Hubbert's Peak Theory

-

Upload

hrishikesh-chappadi -

Category

Documents

-

view

53 -

download

1

Transcript of Hubbert's Peak Theory

1

A SEMINAR REPORT ON

PEAK THEORY OF HUBBERT

Submitted by

HRISHIKESH RC: 08D17002

DEPARTMENT OF ENERGY SCIENCE AND ENGINEERING

INDIAN INSTITUTE OF TECHNOLOGY, BOMBAY (IITB)

POWAI, MUMBAI 400 076

APRIL 2012

2

TABLE OF CONTENTS

LIST OF FIGURES iii

NOMENCLATURE iv

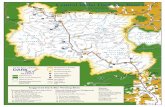

1. INTRODUCTION 1

2. HUBBERT’S PEAK THEORY 2

3. APPLICATION OF THE PEAK THEORY 5

3.1 US 7

3.2 Former Soviet Union 8

3.3 World 9

4. CONCLUSION 11

5. REFERENCES 12

‘

3

Figure 2.1 The bell-shaped curve showing the mathematical relations

involved in the production of the reserve

Figure 2.2 Crude oil production curve for Illionis

Figure 2.3 Crude oil production curve for Ohio

Figure 2.4 Ultimate US crude oil production assuming initial productions of

150 and 200 Gb

Figure 2.5 Ultimate world crude oil production assuming initial productions

of 1250 Gb

Figure 3.1 Production curve for a single oil field

Figure 3.2 Production curve for multiple oil fields (4)

Figure 3.3 Production curve for multiple oil fields (8)

Figure 3.4 Comparable Hubbert and Gauss curves along with their

derivatives

Figure 3.5 The original hubbert curve with an ultimate of 200 Gb compared

with the actual data (US)

Figure 3.6 Laherrere's hubbert curve with the actual data (US)

Figure 3.7 Matching of shifted discovery and production curves (US)

Figure 3.8 Former Soviet Union's production data modelled with hubbert

curves having different ultimates

Figure 3.9 Matching of shifted discovery and production curves (US)

Figure 3.10 Oil production and discovery curves for the world

LIST OF FIGURES

2

2

3

3

4

5

5

5

6

7

8

8

8

9

9

4

NOMENCLATURE

P Production rate of resource

Qt Total resource consumed at time t

Q Ultimate reserve of resource

Pm Production rate of resource at peak

tm Time of peak

b Slope factor

s Standard deviation

Pi Production rate of resource at point of inflection

ti Time of inflection

5

1. INTRODUCTION

Fossil fuels have proved one of the most important resources for mankind over the last one

and a half centuries. Along with the Industrial Revolution, it has led to a dramatic increase in

living standards. Fossil fuels originate from the decomposition of buried dead organisms over

hundreds of millions of years. Over time, due to effect of heat and pressure, and a series of

processes, these are converted into what we presently know as coal and petroleum.[1]

However, the slow rate of formation means that in the present age, we have practically, a

constant resource of fossil fuels. This in turn, gives rise to the question of how long they can

run into the future. Considering the present reliance of our daily lives on fossil fuels, it has

become an important question for governments of today. Hubbert’s peak theory is the earliest

attempt to model the rate of fossil fuel production with time. ‘Peak’ refers to the fact that the

production curve is normally bell-shaped with a peak, denoting maximum production rate

occurrence.

This theory was presented by Marion King Hubbert to the American Petroleum Institute in

1956 in the form of a paper, where he predicted correctly that the US oil production would

peak between 1965 and 1970. This, coupled with the oil crises in the 1970s has led to the

issue gaining prominence. The ‘peak’ for world oil production is an important tipping point,

because this represents the point after which production can only reduce. This implies to

satisfy the existing (and increasing) demand, we would need newer and/or more efficient

sources of energy to supplement the energy deficit. Therefore, governments need to have

mitigation procedures prepared to deal with this fallout. This was the objective of the Hirsch

Report, made at the behest of the US Department of Energy, to look at the energy problem of

the US.

At the same time, this theory has its fair share of criticism, on a number of points, which will

be seen in this report.

6

2. HUBBERT’S PEAK THEORY

In his paper[2]

, Hubbert derives a general curve for production rate vs time without giving an

obvious formula. However, the curve is shown to follow a symmetrical bell-shape.

∫

The area under the curve

denotes the ultimate reserves of

that particular resource.

Hubbert gives his arguments

for the curve using empirical

research, with data from

various states in the US and the

US itself. The paper analyses

three fossil fuels using the

same methodology: oil, coal

and natural gas. In this report, I

will restrict myself to the

scenario of oil.

First let me define ‘oil’ as used in the paper. The petroleum industry is divided broadly into

two parts: upstream, downstream[3]

. The upstream industry involves the searching and

recovery of crude oil and natural gas,

while the downstream industry involves

the refining of crude, selling and

distribution of natural gas, and products

derived from crude refining. The

upstream industry also involves

processing of natural gas, which leads to

Natural Gas Liquids as a byproduct

(NGLs). These include higher alkanes

like ethane, butane, propane, isobutene

and other condensates. These along with

crude oil are called liquid hydrocarbons.

In the few decades unto the publishing of the paper (1955), crude and liquid hydrocarbons

were synonymous because NGLs were not produced in significant amounts. However, that

had changed. Hence, the ‘oil’ Hubbert refers to includes only crude oil, and not liquid

hydrocarbons.

Figure 2.1 The bell-shaped curve showing the mathematical relations involved in the production of the reserve

[2]

Figure 2.2 Crude oil production curve for Illionis[2]

7

Hubbert then justifies the ‘peak’ using the production curves for two regions. While the

production curve for the state of Ohio has a clear peak, the problem seems to be with the state

of Illionis. However this is due to the fact that Illionis had two distinct spells of oil discovery

and therefore there are two peaks

signifying the production spells following

the discovery spells.

Moving on, the paper focusses on the US

and the world.

In order to predict how the production

rates will trend, we’ll need to understand

the reserve data. Two terms are generally

used for depicting reserve data:

Proven Reserves (also referred to

as Proved reserves) – The amount of reserves which are known to exist, but have not

yet been produced

Ultimate Reserves – The estimate of the total possible reserves of oil. This includes

the already consumed resource along with the proven reserves and expected future

discoveries

Nowadays, a more system involving probabilities is used to indicate resources that have not

yet been produced or discovered. These will be explained later. One of the two problems

associated with the estimation of ultimate reserves is that it does not take into account

improvements in technology. (This is a criticism of Hubbert’s theory in general).

Improvements in technology lead to more ultimate reserve, and possibly a delay in the ‘peak’.

The other problem is that the reserve amounts are misreported at various levels. This may be

due to various political or profit-based reasons. This will also be elaborated on later.

For calculation of total reserves of crude oil, Hubbert ignores the unconventional sources of

oil, whose production had not reached a significant amount. Unconventional oil is a ‘heavy’

form of oil. Unlike

‘conventional’ oil, which is

light, easy to extract,

unconventional is not easy to

recover because production

requires a great deal of capital

investment and supplementary

energy.[4]

Thus it is costly and

not preferred. Using the

estimates of LG Weeks,

Wallace Pratt and modifying them, he arrives at a figure of 1250 Gb for the world and 150

Gb for the US. (1 Gb = 1 billion barrels of oil). At the same time, the proven reserves for the

US and the world were 30 Gb and 250 Gb respectively. Using these data and the already

known consumed oil data, Hubbert comes with two curves for the US and the world. Another

Figure 2.3 Crude oil production curve for Ohio[2]

Figure 2.4 Ultimate US crude oil production assuming initial productions of 150 and 200 Gb

[2]

8

assumption Hubbert mentions for calculation for the world peak is that the peak production

rate is 2.5 times that of what it was in 1955. Why is this assumption required? It’ll be

explained in the next chapter.

Using these graphs, Hubbert predicts ‘peak oil’ for world to be around 2000 and the US at

1965. Assuming improvement in production techniques, he also considers for US, the best

case of ultimate reserve at 200 Gb (instead of 150 Gb) and calculates the peak to be at 1970.

He was proven to be correct in the

case of US, while for the world, we

are still not sure whether the tipping

point has come or not. Why was he

wrong?

Figure 2.5 Ultimate world crude oil production assuming initial productions of 1250 Gb

[2]

9

3. APPLICATION OF THE PEAK THEORY

While Hubbert explains the peak theory using empirical research, one has to wonder whether

is any special significance attached to the structure of the curve. Also, one glaring detail

missing is the lack of an equation for the bell-shaped curve. This makes it even more difficult

to analyze the logic behind his peak prediction.

Jean H Laherrere, in his paper[5]

titled ‘Hubbert’s curve, its strength and weaknesses’,

published in 2000 addresses these questions. He also tries to apply the peak theory to

different regions. Laherrere details three constraints for application of the bell-shaped curve:

When there is a large population of fields in the country, such that the sum of

symmetrical fields becomes normal under the Central Limit Theorem of Statistics

When exploration follows a natural pattern unimpeded by economic or political

factors

Where a single geographical domain with a natural distribution of fields is considered,

political boundaries should be avoided

What Laherrere says is intuitively understandable. I think the reason the hubbert curve takes

the bell shape is that the additive production curve of a number oil fields is of a shape similar

to the bell-shape.

An individual field's production generally appears something like H1 - a gradual increase to

maximum output, then a long plateau and a gradual decrease.

When one combine many fields together, placing a small number of large fields near the

beginning and a large number of small fields at the end, as happens in oil exploration, the

combined values produce something like a bell curve. The examples below (H2 and H3)

show how just four and eight 'wells' begin to approximate the shape of the Hubbert Curve.

Obviously the more wells one adds, the smoother the curve. So the production curve for a

political domain can be understood as a combination of oil fields following a ‘natural’

exploration pattern.[6]

This explains the first and third points. However, the second point

merits explanation. Laherrere looks at some practical cases. But first, he tries to identify an

equation for the hubbert curve.

We know that Hubbert used a bell-shaped curve. The well-known bell shaped curves are the

Gauss, Normal and the derivative of the logistic curve. The logistic curve is a curve used to

Figure 3.1 Production curve for a single oil field

[6] Figure 3.2 Production curve for

multiple oil fields (4) [6]

Figure 3.3 Production curve for multiple oil fields (8)

[6]

10

model population curve. According to Laherrere, it is more convenient to use the derivative

of it to model the hubbert curve.

( ( ))

Where Pm (in Gb) denotes the production at peak, tm is the time of the peak and b is a factor

such that,

Here U (in Gb) denotes the ultimate reserve for the resource. Also used is the Gauss curve,

where,

( )

( )

S is the standard deviation and

( )

If the peak is known, constructing the curve is easy as we just need to calculate the slope

factor b (which in a sense denotes the spread of productions rate across time). The problem

comes if the peak is not known. Then, the hubbert curve can be constructed ‘fairly’ well only

Figure 3.4 Comparable Hubbert and Gauss curves along with their derivatives[5]

11

if the inflection point is known. The inflection point is the point where the derivative of the

production curve reaches the maximum. (The production curve referred to is the curve

formed by joining the points representing the production rates, because we haven’t plotted the

hubbert curve yet!)

Using this we get, three equations

( ( ))

Also,

And,

The three unknowns are Pm, tm and b. In fact, the result turns out to be

And,

We saw in the previous chapter, Hubbert needed to make the assumption of world production

peak to be 2.5 times of the peak in 1955. The production point of the world had not reached

inflection. Therefore, an assumption needed to be made. This may also be the reason why he

was wrong.

Let’s move ahead and see the application of the peak theory by Laherrere on different regions

in the world.

3.1 US

While Hubbert gets the peak timing

right, what goes unexplained is the

fact that production peak is higher

than expected. Even the curve used

is the one made by Hubbert for the

higher estimate mentioned in the

previous section. Laherrere in his

paper uses a completely different

hubbert curve whose peak is at 3.5

Gb. This curve implies a drop in the

decade before and after the peak

while starting to witness a rise in the

90s.The reasons given for the drops Figure 3.5 The original hubbert curve with an ultimate of 200 Gb

compared with the actual data (US)

12

on both sides is prorationing and

economic respectively while attributing

the rise to an increase in production of

NGLs. The ability of a state to limit oil

and gas production, usually based on

market demand is called prorationing.[7]

It usually involves limiting production

proportionally to a fraction of the total

capacity of each producer. This happens

when the production far exceeds the

demand. Therefore, the government

maintains an artificially high price and

allocates production to suppliers

according to their production capacity.

This in a sense protects the oil industry.

In absence of prorationing, the

incentive would be there for the

supplier to reduce prices to gain

advantage over his competitors. This

would lead to a swipe in profits for the

companies. Prorationing logically

accompanies a drop in production. This

seems right in Laherrere’s analysis.

However, Hubbert in his paper made

clear he was not including NGLs. This seems to be a flaw in Laherrere’s analysis according

to me. I think the increase in oil production in the late 90s should be attributable to improved

recovery practices, as mentioned by Hirsch in his report.[4]

Further, Laherrere suggests that there is a link between production and discoveries. This

seems logical as there would be a lag corresponding to the setup of equipment before drilling.

The time lag for the US is seen to be at 33 years.

3.2 Former Soviet Union (FSU)

In the Soviet Union’s case, it was reported

in 1980 (before the peak) that they had

200 Gb of ultimate reserves. The inflection

point occurs at 1975. The hubbert curve

for an ultimate of 200 Gb then shows the

peak to be near the end of the 80s.

However, the ultimate has been shown to

be overstated, because the peak arrives

around the mid-80s and the production

Figure 3.6 Laherrere's hubbert curve with the actual data (US) [5]

Figure 3.7 Matching of shifted discovery and production curves (US) [5]

Figure 3.8 Former Soviet Union's production data modelled with hubbert curves having different ultimates

[5]

13

rate is also much lower. In fact the Hubert

curve with an ultimate of 170 Gb is shown

to be a better fit. Clearly, there is a

misreporting of reserves, which the

hubbert peak theory has helped identify.

The reduction in production after the peak

is due the disintegration of the Soviet

Union.

On the right side, as is clearly seen, the

production – discovery is also valid,

however this time with a lag of only 17

years.

3.3 World

In the case of the world, Hubbert never had a chance of getting it right. This was because of

the formation of OPEC. OPEC (Organization of Petroleum Exporting Countries) is an

intergovernmental organization of 12 oil-producing countries, formed to protect the interests

of its members’ petroleum industry.[8]

It operates on the principle of prorationing. Due to

political reasons, in 1973, OPEC reduced production of oil and this causes a significant

tremor in the production curve. In fact, Hubbert’s estimation of 1250 Gb for the ultimate is

also proven to be wrong. From 1955, things have changed a lot. The convention for

indicating reserves has changed. The new system[9]

used has three categories for reserves:

Proven reserves, also called 1P. These reserves have more than 90% probability of

being produced

Probable reserves have more than 50%, but less than 90% probability of being

produced. Along with proven reserves, referred to as 2P

Possible reserves have more that 10%, but less than 50% probability of being

produced. Along with 2P, referred to as 3P

The figure on the right gives the oil data for the world. The discovery curve shifted 30 years

satisfies the production curve up to

the oil crisis in 1973. To find the

ultimate reserves, the cumulative

discovery data was sought. This

indicates the 2P reserves. It turns out

to be 1800 Gb. It’s unclear how the

data for the ultimate i.e. 2000 Gb is

obtained. 200 Gb for the NGLs is

included, but the source has not been

mentioned.

Figure 3.10 Oil production and discovery curves for the world[5]

Figure 3.9 Matching of shifted discovery and production curves (FSU)

[5]

14

However, there is a bigger snag. Unlike in the previous cases where the production curve was

modelled using a single cycle, the curve here has production rates above the initial ‘peak’. In

this case, Laherrere suggests modelling the production curve with more than one hubbert

cycle. The total production H1 with an ultimate of 150 Gb to correspond with a peak at 1979,

H2 with an ultimate of 1850 Gb. Interestingly, a third curve H3 is added to denote

unconventional oil, though it did not have a significant contribution then. Its ultimate is 750

Gb. This modified model satisfies the production curve well until 2000. Using this, the peak

is predicted to be near 2010.

The method of using multiple curves is an interesting work-around and has inspired further

paper(s).[10]

The production-discovery link is a very good for future production forecasting,

unless as Laherrere rightly mentions, a new major discovery cycle has started. However, we

can see that the production does not follow the hubbert curve strictly, even in the US case,

which is championed as a major success for the peak theory. In any case, it is important to

understand its limitations.

15

4. CONCLUSION

We’ve seen in all cases, the application of the hubbert curve can explain more or less the

production curves. However flaws are also pointed out. E.g. it fails to take into political

reasons. The OPEC not only delays the peak, but renders the one-peak hubbert obsolete.

Prorationing, as was the case in the US caused the production curve to fall beneath levels

suggested by Hubbert. Also, improvements in technology cannot be taken into account by the

curve, as the 90s production rise in the US suggests. In terms of applicability on the world,

unconventional oil has not been taken into account. While Laherrere does this, there are

doubts over whether the hubbert curve will be followed in its case, especially as its industry

is in its infancy. Data clarity is also a serious issue as Laherrere fails to acknowledge the

exclusion of NGLs by Hubbert. G. Maggio et al(2009)[10]

outline the difficulty in

understanding the exact definition of oil considered. Different data sources (BP, ENI EIA)

have different definitions of oil and this furthers the problem in creating an accurate hubbert

curve.

On the other hand, the peak theory has helped uncovering the true ultimate reserve of oil in

the USSR and despite its failing to take into account the political issues, identified the US

peak accurately. While the misreporting in the case of USSR was found out, it was only

because the production was past the inflection point. Misreporting happens at various levels

and it will be difficult to take this into account.

In fact, there is heavy debate over the issue of peak oil. CERA, a consulting company in the

United States has suggested that peak is very much a hyped issue and that we are actually

heading towards a plateau (as opposed to peak) of oil production, as unconventional oil along

with improved recovery methods and reserve growth (unaccounted in the hubbert curve) will

balance out the expected decline.[11]

On the other hand, there are suggestions that peak has

already been reached.[12]

The Hirsch report was created by request for the US Department of Energy and published in

February 2005. It examined the time frame for the occurrence of peak oil, the necessary

mitigating actions, and their likely impacts. It suggests that while the time of peak may wary,

the peak is very much real and that mitigation measures must start 20 years before peak to

minimize the impact of reduction in production along with the increase in demand.

In conclusion, for all its apparent failings, the peak theory must be given credit for what it has

done. It has also put into perspective the fact that oil will peak, which wasn’t the case when

the paper was published.[13]

While it may ultimately fail, it has created a lasting interest into

this issue

16

5. REFERENCES

1. http://web.archive.org/web/20070312054557/http%3A//oaspub.epa.gov/trs/trs_proc_q

ry.navigate_term%3Fp_term_id%3D7068%26p_term_cd%3DTERM . EPA.

Archived from the original on March 12, 2007. Retrieved 2007-01-18.

2. M.K. Hubbert, Nuclear Energy and the Fossil Fuels. Presented before the Spring

Meeting of the Southern District, American Petroleum Institute, Plaza Hotel, San

Antonio, Texas, March 7–8-9, 1956

3. http://www.oilandgasiq.com/glossary/ Retrieved on April 12, 2012

4. Hirsch, R.L., 2005. The inevitable peaking of world oil production. The Atlantic

Council of the United States.

5. Laherrere, J.H.,2000. Hubbert’s curve : its strengths and weaknesses. Version

proposed to Oil and Gas Journal on Feb 18, 2000

6. http://watd.wuthering-heights.co.uk/mainpages/hubbert.html. Graph showing how

number of oil well approximate the hubbert curve. Retrieved on April 12, 2012

7. https://www.tsl.state.tx.us/exhibits/railroad/glossary.html Texas State Library and

Archives Commission. Definition for prorationing. Retrieved on April 12, 2012

8. http://www.opec.org/opec_web/static_files_project/media/downloads/publications/OS

.pdf OPEC statute. Retrieved on April 12, 2012

9. http://www.spe.org/industry/docs/GlossaryPetroleumReserves-

ResourcesDefinitions_2005.pdf Society of Petroleum Engineers. Definition of reserve

categories. Retrieved on April 12, 2012

10. G. Maggio, G. Cacciola, 2009. A variant of Hubbert curve for oil production forecasts

11. Peter Jackson, 2006. Why the “Peak Oil” Theory falls down. myths, legends and

future of Oil Resources. Retrievable from

http://www.liv.ac.uk/~jan/teaching/References/Jackson%202006.pdf

12. J Murray, David King 26 January, 2012. Oil’s tipping point has passed. Published in

Vol 481, Nature.