Happy New Year & Best Wishes Throughout 2012ropssa.org/pdf/newsletter/2011/2011 4th Quarter.pdfHappy...

Transcript of Happy New Year & Best Wishes Throughout 2012ropssa.org/pdf/newsletter/2011/2011 4th Quarter.pdfHappy...

4rd Quarter 2011| Volume 8, Issue 4| Social Security Administration 1

Volume 8, Issue 4

October-November

Pursuing Excellence in Public Service

www.ropssa.org

Happy New Year & Best Wishes Throughout 2012Happy New Year & Best Wishes Throughout 2012Happy New Year & Best Wishes Throughout 2012Happy New Year & Best Wishes Throughout 2012

SSA Website has New Look & Up- to-Date Info

In our efforts to provide more comprehensive information

and up-to-date news, we have launched a new website design, set with a new layout and updated information. There is comprehensive information regarding employer contributions, SS benefits, and the new Healthcare Fund

(HCF) program. You can also download documents, such as SS & HCF laws, regulations, and quarterly newsletters. Visit our website now at www.ropssa.org.

ALSO ONLINE: The HCF has developed a public survey

that will help determine what can be done to improve and enhance the program and to see what additional services can be covered. Take the online HCF survey now

by visiting www.ropssa.org/hcf-survey.php. Your sugges-tions will be reviewed and used to support on-going im-provement efforts.

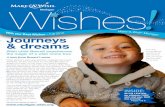

Back row, standing left to right: Hazel Tesei, Florah Tewid, Frolly Ann Bultedaob, Elsie Ann Ikeya, John Stills, Reagille Takataro, Shonya Kadoi-Andreas,

Maria Remeliik, Lasker T. Chin, Crystal Ngiraidong, Michele Murray, Charity Ngiraibai, Moira Azuma, Jessica Emesiochel, Analee Maidesil, Melinda Mills,

Dillusech Sadang, Hefflin Bai. Front Row, sitting left to right: John Markub, Marla Rimirch, Kekerelchad Kloulchad, Janice Mathew, Wilfred Asanuma,

Dessmarie Dilutaoch, Marcelino Xavier. Missing from photo: Jeany Spis, Sharon Golbuu, Denise Ajimine, Kumiko Kurihara, Irorou Mai, Prince Idelkei,

Bibrekei Rengulbai

4rd Quarter 2011 | Volume 8, Issue 4| Social Security Administration 2

Questions from Members Two Additional Private Clinics

Begin Accepting MSAs What can I do now to increase the amount of my monthly benefit payment when I am finally eligible to apply for Social Security Retirement benefits?

The strategy is to continue to work to build up your

cumulative coverage earning base.

What does the cumulative coverage earning base do?

It is from the cumulative covered earnings base that

the basic monthly benefit is computed; therefore the bigger the cumulative covered earnings, the bigger the basic monthly benefit. You can build up your cu-mulative covered earnings only by returning to work

and report your wages and paying due taxes on said

wages.

What if I am currently collecting my retirement bene-fits?

The strategy works equally well for you. You can re-turn to work while receiving Social Security retirement

benefits; you just have to report your income to Social

Security.

What if I am under 65 years old and earning more that $1,800 in any quarter?

Your Social Security Retirement benefit will be sub-

jected to earnings test.

What if I am 65 years old or older?

Your additional contributions will have the net effect

of increasing your monthly benefit amount because all additional contributions are accounted for and

your benefit recomputed.

When will my benefit be recomputed?

Your benefit will be recomputed to reflect any addi-tional contributions after the end of the calendar

year, and the recomputed benefit amount shall be paid for each month following the end of that calen-dar year. If you are 65 years or older, you can keep working and your social security benefit will not be

reduced, no matter how much you earn.

The Healthcare Fund, under the

Social Security Administration, would like to inform the public that Community Wellness Clinic in Ngerchemai, owned by Dr. Sylvia Wallybegan accepting

medical savings accounts (MSAs) in De-

cember 2011.

In early January 2012, OpticVision Opti-cal Clinic in Topside officially agreed to begin accepting MSAs as well. The antici-

pated start date for patients to begin us-ing their MSAs at the optical clinic is Janu-

ary 10, 2012.

That would bring the number of private

accepting MSAs to five: 1) Belau Medical Clinic, 2) Pacific Family Medical Supply, 3) MH Dental Clinic, and 4) Community Well-ness Clinic, and 5) OpticVision Optical

Clinic

We would like to remind the public that pursuant to Section 406 of the Healthcare Fund Regulations, the amount paid out of a medical savings account for a covered

service at a private clinic shall not exceed the amount that would be paid to Belau

National Hospital for the same service.

This means that if a service that a private

clinic charges is more than what BNH would charge, then the private clinic pa-tient must pay the excess amount out-of-pocket. If the private clinic charges less

than what BNH would charge for that same service, then the patient can use his MSA to pay for that specific service with

no out-of-pocket expense.

If anyone has any questions regarding

the use of medical savings accounts,

please call the HCF office at 488-1904.

Have you Received your HCF Statement in the Mail?

The Social Security Administration, the agency administering the

Healthcare Fund (HCF) program, mailed out medical savings account

statements to over 10,000 members in early November 2011. The state-

ment, the very first since the inception of the healthcare program, was

designed to show all your contributions and all your withdrawals begin-

ning on October 1, 2010 until September 30, 2011 and, ultimately, to

See HCF Statements. Page 4

4rd Quarter 2011| Volume 8, Issue 4| Social Security Administration 3

4rd QUARTER 2011 STATISTICS

Reminder to Businesses without Employees

The Social Security Administration is reminding

all Employers with Sole Proprietorship/Partnership

status without employees, that they are required

to file their businesses’ annual income for 2011 no

later than January 31, 2012.

Please be reminded to bring along copies of

valid supporting documents, e.g., Gross Revenue

Tax Forms to support the declared business reve-

nues. If a business has no employees and is mak-

ing less than $10,000 in annual gross revenue, fil-

ing is a MUST but payment is optional. Those that

are making at least $10,000 a year are required

to file and pay accordingly.

4rd Quarter Returns Due

The Social Security Contribu-

tions for 4th Quarter 2011 is due

no later than January 31, 2012.

Quarterly Tax Returns must be

completed upon entrance for

payments. Should you need

assistance in completing your

Quarterly Tax Report Form, our

Representative at the front

area will be happy to assist you.

Be reminded that penalty charges of $250 or

100% of the total amount owed (SS Contribution

only), whichever is higher, and interest of 1% per

month, shall be assessed to returns received af-

ter the deadline. In addition, $1.00 error charge

shall be applied to each incorrect information

provided on the returns filed, specifically, EIN

number, Employee Name and Social Security

Number. Thus, you are encouraged to verify

your return, file and pay on a timely basis to

avoid additional charges.

REFUNDING SS CONTRIBUTIONS

In accordance

with the SSA Op-

erational Rules

and Procedures,

Section 603, an

employee that

contributes on a

total remunera-

tion in excess of

the maximum re-

muneration of

$5,000, whether from one or more employers,

and their employee contributions are withheld

and paid to the Administration, the excess em-

ployee SS contributions during the four quarters

ending on December 31st will be refunded by the

Administration to the employee. However, no

refund will be made for an amount of less than

$5.00.

No refund shall be made to any employer on

any amount of excess issued to any employee

who owes outstanding employer or employee

social security debt; instead, the refund shall be

used to off-set any outstanding Social Security

debt.

Please note, if any of the four quarters is not

fully paid by February 28th, an employee may

lose his/her eligibility for refunds that may be

due.

4rd Quarter 2011 | Volume 8, Issue 4| Social Security Administration 4

Republic of Palau Social Security Administration P.O. Box 679 Koror, Palau 96940

Tel: (680) 488–2457 Fax: (680) 488–1470

E-mail: [email protected]

Visit us on the web: www.ropssa.org

YEARS OF SERVICE

Happy Birthday!!

November Elsie I. Marla R. Michele M.

December Jeany S. Melinda M. Kumiko K.

show you the available balance in your medical

savings account. The statement was also de-

signed to show you the names of your depend-

ents and designated beneficiaries.

You are not required to do anything with the

statement. However, if you note any discrepan-

cies with the amounts of your contributions or

withdrawals or with the names of your depend-

ents and/or designated beneficiaries, you are

encouraged to contact any Member Service

Happy Anniversary!

HCF Statements: Continued from Page 2

Marcelino X. 27 Years

Sharon G. 19 Years Florah T. 15 Years John M. 9 Years

Elsie I. 3 Years Melinda M. 3 Years Bibrekei R. 2 Years Jessica E. 1 Year

Tel: 488-1904

Fax: 488-4019

To Contact HCF @ BNH:

Congratulations Prince, and Welcome to the SSA

Welcome to SSA, Prince!

The Social Security Administration is pleased to

announce the newest member of the Informa-tion Systems Services Section, Mr. Prince Idelkei. Mr. Idelkei joined the SSA Team on December 27, 2011 as the

new Information Systems Specialist Assistant.

M r . I de l ke i earned a certifi-cate in General Electronic from

Palau Community College. Mr. Idelkei en-

joys his new posi-tion and very excited to face the challenges this position has to bring.

Representatives at 488-2457 during regular busi-

ness hours from 8:00 am until 5:00 pm.

As this was the very first member statement is-

sued since the program’s inception, we expect

to receive a large volume of questions and con-

structive comments and suggestions from mem-

bers. All such comments and suggestions will be

considered and incorporated in future design of

the statement. Social Security Administration

plans to mail out member statements twice a

year, once every six months .

Nine Months of MSA Deductions: April 1— December 31, 2011

BNH 11,274 $ 235,650.51

Emergency

Room 3,516 $ 126,475.76

Airai 149 $ 1,544.84

Melekeok 304 $ 3,201.08

Ngeremlengui 69 $ 936.86

Ngarchelong 82 $ 844.65

Peleliu 244 $ 2,474.88

Private Clinics 3,777 $ 115,043.57

Angaur 18 $ 224.20

Dispensaries under MOH

Total No. of Services

Total Amount of Services

19,433 TOTAL: $ 486,396.35

Note: These amounts only include deductions from individuals’ medical savings accounts and do not include reimbursements to

medical providers for inpatient and referral costs covered under

National Health Insurance.