and intuitive which adds to their customer acceptance potential. An example of this is the Energy Orb sold by PG&E in the USA (see figure 2). Origi-nally designed to track stock market prices, the Energy Orb can also be programmed to change from green to yellow to red depending on the cur-rent electricity price.

shows how you are doing against your daily budget

In Home Display (IHD)

Indicates the current cost of electricity per hour (does not include standing charge and Vat)

Indicates price at peak (red), day (organge) and night (green) rates

Indicates how much your electricity has cost this month

(does not include standing charge and Vat)

Figure 2 - Energy Orb

C A B A R E S E A R C H B R I E F S

7autumn 2012

New product, technology and distribution initiatives in the last two years are gaining momentum and promise a wider range of options to consumers. More robust prod-ucts with enhanced features are utilizing both in-home radio (RF) networking as well as “cloud computing” to provide better performance. Compatibility and interoperability of products using the newest technologies (e.g., Z-Wave and ZigBee) are now implemented in a wide range of products appeal-ing to customer interests including security, monitoring, control and improved energy efficiency. While telephone companies, cable companies and security companies are adding options targeting their installed base of customers, retailers (selling both online and in conventional stores) are evolving their products for the general audience. A milestone may have been reached in August 2012 with the release of a private labeled system of products by Lowe’s in 500 of their retail locations as well as online. This article reviews the status of these developments from the author’s perspective as of August.

a Little HistoryHistorically, the volume leader in do-it-yourself (DIY) home networking and security products in the U.S. was X-10 and the majority of those products were sold in re-tail outlets like Radio Shack and Fry’s. Of course, there were sales via other types of outlets, dealers and install-ers. Today, the evolution of broadband access and im-proved technologies has created a wide array of vastly improved but often-similar yet incompatible products and solutions, at higher prices. What is different, per-haps, is the use of Web sites and other methods, such as

in-store interactive displays, to educate and support the sales process. Since most products do not serve the needs of everyone, suppliers, then and now, have to decide what segments of the consumer market they will serve.

Customer segmentationTelcos and cable operators, as well as security compa-nies have been evolving home security products with op-tions to do some energy management. These products are mainly targeted to existing customers. Retailers like Best Buy, on the other hand, have been experimenting with new “home energy” products with options for monitor-ing, control and security. Parks Associates, a market research company that studies consumer product interests, recently found that there is considerable interest both in “energy” and “secu-rity” solutions. Parks Associates has also studied the penetration of these types of systems in detailed surveys. According to Tom Kerber, the firm’s research director for home con-trols and energy, the purchase of solutions like these is much less than the stated interest, perhaps half, and there is a large difference in the usage of security systems in urban versus suburban and rural areas. Overall about 22 percent of homes have some form of security system. In my experience, at any specific time perhaps five percent of consumers are actively shopping for “secu-rity”. Few are pursuing energy efficiency unless they can be shown that it would save an adequate amount of mon-ey for the household. A quick comparison of Lowe’s new IRIS smart home products versus the approach taken by Best Buy reselling

HOMe sYsteMs

Home Automation for the MassesJohn Antonchick suggests that consumer based technology, marketed through big box stores will drive mass-market home automation.

8 iHomes & Buildings

H O M E SyST E M S

several brand name products illustrates the range of tac-tics used to target these segments. Best Buy’s Kris Bow-ring, Senior Director Home and Energy Management and CABA Board member, has explained that their approach is to provide an in-store environment to educate different types of consumers about a variety of products and solu-tions, through “consultative” sales by their “blue shirt” staff. Best Buy stocks a range of products in their home en-ergy departments that are not necessarily compatible but can be used as stand-alone solutions satisfying specific interests. Lowe’s in July 2012 announced the availability of a private-labeled system in 500 of their stores as well as through their Web site. Kevin Meagher, VP and GM of Smart Home Systems at Lowe’s, noted that in addition to IRIS components, many third party products compatible with the IRIS system are being sold. Initially, there were 10 IRIS-labeled products and five third-party products that are IRIS-compatible. Lowe’s has avoided explanations of technologies in these products, eliminating any issues regarding interop-erability, which solves a key consumer problem. Meagher

also emphasized use of cloud computing both for access and product compatibility. I am particularly impressed that the IRIS gateway includes Z-Wave, ZigBee (HA), USB and router connec-tions. Meagher indicates that there will be additional compatible products stocked in their end-of-aisle dis-plays with interactive educational materials. More IRIS-compatible products are planned before the end of 2012, including Schlage door locks. Assuming things go well, more Lowe’s stores will stock these products. Finally, Lowe’s has three pre-pack-aged kits and does not charge for their basic online ser-vice. The security and energy control related kits are $179 while a more complete smart home kit is $299. Additional modules sold separately are competi-tively priced. Lowe’s seems to be appealing to the price-conscious consumer. Their system seems less expensive than options from monitored and online alternatives. Verizon’s entry-level connected home bundle is currently $89.99 plus a $9.99 monthly service charge, which over a year is more expensive. It should be noted that prod-uct suppliers indicate they are accepting lower margins than normal in order to stimulate wider acceptance and

0

25

50ENERGY SECURITY

Top-ranked Connected Home Services

Source: Parks Associates’ Connected Home Systems & Services research service @ Parks Associates

EnergyMonitoring

% S

peci

fyin

g H

igh

Rank

Energy Mgmt,Control &

Convenience

ManagingEnergy to

Utility Rates

ManagingMajor

Appliances

HomeSecurity

Monitoring

RemoteAccess &

Control

VideoHome

Monitoring

9autumn 2012

complexity, security and privacy as key consumer barri-ers to wider acceptance, along with identifying key con-sumer benefits. An open issue is whether electric utilities’ smart me-ters can be integrated with consumer systems and pur-chased via retail distribution as desired by several leading utilities. Regardless, the recent initiatives by Lowe’s, Best Buy and many other suppliers are directly addressing consumer issues and promise considerable success with key consumer segments.

John Antonchick is Principal at NCN Associates, which provides consumer industry analysis and marketing services. Recent assignments include strategic alliance and business development for 2D2C Inc. SafePlug® products.

volume purchases, in some cases making up the differ-ence with monthly service fees. CABA’s most recent State of the Connected Home Market research study identified cost, familiarity,

H O M E SyST E M S

The Continental Automated Buildings Association has recently completed a landmark research study that identifies key emerging areas of opportunity in the North American connected home market-place. “CABA’s State of the Connected Home Market” study analyzed the most desired features for connected home solutions, including communications, security, comfort and energy savings in order to determine how service providers and consumer electronics manufacturers can combine these features to improve consumer lifestyles.

NOW AVAILABLE FOR PURCHASE!

SPECIAL BONUS OFFERWhen you purchase the New State of the Connected Home Market Study, you will also receive the 2008 State of the Connected Home

Market Research Study FREE, which will allow you to review the trend lines in key segments.

For more information and pricing contact: George Grimes, CABA’s Business Development Manager at:613.686.1814 x226 or [email protected].

The research was undertaken by Zanthus Corp.

The following CABA members sponsored this landmark research study:

10 iHomes & Buildings

Part of the problem is that BMS manufacturers are not good at IT and the BMS is an IT system: it’s a server with a database, IP address and software applications, connected to an IT network. What has developed at the industry level for building automation and IT is just a magnification of what is happening in many facility man-agement and IT departments, that is, the readjustment of the roles of facility management and IT departments given the reality of the significant penetration of IT into building systems. Some organizations have worked out those organizational issues, but the BAS manufacturer and the IT industry is stuck in an “IT is from Mars, Build-ing Controls are from Venus” mentality. The movement of BAS manufacturers into IT, as well as IT companies into building controls has been feeble at best.

escalated ComplexityThe driver for improved building management systems is really the increase in the complexity of the new build-ings. From an equipment or hardware perspective we now have buildings with energy and sustainability sys-tems, which are relatively new for buildings, systems that even five years ago were not commonplace. These include systems such as rainwater harvesting, exterior shading, water reclamation, renewable energy, electric “switchable” glass and sun tracking systems. Maintaining and optimizing each of these new systems is a challenge, further burdening and increasing complexity for facility management. The other aspect of increased complexity is related to management decisions regarding building operations that now involve several other variables. For example,

As we transition to more complex, higher performing, and energy efficient buildings, it is apparent that tradi-tional building management systems are not up to the task of monitoring and managing today’s building opera-tions. What are the shortcomings of the legacy BMS? The list is quite long but the major items include limited inte-gration capabilities, inadequate and elementary analytic tools, proprietary programming languages, a dearth of software applications and legacy user interfaces.

OverviewTo some extent, the BMS have gotten to this point be-cause of the business and financial aspects surrounding it. When a traditional BMS is sold and installed it’s usu-ally a small part of a much larger investment. The larger business piece is the sale of BAS controllers. It’s the con-trollers’ need for service, parts and possible replacement over time that will generate significant recurring revenue for the equipment manufacturer. So the main building management tool, the one that provides the user inter-face for many of the building systems, often takes a “back seat” to selling and installing the controller hardware. Why would manufacturers put a lot of resources into de-veloping a product that may be only a very small part of a total sale? Major BMS manufacturers have made some incre-mental improvements to their products. They may have added an “energy management package”, or re-engi-neered an industrial process system for buildings or even bought smaller software companies thinking that would save the day. Despite their efforts, the fact is BMS are well short of where they need to be as an industry.

The Future Building Management SystemAccording to Jim Sinopoli, PE, RCDD, LEED AP, the building management system of the future will be user-friendly and designed to handle escalated levels of system complexity.

LarGe BuILDING autOMatION

11autumn 2012

L A R G E B U I L D I N G AU TO M AT I O N

asset management and incorporating data from BIM files.

• TheFBMSmustallowthird-partyapplicationsfor specific manufacturer equipment. Given that, every company that manufactures a valve, fan, sensor, etc. will create an app for their equipment, much like they have for product objects in BIM. These apps are likely to be much richer in monitoring and managing the equipment and will create a burgeoning marketplace.

• Third-partyanalyticsoftwareapplicationstooptimize the building’s performance are critical, as they will keep high performance buildings performing at their peak.

Recent industry experience with fault detection and di-agnostics have been very positive and provide a rationale for similar analytics in many other building systems. Applications that can consolidate issues and functions across systems, such as alarm management and master scheduling will become popular. Building managers will be able to test, compare and pick and choose the applica-tions they need from a variety of third parties.

• TheintegrationcapabilitiesoftheFBMSmustbe extensive. It has to go beyond the typical fire,

let’s assume a building manager wants to respond to mar-ket-based energy pricing from a utility. In making a deci-sion on whether or how to respond the building manager has to take into account several financial and operational variables, including tangible and intangible benefits and costs. How much load can I shed? How can I shed it? What’s my typically demand profile during the timing and duration of the event? How do I factor in the need to support the ongoing business? How do I implement, monitor and measure? What’s the effect on occupant comfort? How do I communicate to everyone affected by the event? Do I forgo the pricing signal to keep the busi-ness operation as usual? Do I use auxiliary energy gen-eration? What’s the maximum demand I can curtail? These types of challenges and decisions are way be-yond the typical question of “What should the set point be?” Obviously, some of these issues can be studied and a policy or program can be implemented but eventually a final decision would have to take into account real-time circumstances. This is where analytic and automation software tools and applications can support the opera-tions and facility personnel, yet traditional BMS systems aren’t capable of providing those applications.

specifications for the Future Building Management system (FBMs)Some innovative medium-sized companies around the globe have made the first significant steps in providing building management systems that are beginning to meet today’s challenges in building operations. What follows is a list of “must haves” in the FBMS:

• TheplatformfortheFBMSmustbesimilartothat of smartphones and tablets. The base FBMS platform will have an operating system, much like Apple’s iOS or Google’s Android, where third parties provide the applications. Everyone is familiar and comfortable with that model.

• ThebaseoperatingsystemfortheFBMSwilltodo the heavy lifting: acquiring data from different building systems, standardizing or normalizing the data into an open or standard database, possibly using something like XML/SOAP. This is really extensive middleware, in that the operating system can not only deal with the BAS communications protocol standards and data formats, but also non-standard data (i.e. some PLCs), as well as other facility management and business systems, such as work order systems,

• continued on page 20

Intelligent Building Services

• Building Automation Systems• Lighting Controls• Security Systems• AV Controls• MEP Engineering• Commissioning• Retro-Commissioning• Re-Commissioning• Energy Audits• Sustainability

For more information please contact: [email protected]

12 iHomes & Buildings

I chair an international committee of experts in home and building systems who are writing standards impor-tant for smart grid customers. Officially this committee is called a “working group” of ISO (International Orga-nization for Standardization) and the IEC (International Electrotechnical Commission). ISO and IEC jointly de-velop information technology (IT) standards. The scope of this working group includes IT applications such as entertainment, lighting, comfort control, life safety, health, and energy management. These standards are reviewed and approved by about 40 member nations, and published by ISO/IEC in Gene-va, Switzerland. The missions of ISO and the IEC are to foster international trade and commerce. This material is based on an article I was invited to submit for the June 2012 issue of ISO Focus+, the maga-zine of the International Organization for Standardization.

Home electronic system standardsThe scope of my ISO/IEC working group, which started in 1983, was recently extended to incorporate the home and building area aspects of smart grids. The family of standards we develop constitutes the Home Electronic System (HES). HES consists of a network of networks that enables interoperation among consumer products, sensors, control devices, and user interfaces within the home and may extend access to external services. International standards are essential for smart grids to interoperate with customer interfaces and customer equipment. The working group participants are experts in home systems, consumer electronics, and utility customer

services. They include members of key national and re-gional smart grid programs in Asia, Europe, and North America. Therefore, we are well positioned to develop in-ternational standards essential for the customer aspects of smart grids.

enhancing smart gridsSmart homes with smart devices enhance residential liv-ing. They can improve the effectiveness of smart grids in essential ways by reducing energy consumption and managing electric bills. Smart homes can provide residents with tools and user interfaces to increase energy efficiency, comfort, and security. Energy consumption can be automatically aligned with energy availability. Smart homes also may provide an infrastructure that supports the integration of energy management with other home system applica-tions.

Powering the futureThe electricity power grid, spanning generation, transmission, and distribution, has been hailed as one of the most important achievements of the 20th century. A power grid is considered by most countries a national necessity. However, this traditional grid needs to align with updated communications, energy and environ-mental technologies, and policies. To bring the electrical infrastructure up to date, smart grids using communica-tions, new operating structures, and business practices are being implemented worldwide. The proliferation of renewable energy sources is changing the relationship between the production and

KeN WaCKs’ PersPeCtIVes

International Standards for Smart Grids

By Ken Wacks

13autumn 2012

usage of electricity. Centralized producers will need con-tinual communications with distributed energy resourc-es and customer loads in buildings in order to balance supply and demand, and to stabilize the grid. Accommodating significant renewable generation, such as wind and solar, that is distributed locally is a chal-lenge. Smart grids can address this challenge and help reduce environmental concerns, increase system and equipment reliability, and temper infrastructure costs. The existing grid for electric power was designed for traditional, large centralized generation typically located at great distances from the customers. Smart grids can equip the traditional grid with extensions for electric ve-hicles, local generation, and energy storage possibly pro-vided by in-home fuel cells, stationary batteries, or even automobile batteries. Smart grids linked to a home network allow consumer electronic products, networks, and services to interoper-ate or to operate, where feasible, as a single coherent sys-tem. This systems approach may benefit all stakeholders including manufacturers, developers, service providers, installers, utility companies, and consumers.

smart grid domainsSmart grids span domains ranging from central genera-tion to transmission and distribution to customers. The HES working group addresses the customer domain by

focusing on the premises end of smart grids. It develops application standards for controlling energy-consuming equipment and smart appliances in support of new tech-nologies for energy efficiency, energy management, con-servation, and the widespread introduction of electric vehicles. There are a variety of devices in the home that can be interconnected for effective energy management locally and linked to an external network for enhanced smart grid energy management. Figure 1 illustrates these smart grid aspects.

aspects of smart gridsStandards developed by the HES working group specify IT infrastructures for homes and address the following aspects of smart grids:

• Energymanagement,demandresponse(DR),distributed energy resources (DER), and local storage

• Energy-efficientdevicecommunications• Gateways• Productinteroperability• Residentialcommunicationsarchitecture

Table 1 lists HES standards relevant for smart grids, which are explained in the following sections. The com-plete list of HES working group projects, standards, and

Figure 1 - Customer Domain of a Smart Grid

K E N WAC KS ’ P E R S P E CT I V E S

14 iHomes & Buildings

technical reports related to energy and smart grids may be found on the ISO website (www.iso.org). Information about purchasing print or electronic versions of these standards is available on this website.

energy managementISO/IEC 15067-3 specifies a framework for methods that can align residential needs for electricity with available supplies. These supplies may be provided by a public util-ity, local generators (wind, solar, etc.), and storage. For example, this standard can help maximize resi-dential efficiency through an automated analysis of en-ergy costs, budgets, energy requirements, and customer preferences, such as the timing of appliance usage, and through the integration of local generation sources. A fundamental objective of utility operators is to bal-ance supply and demand dynamically. An important tool for achieving this balance is distributed load control us-ing demand response signals and pricing mechanisms, such as time-varying or event-driven electricity rates. Distributed load control encourages customers (with their permission) to reduce their demands at certain times.

energy-efficient device communicationsMany methods for energy management in homes require communications among sensors, appliances, user inter-faces, controllers, and a gateway. Wireless communica-tions may be chosen to complement cable and wires, and are a medium preferred by some utility providers for smart grid applications. To this end, the HES working group is writing standards for efficient wireless commu-nications within premises.

ISO/IEC 14543-3-10 is a communications protocol tai-lored to short data packets used by devices in homes and buildings for command and control functions with a min-imal amount of energy. This includes devices that operate by harvesting energy from the environment (such as heat, motion and light) without mains power or batteries. ISO/IEC 29145 specifies a method for efficient mesh networking among devices that communicate using radi-os conforming to IEEE 802.15.4-2011, IEEE Standard for Local and Metropolitan Area Networks – Part 15.4: Low-Rate Wireless Personal Area Networks (LR-WPANs). This is the same radio used by the ZigBee protocol.

GatewaysA gateway links a home network and an external net-work, including smart grid communications. This subject is addressed in ISO/IEC 15045, a series of standards for the HES gateway. The residential gateway specifies an interface be-tween an external smart grid and a home network. This gateway may also be applied to other home services that interact with external service providers. The gateway translates between different communication protocols and has options for enhancing consumer privacy, safety, and data security.

Product interoperabilityInteroperability would not be an issue if all products were designed for the same communications protocol including the same message set. This has been a goal in the development of home network standards for decades. However, market forces have resulted in a diversity of communication options. Therefore, interoperability is

table 1 - International Smart Grid Standards for Home Systems

standard Designation title

ISO/IEC 14543 Home Electric System Architecture

ISO/IEC 14543-3-10 Wireless Short-Packet (WSP) Protocol Optimized for Energy Harvesting

ISO/IEC 14908 Control Network Protocol

ISO/IEC 15045 Home Electronic System (HES) Gateway

ISO/IEC 15067-3 Model of an Energy Management System for HES

ISO/IEC 18012 Guidelines for Product Interoperability

ISO/IEC 29145 Wireless Beacon-Enabled Energy Efficient Mesh network (WiBEEM) Standard for Wireless Home Network Services

K E N WAC KS ’ P E R S P E CT I V E S

15autumn 2012

K E N WAC KS ’ P E R S P E CT I V E S

Finally, requirements for privacy protection of energy management and other customer data communicated via the residential gateway must be determined and speci-fied. A project to extend the ISO/IEC 15045 series is ex-pected to commence in 2012.

Participating in international standardsExperts in home, building, and smart grid systems are welcome to participate in the HES working group. North American experts are appointed by Standards Council of Canada (SCC) and the Telecommunications Industry As-sociation (TIA) as authorized by the American National Standards Institute (ANSI). Please contact me for fur-ther information about helping to shape these important world standards.

Dr. Kenneth Wacks has been a pioneer in establishing the home systems industry. He advises manufacturers and utilities worldwide on business opportunities, network alternatives, and product development in home and building systems. In 2008, the United States Department of Energy appointed him to the GridWise Architecture Council. For further information, please contact Dr. Wacks at 781.662.6211; [email protected]; www.kenwacks.com.

necessary to provide for seamless operation of home sys-tem products that speak different languages on a variety of communication protocols. Among these products are devices, appliances, and user interfaces involved with en-ergy management. The series of ISO/IEC 18012 standards allows these products to exchange messages and data within the home, and with energy management service providers. The methods for achieving interoperability specified in ISO/IEC 18012 may be implemented in an ISO/IEC 15045 gateway to interconnect networks running differ-ent protocols.

residential communications architectureThe ISO/IEC 14543 series of standards specifies a resi-dential communications architecture, protocols, network configuration, and network management methods that could apply to smart grid messages. This series of stan-dards includes generic interfaces and complete commu-nication systems with messaging and discovery for con-necting devices to a home network. ISO/IEC 14908 is a series of control protocol stan-dards that the HES working group has reviewed. Appli-cations span home and building systems including energy management.

Future developmentsOur working group encourages the creation of additional proposals for smart grid standards such as:

• Thefurtherintegrationofenergymanagementcomponents in the home

• Localpowergenerationandstoragewithsmartgrids

• Loadaggregatorsandpublicenergysuppliers• Interconnectionamongenergymanagement

devices and user interfaces, such as entertainment and portable communication devices

• Metricandmeasurementspecificationstoevaluate the performance of energy management systems

• Aschemaforenergymanagementproductinteroperability based on the interoperability standards (the ISO/IEC 18012 series)

• Standardsforextendingsmartgridenergy-management concepts to gas, water, and district heating.

October 11-12, 2012

CABA’s Digital Home Forum, hosted by Qualcomm in San Diego, will bring together leading companies dealing with integration

of consumer electronics and other cutting-edge technologies.

Attendees will be invited to theMiramar Air Show.

www.caba.org/digital-home-forum

CABA’s DigitalHome Forum

HOSTED BY

16 iHomes & Buildings

res ear CH VIeWPOINts

Marketing for the Building Technologies Division, In-frastructure & Cities at Siemens Industry, Inc. and Chair of the CABA Intelligent & Integrated Buildings Council. “The white papers will be a great addition that will gath-er for CABA members the latest industry thinking and direction on hot issues in the intelligent building market. The IIBC members believes these reports will enhance the ability of the entire CABA membership to make appropriate investment, strategic planning and integra-tion decisions for their companies.” Organizations can learn more about the CABA white paper initiative at: www.caba.org/caba-white-papers. CABA already undertakes a wide number of research initiatives, which includes its Research Program, that of-fers a range of opt-in technical and advisory research de-signed to provide industry stakeholders with collabora-tive market research and R&D opportunities. Recently, CABA launched its “Intelligent Buildings and the Bid Specifications Process” and the “Impact of Smart Grid and the Connected Home” research projects. The purpose of the Bid Spec landmark research study is to improve the understanding of the market imper-fections and the inconsistencies that exist in designing and implementing intelligent building projects, as well as making investment decisions on intelligent technologies. The Bid Spec research project will be designed to identify major problems in existing bid specification ap-proaches and models, in order to help organizations cre-ate new strategies that unify the stakeholder decision-making process. The goal of the project is to provide its participating sponsors with actionable recommendations

The Continental Automated Buildings Association will undertake a set of new market research initiatives, which includes undertaking work on two new studies and in-troducing its own white paper series, which will focus on both connected homes and intelligent buildings. White papers are authoritative reports and studies that educate and support professionals in their decision-making. CABA’s white paper series will be designed to provide its membership with actionable market research and technical analysis. The white papers will provide strong ROI analysis to quantify the benefits of implementing fully converged technology through home and building automation, se-curity and IT infrastructure. The white papers will also focus on providing full examinations of commercial en-ergy management using cloud technology and the impact of wireless technology on HVAC, security, life safety and lighting equipment within the home and building auto-mation field. In order to facilitate publication of the white paper series, CABA’s Connected Home Council and the CABA Intelligent & Integrated Buildings Council will both es-tablish committees to oversee and guide white paper de-velopment and production. CABA will work with a number of research consul-tancies to develop the white papers. This will provide CABA’s research partners the opportunity to generate qualitative leads for further research and showcase their expertise in the intelligent home and building market. “We are pleased to announce the enhancement of CABA’s research offerings through the creation of this white paper series,” stated Elizabeth Jacobs, Director of

CABA Unveils New Market Research Initiatives

By Rawlson O’Neil King

17autumn 2012

that they can utilize to improve the entire bid specifica-tion process. Sponsors of this CABA study include: Automated-Logic/Lenel/UTC/Carrier Corporation, BACnet In-ternational, Cadillac Fairview Corporation, Diebold Incorporated, Distech Controls, Inc., Honeywell Interna-tional, Hydro One Networks, Inc., Ingersoll Rand/Trane/Schlage, Johnson Controls, Ontario Power Authority, Philips, Smardt Chiller Group Inc., Siemens Industry, Inc., Telecommunications Industry Association (TIA) and Verizon. “The aim of this research project is to turn frustration into profitability,” stated Ronald J. Zimmer, CABA Presi-dent & CEO. “Creating a more efficient bid specification process will ultimately lead to an efficient and less expen-sive facility construction process and will lead to better buildings with advanced intelligence.” At the end of the process, CABA expects to provide its research sponsors with a comprehensive bid speci-fication model that can deliver a significant measure of consistency and control along with the identification and description of a consistent scope of work that ad-dresses the need to ensure timely facility construction and cost-effective maintenance through intelligent build-ing technologies. CABA will also be undertaking a smart grid study that examines its impact on the connected home. The study will analyze smart grid and connected home tech-nologies from different industry perspectives and ad-jacent markets, elucidating opportunities for industry players. CABA will design the study to identify market de-mand and growth areas for new products and to compare and contrast competing product strategies. The research will also determine product preferences for end-users, develop messaging that resonates with target audiences, define critical success factors to expand product offerings to end-user markets and establish a market approach and foundation for strategic decision-making efforts. Past CABA research has outlined ambiguities in de-termining which technologies will remain current and adaptable in the connected home. For industry partici-pants to execute a successful market strategy regarding smart grid infrastructure deployments, it will be critical to be well informed concerning the distinct challeng-es, market gaps, and channel influences. It will also be important to have a firm understanding of the evolving market environment.

R E S E A R C H V I E W P O I N T S

To address this expansive and changing environment for home energy services, which overlap between various verticals from Internet connectivity and power genera-tion to building technologies, CABA’s study will utilize a unique cross-industry and cross-functional perspective. “CABA always values the opportunity to assist its membership in gaining an understanding of the connect-ed home market,” stated Zimmer. “Through this project, we are intent on combining consumer market research with stakeholder input to create new insights.” Sponsors of CABA’s connected home smart grid study include: CableLabs®, ClimateTalk Alliance, Com-cast Communications, Consolidated Edison of New York, Consumer Electronics Association (CEA), Ener-gent Incorporated, fifthplay nv, Hydro One Networks Inc., Hydro-Québec, IBM, IEEE, Intel Corporation, Landis+Gyr, Microsoft Corporation, Pacific Gas and Electric Company, Pella Corporation, Philips Lighting, Qualcomm Incorporated, Samsung Telecommunications America LLC, Southern California Edison, Sykes Assis-tance Services, TELUS, Tridel Corporation, TRLabs and the Z-Wave Alliance/Sigma Designs. CABA has contracted Frost & Sullivan to undertake the research and expects the study to be completed by October 2012. “Frost & Sullivan and CABA have a close association, developed over years of collaborative research support, as well as the delivery of complex landmark analyses to CABA,” said Frost & Sullivan North America President Art Robbins. “Our demonstrated expertise in a large ar-ray of different business challenges, such as market de-velopment and expansion, industry advancement and growth strategy, combines to help research participants gain answers to their individual and collective challenges in this highly lucrative, yet uncertain market.” For more information, about CABA’s research proj-ects please see www.caba.org/research. Organizations will be able purchase both reports after they are made available by contacting CABA at 888.798.CABA (2222) or 613.686.1814 x 226.

Rawlson O’Neil King is CABA’s Communications Director.

18 iHomes & Buildings

Integrated Systems Are A “Must Do” Requirement

By Frank Bisbee

O PI NI O N

The light up ahead is an oncoming train. New demands are adding to the existing growth in security and safety. The burglar and fire alarm industry continues to grow, fueled by advancements in computing technology and Internet protocol devices, software, and cellular and smart phones. In fact the new wave of smart phones have created a huge increase in demand for additional fiber optic backhaul facilities to support an overburdened cel-lular network. Companies such as Avaya, Cisco, and ShoreTel con-tinue to enhance their unified communication systems in order to add features that work with the security and life and property safety systems. Electrical contractors are challenged to expand their traditional skill sets in or-der to address the challenges of integrated systems that blend physical infrastructure with information technol-ogy. A vast majority of the electrical contractors in the U.S. have augmented their traditional electrical skills with low-voltage, copper and fiber optic design and in-stallation services for telecom and datacom. Voice-Data-Video (VDV) needs to be transformed to include wireless support, energy efficiency, lighting control, and the inte-grated systems that are being introduced continually. Security has become a boom industry as new tech-nology gives us capabilities to increase our personal and professional security blanket. A substantial increase in cabling is required to actualize closed-circuit television surveillance (CCTV) and access control and other auto-mation functions. Life safety systems also converge with the systems that work with door controls, heating, venti-lating and air conditioning and energy management. We also need systems to communicate with fire, smoke, and gas detectors with audible and visual signaling.

The electrical contractor is also a full service provider of all aspects of the customers’ needs dealing with elec-trical power, control, and illumination, communication, safety and security systems. Many contractors are avail-able 24/7. From a consumer’s perspective, the contrac-tor is usually the most effective and efficient source for design, implementation, and maintenance of these infra-structure systems. Surveys have confirmed that contrac-tors reduce the total cost of ownership while increasing longevity with proper maintenance. Contractors will also integrate the technologies of the future into intelligent buildings, such as systems that in-terface with the smart grid. Ron Zimmer, CABA Presi-dent & CEO, says that the growth of smart grids, in rela-tion to intelligent buildings will be an area of major focus within the next five to 10 years. CABA provided a market size forecast and roadmap for smart grid and intelligent buildings to the industry through its Research Program and its “Smart Grid Impact on Intelligent Buildings” re-search report. These growing trends are a significant op-portunity for electrical contractors. Understanding how they work and what they can contribute, is necessary to capitalize on investments in smart technology. In the future the electrical contractor will lead intel-ligent buildings towards net zero energy. There is a grow-ing belief that energy sustainability and the growth of building intelligence are interdependent. The smart grid and integrated building systems will contribute and exert a collective influence in the progression of high perfor-mance intelligent buildings. Smart cities may be the re-sult. The smart grid is an advanced power grid for twen-tieth-first century, in that it adds and integrates many

19autumn 2012

produce as much energy as they consume over a given time period – but definitions vary. NZEB are, by design, very energy efficient and their remaining low energy needs are typically met with on/off-site renewable en-ergy. The net result is a major increase in efficiency and a huge decrease in the cost of waste energy. The electrical contractor will become a major player in making this sce-nario a reality.

Frank Bisbee is President of Communication Planning Corp., a telecom and datacom design/build firm. He provides a free monthly summary of industry news on www.wireville.com.

varieties of digital computing and communication tech-nologies with the power delivery infrastructure. Bi-di-rectional flows of energy and two-way communication and control capabilities will enable an array of new func-tionalities and applications for intelligent building in-frastructure. In 2009, the U.S. smart grid industry was valued at approximately $21.4 billion. It will exceed an estimated $42.8 billion by 2014, according to a recent Zpryme Research report on the smart grid market. In the future, expect electrical contractors to pro-vide assessments within the commercial building space to help assist with the development of net zero energy buildings (NZEB) and their relationship to smart grids. NZEB are generally characterized as buildings which

I NDustrY treNDs

smart Home appliancesABI Research forecasts that shipments of smart home appliances will surpass 24 million units by 2017. The market research firm points to product offerings by LG Electronics, Samsung Electronics, BSH and Whirlpool.

smart Building MarketBSRIA predicts that increasing urbanization will see the Asian smart building marketplace increase from $427 bil-lion in revenue in 2011 to over $1 trillion by 2020. This growth will be strongest in Japan, Singapore and South Korea.

Consumer electronicsSkyrocketing U.S. sales of smartphones and tablets are on track to boost overall gadget sales to $206.5 billion this year, a 5.9 percent increase, according to the Consumer Electronics Association.

Green BuildingsPike Research announced the findings of its “Energy Efficiency Retrofits for Commercial and Public Buildings” report, which estimates that global energy efficient retrofits for commercial buildings will nearly double by 2020. In 2012, the market value was $80.3 billion, but the clean tech research firm estimates it will be worth $151.8 billion in 2020.

tabletscomScore reports that the iPad accounted for more than 97 percent of all Internet traffic generated by tablets in the U.S. in August 2011 and that the Apple tablet’s share of all Internet traffic from iOS-based devices was nearly 47 percent, compared with just under 43 percent for the iPhone.

Home automationNinety million residences worldwide will have some form of home automation system in place by 2017, says a recent study by global technology trend forecasters ABI Research.

Intelligent Lighting ControlAccording to a new report from Pike Research, the global market for intelligent lighting controls will enjoy steady and robust growth over the rest of this decade, rising from $1.5 billion in 2012 to more than $4.3 billion in 2020.

20 iHomes & Buildings

lArgE BuilDing AutOMAtiOn – CONTINUED FROM PAGE 11

HVAC, access control and elevator integration domain, and progressively integrate any building system, facility management systems (work orders, preventive maintenance, inventory, etc.), business systems, the smart grid and external data such as weather and energy markets.

• TheFBMSmustbeanopenandsecuredsystem.That doesn’t mean it’s free, but it does require the tools and rules that program the FBMS be transparent so the building owner has options and choices in maintaining and programming the FBMS. System security, which is almost non-existent on traditional BMS, is a must on an open FBMS and probably best dealt with via IT security appliances and software.

• TheFBMSmustbeableto“datamine”auser’suse of the FBMS to identify their preferences and particular data that appears to be important

to that user. Each dashboard is meant to convey important information and key indicators and requires an examination of the needs of individual and group audiences. FBMS analytic tools of users’ routines, usage and interactions with the FBMS will help in determining what the user really needs to see.

The future building management system will change and reinvent what currently is a lethargic industry. It’s also likely to spawn new companies and manufacturers, pro-vide more choices for users and the buyers of such prod-ucts, and do so at lower costs.

James M. Sinopoli, PE, RCDD, LEED AP, is Principal of Smart Buildings LLC. He recently authored a book titled Smart Buildings.

NetW O r KING aND OutreaCH

CABA’s mandate includes providing its members with networking and outreach opportunities through participation at numerous industry events.

Rawlson O’Neil King, CABA’s Communication Director, gave pre-sentations on lighting and intelligent building technologies at the 2012 Building Solar China Conference and Exhibition and at the 17th Guangzhou International Lighting Exhibition and 9th Electrical Building Technology show in China.

Rawlson O’Neil King, CABA’s Communication Director, met with various trade representatives at the 17th Guangzhou International Lighting Exhibition and 9th Electrical Building Technology show in China. He collected data on behalf of the Canadian government in order to build strong partnerships between Chinese businesses at the event and Canadian small to mid-sized enterprises, with the intent to strengthen import, export and partnership opportunities.

21autumn 2012

shanghai Intelligent Building technology 2012September 20-22, 2012Shanghai, Chinabit.ly/M9AdOA

2012 FttH Conference & expoSeptember 23-27, 2012Dallas, TXwww.ftthconference.com

Isa automation Week 2012September 24-27, 2012Orlando, FLwww.isaautomationweek.org

2degrees & CaBa presents:Smart Grid Impact on Intelligent Buildings WebinarSeptember 25, 2012 at 11 am ETwww.caba.org/research/projects/smart-grid-2011

Light Middle eastOctober 1-3, 2012Dubai, UAEwww.lightme.net

NFMt VegasOctober 2-3, 2012Las Vegas, NVwww.nfmt.com/vegas

CaBa Digital Home Forum October 11-12, 2012San Diego, CAwww.caba.org/digital-home-forum

2012 smartGrid Canada ConferenceOctober 15-16, 2012Toronto, ONwww.sgcanada.org/conference

the emerging technologies summit October 15-17, 2012Pasedena, CAwww.etsummit.com

security Canada CentralOctober 24-25, 2012Toronto, ONwww.securitycanadaexpo.com

technologies des bâtiments intelligents expoOctober 24-25, 2012Montréal, QCwww.tbix.ca

HI-teCH BuILDING (HtB)October 30 - November 1, 2012Moscow, Russiawww.midexpo.ru/index_eng.html

IsC solutionsOctober 31 - November 1, 2012New York, NYwww.reedexpo.com/en/Events/2693/ISC-Solutions

IFHs Conference November 5-6, 2012Dubai, UAEwww.ifhsassociation.org/events.html

Interlight MoscowNovember 6-9, 2012Moscow, Russiawww.interlight.messefrankfurt.ru/?lang=en

CONNeCtIONs europe November 13-14, 2012Amsterdam, Netherlandswww.parksassociates.com/events/connections-europe

the National Institute of Building sciences Conference & expo January 7-10, 2013Washington, DCwww.nibs.org/index.php/conference

CONNeCtIONs summit at Ces 2013January 8, 2013Las Vegas, NVwww.parksassociates.com/events

u P C O M I N G e V e N t s

Need information on upcoming industry events? Go to: www.caba.org/events

![170804 NewContentChecklists ALmypixels2pages.com/1_P2P_Handouts/Checklists/...C] Awesome Autumn Paper Pack C] Awesome Autumn Photo Mats Awesome Autumn Plastics Awesome Autumn Ribbon](https://static.fdocuments.net/doc/165x107/5fb33e63ad809c152a2deb08/170804-newcontentchecklists-c-awesome-autumn-paper-pack-c-awesome-autumn-photo.jpg)