How Dispositional Social Risk-Seeking Promotes … · How Dispositional Social Risk-Seeking...

-

Upload

truongdang -

Category

Documents

-

view

218 -

download

0

Transcript of How Dispositional Social Risk-Seeking Promotes … · How Dispositional Social Risk-Seeking...

How Dispositional Social Risk-Seeking Promotes Trusting Strangers:Evidence Based on Brain Potentials and Neural Oscillations

Yiwen WangFuzhou University

Yiming JingFuzhou University and University of Oklahoma

Zhen ZhangFuzhou University

Chongde LinBeijing Normal University

Emilio A. ValadezUniversity of Delaware

Trust is a risky social decision because betrayal may occur. It’s not clear how individual differences insocial risk-seeking propensity modulate brain processes of trusting strangers. We examined event-relatedpotentials and time-frequency power to investigate this question while 40 participants played the one-shottrust game. Twenty high social risk-seekers (HSR) and 20 low social risk-seekers (LSR) made trustingor distrusting decisions regarding unknown trustees while their electroencephalogram activity wasrecorded. At the decision-making stage, HSR participants exhibited a larger N2 and increased � powerfollowing distrusting decisions than trusting decisions, suggesting greater cognitive control exerted todistrust. By contrast, no such N2 and � differences were found for LSR participants. At the outcomeevaluation stage, LSR participants exhibited a more negative-going difference wave between lossfeedback-related negativity (FRN) and gain FRN (dFRN) and increased � power (following lossescompared to gains) than did HSR participants, indicating enhanced risk sensitivity of LSR people. Ourfindings provide insights into the mechanism by which social risk-taking facilitates trusting strangers.The results also shed light on the temporal course of brain activity involved in trust decision-making andoutcome evaluation, as well as how individual differences modulate brain dynamics of trusting strangers.

Keywords: social risk-taking, trust, N2, FRN, time-frequency analysis

Supplemental materials: http://dx.doi.org/10.1037/xge0000328.supp

Modern societies thrive on group-bridging cooperation such asglobal trading and civic association (Fukuyama, 1995; Putnam,2000). However, intergroup cooperation is susceptible to oppor-tunism and ingroup bias (Yamagishi, 2011, ch.1–3). Psychologicallubricants easing intergroup suspicion thus become vital for eco-nomic and social exchanges across group boundaries. From thisperspective, it is not surprising to witness a rapidly growing bodyof trust research across different disciplines of social sciences (e.g.,economics, sociology, political science, and psychology); thesestudies have highlighted that trust of unfamiliar people—a will-ingness to rely on strangers (Thielmann & Hilbig, 2015)—gener-

ates various economic, social, and political payoffs for modernsocieties (e.g., Knack & Keefer, 1997; Newton, 2001).

What motivates people to trust and cooperate with unknownothers? Previous research has focused on the trustor’s expectationof strangers’ benevolence (for a review, see Balliet & Van Lange,2013), the trustor’s prosociality (e.g., Cox, 2004; Yamagishi et al.,2015), and social norms of cooperation (e.g., Dunning, Anderson,Schlösser, Ehlebracht, & Fetchenhauer, 2014; Schlösser, Mensch-ing, Dunning, & Fetchenhauer, 2015). On the other hand, eventhough trust by definition entails risky social interdependence (Das& Teng, 2004; Rousseau, Sitkin, Burt, & Camerer, 1998; Thiel-

Yiwen Wang, Institute of Psychological and Cognitive Sciences, FuzhouUniversity; Yiming Jing, Institute of Psychological and Cognitive Sci-ences, Fuzhou University, and Institute for US-China Issues, University ofOklahoma; Zhen Zhang, Institute of Psychological and Cognitive Sciences,Fuzhou University; Chongde Lin, Institute of Developmental Psychology,Beijing Normal University; Emilio A. Valadez, Psychological and BrainSciences, University of Delaware.

Yiwen Wang and Yiming Jing contributed equally to this work andshould be considered co-first authors. This research was supported by theNational Natural Science Foundation of China [31371045], the Program

for New Century Excellent Talents in Universities [NCET-11-1065], andthe MOE Project of Key Research Institute of Humanities and SocialSciences at Universities [12JJD190004]. Part of this work was presented atthe 2016 Joint China-Dutch Workshop on Game Theory and Applicationsat Fuzhou University, Fuzhou, China (November 2016), and the 2016International Conference on Neuromanagement and Neuroeconomics atZhejiang University, Hangzhou, China (November 2016).

Correspondence concerning this article should be addressed to ZhenZhang, 2 Xueyuan Road Fuzhou, Fujian, China 350116, or to ChongdeLin, 19 Xinjiekouwai Street, Haidian, Beijing, China 100875. E-mail:[email protected] or [email protected]

Thi

sdo

cum

ent

isco

pyri

ghte

dby

the

Am

eric

anPs

ycho

logi

cal

Ass

ocia

tion

oron

eof

itsal

lied

publ

ishe

rs.

Thi

sar

ticle

isin

tend

edso

lely

for

the

pers

onal

use

ofth

ein

divi

dual

user

and

isno

tto

bedi

ssem

inat

edbr

oadl

y.

Journal of Experimental Psychology: General © 2017 American Psychological Association2017, Vol. 0, No. 999, 000 0096-3445/17/$12.00 http://dx.doi.org/10.1037/xge0000328

1

AQ: 1

AQ: au

AQ: 2

AQ: 25

tapraid5/zfr-xge/zfr-xge/zfr99917/zfr2921d17z xppws S�1 5/12/17 1:31 Art: 2016-2311APA NLM

mann & Hilbig, 2015), the linkage between people’s risk propen-sities (risk-seeking or risk-averse) and stranger trust has not beenconsistently found in previous research. This issue likely arisesfrom how risk attitudes are conceptualized and measured. Strangertrust was once understood as a special case of financial risk-taking,but a growing body of research has suggested that risks involvedin trust are inherently social and that trust of unfamiliar others isbetter linked with the preference for taking social risks thanmaking financial gambles (e.g., Aimone & Houser, 2012; Bohnet& Zeckhauser, 2004; Fehr, 2009; Lauharatanahirun, Christopou-los, & King-Casas, 2012).

In the current study, we investigated brain processes by whichan individual’s social risk-taking propensity is translated intotrusting unknown people. The mechanisms by which social risk-seeking facilitates trust has not been well understood. Moreover,limited brain research has examined trust between strangers (e.g.,Wang, Zhang, Jing, Valadez, & Simons, 2016). And how individ-ual differences (e.g., in social risk-taking) may modulate neuralprocesses of trusting strangers has yet to be fully explored. Weaddressed these issues by looking into electrical brain activity ofhigh social-risk seekers and low social-risk seekers while theyplayed the role of the trustor in a one-shot trust game (Berg,Dickhaut, & McCabe, 1995) facing different unfamiliar trustees.Specifically, we recorded their electroencephalograms (EEGs)which have high temporal resolution for capturing brain activityassociated with trust decision-making and outcome evaluation.

Social Risk-Taking and Stranger Trust

Trusting strangers is a risky decision, given that (a) strangers arenot familiar with each other’s reputation and (b) the enforcementof cooperation is weaker between strangers than between morefamiliar people (Yamagishi, 2011, ch.1–3). From the economicallyrational point of view, trusting strangers is similar to taking finan-cial gambles; trustors render themselves vulnerable to chance orluck in hope of a monetary gain from trustees’ cooperation. Thisrational economic model predicts that people’s tolerance of finan-cial risks should influence their decisions to trust unfamiliarothers. However, empirical findings are mixed. Whereas somestudies have confirmed that people who preferred to make riskyfinancial decisions (e.g., lottery-based gambles) were also morelikely to entrust strangers with money (e.g., Lönnqvist,Verkasalo, Walkowitz, & Wichardt, 2015; Sapienza, Toldra-Simats, & Zingales, 2013), other studies found no statisticalrelationship between financial risk attitudes and the decision totrust strangers (e.g., Dunning et al., 2014; Eckel & Wilson,2004; Houser, Schunk, & Winter, 2010).

On the other hand, more and more researchers have begun toargue that risks involved in trusting are psychologically differentfrom financial risks. In particular, Bohnet and her colleagues foundthat the average person was less willing to take risks for beingtrusting than for financial gambling, an effect known as betrayalaversion (Bohnet & Zeckhauser, 2004; Bohnet, Greig, Herrmann,& Zeckhauser, 2008). It has been suggested that the fear of beingcheated underlies betrayal aversion; people feel worse about lossesincurred by another person’s intentional betrayal than losses de-termined by random and impersonal mechanisms, so they are moremotivated to avoid social risks (Aimone & Houser, 2012; Aimone,Houser, & Weber, 2014). Indeed, previous research has found that

oxytocin, a neuropeptide, increased participants’ willingness totrust strangers but did not change their willingness to take nonso-cial risks (Kosfeld, Heinrichs, Zak, Fischbacher, & Fehr, 2005); ofimportance, the mechanism by which oxytocin promotes trustappeared to have to do with deactivating brain circuits (e.g.,amygdala) involved in fear processing (Baumgartner, Heinrichs,Vonlanthen, Fischbacher, & Fehr, 2008). These findings stronglysuggest that social risk-taking and financial risk-taking have somefundamental distinction and that stranger trust may be better un-derstood in the context of social risk-taking (see also Fehr, 2009).

Brain Correlates of Stranger Trust: Social Risk-Taking Disposition as a Potential Modulator

The current study was motivated by the question of whetherpeople’s social-risk preferences modulate their brain processes ofdecision-making and outcome evaluation in relation to strangertrust. We define social risk-seeking as the willingness to engage inactivities that have uncertain consequences (positive or negative)for one’s social well-being. Recent research has indicated thatsocial risk-seeking propensity is a moderately stable personalitytrait over the life span and is positively associated with one’s levelof stranger trust (Josef et al., 2016). Dispositional social risk-seeking probably alleviates the fear of being betrayed by unfamil-iar people and promotes the desire to explore positive socialexperiences outside the safe ingroup (Thielmann & Hilbig, 2015;Yamagishi, 2011, ch.1–3). From this perspective, high versus lowsocial risk-seekers may also differ in how their brains processstranger trust.

Event-Related Potential (ERP) Components

Past studies have employed diverse techniques (e.g., functionalbrain imaging, genetic analysis) to explore neural correlates oftrust (for reviews, see Riedl & Javor, 2012; Wang et al., 2016).With respect to brain correlates of current interest, our previouswork (Wang et al., 2016) using the ERP technique has found thattrustors in general exhibited a larger N2 ERP component (peakingat 250– 350 ms after the onset) following the decision to distrustthan to trust strangers. The N2 is a frontocentral distributed com-ponent whose neural generator is likely to be anterior cingulatecortex (Yeung, Botvinick, & Cohen, 2004). Evidence from animaland human research has linked a frontal-midline N2 with premotorcognitive processes involving conflict monitoring or response in-hibition (for a review, see Huster, Enriquez-Geppert, Lavallee,Falkenstein, & Herrmann, 2013). In particular, a greater N2 isoften associated with increased attention or cognitive control incognitively demanding tasks (e.g., the go-no go task and theflanker task; for a review, see Folstein & Van Petten, 2008).

Larger N2 associated with distrusting strangers, as found in ourprevious work (Wang et al., 2016), may suggest that the averageperson exerts greater cognitive control in relation to distrust (vs.trust), probably because distrust deviates from conventional normsof cooperation (Dunning et al., 2014; Schlösser et al., 2015). Weexpected that this N2 effect (i.e., greater N2 following strangerdistrust than stranger trust) would be more pronounced for highsocial risk-seekers than for low social risk-seekers (Hypothesis 1),a prediction reflecting stronger propensities for high social risk-seekers to take social risks and trust unfamiliar people.

Thi

sdo

cum

ent

isco

pyri

ghte

dby

the

Am

eric

anPs

ycho

logi

cal

Ass

ocia

tion

oron

eof

itsal

lied

publ

ishe

rs.

Thi

sar

ticle

isin

tend

edso

lely

for

the

pers

onal

use

ofth

ein

divi

dual

user

and

isno

tto

bedi

ssem

inat

edbr

oadl

y.

2 WANG, JING, ZHANG, LIN, AND VALADEZ

AQ: 3

AQ: 4

AQ: 5

AQ: 6

tapraid5/zfr-xge/zfr-xge/zfr99917/zfr2921d17z xppws S�1 5/12/17 1:31 Art: 2016-2311APA NLM

On the other hand, our previous research (Wang et al., 2016)revealed that loss feedback for being trusting (i.e., being exploitedby strangers) elicited a more negative-going feedback-related neg-ativity (FRN; peaking at 200-350 ms after feedback onset) than didgain feedback (i.e., being reciprocated by strangers). The FRN is afrontocentral negativity that appears to be generated in the anteriorcingulate cortex (Gehring & Willoughby, 2002) and in the striatum(Foti, Weinberg, Dien, & Hajcak, 2011). A large body of ERPresearch has linked FRN with processing of reward predictionerror (for a review, see Sambrook & Goslin, 2015). Convention-ally, the FRN is interpreted as a negativity driven by unexpectederrors or losses (Holroyd & Coles, 2002; Sambrook & Goslin,2015), but recent evidence has suggested that FRN might actuallyreflect a reward positivity that is reduced or absent when expectedreward is not received (Proudfit, 2015).

Greater loss-FRN found in our previous research (Wang et al.,2016) may suggest that trustors typically feel “surprised” (i.e.,expectation violation) when strangers take advantage of their trust.We expected that this FRN effect (i.e., more negative-going FRNfollowing loss feedback than gain feedback) would be stronger forlow social risk-seekers than for high social risk-seekers, as indi-cated by a larger difference wave between loss FRN and gain FRN(dFRN; Hypothesis 2). People with greater social risk aversionmay experience unexpected losses of being betrayed more nega-tively (Thielmann & Hilbig, 2015) and thus exhibit a larger dFRNin response to reward prediction errors (e.g., Zheng & Liu, 2015).

Time-Frequency Power Components

We utilized, in addition to ERP analysis, time-frequency anal-ysis of single-trial EEG data. It has been argued that the latter EEGtechnique, measuring energy changes in synchrony of the under-lying neuronal populations at different frequencies, may provideinformation that otherwise is lost in ERP averaging (Cohen, Elger,& Ranganath, 2007; Pfurtscheller & Lopes da Silva, 1999). Withrespect to brain processes of current interest, previous research hasindicated that activity in the � band (about 12–30 Hz) may beassociated with cognitive control (for reviews, see Aron, 2011;Huster et al., 2013). For instance, inhibitory responses in the go–nogo task were linked with increased power of � band activity in theright inferior frontal gyrus and the presupplementary motor area(Swann et al., 2012).

On the other hand, previous research has also indicated that inreward learning tasks midfrontal � band (about 4–8 Hz) activitywas larger for negative feedback compared to positive feedback(Cavanagh & Frank, 2014; Cavanagh, Zambrano-Vazquez, & Al-len, 2012; Cohen et al., 2007). Midfrontal � band oscillations arepossibly generated in anterior cingulate cortex (Christie & Tata,2009) and reflect error-monitoring-related brain activity (for areview, see Cavanagh & Shackman, 2015). In this study, we werealso interested in how ERP and time-frequency analyses corrobo-rate each other for understanding social risk-taking and strangertrust.

Method

Participants

Forty-one Chinese undergraduates participated in this experi-ment; one was excluded because of excessive artifacts in the

electrophysiological recordings. As a result, 40 participants (50%male) were included in the analysis, their ages ranging from 18 to22 years (Mage � 19.73 years, SD � 1.01).

Participants were selected from a large undergraduate partici-pant pool (N � 429, 54% male, Mage � 19.50 years) in which eachindividual’s self-reported, social risk-taking propensity was as-sessed with the Domain Specific Risk-Taking Scale (DOSPERT;Blais & Weber, 2006). Twenty of the 40 participants (60% male;Mage � 19.75 years, SD � 1.07) were classified as high socialrisk-seekers whose scores fell within the top 20% of the wholeparticipant pool sample, whereas the remaining 20 participants(40% male; Mage � 19.70 years, SD � .98) were classified as lowsocial risk-seekers whose scores fell within the bottom 20%. Wedecided the sample size of 20 for each group was sufficient, giventhat a priori power analysis suggested that 17 participants pergroup would allow detection of a large effect (Cohen’s d � 1.00)1

with .80 power and .05 Type I error rate. Additionally, previousERP research examining risk propensities had a similar samplesize per condition (e.g., Zheng & Liu, 2015).

All participants had normal or corrected-to-normal vision. Nonehad a history of neurological or psychiatric disorders. Participantsgave written consent for participation. They also received mone-tary compensation. The research protocol was approved by thelocal Ethics Committee and was in compliance with ethical stan-dards of the American Psychological Association.

Self-Reported Survey

We administrated, as the basis for participant selection, a self-reported survey in our undergraduate participant pool prior to theEEG experiment.

Domain-Specific Risk-Taking Scale (DOSPERT; Blais &Weber, 2006). This scale was developed to assess people’sself-reported tendencies to engage in risky activities in fivedomains, including ethical, financial, health-safety, social, andrecreational decisions. Previous research has suggested thatDOSPERT scores are relatively stable over time (e.g., Drichoutis& Vassilopoulos, 2016), indicating that the DOSPERT Scale cap-tures dispositional characteristics. More important, the DOSPERTscale’s social and financial subscales have discriminative validity;for example, it has been found that problem-gambling tendencieswere positively associated with risk-seeking propensities in thescale’s financial domain rather than in its social domain (Mishra,Lalumière, & Williams, 2017), whereas perceived relational mo-bility (i.e., easiness to form new and terminate old relationships)was positively associated with risk-seeking propensities in thescale’s social domain rather than in its financial domain (Li,Hamamura, & Adams, 2016). For our aims, we administered onlythe social and financial subscales in the survey battery. Participantswere asked to indicate the likelihood of engaging in six riskyactivities in the social domain and six risky activities in thefinancial domain on a 7-point scale ranging from 1 (Extremelyunlikely) to 7 (Extremely likely). The English items were translatedinto Chinese by two bilingual researchers.

Cronbach’s alphas were .62 for the social subscale and .61 forthe financial subscale in the whole participant pool sample (N �

1 Our previous work (Wang, Zhang, Jing, Valadez, & Simons, 2016)obtained a large effect size (�p

2 � .20) for key ERP effects.

Thi

sdo

cum

ent

isco

pyri

ghte

dby

the

Am

eric

anPs

ycho

logi

cal

Ass

ocia

tion

oron

eof

itsal

lied

publ

ishe

rs.

Thi

sar

ticle

isin

tend

edso

lely

for

the

pers

onal

use

ofth

ein

divi

dual

user

and

isno

tto

bedi

ssem

inat

edbr

oadl

y.

3TRUST, SOCIAL RISK-SEEKING, AND EEG

AQ: 7

Fn1

tapraid5/zfr-xge/zfr-xge/zfr99917/zfr2921d17z xppws S�1 5/12/17 1:31 Art: 2016-2311APA NLM

429). These statistics were below the conventional threshold of .70and raised concern about the scale’s internal consistency. Weconducted a confirmatory factor analysis (CFA) testing whetheritems form two factors as prescribed by Blais and Weber (2006).The original measurement model did not fit our data, so we revisedthe model based on modification indices and factor loadings. Therevised two-factor model fit the data well, �2 � 39.92, df � 19,�2/df � 2.10, p � .003, comparative fit index (CFI) � .960,root-mean-square error of approximation (RMSEA) � .051, stan-dardized root-mean-square residual (SRMR) � .048 (the recom-mended cutoffs are CFI � .90, RMSEA � .10, and SRMR � .80;Hooper, Coughlan, & Mullen, 2008; Hu & Bentler, 1999) and wascross-validated by splitting the whole sample into two randomsubsets. Specifically, the revised scale retained five of the six itemsfor the social subscale and three of the six items for the financialsubscale (for the revised scale, see the Appendix). Cronbach’salphas were .62 for the revised social subscale and .75 for therevised financial subscale.2 In the subsequent analyses, we usedscores averaged across items for each revised subscale.3

Other measures. We also assessed other personality-likevariables, including empathetic tendencies and social value orien-tations, because individual differences in these variables mayinfluence trust and cooperation. Besides, we assessed participants’risk thresholds for being trusting in a hypothetic one-shot trustgame. However, our social risk-seeking groups did not signifi-cantly differ on these variables (for details of the measures andgroup comparisons, see the online supplemental materials).

Behavioral Task

We utilized a modified version of Berg et al.’s (1995) one-shottrust game as the behavioral task. This is the same task describedin our previous work (Wang et al., 2016). Participants played therole of the trustor with different trustees. At the beginning of eachround, both the trustor and the trustee receive 10 game points as aninitial endowment. The trustor has two choices: to send all 10points to the trustee or to keep this endowment. If no point is sent,this round winds up with both players receiving 10 points. If all theendowment is sent, the points sent will be tripled to 30 points andthe trustee will then decide how to divide the pie (30 pointsreceived plus 10 points initial endowment). The trustee has twochoices as well: to divide the 40 points equally (the trustor receives20 points) or to keep all 40 points (the trustor receives nothing). Inthis risky interdependent situation, the trustor’s decision to sendpoints is the behavioral operationalization of trust (i.e., the will-ingness to be vulnerable to another party; Mayer, Davis, & Schoor-man, 1995).4

We instructed participants that in each round they would face adifferent anonymous trustee and that these trustees were selectedfrom a large and representative adult participant pool (N � 400).Participants were told that the experimenter interviewed thesetrustees before the experiment and recorded their choices of send-ing back 20 points or nothing if being entrusted with 30 points.Participants believed that the computer would randomly select oneof these choices to respond to their investments in each round. Inreality, however, the computer’s responses were based on a pre-programed procedure (fixed across all participants) that randomlyreciprocated participants’ trusting decisions approximately 50% ofthe time. Game points had monetary significance, and monetary

incentives were controlled between participants (see the onlinesupplemental materials).

Stimuli and Procedure

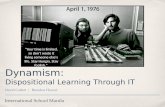

Participants completed 150 rounds of the trust game decisionswhile their brain potentials were recorded using electroencephalo-grams (EEGs). In each round, as illustrated in Figure 1, partici-pants first see a picture showing possible outcomes for theirtrust-distrust decision for 1,500 ms. After a variable 800- to1,000-ms fixation cross, a picture displays decision options in thecenter of the screen for 2,000 ms; participants choose either tokeep (cued by the number 10) or to send (cued by the number 30)the initial endowment by using their index finger to press either the1 or 3 key on the keyboard. The position of keeping (distrust) andsending (trust) is counterbalanced between subjects. If participantsfail to respond within 2,000 ms, a new trial is provided for them toinput a valid response. Following a variable 800- to 1,200-msinterval with a black screen, the outcome feedback of participants’current trial is displayed for 1,200 ms. Last, a blank screen isdisplayed for 2,000 ms as an intertrial interval (ITI). To familiarizeparticipants with this procedure, we provided 10 trials of practicebefore the formal task.

EEG Recording and ERP Analysis

Brain electric activity was measured from 64 channels using amodified 10- to 20-system electrode cap (Neuroscan Inc.). All EEGswere continuously sampled at 1,000 Hz with a left mastoid referenceand a forehead ground and rereferenced offline to an averaged refer-ence derivation by mathematically combining the left and right mas-toid. Vertical electrooculography (EOG) activity was recorded withelectrodes placed above and below the left eye; horizontal EOGactivity was recorded with electrodes placed on the outboard of botheyes. Interelectrode impedance was below 5 k. EEG and EOG wererecorded using a .05- to 100-Hz bandpass filter and continuouslysampled at 1,000 Hz/channel for off-line analysis. Eyeblink artifactswere removed using Scan software (Semlich, Anderer, Schuster, &Presslich, 1986). All trials in which EEG voltages exceeded a thresh-old of 75 �V during recording were excluded from analyses. Wealso considered the fact that participants made more trusting decisionsthan distrusting decisions; the number of trusting and distrusting trialswas carefully matched (for details, see the online supplemental ma-terials).

2 Although alpha for the revised social subscale was still below .70, itshould not be interpreted as a strong indication of a lack of internalconsistency or item homogeneity. This is because (a) CFA has confirmedthat this subscale’s items hang together and (b) alpha can be lower if abroader construct is measured (Peters, 2014; Singelis, Triandis, Bhawuk, &Gelfand, 1995).

3 At the stage of participant selection, we identified and selected highand low social risk-seekers based on the original DOSPERT social sub-scale. The correlation between individual scores of the original subscaleand of the revised subscale was nearly perfect (r � .99). Scale revisionshould have limited impact on our participant selection.

4 This behavioral operationalization does not assume that one’s expec-tation and behavior for being trusting have to go together. In fact, peoplecan be quite cynical about another person’s trustworthiness but still makethemselves vulnerable to that person in accordance with moral obligations(for more detailed discussion, see Schlösser, Mensching, Dunning, &Fetchenhauer, 2015).

Thi

sdo

cum

ent

isco

pyri

ghte

dby

the

Am

eric

anPs

ycho

logi

cal

Ass

ocia

tion

oron

eof

itsal

lied

publ

ishe

rs.

Thi

sar

ticle

isin

tend

edso

lely

for

the

pers

onal

use

ofth

ein

divi

dual

user

and

isno

tto

bedi

ssem

inat

edbr

oadl

y.

4 WANG, JING, ZHANG, LIN, AND VALADEZ

AQ: 8

Fn2

Fn3

Fn4

AQ: 9

F1

AQ: 10

tapraid5/zfr-xge/zfr-xge/zfr99917/zfr2921d17z xppws S�1 5/12/17 1:31 Art: 2016-2311APA NLM

At the decision-making stage, epochs were extracted from 200ms prestimulus to 550 ms poststimulus (see Figure 2A). At theoutcome evaluation stage, epochs were extracted from 200 msprestimulus to 1,000 ms poststimulus (see Figure 3A). At eachstage, ERPs for trusting and distrusting decisions were then con-structed separately, averaging trials of each condition. For allERPs, the baseline period was 200 ms prestimulus to stimulusonset. We used five electrodes (Fz/FCz/Cz/CPz/Pz) to yield ananteriority factor (frontal, frontocentral, central, centroparietal,parietal; Wang et al., 2013, 2017).

Time-Frequency Analysis

The epoching of continuous EEG data and artifact correction wereperformed using Scan software separately for the decision-makingstage and feedback stage. Single-trial epochs were extracted from1,000 ms before to 2,000 ms after the stimulus. The raw EEG wasdown-sampled to 500 Hz. A Morlet-based wavelet transform proce-dure implemented in EEGLAB (Version 13.4.4b) was employed(3-35 Hz), providing a continuous estimate of power of a givenfrequency band as a function of time (time-frequency power) be-tween �1,000 ms and 2,000 ms (Delorme & Makeig, 2004). Time-frequency power was computed on the wavelet-transformed epochsfor each condition at each time point and each wavelet frequency toyield time-frequency maps (Makeig, Debener, Onton, & Delorme,2004). Power values were normalized with respect to a �400-to �200-ms prestimulus baseline and converted to decibels [10 log(�V2)]; for other details of our time-frequency analyses, see thecaption for Figure 4).

Results

Individual Differences in Risk-Taking Propensities

Table 1 displays descriptive statistics for self-reported risk-taking propensities. Confirming our participant selection, high and

low social risk-seekers differed largely in their risk-taking propen-sities in the social domain, t(38) � 17.21, p � .001, d � 5.46, 95%confidence interval (CI) for mean differences [2.72, 3.44]. On theother hand, these two groups of participants also had a smallerdifference in their risk-taking propensities in the financial domain,t(38) � �2.38, p � .022, d � .75, 95% CI for mean differences[�.14, �1.76]; both high and low social risk-seekers were rela-tively low on financial risk-seeking, but low social risk-seekerswere more willing to take financial risks than were high socialrisk-seekers. Last, high and low social risk-seekers in this sampledid not differ on their empathetic tendencies, social value orien-tations, and risk thresholds (maximum accepted amounts of risks)for being trusting (see the online supplemental materials).

Behavioral Responses in the Trust Game

Cross-sectional analysis. Across all trials of the trust game,average rates of making trusting choices were 67.47% (95% CI[63.01, 72.74]) for high social risk-seekers and 59.07% (95% CI[54.16, 62.84]) for low social risk-seekers (see Table 1). Asexpected, an independent-sample t test revealed that high socialrisk-seekers had higher trust rates than did low social risk-seekers,t(38) � 2.50, p � .017, d � .79, 95% CI for mean differences[1.61, 15.19]; of importance, even for low social risk-seekers, theirtrust rates were significantly greater than chance (50%), t(19) �3.90, p � .001, d � 1.79, 95% CI for mean differences [4.20,13.93].

On the other hand, high and low social risk-seekers did notdiffer on their reaction times (RTs) for both trusting decisions,t(38) � �.86, p � .250, d � .27, 95% CI for mean differences[�166.97, 67.72], and distrusting decisions, t(38) � �1.29, p �.206, d � .41, 95% CI for mean differences [�181.60, 40.45] (seeTable 1 for descriptive statistics).

Trial-by-trial analysis. We instructed participants to be-lieve that trustees were different persons. To test the effective-

Figure 1. Time sequence of stimuli in each trial of the decision task. Positions of 10 (distrust) and 30 (trust)for decision choices were counterbalanced between participants. 0 was loss feedback, 10 was neutral feedback,and 20 was gain feedback. This figure was modified from the one used in our previous publication (Wang et al.,2016). ISI � interstimulus interval; ITI � intertrial interval. See the online article for the color version of thisfigure.

Thi

sdo

cum

ent

isco

pyri

ghte

dby

the

Am

eric

anPs

ycho

logi

cal

Ass

ocia

tion

oron

eof

itsal

lied

publ

ishe

rs.

Thi

sar

ticle

isin

tend

edso

lely

for

the

pers

onal

use

ofth

ein

divi

dual

user

and

isno

tto

bedi

ssem

inat

edbr

oadl

y.

5TRUST, SOCIAL RISK-SEEKING, AND EEG

F2

F3

F4,AQ:11

T1,AQ:12

O CN OL LI ON RE

tapraid5/zfr-xge/zfr-xge/zfr99917/zfr2921d17z xppws S�1 5/12/17 1:31 Art: 2016-2311APA NLM

ness of this instruction, we did a trial-by-trial analysis exam-ining whether participants’ trusting decisions were influencedby the prior feedback (i.e., the trustee’s reputation effect). Atwo-level hierarchical linear modeling (HLM; Raudenbush &Bryk, 2002; HLM7 software: Raudenbush, Bryk, Cheong, Con-gdon, & du Toit, 2011) analysis was conducted such thattrial-by-trial responses were nested within each participant.Because the outcome (i.e., the decision to trust or distrust) wasa binary variable, hierarchical generalized linear modeling wasutilized.

The predictor-only model revealed that, across all participants,the feedback in the prior trial did not influence trusting choices inthe next trial (� � �.01), t(39) � �.72, p � .250, OR � .99, 95%

CI [.97, 1.02]. Of importance, this result was not qualified byparticipants’ social risk-taking propensities (� � .00), t(38) � .10,p � .250, OR � 1.00, 95% CI [.98, 1.02]; regardless of whetherparticipants were risk-seeking or risk-averse, their later decisionswere not affected by the prior outcome. These results support theeffectiveness of our one-shot trust instruction.

ERP Analyses

Decision-making stage. We hypothesized that social risk-taking propensities would modulate N2 amplitude elicited bytrusting and distrusting decisions. By looking at grand averagewaveforms for trust and distrust (see Figure 2A), however, we also

Figure 2. Panel A: Grand average waveforms for trusting and distrusting decisions, separated by high and lowsocial risk-seekers at electrodes Fz, FCz, Cz, CPz, and Pz. Panel B: Scalp maps of N2 (200–330 ms) and P3(330–430 ms) associated with trusting and distrusting choices, separated by high and low social risk-seekers.See the online article for the color version of this figure.

Thi

sdo

cum

ent

isco

pyri

ghte

dby

the

Am

eric

anPs

ycho

logi

cal

Ass

ocia

tion

oron

eof

itsal

lied

publ

ishe

rs.

Thi

sar

ticle

isin

tend

edso

lely

for

the

pers

onal

use

ofth

ein

divi

dual

user

and

isno

tto

bedi

ssem

inat

edbr

oadl

y.

6 WANG, JING, ZHANG, LIN, AND VALADEZ

AQ: 13

AQ: 14

O CN OL LI ON RE

tapraid5/zfr-xge/zfr-xge/zfr99917/zfr2921d17z xppws S�1 5/12/17 1:31 Art: 2016-2311APA NLM

noted another ERP component that appeared to distinguish betweenhigh and low social risk-seekers; this component may be identified asP3, which peaked between 330 ms and 430 ms after onset. As a result,our ERP analyses were focused on both N2 and P3.

N2. N2 was quantified as the mean amplitude between 200 msand 330 ms after stimulus onset. A 2 (social risk-taking propen-sities: high vs. low) 2 (decision choices: trust vs. distrust) 5(anteriority: Fz/FCz/Cz/CPz/Pz) mixed analysis of variance

Figure 3. Panel A: Grand average waveforms for losses and gains, separated by high and low socialrisk-seekers at electrodes Fz, FCz, Cz, CPz, and Pz. Panel B: Scalp maps of feedback-related negativity (FRN;200–300 ms) associated with losses and gains, separated by high and low social risk-seekers. dFRN � betweenloss FRN and gain FRN. See the online article for the color version of this figure.

Thi

sdo

cum

ent

isco

pyri

ghte

dby

the

Am

eric

anPs

ycho

logi

cal

Ass

ocia

tion

oron

eof

itsal

lied

publ

ishe

rs.

Thi

sar

ticle

isin

tend

edso

lely

for

the

pers

onal

use

ofth

ein

divi

dual

user

and

isno

tto

bedi

ssem

inat

edbr

oadl

y.

7TRUST, SOCIAL RISK-SEEKING, AND EEG

O CN OL LI ON RE

tapraid5/zfr-xge/zfr-xge/zfr99917/zfr2921d17z xppws S�1 5/12/17 1:31 Art: 2016-2311APA NLM

(ANOVA)5 revealed a significant interaction between social risk-taking propensities and decision choices, F(1, 38) � 12.85, p �.001, �p

2 � .25. Pairwise comparisons6 indicated that, as illustratedin Figure 2A (the second group of waveforms from the top), highsocial risk-seekers exhibited a more negative N2 following dis-trusting decisions (M � 2.48 �V, 95% CI [1.43, 3.53]) thantrusting decisions (M � 4.92 �V, 95% CI [3.83, 6.01]), F(1, 38) �31.81, p � .001, �p

2 � .46, 95% CI for mean differences[�3.32, �1.57], whereas low social risk-seekers exhibited no N2difference between trusting decisions (M � 2.98 �V, 95% CI[1.89, 4.07]) and distrusting decisions (M � 2.73 �V, 95% CI[1.68, 3.78]), F(1, 38) � .33, p � .250, �p

2 � .01, 95% CI for meandifferences [�.63, 1.22]. The main effect of decision choices was

significant, F(1, 38) � 19.29, p � .001, �p2 � .34; N2 was more

positive for trusting decisions (M � 3.95 �V, 95% CI [3.18, 4.72])than for distrusting decisions (M � 2.60 �V, 95% CI [1.87, 3.34]).The main effect of anteriority was also significant, F(1.40,53.27) � 6.29, p � .008, �p

2 � .14; N2 was largest at Fz andbecame smaller at the posterior sites. The other main effect andinteractions were not significant at the .05 level.

P3. P3 was quantified as the mean amplitude between 330 msand 430 ms after onset. A 2 (social risk-taking propensities: highvs. low) 2 (decision choices: trust vs. distrust) 5 (anteriority:Fz/FCz/Cz/CPz/Pz) mixed ANOVA again found a significant in-teraction between social risk-taking propensities and decisionchoices, F(1, 38) � 6.72, p � .013, �p

2 � .15. Pairwise compari-sons indicated that, as illustrated in Figure 2A (the third group ofwaveforms from the top), high social risk-seekers exhibited alarger P3 following trusting decisions (M � 4.68 �V, 95% CI[3.58, 5.78]) than distrusting decisions (M � 2.48 �V, 95% CI[.93, 4.02]), F(1, 38) � 20.88, p � .001, �p

2 � .36, 95% CI formean differences [1.23, 3.18], whereas low social risk-seekersexhibited no P3 difference between trusting decisions (M � 3.11�V, 95% CI [2.01, 4.21]) and distrusting decisions (M � 2.68 �V,95% CI [1.13, 4.22]), F(1, 38) � .82, p � .250, �p

2 � .02, 95% CIfor mean differences [�.54, 1.42]. The main effect of decisionchoices was significant, F(1, 38) � 14.99, p � .001, �p

2 � .28; P3

5 Greenhouse-Geisser correction was used when the assumption of sphe-ricity of the repeated measure was violated.

6 All pairwise comparisons used Bonferroni correction.

Figure 4. Time-frequency power plot for distrusting and trusting decisions, separated by high and low socialrisk-seekers at electrode FCz. Bold, dark rectangles highlight the time-frequency component (and its correspondingscalp topographies) which statistically distinguished between high and low social risk-seekers. Statistical analyses -2 (high vs. low social risk-seekers) 2 (trust vs. distrust) ANOVAs - were focused on the midline electrodes Fz, FCz,Cz, CPz, and Pz. Given that the topographic distributions of power exhibited a frontocentral peak, only thetime-frequency power results at FCz are presented. See the online article for the color version of this figure.

Table 1Descriptive Statistics for Participants’ Risk-Taking Propensitiesand Trust-Game Responses

VariableHigh socialrisk-seekers

Low socialrisk-seekers

Social risk-taking 5.94 (.49) 2.86 (.63)Financial risk-taking 1.97 (1.28) 2.92 (1.24)Trust rates (%) 67.47 (10.83) 59.07 (10.39)Reaction time (ms)

For trusting decisions 529.70 (130.65) 579.32 (223.90)For distrusting decisions 506.51 (140.22) 577.09 (201.23)

Note. Data represent means, with standard deviations in parentheses.Trust rates were frequencies of making trusting choices across all trials inthe trust game.

Thi

sdo

cum

ent

isco

pyri

ghte

dby

the

Am

eric

anPs

ycho

logi

cal

Ass

ocia

tion

oron

eof

itsal

lied

publ

ishe

rs.

Thi

sar

ticle

isin

tend

edso

lely

for

the

pers

onal

use

ofth

ein

divi

dual

user

and

isno

tto

bedi

ssem

inat

edbr

oadl

y.

8 WANG, JING, ZHANG, LIN, AND VALADEZ

Fn5

Fn6,AQ:15

O CN OL LI ON RE

AQ: 16

tapraid5/zfr-xge/zfr-xge/zfr99917/zfr2921d17z xppws S�1 5/12/17 1:31 Art: 2016-2311APA NLM

amplitudes were larger for trusting decisions (M � 3.90 �V, 95%CI [3.12, 4.68]) than for distrusting decisions (M � 2.58 �V, 95%CI [1.48, 3.67]). The main effect of anteriority was also significant,F(1.49, 56.70) � 16.06, p � .001, �p

2 � .30; P3 was largest at Pzand became smaller at the anterior sites. The other main effect andinteractions were not significant.

Outcome evaluation stage. We hypothesized that social risk-taking propensities would modulate FRN amplitude elicited byloss and gain feedback. To isolate FRN effects and minimize otherpositive components’ (e.g., P300) influences (Wang et al., 2013),we looked into the difference wave between loss FRN and gainFRN (dFRN; see Figure 3A).

The FRN difference waveform was created by subtracting thegain trials from the loss trials. dFRN was quantified as the meanvalue of the difference wave in the 200- to 300-ms time windowafter feedback onset (Ma, Meng, & Shen, 2015). A 2 (socialrisk-taking propensities: high vs. low) 5 (anteriority: Fz/FCz/Cz/CPz/Pz) mixed ANOVA revealed a significant main effect ofsocial risk-taking propensities, F(1, 38) � 5.35, p � .026, �p

2 �.12; dFRN was more negative-going for low social-risk seekers(M � �5.53 �V, 95% CI [�6.75, �4.32]) than for high socialrisk-seekers (M � �3.57 �V, 95% CI [�4.78, �2.35]). The maineffect of anteriority was also significant, F(1.81, 68.78) � 4.90,p � .013, �p

2 � .11, such that dFRN was largest at FCz and becamesmaller at the posterior sites. The interaction between social risk-taking propensities and anteriority was not significant.

Controlling for financial risk-seeking propensities and gen-der disparity. Given that the two groups of high and low socialrisk-seekers differed in their financial risk-seeking propensitiesand gender composition (60% male vs. 40% male, respectively),we also ran analyses of covariance controlling for these twocovariates. The finding on each ERP component did not have anoticeable change after controlling covariates of interest. More-over, the two covariates had no significant effects on each ERPcomponent. Specifically, the interaction between gender and de-cision choices was not significant for either N2, F(1, 36) � .22,p � .250, �p

2 � .01, or P3, F(1, 36) � .30, p � .250, �p2 � .01. The

main effect of gender on dFRN was also not significant, F(1,36) � .34, p � .250, �p

2 � .01. Likewise, the interaction betweenfinancial risk-seeking propensities and decision choices was notsignificant for either N2, F(1, 36) � 1.39, p � .246, �p

2 � .04, orP3, F(1, 36) � 1.11, p � .250, �p

2 � .03. The main effect offinancial risk-seeking propensities on dFRN was also not signifi-cant, F(1, 36) � 1.09, p � .250, �p

2 � .03.

Time-Frequency Analyses

Decision-making stage.� band. Based on previous research (Cavanagh et al., 2012;

Huster et al., 2013) and the permutation test implemented in the“statcond” function of EEGLAB—an open-source toolbox forMATLAB (Delorme & Makeig, 2004)—time-frequency power inthe range of 14–20 Hz during 200–300 ms were averaged forstatistical analysis. A 2 (social risk-taking propensities: high vs.low) 2 (decision choices: trust vs. distrust) 5 (anteriority:Fz/FCz/Cz/CPz/Pz) mixed ANOVA revealed a significant interac-tion between social risk-taking propensities and decision choices,F(1, 38) � 4.42, p � .042, �p

2 � .10. Pairwise comparisonsindicated that, as illustrated in Figure 4, high social risk-seekers

exhibited increased power of the � band following distrustingdecisions (M � .02 dB, 95% CI [�.27, .31]) compared withtrusting decisions (M � �.94 dB, 95% CI [�1.48, �.41]), F(1,38) � 12.57, p � .001, �p

2 � .25, 95% CI for mean differences[.41, 1.51], whereas low social risk-seekers exhibited no � powerdifference between trusting decisions (M � �.74 dB, 95% CI[�1.28, �.20]) and distrusting decisions (M � �.58 dB, 95% CI[�.87, �.29]), F(1, 38) � .33, p � .250, �p

2 � .01, 95% CI formean differences [�.39, .70]. The main effect of decision choiceswas significant, F(1, 38) � 8.49, p � .006, �p

2 � .18; � power waslarger for distrusting decisions (M � �.28 dB, 95% CI[�.49, �.08]) than for trusting decisions (M � �.84 dB, 95% CI[�1.22, �.46]). This time-frequency result seems to be consistentwith our ERP result for N2, given that increased � power may alsoindicate cognitive control. No other significant main effects andinteractions were found.

� band. The permutation test did not detect any differencebetween high and low social risk-seekers on � band activityfollowing trusting and distrusting decisions. We therefore did notconduct further analysis on this component.

Outcome evaluation stage.� band. The permutation test did not detect any difference

between high and low social risk-seekers on � band activityfollowing gains and losses. We therefore did not conduct furtheranalysis on this component.

� band. Based on the same criteria described earlier, time-frequency power in the range of 5.5–7.5 Hz during 200–250 ms wereaveraged for statistical analysis. A 2 (social risk-taking propensities:high vs. low) 2 (feedback: gain vs. loss) 5 (anteriority: Fz/FCz/Cz/CPz/Pz) mixed ANOVA revealed a significant three-way interac-tion between social risk-taking propensities, feedback, and anteriority,F(1.67, 63.45) � 3.45, p � .046, �p

2 � .08. Pairwise comparisonsindicated that low social risk-seekers exhibited increased � powerfollowing losses compared to gains at FCz (see Figure 5; losses: M �3.70 dB, 95% CI [2.97, 4.43]; gains: M � 2.52 dB, 95% CI [1.74,3.31]), F(1, 38) � 16.32, p � .001, �p

2 � .30, 95% CI for meandifferences [.59, 1.76], as well as at Fz (losses: M � 3.35 dB, 95% CI[2.70, 3.99]; gains: M � 2.26 dB, 95% CI [1.53, 2.99]), F(1, 38) �14.37, p � .001, �p

2 � .27, 95% CI for mean differences [.51, 1.67],and at Cz (losses: M � 3.11 dB, 95% CI [2.41, 3.80]; gains: M � 2.29dB, 95% CI [1.51, 3.06]), F(1, 38) � 7.25, p � .010, �p

2 � .16, 95%CI for mean differences [.20, 1.44]. By contrast, high social risk-seekers did not exhibit � power difference between gains and lossesover all five electrodes, all F(1, 38) � .35, all p � .250, and all �p

2 �.01. This time-frequency result seems to corroborate our ERP resultfor dFRN; in light of that, increased � may also indicate error-monitoring activities.

Additionally, the main effect of anteriority was significant,F(1.76, 66.74) � 7.60, p � .002, �p

2 � .17, such that � power waslargest at FCz and became smaller at the posterior sites. No othermain effects and interactions were significant.

Controlling for financial risk-seeking propensities and gen-der disparity. Once again, controlling financial risk-seekingpropensities and gender did not change our time-frequency resultssubstantially. In addition, neither covariate had significant effectson each time-frequency power component. In particular, the inter-action between gender and decision choices was not significant for� power, F(1, 36) � .08, p � .250, �p

2 � .00. And the interactionbetween gender and feedback was not significant for � power, F(1,

Thi

sdo

cum

ent

isco

pyri

ghte

dby

the

Am

eric

anPs

ycho

logi

cal

Ass

ocia

tion

oron

eof

itsal

lied

publ

ishe

rs.

Thi

sar

ticle

isin

tend

edso

lely

for

the

pers

onal

use

ofth

ein

divi

dual

user

and

isno

tto

bedi

ssem

inat

edbr

oadl

y.

9TRUST, SOCIAL RISK-SEEKING, AND EEG

AQ: 17

AQ: 18

F5

tapraid5/zfr-xge/zfr-xge/zfr99917/zfr2921d17z xppws S�1 5/12/17 1:31 Art: 2016-2311APA NLM

36) � .00, p � .250, �p2 � .00. Likewise, the interaction between

financial risk-seeking propensities and decision choices was notsignificant for � power, F(1, 36) � .24, p � .250, �p

2 � .01. Andthe interaction between financial risk-seeking propensities andfeedback was not significant for � power, F(1, 36) � .19, p � .250,�p

2 � .01.

Discussion

As the core feature of group-bridging social capital (Putnam,2000), trust of strangers plays a critical role in promoting modernsocieties’ growth and success. A growing body of interdisciplinaryresearch has indicated that social risk-taking underlies the decisionto trust unfamiliar social agents. In the current study, we investi-gated how individual differences in social risk-seeking modulatebrain processes of trusting strangers. It has not yet been fullyunderstood why prorisk motivations facilitate human trust. As oneof the few EEG studies, we provide novel findings that shed lighton the mechanism by which the preference for taking social risksis translated into trusting unfamiliar people.

Consistent with our hypothesis, high social risk-seekers exhibited amore negative N2, as well as increased � power, following distrustingdecisions compared to trusting decisions; however, such N2 and �differences were not observed among low social risk-seekers. Ampleevidence has suggested that N2 is associated with effortful cognitivecontrol such as inhibiting prepotent responses; there has also existedsome evidence that increased � activity may indicate response inhi-bition (for a review, see Huster et al., 2013). Our results suggest thatpeople with higher social risk-taking propensities may exert greatercognitive control to distrust compared to trust. This is likely becausesocial risk-seekers are inclined to take risks and trust strangers; to

distrust others thus requires more cognitive effort to inhibit thisdefault inclination. For people aversive to social risks (e.g., potentialbetrayal), however, the decision to trust (tolerance for risks) anddistrust (deviation of the cooperative norm) may require similarcognitive control.7

On the other hand, low social risk-seekers exhibited a morenegative-going dFRN (losses minus gains), as well as increased �(losses vs. gains), than did high social risk-seekers. The extantresearch has linked the FRN effect with reward prediction errors(Sambrook & Goslin, 2015). From the economically rational pointof view, a negative-going dFRN associated with trust suggests thattrust is based on the trustor’s motive to gain monetary reward;suffering losses from being trusting violates one’s reward expec-tation (e.g., Chen et al., 2012). This interpretation, however, maybe problematic, because a growing body of research has demon-strated that people trust strangers not only based on self-interestsbut also based on social preferences such as generosity (e.g., Cox,2004), morality (e.g., Dunning et al., 2014), or the desire formaintaining positive interpersonal relations (Zhao & Smillie,2015).

7 Additional pairwise comparisons indicated that trusting decisions elic-ited a more negative N2 for low social risk-seekers (M � 2.98 �V, 95% CI[1.89, 4.07]) than for high social risk-seekers (M � 4.92 �V, 95% CI [3.83,6.01]), F(1, 38) � 6.54, p � .015, �2 � .15, 95% CI for mean differences[�3.48, �.41], whereas distrusting decisions elicited similar N2 for thetwo groups (M � 2.73 �V, 95% CI [1.68, 3.78], vs. M � 2.48 �V, 95%CI [1.43, 3.53], respectively), F(1, 38) � .12, p � .250, �2 � .00, 95% CIfor mean differences [�1.73, 1.23]. It appeared that both groups inhibiteddistrust to the similar extent, but low social risk-seekers inhibited trustmore strongly than did high social risk-seekers.

Figure 5. Time-frequency power plot for gain and loss feedback, separated by high and low social risk-seekersat electrode FCz. Bold, dark rectangles highlight the time-frequency power component (and its correspondingscalp topographies), which statistically distinguished between high and low social risk-seekers. Statisticalanalyses were focused on the midline electrodes Fz, FCz, Cz, CPz, and Pz. Only the time-frequency results atFCz are presented. See the online article for the color version of this figure.

Thi

sdo

cum

ent

isco

pyri

ghte

dby

the

Am

eric

anPs

ycho

logi

cal

Ass

ocia

tion

oron

eof

itsal

lied

publ

ishe

rs.

Thi

sar

ticle

isin

tend

edso

lely

for

the

pers

onal

use

ofth

ein

divi

dual

user

and

isno

tto

bedi

ssem

inat

edbr

oadl

y.

10 WANG, JING, ZHANG, LIN, AND VALADEZ

O CN OL LI ON RE

Fn7

tapraid5/zfr-xge/zfr-xge/zfr99917/zfr2921d17z xppws S�1 5/12/17 1:31 Art: 2016-2311APA NLM

Our dFRN findings may support the social preference view oftrust. It is likely that high social risk-seekers are more rewarded bythe positive, subjective experience of being trusting and downplaythe negative, material outcome of being exploited (less negative-going dFRN); low social risk-seekers, on the other hand, are moresensitive to the risks of intergroup interaction and more disturbedby the stranger’s betrayal (more negative-going dFRN). The twogroups’ � power, a neural indicator that may indicate error mon-itoring (Cavanagh & Shackman, 2015), were also consistent withthis reasoning. Indeed, both high and low social risk-seekersreported similar risk thresholds (i.e., the minimum accepted prob-ability of the trustee’s being benign) for being trusting in theone-shot trust game (see the online supplemental materials), sotheir differential brain reactions to betrayal (relative to trustwor-thiness) may have more to do with outcome interpretations thandecision expectations. Previous research has found that risk-seekers have blunted neural responses to economic risks (e.g.,Zheng & Liu, 2015). Our study extended this finding to the socialdomain.

We found that high and low social risk-seekers can be distin-guished based on, in addition to N2 and dFRN, their P3 amplitudesassociated with trust decision-making. In particular, stronger socialrisk-taking propensities were associated with more positive P3following trusting decisions compared to distrusting decisions. Inthe ERP literature, P3 has been commonly linked with attentionand motivation; attention-capturing or motivational significantstimuli elicit a greater P3 (for a review, see Nieuwenhuis, Aston-Jones, & Cohen, 2005). Our finding suggests that higher socialrisk-seekers may attend more to trusting decisions (compared todistrust) that have greater social significance to them.

The high temporal resolution of EEG enabled us to investigatethe time sequence of brain processing. The current study offerssome intriguing findings regarding how the brain processes trustdecisions in sequence. As illustrated in Figure 6, our resultssuggest two distinctive stages of decision-making in the one-shottrust game, distinguished by different time windows, psychologi-cal functions, and ERP correlates. Moreover, our results illuminatehow social risk-seeking disposition influences trust behavior bymodulating brain processes of decision-making and outcome eval-uation. The results shed new light on the interplay between per-sonality, social behavior, and the brain. We hope that this research

will inspire more interdisciplinary studies toward a finer under-standing of how humans decide to cooperate and trust.

It is important to note that our ERP and time-frequency powerresults were modulated by participants’ propensities to take socialrisks but not to take financial risks. This provides new evidencethat risk-taking is domain-sensitive rather than context-free (seealso Blais & Weber, 2006) and that stranger trust is closely linkedwith social risk-taking. On the other hand, the current study doesnot appear to provide conclusive evidence regarding whether fi-nancial risk-seeking propensities predict stranger trust. After all,the range of individual variation in financial risk attitudes waslimited in this sample. It is also likely that the type of risk attitudemeasurement (e.g., self-reported vs. behavioral)8 and the stake sizeof the trust game decision (cf. Sapienza et al., 2013) may constrainrelevant results.

Practical Implication

Converging with behavioral findings (e.g., Josef et al., 2016),our brain results suggest that social risk-seeking preferences maypromote broader social trust and civic cooperation. A practicalsuggestion for low-trusting societies may be that policymakersneed to cultivate their citizens for taking risks for social good,probably by providing better institutional support for intergroupcooperation and promoting personal endorsements of values re-lated to openness and autonomy (Jing & Bond, 2015).

Limitations and Future Directions

In our study, participants made trust decisions without anypersonal information regarding the trustees. Future research shouldinvestigate to what extent our findings can be generalized to morepersonal interactions. It is possible that the trust difference be-tween high and low social risk-seekers will be reduced if thetrustee is a more familiar person. It would also be interesting toexamine how social risk-seeking disposition modulates trust build-ing between two fixed partners over time.

8 The revision of DOSPERT scale’s financial subscale did not contributeto our null finding. Even using scores of the original full scale, there wasno statistical relationship between financial risk-seeking propensities andstranger trust (behavioral and neural) in this sample.

Figure 6. Time sequence of decision-making in the one-shot trust game. The transparent rectangles contain thetime window of each stage and its related psychological function and event-related potential component. See theonline article for the color version of this figure.

Thi

sdo

cum

ent

isco

pyri

ghte

dby

the

Am

eric

anPs

ycho

logi

cal

Ass

ocia

tion

oron

eof

itsal

lied

publ

ishe

rs.

Thi

sar

ticle

isin

tend

edso

lely

for

the

pers

onal

use

ofth

ein

divi

dual

user

and

isno

tto

bedi

ssem

inat

edbr

oadl

y.

11TRUST, SOCIAL RISK-SEEKING, AND EEG

F6

O CN OL LI ON RE

Fn8

tapraid5/zfr-xge/zfr-xge/zfr99917/zfr2921d17z xppws S�1 5/12/17 1:31 Art: 2016-2311APA NLM

To further understand the learning process through which peo-ple develop interpersonal trust, future research can take advantageof computational models that depict algorithms of reward learning.For instance, Schultz, Dayan, and Montague (1997) mathemati-cally modeled how the human neural system computes and en-codes prediction errors, and how prediction errors modulate actionselection. Friston et al. (2014) also offered a computational frame-work for understanding how the expectation of reward predictionmodulates perceptual inference and action selection. There hasbeen both behavioral and neurophysiological evidence supportingthese models’ predictions (for reviews, see Friston et al., 2014;Rangel, Camerer, & Montague, 2008). Brain research on trust andcooperation may also benefit from this type of computationalwork.

References

Aimone, J. A., & Houser, D. (2012). What you don’t know won’t hurt you:A laboratory analysis of betrayal aversion. Experimental Economics, 15,571–588. http://dx.doi.org/10.1007/s10683-012-9314-z

Aimone, J. A., Houser, D., & Weber, B. (2014). Neural signatures ofbetrayal aversion: An fMRI study of trust. Proceedings of the RoyalSociety, B: Biological Sciences, 281, 20132127. http://dx.doi.org/10.1098/rspb.2013.2127

Aron, A. R. (2011). From reactive to proactive and selective control:Developing a richer model for stopping inappropriate responses. Bio-logical Psychiatry, 69, e55–e68. http://dx.doi.org/10.1016/j.biopsych.2010.07.024

Balliet, D., & Van Lange, P. A. (2013). Trust, conflict, and cooperation: Ameta-analysis. Psychological Bulletin, 139, 1090–1112. http://dx.doi.org/10.1037/a0030939

Baumgartner, T., Heinrichs, M., Vonlanthen, A., Fischbacher, U., & Fehr,E. (2008). Oxytocin shapes the neural circuitry of trust and trust adap-tation in humans. Neuron, 58, 639–650. http://dx.doi.org/10.1016/j.neuron.2008.04.009

Berg, J., Dickhaut, J., & McCabe, K. (1995). Trust, reciprocity, and socialhistory. Games and Economic Behavior, 10, 122–142. http://dx.doi.org/10.1006/game.1995.1027

Blais, A. R., & Weber, E. U. (2006). A domain-specific risk-taking(DOSPERT) Scale for adult populations. Judgment and Decision Mak-ing, 1, 33–47.

Bohnet, I., Greig, F., Herrmann, B., & Zeckhauser, R. (2008). Betrayalaversion: Evidence from Brazil, China, Oman, Switzerland, Turkey, andthe United States. American Economic Review, 98, 294–310. http://dx.doi.org/10.1257/aer.98.1.294

Bohnet, I., & Zeckhauser, R. (2004). Trust, risk and betrayal. Journal ofEconomic Behavior & Organization, 55, 467–484. http://dx.doi.org/10.1016/j.jebo.2003.11.004

Cavanagh, J. F., & Frank, M. J. (2014). Frontal theta as a mechanism forcognitive control. Trends in Cognitive Sciences, 18, 414–421. http://dx.doi.org/10.1016/j.tics.2014.04.012

Cavanagh, J. F., & Shackman, A. J. (2015). Frontal midline theta reflectsanxiety and cognitive control: Meta-analytic evidence. Journal of Phys-iology, 109, 3–15. http://dx.doi.org/10.1016/j.jphysparis.2014.04.003

Cavanagh, J. F., Zambrano-Vazquez, L., & Allen, J. J. (2012). Theta linguafranca: A common mid-frontal substrate for action monitoring processes.Psychophysiology, 49, 220–238. http://dx.doi.org/10.1111/j.1469-8986.2011.01293.x

Chen, J., Zhong, J., Zhang, Y., Li, P., Zhang, A., Tan, Q., & Li, H. (2012).Electrophysiological correlates of processing facial attractiveness and itsinfluence on cooperative behavior. Neuroscience Letters, 517, 65–70.http://dx.doi.org/10.1016/j.neulet.2012.02.082

Christie, G. J., & Tata, M. S. (2009). Right frontal cortex generatesreward-related theta-band oscillatory activity. NeuroImage, 48, 415–422. http://dx.doi.org/10.1016/j.neuroimage.2009.06.076

Cohen, M. X., Elger, C. E., & Ranganath, C. (2007). Reward expectationmodulates feedback-related negativity and EEG spectra. NeuroImage,35, 968–978. http://dx.doi.org/10.1016/j.neuroimage.2006.11.056

Cox, J. C. (2004). How to identify trust and reciprocity. Games andEconomic Behavior, 46, 260 –281. http://dx.doi.org/10.1016/S0899-8256(03)00119-2

Das, T. K., & Teng, B. S. (2004). The risk-based view of trust: Aconceptual framework. Journal of Business and Psychology, 19, 85–116.http://dx.doi.org/10.1023/B:JOBU.0000040274.23551.1b

Davis, M. H. (1980). A multidimensional approach to individual differ-ences in empathy. Catalog of Selected Documents in Psychology, 10, 85.

Delorme, A., & Makeig, S. (2004). EEGLAB: An open source toolbox foranalysis of single-trial EEG dynamics including independent componentanalysis. Journal of Neuroscience Methods, 134, 9–21. http://dx.doi.org/10.1016/j.jneumeth.2003.10.009

Drichoutis, A. C., & Vassilopoulos, A. (2016). Intertemporal stability ofsurvey-based measures of risk and time preferences over a three-yearcourse (AUA Working Paper Series No. 2016–3). Retrieved from http://aoatools.aua.gr/RePEc/aua/wpaper/files/2016-3_drichoutis_stability.pdf

Dunning, D., Anderson, J. E., Schlösser, T., Ehlebracht, D., & Fetchen-hauer, D. (2014). Trust at zero acquaintance: More a matter of respectthan expectation of reward. Journal of Personality and Social Psychol-ogy, 107, 122–141. http://dx.doi.org/10.1037/a0036673

Eckel, C. C., & Wilson, R. K. (2004). Is trust a risky decision? Journal ofEconomic Behavior & Organization, 55, 447–465. http://dx.doi.org/10.1016/j.jebo.2003.11.003

Fehr, E. (2009). On the economics and biology of trust. Journal of theEuropean Economic Association, 7, 235–266. http://dx.doi.org/10.1162/JEEA.2009.7.2-3.235

Folstein, J. R., & Van Petten, C. (2008). Influence of cognitive control andmismatch on the N2 component of the ERP: A review. Psychophysiol-ogy, 45, 152–170.

Foti, D., Weinberg, A., Dien, J., & Hajcak, G. (2011). Event-relatedpotential activity in the basal ganglia differentiates rewards from non-rewards: Temporospatial principal components analysis and source lo-calization of the feedback negativity. Human Brain Mapping, 32, 2207–2216. http://dx.doi.org/10.1002/hbm.21182

Friston, K., Schwartenbeck, P., FitzGerald, T., Moutoussis, M., Behrens,T., & Dolan, R. J. (2014). The anatomy of choice: Dopamine anddecision-making. Philosophical Transactions of the Royal Society ofLondon: Series B. Biological Sciences, 369, 20130481. http://dx.doi.org/10.1098/rstb.2013.0481

Fukuyama, F. (1995). Trust: The social virtues and the creation of pros-perity. New York, NY: Free Press.

Gehring, W. J., & Willoughby, A. R. (2002). The medial frontal cortex andthe rapid processing of monetary gains and losses. Science, 295, 2279–2282. http://dx.doi.org/10.1126/science.1066893

Holroyd, C. B., & Coles, M. G. (2002). The neural basis of human errorprocessing: Reinforcement learning, dopamine, and the error-relatednegativity. Psychological Review, 109, 679–709. http://dx.doi.org/10.1037/0033-295X.109.4.679

Hooper, D., Coughlan, J., & Mullen, M. R. (2008). Structural equationmodelling: Guidelines for determining model fit. Electronic Journal ofBusiness Research Methods, 6, 53–60.

Houser, D., Schunk, D., & Winter, J. (2010). Distinguishing trust from risk:An anatomy of the investment game. Journal of Economic Behavior &Organization, 74, 72–81. http://dx.doi.org/10.1016/j.jebo.2010.01.002

Hu, L. T., & Bentler, P. M. (1999). Cutoff criteria for fit indexes incovariance structure analysis: Conventional criteria versus new alterna-tives. Structural Equation Modeling, 6, 1–55. http://dx.doi.org/10.1080/10705519909540118

Thi

sdo

cum

ent

isco

pyri

ghte

dby

the

Am

eric

anPs

ycho

logi

cal

Ass

ocia

tion

oron

eof

itsal

lied

publ

ishe

rs.

Thi

sar

ticle

isin

tend

edso

lely

for

the

pers

onal

use

ofth

ein

divi

dual

user

and

isno

tto

bedi

ssem

inat

edbr

oadl

y.

12 WANG, JING, ZHANG, LIN, AND VALADEZ

tapraid5/zfr-xge/zfr-xge/zfr99917/zfr2921d17z xppws S�1 5/12/17 1:31 Art: 2016-2311APA NLM

Huster, R. J., Enriquez-Geppert, S., Lavallee, C. F., Falkenstein, M., &Herrmann, C. S. (2013). Electroencephalography of response inhibitiontasks: Functional networks and cognitive contributions. InternationalJournal of Psychophysiology, 87, 217–233. http://dx.doi.org/10.1016/j.ijpsycho.2012.08.001

Jing, Y., & Bond, M. H. (2015). Sources for trusting most people: Hownational goals for socializing children promote the contributions madeby trust of the ingroup and the outgroup to non-specific trust. Journal ofCross-Cultural Psychology, 46, 191–210. http://dx.doi.org/10.1177/0022022114557488

Josef, A. K., Richter, D., Samanez-Larkin, G. R., Wagner, G. G., Hertwig,R., & Mata, R. (2016). Stability and change in risk-taking propensityacross the adult life span. Journal of Personality and Social Psychology,111, 430–450. http://dx.doi.org/10.1037/pspp0000090

Knack, S., & Keefer, P. (1997). Does social capital have an economicpayoff? A cross-country investigation. Quarterly Journal of Economics,112, 1251–1288. http://dx.doi.org/10.1162/003355300555475

Kosfeld, M., Heinrichs, M., Zak, P. J., Fischbacher, U., & Fehr, E. (2005).Oxytocin increases trust in humans. Nature, 435, 673–676. http://dx.doi.org/10.1038/nature03701

Lauharatanahirun, N., Christopoulos, G. I., & King-Casas, B. (2012). Neuralcomputations underlying social risk sensitivity. Frontiers in Human Neu-roscience, 6, 213. http://dx.doi.org/10.3389/fnhum.2012.00213

Li, L. M. W., Hamamura, T., & Adams, G. (2016). Relational mobilityincreases social (but not other) risk propensity. Journal of BehavioralDecision Making, 29, 481–488. http://dx.doi.org/10.1002/bdm.1894

Lönnqvist, J. E., Verkasalo, M., Walkowitz, G., & Wichardt, P. C. (2015).Measuring individual risk attitudes in the lab: Task or ask? An empiricalcomparison. Journal of Economic Behavior & Organization, 119, 254–266. http://dx.doi.org/10.1016/j.jebo.2015.08.003

Ma, Q., Meng, L., & Shen, Q. (2015). You have my word: Reciprocityexpectation modulates feedback-related negativity in the trust game. PLoSONE, 10, e0119129. http://dx.doi.org/10.1371/journal.pone.0119129

Makeig, S., Debener, S., Onton, J., & Delorme, A. (2004). Mining event-related brain dynamics. Trends in Cognitive Sciences, 8, 204–210.http://dx.doi.org/10.1016/j.tics.2004.03.008

Mayer, R. C., Davis, J. H., & Schoorman, F. D. (1995). An integrative modelof organizational trust. Academy of Management Review, 20, 709–734.

Mishra, S., Lalumière, M. L., & Williams, R. J. (2017). Gambling, risk-taking, and antisocial behavior: A replication study supporting the gen-erality of deviance. Journal of Gambling Studies, 33, 15–36. http://dx.doi.org/10.1007/s10899-016-9608-8

Möllering, G. (2006). Trust: Reason, routine, reflexivity. Kidlington,United Kingdom: Elsevier.

Murphy, R. O., Ackermann, K. A., & Handgraaf, M. (2011). Measuringsocial value orientation. Judgment and Decision Making, 6, 771–781.

Newton, K. (2001). Trust, social capital, civil society, and democracy.International Political Science Review, 22, 201–214. http://dx.doi.org/10.1177/0192512101222004

Nieuwenhuis, S., Aston-Jones, G., & Cohen, J. D. (2005). Decision mak-ing, the P3, and the locus coeruleus-norepinephrine system. Psycholog-ical Bulletin, 131, 510–532. http://dx.doi.org/10.1037/0033-2909.131.4.510

Peters, G. J. Y. (2014). The alpha and the omega of scale reliability andvalidity: Why and how to abandon Cronbach’s alpha and the routetowards more comprehensive assessment of scale quality. EuropeanHealth Psychologist, 16, 56–69.

Pfurtscheller, G., & Lopes da Silva, F. H. (1999). Event-related EEG/MEGsynchronization and desynchronization: Basic principles. Clinical Neu-rophysiology, 110, 1842–1857. http://dx.doi.org/10.1016/S1388-2457(99)00141-8

Proudfit, G. H. (2015). The reward positivity: From basic research onreward to a biomarker for depression. Psychophysiology, 52, 449–459.http://dx.doi.org/10.1111/psyp.12370

Putnam, R. D. (2000). Bowling alone: The collapse and revival of Amer-ican community. http://dx.doi.org/10.1145/358916.361990

Rangel, A., Camerer, C., & Montague, P. R. (2008). A framework forstudying the neurobiology of value-based decision making. Nature Re-views Neuroscience, 9, 545–556. http://dx.doi.org/10.1038/nrn2357

Raudenbush, S. W., & Bryk, A. S. (2002). Hierarchical linear models:Applications and data analysis methods. Thousand Oaks, CA: Sage.

Raudenbush, S. W., Bryk, A. S., Cheong, Y. F., Congdon, R. T., & du Toit,M. (2011). HLM 7. Lincolnwood, IL: Scientific Software International.

Riedl, R., & Javor, A. (2012). The biology of trust: Integrating evidencefrom genetics, endocrinology, and functional brain imaging. Journal ofNeuroscience, Psychology, and Economics, 5, 63–91. http://dx.doi.org/10.1037/a0026318

Rousseau, D. M., Sitkin, S. B., Burt, R. S., & Camerer, C. (1998). Not sodifferent after all: A cross-discipline view of trust. Academy of ManagementReview, 23, 393–404. http://dx.doi.org/10.5465/AMR.1998.926617

Sambrook, T. D., & Goslin, J. (2015). A neural reward prediction errorrevealed by a meta-analysis of ERPs using great grand averages. Psycho-logical Bulletin, 141, 213–235. http://dx.doi.org/10.1037/bul0000006

Sapienza, P., Toldra-Simats, A., & Zingales, L. (2013). Understanding trust.Economic Journal, 123, 1313–1332. http://dx.doi.org/10.1111/ecoj.12036

Schlösser, T., Mensching, O., Dunning, D., & Fetchenhauer, D. (2015).Trust and rationality: Shifting normative analyses of risks involvingother people versus nature. Social Cognition, 33, 459–482. http://dx.doi.org/10.1521/soco.2015.33.5.459

Schultz, W., Dayan, P., & Montague, P. R. (1997). A neural substrate ofprediction and reward. Science, 275, 1593–1599. http://dx.doi.org/10.1126/science.275.5306.1593

Semlich, H. V., Anderer, P., Schuster, P., & Presslich, O. (1986). Asolution for reliable and valid reduction of ocular artifacts, applied to theP300 ERP. Psychophysiology, 23, 695–703. http://dx.doi.org/10.1111/j.14698986.1986.tb00696.x

Singelis, T. M., Triandis, H. C., Bhawuk, D. P., & Gelfand, M. J. (1995).Horizontal and vertical dimensions of individualism and collectivism: Atheoretical and measurement refinement. Cross-Cultural Research, 29,240–275. http://dx.doi.org/10.1177/106939719502900302

Swann, N. C., Cai, W., Conner, C. R., Pieters, T. A., Claffey, M. P., George,J. S., . . . Tandon, N. (2012). Roles for the pre-supplementary motor area andthe right inferior frontal gyrus in stopping action: Electrophysiologicalresponses and functional and structural connectivity. NeuroImage, 59,2860–2870. http://dx.doi.org/10.1016/j.neuroimage.2011.09.049

Thielmann, I., & Hilbig, B. E. (2015). Trust: An integrative review from aperson–situation perspective. Review of General Psychology, 19, 249–277. http://dx.doi.org/10.1037/gpr0000046

Wang, Y., Roberts, K., Yuan, B., Zhang, W., Shen, D., & Simons, R.(2013). Psychophysiological correlates of interpersonal cooperation andaggression. Biological Psychology, 93, 386–391. http://dx.doi.org/10.1016/j.biopsycho.2013.04.008

Wang, Y., Zhang, Z., Bai, L., Lin, C., Osinsky, R., & Hewig, J. (2017).Ingroup/outgroup membership modulates fairness consideration: Neuralsignatures from ERPs and EEG oscillations. Scientific Reports, 7, 39827.http://dx.doi.org/10.1038/srep39827

Wang, Y., Zhang, Z., Jing, Y., Valadez, E. A., & Simons, R. F. (2016).How do we trust strangers? The neural correlates of decision making andoutcome evaluation of generalized trust. Social Cognitive and AffectiveNeuroscience, 11, 1666–1676. http://dx.doi.org/10.1093/scan/nsw079

Wiswede, D., Münte, T. F., & Rüsseler, J. (2009). Negative affect inducedby derogatory verbal feedback modulates the neural signature of errordetection. Social Cognitive and Affective Neuroscience, 4, 227–237.http://dx.doi.org/10.1093/scan/nsp015

Yamagishi, T. (2011). Trust: The evolutionary game of mind and society.http://dx.doi.org/10.1007/978-4-431-53936-0

Thi

sdo

cum

ent

isco

pyri

ghte

dby

the

Am

eric

anPs

ycho

logi

cal

Ass

ocia

tion

oron

eof

itsal

lied

publ

ishe

rs.

Thi

sar

ticle

isin

tend

edso

lely

for

the

pers

onal

use

ofth

ein

divi

dual

user

and

isno

tto

bedi

ssem

inat

edbr

oadl

y.

13TRUST, SOCIAL RISK-SEEKING, AND EEG

AQ: 20

AQ: 21

AQ: 22

tapraid5/zfr-xge/zfr-xge/zfr99917/zfr2921d17z xppws S�1 5/12/17 1:31 Art: 2016-2311APA NLM

Yamagishi, T., Akutsu, S., Cho, K., Inoue, Y., Li, Y., & Matsumoto, Y.(2015). Two-component model of general trust: Predicting behavioraltrust from attitudinal trust. Social Cognition, 33, 436–458. http://dx.doi.org/10.1521/soco.2015.33.5.436

Yeung, N., Botvinick, M. M., & Cohen, J. D. (2004). The neural basis of errordetection: Conflict monitoring and the error-related negativity. PsychologicalReview, 111, 931–959. http://dx.doi.org/10.1037/0033-295X.111.4.931

Zhang, F. F., Dong, Y., Wang, K., Zhan, Z., & Xie, L. (2010).中文版人际反应指针量表(IRI-C)的信度及效度研究 [Reliability andvalidity of the Chinese version of the Interpersonal Reactivity Index-C.].Chinese Journal of Clinical Psychology, 18, 155–157.

Zhang, Z., Zhang, F., Yuan, S., Guo, F. B., & Wang, Y. W. (2015).社会价值取向滑块测验中文版的测量学分析 [Psychometric analysisof the SVO Slider measure in Chinese cultural context]. Studies ofPsychology and Behavior, 13, 404–409.

Zhao, K., & Smillie, L. D. (2015). The role of interpersonal traits in socialdecision making: Exploring sources of behavioral heterogeneity in eco-nomic games. Personality and Social Psychology Review, 19, 277–302.http://dx.doi.org/10.1177/1088868314553709