IAS 12- Income Tax

-

Upload

jenny-ilagan-nuqui -

Category

Documents

-

view

10 -

download

0

description

Transcript of IAS 12- Income Tax

Objective of IAS 12

The objective of IAS 12 (Revised 1996) is to prescribe the accounting treatment for income taxes.

Key Definitions [IAS 12.5]

Temporary difference: A difference between the carrying amount of an asset or liability and its tax base.

Taxable temporary difference: A temporary difference that will result in taxable amounts in the future when the carrying amount of the asset is recovered or the liability is settled.

Deductible temporary difference: A temporary difference that will result in amounts that are tax deductible in the future when the carrying amount of the asset is recovered or the liability is settled.

Current Tax

Current tax for the current and prior periods should be recognized as a liability to the extent that it has not yet been settled, and as an asset to the extent that the amounts already paid exceed the amount due. [IAS 12.12] The benefit of a tax loss which can be carried back to recover current tax of a prior period should be recognized as an asset. [IAS 12.13] Current tax assets and liabilities should be measured at the amount expected to be paid to (recovered from) taxation authorities, using the rates/laws that have been enacted or substantively enacted by the balance sheet date. [IAS 12.46]

Recognition of Deferred Tax Liabilities

The general principle in IAS 12 is that deferred tax liabilities should be recognized for all taxable temporary differences. There are 3 exceptions to the requirement to recognize a deferred tax liability, as follows: [IAS 12.15]

liabilities arising from goodwill for which amortization is not deductible for tax purposes; liabilities arising from the initial recognition of an asset/liability other than in a business combination which, at

the time of the transaction, does not affect either the accounting or the taxable profit; and liabilities arising from undistributed profits from investments where the enterprise is able to control the timing

of the reversal of the difference and it is probable that the reversal will not occur in the foreseeable future.

Recognition of Deferred Tax Assets

A deferred tax asset should be recognized for deductible temporary differences, unused tax losses and unused tax credits to the extent that it is probable that taxable profit will be available against which the deductible temporary differences can be utilized, unless the deferred tax asset arises from: [IAS 12.24]

negative goodwill which was treated as deferred income under IAS 22 Business Combinations; or the initial recognition of an asset/liability other than in a business combination which, at the time of the

transaction, does not affect the accounting or the taxable profit.

Deferred tax assets for deductible temporary differences arising from investments in subsidiaries, associates, branches and joint ventures should be recognized to the extent that it is probable that the temporary difference will reverse in the foreseeable future and that taxable profit will be available against which the temporary difference will be utilized. [IAS 12.44]

The carrying amount of deferred tax assets should be reviewed at the end of each reporting period and reduced to the extent that it is no longer probable that sufficient taxable profit will be available to allow the benefit of part or all of that deferred tax asset to be utilized. Any such reduction should be subsequently reversed to the extent that it becomes probable that sufficient taxable profit will be available. [IAS 12.37]

A deferred tax asset should be recognized for an unused tax loss carry forward or unused tax credit if, and only if, it is considered probable that there will be sufficient future taxable profit against which the loss or credit carry forwards can be utilized. [IAS 12.34]

Measurement of Deferred Tax Assets and Liabilities

Deferred tax assets and liabilities should be measured at the tax rates that are expected to apply to the period when the asset is realized or the liability is settled (liability method), based on tax rates/laws that have been enacted or substantively enacted by the end of the reporting period. [IAS 12.47] The measurement should reflect the entity's expectations, at the balance sheet date, as to the manner in which the carrying amount of its assets and liabilities will be recovered or settled. [IAS 12.51]

Deferred tax assets and liabilities should not be discounted. [IAS 12.53]

Recognition of Tax Expense or Income

Current and deferred tax should be recognized as income or expense and included in profit or loss for the period, except to the extent that the tax arises from: [IAS 12.58]

a transaction or event that is recognized directly in equity; or a business combination accounted for as an acquisition.

If the tax relates to items that are credited or charged directly to equity, the tax should also be charged or credited directly to equity. [IAS 12.61]

If the tax arises from a business combination that is an acquisition, it should be recognized as an identifiable asset or liability at the date of acquisition in accordance with IFRS 3 Business Combinations (thus affecting goodwill or negative goodwill).

Tax Consequences of Dividends

In some jurisdictions, income taxes are payable at a higher or lower rate if part or all of the net profit or retained earnings is paid out as a dividend. In other jurisdictions, income taxes may be refundable if part or all of the net profit or retained earnings is paid out as a dividend. Possible future dividend distributions or tax refunds should not be anticipated in measuring deferred tax assets and liabilities. [IAS 12.52A]

IAS 10, Events after the Reporting Period, requires disclosure, and prohibits accrual, of a dividend that is proposed or declared after the end of the reporting period but before the financial statements were authorized for issue. IAS 12 requires disclosure of the tax consequences of such dividends as well as disclosure of the nature and amounts of the potential income tax consequences of dividends. [IAS 12.82A]

Presentation

Current tax assets and current tax liabilities should be offset on the balance sheet only if the enterprise has the legal right and the intention to settle on a net basis. [IAS 12.71]

Deferred tax assets and deferred tax liabilities should be offset on the balance sheet only if the enterprise has the legal right to settle on a net basis and they are levied by the same taxing authority on the same entity or different entities that intend to realize the asset and settle the liability at the same time. [IAS 12.74]

Disclosure

In addition to the disclosures required by IAS 12, some disclosures relating to income taxes are required by IAS 1, as noted below.

IAS 1 requires disclosures on the face of the statement of financial position about current tax assets, current tax liabilities, deferred tax assets, and deferred tax liabilities [IAS 1.54(n) and (o)]

IAS 1 requires disclosure of tax expense (tax income) on the face of the statement of comprehensive income [IAS 1.82(d)].

IAS 12 requires disclosure of tax expense (tax income) relating to ordinary activities on the face of the statement of comprehensive income [IAS 12.77].

IAS 12 requires that if an entity presents a statement of income, in addition to a statement of comprehensive income, tax expense (income) from ordinary activities should be presented in the statement of income. [IAS 12.77A]

major components of tax expense (tax income) [IAS 12.79] Examples include: [IAS 12.80] o current tax expense (income); o any adjustments of taxes of prior periods o amount of deferred tax expense (income) relating to the origination and reversal of temporary

differences; o amount of deferred tax expense (income) relating to changes in tax rates or the imposition of new

taxes; o amount of the benefit arising from a previously unrecognized tax loss, tax credit or temporary

difference of a prior period o write down, or reversal of a previous write down, of a deferred tax asset; and o amount of tax expense (income) relating to changes in accounting policies and corrections of errors

aggregate current and deferred tax relating to items reported directly in equity [IAS 12.81] tax relating to each component of other comprehensive income [IAS 12.81] explanation of the relationship between tax expense (income) and the tax that would be expected by

applying the current tax rate to accounting profit or loss (this can be presented as a reconciliation of amounts of tax or a reconciliation of the rate of tax) [IAS 12.81]

changes in tax rates [IAS 12.81] amounts and other details of deductible temporary differences, unused tax losses, and unused tax credits

[IAS 12.81]

temporary differences associated with investments in subsidiaries, associates, branches, and joint ventures [IAS 12.81]

for each type of temporary difference and unused tax loss and credit, the amount of deferred tax assets or liabilities recognized in the statement of financial position and the amount of deferred tax income or expense recognized in the income statement [IAS 12.81]

tax relating to discontinued operations [IAS 12.81] tax consequences of dividends declared after the end of the reporting period[IAS 12.81] details of deferred tax assets [IAS 12.82] tax consequences of future dividend payments [IAS 1.82A]

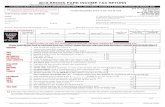

![FINANCIAL ACCOUNTING 202 [FAC612S] (SOFP) 60,000 Provisional tax payments (2 provisional payments total) Income tax expense (p/l) 99,000 Current tax payable 99,000 ... IAS 37 defines](https://static.fdocuments.net/doc/165x107/5ea6c1064d27954c105786a4/financial-accounting-202-fac612s-sofp-60000-provisional-tax-payments-2-provisional.jpg)