Government Spending Matt Timmons Vince DAlanno Dan Curtis.

-

Upload

devin-fraser -

Category

Documents

-

view

213 -

download

1

Transcript of Government Spending Matt Timmons Vince DAlanno Dan Curtis.

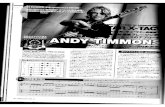

Government SpendingGovernment Spending

Matt TimmonsMatt Timmons

Vince D’AlannoVince D’Alanno

Dan CurtisDan Curtis

Section 1Section 1

In 1997, government spent 2.6 trillion In 1997, government spent 2.6 trillion Per Capita- per person Per Capita- per person

Ex. In 1997, government spent $9,610 Ex. In 1997, government spent $9,610 per capita.per capita.

Two kinds of spendingTwo kinds of spending

1)1) Public Sector- federal, state, and local Public Sector- federal, state, and local gov.gov.

2)2) Private Sector- goods and services from Private Sector- goods and services from private businessesprivate businesses

Goods and ServicesGoods and Services Ex. Tanks, planes, shipsEx. Tanks, planes, ships Parks, highways, presidents, governorsParks, highways, presidents, governors

Transfer Payments- a payment for which Transfer Payments- a payment for which the government receives neither goods the government receives neither goods nor services.nor services.

Ex. Social Security, WelfareEx. Social Security, Welfare

Grant-in-aidGrant-in-aid

Ex. Inter-state highway constructionEx. Inter-state highway construction

Distribution of Income- the way in Distribution of Income- the way in which income is allocated to peoplewhich income is allocated to people

The income of poor people can directly be The income of poor people can directly be affected bt change in transfer paymentaffected bt change in transfer payment

Incomes are also affected when the Incomes are also affected when the government decides where to make government decides where to make expendituresexpenditures

Section 2Section 2

Federal Budget- annual plan outlining Federal Budget- annual plan outlining proposed revenues and expendituresproposed revenues and expenditures Developed in two main phasesDeveloped in two main phases

1) president submits financial plan1) president submits financial plan 2) congress approves financial plan2) congress approves financial plan

Fiscal year- a 12 month financial planning Fiscal year- a 12 month financial planning periodperiod

Federal budget deficit- when the Federal budget deficit- when the expenditures are larger than the expenditures are larger than the revenuesrevenues

Appropriations bill- sets federal money Appropriations bill- sets federal money aside for a specific purposeaside for a specific purpose

Spending CategoriesSpending Categories

1.1. Social securitySocial security

2.2. National defenseNational defense

3.3. MedicareMedicare

4.4. HealthHealth

5.5. TransportationTransportation

Section 3Section 3

Under the balanced budget Under the balanced budget amendment, states are forced to cut amendment, states are forced to cut spending when state revenues drop.spending when state revenues drop.

The mayor, city council, county The mayor, city council, county judge, or elected representatives judge, or elected representatives approve spendingapprove spending

State Government ExpendituresState Government Expenditures

73% of all state spending are public 73% of all state spending are public welfare, higher education, insurance trust, welfare, higher education, insurance trust, highways, hospitals, and interest on state highways, hospitals, and interest on state debt.debt.

Public WelfarePublic Welfare Largest category of expendituresLargest category of expenditures (Cash assistance, Medicare)(Cash assistance, Medicare)

Higher EducationHigher Education Traditional responsibility of state governments Traditional responsibility of state governments

with their networks of state colleges.with their networks of state colleges.

Insurance Trust FundsInsurance Trust Funds Funds are invested until people either Funds are invested until people either

retire, become unemployed, or injure retire, become unemployed, or injure themselvesthemselves

HighwaysHighways The federal government builds and The federal government builds and

maintains much of the interstate maintains much of the interstate highway system, but states maintain the highway system, but states maintain the state roads and other highwaysstate roads and other highways

HospitalsHospitals The government spends money because The government spends money because

hospitals don’t charge enough to fully hospitals don’t charge enough to fully recover all of their costsrecover all of their costs

Interest of DebtInterest of Debt States issue bonds to cover everything States issue bonds to cover everything

from general revenue to highways to from general revenue to highways to university dormsuniversity dorms

Other SpendingOther Spending 27% of direct state government 27% of direct state government

expenditures consist of a variety of expenditures consist of a variety of expendituresexpenditures

Local Government SpendingLocal Government Spending

Local governments include countries, Local governments include countries, municipalities, townships, school districts, municipalities, townships, school districts, and other special districtsand other special districts

Elementary and Secondary EducationElementary and Secondary Education Includes teachers and administrators salaries, Includes teachers and administrators salaries,

textbooks, and construction and maintenance textbooks, and construction and maintenance of school buildingsof school buildings

Public UtilitiesPublic Utilities Local government pays for water and Local government pays for water and

electricity because fewer utilities server people electricity because fewer utilities server people on a state-wide basison a state-wide basis

HospitalsHospitals Many are city or municipal ownedMany are city or municipal owned

Interest on DebtInterest on Debt Nearly the same as federal government Nearly the same as federal government

spendingspending Police ProtectionPolice Protection

Most localities have a full-time police Most localities have a full-time police force, so it’s a significant cost for local force, so it’s a significant cost for local governmentsgovernments

HighwaysHighways Highways, roads, and street repairsHighways, roads, and street repairs (Potholes, street signs)(Potholes, street signs)

Other ExpendituresOther Expenditures Approx. 1/3 are a wide variety of Approx. 1/3 are a wide variety of

categoriescategories (Housing, and community development, (Housing, and community development,

fire protection, and parks and fire protection, and parks and recreation)recreation)

Section 4 and Other InfoSection 4 and Other Info

InflationInflation The Government tries to increase the The Government tries to increase the

price of goods so citizens don’t hoard price of goods so citizens don’t hoard money, which can cause economic money, which can cause economic slowdownslowdown

US regulates Economy in two ways:US regulates Economy in two ways: Economic RegulationEconomic Regulation Social RegulationSocial Regulation

Deficit spending: spending more than Deficit spending: spending more than is collected in revenues. In other is collected in revenues. In other words the government spends even words the government spends even though they are in debtthough they are in debt.. The government actually plans their The government actually plans their

deficit spending and estimates how deficit spending and estimates how much further they are going to be in much further they are going to be in debt after certain expenses.debt after certain expenses.

Impact of National DebtImpact of National Debt

Public Debt: federal debt that we owe Public Debt: federal debt that we owe to ourselvesto ourselves

Private Debt: Debt that is owed to Private Debt: Debt that is owed to others, in theory the borrowing party others, in theory the borrowing party is supposed to repay individual, but is supposed to repay individual, but in this case the government shows in this case the government shows little signs of repaying party. With little signs of repaying party. With Private Debt the party repaying loses Private Debt the party repaying loses purchasing power because they have purchasing power because they have to give up a source of revenue.to give up a source of revenue.

Crowding out effect: the higher than Crowding out effect: the higher than normal interest rates that cause an normal interest rates that cause an increase in the repayable amount a increase in the repayable amount a party owes. party owes.

Balanced Budget: A budget that Balanced Budget: A budget that creates neither a profit or a deficit. creates neither a profit or a deficit. Any profit that is created is spent, Any profit that is created is spent, and any deficit is immediately paid.and any deficit is immediately paid.

GRH: Gramm Rudman Hollings, GRH: Gramm Rudman Hollings, Balanced Budget and Emergency Balanced Budget and Emergency Control Act of 1985, created to fix Control Act of 1985, created to fix Federal Deficit and decrease debt Federal Deficit and decrease debt until it reached zero in 1991.until it reached zero in 1991.

BEA: Budget Enforcement Act: “Pay BEA: Budget Enforcement Act: “Pay as you go” as you go” Created to limit discretionary spendingCreated to limit discretionary spending

Economic Regulation: Using the Economic Regulation: Using the Antitrust Law, The Government Antitrust Law, The Government attempts to prevent monopolies from attempts to prevent monopolies from forming in the Market and control forming in the Market and control prices.prices.

Social Regulations: US spends money Social Regulations: US spends money on meeting the demands of the on meeting the demands of the public through providing health and public through providing health and safety.safety.

National DebtNational Debt

The National Debt is the overall The National Debt is the overall collective sum of yearly budget collective sum of yearly budget deficit owed by all branches of the deficit owed by all branches of the United States government, plus United States government, plus interest. interest. About $9 trillionAbout $9 trillion