General BCG-Ansoff's Matrix

Transcript of General BCG-Ansoff's Matrix

7/28/2019 General BCG-Ansoff's Matrix

http://slidepdf.com/reader/full/general-bcg-ansoffs-matrix 1/4

Home » The Boston Matrix and Ansoff's Matrix

The Boston Matrix and Ansoff's Matrix

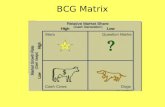

The influences of growth and market share have been brought together into amatrix by the Boston Consulting Group (BCG). Products are labelled accordingto their likely impact on an organization’s resources. They can be classified as astar, cash cow, wildcat (sometimes referred to as problem child or questionmark) or dog.

The BCG growth-share matrix

A star product is growing fast and has achieved a high market share. Although it generates high revenues and is profitable, it uses lots of cashto fuel its growth and maintain its competitive position. It is well placed tosurvive and prosper when growth slackens.

A cash cow has a high share of a market which has matured. Because of its dominant market position, it is able to exploit maturity and generateplenty of surplus cash from its sales. Cash cows ‘evolve’ from the stars of the growth stage and are a critical source of cash and other resources todevelop new products.

A wildcat (sometimes referred to as a 'problem child' or 'question mark')is in a growth stage but has achieved a relatively small market share. Asthis makes the product unprofitable at present and could put it in an evenweaker position when the market matures, it requires some changes andprobably investment to improve its market position. Wildcats are thereforenet users of cash resources. They may be managed into stars but theycan also degenerate into dogs if market growth disappears.

A dog has the worst of both worlds, having a low share of a market with

no or low growth. It represents a drain on an organisation's resources,often at the expense of other products, and is a candidate for deletionunless it can be transformed through growth into a wildcat.

Biz/ed - The Boston Matrix and Ansoff's Matrix | Biz/ed http://www.bized.co.uk/notes/2012/05/boston-matrix-and-ansoffs -...

1 of 4 4/15/2013 4:36 PM

7/28/2019 General BCG-Ansoff's Matrix

http://slidepdf.com/reader/full/general-bcg-ansoffs-matrix 2/4

Figure 1. The BCG growth-share matrix

The growth-share matrix emphasizes the need for a balanced portfolio of products if an organization is to grow and be self-sufficient in resources. Oncethe portfolio profile has been established four basic strategies for each productare possible:

Build: Increase market share to strengthen the future position at theexpense of shorter-term profits and cash flow, for example turningwildcats into stars.

Hold: Maintain current market share to make sure maximum profit andcash is generated now or in the future, for example by sustaining andmilking a cash cow.

Harvest: Increase short-term cash flow even at the expense of longer-term profits, for example by taking profits from stars and wildcatsrather than investing in them and milking cash cows dry if market

conditions seem set to worsen.Divest: Cut off a drain on resources even if it means taking short-termlosses, for example by terminating a dog.

Critics of the growth-share method of analysing product portfolios point to itssimplistic assumption that market share is always the key measure of aproduct’s competitive position and that market growth is always the mostimportant indicator of an industry's attractiveness. In particular, it overlooks thelarge number of highly successful products that occupy niche positions inlarger markets and the diseconomies of scale in providing some services whichundermines the value of a high market share.

Ansoff's classification of product strategies

Ansoff's Matrix, which links products to the markets they are targeted to serve,as shown in Figure 2.

Biz/ed - The Boston Matrix and Ansoff's Matrix | Biz/ed http://www.bized.co.uk/notes/2012/05/boston-matrix-and-ansoffs -...

2 of 4 4/15/2013 4:36 PM

7/28/2019 General BCG-Ansoff's Matrix

http://slidepdf.com/reader/full/general-bcg-ansoffs-matrix 3/4

Figure 2. Ansoff's matrix

Market penetration develops existing products within existing markets.The underlying assumption is that there is still untapped demand or competitive advantage that can be further exploited without either changing the product or looking beyond existing market segments. Thisstrategy usually involves use of other elements in the marketing mix, such

as an increase in promotional effort, more aggressive pricing policies or more extensive distribution. Providing the potential exists, it is the strategyof least risk because both products and markets are known, for example,Kellogg's has encouraged the use of breakfast cereals for other meals, soconsumers are encouraged to eat cereal for their lunch or evening meal.

Product development introduces new products into existing markets. Itassumes that an innovation will be accepted by the organization's existingcustomer group. Product development can be radical, with theintroduction of an entirely new product; or moderate, involving only themodification of existing products in some way such as performance,

presentation or quality. Many prestige car manufacturers offer a range of merchandise targeted at car owners so that you can buy replica models,clothing and pens.

Market extension takes existing products into new markets. This strategyassumes that existing markets are fully exploited or that new markets canbe developed concurrently with existing markets. New markets may bedefined geographically (e.g. potential export areas), or by customer grouping (e.g. a different age or social group) or other parameters (e.g.purchasing patterns, industrial classification or sectors). Some marketextensions may be counter-intuitive – for example, Guinness, traditionallya drink for colder climates, is now a successful brand in a number of

African countries.Diversification develops new products and offers them to new markets. As it represents a departure from an organization's existing product andmarket involvement, it is the strategy of highest risk. Richard Branson of Virgin has often used this strategy with mixed results. His forays into thevodka and cola markets have not been successful. The music stores(sold) and airline have been more successful, but the train companycontinues to be troubled.

Testing questions:

Which strategy is relevant for a business: a) attempting to turn wildcatsinto stars, b) dealing with a dog of a product, c) taking profits from stars

1.

Biz/ed - The Boston Matrix and Ansoff's Matrix | Biz/ed http://www.bized.co.uk/notes/2012/05/boston-matrix-and-ansoffs -...

3 of 4 4/15/2013 4:36 PM

7/28/2019 General BCG-Ansoff's Matrix

http://slidepdf.com/reader/full/general-bcg-ansoffs-matrix 4/4

rather than investing the profits?Describe a criticism of the growth-share methods of analysis of productpromotion.

2.

Which of Ansoff's four matrix strategies best describes: a) taking productsinto new markets, b) developing new products for new markets.

3.

Which of Ansoff's matrix strategies is the highest risk.4.

Extension work:

Research ten well known products such as iPhone, CDs, Cadbury's Dairy Milk,Fairy Liquid, Sinclair C5 and allocate them into the BCG growth-share matrixand then Ansoff's matrix. Make sure you include some failures. Choose oneproduct that started out as a wildcat, became a star and is now a cash cow andwrite a brief history of its development.

Information source:

This is an extract from a chapter in Marketing: A Brief Introduction by Stokes

and Lomax. To find out more about this book, to purchase it as a hardcopy or as an e-book or to buy eChapters please select Cengage Brain

Related resources:The Boston Matrix and Ansoff's MatrixThe Boston Matrix Ansoff MatrixSubmitted by Neil Reaich on Wed, 16/05/2012 - 19:03

Biz/ed - The Boston Matrix and Ansoff's Matrix | Biz/ed http://www.bized.co.uk/notes/2012/05/boston-matrix-and-ansoffs -...

4 of 4 4/15/2013 4:36 PM