GQ EN Presentation

-

Upload

adnet-communications -

Category

Documents

-

view

625 -

download

1

description

Transcript of GQ EN Presentation

Click to edit Master title style

CORPORATE PRESENTATION NOVEMBER 2012

TSX-V:GQ

Disclaimer

This presentation contains forward-looking statements or forward-looking information within the meaning of applicable securities legislation (hereinafter collectively referred to as "forward-looking statements") concerning the Company's plans for its properties, projects, operations, subsidiaries and other matters. These statements relate to analyses and other information that are based on forecasts of future results, estimates of amounts not yet determinable and assumptions of management regarding operations of the Company which are subject to a variety of business and market risks, including political and regulatory risks associated with mining and exploration in Mali.

Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as "expects" or "does not expect", "is expected", "anticipates" or "does not anticipate", "plans", "estimates" or "intends", or stating that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved) are not statements of historical fact and may be forward-looking statements.

These forward-looking statements are based on certain assumptions which the Company believes are reasonable, however, forward-looking statements are subject to a variety of business and political risks and uncertainties. Some of the important risks and uncertainties that could affect forward-looking statements are also described in the Company's continuous disclosure filings made with Canadian securities regulatory authorities, which are available at the SEDAR website and on the Company’s website. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, they may adversely affect the Company’s business and prospects and actual results may vary materially from those described in forward-looking statements. Forward-looking statements are made based on management's beliefs, estimates and opinions on the date the statements are made and the Company undertakes no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change, other than as required by applicable laws. Investors are therefore cautioned against placing undue reliance on forward-looking statements. The technical information in this presentation has been reviewed by Jed Diner, MSc. P.Geol., a qualified person as defined by National Instrument 43-101.

2

Tilemsi Phosphate – GQ Flagship Project

3

Advancing Tilemsi Phosphate Project

• 50 million tonnes inferred resource

• High natural grade 24.3% P₂O₅

• Significant upsizing potential

• Strategic source of phosphate for direct application fertilizer or as a NPK component

PROJECT HIGHLIGHTS SHARE INFORMATION

TSX-V: GQ

SHARES OUTSTANDING 44.7 m

-OPTIONS 3.8 m

-WARRANTS 0.7m

FULLY DILUTED 49.3 m

52-WEEK LOW/HIGH $0.68/$3.71

3-MONTH AVG. VOL. 20,927

52-WEEK MARKET CAP $31.8/173.6m

DIRECTORS & OFFICERS 9%

As of October 2, 2012

4

Investment Highlights

5

• Phosphate deposit regarded as strategic to solve regional food security issues in the Sahel Region, West Africa (AGRA, IFDC) STRATEGIC DEPOSIT

• Effective fertilizer product with low OpEx and CapEx expectations

• Strip minable – Near surface deposit (<10 meters on average)

• Simple production process proven by characterization tests POSITIVE ATTRIBUTES

• 3 phosphate concessions with total surface of 1,206km²

• Only 26 km² drilled to date (Drilling program - Phases 1 and 2, out of 4) UPSIZE POTENTIAL

• Fast growing population (>2% pa) drive food demand in West Africa

• Large agribusiness investments in West Africa MARKET POTENTIAL

• Proximity to key agricultural markets in West Africa (<1,000 km radius)

• Ability to offer low farm-gate price thanks to market proximity LOGISTICAL ADVANTAGE

• Strong combined management and board expertise in mineral exploration in Africa and the global phosphate and fertilizer industry EXPERTISE

Board and Management

6

Management

Joel Jeangrand President, CEO and Director

Former CEO of Pan American Hydro and VP Corporate Development of Spur Ventures

with a phosphate project in China.

Jayram Hosanee Chief Financial Officer

Former CFO at Mineral Hill and Golden Dawn Minerals. Holds a CGA.

Mohammed Bouhsane Chief Operating Officer

Former Project Engineer in the Moroccan mining and metallurgy industries working for

the ONA Group and OCP.

Candice Font Investor Relations Manager

Former Media Project Manager for Africa Investor, a specialised publication; and IR

Consultant at Silver Bull Resources.

Board

John A. Clarke – Chairman Former CEO of Nevsun Resources and

Executive Director of Ashanti Goldfields

Joel Jeangrand – Director Former CEO of Pan American Hydro; VP Corporate Development

of Spur Ventures with a phosphate project in China

Victor Jones – Director 30 years of experience in senior executive and board positions

in public mineral exploration and technology companies

Ehud Levy – Director Phosphate manufacturing industry consultant with

a 30-year career with Bateman Engineering and Rotem

Gordon Peeling – Director President of Mining Association of Canada (MAC) with 30 years

of mining experience in the public and private sectors

Jed Richardson – Director Former VP Corporate Development at Verde Potash and

Institutional Equity Research Analyst at Cormark Securities

David Shaw – Director Worked as Senior Mining Analyst at Yorkton Securities; initiated and developed Resource Research Group at Charlton Securities

Deposit Attributes

With a high average phosphate grade and significant exploration

upside, the Tilemsi deposit has the potential

to become a world-class phosphate resource

7

TILEMSI PHOSPHATE

INITIAL INFERRED RESOURCE 50 million tonnes

AVERAGE PHOSPHATE GRADE 24.3% P₂O₅

CONCENTRATE GRADE 25-38% P₂O₅

CONCENTRATE QUALITY Low levels of contaminants

(ie. cadmium)

BENEFICIATION Easy separation and treatment

DEPOSIT DEPTH Near surface

Strip-minable potential

Drilling Program to Expand Resource

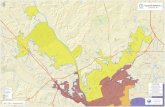

Map of Tilemsi phosphate project showing our concessions

on remote sensing and drilling program (completed and planned)

8

5 km

Phases 1 and 2 of Drilling Program completed

Product Development

GQ has successfully been conducting characterization tests

to determine the effectiveness of the potential product

9

Test Results Impact

BENEFICIATION Screening at 850 microns to

achieve P2O5 grades of 36.8%

Via simple screening process, the product can easily beneficiated to up to 36.8% P2O5 % P₂O₅

SOLUBILITY

71.1% soluble P2O5 in citric acid

62.5% soluble P2O5 in formic acid

The rock solubility shows that it is able to compete with other chemical fertilizers, as fertilizers’ effectiveness is based on

immediate availability of the nutrients

GRANULATION Successfully produced granules sized 1-4mm

The product can easily be granulated, allowing the product to withstand transportation and be used as a component of NPK

blended fertilizer

Characterization tests indicate:

Tilemsi natural phosphate (TNP) meets or exceeds market specifications for beneficiation, solubility and granulation.

TNP can be used as either as very low cost phosphate component for blended NPK fertilizer or as a direct application fertilizer.

Path to Product

10

SSP: Single Superphosphate – TSP: Triple Superphosphate – MAP:Mono-Ammonium Phosphate - DAP: Di-Ammonium Phosphate NPK: Nitrogen, Phosphate, Potassium

4. Primary use

1. Raw Material

2. Beneficiation

3. Transformation

to Final Product,

incl. Granulation

Phosphate Ore

Phosphate Rock Concentrate

DAP/MAPTSPSSP

Direct Application Direct Application or Custom Mix Fertilizer

NPK

Sulfuric Acid PlantPhosphoric Acid/

Nitrophosphate Plant

PotashNutrient Additives Ammonia

Target Markets and Infrastructure

GQ is well positioned to supply West Africa’s key

agricultural markets in high grade natural phosphate:

12

Why is W. African agriculture dynamic ?

13

•Only 23-30% of arable land in W. Africa is currently cultivated

•Low fertilizer usage (9kg/ha vs. 101kg/ha in the rest of the world)

1. Africa - the next agricultural frontier to feed the world

•Fast growing population (>2% pa) in West Africa lead to higher food demand

•Dynamic and growing agribusiness sector attracting large foreign agribusiness investments

2. Growing food demand require higher agriculture yields

•West Africa’s soils generally fragile and unfertile

•Acidic soils require more phosphorus for higher agricultural productivity

3. Poor soil quality requires mineral fertilizers

• Most phosphate are imported from overseas long lead time, added costs

• High farm gate prices (up to 80% above world retail prices) due to high transportation costs, market inefficiencies, taxes,…

4. Need for a local, low cost phosphate supplier

Regional Agricultural Activity

14

The use of fertilizers should be increased to 50 kg/ha by 2015 (Africa Fertilizer Summit, 2006). The present use of fertilizers in Sub-Saharan Africa is only about 9 kg/ha of arable land, compared to a world average of 101 kg/ha. (FAOSTAT, 2009)

GQ target markets: Principal production

and food crop locations Source: Bureau Issala, JL Chaleard and SWAC

Development of cash crops in West Africa (1980-2006)

Source: FARM 2008

Closing the (yield) gap in West Africa

15 Source: FAO

0

5,000

10,000

15,000

20,000

25,000

30,000

35,000

40,000

45,000

50,000

0

500

1000

1500

2000

2500

3000

3500

4000

1961 1966 1971 1976 1981 1986 1991 1996 2001 2006

World

West Africa

000s o

f h

ecta

res kg/ha

Gap between actual and potential maize yields

Source: Jayne et al. 2009

Cereal yield growth vs. area harvested

These 2 graphs support the case for more fertilizer use in Africa, for higher agricultural yield.

Achievements to date

16

2010

• Initial prospecting license of Tilemsi phosphate Concession granted to GQ

•Phosphate Advisory Committee appointed for Mali phosphate project

•Appointment of new director signals focus on Malian phosphates

•Sale of Kenieba gold concession to Avion Gold Corporation (now Endeavour Mining)

2011

•Phosphate exploration permit granted for Tilemsi and Tarkint Est concessions

•Drilling phases I and II of Exploration Program completed.

•Tilemsi Phosphate Project receives 32.6Mt initial mineral resource estimate

•Addition of Ader Foul concession extends the Tilemsi project area to 1,206 sq. km

2012

•Bulk samples sent to MINTEL for metallurgical and processing analysis

•Promising characterisation tests received indicating high grade and reactivity of the rock

•GQ files 2 technical reports and expand the inferred mineral resource to 50Mt

Development Plans 2012-2015

17

Q4 2012 Complete PEA

Q1-Q2 2013 Resume Exploration Program

Q3 2013 Complete Pre-Feasibility Study

Q4 2013 - Q1 2014 Complete Feasibility Study

2014 Complete Construction

2015 Launch Production

Tilemsi Project - Positive Attributes

18

High grade phosphate

deposit

Potential for significant upsizing

Proximity to markets

Low cost product

expectation

Growing market needs

19

Appendices

Tilemsi Exploration Program

20 * Historical results have not been confirmed

STATUSPermit

Name

Drilling

ProgramTarget Name

# of Holes and Total

Meters Drilled

Resource

Estimate

Average Grade

(P₂O₅)

12.17 km²

141 holes totalling 1,717m

128 holes totalling 3,218m

Drilled Surface

6.75 km²

6.7 km²

PLA

NN

ED

Phase I

Phase III

23.4 km²

Tilemsi

Tarkint Est

Tarkint Est

Tilemsi

Ader Foul

Tin Siriden

Phase IV

Ader Foul

Chemanaguel

Tarkint Est

CO

MP

LETE

D

Alfatchafa

n.a

55 km²

Historical samples*

0.60-1.25m @ 28%375 holes totalling 5,625m

0.9m @ 22.0%

5 km² but holes were

drilled along 3.7 km of line

11.3 holes were drilled

along 9.1 km of line

n.a n.a

n.a

48 holes drilled over

these 3 targets totalling

608m

55 km²

Holes were drilled along

11.1 km of line

13.2 km²

Tin Hina

Phase II

Chemanaguel

Tin Siriden

Chemanaguel

Tagit

N'Ouarane

Tin Hina

Tin Siriden

Alfatchafa

17.4 Mt

32.6Mt

198 holes totalling 2,970 m

n.a

n.a

n.a

n.a

Historical samples*

1- 1.15m @ 26%

n.a

n.a

n.a

128 holes totalling 1,920 m

180 holes totalling 2,700 m

125 holes totalling 1,875m

1.4m @ 24.2%

25.87%

Resource Estimate

The NI 43-101 mineral resource reports provide

an inferred mineral resource estimate of 50 million tonnes

at a grade of 24.3% P2O5 (at a cut-off of 10% P2O5)

21

Drilling

CampaignTarget Zone

Cut-Off

Grade (%)

Tonnes

(000's)

Average Grade

(P₂O₅ %)Strip Ratio

Phase I Alfatchafa 10 12,538 22.16 15:01

Phase I Tin Hina 10 20,000 24.24 4.5:1

Phase II Tarkint Est 10 17,436 25.87 5.7:1

Phase I and II TOTAL 10 49,974 24.29 -

Global Phosphate Industry

22

• Essential nutrient to plant and animal life

• One of 3 key components of NPK fertilizers

• 90% of phosphate is used in fertilizers

• No substitute for phosphorus in agriculture

• Moroccan phosphate rock regarded as standard

About phosphate

• Phosphoric Acid

• Nitro Phosphate Fertilizers

• Basic Fertilizers (SSP, TSP)

• Direct Application

Fertilizer uses of phosphate rock

• 65 billion tonnes estimated global phosphate rock reserves

• Phosphate reserves depleting globally

• Global consumption expected to grow by 2% annually

Key industry facts

China

USA

Morocco

Russia

Other

67% of global production concentrated in just 3 countries

Source: FAO

Phosphorus deficiency symptoms in rice (on the right)

Source: INPI

GQ Gold Concessions

23

•3 gold concessions located in the productive Mali Birimian Gold Belt in western Mali:

•Sanoukou 24 sq. km

•Bourdala 16 sq.km

•Dabia Ouest 100 sq.km

GQ Gold

•A prolific gold belt with 14 deposits and >30m Oz of gold discovered to date

•Mali – 3rd largest gold producer in Africa

Background - Birimian Belt

•Producing gold mines in the same area:

•Randgold Loulo + Gounkoto

•Avion Gold Segala + Tabakoto

•Anglogold/Iamgold Sadiola + Yatela

Mali Operational Gold Mines

About Mali

24

LOCATION

• Located in the heart of West Africa

• Vast landlocked country 1.2m km²

• 14.5 million people

• Well connected to other West African nations (paved roads and rail) and major maritime hubs of Abidjan and Dakar

GEOLOGY

• Favorable geology dominated by the Birimian gold belt

• Several operating gold mines in Mali incl. Endeavour, IAMGold…

• Third largest gold producer in Africa

• Large phosphate occurrences in northeastern Mali known since 1927-35 (IFDC)

• Tilemsi phosphate recognised by several organisations (AGRA, IFDC) for its agronomic potential

INVESTMENT CLIMATE

• September 3, 2012 Mali Ministry of Mines invited GQ and other mining companies to formally reassure them of the attractiveness of doing business in Mali despite the current political situation

• Amongst top sub-Saharan Africa performers on the World Bank’s ‘Doing Business Survey’ 2012

• According to same survey – Mali outperformed its neighbours incl. Niger, Mauritania, Burkina Faso and Guinea

Mali Mineral Policy

Mali mineral law is based on the French civil law.

The mining code was revised in 2012.

25

• Exclusive right to carry out prospecting activities

• Valid for a period of 3 months

• Renewable once for 3 months

EXPLORATION LICENSE

(Autorisation d’Exploration)

• Awarded for 3 years

• Covers 8 km²

• Renewable once for same period

PROSPECTING LICENSE

(Autorisation de Prospection)

• Valid for specified commodities (called “Arrêté”) • Granted for 3 years • Renewable twice for an additional 2 years each time

RESEARCH PERMIT

(Permis de Recherche)

• Granted for 30 years

• Renewable for 10 years each time, until depletion of the ore reserves

MINING PERMIT

(Permis d’Exploitation)

Management Bios

26

Joel Jeangrand President, CEO and Director

Mr. Jeangrand has more than 20 years of global experience in marketing, business and corporate development in the natural resource sector and renewable energy business. Prior to joining Great Quest, he held the role of President and CEO of Pan American Hydro Corporation from 2008 to 2012. Previously, Mr. Jeangrand served as VP Corporate Development of Spur Ventures Inc., a publicly traded Vancouver-based fertilizer company with a phosphate project in China. He also spent 11 years in roles of increasing responsibility with the Eramet Group and worked in locations such France, Hong Kong and Taipei. He holds an Executive MBA from Simon Fraser University in Vancouver (2005), and earned a Bachelor of Commerce (equivalent) from Ecole Supérieure de Commerce de Toulon, France (1989).

Jay Hosanee Chief Financial Officer

Mr. Hosanee is a General Certified Accountant who brings over 20 years of senior management experience in corporate finance, auditing and internal control. Prior to joining Great Quest, he held the position of CFO at Mineral Hill and Golden Dawn Minerals Inc.. His international experience include multi-currency group consolidation, overseeing financial reporting and regulatory compliance of several public listed companies. He also held the position of CFO at Loita Group, an investment banking firm focused on Africa. This role gave him tremendous exposure to sub-Saharan markets. Mr. Hosanee is fluent in French and holds a CGA qualification as well as an Internal Auditor certification.

Mohammed Bouhsane Chief Operating Officer

Mr. Bouhsane brings 20 years of experience in project management and engineering in the Moroccan mining, hydrometallurgical, and metallurgy industries. He spent most of his time at a mining subsidiary of the ONA Group, where he served as project director and project manager of two major projects. Most recently, Mr. Bouhsane was Project Manager at Nareva Holding, managing construction and financing of an irrigation network. Mohammed is a member of the Quebec Order of Engineers.

Candice Font Investor Relations and Communications

Ms. Candice Font comes to GQ with a wealth of experience working in Africa. As a regional manager for Africa Investor, a specialized publication focused on business in Africa, Ms. Font was based in Abidjan, Cote d’Ivoire and Libreville, Gabon from 2008 to 2010. Between 2005 and 2008, she worked as a project manager producing business reports on the growth opportunities in emerging countries such as Russia, Nigeria, and Qatar. Prior to joining Great Quest, Ms. Font worked in Investor Relations at Silver Bull Resources, Inc. perfecting her expertise in streamlining information flow, cultivating relationships with stakeholders and enhancing companies public profiles. She holds a Bachelor's degree in International Business from the University of Plymouth (UK) and is fluent in English and French.

Directors Bios

27

John A Clarke Chairman

Mr. Clarke brings considerable experience in exploration, acquisition and development in the gold mining sector in Africa. He has held roles as Vice Chairman and CEO of Nevsun Resources and Executive Director of Ashanti Goldfields Company Ltd. He holds B.Sc. in metallurgy from University College Cardiff, a Ph.D. in metallurgy from Cambridge University and MBA from Middlesex Polytechnic.

Joel Jeangrand Director

Mr. Jeangrand has more than 20 years of global experience in marketing, business and corporate development in the natural resource sector and renewable energy business. Prior to joining Great Quest, he held the role of President and CEO of Pan American Hydro Corporation from 2008 to 2012. Previously, Mr. Jeangrand served as VP Corporate Development of Spur Ventures Inc., a publicly traded Vancouver-based fertilizer company with a phosphate project in China. He also spent 11 years in roles of increasing responsibility with the Eramet Group and worked in locations such as Gabon, Paris, Hong Kong and Taipei. He holds an Executive MBA from Simon Fraser University in Vancouver (2005), and earned a Bachelor of Commerce (equivalent) from Ecole Superieure de Commerce de Toulon, France (1989).

Victor Jones Director

Mr. Jones has over 30 years of experience in senior executive and board positions in public mineral exploration and technology companies. He has been active on projects across North America and Africa on financings and JV and acquisition negotiations. Mr. Jones received both his B.Sc and MBA from McGill University.

Ehud Levy Director

Mr. Levy is a phosphate manufacturing industry consultant, based in Israel. Ehud formed his consulting firm following a 30-year career in Israel with Bateman Engineering and Rotem. At Bateman, he was the managing director of the chemical technologies, directing project initiation and new processes for sophisticated applications of phosphates.

Gordon Peeling Director

Mr. Peeling has been the president of Mining Association of Canada (MAC) since 1997 and has over 30 years of mining experience in the public and private sectors. Prior to MAC, he served as Vice President at the International Council on Metals and the Environment and Director General at both the Mineral Commodities Branch and Mineral Strategy Branch at Natural Resources Canada.

Jed Richardson Director

Mr. Richardson graduated from University of Toronto with B.A.Sc. in mineral and geological engineering. He worked for Alcan as an engineer, and RBC and Cormark as research analyst. He is currently a director and the VP Corporate Development of Verde Potash (formerly Amazon Mining). Jed is the founding principal of Javelin Partners, consulting firm for junior resource companies.

David Shaw Director

Mr. Shaw has worked both in the technical and financial communities in the resource industry. He initiated and developed Resource Research Group at Charlton Securities, worked as Senior Mining Analyst at Yorkton Securities and as a technical expert at Chevron Resources. He is well connected within European financial institutions and the mining sector.

Great Quest Comparables

28

As of September 4, 2012 Sources: Yahoo Finance, Capital IQ and Company Reports DFS: Definitive Feasibility Study; PEA: Preliminary Economic Assessment

Aguia Resources Ltd AGR:ASX AUD 0.15 0.74 0.12 51,007 $15.94 Drilling Brazil – 21.3 4.6%

Arianne Resources Inc DAN:TSXV CAD 0.90 2.48 0.80 58,575 $58.68 Pre-Feas Completed Canada 347.7 462.0 5.5%-6.5%

Celamin Holdings CNL:ASX AUS 0.14 0.39 0.13 29,647 $11.10 Drilling Tunisia Algeria – – –

Eagle Star Minerals Corp EGE:TSXV CAD 0.12 0.18 0.07 19,889 $7.28 Drilling Brazil – – –

Great Quest Metals Ltd GQ:TSXV CAD 1.14 3.71 0.68 22,891 $48.80 PEA Underway Mali – 32.6 23.4%

Legend International Holding LGDI:MKT USD 0.11 0.48 0.06 434,612 $24.90 Feasibility Completed Australia 202.8 516.1 14%-15%

MBAC Fertilizer Corp MBC:TSX CAD 2.82 3.30 2.16 88,472 $275.57 Production Target 2012 Brazil 58.8 119.0 5.01%-5.27%

Minbos Resources Ltd MNB:ASX AUD 0.21 0.40 0.14 112,356 $18.80 Scoping Study Underway Angola, DRC – – –

Minemarkers Ltd MAK:ASX AUD 0.14 0.40 0.13 284,044 $32.70 Pre-Feas Completed Australia, Namibia 399.5 1,561.9 18%-20%

Plains Creek Phosphate PCP: TSXV CAD 0.03 0.12 0.02 n/a $9.69 Pre-Feas Completed Guinea Bissau 83.8 83.8 29.6%

Rio Verde Minerals RVD:TSX CAD 0.20 0.55 0.18 48,024 $24.32 Scoping Study Underway Brazil 1.9 1.9 11.7%-20.3%

Rum Jungle Resources Ltd RUM:ASX AUD 0.23 0.41 0.19 436,854 $37.00 Drilling Australia 13 13.0 15.0%

Stonegate Agricom Ltd ST:OTC CAD 0.41 1.27 0.32 5,855 $59.19 Pre-Feas Completed Peru, US 61.8 446.2 9%-30.6%

Strata Minerals SMP:TSXV CAD 0.08 0.08 0.08 4,700 $4.30 Drilling Australia – – –

Sunkar Resources Plc SKR:LSE GBP 0.04 0.09 0.03 334,516 £7.08 Feas. Study Underway Kazakhstan 293 475.3 11.0%

UCL Resources Ltd UCL:ASX AUD 0.12 0.37 0.01 35,385 $9.70 DFS nearing completion Australia, Namibia 96.5 779.9 18.9%

Market

Cap (m)Project Stage Project Location

Share

Price

Stock

Ticker

3m Avg

Vol

52-week

High LowCurrency

Ore Resources

M&I

(Mt)Total Grade P₂O₅

29

Great Quest Metals Ltd

TSX-V: GQ

Suite 515, 475 Howe Street Vancouver, BC, V6C 2B3

WWW.GREATQUEST.COM

IR Candice Font Tel +1 604.689.2882 Toll Free 1.877.325.3838 Fax +1 604.684.5854 Email [email protected]