Idaho State Buidling Authority Bond Issuance 2013 A and B

-

Upload

mark-reinhardt -

Category

Documents

-

view

219 -

download

0

Transcript of Idaho State Buidling Authority Bond Issuance 2013 A and B

-

8/13/2019 Idaho State Buidling Authority Bond Issuance 2013 A and B

1/169

-

8/13/2019 Idaho State Buidling Authority Bond Issuance 2013 A and B

2/169

IDAHO STATE BUILDING AUTHORITY755 W. FRONT STREET, SUITE 200

BOISE, IDAHO 83702(208) 345-6057

Board of Commissioners

V.L. Bud Tracy, ChairmanJames C. Hammond, Vice-Chairman

Candice Allphin, CommissionerShelly Jo Enderud, Commissioner

John Ewing, CommissionerGregory J. Schade, DDS, MS, Commissioner

(vacant position)

Executive Director, Secretary, and General Counsel

Wayne V MeulemanMeuleman Mollerup LLP

_____________________

Underwriter

George K. Baum & Company

Bond Counsel

Skinner Fawcett LLP

Financial Advisor

Seattle-Northwest Securities Corporation

TrusteeZions First National Bank

-

8/13/2019 Idaho State Buidling Authority Bond Issuance 2013 A and B

3/169

i

MATURITY SCHEDULE

$9,045,000

IDAHO STATE BUILDING AUTHORITY

STATE BUILDING REVENUE BONDS, SERIES 2013A

(CAPITOL MALL PARKING PROJECT)

SERIAL BONDS

Due Principal Interest CUSIP Numbers(1)

September 1 Amounts Rates Yields 451443

2014 $ 330,000 2.000% 0.45% XS9

2015 335,000 2.000 0.58 XT7

2016 345,000 3.000 0.75 XU4

2017 355,000 3.000 1.00 XV2

2018 365,000 2.000 1.25 XW0

2019 375,000 3.000 1.53 XX8

2020 385,000 3.000 1.82 XY6

2021 395,000 4.000 2.07 XZ3

2022 410,000 4.000 2.25 YA7

2023 430,000 4.000 2.40 YB5

2024 450,000 4.000 2.56(2) YC3

2025 455,000 4.500 2.70 (2) YD1

2026 485,000 4.500 2.82 (2) YE9

2027 505,000 4.500 2.89 (2) YF6

TERM BONDS

$3,425,000 3.125% Term Bond due September 1, 2033 @ 3.22%CUSIP 451443YM1

(1) CUSIP is a registered trademark of the American Bankers Association. The CUSIP numbers herein are provided by CUSIP GlobalServices, which is managed on behalf of the American Bankers Association by Standard & Poors. CUSIP numbers are providedfor convenience of reference only, and are subject to change. The Authority takes no responsibility for the accuracy of suchCUSIP numbers.

(2) Priced to the redemption date of September 1, 2023.

-

8/13/2019 Idaho State Buidling Authority Bond Issuance 2013 A and B

4/169

ii

MATURITY SCHEDULE

$6,905,000

IDAHO STATE BUILDING AUTHORITY

STATE BUILDING REFUNDING REVENUE BONDS, SERIES 2013B

(EASTERN IDAHO TECHNICAL COLLEGE PROJECT)

SERIAL BONDS

Due Principal Interest CUSIP Numbers(1)

September 1 Amounts Rates Yields 451443

2016 $ 550,000 3.000% 0.75% YN9

2017 560,000 3.000 1.00 YP4

2018 580,000 3.000 1.25 YQ2

2019 595,000 3.000 1.53 YR0

2020 620,000 4.000 1.82 YS8

2021 645,000 4.000 2.07 YT6

2022 670,000 4.000 2.25 YU3

2023 695,000 4.000 2.40 YV1

2024 725,000 2.400 2.65 YW9

2025 740,000 5.000 2.80 YX7

2026 525,000 3.000 3.00 YY5

(1) CUSIP is a registered trademark of the American Bankers Association. The CUSIP numbers herein are provided by CUSIP Global Services, whichis managed on behalf of the American Bankers Association by Standard & Poors. CUSIP numbers are provided for convenience of referenceonly, and are subject to change. The Authority takes no responsibility for the accuracy of such CUSIP numbers.

-

8/13/2019 Idaho State Buidling Authority Bond Issuance 2013 A and B

5/169

iii

NO DEALER, BROKER, SALESPERSON, OR OTHER PERSON HAS BEEN AUTHORIZED BY THE

AUTHORITY OR BY THE UNDERWRITER TO GIVE ANY INFORMATION OR TO MAKE ANY

REPRESENTATIONS OTHER THAN AS CONTAINED IN THIS OFFICIAL STATEMENT AND, IF GIVEN OR

MADE, SUCH OTHER INFORMATION OR REPRESENTATIONS MUST NOT BE RELIED UPON AS

HAVING BEEN AUTHORIZED BY THE AUTHORITY OR THE UNDERWRITER. THIS OFFICIAL

STATEMENT DOES NOT CONSTITUTE AN OFFER TO SELL OR THE SOLICITATION OF AN OFFER TO

BUY THE BONDS, NOR WILL THERE BE ANY SALE OF THE BONDS BY ANY PERSON IN ANY

JURISDICTION IN WHICH IT IS UNLAWFUL FOR SUCH PERSONS TO MAKE SUCH OFFER,

SOLICITATION, OR SALE.

THE INFORMATION SET FORTH HEREIN HAS BEEN FURNISHED BY THE AUTHORITY, DTC, AND

CERTAIN OTHER SOURCES THAT ARE BELIEVED TO BE RELIABLE BUT IS NOT GUARANTEED AS TOACCURACY OR COMPLETENESS BY, AND IS NOT TO BE CONSTRUED AS A REPRESENTATION BY,

THE UNDERWRITER. THE INFORMATION AND EXPRESSIONS OF OPINION CONTAINED HEREIN ARE

SUBJECT TO CHANGE WITHOUT NOTICE. ANY STATEMENTS MADE IN THIS OFFICIAL STATEMENT

INVOLVING MATTERS OF OPINION OR ESTIMATES, WHETHER OR NOT SO EXPRESSLY STATED, ARE

SET FORTH AS SUCH AND NOT AS REPRESENTATIONS OF FACT OR REPRESENTATIONS THAT THE

ESTIMATES WILL BE REALIZED.

IN CONNECTION WITH THIS OFFERING, THE UNDERWRITER MAY OVER ALLOT OR EFFECT

TRANSACTIONS THAT STABILIZE OR MAINTAIN THE MARKET PRICE OF THE BONDS AT LEVELS

ABOVE THAT WHICH MIGHT OTHERWISE PREVAIL IN THE OPEN MARKET. SUCH STABILIZATION,

IF COMMENCED, MAY BE DISCONTINUED AT ANY TIME.

NEITHER THE DELIVERY OF THIS OFFICIAL STATEMENT NOR ANY SALE MADE HEREUNDER WILL,

UNDER ANY CIRCUMSTANCES, CREATE ANY IMPLICATION THAT THERE HAS BEEN NO CHANGE IN

THE AFFAIRS OF THE AUTHORITY SINCE THE DATE HEREOF.

THE AUTHORITY HAS ALSO UNDERTAKEN TO PROVIDE CONTINUING DISCLOSURE ON CERTAIN

MATTERS, INCLUDING ANNUAL FINANCIAL INFORMATION AND SPECIFIC MATERIAL EVENTS, AS

MORE FULLY DESCRIBED HEREIN. SEE CONTINUING DISCLOSURE.

THE FOLLOWING SENTENCE HAS BEEN PROVIDED BY THE UNDERWRITER FOR INCLUSION IN THIS

OFFICIAL STATEMENT: THE UNDERWRITER HAS REVIEWED THE INFORMATION IN THIS OFFICIAL

STATEMENT IN ACCORDANCE WITH, AND AS PART OF, ITS RESPONSIBILITIES TO INVESTORS

UNDER THE FEDERAL SECURITIES LAWS AS APPLIED TO THE FACTS AND CIRCUMSTANCES OF

THIS TRANSACTION, BUT THE UNDERWRITER DOES NOT GUARANTEE THE ACCURACY OR

COMPLETENESS OF SUCH INFORMATION.

THE BONDS HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED, IN

RELIANCE UPON A SPECIFIC EXEMPTION CONTAINED IN SUCH ACT, NOR HAVE THEY BEEN

REGISTERED UNDER THE SECURITIES LAWS OF ANY STATE.

-

8/13/2019 Idaho State Buidling Authority Bond Issuance 2013 A and B

6/169

iv

TABLE OF CONTENTSPage

INTRODUCTION ............................................................................................................................................................................ 1IDAHO STATE BUILDING AUTHORITY .................................................................................................................................... 1

General ....................................................................................................................................................................................... 1Commissioners ........................................................................................................................................................................... 1Executive Director and Secretary ............................................................................................................................................... 2Annual Budget ............................................................................................................................................................................ 2Financing Authority.................................................................................................................................................................... 2Authority Projects ....................................................................................................................................................................... 2

DESCRIPTION OF THE BONDS ................................................................................................................................................... 4Authority to Issue the Bonds ...................................................................................................................................................... 4General ....................................................................................................................................................................................... 5Redemption Provisions ............................................................................................................................................................... 5The Trustee ................................................................................................................................................................................. 5

USE OF PROCEEDS ....................................................................................................................................................................... 62013A Bonds .............................................................................................................................................................................. 62013B Bonds .............................................................................................................................................................................. 6Sources and Uses ........................................................................................................................................................................ 7

DEBT SERVICE REQUIREMENTS ............................................................................................................................................... 8SECURITY AND SOURCES OF PAYMENT ................................................................................................................................ 8

Pledge for the Bonds .................................................................................................................................................................. 8No Cross-Collateralization ......................................................................................................................................................... 9Flow of Funds............................................................................................................................................................................. 9No Debt Service Reserve Account for the Bonds ..................................................................................................................... 10Covenants ................................................................................................................................................................................. 10Facilities Leases ....................................................................................................................................................................... 10Site Leases ................................................................................................................................................................................ 11Additional Bonds ...................................................................................................................................................................... 11Limited Obligations .................................................................................................................................................................. 11Limitations on Enforceability ................................................................................................................................................... 12Destruction of the Facilities ...................................................................................................................................................... 12Open Market Purchase ............................................................................................................................................................. 13Idaho Department of Administration ........................................................................................................................................ 13Eastern Idaho Technical College .............................................................................................................................................. 13

STATE BUDGET AND APPROPRIATIONS PROCESS ............................................................................................................. 13General ..................................................................................................................................................................................... 13Recent General Fund Revenues and Appropriations ................................................................................................................ 142012 Legislative Actions .......................................................................................................................................................... 15Appropriations for Authority Lease Payments ......................................................................................................................... 15

RETIREMENT SYSTEM INFORMATION .................................................................................................................................. 15Public Employee Retirement System of Idaho ......................................................................................................................... 15Defined Benefit Retirement Plans ............................................................................................................................................ 16Defined Contribution Retirement Plans .................................................................................................................................... 16Contributions ............................................................................................................................................................................ 17Summary of Actuarial Assumptions and Methods Effective July 1, 2012 ............................................................................... 18Unfunded Actuarial Accrued Liability ..................................................................................................................................... 18Optional Retirement Program ................................................................................................................................................... 20Other Post-employment Benefits .............................................................................................................................................. 20

CONTINUING DISCLOSURE ...................................................................................................................................................... 21TAX MATTERS ............................................................................................................................................................................ 22

Opinion of Bond Counsel ......................................................................................................................................................... 22

OTHER BOND INFORMATION .................................................................................................................................................. 24Rating ....................................................................................................................................................................................... 24Underwriting ............................................................................................................................................................................ 24Independent Auditors ............................................................................................................................................................... 24Legal Matters ............................................................................................................................................................................ 24Legality of the Bonds for Investment ....................................................................................................................................... 24Pending and Threatened Litigation ........................................................................................................................................... 24Additional Information ............................................................................................................................................................. 25

-

8/13/2019 Idaho State Buidling Authority Bond Issuance 2013 A and B

7/169

v

Appendix A: Economic Information About the State of IdahoAppendix B: Summary of Bond ResolutionsAppendix C: Summary of Site Leases and Facilities LeasesAppendix D: Audited Financial Statements of the AuthorityAppendix E: State of Idaho Comprehensive Annual Financial ReportIncorporated by ReferenceAppendix F: Forms of Continuing Disclosure AgreementAppendix G: Forms of Opinion of Bond Counsel

Appendix H: Depository Trust Company Information

-

8/13/2019 Idaho State Buidling Authority Bond Issuance 2013 A and B

8/169

- 1 -

OFFICIAL STATEMENT

IDAHO STATE BUILDING AUTHORITY

$9,045,000

STATE BUILDING REVENUE BONDS, SERIES 2013A

(CAPITOL MALL PARKING PROJECT)

$6,905,000

STATE BUILDING REFUNDING REVENUE BONDS, SERIES 2013B

(EASTERN IDAHO TECHNICAL COLLEGE PROJECT)

INTRODUCTION

The purpose of this Official Statement is to set forth information regarding the Idaho State Building Authority(the Authority) and the issuance by the Authority of its State Building Revenue Bonds, Series 2013A (CapitolMall Parking Project) (the 2013A Bonds), and its State Building Refunding Revenue Bonds, Series 2013B

(Eastern Idaho Technical College Project) (the 2013B Bonds). Together, the 2013A Bonds and the 2013BBonds are referred to in this Official Statement as the Bonds. Capitalized terms as used herein, but not definedherein, have the same meaning given to them in the 2013A and 2013B Bond Resolutions, defined underDescription of the BondsAuthority to Issue the Bonds. See Appendix BSummary of Bond Resolutions.

IDAHO STATE BUILDING AUTHORITY

General

The Authority is a body corporate and politic of the State of Idaho (the State), created as a publicinstrumentality by the Idaho State Building Authority Act, being Title 67, Chapter 64, Idaho Code, as amended(the Act), for the purpose of assisting in the acquisition, construction, operation, and financing of Stategovernmental facilities and the facilities of community college districts. In accordance with the Act, the

Authority is authorized to issue its bonds or notes to finance governmental facilities pursuant to agreementsentered into with departments, boards, commissions, or agencies of the State (State Bodies or State Body) orwith community college districts (together with the State Bodies, collectively, the lessees), subject to priorapproval of the State Legislature by concurrent resolution. To that end, the Authority issues bonds secured byannual rent payments equal to debt service on such bonds for the applicable fiscal year, plus certain administrativecosts of the Authority and any required deposits to reserve or operating funds or accounts for such fiscal year,payable by the State acting by and through one or more lessees under the terms of facilities leases relating to theproject or projects being financed or refinanced, as applicable, by such bonds. All facilities leases are subject toannual renewal, and once renewed, the annual rent payments payable thereunder are subject to annualappropriation by the State. Annual rent payments for each facilities lease are due and payable in full within30 days after commencement of each annual lease term. See Description of the Bonds,Security and Sourcesof Payment, and State Budget and Appropriations Process herein.

Commissioners

The powers of the Authority are vested in a board of seven commissioners appointed by the Governor of theState, with the advice and consent of a majority of the members of the State Senate. Appointments are forstaggered five-year terms. The Commissioners annually select a chairman and vice-chairman from their numberand employ an Executive Director, who also serves as Secretary of the Authority. The Executive Directoradministers, manages, and directs the affairs and business of the Authority subject to the policy, control, anddirection of the Board of Commissioners. Commissioners whose terms have expired continue to serve until areplacement is appointed and confirmed. There is one vacancy on the Board of Commissioners. TheCommissioners currently serving the Authority are set forth below.

-

8/13/2019 Idaho State Buidling Authority Bond Issuance 2013 A and B

9/169

- 2 -

COMMISSIONERS

Executive Director and Secretary

Wayne V Meuleman has served as Executive Director and Secretary of the Authority since 1980. He is a partnerin the law firm of Meuleman Mollerup LLP, Boise, Idaho, which also serves as general legal counsel to theAuthority. The Authority has no permanent full-time employees and contracts for professional services on aconsulting basis as required.

Annual Budget

Pursuant to the bond resolutions authorizing each series of the Authoritys bonds, the Authority is required toprepare, not less than 30 days prior to the beginning of each fiscal year, an annual budget setting forth inreasonable detail the estimated receipts and expenditures for the ensuing fiscal year.

Financing Authority

The Authority fulfills its statutory responsibilities to provide facilities for use by State Bodies or communitycollege districts through a variety of development activities, including master planning, land acquisition,financing, design and construction, and continuing maintenance and operation of facilities. In general, theAuthority finances the acquisition and/or construction of facilities for use by State Bodies and community collegedistricts with proceeds of bonds issued by the Authority for such purpose. The Authoritys bonds are secured byannual rent payments payable to the Authority by the State, acting by and through one or more State Bodies or

community college districts under the terms of separate facilities leases entered into at the time the Authorityissues its bonds to finance the respective facilities. Prior to the issuance of bonds to finance a facility, the StateLegislature, by concurrent resolution, must authorize a State Body or community college district to enter into afacilities lease or other agreement with the Authority to provide for the specific facility, and the Authority mustmake a determination that the facility or project will be of public use and will provide a public benefit.

Authority Projects

The Authority has multiple series of bonds and notes outstanding, in the aggregate principal amount of$184,888,752 as of January 1, 2013. Each series of bonds is separately secured by a facilities lease substantiallysimilar to the facilities leases securing the 2013A Bonds and the 2013B Bonds. Each facilities lease provides,among other things, (i) annually renewable terms at the election of the State, acting through the lessee under thefacilities lease, (ii) the right of the lessee to terminate the facilities lease in the event funds are not appropriated bythe State for the annual rent payments, and (iii) the obligation of the lessee to provide repairs, operations, andmaintenance of the subject facilities. Except for refunding bonds relating to the same project (see Use ofProceeds2013B Bonds) and two series of bonds (taxable and tax-exempt) related to Project 13 (the WaterCenter Project), no series of bonds is cross-collateralized with any other series of bonds.

Every lessee that is a party to a facilities lease with the Authority has paid all lease payments in each year underall facilities leases with the Authority, and the Authority has never failed to make any payment of principal orinterest on its bonds when due.

The following table summarizes the construction and financing activities of the Authority from its inceptionthrough January 1, 2013, and the principal amount of bonds currently outstanding. Except as noted in the

Board Member Residence Occupation Term Expiration

V.L. Bud Tracy, Chair Malta Retired CEO, Electric Cooperative January 1, 2016

James C. Hammond, Vice Chair Post Falls Managing Partner, HammondDickinson LLC January 1, 2017

Candice Allphin Boise Senior Vice President and Group Manager, US Bank January 1, 2014

John Ewing Meridian General Construction Contractor January 1, 2014Gregory J. Schade, DDS, MS Boise Retired Orthodontist January 1, 2017

Shelly Jo Enderud Post Falls Post Falls City Administrator January 1, 2016

(vacant)

-

8/13/2019 Idaho State Buidling Authority Bond Issuance 2013 A and B

10/169

- 3 -

following table, all bonds and notes require payments of principal on September 1 of each year and payments ofinterest on March 1 and September 1 of each year. The Authority made all payments of principal and interest dueon September 1, 2012, which principal payments reduced the amounts outstanding from the amounts as ofJune 30, 2012, that are set forth in the audited financial statements of the Authority. See Appendix DAuditedFinancial Statements of the Authority.

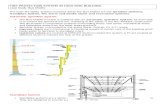

PROJECT AND FINANCING ACTIVITIES OF THE AUTHORITY

Project

Date of

Facilities Lease Bond or Note Status

Final Maturity

(September 1 or

as indicated)

1 State office buildings in Boise, Lewiston, and Idaho Falls Apr 1, 1976 Bonds paid in full N/A

2 School for the Deaf and Blind, Gooding Oct 17, 1984 Bonds paid in full N/A

3 Idaho Industrial Administration Building, Boise Aug 1, 1987 Bonds paid in full N/A

4Idaho Maximum Security Institution, near Boise, and Idaho

Correctional Institution, OrofinoFeb 10, 1988 Bonds paid in full N/A

5 Idaho State Correctional Institution, near Boise Oct 21, 1992 Bonds paid in full N/A

6Alcohol, Drug, and Psychiatric Treatment Hospital,

OrofinoDec 4, 1992 Bonds paid in full N/A

7Headquarters and related facilities for Idaho Dept. of Parks

and Recreation, near BoiseJun 1, 1994 Bonds paid in full N/A

8Prison facilities, near Boise, operated under management

contract with Corrections Corp. of America)Oct 14, 1997 $45,350,000 Series 2008A Refunding Bonds 2025

9 Lava Hot Springs, City of Lava Hot Springs Nov 16, 2000 No bonds issued, funded with Authority funds N/A

10 Ponderosa State Park, McCall Nov 16, 2000 Bonds paid in full N/A

11 Southwest Idaho Treatment Center, Nampa(1)

Aug 1, 2001 $5,775,000 Series 2012A Refunding Bonds 2026

12 Billingsley Creek State Park, Hagerman Sep 1, 2001 Bonds paid in full N/A

13 Idaho Water Center, Boise Dec 17, 2002 $37,785,000 Series 2012B Refunding Bonds and 2043

$11,660,000 Series 2003B Revenue Bonds (Taxable)

14 Idaho State University, Pocatello Jul 17, 2003 $595,000 Series 2003D Revenue Bonds and 2023

$7,285,000 Series 2012C Refunding Bonds

15 Boise State University, West Campus, Nampa Jul 17, 2003 $430,000 Series 2003E Revenue Bonds and 2023

$5,180,000 Series 2012D Refunding Bonds

16 University of Idaho, Moscow Jul 17, 2003 $580,000 Series 20003F Revenue Bonds and 2023

$6,965,000 Series 2012E Refunding Bonds

17 Lewis-Clark State College, Lewiston Jul 17, 2003 $495,000 Series 2003G Revenue Bonds and 2023

$5,960,000 Series 2012F Refunding Bonds

18 North Idaho College, Coeur d'Alene Jul 17, 2003 $545,000 Series 2003H Revenue Bonds and 2023

$6,625,000,Series 2012G Refunding Bonds

Project

Number

-

8/13/2019 Idaho State Buidling Authority Bond Issuance 2013 A and B

11/169

-

8/13/2019 Idaho State Buidling Authority Bond Issuance 2013 A and B

12/169

- 5 -

Together, the 2013A Bond Resolution and the 2013B Bond Resolution are referred to in this Official Statement asthe Bond Resolutions. See Appendix BSummary of Bond Resolutions.

General

The 2013A Bonds and the 2013B Bonds will be dated the date of issuance and will bear interest from their dateddate at the respective rates, and will mature in the respective principal amounts and in the respective years, noted

on pages i and ii of this Official Statement. Interest on the 2013A Bonds and the 2013B Bonds will be payable onMarch 1 and September 1 of each year, beginning September 1, 2013. The 2013A Bonds and the 2013B Bondsare issued as fully registered serial and term bonds, in book-entry form only, and, when issued, will be registeredin the name of Cede & Co. as bondowner and nominee for The Depository Trust Company, New York, New York(DTC). DTC will act as securities depository for each series of the Bonds. Individual purchases and sales ofthe 2013A Bonds and the 2013B Bonds may be made in book-entry form only in minimum denominations of$5,000 within a single maturity and integral multiples thereof. The principal of and interest on the 2013A Bondsand the 2013B Bonds will be payable by Zions First National Bank, acting as trustee for the Bonds (theTrustee), in immediately available funds to DTC which, in turn, will remit such principal and interest to thosefinancial institutions for whom DTC effects book-entry transfers and pledges of securities deposited with DTC, assuch listing of participants exists at the time of such reference (the DTC Participants), for subsequentdisbursement to the Beneficial Owners of the respective series of the Bonds. See Appendix HDepository Trust

Company Information.

In the event the Authority elects to discontinue the book-entry system, the principal of and premium, if any, onthe 2013A Bonds and the 2013B Bonds will be payable at the Principal Corporate Trust Office of the Trustee inBoise, Idaho. In such event, interest on the 2013A Bonds and the 2013B Bonds will be payable by check or draftmailed on the interest payment date to the Registered Owners at the addresses appearing on the Bond Register onthe 15th day of the month preceding each interest payment date.

Redemption Provisions

Optional Redemption.

2013A Bonds. The 2013A Bonds maturing on and after September 1, 2024, are subject to optional redemption onand after September 1, 2023, in whole or in part (with maturities to be selected by the Authority and by lot within

a maturity in a manner determined by the Trustee) at the principal amount thereof, plus interest accrued to the dateof redemption.

2013B Bonds. The 2013B Bonds maturing on September 1, 2024 and September 1, 2026, are subject to optionalredemption on and after September 1, 2023, in whole or in part (with maturities to be selected by the Authorityand by lot within a maturity in a manner determined by the Trustee) at the principal amount thereof, plus interestaccrued to the date of redemption. The 2013B Bonds maturing on September 1, 2025 are not subject to optionalredemption prior to maturity.

Mandatory Sinking Fund Redemption.

The Series 2013A Bonds maturing on September 1, 2033, shall be subject to mandatory redemption andretirement prior to maturity, in part, by lot in such manner as the Trustee shall determine, on September 1, in the

years 2028 to 2033, inclusive, at 100% of the principal amount thereof plus accrued interest to the date ofredemption, in the amounts set forth below:

-

8/13/2019 Idaho State Buidling Authority Bond Issuance 2013 A and B

13/169

- 6 -

Mandatory Redemption Date:September 1

MandatoryRedemption Amount

2028 $530,0002029 545,0002030 560,0002031 580,0002032 595,0002033 615,000

The Trustee

By appointment of the Authority, Zions First National Bank will act as trustee, bond registrar, authenticatingagent, paying agent, and transfer agent with respect to the Bonds.

Except for the contents of this section, the Trustee assumes no responsibility for the nature, content, accuracy, orcompleteness of the information set forth in this Official Statement.

USE OF PROCEEDS

2013A Bonds

The Authority acquired a 30-year leasehold interest in real property and improvements in the Capitol Mall area ofBoise, Idaho, owned by the State (the Parking Site) by entering into a site lease dated December 13, 2012, withthe State, acting through the Idaho Department of Administration (IDOA) (the Parking Site Lease).

The Authority has entered into a development agreement dated December 13, 2012, with the State acting by andthrough the IDOA and its Division of Public Works (the Development Agreement) under which the Stateagrees to construct a parking garage, surface parking, and related improvements (the Improvements) on theParking Site in accordance with the terms of the Development Agreement. Together, the Improvements and theParking Site are referred to in this Official Statement as the Parking Facilities. The State guarantees completionof the Improvements and must obtain the consent of the Authority to make changes to the scope and size of theImprovements that materially increase the cost of the Improvements or that materially extend the time forcompletion.

The Authority has entered into a separate lease with the State acting through the IDOA dated December 13, 2012(the Parking Facilities Lease), under which the Authority agrees to finance the Improvements and lease theParking Facilities to the State, in exchange for payment of annual rent sufficient to pay the Debt Service on the2013A Bonds and the Authoritys Operating Costs allocable to the Parking Facilities (Annual Rent). The termsof the Parking Facilities Lease are described herein under Security and Sources of Payment. For a furtherdescription of the terms of the Parking Facilities Lease, Parking Site Lease, and Development Agreement, seeAppendix CSummary of Site Leases and Facilities Leases.

The proceeds of the 2013A Bonds are being issued to provide long-term financing for the Improvements, to make adeposit of capitalized interest into the Debt Service Fund, and to pay the costs of issuing the 2013A Bonds.

2013B Bonds

The 2013B Bonds are being issued to refund the callable portion of the 2005A Bonds as shown below (as refunded, theRefunded Bonds) for debt service savings, and to pay the costs of issuing the 2013B Bonds and refunding theRefunded Bonds. The 2005A Bonds were issued to finance the design, construction, and development of a healtheducation classroom building (the EITC Facilities) on the Eastern Idaho Technical College (EITC) campus inIdaho Falls, Idaho.

The proceeds of the 2013B Bonds will be used to pay, redeem, and retire all of the Refunded Bonds on theredemption date of September 1, 2015, at a price equal to 100% of the principal amount thereof, plus interest tothe date of redemption.

-

8/13/2019 Idaho State Buidling Authority Bond Issuance 2013 A and B

14/169

- 7 -

REFUNDED BONDS

Sources and Uses

The sources and uses of the proceeds of each series of the Bonds and other available funds are shown below.

* Includes rating agency fees, financial advisory fees, escrow agent fees, Underwriters discount, legal fees, printing costs, and other costs

of issuing the Bonds and refunding the Refunded Bonds.

Maturity Date

(September 1) Coupon CUSIP

2016 515,000$ 3.750% 451443TC9

2017 535,000 3.750% 451443TD7

2018 555,000 3.750% 451443TE52019 575,000 3.875% 451443TF2

2020 600,000 4.000% 451443TG0

2021 625,000 4.000% 451443TH6

2022 650,000 4.000% 451443TJ4

2023 675,000 4.000% 451443TK1

2024 705,000 4.000% 451443TL9

2025 735,000 4.000% 451443TM7

2026 765,000 4.000% 451443TN5

Par Amount

2013A Bonds 2013B Bonds Total

Sources of Funds

Par Amount of Bonds 9,045,000$ 6,905,000$ 15,950,000$

Net Reoffering Premium (Discount) 570,512 742,428 1,312,940

Total Sources of Funds 9,615,512$ 7,647,428$ 17,262,940$

Uses of Funds

Deposit to Construction Fund 9,139,400$ -$ 9,139,400$

Deposit to Escrow Account - 7,561,505 7,561,505

Deposit to Debt Service Fund 292,884 - 292,884

Costs of Issuance* 183,228 85,923 269,151

Total Uses of Funds 9,615,512$ 7,647,428$ 17,262,940$

-

8/13/2019 Idaho State Buidling Authority Bond Issuance 2013 A and B

15/169

- 8 -

DEBT SERVICE REQUIREMENTS

The following table shows the annual debt service on the Bonds to be paid by the Authority.

DEBT SERVICE SCHEDULE

SECURITY AND SOURCES OF PAYMENT

Pledge for the Bonds

The 2013A Bonds are a special obligation of the Authority, secured by and payable solely from a pledge of theRevenues (as defined below) of the Authority and all moneys and securities in the funds and accounts createdunder the 2013A Bond Resolution, excluding the Rebate Fund and the General Reserve Fund.

The 2013B Bonds are a special obligation of the Authority, secured by and payable solely from a pledge of theRevenues of the Authority and all moneys and securities in the funds and accounts created under the 2013B BondResolution, excluding the Rebate Fund and the General Reserve Fund.

There is a separate facilities lease agreement between the Authority, EITC, and the IDOA (the EITC FacilitiesLease). The Parking Facilities Lease and the EITC Facilities Lease are each referred to herein as the FacilitiesLease and collectively as the Facilities Leases. Annual Rent payable under each Facilities Lease is payablefrom funds subject to appropriation annually by the State from the States General Fund annual appropriation andother funds legally available therefor. Under each Facilities Lease, Annual Rent is due in full within 30 daysfollowing the beginning of each annual lease term.

For each series of the Bonds, Revenues include (i) all revenues, income, rent, and receipts derived by theAuthority from its ownership or leasing of the respective facilities financed (together, the Facilities), including

Fiscal Year

Ending June 30 Total Principal Interest

2014 292,884$ 292,884$ 235,093$ 235,093$

2015 330,000 300,556 630,556 243,900 243,900

2016 335,000 293,906 628,906 243,900 243,900

2017 345,000 285,381 630,381 550,000 235,650 785,650

2018 355,000 274,881 629,881 560,000 219,000 779,000

2019 365,000 265,906 630,906 580,000 201,900 781,900

2020 375,000 256,631 631,631 595,000 184,275 779,275

2021 385,000 245,231 630,231 620,000 162,950 782,950

2022 395,000 231,556 626,556 645,000 137,650 782,650

2023 410,000 215,456 625,456 670,000 111,350 781,3502024 430,000 198,656 628,656 695,000 84,050 779,050

2025 450,000 181,056 631,056 725,000 61,450 786,450

2026 455,000 161,819 616,819 740,000 34,250 774,250

2027 485,000 140,669 625,669 525,000 7,875 532,875

2028 505,000 118,394 623,394

2029 530,000 98,750 628,750

2030 545,000 81,953 626,953

2031 560,000 64,688 624,688

2032 580,000 46,875 626,875

2033 595,000 28,516 623,516

2034 615,000 9,609 624,609

Total 9,045,000$ 3,793,374$ 12,838,374$ 6,905,000$ 2,163,293$ 9,068,293$

Principal Interest Total

2013A Bonds 2013B Bonds

-

8/13/2019 Idaho State Buidling Authority Bond Issuance 2013 A and B

16/169

- 9 -

all Annual Rent and other amounts received by the Authority pursuant to the applicable Facilities Lease;(ii) proceeds of any insurance covering business interruption loss related to the applicable facility; and(iii) interest received on money and securities held pursuant to the applicable Bond Resolution, except interestearned on money or securities in the Administrative Fund established under each Bond Resolution.

Operating Costs, as defined in the 2013A Bond Resolution, do not include any of the costs of operating theFacilities, all of which are paid by the State under the Facilities Leases. Operating Costs include only certain

direct and allocated costs of the Authority for its administrative costs and expenses in connection with the 2013ABonds, such as Trustee and other fees and expenses.

Administrative Costs, as defined in the 2005A Bond Resolution, include the Authoritys allocableadministration and general expenses, and do not include any cost of acquisition or construction of the EITCFacilities.

Additional Bonds relative to either series of the Bonds are any revenue bonds that the Authority may hereafterissue having a lien upon the Revenues for the payment of the principal thereof and premium, if any, and interestthereon that is equal to the lien upon the Revenues to pay the principal of and premium, if any, and interest on therespective series of the Bonds.

No Cross-Collateralization

The 2013A Bonds are secured by a pledge of revenues under the 2013A Resolution, including Annual Rent underthe Parking Facilities Lease, which is pledged only to the 2013A Bonds.

The 2013B Bonds are secured by a pledge of revenues under the 2013B Resolution, including Annual Rent underthe EITC Facilities Lease, which is pledged only to the 2013B Bonds and the non-refunded maturities of the2005A Bonds.

Each series of the Bonds is not cross-collateralized with any other series of bonds issued by the Authority, exceptthat rent revenue from the EITC Facilities Lease is pledged to the 2013B Bonds, which are being used to refundthe callable portion of the 2005A Bonds, and to the non-refunded portion of the 2005A Bonds. See Use ofProceeds2013B Bonds.

Flow of Funds

For each series of the Bonds, upon receipt, the Revenues from the applicable Facilities Lease received by theAuthority are to be deposited in the Revenue Fund established by the applicable Bond Resolution. As soon aspracticable in each month after the deposit of such Revenues, but in any case no later than the last Business Dayof such month, the Trustee is required to withdraw from the Revenue Fund established by each Bond Resolutionand deposit into the following funds for each series of the Bonds in the following order of priority the amounts setforth below.

For the 2013A Bonds:

First: Into the 2013A Debt Service Fund, the receipts of such Revenues so that the balance therein issufficient to pay the total amount of principal, if any, and interest due on the next principal or interestpayment date on the 2013A Bonds and any Additional Bonds.

Second: Into the 2013A Administrative Fund, the sum budgeted for Operating Costs in the Annual Budgetallocable to the Improvements for the applicable Fiscal Year, as directed in writing by an Authorized Officer.

Third: Into the General Reserve Fund, any remaining balance of money in the Revenue Fund after makingthe above deposits.

For the 2013B Bonds:

First: Into the 2013B Debt Service Account, the receipts of such Revenues so that the balance therein issufficient to pay the total amount of principal, if any, and interest due on the next principal or interestpayment date on the 2013B Bonds and any Additional Bonds.

-

8/13/2019 Idaho State Buidling Authority Bond Issuance 2013 A and B

17/169

- 10 -

Second: Into the Debt Service Reserve Account for the non-refunded 2005A Bonds (the 2005A DebtService Reserve Account), the receipts of such Revenues so that the balance therein is equal to the ReserveAccount Requirement for the 2005A Bonds.

Third: Into the 2013B Administrative Fund, the sum budgeted for Administrative Costs in the Annual Budgetallocable to the EITC Facilities for the applicable Fiscal Year, as directed in writing by an Authorized Officer.

Fourth: Into the General Reserve Fund, any remaining balance of money in the Revenue Fund after makingthe above deposits. There are no funds currently held in the General Reserve Fund for the 2005A Bonds.

No Debt Service Reserve Account for the Bonds

There is no debt service reserve account established for the 2013A Bonds or the 2013B Bonds.

Covenants

Each of the Bond Resolutions contains affirmative and negative covenants by the Authority including, but notlimited to, covenants with respect to (i) restrictions on liens against the Revenues or other monies, securities, andfunds pledged under the respective Bond Resolution; (ii) preparation of an Annual Budget to be filed with theTrustee; (iii) operation and maintenance of the Facilities; (iv) collection of rents, fees, and other charges for theFacilities; (v) maintenance of insurance coverage on the Facilities; (vi) preparation and maintenance of books ofrecord and accounts relating to the Facilities and the funds and accounts under the respective Bond Resolution;(vii) preparation and provision of information reports; (viii) maintenance of the State tax exempt status of therespective series of the Bonds; (ix) restrictions on the issuance of Additional Bonds; and (x) restrictions on theassignment, mortgage, and subletting of the Facilities.

For a more detailed description of the provisions of the Bond Resolutions, see Appendix BSummary of BondResolutions.

Facilities Leases

Annual Rent

The primary source of Revenues for payment of the applicable series of the Bonds is the Annual Rent payable to

the Authority by the State, pursuant to the applicable Facilities Lease. Pursuant to each Facilities Lease, AnnualRent is equal to (i) the principal (including sinking fund payments) and interest due on the respective Bonds andany related Additional Bonds for the upcoming fiscal year; (ii) the Authoritys Operating or Administrative Costsallocable to the respective Facilities Lease (as defined therein); and (iii) any deposits to the 2005A Debt ServiceReserve Account, with respect to the 2013B Bonds, and any other operating, reserve, or expense account requiredby the applicable Bond Resolution. The Authoritys Operating and Administrative Costs are generally limited toadministrative expenses incurred by the Authority under the applicable Facilities Lease and, absent an event ofdefault under the applicable Facilities Lease, do not include the costs associated with operating, repairing, andmaintaining the respective Facilities (as defined in the applicable Facilities Lease), which costs are theresponsibility of the State. Annual Rent is due in full in advance within 30 days after commencement of eachannual lease term. SeeAppendix CSummary of Site Leases and Facilities Leases.

As described below, each Facilities Lease requires payment of Annual Rent and performance of other obligations

only to the extent that the cost and expense of such performance may have been provided for through anappropriation by the State Legislature from any source. See Appropriation Process below.

Term

Each Facilities Lease renews automatically until the applicable Bonds are paid unless the State notifies theAuthority of its intent not to renew such Facilities Lease at least ten months prior to the expiration of any leaseterm. Additionally, and even assuming the State renews the applicable Facilities Lease, the obligation of the Stateto pay Annual Rent due under such Facilities Lease is subject to the States right not to appropriate funds to makesuch payments. No penalties are imposed for an election not to renew such Facilities Lease. The initial term ofthe Parking Facilities Lease securing the 2013A Bonds extends through June 30, 2014, and is subject to annualrenewal thereafter by the State. The current term of the EITC Facilities Lease securing the 2013B Bonds and the

-

8/13/2019 Idaho State Buidling Authority Bond Issuance 2013 A and B

18/169

-

8/13/2019 Idaho State Buidling Authority Bond Issuance 2013 A and B

19/169

-

8/13/2019 Idaho State Buidling Authority Bond Issuance 2013 A and B

20/169

-

8/13/2019 Idaho State Buidling Authority Bond Issuance 2013 A and B

21/169

- 14 -

the State Legislature, constitute the limit for each agencys authorized expenditures, subject to limited flexibilityfor emergency situations and/or unanticipated revenue.

If, in the course of a fiscal year prior to the commencement of the legislative session, the Governor determinesthat the expenditures authorized by the State Legislature for the current fiscal year exceed anticipated revenuesexpected to be available to meet those expenditures, the Governor by executive order may reduce (holdback)the spending authority on file in the office of the State Controller for any department, agency, or institution of the

State. Annual Rent due under the Facilities Leases from the State to the Authority is due in full in advance within30 days after commencement of each annual lease term. See Appendix CSummary of Site Leases andFacilities Leases.

Recent General Fund Revenues and Appropriations

The following table shows the General Fund revenues for fiscal years ended June 30, 2008 through 2012:

GENERAL FUND REVENUES FISCAL YEAR 2008FISCAL YEAR 2012($ millions)

Source: Division of Financial Management, General Fund Revenue Book, Fiscal Year 2013 Executive Budget, January 2012, and GeneralFund Revenue Report, August 2012

The General Fund Revenue Book (GFRB) is an annual publication prepared by the DFM which provides inputinto the Governor's proposed budget. It consists of General Fund projections by source, the economic forecastupon which the revenue forecasts are based, and a section devoted to the States tax structure. The January 2012GFRB forecast $2,700.26 million of General Fund revenues for Fiscal Year 2013. Subsequent DFM updates to

the Fiscal Year 2013 General Fund revenue forecast were revised lower in August 2012 to $2,670.7 million. TheGFRB published in January 2013 includes the most recent forecast update for Fiscal Year 2013 General Fundrevenues of $2,657.97 million and a forecast for Fiscal Year 2014 General Fund revenues of $2,799.11 million.

The GFRB is available on the internet at

http://dfm.idaho.gov/Publications/Econ_Publications.html

(which website is not incorporated into this Official Statement by such reference and is not a part hereof).

The following table shows the total General Fund appropriations for the fiscal years ended June 30, 2008through 2012, and budgeted appropriations for Fiscal Year 2013. There can be no assurance that there will not beholdbacks or rescissions to the Fiscal Year 2013 appropriations.

Fiscal Year

Ended June 30

2008 1,429.74$ 189.28$ 1,141.44$ 26.84$ 120.67$ 2,907.97$2009 1,167.89 141.03 1,022.20 29.74 104.71 2,465.57

2010 1,061.88 97.02 955.91 41.18 108.47 2,264.46

2011 1,152.65 168.95 972.38 42.82 107.68 2,444.48

2012 1,206.41 187.01 1,027.34 43.18 123.77 2,587.71

Revenues

Miscellaneous

TotalIncome Tax

Individual

Income Tax

Corporate

Sales Tax Taxes

Product

-

8/13/2019 Idaho State Buidling Authority Bond Issuance 2013 A and B

22/169

- 15 -

GENERAL FUND APPROPRIATIONS FISCAL YEAR 2008FISCAL YEAR 2013($ millions)

Source: Sine Die Reports, Published by Legislative Services Office, April 2012, April 2011, April 2010, May 2009, April 2007

2012 Legislative Actions

The 2012 State Legislature budgeted a total General Fund appropriation of $2,702.1 million for Fiscal Year 2013,a 6.01% increase from Fiscal Year 2012. The 2013 State Legislature may make adjustments, if needed, to theFiscal Year 2013 budget and appropriations, and will set the budget and appropriations for the fiscal yearbeginning July 1, 2013, and ending June 30, 2014. Through December 2012, six months into Fiscal Year 2013,revenue collections were approximately $4.3 million, or approximately 0.35% below the Fiscal Year 2013General Fund revenue estimates included in the January 2013 GFRB.

Appropriations for Authority Lease Payments

The State Legislature has never failed to appropriate lease payments for facilities leases between agencies of theState and the Authority.

RETIREMENT SYSTEM INFORMATION

Public Employee Retirement System of Idaho

The Public Employee Retirement System of Idaho (PERSI) is the administrator of a multiple-employer cost-sharing defined benefit public employee retirement system that includes the States employees. All benefit-eligible State employees, which consist of employees who work 20 or more hours per week for five consecutivemonths, must enroll in one of two retirement plans: PERSI or the Optional Retirement Program (ORP),described below. A retirement board (the PERSI Board), appointed by the Governor and confirmed by theState Legislature, manages the system, including selecting investment managers to direct the investment,exchange, and liquidation of assets in the managed accounts and to establish policy for asset allocation and otherinvestment guidelines. The retirement board is charged with the fiduciary responsibility of administering theplan.

PERSI is the administrator of six fiduciary funds, including two defined benefit retirement plans, the PublicEmployee Retirement Fund Base Plan (PERSI Base Plan) and the Firefighters Retirement Fund (FRF); twodefined contribution plans, the Public Employee Retirement Fund Choice Plans 401(k) and 414(k) (PERSI

Choice Plans); and two Sick Leave Insurance Reserve Trust Funds, one for State employers and one for schooldistrict employers. Net assets for all funds administered by PERSI increased $1.97 billion in Fiscal Year 2011and decreased by $22.66 million in Fiscal Year 2012.

PERSI membership includes employees of the State, including State colleges and universities, employees ofpolitical subdivisions (e.g.,counties, cities, and hospitals), and employees of local school districts. As of July 1,2012, the PERSI Base Plan had 65,270 active members, 26,682 inactive members (of whom 10,823 are entitled tovested benefits), and 37,150 annuitants, and the FRF had two active members and 564 retired members orbeneficiaries collecting benefits from FRF. As of June 30, 2012, there were 752 participating employers in thePERSI Base Plan, and 22 participating employers in the FRF.

Fiscal Year

Ended June 30

2008 1,797.7$ 567.0$ 253.2$ 193.8$ 2,811.7$ --

2009 1,771.3 537.4 255.1 184.9 2,748.7 (2.7%)

2010 1,504.8 472.9 226.1 144.9 2,348.7 (14.5%)

2011 1,561.7 465.3 224.1 137.3 2,388.4 1.2%

2012 1,562.0 609.8 238.8 138.3 2,548.9 6.7%

2013 (Budget) 1,645.7 654.9 253.4 148.1 2,702.1 6.0%

% Change

PublicK-12 and Other Health and All Other

Education Human Services Safety Agencies Total

-

8/13/2019 Idaho State Buidling Authority Bond Issuance 2013 A and B

23/169

- 16 -

PERSI issues a publicly available financial report that includes financial statements and required supplementaryinformation. That report may be obtained at:

www.persi.idaho.gov/documents/investments/FY12/AR-FY2012.pdf

(which website is provided purely for convenience and is not incorporated or made a part of this OfficialStatement by this reference).

Defined Benefit Retirement Plans

The PERSI Base Plan and FRF are both cost-sharing, multiple-employer, defined benefit retirement plans thatprovide benefits based on members years of service, age, and highest average salary. PERSI collectscontributions from employees and employers to fund retirement, disability, death, and separation benefits, asprovided by Chapter 13, Title 59, Idaho Code. The funding policy, including contribution and vestingrequirements, for the PERSI Base Plan is determined by the PERSI Board. Title 59, Chapter 13, Idaho Code,governs the PERSI Base Plan; Title 72, Chapter 14, Idaho Code, governs the FRF.

Generally, members become fully vested in their retirement benefits with five years of credited service (fivemonths for appointed officials). Members are eligible for retirement benefits upon attainment of the agesspecified in their employment classification. The annual service retirement allowance for each month of creditedservice is 2.0% (2.3% for police/firefighters) of the average monthly salary for the highest consecutive 42 monthsof service.

The PERSI Base Plan requires that both the employers and the member employees contribute. These employerand employee contributions, in addition to earnings from investments, fund the PERSI Base Plan benefits. Thebenefits were established, and may be amended, by the State Legislature. An employer has no additional liabilitywith respect to the funding of PERSI Base Plan benefits once it makes the required annual contributions.

The benefit payments for the PERSI Base Plan and FRF are calculated using a benefit formula adopted by theState Legislature. The PERSI Base Plan is required to provide a 1% minimum cost of living increase per year,provided the Consumer Price Index increases 1% or more in that year. The Retirement Board has the authority toprovide higher PERSI Base Plan cost of living adjustment (COLA) increases to a maximum of the ConsumerPrice Index movement or 6%, whichever is less, provided the Retirement Board determines PERSI can stillmaintain the appropriate funded position. Such discretionary COLA increases are reported to the State

Legislature, and if the State Legislature fails to act to approve or disapprove the increase by the 45th day ofsession, the increase automatically takes effect as of March 1. The COLA increase for FRF is based on theincrease in the State-wide average firefighters wage.

PERSI Base Plan and FRF benefits are funded by contributions from members and employers and earnings frominvestments. Additional FRF funding is obtained from receipts from a State fire insurance premium tax. Memberand employer contributions are paid as a percentage of applicable member compensation. PERSI Base Planmember contribution rates are defined by State law as a percentage of the employer contribution rate. FRFmember contribution rates are fixed by State law. Employer contribution rates are recommended by periodicactuarial valuations and are subject to the approval of the Retirement Board and limitations set forth in Statestatute. Valuations are based on actuarial assumptions, benefit formulas, and PERSIs employee groups. Costs ofadministering the fund are financed through the contributions and investment earnings of PERSI.

Defined Contribution Retirement Plans

The PERSI Choice Plans are defined contribution retirement plans, governed by Title 59, Chapter 13, Idaho Code,and made up of a qualified 401(k) plan and a 414(k) plan. The assets of the two plans are commingled forinvestment and recordkeeping purposes.

The 401(k) portion of the PERSI Choice Plans was established in 2001 and is open to all active PERSI members.This allows employees to make tax-deferred contributions of up to 100% of their gross salary, less deductions andsubject to the Internal Revenue Service annual contribution limit, and provides for voluntary employer matchingcontributions at rates determined by the employers.

-

8/13/2019 Idaho State Buidling Authority Bond Issuance 2013 A and B

24/169

-

8/13/2019 Idaho State Buidling Authority Bond Issuance 2013 A and B

25/169

-

8/13/2019 Idaho State Buidling Authority Bond Issuance 2013 A and B

26/169

- 19 -

The following table displays the funded status on an actuarial value basis for the PERSI Base Plan:

FUNDED STATUS ON ACTUARIAL VALUE BASIS FOR THE PERSI BASE PLAN ($ MILLIONS)

(1) Actuarial present value of benefits less the actuarial present value of future normal costs based on the entry age actuarial cost method.

(2) Actuarial accrued liabilities less actuarial value of assets and present value of future ORP contributions. Amounts reported in this table do not includethe value of any discretionary COLA or gain-sharing allocations granted after the valuation date. If negative, the amount is referred to as a fundingreserve.

(3) Ratio of actuarial value of assets to the actuarial accrued liabilities less the present value of future ORP contributions.

(4) Includes compensation paid to all active employees on which contributions are calculated.

Source: Public Employee Retirement System of Idaho, 2012 Comprehensive Annual Financial Report.

CONTRIBUTIONS FROM THE EMPLOYER AS A PERCENTAGE OF PAYROLL

(1) The actual PERSI employer contributions are expressed as a percentage of payroll. Employer contributions are made as a percentage of actual payrollin accordance with statute and the PERSI Boards funding policy. Thus, the actual employer contribution set by both statute and the PERSI Boardsfunding policy may differ from the computed ARC employer contribution rate for GASB disclosure purposes. Dollar amounts shown excludeadditional receipts due to merger of retirement systems.

(2) For PERSI employers, the Annual Required Contributions (ARC) is equal to the normal cost rate plus a 25-year amortization of any UAAL or minusa 25-year amortization of any Funding Reserve amount. The ARC determined as of the valuation date is assumed applicable for employerscommencing October 1 of the calendar year following the valuation date. For ORP employers, the ARC is equal to 1.49% of salaries of universitymembers in the ORP until 2025 and 3.83% of salaries of junior college members in the ORP until 2011.

Present Value of

Actuarial Valuation Future ORP

Date (July 1) Contributions

2005 8,208.8$ 8,778.7$ 61.3 508.6$ 94.2% 2,208.7$ 23.0%

2006 9,177.1 9,699.0 60.2 461.7 95.2% 2,343.5 19.7%

2007 10,945.8 10,431.9 59.5 (573.4) 105.5% 2,421.0 (23.7%)

2008 10,402.0 11,211.8 60.9 748.9 93.3% 2,578.9 29.0%

2009 8,646.0 11,732.2 59.6 3,026.6 74.1% 2,683.5 112.8%

2010 9,579.8 12,187.9 52.3 2,555.8 78.9% 2,684.4 95.2%

2011 11,360.1 12,641.2 48.5 1,232.6 90.2% 2,627.9 46.9%

2012 11,306.2 13,396.7 47.0 2,043.5 84.7% 2,619.6 78.0%

of Ass ets

Actuarial Value

Liabilities

Actuarial Accrued UAAL as % of

Covered PayrollUAAL

Covered

PayrollFunded Ratio

Fiscal Year Actual PERSI Employer Percentage of

Ending 06/30 Contribution %(1)

ARC %(2)

ARC Contributed

2006 10.43% 9.885% 105%

2007 10.44% 9.448% 110%

2008 10.44% 9.588% 109%

2009 10.44% 8.483% 123%

2010 10.44% 9.523% 109%

2011 10.44% 12.243% 85%

2012 10.44% 12.375% 84%

-

8/13/2019 Idaho State Buidling Authority Bond Issuance 2013 A and B

27/169

- 20 -

Actuarial gains and losses (gains and losses compared to expectations) of the PERSI Base Plan for the last threeyears are shown in the following table:

ANALYSIS OF ACTUARIAL GAINS OR LOSSES ($ MILLION)

(1) Reflects losses on active and inactive member experience.

(2) For 2009-2010, reflects changes made to mortality and economic assumptions. For 2011-2012, reflects changes made to the demographic andeconomic assumptions.

(3) For 2009-2010, reflects scheduled rate increases. For 2010-2011, reflects factors contained at PERSI Retirement Rule 162 (IDAPA 59.01.06.1620.

Source: Public Employee Retirement System of Idaho, 2012 Comprehensive Annual Financial Report

Optional Retirement Program

Certain employees of State higher education institutions are eligible to participate in an ORP established underSections 33-107A and 33-107B, Idaho Code, by the State Board of Education. Commencing July 1, 2007, 1.49%of the payroll of higher education faculty and staff covered by the ORP is payable to PERSI until July 1, 2025.From July 1, 1997 to July 1, 2011, 3.83% of the payroll of faculty and staff at post-secondary professional-technical education institutions covered by the ORP was payable to PERSI. Effective July 1, 2011, this 3.83% ispayable to the ORP. The payments to PERSI are in lieu of amortization payments and withdrawal contributionsotherwise required under PERSI statutes related to future payments to higher education employees who elected toremain in PERSI. The ORP is a portable, multiple-employer, defined contribution retirement plan in accordancewith Internal Revenue Code section 401(a), with options offered by Teachers Insurance and AnnuityAssociation/College Retirement Equities Fund (TIAA/CREF) and Variable Annuity Life Insurance Company(VALIC). The total contribution rate is the same for all employees, with a portion of the employerscontribution for ORP members that are four-year institutions (pursuant to Idaho Code 33-107A) being credited

to the employees account and a portion to the PERSI unfunded liability until 2025.

Other Post-employment Benefits

The Department of Administration administers post-employment benefits for health, disability, and life insurancefor retired or disabled employees of State agencies, public health districts, state colleges and universities, andother political subdivisions that participate in the plans. PERSI participates in the States post-employmentbenefit programs. The State administers the retiree healthcare plan, which allows eligible retirees to purchasehealth insurance coverage for themselves and their eligible dependents. Retirees eligible for medical healthinsurance pay the majority of the premium cost; however, the retiree plan costs are subsidized in the amount of$1,860 per retiree per year.

Investment Income 392.9$ 1,212.2$ (669.0)$

Pay Increases 260.3 281.9 171.3

Membership Growth (11.8) (13.0) (8.1)

Return to Employment (9.5) (10.7) (10.5)

Death After Retirement 0.7 (5.8) (9.2)

Cost of Living Adjustment NA NA NA

Other(1)

(28.6) (37.8) 7.1

Total Gain (Loss) From Actuarial Experience 604.0$ 1,426.8$ (518.4)$

Contribution Income (130.5)$ (92.8)$ (31.5)$

Changes in Actuarial Ass umptions

(2)

82.7 - (255.0)Changes in Plan Provisions

(3)38.9 (4.7) -

Delay of Fu ture Contribution Rate Increases - (6.1) (6.0)

Composite Gain (Loss ) 595.1$ 1,323.2$ (810.9)$

2009-2010 2010-2011 2011-2012

Gain (Loss ) for Period

-

8/13/2019 Idaho State Buidling Authority Bond Issuance 2013 A and B

28/169

-

8/13/2019 Idaho State Buidling Authority Bond Issuance 2013 A and B

29/169

- 22 -

Financial Report; provided, however, that if such report is unavailable 270 days after the end of the fiscalyear, the earliest such report becomes available.

(iii) Within 270 days after the end of PERSIs fiscal year, beginning with the fiscal year ended June 30, 2012,PERSIs audited financial statements contained in its most recent Comprehensive Annual FinancialReport; provided, however, that if such report is unavailable 270 days after the end of the fiscal year, theearliest such report becomes available.

Further, the Authority has agreed to timely deliver to the Trustee notices, as applicable, of the events described inparagraph (b)(5)(i)(C) of the Rule. Upon receipt from the Authority, the Trustee, as disclosure agent, has agreedto deliver the related information and notices of any event described in paragraph (b)(5)(i)(C) of the Rule withinten Business Days following the event to the Municipal Securities Rulemaking Board through its ElectronicMunicipal Market Access system, the nationally recognized municipal securities information repository, athttp://emma.msrb.org, (which website is provided purely for convenience and is not incorporated or made a partof this Official Statement by this reference).

Any failure by the Authority to perform the above described obligations does not constitute an Event of Defaultunder the applicable Bond Resolution or the applicable series of Bonds; rather, the right to enforce suchprovisions is limited to the right to compel performance. The Authority and the State have not failed to performany obligation with respect to prior undertakings pursuant to the Rule.

TAX MATTERS

Opinion of Bond Counsel

In the opinion of Bond Counsel, based upon an analysis of existing laws, regulations, rulings and court decisions,and assuming, among other matters, the accuracy of certain representations and compliance with certaincovenants, interest on the Bonds is excluded from gross income for federal income tax purposes under Section103 of the Internal Revenue Code of 1986 and is exempt from State of Idaho personal income taxes. In thefurther opinion of Bond Counsel, interest on the Bonds is not a specific preference item for purposes of thefederal individual or corporate alternative minimum taxes, although Bond Counsel observes that such interest isincluded in adjusted current earnings when calculating corporate alternative minimum taxable income. Complete

copies of the proposed forms of opinions of Bond Counsel for the 2013A Bonds and the 2013B Bonds are setforth in Appendix G hereto.

To the extent the issue price of any maturity of the Bonds is less than the amount to be paid at maturity of suchBonds (excluding amounts stated to be interest and payable at least annually over the term of such Bonds), thedifference constitutes original issue discount, the accrual of which, to the extent properly allocable to eachBeneficial Owner thereof, is treated as interest on the Bonds which is excluded from gross income for federalincome tax purposes and is exempt from State of Idaho personal income taxes. For this purpose, the issue price ofa particular maturity of the Bonds is the first price at which a substantial amount of such maturity of the Bonds issold to the public (excluding Bond houses, brokers, or similar persons or organizations acting in the capacity ofunderwriters, placement agents or wholesalers). The original issue discount with respect to any maturity of theBonds accrues daily over the term to maturity of such Bonds on the basis of a constant interest rate compoundedsemiannually (with straight-line interpolations between compounding dates). The accruing original issue discount

is added to the adjusted basis of such Bonds to determine taxable gain or loss upon disposition (including sale,redemption, or payment on maturity) of such Bonds. Beneficial Owners of the Bonds should consult their owntax advisors with respect to the tax consequences of ownership of Bonds with original issue discount, includingthe treatment of beneficial owners who do not purchase such Bonds in the original offering to the public at thefirst price at which a substantial amount of such Bonds is sold to the public.

Bonds purchased, whether at original issuance or otherwise, for an amount higher than their principal amountpayable at maturity (or, in some cases, at their earlier call date) (the Premium Bonds) will be treated as havingamortizable Bond premium. No deduction is allowable for the amortizable Bond premium in the case of Bonds,like the Premium Bonds, the interest on which is excluded from gross income for federal income tax purposes.However, the amount of tax-exempt interest received, and a beneficial owners basis in a Premium Bond, will be

-

8/13/2019 Idaho State Buidling Authority Bond Issuance 2013 A and B

30/169

-

8/13/2019 Idaho State Buidling Authority Bond Issuance 2013 A and B

31/169

-

8/13/2019 Idaho State Buidling Authority Bond Issuance 2013 A and B

32/169

-

8/13/2019 Idaho State Buidling Authority Bond Issuance 2013 A and B

33/169

A-1

APPENDIX A:

ECONOMIC INFORMATION ABOUT THE STATE OF IDAHO

Idaho State Government

Government in the State of Idaho (the State) originates from the State Constitution adopted at theconstitutional convention of August 6, 1889, and ratified by the people in November of the same year.The U.S. Congress approved the Constitution and admitted Idaho to the Union on July 3, 1890.

The Executive Department

The Idaho Executive Department consists of seven constitutionally empowered elected officials:Governor, Lieutenant Governor, Secretary of State, State Controller, State Treasurer, Attorney General,and Superintendent of Public Instruction.

The Governor is vested with supreme executive power. The Governor appoints department heads andmembers of boards and commissions. On extraordinary occasions, the Governor can convene specialsessions of the State Legislature. The Governor gives final approval, by signing, of bills passed by theState Legislature, and has the power to veto bills but must list the objections. The State Legislature canoverride a veto by a two-thirds vote of each chamber.

The Lieutenant Governor presides over the State Senate and, when the Governor is absent from the State,serves as Acting Governor. In case of vacancy for any reason in the Governors office, the LieutenantGovernor succeeds to that office.

The Secretary of State is the custodian of records, including those of corporations, other entities, anduniform commercial code filings, and of the Great Seal of the State of Idaho. The Secretary of State is theStates Chief Election Officer and is a member of the Board of Examiners, the State Land Board, andState Board of Canvassers.

The State Controller, as Chief Accounting Officer, is responsible for accounting records and is the Statescash disbursement officer. The State Controller is also responsible for maintaining the State-wide systemof internal control procedures. The State Controller is the State Administrator of Social Security, amember of the State Land Board, ex officioSecretary of the Board of Examiners, and a member of the

State Board of Canvassers.

The State Treasurer, as Chief Financial Officer, receives all State revenues and fees and is cash managerand investor for all State revenues. The State Treasurer pays all State bills by redeeming State warrants,and is custodian of the Workers Compensation Fund and the Public School Endowment Fund. The StateTreasurer also is a member of the State Board of Canvassers and serves as advisor to the Idaho Housingand Finance Association.

The Attorney General is the Chief State Legal Officer and represents State officers and agencies in legalmatters. The Attorney General must provide legal opinions in writing when requested by governmentofficials. The Attorney General is required to supervise all persons holding property subject to any publicor charitable trust, and to assist county prosecutors in the discharge of their duties if they so request. TheAttorney General is in charge of consumer protection laws and has jurisdiction to enforce State antitrust

laws. The Attorney General is a member of the Board of Examiners and the State Board of LandCommissioners.

The State Superintendent of Public Instruction is an ex officioand voting member of the State Board ofEducation, the executive officer of the State Department of Education, and advisor to school districts onall aspects of education. The State Superintendent also is a member of the State Land Board and serves as

ex officiomember of the State Library Board.

-

8/13/2019 Idaho State Buidling Authority Bond Issuance 2013 A and B

34/169

-

8/13/2019 Idaho State Buidling Authority Bond Issuance 2013 A and B

35/169

A-3

TABLE 1IDAHO ECONOMIC INDICATORS

Actual Projected(1)

2009 2010 2011 2012 2013

Idaho Economic Indicators

Personal Income (current $ millions) 48,183 50,144 52,821 53,630 55,208

Percent Change -5.2% 4.0% 5.4% 1,5% 2.9%

Total Nonfarm Employment 609,975 602,608 605,441 613,295 625,108

Percent Change -6.0% -1.2% 0.5% 1.3% 1.9%

Goods-Producing Employment 92,401 87,768 87,630 89,537 90,739

Percent Change -17.7% -5.0% -0.2% 2.2% 1.3%

Nongoods-Producing Employment 517,574 514,840 517,812 523,757 534,369

Percent Change -3.6% -0.5% 0.6% 1.1% 2.0%

Populations (thousands) 1,550.5 1,572.6 1,593.6 1,619.1 1,646.5

Percent Change 1.3% 1.4% 1.3% 1.6% 1.7%

Housing Starts-Single Unit 4,957 4,659 3,980 6,060 7,538

Housing Starts-Multiple Unit 706 573 654 1,099 1,077

Selected US Production Indices

Wood Products 65.3 67.9 69.6 73.5 80.27Computer and Electronic Products 92.9 103.0 111.1 118.1 126.0

Food 98.2 98.0 100.3 102.9 104.7

Agricultural Chemicals 90.9 94.8 93.1 94.1 94.7

Metal Ore Mining 90.4 96.4 98.7 98.9 99.9

Selected US Producer Prices (1982=1.000) (2)

All Items 1.729 1.848 2.000 2.028 2.070

Lumber and Wood Products 1.828 1.927 1.972 2.071 2.185

Machinery and Equipment 1.313 1.311 1.333 1.349 1.358

Farm 1.346 1.511 1.808 1.687 1.648

Pulp, Paper and Allied Products 2.256 2.369 2.495 2.584 2.633

Chemicals 2.294 2.467 2.729 2.796 2.839

(1) Projections commence third quarter 2012.

(2) The source for the Selected U.S. Producer Prices data is the January 2012 Idaho Economic Forecast. The projections commence the thirdquarter of 2011. This information was omitted from the April 2012 IEF and from the July 2012 IEF.

Source: IHS Global Insight and Idaho Division of Financial Management, Idaho Economic Forecast, January 2013

TABLE 2STATE OF IDAHO POPULATION TRENDS

Year Population

2000* 1,293,953

2001 1,321,170

2002 1,342,149

2003 1,364,109

2004 1,391,718

2005 1,425,8622006 1,464,413

2007 1,499,245

2008 1,527,506

2009 1,545,801

2010* 1,567,582

2011 1,584,985

* Census data

Source: U.S. Census Bureau

-

8/13/2019 Idaho State Buidling Authority Bond Issuance 2013 A and B

36/169

-

8/13/2019 Idaho State Buidling Authority Bond Issuance 2013 A and B

37/169

A-5

TABLE 5STATE OF IDAHO

PRINCIPAL EMPLOYERS(Annual Average July 2011 through June 2012)

Employer

Average Number

of Employees

% of Total State

Employment

Local Government 70,300 11.37%

State of Idaho(1) 26,900 4.35%

Federal Government 13,800 2.23%

St. Lukes Regional Medical Center 9,850 1.58%

Wal-Mart Associates, Inc. 6,850 1.10%

Micron Technology, Inc. 5,650 0.91%

University of Idaho 4,950 0.78%

Boise State University 4,250 0.68%

Meridian Joint School District No. 2 4,250 0.68%

Battelle Energy Alliance(2) 4,150 0.66%

Brigham Young University Idaho 4,150 0.66%

Independent School District of Boise City 3,750 0.60%

Idaho State University 3,550 0.57%