Five Forces Driving the Real Estate Market in 2016 · 2015. 11. 18. · 2009 - Jan 2009 - Jul 2010...

Transcript of Five Forces Driving the Real Estate Market in 2016 · 2015. 11. 18. · 2009 - Jan 2009 - Jul 2010...

Economic Summit

2016 Real Estate Trends and Insights

Five Forces Driving the Real Estate

Market in 2016

Paul C. Bishop, PhD, CBE

Vice President, Research

NATIONAL ASSOCIATION OF REALTORS®

November 18, 2015

The Economy

Taking the Long View, GDP Average Growth of about

3.5% before Great Recession and Just Over 2% Since

-4.0%

-2.0%

0.0%

2.0%

4.0%

6.0%

8.0%

10.0%

1950 1955 1960 1965 1970 1975 1980 1985 1990 1995 2000 2005 2010

SAAR

Source: Bureau of Economic Analysis

Employment has Recovered – and then some

(8 million lost … 12 million gained)

120

125

130

135

140

145

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015

U.S. Total Payroll Employment

6 years

4 million jobs

Source: Bureau of Labor Statistics

millions

8 million jobs

8 million jobs

Job Market Recovery was Quicker in Denver

(76,000 lost … 201,000 gained)

1,000

1,050

1,100

1,150

1,200

1,250

1,300

1,350

1,400

1,450

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015

Denver MSA Payroll Employment

4 1/2 years

125,000 jobs

76,000 jobs76,000 jobs

Source: Bureau of Labor Statistics

thousands

The Economy

Interest Rates

No CPI Inflation – Yet

0.0%

0.5%

1.0%

1.5%

2.0%

2.5%

3.0%

3.5%

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015

Consumer Price Inflation (excluding Food and Energy)

percent change from one year ago

Source: Bureau of Labor Statistics

Rents Rising Faster than Most Other Segments

-1.0%

0.0%

1.0%

2.0%

3.0%

4.0%

5.0%

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015

Consumer Price Inflation

Rent Other than Shelter

percent change from one year ago

Source: Bureau of Labor Statistics

Fed Policy and Mortgage Rate

0.0%

1.0%

2.0%

3.0%

4.0%

5.0%

6.0%

7.0%

8.0%

9.0%

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015

30-Year Mortgage Rate Fed Funds Target Rate

Source: Federal Reserve

The Economy

Interest Rates

Inventory

Low Number of Homes Available for Sale

0

500,000

1,000,000

1,500,000

2,000,000

2,500,000

3,000,000

3,500,000

4,000,000

4,500,000

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015

U.S. Inventory of Existing Homes for Sale

Source: National Association of REALTORS®

Low Inventory

Sales Constrained by Limited Inventory

0

1,000,000

2,000,000

3,000,000

4,000,000

5,000,000

6,000,000

7,000,000

8,000,000

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015

U.S. Existing Home Sales

SAAR

Source: National Association of REALTORS®

Low Inventory

Pending Sales Continue to Trend Higher But

Paused in Recent Months

60

70

80

90

100

110

120

130

140

2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015

U.S. Pending Home Sales

Source: National Association of REALTORS®

SA, 2001 = 100

Sales are Taking a Little Longer Since

Low Point Earlier this Year

49

0

20

40

60

80

100

120

2011 -Jun

2011 -Dec

2012 -Jun

2012 -Dec

2013 -Jun

2013 -Dec

2014 -Jun

2014 -Dec

2015 -Jun

U.S. Median Days on Market

In Denver Metro

Sept 2014: 34 days

Sept 2015: 28 days

days

Source: National Association of REALTORS®

Like Many Other Areas, Denver Has Fewer

Listings and Rapid Turnover

Active Listings At Low Level

0

2,000

4,000

6,000

8,000

10,000

12,000

14,000

16,000

18,000

2011 2014 2013 2014 2015

Days on Market Fall

0

20

40

60

80

100

120

2011 2012 2013 2014 2015

Sept YTD

Source: Denver Metro Association of REALTORS®

Sept YTD

0.0

2.0

4.0

6.0

8.0

10.0

12.0

14.0

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015

U.S. Months Supply of Homes for Sale

Supply vs Demand Balance Means Price Gains

months

Source: National Association of REALTORS®

Median Home Price Gains Have Eased Nationally

-20%

-15%

-10%

-5%

0%

5%

10%

15%

20%

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015

U.S. Median Existing Home Price Growth

percent change from one year earlier

10 months supply

4.5 to 5.5

months supply

Source: National Association of REALTORS®

Low Inventory in Denver Means Fewer Sales –

Especially at Lower Prices Ranges

-80%

-60%

-40%

-20%

0%

20%

40%

60%

80%

100%

All Prices $0 to$99,999

$100,000 to$199,999

$200,000 to$299,999

$300,000 to$399,999

$400,000 to$499,999

$500,000 to$749,999

$750,000 to$999,999

$1,000,000& over

Change in Sales by Price Range(YTD Sept 2014 to Sept 2015)

Single Family Condos

Source: Denver Metro Association of REALTORS®

17% of Sales

<1 MOI (SF & Condo)

30% of Sales

3.5 MOI (SF & Condo)53% of Sales

<1 MOI (SF & Condo)

In Denver – Sales Held Back by Lack of Inventory

Sales Have Plateaued

0

5,000

10,000

15,000

20,000

25,000

30,000

35,000

40,000

45,000

2011 2012 2013 2014 2015

Sept YTD

Average Sold Prices Keep Rising

$0

$50,000

$100,000

$150,000

$200,000

$250,000

$300,000

$350,000

$400,000

2011 2012 2013 2014 2015

Sept YTD

Source: Denver Metro Association of REALTORS®

Area Home Prices Rising 2x as Fast as in the U.S.

-10.0%

-5.0%

0.0%

5.0%

10.0%

15.0%

20.0%

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015

Home Price Growth

Denver Colorado U.S.

Source: Federal Housing Finance Agency

percent change from year earlier

Distressed Sales Share Trending Down

0%

10%

20%

30%

40%

50%

60%

2009 2010 2011 2013 2013 2014 2015

Foreclosures Short-sales

percent of existing home sales

Source: National Association of REALTORS®

Pipeline of Seriously Delinquent Mortgages

is Declining

0.0%

2.0%

4.0%

6.0%

8.0%

10.0%

12.0%

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015

90+ days Past Due and in Foreclosure

Colorado U.S.

4.3 million

1.6 million

58,760

14,235

percent of mortgages

Source: Mortgage Bankers Association

We Need to Build More Houses

0

500,000

1,000,000

1,500,000

2,000,000

2,500,000

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015

U.S. Housing Starts

SAAR Avg Annual Starts

1997-2006

Source: Census Bureau

Colorado Housing Starts Growing, But Not Back

to Long-term Average Yet

0

10,000

20,000

30,000

40,000

50,000

60,000

70,000

80,000

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015

Colorado Housing Starts

Avg Annual Starts

1997-2006

Source: Bank of Tokyo-Mitsubishi

The Economy

Interest Rates

Inventory

Affordability

Saving for Downpayment Increasingly Difficult

for First-time Buyers

Saving for Downpayment Difficult

0%

5%

10%

15%

20%

25%

30%

2010 2011 2012 2013 2014 2015

First-time Buyers Repeat Buyers

Expenses that Delayed Saving

Downpayment(among those who indicated difficulty saving)

0%

10%

20%

30%

40%

50%

60%

70%

First-time Buyers Repeat Buyers

Student Loans Credit Card Debt

Car Loan Child Care Expenses

Healthcare Costs

Source: 2014 NAR Profile of Home Buyers and Sellers

Current Renters Point to Affordability as Main

Hurdle to Ownership

Do renters ever want to own a home?

Yes, 83%

No, 14%

Not sure, 3%

Why don’t renters own a home?

Can’t afford a home 42%

Life circumstances not

suitable for owning now28%

Need flexibility of renting

vs owning9%

Don’t want responsibility

of owning7%

59% think it would be difficult to

qualify for a mortgage

Source: National Association of REALTORS®

The Economy

Interest Rates

Inventory

Affordability

First-time Buyers

Younger Households Less Likely to Own a Home

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

Colorado 34 andyounger

35-44 years 45-54 years 55-64 years 65 and older

Colorado Homeownership Rate

2005 2014

Source: Census Bureau

First-time Buyers Not Fully Back in the Market

0%

10%

20%

30%

40%

50%

60%

2009 -Jan

2009 -Jul

2010 -Jan

2010 -Jul

2011 -Jan

2011 -Jul

2012 -Jan

2012 -Jul

2013 -Jan

2013 -Jul

2014 -Jan

2014 -Jul

2015 -Jan

2015 -Jul

Percent of Existing Homes Sold to First-time Buyers

Source: National Association of REALTORS®

Most Consumers View Home Ownership

As A Good Financial Choice

Don’t Know4%

Not a Good Decision

12%

Strongly Agree64%

Moderately Agree20%

Good Decision

84%

Is Buying A Home A Good Financial Decision?

Among current renters: 76%

Source: National Association of REALTORS®

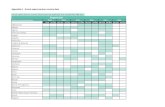

Outlook

Economic Forecast

2013 20142015

Forecast

2016

Forecast

GDP Growth 1.5% 2.4% 2.1% 2.7%

Job Growth 1.7% 1.9% 1.8% 1.7%

CPI Inflation 1.5% 1.6% 0.1% 3.2%

10-year Treasury 2.5% 2.6% 2.1% 2.7%

Source: National Association of REALTORS® (November 2015)

Housing Forecast

2013 20142015

Forecast

2016

Forecast

Housing Starts 925,000 1,001,000 1,117,000 1,263,000

New Home Sales 430,000 439,000 505,000 589,000

Existing Home

Sales5,100,000 4,940,000 5,299,000 5,454,000

Median Existing

Home Price Growth11.5% 5.7% 5.9% 4.6%

30-year Mtg Rate 4.0% 4.2% 3.8% 4.5%

Source: National Association of REALTORS® (November 2015)