GOING OR GONE REGIONAL? - Labuan IBFC...GOING OR GONE REGIONAL? ... Income received by Labuan...

Transcript of GOING OR GONE REGIONAL? - Labuan IBFC...GOING OR GONE REGIONAL? ... Income received by Labuan...

GOING OR GONE REGIONAL? STRUCTURING YOUR BUSINESS EXPANSION VIA

LABUAN INTERNATIONAL BUSINESS AND FINANCIAL CENTRE (LIBFC)

20 September 2016

WELCOME REMARKS

YBHG DATUK WIRA JALILAH BABA

PRESIDENT, MALAYSIAN INTERNATIONAL CHAMBER

OF COMMERCE AND INDUSTRY (MICCI)

OPENING REMARKS

DANIAL MAH ABDULLAH

CEO, LABUAN IBFC INC.

AN INTRODUCTION TO LABUAN IBFC

ASIA PACIFIC’S MIDSHORE INTERNATIONAL BUSINESS

AND FINANCIAL CENTRE

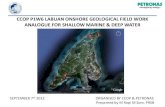

Where is Labuan?

Off the coast of Sabah, East Malaysia Federal Territory About 100,000 population Common time zone with major cities Where business meets leisure

6

What is Labuan IBFC?

Our Vision To be Asia Pacific’s leading midshore international business and financial centre

Striking an ideal balance between client confidentiality and international best standards

• International business and financial centre

• A tax-efficient jurisdiction to facilitate businesses, trading, investments

and etc., through financial services and legal structures

• Well-balanced legal and regulatory framework

7

Connecting Asia’s Economies

70% of Labuan Companies are Asian-based

(as at 2014) 8

Internationally Recognised

Group of International Finance Centre Supervisors (GIFCS) Member since 1999

International Organisation of Securities Commissions (IOSCO) Member since 2003

Group of International Insurance Centre Supervisors (GIICS) Member since 1999

International Association of Insurance Supervisors (IAIS) Member since 1998

Islamic Financial Services Board (IFSB) Member since 1998

Asia/Pacific Group on Money Laundering (APG) Member since 2000

Labuan IBFC Adheres to OECD’s International Standards and Best Practices

International Islamic Financial Market (IIFM) Member since 2002

9

Comprehensive Legislation

Labuan Financial Services and Securities Act 2010

Labuan Islamic Financial Services and Securities Act 2010

Labuan Foundations Act 2010

Labuan Limited Partnerships and Limited Liability Partnerships Act 2010

Labuan Business Activity Tax Act 1990

Labuan Financial Services Authority Act 1996

Labuan Trusts Act 1996

Labuan Companies Act 1990

10

An Ecosystem of Solutions

Services

• Banking

• Insurance – Risk Management

• Corporate secretarial

• Legal services

• Administrative activities

• Trusteeship

• Accounting

Structures

• Holding company

• Trading company

• Protected cell companies

• Captive Insurance

• Company limited by shares and guarantee

• Limited partnership

• Limited liability partnership

• Trusts, including purpose trusts

• Foundations

Available in conventional and Shariah-compliant forms

Marketing offices may be located in Kuala Lumpur or Iskandar Malaysia (north of Singapore) 11

Business Activities

Source: Statistics from Labuan FSA’s Annual Report 2015

Banking (54)

•Wholesale banking

•Investment banking

•Loans/deposit

•Financial guarantees

•Trade finance

Leasing (374)

Companies (12,470)

• Investment holding

• Trading

•Life/general

•Broking

•Captives

•Re-insurance

Insurance (209)

•Company incorporation

•Company administration

•Corporate secretarial

•Trustee services

Trust Cos. (43)

•Aviation

•Shipping

•Heavy machinery

Wealth Management

(more than 300)

Commodity Trading

(43)

•Business succession

•Estate management

•Legacy planning

•Oil and gas

•Agriculture

•Minerals

Unique Tax Systems

Flexibility

0% Investment

holding

3%

RM 20,000

Election for Income Tax Act

1967

Irrevocable election

13

Labuan IBFC - Fiscal Incentives

Withholding tax exemption on dividends, interest, royalties, service fees, lease payments

50% exemption on gross employment income of non-Malaysian professional, managerial staff

100% exemption on director fee paid to non-Malaysian director

Stamp duty exemption

No exchange control

Access to most of Malaysia’s 80 double taxation agreements 14

Double Taxation Agreements Network

ALBANIA ARGENTINA AUSTRALIA AUSTRIA BAHRAIN BANGLADESH BELGIUM

CROATIA

IRAN IRELAND ITALY JAPAN JORDAN KAZAKHSTAN KOREA KUWAIT KYRGYZ LAOS LEBANON LUXEMBOURG

MALTA MAURITIUS MONGOLIA MOROCCO MYANMAR NAMIBIA NETHERLANDS

POLAND QATAR ROMANIA RUSSIA

BOSNIA HERZEGOVINA

BRUNEI CANADA CHILE CHINA

DENMARK EGYPT FIJI FINLAND FRANCE GERMANY HONG KONG HUNGARY INDIA INDONESIA CZECH REPUBLIC

NEW ZEALAND

NORWAY PAKISTAN PAPUA NEW GUINEA

PHILIPPINES

SAN MARINO

SAUDI ARABIA

SEYCHELLES SINGAPORE SOUTH AFRICA

SPAIN SRI LANKA SUDAN

SWEDEN SWITZERLAND SYRIA THAILAND TURKEY TURKMENISTAN UAE UK USA UZBEKISTAN VENEZUELA VIETNAM

Why Labuan IBFC?

• Developed legal framework providing a wide array of products and services

• Tax efficiency and flexibility; e.g. Labuan or onshore tax option

• Malaysia is ranked 18th/ 189 - World Bank's Ease of Doing Business Report 2015

• Cost effective, One third the cost of Singapore/Hong Kong

• Professional expertise and services

• Re domiciliation to or from Labuan IBFC of companies and structures allowed

• Ability to create economic substance on Labuan island or Malaysia, onshore

• Same time zone as all key Asian cities, including Singapore, Hong Kong

• Labuan Companies accepted as a listing vehicle on: National Stock Exchange of Australia, Hong Kong Stock Exchange and Singapore Stock Exchange

16

25 Years and Growing…

• Reputation and Track Record

• Connecting Asia’s Economies

17

GOING OR GONE REGIONAL? STRUCTURING YOUR BUSINESS EXPANSION VIA

LABUAN INTERNATIONAL BUSINESS AND FINANCIAL CENTRE (LIBFC)

CHEE PEI PEI DELOITTE TAX SERVICES SDN BHD

Agenda

Overview of Labuan Taxation System

Labuan IBFC in Cross Border Dealings

Local and International Tax Developments

19

Overview of Labuan Taxation System

LABUAN TAX SYSTEM

20

Labuan Tax System

Corporate Tax : Under the purview of the Labuan Business Activity Act 1990 (“LBATA”) Definitions: • Labuan Company – means a Labuan company incorporated under the

Labuan Companies Act 1990, and includes a foreign Labuan company registered under that Act.

• Labuan Business Activity - means a Labuan trading or a Labuan non-trading activity carried on in, from or through Labuan in a currency other than Malaysian currency, by a Labuan entity with non-resident or with another Labuan entity (with certain conditions).

21

Labuan Tax System (Cont’d)

Labuan Tax System 3% tax or RM20,000 upon election

All chargeable profits derived from Labuan

Business Activity

Capital gains included in net

profits Claim for Zakat paid for a year of assessment

22

Labuan Tax System (Cont’d)

Labuan Business Activity Tax Act 1990 (LBATA)

Labuan Trading Activity Labuan Non-Trading Activity

3% of audited net profit RM20,000 Not chargeable to tax

"Labuan trading activity" includes banking, insurance, trading, management, licensing, shipping operations or any other activity which is not a Labuan non-trading activity.

"Labuan non-trading activity" means an activity relating to the holding of investments in securities, stock, shares, loans, deposits or any other properties by a Labuan entity on its own behalf.

Exceptions: - Dealings with residents - Dealings in Ringgit Malaysia 23

Labuan Tax System (Cont’d)

Labuan Trading Activity Both Labuan Trading and Non-Trading

Activity

Labuan Non-Trading

Activity

Non-Labuan Business Activity

• 3% of net profits per audited accounts; or

• RM20,000 upon election; or

• Irrevocable to be taxed under Income Tax Act, 1967 (“ITA”)

• Taxed as Labuan Trading Activity

• Not subject to tax

• Taxed under ITA

24

Double Taxation Agreements (DTAs)

• There are currently 73 effective DTAs in force which Malaysia has entered into with other countries. (Note)

• 14 countries specifically exclude Labuan from DTA:- • Australia, Chile, Germany*, India*, Indonesia, Japan, Korea,

Luxembourg, Netherlands, Seychelles, South Africa, Spain, Sweden, United Kingdom

* Labuan company is included in DTA if it elects to be taxed under the Income Tax Act, 1967.

Note: Status as at 26 August 2016 from IRB’s website.

25

Double Taxation Agreements (DTAs) (Cont’d)

Types of income Non-treaty rates Reduced DTA rates for payment made to MY

Dividends 10% 10%

Interest 15% 10%/15%

Royalties 15% 15%

Capital gains 15% 15%

Example: Thailand

Types of income Non-treaty rates Reduced DTA rates for payment made to MY

Dividends 0 0

Interest 0/5% 0/5%

Royalties 10% 10%

Capital gains No withholding tax No withholding tax

Example: Vietnam

26

Double Taxation Agreements (DTAs) (Cont’d)

Types of income Non-treaty rates Reduced DTA rates for payment made to MY

Dividends 0 0

Interest 15% 0/10%

Royalties 10% 10%

Capital gains No withholding tax No withholding tax

Example: Brunei

Types of income Non-treaty rates Reduced DTA rates for payment made to MY

Dividends 10% 5%/10%

Interest 10% 0/10%

Royalties 5% 5%

Capital gains No withholding tax No withholding tax

Example: Laos

27

Double Taxation Agreements (DTAs) (Cont’d)

Certificate of Residence (“COR”)

COR, issued under the Income Tax Act 1967 enables Malaysian tax resident to claim tax benefits under the DTA, to avoid being tax twice on the same income. “Resident" means-

(a) in relation to a natural person, a citizen or a permanent resident of Malaysia; or

(b) in relation to any other person, a person who has established a place of business, and is operating, in Malaysia,

and includes a person who is declared to be a resident pursuant to subsection 43(2) of the Exchange Control Act 1953;

28

Double Taxation Agreements (DTAs) (Cont’d)

Key factor: Management and control of the company • At least one meeting of the board of directors is held in Malaysia • Refers to controlling authority which determines the policies to be followed

by the company

The COR application should be submitted to the Inland Revenue Board (“IRB”) Labuan Branch and the COR granted is valid for one year of assessment.

29

Tax Filing

• Submission deadline – 31 March each year (i.e. within a period of 3 months from the commencement of a year of assessment)

• In practice, the filing deadline is normally extended to end of May.

• Full payment of tax at time of filing of tax return.

• Labuan entities must file the relevant form(s) applicable to them:-

Type of form

Return of Profits – Labuan trading activity Form LE1

Irrevocable election to be taxed at RM20,000 Form LE2

Irrevocable election to be taxed under the ITA Form LE3

Statutory declaration under Section 5/7/8 of the LBATA Form LE4

Statutory declaration – Labuan non-trading activity Form LE5 30

Tax Exemptions

Income received by Labuan Entities Payment made by Labuan Entities

Dividend

Dividend Distribution by Labuan trust Royalty paid to non-resident or another

Labuan entity Interest paid to resident/non-resident (other

than a person carrying on banking or insurance business) or another Labuan entity

Technical fee paid to non-resident or another Labuan entity

Payment made to non-resident for the use of moveable properties by a Labuan licensed leasing company

Other gains or profits under Section 4(f) of ITA paid to non-resident

31

Tax Exemptions (Cont’d)

Individual tax Other tax benefits

• 50% tax abatement for expatriate professionals and managers.

• 100% exemption for director’s fees received by non-citizen directors.

No stamp duty/ import duty/ exchange control. Supplies of goods or services (except for the supply of freight services) within or between designated areas (DA) are not subject to GST.

32

Labuan Tax Incentives

Incentives under the Global Incentives for Trading (GIFT) programme • Available to a Labuan international commodity trading company (“LITC”)

which uses Malaysia as its international trading base.

• A LITC is allowed to established its operational office anywhere in Malaysia so long as it maintains a registered office in Labuan.

• A LITC is taxed at 3% of audited net profits while a LITC set up purely as a liquefied natural gas (“LNG”) trading company is entitled to 100% income tax exemption on chargeable profit for the first 3 years of its operation provided the LITC is licensed before 31 December 2014.

33

Election to be taxed under the ITA

Section 3A - Labuan business activity chargeable to the ITA upon election. (1) Notwithstanding any other provision of this Act, a Labuan company carrying on a Labuan business activity may make an irrevocable election in the prescribed form that any profit of the Labuan entity for any basis period for a year of assessment and subsequent basis period to be charged to tax in accordance with the Income Tax Act 1967 in respect of that Labuan business activity.

34

Transacting with Malaysian Resident

Transaction allowed with Malaysian

Resident [Section 7(6)]

Licensed banking, insurance or

financial business

Makes or maintains deposits

Administrative and statutory requirement

Lease of properties for office or staff

accommodation

MY resident hold shares in Labuan

company

Holding of shares, debt obligations

or other securities in MY company

The lifting of notification in June 2010 – liberalization which further facilitate the setting up of Labuan International by Malaysian companies and individuals for non-Ringgit business and transactions. 35

Advantages Registering Labuan Company

Individual tax Labuan International Company Malaysian Foreign Company

a) Ownership All types of businesses operate under Labuan International Company can have 100% foreign ownership

Specific business does not allow 100% foreign ownership

b) Flexibility of corporate tax and audit

1) Dormant – No tax/audit 2) Investment holding – No

tax/audit 3) Trading business – 3% of

net profit or RM20,000

Foreign company (24%) unless qualifies as a SME company Tax on 1st RM500,000 : 19% Subsequent : 24%

36

Advantages Registering Labuan Company (Cont’d)

Individual tax Labuan International Company Malaysian Foreign Company

c) Initial set up cost • No paid up capital to start up • No physical office • No trade license • Appointment of secretarial,

audit is optional

• Minimum paid up: RM1mil • Required set up function

office with tel no. • Permission is required for

foreign ownership • Must appoint secretarial, tax

and audit

d) Business Visa for expatriates

• 2 years renewal readily available to facilitate smooth entry to Malaysia

• Paid up capital RM250,000 can be done right after registration of company is completed

• Approval within 30-45 days

• Minimum paid up capital of RM350,000 to RM1mil depends on justification for the visa application

• Take 3 to 4 months

37

Advantages Registering Labuan Company (Cont’d)

Individual tax Labuan International Company Malaysian Foreign Company

e) Personal income tax • No tax for foreign director • Tax rate @ 50% - for expatriate

employment

• Visa issued for expatriates must have minimum salary of RM5,000, a total of RM60,000 per year

• Taxed at 0-26% if stay > 182 days

• If < 182 days: flat 26%

f) Easy management and invoicing

• Must be issued in any foreign currency

• Onshore banking and offshore banking

• No GST

• Must be issued in RM or RM equivalent

• Subject to GST on taxable supply if annual taxable turnover exceeds RM500,000

38

LABUAN IBFC IN CROSS BORDER

DEALINGS

Labuan Trading Company

Supplier of goods (e.g. US, China,

Japan) Labuan Trading Company (LTC)

Buyer/ Customer (e.g. China, Japan,

Europe)

Sell goods

Goods

Physical flow

• Low tax regime • Exemption on WHT (royalty/interest/management fee paid by LTC) • Franking of dividend by LTC (tax-exempt) • No custom duties/ No GST • Access to treaty benefits (DTAs)

Related Service Company

Sell goods

Undertake add on process and sell back

Physical flow

Sell goods/ Issue invoice

40

Labuan Leasing Company

Foreign Lessor (asset owner)

Labuan Leasing Company (LLC)

Malaysian Lessee

Overseas Lessee

Lease

Sub-lease

Lease payment (no WHT)

Lease payment (no WHT) Lease

payment (reduced WHT)

Benefits: • No WHT on lease payments

from Malaysian lessee to LLC and from LLC to foreign lessor

• May rely on the reduced WHT rate on lease payment received by LLC from overseas lessee

• LLC subject to tax at 3% of audited net profit or RM20,000

• No stamp duty on lease agreements

RM20,000 fee payable for each transaction

Leasing by Foreign Company via Labuan

41

Labuan Leasing Company (Cont’d)

Operational Requirements and Fees for a Labuan Leasing Company:-

• Required to submit to the Supervision and Enforcement Department of Labuan FSA within six (6) months after the close of each financial year, a copy of its audited financial statements.

• Required to provide statistics and information as required by the Labuan Financial Services Authority.

• If transacts with Malaysian residents: Annual fee RM60,000, each subsequent lease application RM20,000.

• If transacts with non-residents / other Labuan companies only : Nil fee (but still have to submit application for each transaction).

42

Labuan Leasing Company (Example)

Foreign Financier

Malaysian Company

Malaysian Lessee Overseas Lessee

Loan

Lease

WHT on interest payment

Lease payment WHT on

lease payment 10% (royalty)

Tax Implications

Malaysian company USD Lease rental (Malaysia) 50 mil Lease rental (Overseas) 50 mil 100 mil Less: Depreciation of asset (40 mil)

Less: Interest (5 mil)

Chargeable income 55 mil

Tax payable @ 24% 13.2 mil

Cash flow disadvantage 10% WHT on lease rental (creditable 5 mil against Malaysian tax payable)

Financing 15% WHT on interest (RM5 mil 0.75 mil X 15%)

WHT may be reduced depending on country of tax residence.

Leasing via Malaysian Company

43

Labuan Leasing Company (Example)

Foreign Financier

Labuan Company

Malaysian Lessee Overseas Lessee

Loan

Lease

WHT on interest payment

Lease payment WHT on

lease payment 10% (royalty)

Tax Implications

Leasing via Labuan Company

Current Structure

USD

Proposed Structure

USD

Corporate tax 13.2 mil 5,000

WHT on lease payment from overseas lessee

Offset against tax payable

5 mil

WHT on interest

0.75 mil No WHT

WHT on lease payment may be reduced depending on country of tax residence.

44

Labuan Holding Company

Foreign Company

Labuan Holding Company

WHT exemption

Income not subject to tax

• Dividend income received by Labuan company is exempted from income tax

• There is no capital gains tax • WHT exemptions (certain payments

from Labuan company to Foreign Company)

• No stamp duties on instruments executed by Labuan Holding Company

• Access to benefits under Malaysia’s DTAs, in particular reduced WT rates

Foreign Company

Preferential WHT on dividends (based on DTA)

Debt/ Equity

Dividend distribution no WHT

45

LOCAL AND INTERNATIONAL

TAX DEVELOPMENTS

Legitimacy of Labuan Structures

• The IRB disregard the payments for the leasing of the vessels made by the taxpayer to the Labuan company

• Basis: No Substance

• The IRB demanded that the taxpayer

pay withholding taxes and penalties >RM500 million

• IRB’s appeal dismissed

• Conclusion: Tax structures are legitimate and within the framework of the law

Taxpayer

Labuan company

Non-resident Vessel-owing

company

Lease vessels

Sub-lease vessels

Lease payments

Lease payments No WHT

47

Disclosure for Form e-C

With effect from year of assessment 2016, companies are required to declare whether there are subsidiaries / related parties in Labuan in the Form e-C. Field R6 of the Form e-C:-

48

Substance in Labuan

Economic substance is essential

• Functions, assets and risks

• Business flow

• Goods

• Finance

• Intangibles

• People

• Services

49

Substance in Labuan (Cont’d)

• The Labuan entity must actually exist. • Beneficial owners of the profits to be derived from its business operation

in Labuan. Proof of Substance in Labuan entity:- i. Office, facilities, assets ii. Personnel iii. Location of top management iv. Bank account v. Sales proceeds

50

Substance in Labuan (Cont’d)

i. Office, Facilities, Assets

• Must maintain own office space. Office space can be acquired or leased. No hard and fast rules on the size, but reasonable enough to carry out the trading operations.

• Merely having a registered office is not acceptable. In other words, the use of a “paper company” will not achieve economic substance.

• Have all necessary services and facilities, including telephone, emails, fax and telex, for the carrying out of the business operations.

• All correspondences, such as letters, invoices and payment voucher, must be prepared using stationery with letterhead bearing the name and registration number of the Labuan entity.

51

Substance in Labuan (Cont’d)

ii. Personnel

• Must employ own employees. • No hard and fast rules on the number of employees, but reasonable

enough to carry out the trading operations. Merely providing data entry, accounting entry or invoice generating services are not sufficient.

• Key personnel performing important duties, such as management, negotiation, purchasing and selling, should be under the employment of Labuan entity and not merely on secondment basis.

• Key personnel must be employed by the Labuan entity. Other local employees should be employed, if necessary, to undertake various duties including those that are of general and administrative nature.

52

Substance in Labuan (Cont’d)

iii. Location of Top Management

• It is important to ensure that key personnel are based Labuan to ensure that the key decisions, negotiations and conclusion of purchase/sale contract etc are carried out in Labuan.

• Although there are no specific rules, at the very minimal, it is recommended that at least one key personnel who has the authority to negotiate and conclude contracts and can make important business decisions be based in Labuan permanently. This key person can be supported by the other key personnel that may need to travel.

53

Substance in Labuan (Cont’d)

iv. Bank Account

• The Labuan entity must maintain its own bank account for all trade receipts and payment entered in during its daily business transactions. This should be a bank located in Labuan, be it a local or foreign bank.

v. Sales Proceeds

• Sales proceeds from all trading activities of the entity should be received in Labuan through its bank account.

54

OECD’s BEPS Action Plan

Base Erosion and Profit Shifting (BEPS) What exactly is BEPS? BEPS simply means a strategy used by MNCs (including MNCs headquartered in Malaysia) to achieve global tax efficiencies by taking advantage of the tax treaties, differences in taxation systems and treatment of income/expenses in different jurisdictions. On 5 October 2015, the Organisation for Economic Co-operation and Development [OECD] released the final action plan in relation to BEPS. The G20 in their summit at Turkey on 15 and 16 November endorsed the package of measures and strongly urged the timely implementation of the project and encouraged all countries and jurisdictions, including developing ones, to participate. There are 15 action plans under the BEPS.

55

OECD’s BEPS Action Plan (Cont’d)

Sixty-two countries have collaborated on BEPS: Albania, Argentina, Australia, Austria, Azerbaijan, Bangladesh, Belgium, Brazil, Canada, Chile, Colombia, Costa Rica, People’s Republic of China, Croatia, Czech Republic, Denmark, Estonia, Finland, France, Georgia, Germany, Greece, Hungary, Iceland, India, Indonesia, Ireland, Israel, Italy, Jamaica, Japan, Kenya, Korea, Latvia, Lithuania, Luxembourg, Malaysia, Mexico, Morocco, Netherlands, New Zealand, Nigeria, Norway, Peru, Philippines, Poland, Portugal, Russian Federation, Saudi Arabia, Senegal, Singapore, Slovak Republic, Slovenia, South Africa, Spain, Sweden, Switzerland, Tunisia, Turkey, United Kingdom, United States and Vietnam. Regional organisations: ATAF, CREDAF, CIAT IMF, World Bank, UN 56

OECD’s BEPS Action Plan (Cont’d)

MY Co

X Co

Malaysia

Country X

100% Dividend WHT@ 30%

MY Co

Y Co

X Co

Malaysia

Country X

Country Y

Dividend WHT@0%

Dividend WHT@ 10%

Example 1: Treaty Shopping (Action No.6)

57

OECD’s BEPS Action Plan (Cont’d)

Domestic law change Transfer Pricing Treaties Monitoring

Recommendations for national law, regulations, or administrative practice

Changes to the OECD’s Transfer Pricing Guidelines

Signing of multilateral instrument, and changes to the OECD Model Treaty & Commentary

Monitoring / reporting by OECD / Global Forum

• Action 1: Digital Economy

• Action 2: Hybrid mis-matches

• Action 3: CFCs

• Action 4: Limiting interest deductions

• Action 5: Harmful tax practices

• Action 12: Mandatory disclosure

• Action 13: TP documentation (incl CbC)

• Actions 8 – 10: Assure that transfer pricing outcomes are in line with value creation

‒ What type of “adoption” needs to happen in each country?

‒ Grandfathering?

• Action 2: Hybrid mis-matches

• Action 6: Treaty abuse

• Action 7: Permanent establishments

• Action 14: Dispute resolution

• Action 15: Multilateral instrument

• Action 5: Harmful tax practices

• Action 11: BEPS information

• Action 13: TP documentation (incl CbC)

• Action 14: Dispute resolution

58

Tax Transparency FATCA and CRS

Increased global transparency of account information presents unique challenges and requires a global, scalable solution

An evolving landscape…

59

Tax Transparency FATCA and CRS (Cont’d)

Labuan financial institutions are required to comply with FATCA and CRS.

Domestic tax authorities

Reporting Financial Institutions

Reporting

Controlling Person(s)

Individual

Account Holders

Due Diligence

Entity

Account

Holders

Foreign tax authorities in countries of

Account Holders and Controlling

Persons

Reporting under FATCA

AEOI

60

Conclusion - Why Labuan?

• Strategic location

• Simple, clear and straightforward tax system

• Favourable tax benefits for the businesses as well as non-citizen

individuals

• Access to Malaysia DTAs

• One-stop Regulatory Authority – Labuan FSA

• Ease of set up of Labuan entities

• Compliance with International Standards

• Lower cost of operations (as compared to Hong Kong and Singapore)

61

Q & A SESSION

Panel Discussion:

How can Malaysian Home Grown Businesses Develop into Regional Powerhouses?

Moderator

Hiu Chee Fatt, Director, Business Development, Labuan IBFC Inc.

Panelists Chee Pei Pei, Financial Services and Insurance Leader, Deloitte Malaysia

Goh Ka Im, Partner and Head of Tax & Revenue Practice Group, Shearn Delamore & Co Colin Paul Seah, Council Member, Association of Labuan Trust Companies (ALTC)

Disclaimer

This presentation should not be regarded as offering a complete explanation of the matters referred to and is subject to changes in law. It is not intended to be a substitute for detailed research or the exercise of professional judgment. Labuan IBFC cannot accept any responsibility for loss occasional to any person acting or refraining from action as a result of any material in this presentation. The republication, reproduction or commercial use of any part of this presentation in any manner whatsoever, including electronically, without the prior written permission from Labuan IBFC Inc. is strictly prohibited.

LABUAN IBFC INC SDN BHD IS THE OFFICIAL AGENCY ESTABLISHED BY GOVERNMENT OF MALAYSIA TO POSITION LABUAN IBFC AS THE PREFERRED INTERNATIONAL BUSINESS AND FINANCIAL CENTRE IN ASIA PACIFIC

Thank You!