Gino casestudy

-

Upload

sanket-sao -

Category

Business

-

view

2.676 -

download

1

Transcript of Gino casestudy

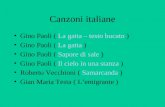

Gino SA: Distribution Channel Strategy

Case Analysis Report

April 2, 2012

By Sanket Sao (1192439)

Gino SA: Distribution Channel Strategy – Sanket Sao

2

Table of Contents

Executive Summary .............................................................................................................................................................3

Introduction & Statement of Key Issues ......................................................................................................................4

SWOT Analysis .....................................................................................................................................................................4

Strengths ..............................................................................................................................................................................4

Weaknesses.........................................................................................................................................................................4

Opportunities .....................................................................................................................................................................5

Threats ..................................................................................................................................................................................5

Alternatives..............................................................................................................................................................................5

Alternative 1 – Decline Feima’s offer .....................................................................................................................5

Alternative 2 – Accept Feima’s offer for Industrial segment and other segments to Jinghua ............5

Alternative 3 – Offer discounts to Feima from Gino’s current contribution margin. ............................6

Evaluation of Alternatives .................................................................................................................................................6

Recommendation of Strategy ...........................................................................................................................................7

Action plan and Implementation .....................................................................................................................................7

Contingency Planning .........................................................................................................................................................8

Appendix 1 .........................................................................................................................................................................9

Appendix 2 .........................................................................................................................................................................9

Appendix 3 .........................................................................................................................................................................9

Appendix 4 ...................................................................................................................................................................... 10

Appendix 5 ...................................................................................................................................................................... 11

Appendix 6 ...................................................................................................................................................................... 12

Gino SA: Distribution Channel Strategy – Sanket Sao

3

Executive Summary

Gino SA manufactures burners and sells in market via distributor’s channel. Three distributors are

responsible for selling 95% of Gino’s burners in China and hence acquired a major bargaining

power. The distributors have been assigned regions and have to sell only in their specified regions.

Feima, a leading boiler, offered Gino for direct sales to get additional discounts of atleast 10% and

in return would give purchase 100% of domestic burners, and 50% of commercial and Industrial

burners from Gino. Gino is really excited about this offer as it meets its long term objective of OEM

accounts and Industrial segment penetration. Currently, Feima meets its burner requirement through

Jinghua, leading distributor of Gino, and hence Jinghua is opposed to this offer. Losing one out of

three distributers means direct hit on sales and hence Gino has to take this decision very carefully. If

Zhou, Marketing manager of Gino SA, decided to accept Feima’s OEM business and deliver

burners directly to Feima, Gino is very likely to lose one of its main distributors in China, and

ultimately harm future sales. It could also have a negative impact on other 2 distributers. If Zhou

doesn’t accept Feima’s offer, Gino will lose the potential opportunity to create an OEM business in

China and potential sales, primarily in Industrial segment. Moreover, it will have to succumb to

demands of distributers again, hurting sales in all segments including lucrative Industrial segment.

To solve this problem, we found several alternatives and evaluated them not only to resolve the

current issue but to address other concerns such as distributor’s bargain power, Industrial segment

penetration, and acquiring OEM accounts. Alternative 2, which suggest signing OEM contract with

Feima in industrial segment and offering discounts on other segment via Jinghua, is the best

alternative and it also meets Gino’s long term goals.

Gino SA: Distribution Channel Strategy – Sanket Sao

4

Introduction & Statement of Key Issues

Gino SA, one of the world’s largest manufacturers and exporters of burners, faced a dilemma about

its distribution channel to Feima. Whether to acquire OEM contract of Feima and disappoint its

existing distributor or to forgone extra revenue from sales was a difficult choice Gino has to make.

The decision was bound to have larger impact on Gino sales in China. Gino has to make sure any

decision should address following Key issues or Concerns. A) Resolve the existing conflict in a

possible win-win situation for both parties. B) Control the distributers bargaining power C)

Penetrate into high growing Industrial segment of burners D) Revenue and high profitability

SWOT Analysis

Strengths

Gino SA is a market leader in Domestic burner segment and almost impossible for any competitor

to challenge on domestic segment. It also enjoys in-house production capability for lengthy product

line mix (about 50 models), and hence offers low margins. The cost advantage in comparison to its

competitors is about 10-20% and hence Gino build its reputation for offering best value to its

customers. Gino also enjoys strong market share is largest European market and hence financially

stable. The emerging markets like China were growing rapidly and Gino had strong distributer

relationship in China, a major advantage in burner market.

Weaknesses

Gino’s primary weakness was its poor market penetration in Industrial segment. It was difficult for

Gino to shift priorities of distributers that directly impact sales in industrial segment because it

doesn’t have direct sales force and has to depend on distributers for sales. This leads to increasing of

distributer’s bargaining power. Gino’s recent strategy to get more OEM accounts and penetrate in

Industrial segment were in direct conflict with distributer’s goals and distributer’s increase in

bargaining power means it was difficult to achieve Gino’s goals in near future. Other major concern

for Gino is it has to depend on distributer for its sales and services.

Gino SA: Distribution Channel Strategy – Sanket Sao

5

Opportunities

The emerging markets such as China have lot of potential for growth and profit margin was

generally higher in such markets. Also, Industrial segment is expected to grow at 20% annually for

next 5 years. Gino can capitalize in these opportunities and convert itself into major player. OEM’s

were ready to purchase directly from manufacture rather than distributor to get better prices.

Threats

China has large presence of local burner manufactures and some of them have strong political hold.

They pose the threat primarily in government projects. Other major threat can be loosing any of the

distributors, which will directly impact the sales.

The detailed SWOT analysis can be found in Appendix 1.

Alternatives

Alternative 1 – Decline Feima’s offer As mentioned in SWOT, losing any of the distributors would be a major threat for Gino. It can also

impact its current dominant position in domestic burner segment too. Hence this alternative would

be a conservative approach to maintain the good relationship with distributor and retain the current

competitive advantage. As per our financial analysis (Appendix4), this alternative would lead to net

revenue of $8 million and a contribution margin of $1.5 million for Gino. However, with this

alternative Feima’s relationship with Gino and Jinghua can get impacted and Feima can go to

Gino’s competitors. Gino will also possess a heavy opportunity cost for industrial segment.

Moreover, the bargaining power of distributor will be difficult to control. The detailed financial

analysis can be found in Appendix 4, while pros and cons can be found in Appendix 5

Alternative 2 – Accept Feima’s offer for Industrial segment and other segments to Jinghua

Feima wants to get into OEM contract with Gino mainly for reduction in prices. With this

alternative, Gino should sign OEM contract with Fiema for industrial segment only with 10%

additional margin in Industrial segment, and push Jinghua for 10% discount to Feima’s commercial

and domestic burners. Jinghua can compensate the 10% discounts from additional sales of domestic

Gino SA: Distribution Channel Strategy – Sanket Sao

6

and commercial burners Feima. As per financial analysis in Appendix 4, Jinghua can still achieve

profitability of $1.16 million with 10% discounts on domestic and commercial and losing industrial

segment sales of Feima. The warehouse will be built by Gino for these additional 33 industrial

burners to Feima. The service contracts can be given to existing distributors. This alternative is also

consistent with Gino’s goals of OEM accounts and market penetration in Industrial segment. The

detailed financial analysis can be found in Appendix 4, while pros and cons can be found in

Appendix 5. The Pro-forma income statement with this alternative is shown in Appendix 6.

Alternative 3 – Offer discounts to Feima from Gino’s current contribution margin.

Feima is already happy with Jinghua’s service and offered Gino OEM contract to get 10%

additional discounts. Gino can offer these discounts to Feima via distributor Jinghua. However,

offering discount to one OEM, which is one among other 20, will open a Pandora ’s Box where

other distributor’s OEM accounts will ask for same margin and eventually the margins of entire

industry will be affected. The detailed financial analysis can be found in Appendix 4, while pros and

cons can be found in Appendix 5.

Evaluation of Alternatives

Naturally, resolving the current problem should be a priority, followed by increasing revenue and

profitability for Gino as well as for Jinghua. According to our financial analysis (Appendix 4),

alternative 2 yields contribution revenue of $2 million as compared to alternative 1 & alternative 3

of $1.5 million and $1.2 million respectively. Hence in decision matrix (appendix 3), alternative 2

ranks highest in profitability, It is also a win-win situation for all the parties. Since Gino will have

its own sales force for Industrial segment with this alternative, the bargaining power of distributers

will be reduced. Alternative 3 targets the bargaining power and also address the current problem but

is not good with respect to other primer factors. Overall, alternative 2 is best decision.

Gino SA: Distribution Channel Strategy – Sanket Sao

7

Recommendation of Strategy

As seen from decision matrix, we recommend alternative 2 to acquire Feima’s OEM account for

industrial segment and push Jinghua for 10% reduction in domestic and commercial margin for

Feima. In today’s business environment, it’s very important for any business to take decision

consistent with its strategy and with long term objectives. This alternative is completely aligned to

Gino’s long term strategy and achieves its target of 200 industrial burner sales. Appendix 4 shows

Jinghua can compensate 10% discount by additional sales of 705 domestic and 32 commercial

burners at a mere loss of 3 industrial burners. The warehouse will also house industrial burner

inventory to reduce the inventory cycle time for other distributors orders, giving a strong

competitive advantage to Gino. The Sales and services contract can be outsourced to distributor

with appropriate SLA contracts. The final price (120,575RMB) is set to be 48.4% above transfer

price (65,000 RMB) plus a markup of 25%. The forecast for sales for 3 years is shown in Appendix

2, while Pro-forma income statement in Appendix 6.

Action plan and Implementation

Before the global distributors meeting, Gino need to convince Jinghua about this offer highlighting

its increase in profitability. The contract between Jinghua and Gino gives right to Gino to enter into

OEM deal, and hence Jinghua has to understand this. During the same period, Gino should keep

FUNG’s and Wayip into confidence with this action plan. FUNG’s and Wayip will also benefit as

their high inventory cycle time for industrial burners can be reduced from Gino’s warehouse. The

warehouse to house the inventory would also built a good competitive advantage as compared to

other competitors.

Immediately after the meeting, Gino should start working on preparing the terms of contract with

Feima as OEM account for Industrial burners. The terms of the contract should include the promised

sale of burners. It would take approximately 1 month for legal formalities and to sign the contract.

By 2000 april end, Gino should start building a warehouse. It can take approximately 3 months to

Gino SA: Distribution Channel Strategy – Sanket Sao

8

prepare a fully functional warehouse and hence, the delivery date of Industrial burners to Feima

should be reviewed while signing the contract. The warehouse should be located in northern region

of China because of close proximity to Feima. The delivery of industrial burners should start from

August 2000. From July 2000 to August 2000, a service and maintenance contract should be given

to Jinghua highlighting all the SLA guidelines and frequent feedback should be collected from

Feima about service quality & product quality. Satisfaction of Feima is very important for Gino

because it can further build on industrial burners segment and improve its industrial burners

demand. By December 2000, Gino can start building its sales force in China for further industrial

burners OEM contracts.

Contingency Planning

1. Jinghua not agreeing to the plan: Jinghua, despite increase in profits will be worried about

its long term sales in industrial sector and hence can disagree with Gino. Gino can sign a

memorandum of understanding with Jinghua that Gino will not acquire any other industrial

burner OEM contract for 2 years. This will delay its sales force planning as well.

2. FUNG’s and Wayip’s concern about loss of future industrial sales: This can be a

potential threat to FUNG’s and Wayip’s future sales in industrial sector. Gino should convey

its intent to penetrate in industrial segment. They already have lost around 50 sales and

hence this action has been taken.

3. Feima not able to deliver on its promise: The contract should have a clause that protects

the special investment of warehouse for Feima and its future sales force. Other OEM

contracts should be also be encouraged to split the warehouse cost in high number of units.

4. Other OEM’s of distributer ask for same margin: Any discounts in Industrial segment

should be compensated by increase in volume of industrial burners.

Gino SA: Distribution Channel Strategy – Sanket Sao

9

Appendix 1

Strengths Weaknesses

- Good distributor-manufacturer

relationship.

- Good range of products in product line

- Financially stable

- In-House production capabilities

- Strong hold in large European markets

- Reputation of manufacturing best value

products for customers.

- Also known for its strong brand

influenced by people, leading edge

technology, and distribution channel.

- Cost advantage of 10-20% lower

margin.

- Less market penetration in industrial

segment

- Growing power of distributors.

- Dependency on distributor for sales and

services.

- Distributor unable to manage Industry

segment demand.

- Less scope of growth in European

market.

- Gino’s new strategy goals of OEM

accounts and penetration in industrial

segment are in direct conflict with

distributors goals.

Opportunities Threats

- Strong emerging such as China can

increase its revenue and profitability.

- High growth in industrial segment –

about 20% annually for next 5 years.

- Losing any of the distributors is a major

threat as it directly impacts sales.

- Presence of large local manufacturer

having strong political connections in

area.

Appendix 2

Forecasting of Number of Units

Current

Industry Growth

(2%,5%,20%)

Addn Feima

Sales

Proj. Dec 2000

Sales 2001 2002

Domestic 10887 11105 705 11810 12047 12288

Commercial 1877 1971 32 2003 2104 2210

Industrial 137 165 33 198 238 286

Appendix 3

Resolve Jinghua’s

Problem

(0.35)

Revenue and

Profitability

(0.3)

Industrial

Segment

Penetration

(0.25)

Bargaining

power of

Distributors

(0.10)

Total

Alternative 1 1 1 2 1 1.35

Alternative 2 3 3 3 2 2.9

Alternative 3 2 2 1 3 1.85

Gino SA: Distribution Channel Strategy – Sanket Sao

10

Appendix 4

Gino's financial Analysis for alternative:

Jinghua's financial Analysis for each alternative

Domestic Comercial Industrial Industrial direct sell Total

Units Sold by all distributer 10887 1877 137

Transfer price(RMB) ¥2,500 ¥9,000 ¥65,000

Revenue from burners (RMB) ¥27,217,500.00 ¥16,893,000.00 ¥8,905,000.00 ¥53,015,500.00

Revenue from Spares in USD (80/20 split) ¥6,804,375.00 ¥4,223,250.00 ¥2,226,250.00 ¥13,253,875.00

Net Revenue of Gino in RMB 34,021,875.00¥ 21,116,250.00¥ 11,131,250.00¥ 66,269,375.00¥

Net Revenue of Gino in USD 4,099,021.08$ 2,544,126.51$ 1,341,114.46$ 7,984,262.05$

Total Contribution Margin (20%;25%,30%) $819,804.22 $508,825.30 $268,222.89 $1,596,852.41

Domestic Comercial Industrial Industrial direct sell Total

Price Per unit for Gino Burners 2,500.00¥ 9,000.00¥ 65,000.00¥ 120,575.00¥

Forecasted units (from appendix) 11810 2003 165 36

Revenue from Burners 29,525,000.00¥ 18,027,000.00¥ 10,725,000.00¥ 4,340,700.00¥ 58,277,000.00¥

Revenue from Spares(80/20 split) 7,381,250.00¥ 4,506,750.00¥ 2,681,250.00¥ 1,085,175.00¥ 14,569,250.00¥

Net Revenue in RMB 36,906,250.00¥ 22,533,750.00¥ 13,406,250.00¥ 5,425,875.00¥ 78,272,125.00¥

Net Revenue in USD 4,446,536.14$ 2,714,909.64$ 1,615,210.84$ 653,719.88$ 9,430,376.51$

Total Contribution Margin(20%;25%;30%;30%) in USD 889,307.23$ 678,727.41$ 484,563.25$ 196,115.96$ 2,248,713.86$

Cost of setting up warehouse (30000*12/8.3) 43,373.49$

Other cost of shipping, insurance etc.(48.4% of CM) 94,920.13$

Outsourcing cost of Sales and services(5% of SP) 14,096.39$

Net Contribution 889,307.23$ 678,727.41$ 484,563.25$ 43,725.96$ 2,096,323.85$

Domestic Comercial Industrial Industrial direct sell Total

Price Per unit for Gino Burners 2,500.00¥ 9,000.00¥ 65,000.00¥

Forecasted units (from appendix) 11810 2003 198

Revenue from Burners 29,525,000.00¥ 18,027,000.00¥ 12,870,000.00¥ 60,422,000.00¥

Revenue from Spares(80/20 split) 7,381,250.00¥ 4,506,750.00¥ 3,217,500.00¥ 15,105,500.00¥

Net Revenue in RMB 36,906,250.00¥ 22,533,750.00¥ 16,087,500.00¥ 75,527,500.00¥

Net Revenue in USD 4,446,536.14$ 2,714,909.64$ 1,938,253.01$ 9,099,698.80$

Total Contribution Margin(10%;15%;20%) in USD 444,653.61$ 407,236.45$ 387,650.60$ 1,239,540.66$

Alternative 1

Alternative 2

Alternative 3

Domestic(2500RMB/8.3*1.484) Comercial(9000RMB/8.3*1.484) Industrial(65000 RMB/8.3*1.484) Total

Jinghua's Cost to Acquire (Qx2500x1.484/8.3) $1,946,185.54 $1,409,621.20 $430,002.41 $3,785,809.16

Jinghua Revenue(5% public,95% Contracts) $2,522,256.46 $1,826,869.08 $557,283.12 $4,906,408.67

jinghua's profits $576,070.92 $417,247.88 $127,280.71 $1,120,599.51

Segmentation share of profit 51% 37% 11%

Domestic(2500RMB/8.3*1.484) Comercial(9000RMB/8.3*1.484) Industrial(65000 RMB/8.3*1.484) Total

Jinghua's Cost to Acquire (Qx2500x1.484/8.3) $2,261,312.05 $1,461,114.22 $395,137.35 $4,117,563.61

Jinghua Revenue(5% public,95% Contracts) $2,930,660.41 $1,893,604.03 $512,098.00 $5,336,362.44

Discounts to Feima(10% x 1055, 81) $47,157.23 $8,783.13

jinghua's profits $622,191.14 $423,706.68 $116,960.66 $1,162,858.47

Segmentation share of profit 54% 36% 10%

Domestic(2500RMB/8.3*1.484) Comercial(9000RMB/8.3*1.484) Industrial(65000 RMB/8.3*1.484) Total

Jinghua's Cost to Acquire (Qx2500x1.484/8.3) $1,946,185.54 $1,409,621.20 $430,002.41 $3,785,809.16

Jinghua Revenue(5% public,95% Contracts) $2,226,436.26 $1,612,606.66 $491,922.76 $4,330,965.68

jinghua's profits $280,250.72 $202,985.45 $61,920.35 $545,156.52

Segmentation share of profit 51% 37% 11%

Alternative 1

Alternative 2

Alternative 3

Gino SA: Distribution Channel Strategy – Sanket Sao

11

Appendix 5

Alternative Evaluation

Alternative 1

Pros Cons

- Strengthen distributor-manufacturing

relationship

- Maintain its leadership position in

domestic segment.

- Forgone revenue from potential sales in

domestic and commercial from Feima.

- Opportunity cost in lucrative Industrial

segment

- Conflict with strategy of adding more

OEM accounts.

- Increase in distributor power

Alternative 2

Pros Cons

- Alternative completely inline with

management strategy goals.

- Will acquire OEM accounts

- Will penetrate into high growing

Industrial segment

- Increase in overall sales & profitability

- Warehouse will resolve in Inventory

Cycle time problems for other

distributors

- Increase in distributors profit

- Meeting company’s target of selling

200 Industrial burners.

- Convincing distributor can be challenge

despite high profits for year1

-

Alternative 3

Pros Cons

- Will satisfy both the parties

- Can work further on distributer-

Manufacture relationship

- Can open a Pandora ’s Box where other

distributor’s OEM accounts will also

ask for same margin

- Alternative not aligned to Gino’s

strategy

- Distributors will be difficult to

convince for reduction in margin

- Distributors power will further increase

- Marketing and other expenses needs to

be streamlined

- Can impact the entire profit margin of

industry

Gino SA: Distribution Channel Strategy – Sanket Sao

12

Appendix 6

Assumptions:

1. The Profit Margin is assumed as 25% of Contribution Margin to compute Variable &

fixed cost.

2. The initial investment or Sunk cost of RMB200,000 has been considered as fixed cost

to evaluate this year’s performance.

3. The Sales and Service contract has been assigned to existing distributer and paid

approximately 5% of product cost.

Revenue Domestic Comercial Industrial Industrial direct sell Total

Price Per unit for Gino Burners 2,500.00¥ 9,000.00¥ 65000 120,575.00¥

Revenue from Burners 29,525,000.00¥ 18,027,000.00¥ 10,725,000.00¥ 3,978,975.00¥ 58,277,000.00¥

Revenue from Spares(80/20 split) 7,381,250.00¥ 4,506,750.00¥ 2,681,250.00¥ 994,743.75¥ 14,569,250.00¥

Net Revenue 36,906,250.00¥ 22,533,750.00¥ 13,406,250.00¥ 4,973,718.75¥ 77,819,968.75¥

Total Contribution Margin(20%;25%;30%;30%) in USD 889,307.23$ 678,727.41$ 484,563.25$ 179,772.97$ 2,232,370.86$

Cost of Goods Sold

Fixed Manufacturing Cost per unit (15%,17.5%,21%,21%) 375.00¥ 1,575.00¥ 13,650.00¥ 13,650.00¥

Fixed Bonded Warehouse Cost Per unit(20000/33) -¥ -¥ -¥ 6,060.61¥

Total Fixed Cost Per unit 375.00¥ 1,575.00¥ 13,650.00¥ 19,710.61¥

Variable manufacturing Cost per unit (20%,25%,30%,30%) 2,000.00¥ 6,750.00¥ 45,500.00¥ 45,500.00¥

Variable Bonded Warehouse Cost Per unit (30000*12/33) -¥ -¥ -¥ 10,909.09¥

Other Variable costs (48.4% for shipping, insurance etc) 31,460.00¥

Variable Sales and Service Cost -¥ -¥ 12,057.50¥

Total Variable Cost Per Unit 2,000.00¥ 6,750.00¥ 45,500.00¥ 99,926.59¥

Total Cost Per unit 2,375.00¥ 8,325.00¥ 59,150.00¥ 119,637.20¥

Total Cost 28,048,750.00¥ 16,674,975.00¥ 9,759,750.00¥ 3,948,027.50¥ 58,431,502.50¥

Gross Income 8,857,500.00¥ 5,858,775.00¥ 3,646,500.00¥ 1,025,691.25¥ 19,388,466.25¥

Gross Income (1USD=8.3¥) $1,067,168.67 $705,876.51 $439,337.35 $123,577.26 $2,335,959.79

GINO SA

Income Statement

At the end of December 2000

Gino SA: Distribution Channel Strategy – Sanket Sao

13