Global Banking & Capital Markets - EY · PDF fileGlobal Banking & Capital Markets: ... drag on...

Transcript of Global Banking & Capital Markets - EY · PDF fileGlobal Banking & Capital Markets: ... drag on...

Global Banking & Capital Markets

Key themes from 2Q15 earnings calls

August 2015

Global Banking & Capital Markets: Key themes for 2Q15 earnings calls 2

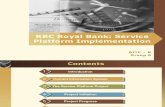

Contents

Top 10 key themes: 2Q15 earnings season 3

Top 10 themes: a quarter-over-quarter comparison 4

Key themes overview 5

1. Earnings performance: solid results reported across regions, but especially in Europe 5

2. Macro-challenges: operating environment appears to be improving 7

3. Expenses: efficiency improves despite elevated compliance costs 8

4. Capital plans: dividends in focus as banks generate excess capital 10

5. Regulatory and compliance: end point capital requirements remain a moving target 11

6. Cross-border: new CEOs address global footprints 12

7. Lending trends: expectations for growth start to materialize 13

8. Credit quality: strong performance continues, but banks monitor pockets of concern 14

9. Acquisition and divestment: organic growth favored over acquisitions 15

10. Innovation: digital investments expected to contribute to improved efficiency 16

Appendix 17

Key themes addressed, by bank 17

Key themes addressed, by bank (contd) 18

Select KPIs 19

Scope, limitations and methodology of the review 20

Global Banking & Capital Markets: Key themes for 2Q15 earnings calls 3

Top 10 key themes: 2Q15 earnings season

“We have a medium-term plan that was published in March 2014. We are on track to reach the targets that were set at that time for the global activities of the business lines of the Group. And so these targets are set for the end of 2016. We don’t intend to produce another medium-term plan soon but, of course, we [continuously] adapt our strategy to the context.”

Jérôme Grivet, Deputy CEO in charge of Group Finance, Crédit Agricole

Positive trends that emerged in 1Q15 continue into 2Q15. During the second quarter 2015 season, most of the banks included in this analysis reported year-over-year gains in earnings, revenues and return on equity (ROE), extending the positive trends that characterized the start of the year.

Banks across regions highlighted several areas of momentum, including their ability to generate capital organically, improvements in efficiency, growing evidence of renewed loan demand and continued strength in asset quality performance. In addition, management at a number of banks professed their belief that macro-challenges were easing or, at least, becoming more manageable. In Europe especially, the benefits of quantitative easing were evident in improved results, while management at US banks continued to operate under the assumption that the Federal Reserve will start to increase rates before the end of the year.

Of course, headwinds remain in place, most notably around the resolution of legal and conduct issues, the cost of complying with regulations and potential new rules that could materially elevate end point capital requirements.

Despite this, most banks appear to believe that they are well positioned to achieve strategic targets or have the right business model in place to drive sustainable performance.

• George Culmer, CFO, Lloyds Banking Group: “The Group has a clear strategic focus and a differentiated business model, and the first half of 2015 delivered another strong financial performance with increases in profitability and returns and a stronger balance sheet. And for the full year, we’re improving our guidance for net interest margin and impairments. At the same time, the Group has made a strong start for the next phase of its strategic journey, progressing its three priorities of creating the best customer experience, becoming simpler and more efficient, and delivering sustainable growth. Through these initiatives, the Group is well positioned to become the best bank for customers while delivering strong and sustainable returns to shareholders. Simply put, we’re executing against our strategic priorities, and it’s showing up in our numbers.”

• Sergio Ermotti, Group CEO, UBS: “Today, UBS enjoys a unique period of strategic clarity, with a capital and execution track record to back it up. This gives me great confidence in our future.”

• Gerald Hassell, CEO, Bank of New York Mellon: “Our results reflect the successful execution of our strategic priorities to achieve the three-year targets we shared on Investor Day. We are growing our earnings, investing in next-generation operating platforms and risk management controls, attracting new clients and improving the long-term value of our firm for the benefit of our clients and shareholders.”

Note: Please see Appendix for key to company symbols.

Group-level reported ROE (%), 2Q15

3.9 4.4 4.8 7.4 8.3 8.4 8.8 9.1 9.4 9.4 9.9 10 10 10.1 11.0 11.2 11.4 12.7

12.8 14.3

19.3 19.9

24.8 28.10

2Q15 2Q14

Source: Company reports: BBVA, Crédit Agricole, HSBC, Intesa Sanpaolo, Lloyds, Royal Bank of Scotland and Standard Chartered; UniCredit did not disclose quarterly ROE figures in 2Q15.

Global Banking & Capital Markets: Key themes for 2Q15 earnings calls

4

Top 10 themes: a quarter-over-quarter comparison

2Q15 1Q15

Rank* Earnings season top 10 themes (arranged from most common to least common) — 32 banks

Rank* Earnings season top 10 themes (arranged from most common to least common) — 35 banks

1 Quarterly earnings performance 1 Quarterly earnings performance

2 Macro-challenges 2 Macro-challenges

3 Expense trends 3 Expense trends

4 Capital strength and plans 4 Capital strength and plans

5 Regulation and compliance 5 Regulation and compliance

6 Cross-border and location strategies

6 Lending trends

7 Lending trends 7 Cross-border and location strategies

8 Credit quality trends 8 Credit quality trends

9 Acquisitions and divestments 9 Acquisitions and divestments

10 Innovation 10 Innovation

*Note: Please see Appendix for an explanation of the ranking methodology.

Global Banking & Capital Markets: Key themes for 2Q15 earnings calls

5

Key themes overview

1. Earnings performance: solid results reported across regions, but especially in Europe

“Our results are outstanding. In the first half of 2015, we delivered more than €2 billion in net income. … This has been the best semester since the creation of Intesa Sanpaolo in terms of operating margin and the best semester of the past seven years in terms of net income.”

Carlo Messina, CEO, Intesa Sanpaolo

European banks report solid second quarter results. In 2Q15, ROE* increased at all but seven banks when compared to 2Q14 levels. Notably, each of the banks that reported lower returns is headquartered in the Americas.

• Goldman Sachs delivered an ROE of only 4.8%, marking its first sub-10% result since 3Q13. The steep drop was due entirely to the impact of a US$1.45 billion charge for litigation reserves. Excluding this, ROE would have been 11.5%.

• Lower ROE at State Street was driven by legal charges and elevated regulatory compliance costs, while Morgan Stanley attributed its 140 basis point ROE decline to its high capital levels.

• ROE performance at American Express, Toronto-Dominion, U.S. Bancorp and Wells Fargo reflected a range of factors that contributed to lower revenues or higher expenses, but returns still exceeded the 10%–12% cost of equity threshold.

Net income trends were largely positive as well, with gains at 24 of the 31 banks** that disclose quarterly net income data. Only the 7 banks listed above reported earnings declines from the second quarter of 2014, and only Lloyds Banking Group reported a net loss. In addition, several banks achieved notable earnings milestones.

• Canadian Imperial Bank of Commerce (CIBC) delivered its “22nd consecutive quarter of adjusted ROE in excess of 20%,” and U.S. Bancorp reported record earnings per share.

• At Citigroup, quarterly profits reached their highest level since before the financial crisis.

• Nomura’s net income of ¥68.7 billion was the highest result for the quarter ending 30 June in eight years.

• Itau Unibanco’s 24.8% recurring return on average equity represented the seventh consecutive quarter of increases for this metric.

• And, despite a 1% decline in net profits, U.S. Bancorp had record earnings per share, driven by a lower share count.

However, a number of extraordinary items influenced results and made comparisons with prior quarters difficult.

• While the absence of legal and conduct costs benefitted earnings at several banks, such as Bank of America, BNP Paribas, Citigroup and Credit Suisse, they also undermined performance at Goldman Sachs and served as an ongoing drag on profitability at Deutsche Bank, HSBC and Royal Bank of Scotland.

• Earnings at CIBC and Crédit Agricole were significantly boosted by the nonrecurrent 2Q14 impairment charges for operations in Portugal and the Caribbean, respectively.

• Several banks reported gains from stake sales. BNP Paribas gained €420 million from the sale of a 7% stake in Klépierre, and HSBC received a US$1 billion revenue boost from its sale of a partial stake in Industrial Bank.

• Lower taxes were a positive factor in the earnings reports of Intesa Sanpaolo (2Q15 taxes of €516 billion were 43% lower than in 2Q14), Deutsche Bank (effective tax rate of 33% in 2Q15 vs. 74% in 2Q14) and Commerzbank (effective tax rate of 22% in 2Q15 compared with 50% in 2Q14).

*Quarterly ROE not disclosed at BBVA, Crédit Agricole, HSBC, Intesa Sanpaolo, Lloyds Banking Group, Royal Bank of Scotland, Standard Chartered or UniCredit.

**Quarterly net income not disclosed at Standard Chartered.

Percentage change in litigation and conduct-related costs from 2Q14, selected banks

Source: Company reports.

–100%

–100%

–95%

–90%

–72%

–57%

–11%

67%

84%

161%

411%

658%

CS

BNP

BAC

C

UBS

JPM

BARC

LLD

RBS

DB

GS

HSBC

Global Banking & Capital Markets: Key themes for 2Q15 earnings calls

6

Percentage change in net income from 2Q14*

Source: Company reports.

*Banks are not included for the following reasons: net loss in 2Q14 (Credit Suisse and BNP Paribas); net loss in both periods (Lloyds Banking Group); Standard Chartered does not disclose quarterly net income; Citigroup reported net income of US$181 million in 2Q14 and US$4.8 billion in 2Q15. The percentage increase is too significant to be accurately presented on this chart.

–49%

–32%

–6%

–4%

–4%

–1%

–0.1%

5%

5%

14%

18%

22%

22%

25%

27%

30%

46%

50%

65%

106%

132%

142%

198%

227%

244%

254%

333%

GS

STT

TD

MS

AXP

USB

WFC

HSBC

JPM

RBC

SANT

ITAU

RBS

SG

ING

UCG

UBS

BK

BBVA

CA

BAC

CBK

CIBC

NOM

DB

BARC

INT

Global Banking & Capital Markets: Key themes for 2Q15 earnings calls

7

2. Macro-challenges: operating environment appears to be improving

“Looking ahead, it feels like the macro-landscape is less volatile than it was a few months ago. However, as the outlook for the global economy remains uncertain, we continue to actively monitor industry headwinds.”

Dave McKay, CEO, Royal Bank of Canada

Overall, macro-headwinds may be dissipating … For the first time in many quarters, management at European banks commented on economic improvements or at least stabilization in the Eurozone as the benefits of quantitative easing began to emerge. And, despite slowing GDP growth rates in the US and UK, banks in those countries expressed similarly positive outlooks, suggesting that a more benign operating environment for retail banks may be on the horizon.

• Carlo Messina, CEO, Intesa Sanpaolo: “The positive outlook for the macroeconomic environment represents further potential upside for future results and reinforces our confidence. … GDP and industrial production are growing after several years of decline.”

• Frédéric Oudéa, CEO, Société Générale: “We are also seeing — and it’s positive for the coming quarters — the first benefits of the progressive recovery in the European economy.”

• José Antonio Alvarez, CEO, Banco Santander: “In the US, UK and Spain, growth has been significant. Economies are growing above 2% in all these countries.”

• António Horta-Osório, CEO, Lloyds Banking Group: “The economy continues to recover in a steady and sustainable way, providing a solid foundation for the Group’s future prospects.”

… although specific challenges continue to emerge. While positive economic growth may be emerging, the macro environment in 2Q15 continued to pose a number of challenges. Retail and commercial banks remained vulnerable to potential impacts from falling oil prices, and investment banks faced late quarter volatility sparked by bailout negotiations for Greece and a 32% decline in China’s stock market. The latter, which was largely eclipsed by the focus on Grexit, was the result of the Chinese Government’s attempt to curb speculative investment through measures including margin limits for stockbrokers. Notably, management downplayed the effects of these issues.

Impacts of macro-challenges

Oil prices

• John Shrewsberry, CFO, Wells Fargo: “We had about a $400 million increase in nonperforming assets in energy for the quarter, which feels like it makes sense.”

• Wilfred Nagel, Chief Risk Officer, ING Groep: “The watch list is up a bit. Obviously, we have a number of names that we’re watching more closely than we were a while ago. Nonperforming loans (NPLs) are stable, though. We’re not seeing an increase in defaults or anything like that.”

Geopolitical shocks in Greece and China

• Shigesuke Kashiwagi, CFO, Nomura: “In April, we had the elections in the UK and then there was the Greek issue, which led to clients not moving. Then German bonds declined, and then the Chinese shares, which used to go up, started falling. So there were all these issues overseas. But I think we did well considering all these things that went on.”

• Sergio Ermotti, CEO, UBS: “We are very proud of how we managed the very high-volatility ups and downs in the Chinese market and in the Asian markets in the last few months. I don’t expect any particular consequences [from] the higher-volatility environment.”

• Stuart Gulliver, Group CEO, HSBC: “The first quarter of this year benefited from the Shanghai-Hong Kong Stock Connect and the significantly increased volume running through that. … The sharp fall in the Chinese stock market has depressed some of that activity, but not all of it.”

• Jonathan Pruzan, CFO, Morgan Stanley: “As recent market volatility, particularly driven by events in Greece and China, has demonstrated, the near-term landscape can change quickly. This kind of short-term volatility does not change our long-term strategy. While trading performance can, of course, vary meaningfully in the near term, the stability of our fee-based businesses gives us comfort that a large portion of our business offers us a more predictable outlook.”

Quarter-over-quarter GDP growth rates

Source: OECD, EY analysis

-2.0%

-1.0%

0.0%

1.0%

2.0%

3.0%

US China Eurozone UK Japan

1Q14 2Q14 3Q14 4Q14 1Q15

Global Banking & Capital Markets: Key themes for 2Q15 earnings calls

8

3. Expenses: efficiency improves despite elevated compliance costs

“Regulatory costs of US$453 million were up 60% year-on-year, as we continue to invest in our compliance teams and in our capabilities to fight financial crime. Our investment is largely focused on people, with headcount in these areas up approximately fivefold in the past three years.”

Andy Halford, Group CFO, Standard Chartered

Most banks report lower cost–income ratios. When compared to 2Q14, expenses fell at only 11 of the 31 banks* included in this analysis, reflecting increased investments in compliance and growth. However, efficiency ratios also improved at 22 banks over the same period and, for many, were within, or at least approaching, strategic targets. Progress in this area was driven in part by revenue growth — 25 banks reported higher revenues in the current quarter — and, for some, by simplification initiatives.

• António Horta-Osório, CEO, Lloyds Banking Group: “We continued to increase our investment in IT in the first half, resulting in simpler, more efficient processes, more resilient systems and better digital experiences for our customers, as well as cost reductions for the Group. In the first six months of the year, we have delivered run-rate savings of £225 million against our target of £1 billion of savings from the new simplification program by the end of 2017.”

Despite positive trends on efficiency, management remain strongly focused on costs and cited elevated regulatory costs as one of the primary barriers in achieving further improvements. Notably, the cost of compliance is a universal headwind for the industry, regardless of business model or domicile.

• Richard Davis, CEO, U.S. Bancorp: "The cost of compliance has erased a lot of the benefits that I would have hoped to have gotten a year and a half ago when we started [our full-time employee (FTE) hiring hold].”

• Tom Naratil, CFO, UBS: “The annualized cost to respond to regulatory demands has increased to around CHF1 billion, of which around CHF400 million is permanent in nature. The increased regulatory burden continues to present significant headwinds to our targeted cost reductions.”

• Iain Mackay, Group Finance Director, HSBC: “Change-the-bank costs increased by US$383 million, or 28%, mainly due to higher regulatory and compliance costs. These included the Group-wide roll out of the new anti-money laundering and sanctions policy procedures, and the ongoing parallel deployment of customer due diligence and financial client compliance infrastructure.”

• Patrick Flynn, CFO, ING Groep: “I wish €650 million [in regulatory costs] was the max, because it’s a very big number. But we think it actually could be a little bit over €700 million in 2016.”

• Mike Pedersen, Group Head of US Banking, Toronto-Dominion: “There is a significant infrastructure build just to meet the new [regulatory] expectations that are out there. So, we, like all major banks, are quickly building up those capabilities and that requires some dollars.”

* Quarterly expenses and efficiency ratio not disclosed at Standard Chartered.

Efficiency ratios*

43 46 47 49 50 53 53 54 56 58 59 60 60 61 61 61 62 62 64 67 68 70 72 73 75 76 77

81 82 85

96

2Q15 2Q14

Source: Company reports.

Global Banking & Capital Markets: Key themes for 2Q15 earnings calls

9

Percentage change in expenses and revenues from 2Q14

C

BAC

CS

CIBC

BK JPM

BARC

AXP

USB NOM CA

CBK WFC UBS

LLD UCG INT

ITAU

MS ING

SG

RBC HSBC

SANT

BBVA BNP

RBS STT

GS DB TD

-40%

-30%

-20%

-10%

0%

10%

20%

-15% -10% -5% 0% 5% 10% 15% 20%

Exp

en

ses

Revenues

Lower revenues and lower costs

Lower revenues and higher costs

Higher revenues, but lower costs

Higher revenues and lower costs

Source: Company reports; Note: Standard Chartered does not disclose quarterly expenses and revenues. Yellow markers indicate banks where expenses grew faster than revenues.

Global Banking & Capital Markets: Key themes for 2Q15 earnings calls

10

4. Capital plans: dividends in focus as banks generate excess capital

“We added US$3.5 billion to our regulatory capital during the quarter, even as we returned roughly US$1.7 billion to shareholders in the form of share buybacks and common dividends.”

Mike Corbat, CEO, Citigroup

Plans for dividend payouts vary across regions. All but three of the banks included in this analysis reported that their Common Equity Tier 1 (CET1) capital ratios were stronger at the end of June 2015 than they were at year-end 2014. A lower CET1 ratio at Goldman Sachs reflected the impact of higher legal charges, while foreign currency movements contributed to reductions at Deutsche Bank and Itaú Unibanco. Improvements across the rest of the banks were attributed to higher earnings and risk-weighted asset (RWA) reductions.

Given that banks seem to have made progress on their ability to generate capital organically, comments and questions about plans for dividends were a prominent feature of the 2Q15 earnings calls. Canadian banks continued to prioritize dividends over buybacks as their preferred method of capital deployment, while US banks began to execute the capital plans approved by the Federal Reserve in March 2015.

In Europe, however, management approached the topic of dividends with caution. While they acknowledged the importance of creating shareholder value through payouts, future dividends remain contingent upon achieving internal targets for capital buffers, demonstrating sustainable earnings capacity, and, of course, regulatory approval.

• Ross McEwen, Group CEO, Royal Bank of Scotland: “We’re on track to achieve a CET1 ratio of 13% next year and our current expectation is to approach the Prudential Regulation Authority for approval to pay out surplus capital above 13%.”

• Carlos Torres, COO and President, BBVA: “[We want] to move as soon as possible, once the results are normalized and provided that we have no regulatory limitations, to a full cash dividend policy with a payout ratio between 35% and 40% of recurring net profit. But we will be transitioning to that situation over this year and next.”

• John Peace, Chairman, Standard Chartered: “Actions [to de-risk the business] have adversely impacted our ROE, which, combined with a disappointing earnings performance and the current near-term outlook for the Group, [have led] the Board to decide to rebase the dividend. The decision to rebase the dividend has not been taken lightly. The Board is acutely aware of the importance of our dividend to our shareholders. But equally, it’s critical that the dividend is set at a level which is sustainable, and reflects the current lower earnings expectations of the Group. The interim dividend for the six months to 30 June 2015 will be US$0.144 per share; a reduction of 50% on last year. ”

• Jérôme Grivet, Deputy CEO in charge of Group Finance, Crédit Agricole: “In terms of dividends, we are in a regulatory environment that is moving from many aspects. We see many, many ideas for complementing or strengthening the capital requirement for retail banks. So we think that it’s prudent to remain able [to organically generate capital] through the scrip dividend, for the time being.* … When the landscape of regulatory requirements is a little bit clearer, we will be able to maybe reassess this.”

*With a scrip dividend, the bank issues new shares instead of paying a cash dividend.

**Fully loaded CET1 ratios with the following exceptions: “look-through” CET1 ratio at Credit Suisse and transitional CET1 ratios at American Express, BNP Paribas, Goldman Sachs and Nomura.

Common Equity Tier 1 (CET1) ratios,** 2Q15

9.2

9.8

9.9

9.9

10

.0

10

.3

10

.3

10

.4

10

.4

10

.4

10

.5

10

.5

10

.8

10

.8

10

.9

11

.0

11

.1

11

.3

11

.4

11

.4

11

.5

11

.6

11

.8

12

.3

12

.5

13

.2

13

.2

13

.3

13

.3

13

.5

13

.5

14

.4

2Q15 4Q14Source: Company reports.

Global Banking & Capital Markets: Key themes for 2Q15 earnings calls

11

5. Regulatory and compliance: endpoint capital requirements remain a moving target

“In terms of future requirements for capital, international regulators are going through the process of potentially redefining RWA requirements across different activities and that may lead the entire industry to have to reconsider and review RWA targets.”

Sergio Ermotti, Group CEO, UBS

Capital requirements may move higher. During the 2Q15 earnings season, management commented on many aspects of the changing regulatory environment. The two issues that generated the most discussion, however, have the potential to significantly increase capital requirements as they are currently understood.

• Banks in the US were focused on the Federal Reserve’s anticipated final rule related to capital surcharges for global systemically important banks (G-SIBs). The final rule was released on Monday, 20 July 2015, following the completion of most US banks’ earnings calls. Notably, the buffer defined in the rule for several banks was significantly higher than what has been set by the Financial Stability Board (FSB). JPMorgan Chase has the steepest G-SIB surcharge at 4.5%, which is, notably, 200 basis points higher than its buffer under FSB rules.

• In Europe, banks were asked about the raft of new rules increasingly referred to as “Basel IV,” which includes, among other things, the fundamental review of the trading book and internal model reviews. The rules are not yet finalized and will likely not be implemented until 2018 or later, but management comments indicated that the impact could be material.

Evolving capital requirements

US G-SIB buffers

• Marianne Lake, CFO, JPMorgan Chase: “We continue to execute on everything that we’ve already said we’re going to do to optimize our capital. Our commitment is to be firmly within the 4.5% bucket for the surcharge, and if we believe we can do it and it is economic and it’s not going to hurt our clients, we may [optimize] further.”

• Harvey Schwartz, CFO, Goldman Sachs: “Our expectation at this stage is that any incremental buffer [above the Basel Committee’s surcharge] will be roughly 1%. And so relative to the peer group, that puts us in a good position.”

Basel IV

• Wilfred Nagel, Chief Risk Officer, ING Groep: “There are four [potential regulatory headwinds] from our perspective. One is the revised standardized approach plus floors. Then there is the interest rate risk in the banking books. There is the revised supervisory review and evaluation process (SREP) methodology. And there is total loss-absorbing capacity (TLAC). … Individually, each of them could have a significant impact and collectively they certainly could. … It’s clear that all European banks will be impacted and, depending on which floors and which methodologies land where, it could [impact] some more than others.”

• Marcus Schenck, CFO, Deutsche Bank: “We did mention [that we expect] RWA inflation to the tune of about €100 billion, in particular for the period 2018–19. So not in the near future. This is really driven by Basel IV.”

• Iain Mackay, Group Finance Director, HSBC: “Whether it’s the fundamental review of the trading book, whether it’s operational risk, whether it’s credit risk under a revised standardized approach, each of those are still very much under review by the Basel Committee. … There is a wide range of variability. The only one on which perhaps we’ve got reasonable assurance is that the likelihood of any impact is probably at the very earliest 2017, but more probably 2018 and beyond. … Literally, the outcome could be from zero to very significant.”

• Jérôme Grivet, Deputy CEO in charge of Group Finance, Crédit Agricole: “We are at a very early stage of the reflection of the regulator on Basel IV. … Crédit Agricole will be, as many other banks, impacted by [rules] that would increase significantly the RWA computation on some assets like the home loans.”

• Federico Ghizzoni, CEO, UniCredit: “Regarding capital, clearly we cannot think that regulation would become milder looking forward. It’s better to be realistic, and to imagine that regulations will continue to come and will have maybe further capital requirements. This is the reason why we stay focused on capital generation.”

Global Banking & Capital Markets: Key themes for 2Q15 earnings calls

12

6. Cross-border: new CEOs address global footprints

“In terms of geographic footprint, we will continue to place a strong focus on Asia and other emerging markets, but without neglecting more developed markets, of course. And we will invest where we see profitable growth potential.”

Tidjane Thiam, CEO, Credit Suisse

Banks continue to reassess footprint strategies. During the second quarter earnings season, management commented — as usual — on key geographic markets. Notably, remarks at a few banks were characterized by a sharpened focus on which markets will be considered core to the business going forward, perhaps implying additional moves to reshape. This was especially true at banks undergoing leadership changes, such as Barclays, Credit Suisse, Standard Chartered and Deutsche Bank, where new CEO John Cryan stated, “We will be strict in eliminating businesses, exiting countries and terminating client relationships, especially where they generate costs, complexity and operating risk without producing adequate and sustainable economic returns.”

• John McFarlane, Executive Chairman, Barclays: “We derive literately all of our profits from three major core markets: the UK, the US and South Africa. Two of these are fully integrated broad-scope propositions, the UK and South Africa, and the US is a much more focused proposition with two of the businesses represented, investment banking and Barclaycard. It’s self-evident that most of our near-term shareholder value, therefore, is likely to be delivered from these markets. We should be looking to improve our market position in such markets, and so the strategic priority for Barclays is, therefore, to focus on what really matters and where it matters. Beyond these three markets, Barclays does have an international network in Africa, Asia Pacific, South Asia, Middle East, Continental Europe, Canada and Latin America, all of which remain important. However, we need to define the role of this network. Essentially, it falls into two categories. Firstly, markets where we would seek to develop domestic propositions further; for example, certain African countries and countries where we have a significant Barclaycard presence, such as Germany.”

• Bill Winters, CEO, Standard Chartered: “We are a complicated bank. We’re operating in 70 countries and 35 locations in terms of [on-the-ground] retail. We’re covering most banking products in those 35 countries and so there’s going to be an element of complexity that’s just inherent in Standard Chartered. The question that we will be asking ourselves continuously is, is the value that we’re getting as a result of that particular portfolio mix more than offsetting the cost of complexity?”

But, their commitment to China remains intact. A number of banks also specifically addressed their plans for ongoing investments in China and Asia in the wake of the sharp declines in the Chinese stock market that occurred in the last weeks of the quarter.

• Sergio Ermotti, Group CEO, UBS: “In terms of China and the developments there, in the third quarter we cannot expect to have the same kind of vibrant and positive volume and activity we saw in the second quarter. When you look at our exposure in terms of lending, we are not lending money onshore in China. … We haven’t suffered any credit loss in the second quarter and we don’t expect this to be the case as we move forward. Our secular commitment to Asia and China [remains in place], so those kind of movements are part of a journey of growth and we are not concerned at all about what’s going on there.”

• Lars Machenil, CFO, BNP Paribas: “The overall performance of our Asian activities this year is on track. Our presence in Asia is selective. We are not a retail operator in Asia. We are basically present through our CIB activities and through wealth management activities.”

• Jonathan Pruzan, CFO, Morgan Stanley: “Our Asia-Pacific results were strong across all our businesses — equities, fixed income and investment banking. … We did benefit from higher activity levels in China this quarter. We did see increased volatility there, but given the liberalization of the capital markets in that region we have seen significant increases in investor interest. It’s obviously a large and important region.”

• Stuart Gulliver, Group CEO, HSBC: “Although we are aiming to pivot our business toward profitable growth opportunities in Asia, Asia is not the exclusive focus of reinvestment. In order to maintain broad-based growth and a diversified risk profile, we expect around one-half of incremental RWAs to be redeployed to Asia, with the rest spread across Europe, the Middle East, North America and Mexico.”

Performance of Chinese stock market indices

Source: Thomson Eikon.

80

100

120

140

160

180

200

220

240

Ja

n-1

5

Fe

b-1

5

Ma

r-1

5

Ap

r-1

5

Ma

y-1

5

Ju

n-1

5

Ju

l-1

5

Shanghai Shenzhen

Global Banking & Capital Markets: Key themes for 2Q15 earnings calls

13

7. Lending trends: expectations for growth start to materialize

“The pickup of the Eurozone economy continued in Q2, as shown by the gradual recovery of loan demand, which translated into 1.5% loan growth. You can see that this was driven by Belgian and French retail as well as our specialized businesses.”

Lars Machenil, CFO, BNP Paribas

Demand for loans returns in Europe. During the 2Q15 earnings calls, banks across all regions highlighted positive trends for lending. In North America, commercial lending continued to be the primary driver of increased volumes, although broad-based growth trends were highlighted by several banks, including Wells Fargo, where CFO John Shrewsberry said, “[Growth] is coming from everywhere at attractive paces.” In the UK, declines in end-of-period loan balances at all five of the big banks were attributed to continued runoff of non-core portfolios. At HSBC, Group Finance Director Iain Mackay pointed to “largely sustained growth in our customer lending over the past 12 months,” excluding “Brazil and the effect of red-inked balances.”

In the Eurozone, the green shoots of loan growth that started to emerge in recent quarters appeared to gain momentum, reflecting renewed demand for credit and the support of the European Central Bank’s quantitative easing and targeted longer-term refinancing operation (TLTRO). Notably, management comments during the 2Q15 earnings season appear to confirm EY’s view that following three consecutive years of contraction, business loans in Europe will return to positive growth in 2015.*

• Laurent Goutard, Head of French Retail Banking, Société Générale: “We doubled the production [of new mortgage loans] but you have to compare that with a very, very low quarter last year. And for business loans, we have an increase of 40% with the same comment. We compare with a very low level last year. But for business loans, [it was also helped by] the TLTRO initiative which mainly supported investment loans for small companies.”

• José Antonio Alvarez, CEO, Banco Santander: “Looking at the balance sheet, on the loan book [we have] growth in most units, except Spain, which is almost flat. … We saw for the first time in many quarters that Portugal has started to grow the loan book, [only] 0.3%, but it is the first time in the last two years or three years. That is good news.”

• Federico Ghizzoni, CEO, UniCredit: “Demand is increasing in say Western Europe, but it is also increasing at a lower scale in Germany and Italy, both individuals and corporate. Corporate we see a good trend in Germany. We have seen a good trend driven by the TLTRO in Italy. The only country where we still do not see too much demand is Austria.”

*EY Eurozone forecast: outlook for financial services, Spring 2015

Percentage change in end-of-period loan balances from 2Q14

–18%

–9% –8% –8% –7%

–5% –3% –3%

0% 0%

2% 4% 4% 4% 4%

6% 6% 6% 7% 7% 7% 10% 10% 11% 11% 11% 12%

13%

18%

Source: Company reports; loan data not available for BNY Mellon, Goldman Sachs and State Street.

Global Banking & Capital Markets: Key themes for 2Q15 earnings calls

14

8. Credit quality: strong performance continues, but banks monitor pockets of concern

“We improved the NPL ratio for the fifth quarter running. It was expected, but probably the pace accelerated a little bit. The cost of credit continued to normalize all across the board.”

José Antonio Alvarez, CEO, Santander

Credit metrics continue to normalize. In general, credit metrics remain at or near historically low levels, reflecting improved economic growth trends and the influence of the stricter underwriting standards that have been implemented in the post-crisis years. However, while overall portfolio health is not expected to deteriorate in the near term, several banks flagged specific issues that they are monitoring closely.

• Tom Naratil, Group CFO, UBS: “The stronger Swiss franc is expected to have a negative effect on the Swiss economy, as seen in economic data for the first quarter of 2015. To date, we’ve seen limited effects on small and medium-sized enterprises, which we attribute in part to existing order books. However, with the average order period of three months now passed, we would expect to see a deterioration in the results of these enterprises over the next 12 months, particularly for export-oriented entities. The tourism sector has been largely protected during the 2014–15 winter season, due to preexisting bookings. We, therefore, anticipate seeing a fuller impact on the industry through extended hotel closure in the off-peak season and into the 2015–16 winter season. To date, we’ve seen a limited decline in credit quality. However, we expect that any negative effect on the Swiss economy will impact some of the [accounts] within our domestic lending portfolio and lead to an increase in credit loss expenses in future periods from the low levels observed in the past two quarters.”

• Andy Halford, Group CFO, Standard Chartered: “Total impairment of US$1.7 billion in the first half remains elevated and is up 15%, or $225 million, compared with the second half of last year. There are two primary reasons behind the increase: India and the impairment in private banking I mentioned earlier. … In India, we saw a number of changes in regulation early in the year, and also in the attitude of local banks to refinancing, which have reduced the likelihood of success of certain of our corporate debt recoveries. This, and other ongoing challenges in the economy, have, in our view, pushed back the corporate recovery horizon.”

• Marianne Lake, CFO, JPMorgan Chase: “We built reserves modestly for oil and gas last quarter on the back of the spring redetermination of borrowing base. We built another modest reserve this quarter. We might expect more reserves in the second half of the year. There’s another redetermination cycle in the fall and it’s possible we will be selectively downgrading some clients. … It’s completely normal levels, and, considering the cycle and how we think about the credits, we are still very happy.”

• Bruce Thompson, CEO, Bank of America: “On the commercial front we saw an uptick in nonperforming loans and reservable criticized exposure from the first quarter driven by downgrades in our oil and gas exposures. Despite these downgrades, we feel good about our exposure in this area as they are well collateralized and most of these credits only had a one-level migration on a risk-rating scale.”

• Ralph Hamers, CEO, ING Groep: “Total risk costs were 46 basis points of the average risk-weighted assets. Most of the businesses are now close to the longer-term average where we expect them to be across the cycle, except for the Netherlands. If we take a closer look at the Netherlands, we see that the risk costs in the Netherlands are decreasing but still relatively high.”

Basis point change in NPL ratio* from 2Q14, selected banks

–1

–2

–5

–10

–10

–10

–17

–17

–20

–29

–30

–40

–41

–50

–240

–350

RBC

TD

CIBC

ING

ITAU

UCG

USB

C

JPM

WFC

BBVA

CA

BAC

BNP

LLD

RBS

Source: Company reports; metrics include NPL ratio, net impaired loan ratio, non-accrual loans/total loans.

Global Banking & Capital Markets: Key themes for 2Q15 earnings calls

15

9. Acquisition and divestment: organic growth favored over acquisitions

“Our strategy is based on organic growth. … And that’s why we’re principally not really looking at acquisitions. So, if we were to think about acquisitions, as I have indicated before, we’ll have to be very disciplined.”

Ralph Hamers, CEO, ING Groep

Banks maintain consistent stance on pursuing acquisitions. In the years since the crisis, banks have been focused on building capital and reshaping their businesses to reflect core strengths. As a result, inorganic growth strategies have been a low priority. During the second quarter earnings season, management comments indicated that most banks continue to maintain this stance and would prefer to invest in their current businesses to drive organic growth. Canadian banks were the exception, and management there reiterated a willingness to pursue selective opportunities. As Toronto-Dominion’s Mike Pedersen said, “Whenever we do see any opportunities for tuck-in acquisitions or frankly opportunistic events on either side of the [US-Canada] border, we would certainly be aggressive in pursuing those.”

• Mike Corbat, CEO, Citigroup: “When we think of an acquisition, it would need to be very much in line with our strategy. And it would be probably much more biased toward portfolios rather than business acquisitions. So again, around our framework of fitting in the business and having the right accretive attributes, we’re wide open to portfolio purchases.”

• James Gorman, CEO, Morgan Stanley: “We’re very comfortable with the business we’ve got and the size of the business. And we think the opportunity to improve margin with the business we have, particularly by building out the bank and by organic growth within the businesses, is extremely attractive to us. We had a desire to get to scale and we are well and truly at scale so we feel good about that.”

• Tidjane Thiam, CEO, Credit Suisse: “I have delivered quite a lot of organic growth. I have been on record many times saying that the primary source of capital is to operate profitably. It’s the cheapest capital and it’s the most easily accessible. … In an organization of this size, yes, there will be moments where we’ll do things of an inorganic nature possibly, but they will be small. And I have a track record there too.”

• Sergio Ermotti, CEO, UBS: “We are not so complacent or arrogant to say that we don’t need to grow inorganically, but I’m very happy with the fact that we are able to show that we can grow organically. For sure, if I look around at this stage, broadly speaking, I don’t see anything that would add to our business proposition that is priced correctly. So I don’t think it’s the [time] for us to talk about M&A at this stage and no matter which region we are talking about.”

• Frédéric Oudéa, CEO, Société Générale: “I don’t think there are any strategic gaps that we would need to fill with an acquisition versus the capacity to grow organically.”

Asset sales, 2Q15

BBVA • 4.9% stake of China CITIC Bank (closed)

BNP Paribas • 7% stake in Klépierre (closed)

CIBC • 19% stake in Bermuda’s Bank of N.T. Butterfield & Son (announced)

Citigroup

• Consumer businesses in Peru and Nicaragua (announced)

• OneMain Financial (closed)

Commerzbank • €2.9 billion commercial real estate portfolio (announced)

HSBC • Brazilian unit (announced)

• Partial stake in Industrial Bank (closed)

Lloyds Banking Group • TSB (closed)

Morgan Stanley • Global Oil Merchanting business (announced)

Standard Chartered

• Consumer finance business in Hong Kong, mainland China and Korea (closed)

Global Banking & Capital Markets: Key themes for 2Q15 earnings calls

16

10. Innovation: digital investments expected to contribute to improved efficiency

“With today’s fast-paced lifestyle and increasing dependence on technology, what customers want is banking that’s easy, flexible and personalized. … And that’s why we’ve repositioned our brand, from For What Matters to Banking That Fits Your Life.”

Victor Dodig, CEO, Canadian Imperial Bank of Commerce

Digital investments are not optional. There is no argument that digital investments are a necessity for all banks as they seek to win their customers’ loyalty, increase product penetration and adapt to changing behaviors. Banks that fail to innovate may find themselves out of business in the foreseeable future, as noted by Société Générale CEO Frédéric Oudéa: “If I don’t invest, in five years we will disappear.” The additional, and perhaps more immediately tangible, benefit of such investments is that they are helping to drive efficiency and productivity. During the second quarter earnings season, management at a number of banks specifically addressed this aspect of digitalization.

• José Antonio Alvarez, CEO, Banco Santander: “We are investing in the new channels, and how to do this properly is the key question here. The question is not if you [should] invest or if you [should not] invest in multichannel strategy in your strategy; every bank is going to [invest]. The question is, how and when? And, at the same time, how do you get an increase in the productivity in the traditional channels?”

• Dave McKay, CEO, Royal Bank of Canada: “As part of our overall digitization program, last year we introduced e-signatures, which we estimate resulted in savings of up to 24,000 hours per week in administration time, allowing employees to spend more time providing advice to clients.”

• Bharat Masrani, CEO, Toronto-Dominion: “Speed and innovation matter, and we will continue to make significant investments in digital technologies. As we do so, our focus remains on offering legendary experiences across all channels with the safety and soundness that protects the interests of our customers. We strive to be the high-touch bank in a high-tech world. What’s more, we anticipate these investments would help improve our efficiency in the medium term.”

• John McFarlane, Executive Chairman, Barclays: “Another strategic emphasis is to embrace the digital world, both for our clients using mobile technology, but also to improve the productivity of our legacy platforms. This will drive innovation, further efficiencies and an increase in customer penetration across the whole group.”

• Carlos Torres, COO and President, BBVA: “Digital customers are more engaged than non-digital customers. The average annual number of transactions performed by a digital customer is 11 times that of a traditional non-digital customer and they are more profitable, they reduce the cost of servicing.”

• Eduardo Vassimon, CFO, Itaú Unibanco: “[There] is a constant effort to improve our efficiency ratio and we are seeing kind of a structural movement in terms of client demand for more digital channels, so this produces lower-cost transactions for the bank. So this, I think, encourages us to believe that it’s possible to continue to pursue lower levels of efficiency ratios.”

Digital initiatives in wholesale banking

• Didier Hauguel, Co-Head of International Banking and Financial Services, Société Générale: “Regarding digital initiatives in Global Banking and Investor Solutions … We are working on reengineering our SG Market website as a way to deliver bespoke research ideas to our clients. We will be able to push some trading ideas to our investors in a smarter way. … We are also working more and more on capital markets. Its digitization is a follow-up of electronification that started I would say, 5–10 years ago. But especially on structured products we have now more and more direct access from our private banks to design the products, the structured products that they want when it is a small ticket.”

• Victor Dodig, CEO, CIBC: “Our Wholesale bank also continues to focus on both innovation and investments in technology that benefit our clients across CIBC. For example, our e-business platform seamlessly supports our in-branch foreign exchange service and multi-currency ATMs at Pearson Airport. Our clients traveling through Pearson are embracing the easy and flexibility of this convenient service, and uptake has been strong.”

Global Banking & Capital Markets: Key themes for 2Q15 earnings calls

17

Appendix

Key themes addressed, by bank

2Q15 earnings season

Key theme # AX

P

ITA

U

SA

NT

BA

C

BK

BA

RC

BN

P

CIB

C

C

CB

K

CA

CS

DB

GS

BB

VA

HS

BC

Quarterly earnings performance

32 √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ √

Macro-challenges 32 √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ √

Expense trends 32 √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ √

Capital strength and plans

32 √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ √

Regulation and compliance

32 √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ √

Cross-border and location strategies

31 √ √ √ √ √ √ √ √ √ √ √ √ √ √ √

Lending trends 30 √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ √

Credit quality trends

26 √ √ √ √ √ √ √ √ √ √

√ √ √

Acquisitions and divestments

24 √ √ √

√

√ √ √ √ √ √ √ √

Innovation 23 √ √ √ √

√ √ √

√ √ √ √

Legend

AXP — American Express ITAU — Banco Itaú SANT — Banco Santander BAC — Bank of America

BK — BNY Mellon BARC — Barclays BNP — BNP Paribas CIBC — Canadian Imperial Bank of Commerce

C — Citigroup CBK — Commerzbank CA — Crédit Agricole CS — Credit Suisse

DB — Deutsche Bank GS — Goldman Sachs BBVA — Grupo BBVA HSBC — HSBC Holdings

Global Banking & Capital Markets: Key themes for 2Q15 earnings calls

18

Key themes addressed, by bank (contd)

2Q15 earnings season

Key theme # ING

INT

JP

M

LL

D

MS

NO

M

RB

C

RB

S

SG

ST

AN

ST

T

TD

UB

S

UC

G

US

B

WF

C

Quarterly earnings performance

32 √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ √

Macro-challenges 32 √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ √

Expense trends 32 √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ √

Capital strength and plans

32 √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ √

Regulation and compliance

32 √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ √

Cross-border and location strategies

31 √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ √

Lending trends 30 √ √ √ √ √ √ √ √ √ √ √ √ √ √

Credit quality trends

26 √ √ √ √ √ √ √ √

√ √ √ √ √

Acquisitions and divestments

24 √ √

√ √ √ √ √ √ √ √ √ √

Innovation 23 √ √ √ √ √ √

√ √

√ √ √ √

Legend

ING — ING Groep INT — Intesa Sanpaolo JPM — JPMorgan Chase LLD — Lloyds Banking Group

MS — Morgan Stanley NOM — Nomura Holdings RBC — Royal Bank of Canada RBS — Royal Bank of Scotland

SG — Société Générale STAN — Standard Chartered STT — State Street TD — Toronto-Dominion

UBS — UBS Group UCG — UniCredit Group USB — U.S. Bancorp WFC — Wells Fargo

Global Banking & Capital Markets: Key themes for 2Q15 earnings calls

19

Select KPIs

Operational metrics (% y-o-y growth)

KPIs Share price

Text legend: Better than average Worse than average

Ass

et

Co

mp

co

st

No

n-c

om

p

cost

Re

ve

nu

es/

e

mp

loy

ee

(U

S$

00

0)

Co

st/

em

plo

ye

e

(US

$0

00

)

Co

st-i

nco

me

ra

tio

Op

era

tin

g

ma

rgin

Ne

t in

tere

st

ma

rgin

Co

st o

f e

qu

ity

Re

turn

on

a

ve

rag

e e

qu

ity

Th

ree

-mo

nth

ch

an

ge

On

e-y

ea

r ch

an

ge

Best performer 15.2% –24.6% –44.0% 174.6 25.3 45.7% 54.3% 5.9% 5.5% 27.0% 17.6% 40.1%

Worst performer –9.0% 15.2% 34.5% 47.8 125.7 100.0% –0.1% 1.0% 25.5% -0.2% –16.7% –33.6%

Average 2.9% 1.6% –1.3% 84.6 55.2 65.9% 34.1% 2.3% 10.6% 10.3% 1.3% 6.9%

AXP 3.1% –24.6% –9.1% NA NA 73.1% 26.9% 5.9% 8.7% 27.0% –-0.5% –18.5%

BBVA 11.6% 13.4% –2.6% 47.8 25.3 51.8% 48.2% 2.2% 10.7% 10.2% –6.5% –7.4%

SANT 12.7% 11.5% 15.6% 70.9 37.9 52.4% 47.6% 2.8% 10.5% 11.8% –10.7% –33.6%

BAC –1.0% –5.0% –36.2% 102.1 63.7 62.4% 37.6% 2.4% 9.4% 8.5% 10.6% 9.1%

BK –1.4% –0.3% –6.9% 76.6 53.7 70.0% 30.0% 1.0% 14.5% 9.2% 4.3% 10.7%

BARC –-9.0% –4.9% –5.6% NA NA 71.0% 29.0% 4.2% 8.4% 8.3% 7.4% 20.6%

BNP 12.2% NA NA 65.2 41.7 63.9% 36.1% NA 11.6% 10.9% –4.3% 5.5%

CIBC 10.6% 4.0% 8.2% 63.3 39.3 62.0% 38.0% 2.0% 5.5% 18.5% 0.3% –5.4%

C –4.2% –9.0% –4.5% 83.4 47.9 57.4% 42.6% 3.0% 10.0% 8.9% 7.2% 16.4%

CBK –3.7% 3.3% –0.6% 51.7 38.3 72.6% 27.4% 1.2% 9.0% 4.2% –10.8% –0.7%

CA 0.9% NA NA NA NA 60.2% 39.8% NA 10.6% 7.2% –2.4% 25.8%

CS –1.4% –2.0% –44.0% 149.2 110.3 73.9% 26.1% 1.5% 10.6% 9.7% –1.8% 0.3%

DB 1.7% 15.2% 19.8% 102.8 89.1 85.0% 15.0% 1.0% 9.6% 4.3% –16.7% 4.5%

GS 0.0% –2.9% –4.2% NA NA 81.0% 19.0% NA 9.1% 4.8% 11.1% 25.2%

HSBC –6.6% NA NA 68.4 39.8 58.2% 41.8% NA 9.4% 10.1% –1.3% –4.7%

ING 5.1% 3.5% –1.6% 87.5 46.5 53.2% 46.8% 1.4% NA 11.2% NA NA

INT 6.2% NA NA 55.8 25.5 45.7% 54.3% NA 10.4% 8.4% 2.7% 40.1%

ITAU 9.1% 4.3% 13.9% 98.6 45.6 46.3% 53.7% NA 25.5% 22.8% –3.1% 17.7%

JPM –2.8% 1.1% –12.7% 100.3 61.2 61.0% 39.0% 2.1% 12.9% 10.5% 11.9% 12.9%

LLD –2.5% NA NA NA NA 100.0% –0.1% 1.6% 7.6% –0.2% 8.9% 20.0%

MS –0.1% 4.9% 5.5% 174.6 125.7 72.0% 28.0% NA 8.5% 9.7% 8.7% 14.7%

NOM 0.1% –7.6% 7.8% NA NA 75.0% 25.0% NA 17.2% 10.0% 17.6% –0.8%

RBC 15.2% 9.6% -8.4% 98.2 58.1 59.2% 40.8% 1.7% 5.8% 17.3% 0.2% 7.5%

RBS –4.6% –1.8% –0.6% 52.4 43.2 82.5% 17.5% 2.2% 10.3% 5.2% 3.4% 6.5%

SG 2.8% NA NA 51.3 30.8 60.0% 40.0% NA 11.0% 9.7% –6.9% 13.8%

STT 4.3% 0.6% 34.5% 84.1 68.6 81.5% 18.5% 1.0% 11.2% 8.0% 4.7% –3.7%

TD 13.5% 11.7% –0.7% 77.1 48.5 62.9% 37.1% 2.1% 6.0% 12.0% –2.2% 0.1%

USB 7.7% 7.7% 1.9% NA NA 53.8% 46.2% 3.0% 13.0% 13.3% –0.6% 21.4%

UBS –3.3% 7.3% –3.7% 139.4 107.8 77.4% 22.6% NA 10.5% 9.7% 8.2% –3.8%

UCG 4.6% -2.4% 0.6% 49.7 29.8 59.9% 40.1% NA 9.5% 4.6% –4.8% 6.7%

WFC 7.6% 3.2% 0.8% 80.2 46.9 58.5% 41.5% 3.0% 11.2% 12.2% 3.4% 6.7%

Source: SNL Financial. Notes: 2Q15 numbers for Canadian banks are from February through April 2015; calendar year and not fiscal year numbers are considered for Nomura; operating margin = (net revenue – operating exp.)/net revenue; all numbers are non-annualized (except RoAE and NIM).

Global Banking & Capital Markets: Key themes for 2Q15 earnings calls

20

Scope, limitations and methodology of the review

The purpose of this review is to examine the key themes discussed among 35 global institutions operating within the banking and capital markets sector during the 2Q15 earnings reporting season.

The identification of the top 10 themes is based solely on an examination of the transcripts and associated presentation materials of the earnings conference calls held from 28 May 2015 to 5 August 2015.

The period covered is 2Q15, which ended 30 June 2015. Exceptions include the following:

• Canadian Imperial Bank of Commerce (CIBC), Royal Bank of Canada (RBC) and Toronto-Dominion Bank, for which the 2Q15 period ended 30 April 2015

• Nomura Holdings, Inc., for which the covered period was 1Q16

Banks were selected based on their size and the availability of earnings conference call transcripts. Every effort was made to include a global sample of banks in the review. Exceptions include the following:

• Mitsubishi UFJ Financial Group, Inc., Mizuho Financial Group, Inc. and Sumitomo Mitsui Financial Group, Inc. were excluded from the analysis because of the lack of transcript availability.

• Bank of China Limited and Industrial and Commercial Bank of China Ltd. were excluded because of the timing of their 1Q15 results reporting.

• Macquarie Group, Australia and New Zealand Banking Corporation (ANZ) and National Australia Bank (NAB) did not hold interim earnings calls for the period ending 30 June 2015.

EY | Assurance | Tax | Transactions | Advisory

About EY EY is a global leader in assurance, tax, transaction and advisory services. The insights and quality services we deliver help build trust and confidence in the capital markets and in economies the world over. We develop outstanding leaders who team to deliver on our promises to all of our stakeholders. In so doing, we play a critical role in building a better working world for our people, for our clients and for our communities. EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients. For more information about our organization, please visit ey.com. About EY Global Banking & Capital Markets

In today’s globally competitive and highly regulated environment, managing risk effectively while satisfying an array of divergent stakeholders is a key goal of banks and securities firms. Global Banking & Capital Markets brings together a worldwide team of professionals to help you succeed — a team with deep technical experience in providing assurance, tax, transaction and advisory services. We work to anticipate market trends, identify the implications and develop points of view on relevant sector issues. Ultimately it enables us to help you meet your goals and compete more effectively.

© 2015 EYGM Limited.

All Rights Reserved.

EYG no. EK0379 BMC Agency BACS 1002753 ED None

This material has been prepared for general informational purposes only and is not intended to be relied upon as accounting, tax or other professional advice. Please refer to your advisors for specific advice.

The views of third parties set out in this publication are not necessarily the views of the global EY organization or its member firms. Moreover, they should be seen in the context of the time they were made.

ey.com