GAS PIPELINE OPPORTUNITIES IN CENTRAL EUROPE

Transcript of GAS PIPELINE OPPORTUNITIES IN CENTRAL EUROPE

GAS PIPELINE OPPORTUNITIES IN CENTRAL EUROPE

OCTOBER 2016

Page 2 of 14

TABLE OF CONTENTS

Executive Summary 3

Energy Security 3

Industry structure 4

Gas Infrastructure projects in Central Europe 4

Summary of Major Projects by Country 5

Gas Infrastructure Maintenance 7

Project Procurement 7

Opportunities for Australian Organisations 7

Market Entry requirements 8

Links and Industry Contacts 9

European Union 9

Associations 9

Central Europe Specific 9

Appendix 1 – Major Gas Projects across Central Europe 10

Disclaimer

This report has been prepared by the Commonwealth of Australia represented by the Australian Trade and Investment

Commission (Austrade). The report is a general overview and is not intended to provide exhaustive coverage of the topic. The

information is made available on the understanding that the Commonwealth of Australia is not providing professional advice.

While care has been taken to ensure the information in this report is accurate, the Commonwealth does not accept any liability

for any loss arising from reliance on the information, or from any error or omission, in the report.

Any person relying on this information does so at their own risk. The Commonwealth recommends the person exercise their

own skill and care, including obtaining professional advice, in relation to their use of the information for their purposes.

The Commonwealth does not endorse any company or activity referred to in the report, and does not accept responsibility for

any losses suffered in connection with any company or its activities.

Copyright © Commonwealth of Australia 2016

Publication date: October 2016

Page 3 of 14

EXECUTIVE SUMMARY

There is than €70 billion1 committed or planned for gas infrastructure projects across Europe over the

next five years. This significant investment may offer opportunities for Australian companies involved in the design, construction and supply of equipment to the gas infrastructure sector.

The European Commission in 2014 released its Energy Security Strategy2 outlining a series of measures to improve the resilience of the energy system and improve the security of supply and the efficiency of energy markets in the region. A key component of this strategy is a significant investment in gas infrastructure across Central Europe.

This paper aims to assist Australian firms identify potential opportunities for supply of products and services to the gas infrastructure projects in Central Europe. The paper will examine:

industry structure

gas pipeline infrastructure projects in Central Europe

gas pipeline maintenance

procurement opportunities and processes

market entry considerations.

ENERGY SECURITY

The Central Europe region is particularly vulnerable to an interruption of gas supply3. Europe’s gas

sector is considered vulnerable due to its high import dependence (66 per cent of gas is imported)

and significant market power exerted by Russia as the supplier of 42 per cent of all imported gas into

the European Union4. This vulnerability is exacerbated by an ageing gas infrastructure which is

aligned on an east-west axis to accommodate the single gas supplier.

Further, the existing gas transmission network is fragmented and has a limited capacity to

accommodate reverse flows of gas. This has made it difficult to create a single efficient and

competitive market for gas across the EU. These network gaps have resulted in less security of

supply and price premiums due to limited competition in the gas supply market of some countries.

The policy makers’ energy security concerns have been heightened in recent years by the rising

geopolitical tensions on the eastern and southern borders of the European Union. These tensions

could result in energy supply disruption due to conflict or use of energy as a geopolitical tool.

The planned gas infrastructure investment will not only improve security of supply, it could also lead to

improved market efficiency and reduced gas prices in Central Europe through:

diversifying gas supplies through new pipelines from Azerbaijan (TANAP), Norway and

Finland (Baltic interconnectors) and developing new LNG receiving terminals such as the

proposed Krk Island terminal in Croatia

improving connectivity particularly developing a north-south gas corridor and expanding

capacity to accommodate reverse flows reducing dependence on single suppliers of gas in

some countries

improving market efficiency through a separation of gas distribution infrastructure from gas

supply.

An additional consideration is the heightened terrorist risk which is stimulating investment in protection

of critical energy infrastructure.5

1 https://ec.europa.eu/inea/en/connecting-europe-facility/cef-energy 2 https://ec.europa.eu/energy/en/topics/energy-strategy/energy-security-strategy 3 9 countries including Czech and Slovak Republic rely on Russia for supply of more than 60% of their gas supply. European Commission “In-depth study of European Energy Security” Page 8 4 https://www.bp.com/content/dam/bp/pdf/energy-economics/statistical-review-2015/bp-statistical-review-of-world-energy-2015-full-report.pdf Page 28 5 https://ec.europa.eu/energy/en/topics/infrastructure/protection-critical-infrastructure

Page 4 of 14

In recent years there has been considerable progress in improving the resilience of the gas system in

Central Europe, with a significant increase in gas storage facilities and the development of reverse

flow capacities such as those now in place between Poland, Ukraine, Czech and Slovak Republics.

Notwithstanding this progress, the significant investment in the upgrading of gas pipeline

infrastructure network across Central Europe is just beginning.

INDUSTRY STRUCTURE

Over the last 20 years, the European Union has undertaken a process of market liberalisation in the

energy sector. This has required the separation of gas networks from retail distribution, providing for

third party access to gas networks and improving access to new sources of gas supply amongst other

reforms.

Although these market reforms have resulted in an improved competitive environment, the gas

transmission networks are dominated by state-owned enterprises and although not universal, retail

distribution in many of the countries of Central Europe is also controlled by state owned enterprises.

The proponents for the major gas pipeline developments are generally the state-controlled national

Gas Transmission System Operators (TSO) across the region. However, there are a number of

projects such as the Trans Adriatic Pipeline (TAP) which is controlled by a consortium of private and

public sector oil and gas firms, TSO, infrastructure and energy firms.

GAS INFRASTRUCTURE PROJECTS IN CENTRAL EUROPE

The European Commission has identified that €70 billion in gas infrastructure investment will be

required to improve gas energy security. This includes 53 gas pipeline and 23 other gas projects

designated as Projects of Common Interest (PCI) by the European Commission.

PCIs are projects designated by the EU as essential for creating an integrated European energy

market, increase competition and improve energy security by diversifying sources of supply. As

priority projects, the PCIs have access to streamlined approval and permitting processes and may be

eligible to access €5.35 billion in funding under the Connecting Europe Facility (CEF) to accelerate

development of these projects.

There are 43 PCI projects planned in the Central European region alone with total length of new

pipeline construction of over 7,600 km. significant projects are planned in Poland, Hungary, Bulgaria,

Romania, Croatia and Greece.

Page 5 of 14

SUMMARY OF MAJOR PROJECTS BY COUNTRY

Below is a summary of major projects by country, the primary market participants in each country and

a map illustrating the major PCI pipeline projects planned in Central Europe. A full list of PCI projects

in Central Europe is included as Appendix 1.

Market Gas

transmission

system

operator

# of PCI

projects

PCI -

Length

of

pipeline

projects

Total

length of

pipelines

operated6

Major retail

distributors

Gas supplier7

Poland Gaz-System 16 1,876.6

km

187,304 km PGNiG, RWE,

GEN Gaz

Energia

27.3% local

supply, 56,3%

Russia, 16.2%

other*

Czech

Republic

Net4Gas 3 275.6 km 77,489 km RWE, Prazska

plynarenska,

E.On

1.7% local

supply, 10.8%

Norway,

60.9% Russia,

26.6% other*

Slovak

Republic

Eustream 2 125 km 35,452 km SPP a.s., RWE

Gas

Slovensko,

CEZ Slovensko

1.7% local

supply, 98.3%

Russia

Hungary FGSZ 4 598 km 89,004 km Emfesz, EGAZ,

TIGAZ

18.3% local

supply, 81.7%

Russia

Bulgaria Bulgartransgaz 7 535 km 6,710 km Bulgartransgaz

, Overgas

6% local

supply, 94%

Russia

Romania Transgaz 5 1,411 km 53,666 km E.ON

Romania,

Distrigaz Sud

84.7% local

supply, 15.3%

Russia

Croatia Plinacro 4 998 km 19,904 km Gradska

plinara Zagreb

Distribucija,

HEP Plin

d.o.o.,

Termoplin d.d.

67.5% local

supply, 22.5%

other*

Greece Desfa 7 2,863 km 7,125 km DEPA, M and

M Natural Gas

S.A.

65.9% Russia,

16.5% Algeria,

17.7% other*

Note: 1. * including net exports.

6 Source – Eurogas Statistical Report 2014 - http://www.eurogas.org/uploads/media/Eurogas_Statistical_Report_2014.pdf 7 Source – Eurogas Statistical Report 2014 - http://www.eurogas.org/uploads/media/Eurogas_Statistical_Report_2014.pdf

Page 6 of 14

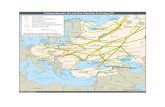

Gas pipeline projects of common interest in Central Europe8

© European Union 2016. Responsibility for the information and views set out in this report lies entirely with the authors.

8 PCI projects include projects in Electricity, Natural Gas, Oil and Smart Grids and full list can be consulted on an interactive map of PCI projects.

Page 7 of 14

GAS INFRASTRUCTURE MAINTENANCE

The main cause of gas pipeline failure incidents in Europe is due to third party interference with

pipelines (28 per cent), with construction defects (16 per cent), corrosion (26 per cent) and ground

movements (16 per cent) less frequent causes of failure9.

The existing TSOs and distributors have an extensive existing pipeline network that needs to be

maintained. Gaz-System in Poland and Net4Gas in the Czech Republic maintain 10,323 km and

3,800 km of high-pressure transmission networks respectively. The TSOs generally have in-house

maintenance units to manage maintenance including corrosion surveillance and maintenance,

telemetrics, technical diagnostics and measurement. Self-regulation by TSOs has been largely

effective, however, increasing awareness of pipeline locations and adoption of new technology has

capacity to improve the integrity of gas pipeline infrastructure.

PROJECT PROCUREMENT

The gas pipeline development projects follow a standard project development pathway familiar to

Australian organisations. The projects typically operate a pre-qualification phase to identify

contractors and suppliers with the skills, capacity, experience and certification to participate in

individual projects. Pre-qualified companies are then invited to participate in the competitive tenders

for products and services related to the project.

The tender processes generally follow EU tender guidelines, with tenders published in official

publications such as the EU Gazette. The major tenders are published in English, however there are

some regional variations with tenders published in local language only. The tenders generally do not

have a national preference criteria, however local content and involvement of local firms and

communities in a project can be an advantage.

The €2 billion 870 kilometre Trans Adriatic Pipeline (TAP) project is a good example of how a large

gas infrastructure project is managed.

OPPORTUNITIES FOR AUSTRALIAN ORGANISATIONS

The scale and diversity of gas infrastructure development across Central Europe offers opportunities

for Australian organisations across the project lifecycle from engineering design, supply of products

and services to support the construction of pipelines, through to support and maintenance of new and

existing pipelines. Specific areas of opportunity include:

front end engineering and design

subsea pipeline design and construction

pipeline construction fault reduction

gas treatment, processing, compression, storage and monitoring

Pipeline integrity and repair – anti-corrosion maintenance and monitoring

environmental and risk management, monitoring and evaluation

LNG industry research, education and training

education and training – geoscience, safety and offshore operations.

9 European Gas Pipeline Incident Data Group Report 2015 P22 Incident data from 2009 - 2013

Page 8 of 14

MARKET ENTRY REQUIREMENTS

The European gas infrastructure project is a mature and sophisticated market with a strong presence

of major European firms in the value chain. For Australian firms considering building a presence in the

region, establishing an on-the-ground presence in the market is one of the most effective means of

developing relationships with the key European players such as Transmission System Operators,

major Engineering Procurement Contractors and local sub-contractors. Firms can also consider

partnering, joint venture or distributor arrangements with existing local firms involved in the supply

chain. To support market entry, we advise regular market visits and direct contact with potential

partners.

The major gas projects operate in a similar fashion to projects of a similar scale in Australia with pre-

qualification procedures in place. It is important to understand the specific supplier qualification

requirements and ensure that you have all necessary certifications.

In order to be eligible to operate high pressure gas pipelines on EU market, operators have to comply

to EN 1594:2000 standard. This standard provides the functional standards for gas transmission

infrastructure. Suppliers to the gas industry are required to comply with EU standards such as:

EN 12186:2015 - Gas pressure regulating stations for transmission and distribution

EN 12279: 2016 - Gas pressure regulating installations on service lines

EN 1776:2016 - Natural gas measuring stations

EN 12583:2014 - Compressor stations

EN 12327:2013 - Pressure testing, commissioning and decommissioning procedures

EN 12732:2013 - Welding steel pipe work

CEN ISO/TS 17969:2015 - Petroleum, petrochemical and natural gas industries - Guidelines

on competency for personnel

EN 1473:2016 – Installation and equipment for liquefied natural gas – Design of onshore

installations

All relevant European standards can be found at the European Committee for Standardization

website.

National Standardisation Bodies are required to implement European Standards as national

standards. Standard certifications should be obtained from the National Standardization Bodies.

A list of organisations is available here https://standards.cen.eu/dyn/www/f?p=CENWEB:5.

Page 9 of 14

LINKS AND INDUSTRY CONTACTS

European Union

European Commission – Directorate General Energy

https://ec.europa.eu/energy/

European Commission – Innovation and Networks Executive Agency -

https://ec.europa.eu/inea/en

Projects of Common Interest:

https://ec.europa.eu/energy/en/topics/infrastructure/projects-common-interest

Connecting Europe Facility

https://ec.europa.eu/inea/en/connecting-europe-facility

European Committee for Standardization

https://standards.cen.eu

Associations

Gas Infrastructure Europe – www.gie.eu

Eurogas –European Union of Natural Gas - http://www.eurogas.org/

European Network of Transmission System Operators for Gas (ENTSOG) – www.entsog.eu

Central Europe Specific

Central Eastern Europe Gas Regional Investment Plan:

› Annex F: List of PCI Projects - http://cld.bz/0uc6CMy#1 and

› Gas Regional Investment Plan 2014-2023 - http://cld.bz/a7spf1y#

AUSTRADE CONTACTS

The Australian Trade and Investment Commission – Austrade – contributes to Australia's economic

prosperity by helping Australian businesses, education institutions, tourism operators, governments

and citizens as they:

Develop international markets

Win productive foreign direct investment

Promote international education

Strengthen Australia's tourism industry

Seek consular and passport services

Austrade provides information and advice that can help you reduce the time, cost and risk of

exporting. We also administer the Export Market Development Grant Scheme and offer a range of

services to Australian exporters in growth and emerging markets.

For more information on how Austrade can assist, please contact:

Australia Central Europe

Ruth Keane Jan Brejcha

Team Leader Energy Business Development Manager, Czech Republic

P +61 8 9261 7916 P +420 221 729 272

Page 10 of 14

APPENDIX 1 – MAJOR GAS PROJECTS OF COMMON INTEREST ACROSS CENTRAL EUROPE

Country

(-ies)

Project name Length

(km)

Max subsidy

value (Euro)

Project promoters Commission

date

Project stage

Czech

Republic,

Poland

6.1.1 - Poland -

Czech inter-

connection [known

as Stork II] between

Libhost - Hat (CZ-

PL) – Kedzierzyn

(PL)

107.6 € 64,182,736 Gaz-System-

www.gaz-

system.pl, Net4Gas

- www.net4gas.cz

2019 Design and

permitting

Poland 6.1.10 - Pogorska

Wola - Tworzen

pipeline

160 N/A Gaz-System-

www.gaz-system.pl

2020 Design and

permitting

Poland 6.1.11 -

Strachocina –

Pogórska Wola

pipeline

120 N/A Gaz-System-

www.gaz-system.pl

2019 Design and

permitting

Poland 6.1.2 - Lwowek -

Odolanow pipeline

162 N/A Gaz-System-

www.gaz-system.pl

2018 Design and

permitting

Poland 6.1.3 - Odolanow

compressor station

compres

sor

station

N/A Gaz-System-

www.gaz-system.pl

2018 Under

consideration

Poland 6.1.4 - Czeszów -

Wierzchowice

pipeline

13 N/A Gaz-System-

www.gaz-system.pl

2016 Design and

permitting

Poland 6.1.5 - Czeszów -

Kiełczów pipeline

32 N/A Gaz-System-

www.gaz-system.pl

2016 Design and

permitting

Poland 6.1.6 -

Zdzieszowice-

Wroclaw pipeline

130 N/A Gaz-System-

www.gaz-system.pl

2018 Design and

permitting

Poland 6.1.8 - Tworog -

Tworzen pipeline

56 N/A Gaz-System-

www.gaz-system.pl

2018 Planned

Poland 6.1.9 - Tworóg -

Kędzierzyn pipeline

47 N/A Gaz-System-

www.gaz-system.pl

2018 Design and

permitting

Page 11 of 14

Country

(-ies)

Project name Length

(km)

Max subsidy

value (Euro)

Project promoters Commission

date

Project stage

Bulgaria 6.10 - PCI Gas

Interconnection

Bulgaria – Serbia

[currently known as

IBS]

150 N/A Ministry of

Economy, Energy

and Tourism of

Bulgaria,

www.mi.governmen

t.bg/en,

Bulgartransgaz,

www.bulg artransg

az.bg /en,

Srbijagas,

www.srbijagas.com

/naslovna.1.html

2018 Design and

permitting

Greece 6.11 - PCI

Permanent reverse

flow at Greek –

Bulgarian border

between Kula (BG)

– Sidirokastro (EL)

reverse

flow

N/A BULGARTRANSG

AZ -

www.bulgartransga

z.bg/en

2014 Commissioned

Romania 6.15.1 - Integration

of the Romanian

transit and

transmission

system

connecti

on

pipeline

N/A SNTGN

TRANSGAZ SA,

www.transgaz.ro

2018 Under

consideration

Romania 6.15.2 - Reverse

flow at Isaccea

compres

sor

station

N/A SNTGN

TRANSGAZ SA,

www.transgaz.ro

2018 Under

consideration

Czech

Republic

6.17 - PCI

Connection to

Oberkappel (AT)

from southern

branch of Czech

transmission

system

110 N/A Net4Gas -

http://www.net4gas.

cz

2022 Design and

permitting

Poland,

Slovakia

6.2.1 - Poland –

Slovakia

interconnection

164 € 4,601,500 Gaz-System-

www.gaz-system.pl

2019 Planned

Poland 6.2.2 -

Rembelszczyzna

compressor station

compres

sor

station

N/A Gaz-System-

www.gaz-system.pl

2016 Under

construction

Poland 6.2.4 - Wola

Karczewska -

Wronów pipeline

409 N/A Gaz-System-

www.gaz-system.pl

2022 Under

consideration

Poland 6.2.5 - Wronow

node

409 N/A Gaz-System-

www.gaz-system.pl

2022 Planned

Page 12 of 14

Country

(-ies)

Project name Length

(km)

Max subsidy

value (Euro)

Project promoters Commission

date

Project stage

Poland 6.2.8 -

Hermanowice -

Jarosław pipeline

39 N/A Gaz-System-

www.gaz-system.pl

2022 Under

consideration

Poland 6.2.9 -

Hermanowice -

Strachocina

pipeline

72 N/A Gaz-System-

www.gaz-system.pl

2018 Design and

permitting

Bulgaria 6.20.1 -

Construction of new

storage facility on

the territory of

Bulgaria

gas

storage

facility

N/A Bulgartransgaz

EAD -

www.bulgartransga

z.bg/en

2017 Under

consideration

Bulgaria 6.20.2 - Chiren

UGS expansion

gas

storage

facility

€ 3,900,000 Bulgartransgaz

EAD -

www.bulgartransga

z.bg/en

2021 Planned

Romania 6.20.4 - Depomures

storage in Romania

gas

storage

facility

N/A Depomures S.A. -

www.depomures.ro

2018 Design and

permitting

Croatia 6.21 -PCI Ionian

Adriatic Pipeline

(Fieri (AB) – Split

(HR))

540 N/A Plinacro Ltd -

www.plinacro.hr,

BHGAS - www.bh-

gas.ba

2020 Design and

permitting

Hungary,

Romania

6.22.1 - Gas

pipeline Constanta

(RO) – Arad –

Csanádpalota (HU))

[currently known as

AGRI]

120 N/A MVM -

www.mvm.hu/en,

SOCAR -

www.new.socar.az,

GOG C -

www.gogc.ge/en,

ROMGAZ,

www.romgaz.ro/en

n/a Feasibility

studies

Hungary 6.23 - PCI Hungary

– Slovenia

interconnection

(Nagykanizsa –

Tornyiszentmiklós

(HU) – Lendava

(SI) – Kidričevo)

113 € 375,000 FGSZ Ltd. -

http://fgsz.hu/en,

Plinovodi d.o.o. -

www.plinovodi.si/en

2020 Planned

Hungary,

Slovakia

6.3 - PCI Slovakia –

Hungary Gas

Interconnection

between Vel’ké

Zlievce (SK) –

Balassagyarm at

border (SK/HU) -

Vecsés (HU)

115 N/A FGSZ - Magyar

Gaz Tranzit ZRt -

http://fgsz.hu/,

Eustream, a .s. -

www.eustream.sk

2015 Commissioned

Page 13 of 14

Country

(-ies)

Project name Length

(km)

Max subsidy

value (Euro)

Project promoters Commission

date

Project stage

Czech

Republic

6.4 - PCI

Bidirectional

Austrian – Czech

interconnection

(BACI) between

Baumgarten (AT) –

Reinthal (CZ/AT) –

Breclav (CZ)

58 € 66,148 Net4Gas -

http://www.net4gas.

cz, Gas Connect

Austria GmbH -

http://www.gasconn

ect.at/

2020 Design and

permitting

Croatia 6.5.1 - LNG

Regasification

vessel in Krk (HR)

LNG

regasific

ation

€ 5,450,000 Plinacro Ltd -

www.plinacro.hr

2019 Design and

permitting

Croatia 6.5.2 - Gas pipeline

Zlobin – Bosiljevo –

Sisak – Kozarac –

Slobodnica (HR )

308 N/A Plinacro Ltd -

www.plinacro.hr

2019 Design and

permitting

Croatia 6.6 - PCI

Interconnection

Croatia – Slovenia

(Bosiljevo –

Karlovac – Lučko –

Zabok– Rogatec

(SI))

150 N/A Plinacro Ltd -

www.plinacro.hr

2018 Design and

permitting

Bulgaria 6.8.1 -

Interconnection

Greece – Bulgaria

[currently known as

IGB] between

Komotini (EL) –

Stara Zagora (BG)

185 N/A ICGB AD -

www.icgb.eu

2018 Design and

permitting

Bulgaria 6.8.2 -

Rehabilitation,

modernization and

expansion of

Bulgarian

transmission

system

pipeline

upgrade

N/A Bulgartransgaz

EAD -

www.bulgartransga

z.bg/en

2019 Planned

Greece 6.9.1-

Alexandroupolis

LNG Independent

Natural Gas

System

29 € 1,755,000 Gastrade S.A. -

www.gastrade.gr

2017 Design and

permitting

Greece 6.9.2 - Aegean LNG

import terminal

LNG

terminal

€ 252,500 DEPA SA -

www.depa.gr

2017 Design and

permitting

Page 14 of 14

Country

(-ies)

Project name Length

(km)

Max subsidy

value (Euro)

Project promoters Commission

date

Project stage

Greece 7.1.2 - Gas

compression station

at Kipi (EL)

compres

sor

station

N/A DESFA S.A. -

www.desfa.gr

2020 Design and

permitting

Greece 7.1.3 - Gas pipeline

from Greece to Italy

via Albania and the

Adriatic Sea [known

as the "Trans-

Adriatic Pipeline"

(TAP)]

550 N/A Trans Adriatic

Pipeline A.G. -

www.trans-adriatic-

pipeline.com

2020 Design and

permitting

Greece 7.1.4 - Gas pipeline

from Greece to Italy

via the Adriatic Sea

[currently known as

the "Interconnector

Turkey-Greece-

Italy" (ITGI)]

613 N/A GI POSEIDON S.A. -

www.igi-

poseidon.com,

DESFA S.A. -

www.desfa.gr

2020 Design and

permitting

Hungary,

Romania,

Bulgaria

7.1.5 - Gas pipeline

from Bulgaria to

Austria via Romania

and Hungary

250 N/A Nabucco Gas

Pipeline International

GmbH or its

shareholders (OMV,

FGSZ, Transgaz,

BEH, BOTAS) -

http://www.nabucco-

pipeline.com/

2019 Design and

permitting

Greece 7.3.1 - Pipeline from

offshore Cyprus to

Greece mainland via

Crete

1550 to

1700

N/A DEPA S.A. -

www.depa.gr,

Ministry of Energy

Commerce, Industry

and Tourism of

Cyprus -

www.mcit.gov.cy

2020 Planned

Bulgaria 7.4.2 -

Interconnector

between Turkey and

Bulgaria - minimum

capacity of 3bcm/a

[known as "ITB"]

200 N/A Bulgartransgaz EAD -

www.bulgartransgaz.

bg/en

2018 Planned

Poland 8.5 - PCI Poland -

Lithuania

interconnection

[currently known as

"GIPL"]

534 € 305,982,588

Gaz-System-

www.gaz-system.pl,

AB Amber Grid -

www.ambergrid.lt

2019 Planned

Source: http://ec.europa.eu/energy/infrastructure/transparency_platform/map-viewer/

![Undergraduate Study Opportunities in Europe [through English]](https://static.fdocuments.net/doc/165x107/56649d635503460f94a45e03/undergraduate-study-opportunities-in-europe-through-english.jpg)