Group4 macr project

-

Upload

sneha-srivastava -

Category

Business

-

view

85 -

download

0

description

Transcript of Group4 macr project

Submitted by:

Group - 4

Arpit Bajpai

Dimple Vijan

Puneet Manot

Sneha Srivastava

Zensar’s Acquisition of 3i Infotech: A Strategic Move

Deal Summary

Acquisition of 3I Infotech by Zensar

Deal Price: Rs. 11.1/ Share (14% Premium from last closing price)

Expected Cost Synergy: Rs.127 crores

Deal rationale:

To match up with the current trend and to explore the new market opportunities, Zensar Technologies is planning to go for acquisition.

Zensar to benefit from Cloud Computing and BFSI business of 3I Infotech

The acquisition deal is expected to bring cost and revenue synergy.

Company Profile – Zensar Technologies Ltd.

Zensar technologies Ltd., incorporated on 25 April 1952 is headquartered in Pune, India.

The company provides software services to the clients of Manufacturing, Retail, Banking, Financial Services and Insurance sector.

It has been doing well in the past 5 years with 25.3 percent average revenue growth.

Zensar believe in leveraging the power of innovation to seize new opportunities.

In the past, following the industry trend, Zensar has acquired 3 companies named ThoughDigital, OBT global and Akibia Inc.

All the acquisition deals have been successful and the company has been growing till now.

Now the company wants to grow further and is planning to go for a strategic move to explore new market opportunities.

Software Industry Overview

Software industry is expected to be the fastest growing industry in the IT space, with the expected growth of 7.1%.

The size of the worldwide software industry in 2013 was US$407.3 billion, an increase of 4.8% over 2012.

In past years, the largest four software vendors were Microsoft, Oracle Corporation, IBM, and SAP respectively.

The software industry has been subjected to a high degree of consolidation over the past couple of decades.

From 1988 to 2010, 41,136 mergers and acquisitions have been announced with a total known value of US$1,451 billion ($1.45 trillion).

The software industry is highly concentrated with a small number of players dominating the industry and holding relatively high market shares.

The confluence of network effects, law of increasing returns, and switching costs associated within the industry is the reason behind that.

The industry is on the path of creating giant players by consolidation, who will be capturing the major market share.

Need for Acquisition

Zensar needs to diversify its client base

Zensar management has clearly stipulated to get future growth from Cloud Computing and E Commerce Sector

Currently Zensar has strong presence in Manufacturing and Retail Sector

Zensar also needs to diversify in terms of geography to mitigate risk

Target Companies

Persistent Systems

Headquarters: Pune

Geography: Europe, America and Asia

Number of Employees: 8000+

Products & Services:

Cloud Computing, Mobility, Analytics and Collaboration

Industries catered to: Telecommunications, life sciences, consumer packaged goods, banking & financial services and healthcare

Financials:

Market Capitalization: 5,195.40

Revenue: 1,184.12 cr

Return on Networth(%): 20.68

3 year CAGR of revenue: 24.46

D/E ratio: 0

3i Infotech

Headquarters: Mumbai

Geography: India, Asia Pacific, Europe, US, Middle East

Number of Employees: 9000+

Products & Services: Managed IT services, software development, maintenance, business intelligence, document imaging and digitisation, IT consulting

Industries catered to: Insurance, BFSI, government, manufacturing and retail.

Financials:

Market Capitalization: 561.51 cr

Revenue: 326.50 cr

Return on Networth(%):-75.96

3 year CAGR of revenue: -15.8%

D/E ratio: 4.35

Cigniti Technologies Ltd

Headquarters: Hyderabad

Geography: US, UK, India, Australia and Canada

Number of Employees: 1400

Products & Services: Testing

Industries catered to: BFSI, Automotive, e-commerce, Energy, Media, Logistics, Retail, Healthcare

Financials:

Market Capitalization: 1,123.94 cr

Revenue: 55.52 cr

Return on Networth(%): 9.09

3 year CAGR of revenue: 92.83

D/E ratio: 0.02

Target Identification

Companies/ Persistent 3i Infotech Cigniti

Strategic Fit

Location

Profitability

Price L

M

H

H

H

M

L

M

L

H

H

Acquisition Rationale:

• Large customer base: 1500 customers, including

62 in the Fortune 500 list, in more than

• Global presence: 50 countries across 5

continents.

• Over 9000 Employees

• Strategic partnerships with Dell, Microsoft,

Oracle, HP, Redhat, etc.

• Recently Zensar acquired one of its US divisions

H

Target Overview- 3i Infotech

Global Information Technology company

3i Infotech was ranked No. 10 in the list of top Indian IT companies and overall ranked #288 by Fortune India 500 in 2011.

Caters to a variety of industries- Banking, Insurance, Capital Markets, Asset & Wealth Management (BFSI), Government, Manufacturing, Retail, Distribution, Telecom and Healthcare.

Locuz Enterprise Solutions Ltd is a subsidiary of 3i Infotech which specializes in High Performance Computing & Cloud services.

Company Overview:• Focus on value added services - business intelligence & analytics

services, infrastructure management services, testing & compliance, application development & maintenance, consulting and its BPO offerings.

• Products & services1. Altimis: Altimis is a superior, robust and functionally rich system aimed at the wealth management, stockbroking and clearing market. 2. Orion: Orion is an ERP.

Revenue Drivers:

Regions Locations

Asia Pacific Singapore, Malaysia, Thailand, China

IndiaMumbai, Noida, Pune, Bengaluru, Chennai, Hyderabad,

New Delhi, Gurgaon, Bhubaneswar

Middle East & Africa UAE, Kenya, Kazakhstan

Kingdom of Saudi Arabia Saudi Arabia, Bahrain

Europe London, Birmingham, Nantwich, Ashby-de-la-Zouch

North America New Jersey, California

Global Presence:

` Growth Rate

5.0% 6.0% 6.5% 7.0%

WA

CC

9.0% 8.82 21.01 30.77 45.39

10.0% 1.75 9.14 14.42 21.45

10.5% -0.82 5.18 9.31 14.61

11.0% -2.97 2.01 5.33 9.47 9

Assumptions

3i Infotech

• Revenue : Initially low growth but significant improvement after 2 years

• Debt : As debt is high, D/E ratio is expected to remain same for next few years andcome down to 30% over time

• Beta: Bottom up beta has been calculated from comparable companies and it hasbeen re levered using target’s D/E ratio

• Growth Rate : Growth Rate has been calculated from Reinvestment rate and Returnon Invested capital

• Tax Rate: 33.99%

Sensitivity Analysis

Discount Rate (WACC)

Cost of Debt (Kd) 14.75%

Risk Free Rate 8.25

Unlevered Beta 0.94

Equity Risk Premium 5.63%

Cost of Equity(ke) 30.77%

D/E 5.46

Summary

Relative Valuation

Ratio FY 14 Average (Past 5Years)

Price/ Sales 2.28 2.16

EV/ Sales 2.32 2.01

Sales (3i Infotech – FY 14)

326.5 cr

Value Per Share (Price/ Sales)

12.17 12.87

Value Per Share (EV/ Sales)

13.15 11.36

DCF ~Rs.9.3

Shares outstanding 57.91 crores

Enterprise value(At DCF price) Rs.3,188 crores

Target Valuation

Zensar does not have strong presence in BFSI and E- Commerce Sectors. It also lacks strong presence in cloud computing domain.

3i Infotech’s expertise in these industries and Zensar’s strong growth momentum make a natural fit. Also Zensar’s sales team can capitalize existing client base for sale in clud computing domain.

10

Strategic Rationale for the Deal

Strategic Fit

Zensar realizes that the future is beyond services and that it will be a combination of services, solutions and platforms. Zensar has invested in building platforms to drive future growth opportunities and will continue to focus on these initiatives as it gains further depth in its verticalised approach.

These domain solutions and technology platforms will offer improved revenue leverage versus talent employed in the organisation and will also significantly increase the intellectual property base.

Acquisition of 3i Infotech will give Zensar much needed entry into many key sectors with established customer base.

Functional Fit

3i’s reach into middle east and Africa can benefit Zensar and will provide much needed hedging benefits.

Middle East, India and Asia Pacific however have been less buoyant for Zensar, and with the proposed acquisition, Zensar can look forward to build strong presence in these regions

Geographical Fit

11

Synergies and Risks

Synergy

Geographical Reach

3I Infotech has good chunk of business inAfrica and Asia. Zensar has opportunity toexpand into those markets without muchhassle

Zensar can have access to technologiesdeveloped by 3i Infotech team in the BFSIdomain.

Cost Synergy Calculation

Currency Hedging: Diversified customer base of 3i InfoTech will provide natural hedging benefits to Zensar

High cost of start up infrastructure of digitization can be reduced by the combined entity by sharing fixed costs of implementation.

Cost Synergies

Cannibalization of exiting cloud computingprograms of Zensar

Negative Synergies

Figures in Rs. Crores 0 1 2 3 4 5

Pre-Tax Cost Savings 10 11 12 12 12

Expected Inflation Rate 6% 6% 6% 6% 6%

Growth Rate of FCF (nominal), in perpetuity 6%

Discount Rate 11%

Ongoing Investment/Savings (year 3+) 2%

Pre-Tax Cost Savings, Current Dollars 11 12 14 15 16

Tax Expense (@ .40) (4) (4) (5) (5) (5)

After-Tax Cost Savings 7 8 9 10 11

Less: Investment Necessary to Realize the Savings (50) (0) (0) (0)

Subtotal (50) 7 8 9 10 10

Terminal Value 239

Free Cash Flow (50) 7 8 9 10 249

Net Present Value of Cost Savings 127

Internal Rate of Return of Synergy Investment 47%

Negative SynergiesRevenue Synergies

Valuation Summary

52 week Stock Price

Price/ Sales (2014)

EV/ Sales (2014) .

12

Discounted Cash Flow

Trading Comparables

DCF

20%

30%

30%

20%

Valuation Method Weightage

Final Value Per Share = 0.2 * 8.19 + 0.3 * 12.17 + 0.3 * 13.15 + 0.2 * 9.31 = Rs. 11.1

Premium from Last Closing Price = 14.43%

Proposed Deal:All Stock Deal

Target Acquirer

3i Infotech Zensar

Earnings (crores) -110.2 187.22

Share (crores) 57.91 4.39

EPS -1.9 42.6

Price 9.7 605

P/E -5.10 14.19

Deal Price 11.1

New Shares from exhange (crores) 1.06

Total Earnings 77.02

P/ E 14.13

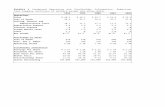

Exhibit 1-Income Statement (Zensar Technologies Ltd.)

FINANCIAL INFORMATION OF THE COMPANY FOR LAST 10 FINANCIAL YEARS

PARTICULARS

(Rupees in Crores)

FINANCIAL YEARS

03-04 04-05 05-06 06-07 07-08 08-09 09-10 10-11 11-12 12-13

Turnover 267.07 344.89 428.79 605.86 782.93 908.08 952.76 1,138.29 1,782.48 2,114.53

Total Income 273.65 349.54 433.42 614.83 795.12 922.16 961.03 983.26 1,824.28 2,132.23

PBIT 17.20 23.06 43.27 76.55 87.34 115.69 151.88 153.99 245.71 270.56

PBT 16.82 22.16 41.66 74.45 81.43 111.82 149.15 150.12 236.37 260.61

PBT including

Exceptional Income 16.82 19.54 39.48 73.80 81.43 111.82 149.15 150.12 236.37 260.61

Net Worth 117.12 152.97 181.23 237.82 284.21 258.61 329.70 446.01 575.47 728.90

Gross Fixed Assets 63.97 88.89 88.30 108.72 123.72 184.66 212.79 548.00 613.48 647.80

Total Assets 163.52 228.74 274.59 441.95 467.69 467.37 511.66 982.47 1,208.00 1,257.24

Key indicators

Earnings Per Share

- Rs. 5.40 16.75 14.48 23.91 26.72 36.12 59.12 30.42 36.56 40.12

Gross Margin Ratio 31.74% 29.56% 30.97% 32.61% 28.71% 30.03% 33.67% 30.55% 30.79% 29.97%

Debt-Equity Ratio 0.00 0.09 0.08 0.37 0.22 0.29 0.14 0.53 0.42 0.27

Return on Capital

Employed 14.68% 13.78% 22.04% 23.46% 25.09% 34.57% 40.57% 22.57% 29.98% 29.27%

Exhibit 2 (Balance Sheet- Zensar Technologies Ltd.)

Thank You