Huffington Post / Nissan Motors - Electric Car Incentives Infographic

-

Upload

dezinegirl-creative-studio -

Category

Automotive

-

view

72 -

download

1

Transcript of Huffington Post / Nissan Motors - Electric Car Incentives Infographic

REFERENCES:

http://online.wsj.com/articles/eight-u-s-states-to-roll-out-electric-vehicle-plan-1401320116

http://governor.maryland.gov/documents/MultiStateZEVActionPlan.pdf

http://www.thecarelectric.com/content/electric-car-benefits-by-state.php

http://www.ncsl.org/research/energy/state-electric-vehicle-incentives-state-chart.aspx

http://www.plugincars.com/federal-and-local-incentives-plug-hybrids-and-electric-cars.html

Alabama• Alabama Power o�ers a 1.7¢ discount for

residents who charge their plug-in during the designated "EV charging period”

Arizona•Unrestricted access

to HOV lanes

•Up to a $75 tax credit for installing a home charging outlet for EVs

California• Unrestricted access to high occupancy

vehicle (HOV) lanes

• EV purchase rebate up to $2,500

Colorado• Unrestricted access to HOV lanes

• Tax credit of up to $6,000

Connecticut• Free metered parking in New Haven

Florida• Unrestricted use of HOV lanes

Georgia• Income tax credit of 20 percent of the

EV's purchase price up to $5,000

• Tax credit for businesses installing EV charging equipment of 10 percent of the charger's price up to $2,500

• Unrestricted access to HOV lanes

Hawaii• Unrestricted access to HOV lanes

Idaho• Exemption from maintenance

inspections

Illinois• Tax rebate of up to 80 percent of the

incremental costs of purchasing an EV

• 50 percent rebate on home charging equipment

Indiana• Tax credit of up to $1,650 to purchase

home charging equipment

Louisiana• Tax rebate of up to 50

percent of the incremental costs of purchasing an EV

Maryland• Unrestricted access to HOV lanes

• Refund credit up to $3,000

• Qualified EVs are exempt fromannual vehicle inspection testing for the first three years of ownership

Massachuse�s• Unrestricted access to HOV lanes

• Rebate of up to $2,500 to purchase or lease an EV for 36 months

Michigan• Up to $2,500 reimbursement for the

purchase, installation and wiring of a Level II charger

• EVs are exempt from annual emissions inspection

Minnesota• Members of a pilot program may take

advantage of a discounted electricity rate during specified o�-peak hours.

Missouri• Exempt from state emissions inspections

Nevada• Unrestricted access to HOV lanes

• Exempt from annual emissions inspection

• Free metered parking

New Jersey• Tax exemption of up to $4,000 for

EV buyers

• Exempt from sales tax

• Unrestricted access to HOV lanes

New York• Tax credit for 50 percent of the cost of EV

charging equipment, up to $5,000

• Unrestricted access to HOV lanes

Nebraska• State loans up to $75,000

are available for certain typesof alternative fuel projects

North Carolina• Unrestricted access to HOV lanes

• Exempt from emissions inspection requirements

Oklahoma• Up to 75% credit on

EV charge installation

Oregon• Tax credit of up to $750 towards the

purchase of EV charging equipment

Pennsylvania• Tax rebate of up to $2,000 for the

purchase of an EV

Tennessee• Unrestricted use of HOV lanes

Texas• Alternative fuel rebate

up to $2,500

• Free metered parking in San Antonio

Utah• Unrestricted access to HOV lanes

• Tax credit of up to $605 to purchase an EV

Virginia• Unrestricted access to HOV lanes

Washington• EV purchases are exempt from state

sales tax.

• Exempt from annual emissions inspections

Washington, DC• EV buyers are exempt from excise taxes

• $36 discount on vehicle registration

*Benefits as of October 2014

In addition to this alliance, 32�tates have alreadyrolled out various incentive programs, perks and more:

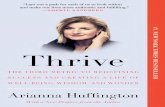

LEGEND:

[Magenta line] ZEV Action Plan states

[Green] States with EV incentive programs

BREAKDOWN OF CURRENT STATE INCENTIVE PROGRAMS: [Magenta dot] Tax benefits and rebates

[Yellow dot] Perks

INCENTIVES FOR BUYING AND OWNING ELECTRIC CARSin Every State

This summer, eight states announced the adoption of the ZEV Action Plan, an ambitious plan to use incentive programs to put 3.3 million electric cars on the road by 2025.