FOR SALE BY PRIVATE TREATY · 2020. 7. 13. · VOLKSWAGEN CLAYTON HOTEL LIFFEY VALLEY PARK LIFFEY...

Transcript of FOR SALE BY PRIVATE TREATY · 2020. 7. 13. · VOLKSWAGEN CLAYTON HOTEL LIFFEY VALLEY PARK LIFFEY...

-

F O R S A L E B Y P R I V A T E T R E A T Y

-

Liffey Valley is a bustling retail hub undergoing significant growth

Liffey Valley Shopping Centre

Liffey Valley Motor Showrooms

Liffey Valley Retail Park

Tesco

N4

Executive Summary 6

Location 8

Accessibility 10

Zoning & Town Planning 11

Lot 1 12

Lot 2 14

Lot 3 16

Market Overview 18

Further Information 22

CONTENTS

Clayton Hotel

M50

N4

2 3

Lot 1

Lot 2

Lot 3

-

5

Ireland continues to record the fastest rate of economic growth in the EU, at

8.2% in 2018

About 45,000 new jobs in the year June 2019

Population growing by around

60,000 persons per annum

Aggregate household disposable income growth of over

5% per annum

28.4% of Ireland’s populationlives in Dublin

CSO expects Dublin population could increase by

31.9% by 2036

Population currently growing by

1.8% per annum

New dwellings completions rose by almost

24% in 2018

Retails rents increasing over the medium term

Highest growth recorded in electrical, hardware & furniture stores (associated with housing market)

Prices of consumer goods falling due to discounting, a shift toward value brands and the weaker pound

Annual growth in consumer spending averaging

3% in 2018

Shopping Centre & surrounding retail parks undergoing significant expansion

Close to Balgaddy-Clonburris Strategic Development Zone set to house additional 20,000 people

10 million footfall per annum

Lucan-Esker electoral population

32,236 people

RAIL

30 minute walk to Clondalkin/Fonthill Station

AIRPORT

20 minute drive

BUS

2 minute walk

ROAD

5 minute drive to M50

STRONG GROWTH ACROSS LEADING INDICATORS

WHY DUBLIN?

RETAIL MARKET

LIFFEY VALLEY

TRANSPORT

4

SAVE

PRICEDROP

-

EXECUTIVE SUMMARY

Three superb commercial sites within the Liffey Valley retail hub

Zoned Major Retail Centre

Various Lot sizes from approximately 0.57-1.70 hectares (1.42 - 4.24 acres)

Excellent frontage to main Liffey Valley thoroughfares and the N4

Liffey Valley & environs undergoing significant expansion

Liffey Valley Shopping Centre

Liffey Valley Retail Park

Clondalkin / Fonthill Train StationFonthill Retail Park

Grange Castle Business Park

Dublin City Centre

Tesco

B&Q

Clayton Hotel

Liffey Valley Motor Showroom

76

M50N4

Lot 3Lot 2

Lot 1

-

R136 R113

R113

R136

1

2

3

2

23

3

44a

N4N4

N7

N7 N81

N4

N3

N3

N2N1

N32

N1

N2

N2

N11

N11

N31

N31

N11

N81

N81

N81

N7

17

16

15

1413

12

11

10

9

1

7

6

5

4

2

1

2

5

3

M1

M50

M50

M50

M50

M50

M11

2

4

4

5

5

7

6

M50

M3

M2

M4

M4

M7

M7

M9

M7

DUBLINAIRPORTDUBLIN

AIRPORT

DUBLINDUBLIN

BallsbridgeBallsbridge

GlenagearyGlenagearySandyfordSandyford

RatfarnhamRatfarnham

DundrumDundrum

ChurchtownChurchtown

StillorganStillorgan

ClonskeaghClonskeagh

BlackrockBlackrock

MilltownMilltown

TerenureTerenure

TempleogueTempleogue

FoxrockFoxrock

LeopardstownLeopardstown

CarrickminesCarrickmines

CherrywoodCherrywood

DunLaoghaire

DunLaoghaire

RanelaghRanelagh

DonnybrookDonnybrook

CrumlinCrumlin

DrumcondraDrumcondra

ChapelizodChapelizod

DocklandsDocklands

Port TunnelPort Tunnel

BeaumontBeaumont

CoolockCoolockSantrySantry

FinglasFinglas

CastleknockCastleknock

LucanLucan

AdamstownRailway Station

AdamstownRailway Station Clondalkin

/FonthillRailway Station

Clondalkin/Fonthill

Railway Station

Liffey ValleyLiffey Valley

BallyfermotBallyfermot

WalkinstownWalkinstown

DUBLINDUBLIN

ClondalkinClondalkin

CitywestCitywest

BelgardBelgard

TallaghtTallaght

SaggartSaggart

PortmarnockPortmarnock

MalahideMalahide

ClontarfClontarf

HowthHowth

SuttonSutton

SwordsSwords

DunboyneDunboyne

KilcloonKilcloon

CelbridgeCelbridge

StraffanStraffan

CastledillonCastledillon

BackwestonBackweston

Adamstown Adamstown

Moyglare HallMoyglare HallOngarOngar

MulhuddartMulhuddart

LeixlipLeixlip

CloneeClonee

BlanchardstownBlanchardstownMaynoothMaynooth

RathcoffeyRathcoffey

FanaghFanagh

KilshanroeKilshanroe

The GreenhillThe Greenhill

StaplestownStaplestown

The CottThe Cott

BlackwoodBlackwood

RobertstownRobertstown

AllenwoodAllenwood

KilmeageKilmeage

AllenAllenCarraghCarragh

MilltownMilltown

ClonaghClonagh

NaasNaas

MullacashMullacash

BallymoreEustace

BallymoreEustace

BlessingtonBlessington

ManorKilbrideManor

Kilbride

BallinageeBallinagee

ArdcloughArdcloughClaneClane

KildareKildare

MaddenstownMaddenstown

BallysaxBallysax

EnfieldEnfield

RathroneRathrone

Dun Na SiDun Na SiArdrumsArdrums

DerrinturnDerrinturn

JohnstownBridge

JohnstownBridge

AdamstownRailway Station

AdamstownRailway Station Clondalkin

/FonthillRailway Station

Clondalkin/Fonthill

Railway Station

Liffey ValleyLiffey Valley

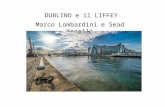

LOCATION Liffey Valley, and the sites are located just off the junction of the M50 and N4, which is mid-way along the M50 at a convenient and busy area.

The location is approximately 12km west of Dublin City Centre between the well established suburbs of Lucan and Palmerstown. It is in close proximity to expansive residential suburbs such as Castleknock, Clondalkin and Leixlip and is therefore home to a wealth of associated amenities.

This location has become a significant retail destination in Dublin, easily accessed by car and by Dublin Bus whom operate 16 routes to and from the area.

The shopping centre is one of Dublin’s largest and has recently undergone a significant expansion with the addition of space to provide more retail stores, a large cinema and extra restaurant and café

units. It is surrounded by retail parks and outlets which provide synergy to the area as destination retail.

The surrounding suburbs are ever expanding, with the recent development of Adamstown in Lucan and the announcement of the Balgaddy- Clonburris Strategic Development Zone. This SDZ area is due to accommodate approximately 8,500 new homes and up to 21,000 additional population and was formally adopted in June 2019.

There are a number of established business parks nearby, which are home to some significant employers. Grange Castle Business Park is located 3km from the subject property or less than a five-minute drive. This park is home to Pfizer, Takeda Pharmaceuticals and Cuisine de France. Pfizer employs approximately 3,000 staff in Dublin. The property is also close to Park West Business Park and Citywest Campus.

98

-

ZONING & TOWN PLANNING Under the South Dublin County Council Development Plan 2016-2022 Lots 1, 2 and 3 are all zoned Major Retail Centre with a stated objective “to protect, improve, and provide for the future development of a Major Retail Centre”.

A range of uses are permissible under this zoning including “office less than 100 sq m”, garden centre, retail warehouse, motor sales outlet and hotel amongst other uses. Residential development is not permitted under this zoning.

R1 1

3

FO

NT

HI L

L R

D N

OR

TH

R1 1

3

C O L D C U T R O A D R 8 3 3 C O L D C U T R O A D

L1042

ST LOMANS ROAD

MO

UN

T A

ND

RE

W A

VE

FON

THIL

L R

OA

D

G

R EE NFORT AVE

SH

AN

CA

STLE

AVE

F ON T H I

L L R O A D

FO

NT

H

I L L R D

N 4

N 4

N 4

L U C A N O L D R O A D

KE

NN

EL

SF

OR

T R

OA

D U

PP

ER

G L E N M A R O A N R DLIF

FE

Y A

VE

NU

E

LÁ

NA

EO

GH

AI N

M50

M50

LIFFEY VALLEYSHOPPING CENTRE

LIFFEY VALLEYRETAIL PARK

THE KING’SHOSPITAL SCHOOL

SMYTHSTOYS

EURASIASUPERMARKET

B&Q

TESCO

Junction 7Junction 7

VOLKSWAGEN

CLAYTON HOTEL

LIFFEYVALLEYPARK

LIFFEYVALLEY

PALMERSTOWNMANOR

WOODFARMACRES

ACCESSIBILITY Dublin Bus operates several routes through the area, with stops located on the Fonthill Road and the N4. The closest Bus stop is within approximately 350m of the sites.

The N4 can be reached in 3 minutes by car (approximately 1.7 km) and M50 can be reached within 5 minutes by car and is (approximately 2.9 km) and the N7 in 12 minutes (approximately 8.5 km) from the subject property.

Clondalkin/ Fonthill Train Station is located within approximately 2.6 km and can be accessed on foot in approximately 30 minutes. This station provides commuter trains access to Dublin Pearse in the CBD in approximately thirty minutes. Heuston Station can be reached within approximately fifteen minutes, where connecting trains can be accessed for Cork, Galway and Limerick.

Dublin Airport is within a 20 minute drive on the M50 northbound and is approximately 16.8 km from Liffey Valley.

BUS2 minute walk

ROAD5 minute drive

to M50

RAIL30 minute walk to Clondalkin/Fonthill

Station

AIRPORT20 minute drive

1110

LOT 1LOT 2

LOT 3

-

1312

LOT 1 This property is specifically located north of the main Liffey Valley entrance road amongst a number of motor showrooms such as Toyota, Kia, Volkswagen, Opel and Nissan. It is bounded to the north directly by the N4, the south by a number of motor showrooms, the east by a vacant greenfield site and to the west by Toyota showroom.

The immediate area is home to a mix of commercial operators such as The Clayton Hotel, Volkswagen offices, Johnson & Johnson offices and Giraffe Childcare. The area has been recently subject to new retail development with Killeen Motors site being developed as the new Toyota showrooms and more recently a development of four drive-thru food facilities directly adjacent to the Volkswagen showroom.

Lots 1 & 2 could be interconnected. Lot 1 measures approximately 1.70 hectares (4.24 acres) and is regular in shape with relatively flat topography. It has approximately 155 m frontage to the secondary road between Toyota and Giraffe Childcare and also approximately 164 m frontage directly on to the N4 at its northern boundary.

This property was previously zoned for residential in the 2008 Local Area Plan. This has now been changed to ‘Major Retail Centre’ under the South Dublin County Council Development Plan 2016-2022.

© Ordnance Survey Ireland

LOT 1

APPR

OX

164M

Lot 1 measures approximately 1.70 hectares (4.24 acres)

N4

-

1514

Lot 2 measures approximately 0.72 hectares (1.78 acres) LOT 2

This property is specifically located on the secondary road to the north of the main Liffey Valley entrance roadway in between Giraffe Childcare and Johnson & Johnson office building. It has a good profile and can be seen from the main thoroughfare and roundabout.

Like Lot 1, it is in close proximity to a number of car showrooms as well as a mix of other commercial and food uses.

This site is directly bounded to the north by the N4, the south by Volkswagens office building, the east by Johnson & Johnson office building and to the west by Giraffe Childcare and Lot 1 greenfield site.

Lots 1 & 2 could be interconnected. Lot 2 measures approximately 0.72 hectares (1.78 acres) and is irregular in shape wrapping around the Giraffe Childcare site and with a relatively flat topography. It has frontage of approximately 88m to the secondary road between Giraffe Childcare and Johnson & Johnson office building as well as frontage of approximately 92m directly to the N4 at it’s northern boundary. It is clearly visible from the main entrance roadway.

This property was previously zoned for office in the 2008 Local Area Plan. This has now been changed to ‘Major Retail Centre’ under the South Dublin County Council Development Plan 2016-2022.

© Ordnance Survey Ireland

LOT 2APPROX 92M

N4

-

© Ordnance Survey Ireland

1716

LOT 3This property is specifically located directly on the main Liffey Valley entrance roadway immediately abutting one of the main roundabouts. It is within the section of the park that comprises most of the motor showrooms as well as a mix of other commercial uses such as office and hotel.

It is bounded to the north by Johnson & Johnson office building and Lot 2 greenfield lands, to the south the main Liffey Valley entranceway and roundabout, the east by another of the main roundabouts and to the west by Volkswagen’s office building.

Lot 3 measures approximately 0.57 hectares (1.42 acres) and is an irregular shape with relatively flat topography.

This property has an excellent profile to the main thoroughfare and frontage of approximately 117m to the roundabout, main road and also the secondary road to the rear where access is provided.

This property was previously zoned for office in the 2008 Local Area Plan. This has now been changed to ‘Major Retail Centre’ under the South Dublin County Council Development Plan 2016-2022.

Lot 3 measures approximately 0.57 hectares (1.42 acres)

LOT 3AP

PROX

117M

-

1918

MARKET OVERVIEW Economic Overview Ireland remains the EU’s fastest growing economy, with output rising by 6.3% year-on-year in Q1 2019. Furthermore, total employment rose by 2% Y/Y in Q2 2019, with an increase of 45,000 people at work. Unemployment is currently at 5.2%, so we are approaching full employment. Greater numbers at work, coupled with increased earnings and consecutive tax cuts, have led to strong growth of over 5% in real aggregate household disposable incomes in the last twelve months and continued deleveraging which has contributed to a 5.1% rise in households’ net worth.

Figure 1: Household Net Worth By Component

Retail Economy The Q1 national accounts show a 2.9% increase in personal consumption expenditure – still positive but something of a slowdown compared with the growth rates seen in late 2017 and the first half of 2018.

The narrower monthly retail sales measure has begun to contract. As of July, the index was down by -4.4% Y/Y, compared with growth of 5.2% a year ago.

The bars, motors, fuel, newsagents and department store sectors captured in the monthly data are all seeing annual sales declines in volume terms (dots to the left of the vertical axis in Figure 2). However, there is growth in sales volumes across all of the sectors in the quadrant to the bottom right. Some of the strongest growth is being recorded in electrical (+18.2% 3mma) and furniture stores (+13.3% 3mma). These store types are commonly associated with housing and their performance would appear to reflect the ramping-up of new housing supply – new dwellings completions rose by 11.8% Y/Y in Q2 2019 – as well as improved disposable incomes and rising house prices – the latter of which has likely encouraged people to invest more in their homes.

Figure 2: Annual Retail Sales & Price Growth by Sector (3-mth Mov. Avg. July 2019)

Only licensed premises, newsagents and car dealerships sit to the right of the vertical axis in Figure 2, indicating rising average prices. In all other sectors prices are falling. Indeed, deflation has been a consistent theme in Irish retail for a number of years now. One reason is an ongoing compositional shift in the Irish retail landscape towards mid-market and value brands. It also reflects lower input costs for retailers due to a weaker Pound since the Brexit referendum, with a share of these savings being passed on to consumers. However, the continuing disparity between volume and value sales also suggests that e-commerce is improving price transparency, forcing face-to-face stores to be more competitive.

Table 1. Consumer Economy Dashboard

Indicator Period % Change Y/Y

Live Register July 2019 -12.0

Overseas Trips to Ireland Q1 2019 +5.5

Real VAT Receipts July 2019 +5.6

Real Household Disposable Income (4QMA)

Q1 2019 +5.2

Household Net Worth Q1 2019 +5.1

Total Retail Sales July 2019 -4.4

Total Employment Q2 2019 +2.0

Real Personal Consumption Expenditure

Q1 2019 +2.9

Real Average Gross Earnings Q2 2019 +2.4

Consumer Credit Outstanding Balances

June 2019 +5.6

Consumer Sentiment (3mma) July 2019 -15.8

Retail Property

Over the 12m to end-June, retail rents rose by 1.5% across the basket of investment grade shops covered by MSCI. This reflects a slowdown compared with 3% a year ago. However values have fallen slightly (-0.3%) as a result of a 20bp drift in yields. As ever with retail there is significant variation by location and store type. Given buoyant consumer demand for electrical goods and homewares, arising from increased household wealth and housing output, the retail warehousing sector has been the best performer. Here rents are rising by 6.5% per annum and

capital values have edged up by 1.8%. However, both of Dublin’s prime high streets – Grafton Street and Henry Street – have seen rents edging back slightly over the last year. This could be due to a lower number of transactions, reflecting the varying quality of stock on the market. Secondary locations remain under pressure in many cases due to a combination of oversupply and competition from e-commerce.

Outlook

Ireland’s consumer economy has been very strong for six years, but there are now increasing signs - across a broad cross section of variables – that the rate of expansion has eased. In addition, external uncertainties, particularly Brexit, US trade and tax policies, and slower growth in Europe add a layer of downside risk to the outlook. The retail property sector is also adjusting to the sector-specific challenge of e-commerce. Together all of these factors have led to slower rental growth, weaker sentiment towards the sector, and a slowdown in retail investment sales. To illustrate this, retail assets accounted for 34% of all commercial property investment turnover in Ireland between 2014 and 2017 inclusive. But in the 18m since the start of 2018 they only account for 14.7%.

Nonetheless the economic backdrop remains favourable for retail property. Ireland’s benign cycle of jobs creation, which has been in place for more than five years now, is expected to continue with consensus forecasts pointing to robust growth of 2.3% and 1.9% in 2019 and 2020 respectively. Additionally, as the labour market approaches full-employment, wage inflation is likely to strengthen, which should provide consumers with additional firing power at the tills. As a result, operators continue to take on additional workers. While staffing levels across retail and food services currently account for 14.8% of overall employment in Ireland, the sectors were responsible for 21% (9,500) of the net new jobs created across the country in the last twelve months (see Figure 4). This signifies a degree of confidence within the sector.

Figure 4: Retail and Food Services Employment in Ireland – as of Q2 2019

€ b

illio

n

2003

Q2

200

4 Q

1

200

4 Q

4

200

5 Q

3

200

6 Q

2

200

7 Q

1

200

7 Q

4

200

8 Q

3

200

9 Q

2

2010

Q1

2010

Q4

2011

Q3

2012

Q2

2013

Q1

2013

Q4

2014

Q3

2015

Q2

2016

Q1

2016

Q4

2017

Q3

2018

Q2

2019

Q1

Source: CBol

1000

750

500

250

0

-250

30

25

20

15

10

5

0

%

Source: CSO% of Overall Employment

% Jobs created in past 12 months

Dept. Stores

Grocery

Auto fuel

Pharmacy

Clothing

Furniture

Hardware

Electrical

Bars

Motors

SpecialistFood

-12

-10

-8

-6

-4

-2

0

2

4

6

-12 -10 -8 -6 -4 -2 0 2 4 6 8 10 12 14 16 18 20 22

Pri

ce G

row

th, %

Sales Volume, %

Source: Savills Research, CSO

Newsagents

Dept. Stores

Grocery

Auto fuel

Pharmacy

Clothing

Furniture

Hardware

Electrical

Bars

Motors

SpecialistFood

Newsagents

-

Liffey Valley Lands offers three superb commercial sites within the Liffey Valley retail hub

Liffey Valley Shopping Centre

Liffey Valley Motor Showrooms

Liffey Valley Retail Park

Clondalkin Industrial Estate

Clondalkin / Fonthill Train Station

Tesco

Clayton Hotel

B&Q

Lot 1

Lot 3

M50

M50

N4

N7

20 21

Lot 2

-

TITLEWe understand the title to be held long leasehold. A title summary is available on request.

SERVICESInterested parties are also advised to satisfy themselves as to the presence, adequacy and availability of all services to the subject lands.

VIEWINGSViewings strictly by appointment and to be arranged with the sole selling agent.

SALES AGENTSavills33 Molesworth StreetDublin 2, Ireland

www.savills.ie

PSRA - 002233

Mark ReynoldsDirectorDevelopmentT: +353 1 618 [email protected]

Nicky ConneelySenior SurveyorDevelopment+353 1 618 [email protected]

SOLICITORRonan Daly Jermyn2 Park PlaceCitygate ParkMahon PointCork

Patrick AhernT: +353 21 480 [email protected]

PROPERTY MISREPRESENTATION ACT

The Vendors/Lessors and their Agents give note that the particulars and information contained in this brochure do not form any part of any offer or contract and are for guidance only. The particulars, descriptions, dimensions, references to condition, permissions or licences for use or occupation, access and any other details, such as prices, rents or any other outgoings are for guidance only and are subject to change. Maps and plans are not to scale and measurements are approximate. Whilst care has been taken in the preparation of this brochure intending purchasers, Lessees or any third party should not rely on particulars and information contained in this brochure as statements of fact but must satisfy themselves as to the accuracy of details given to them. Neither Savills Ireland nor Savills UK nor any of their employees have any authority to make or give any representation or warranty (express or implied) in relation to the property and neither Savills Ireland nor Savills UK nor any of their employees nor the vendor or lessor shall be liable for any loss suffered by an intending purchaser/lessees or any third party arising from the particulars or information contained in this brochure. Prices quoted are exclusive of VAT (unless otherwise stated) and all negotiations are conducted on the basis that the purchasers/lessees shall be liable for any VAT arising on the transaction. Designed and produced by Creativeworld. Tel +353 1 447 0553